Tax Managers often grapple with effectively showcasing their ability to handle complex tax regulations on their resumes. Our resume examples can guide you in highlighting these skills to impress potential employers. Dive into the examples below to craft a standout resume.

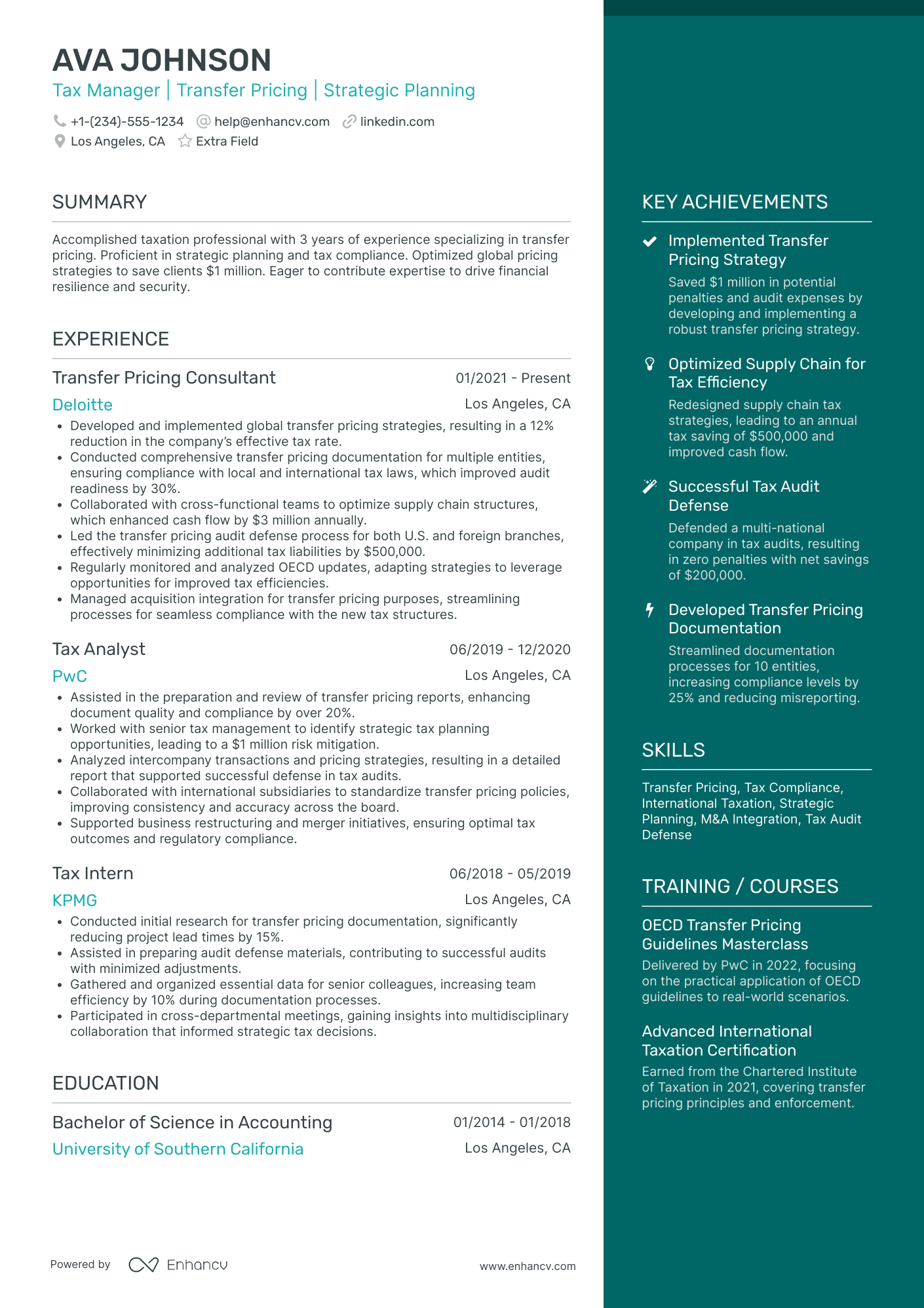

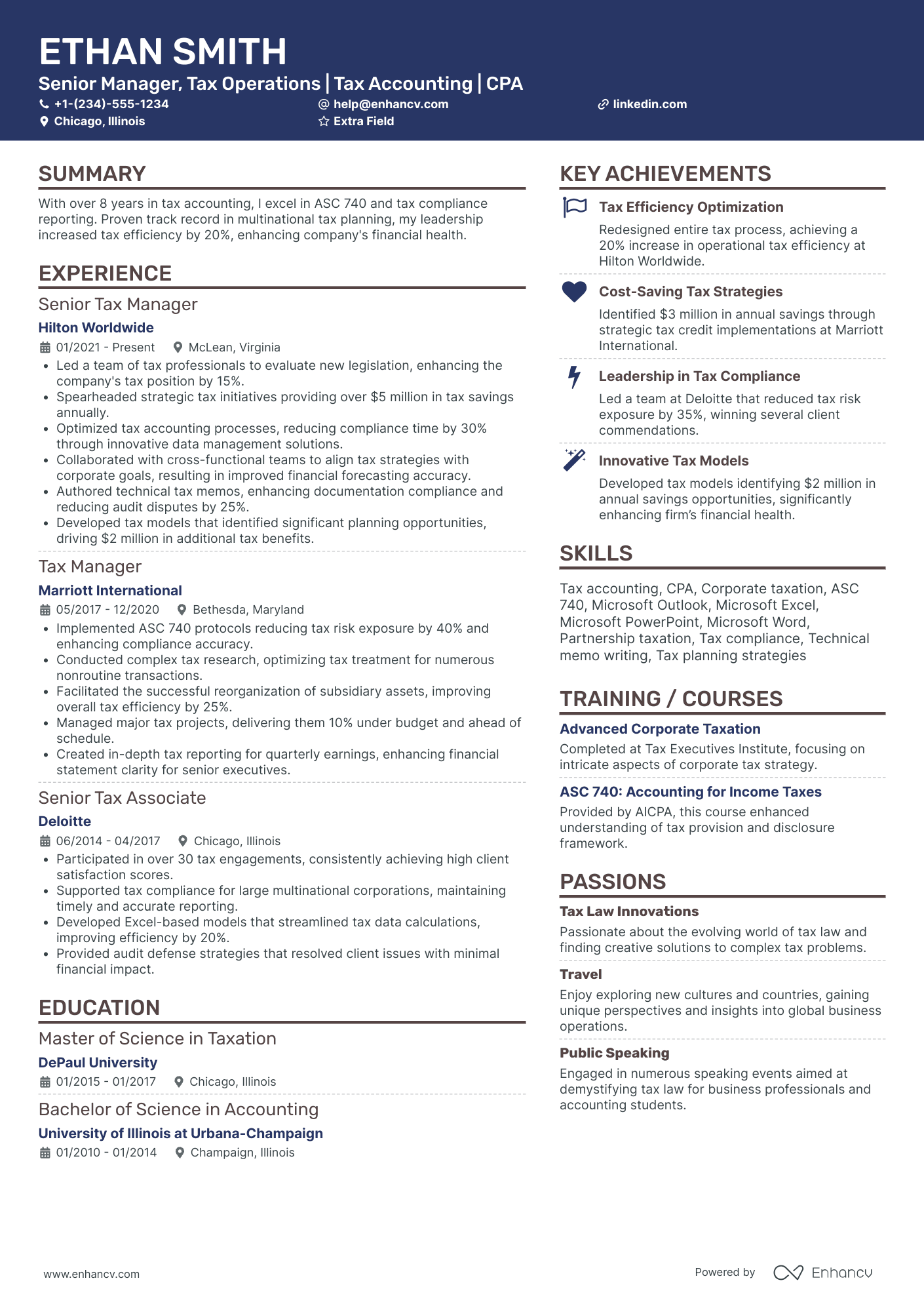

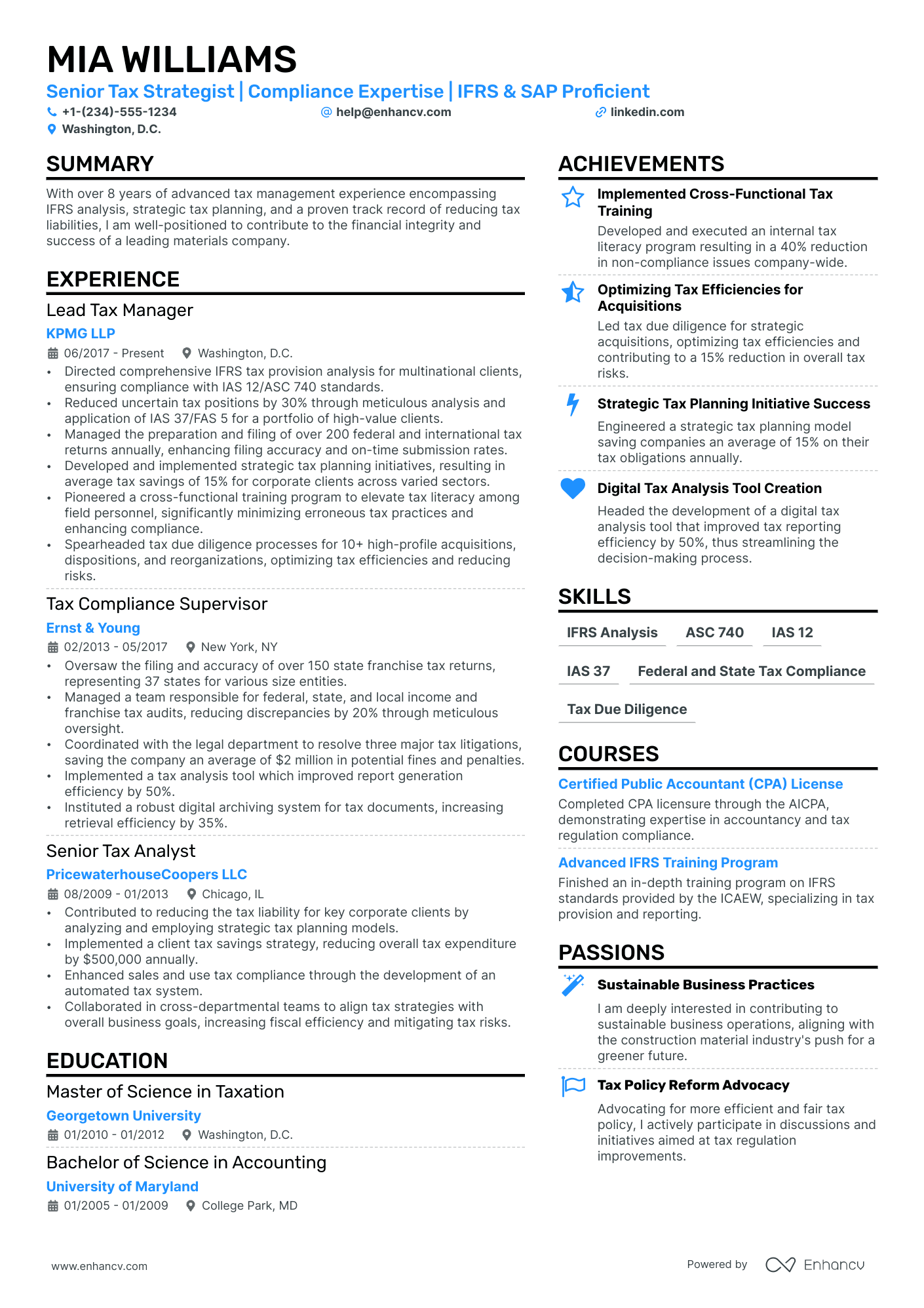

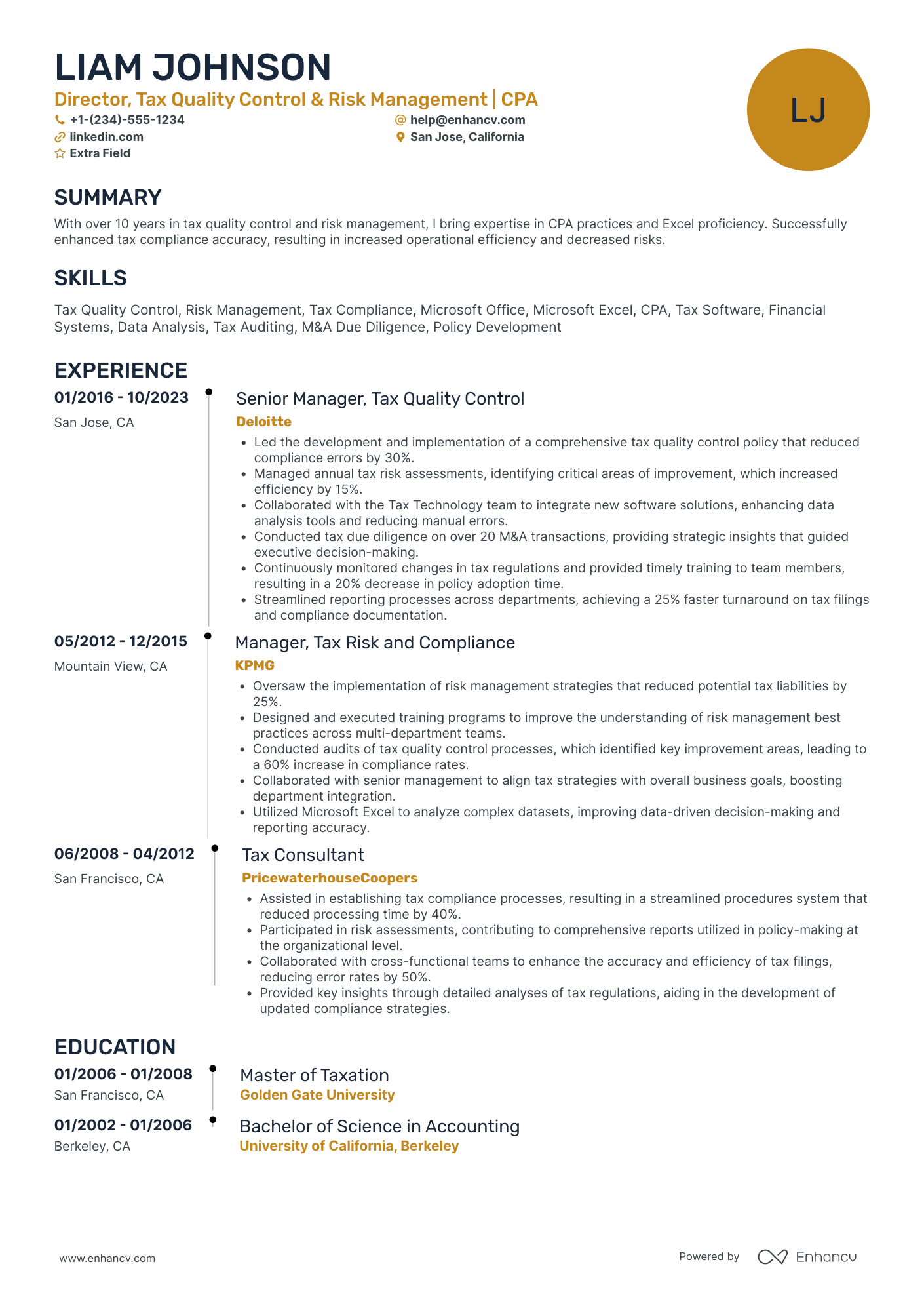

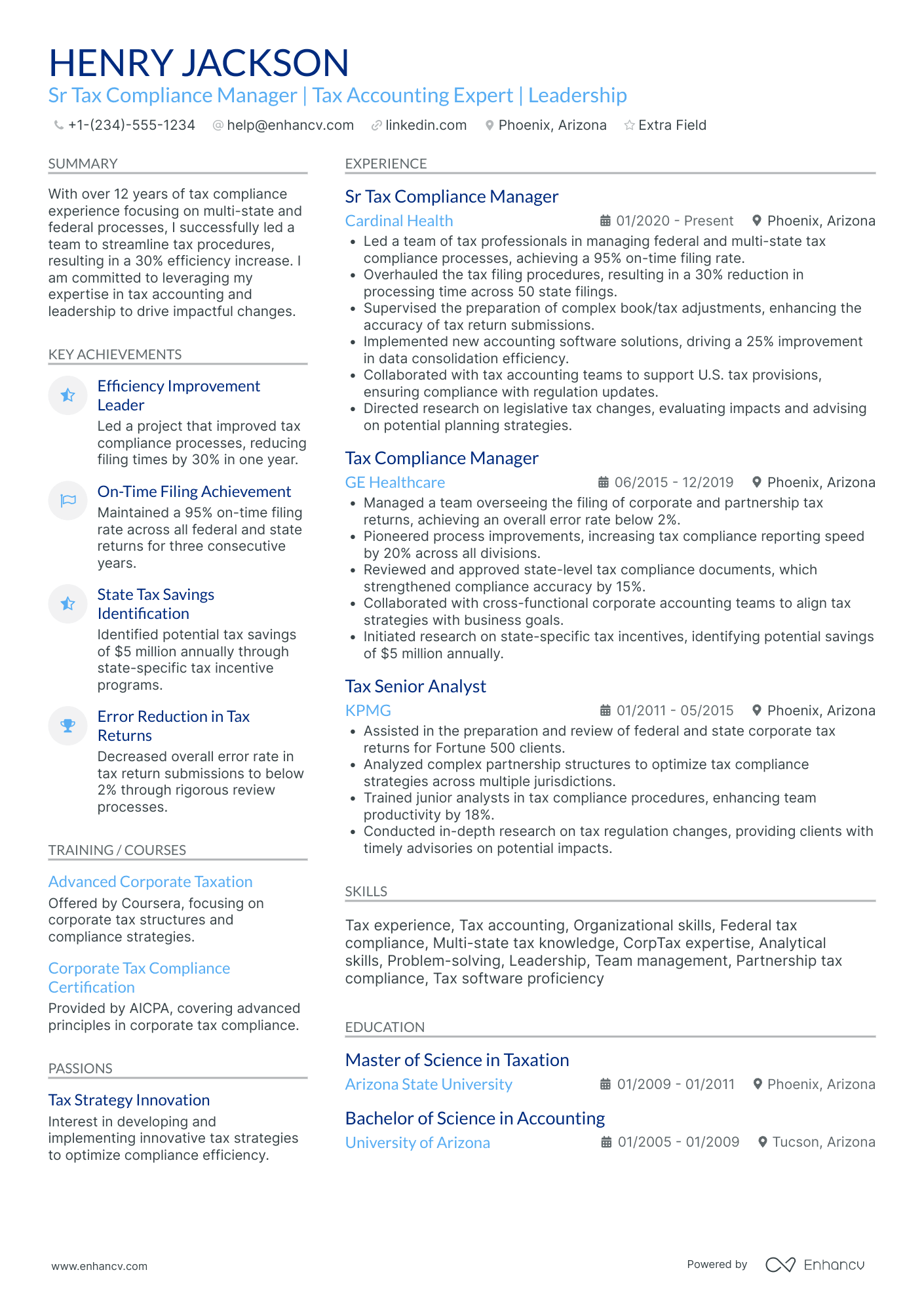

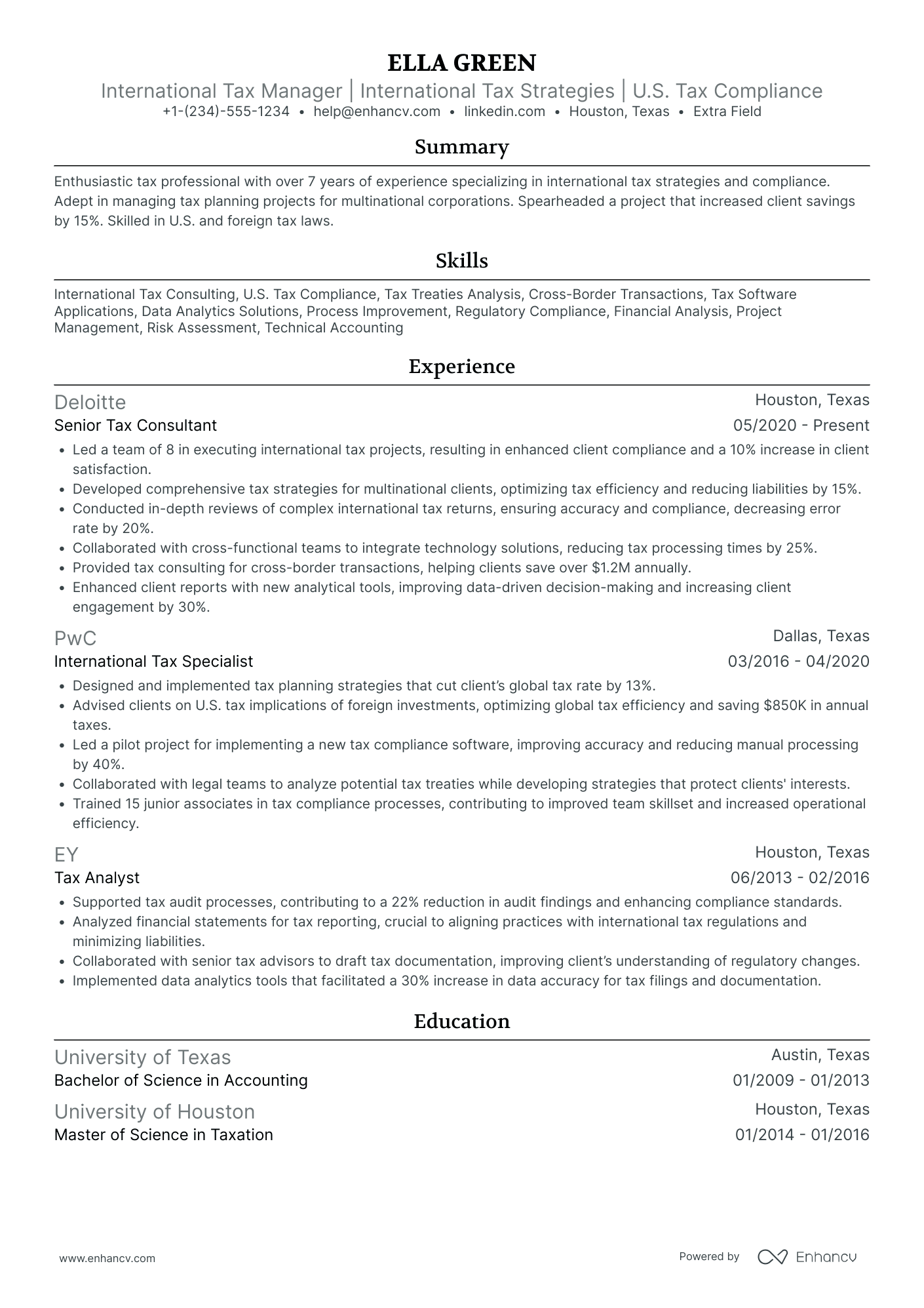

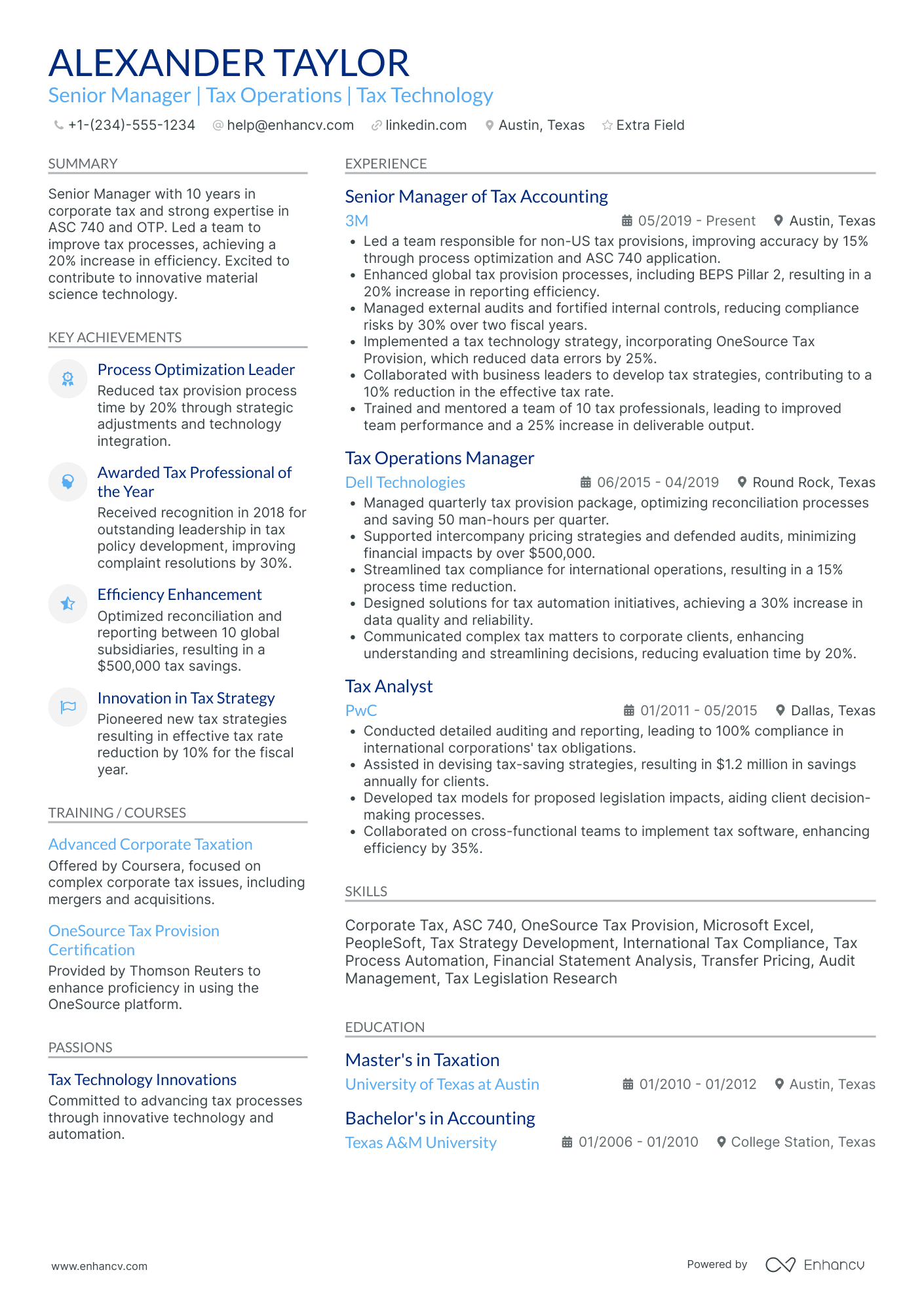

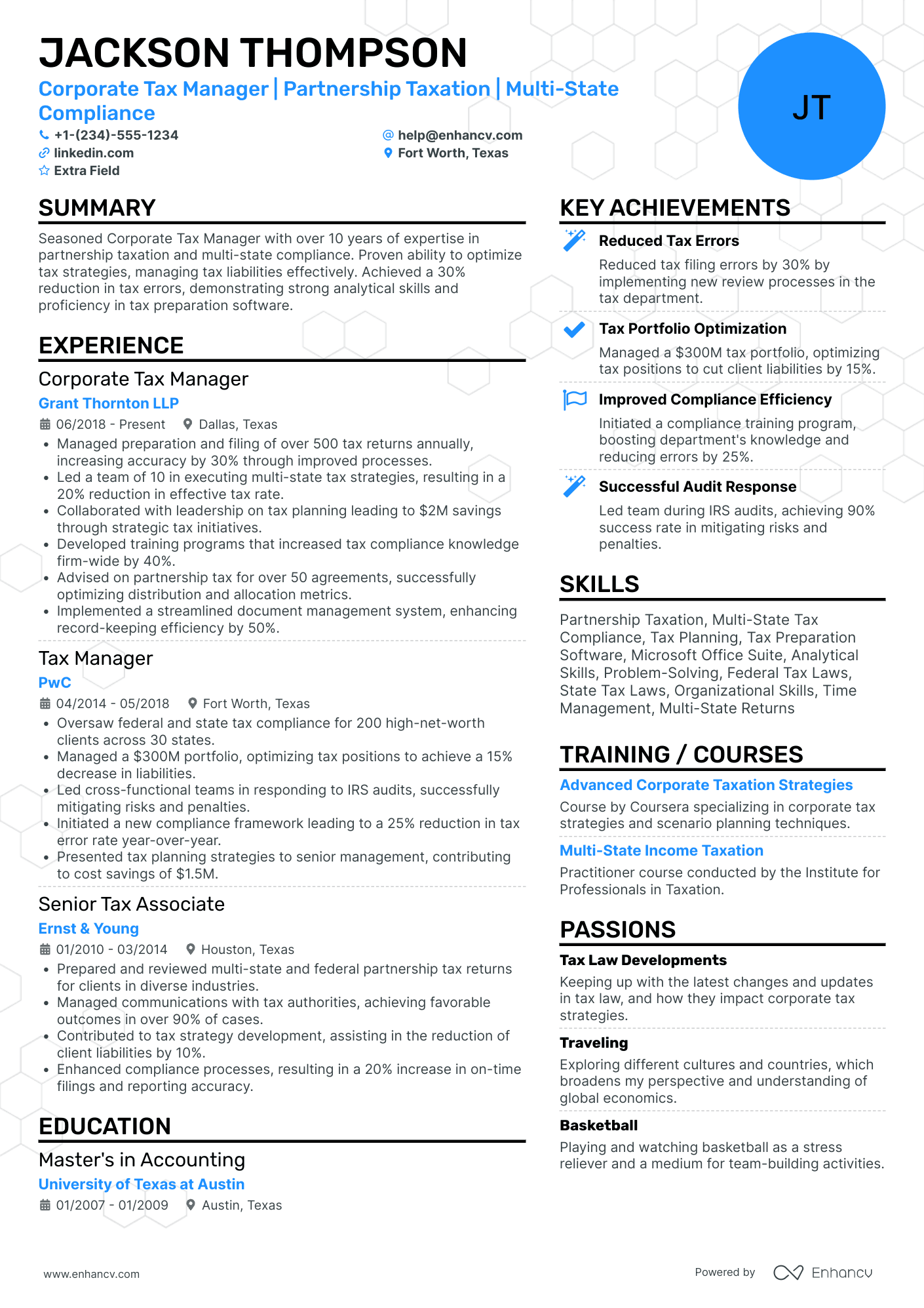

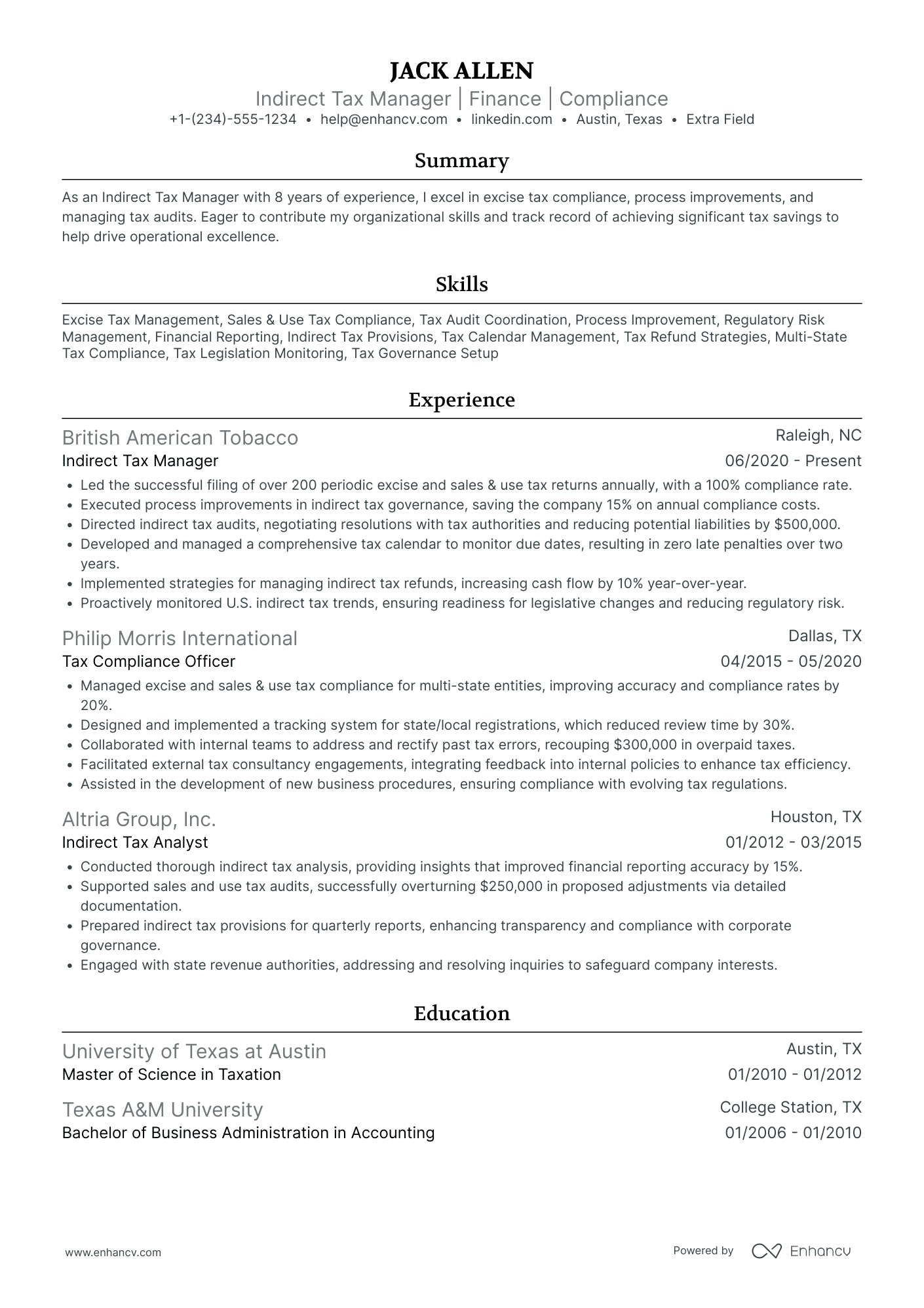

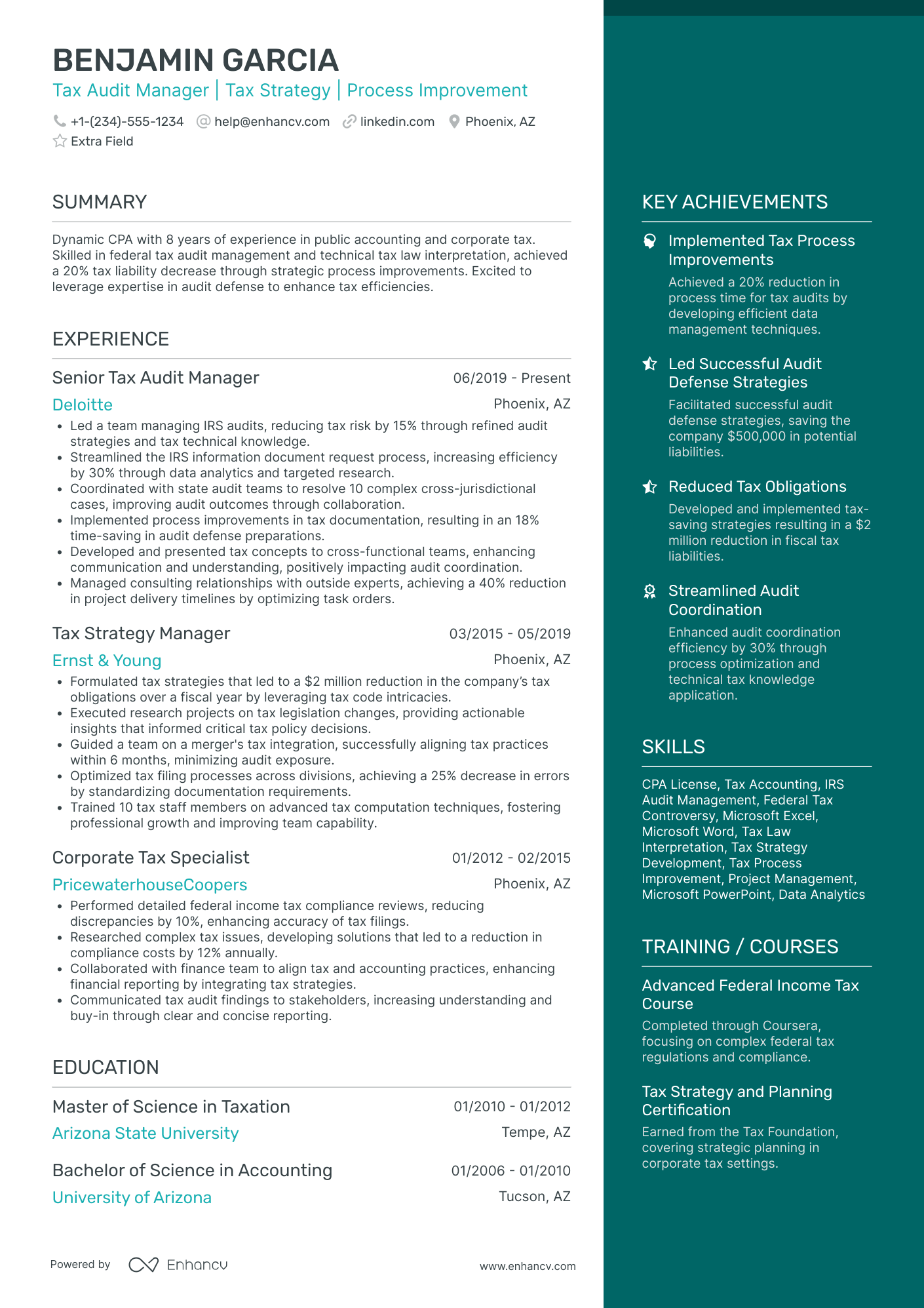

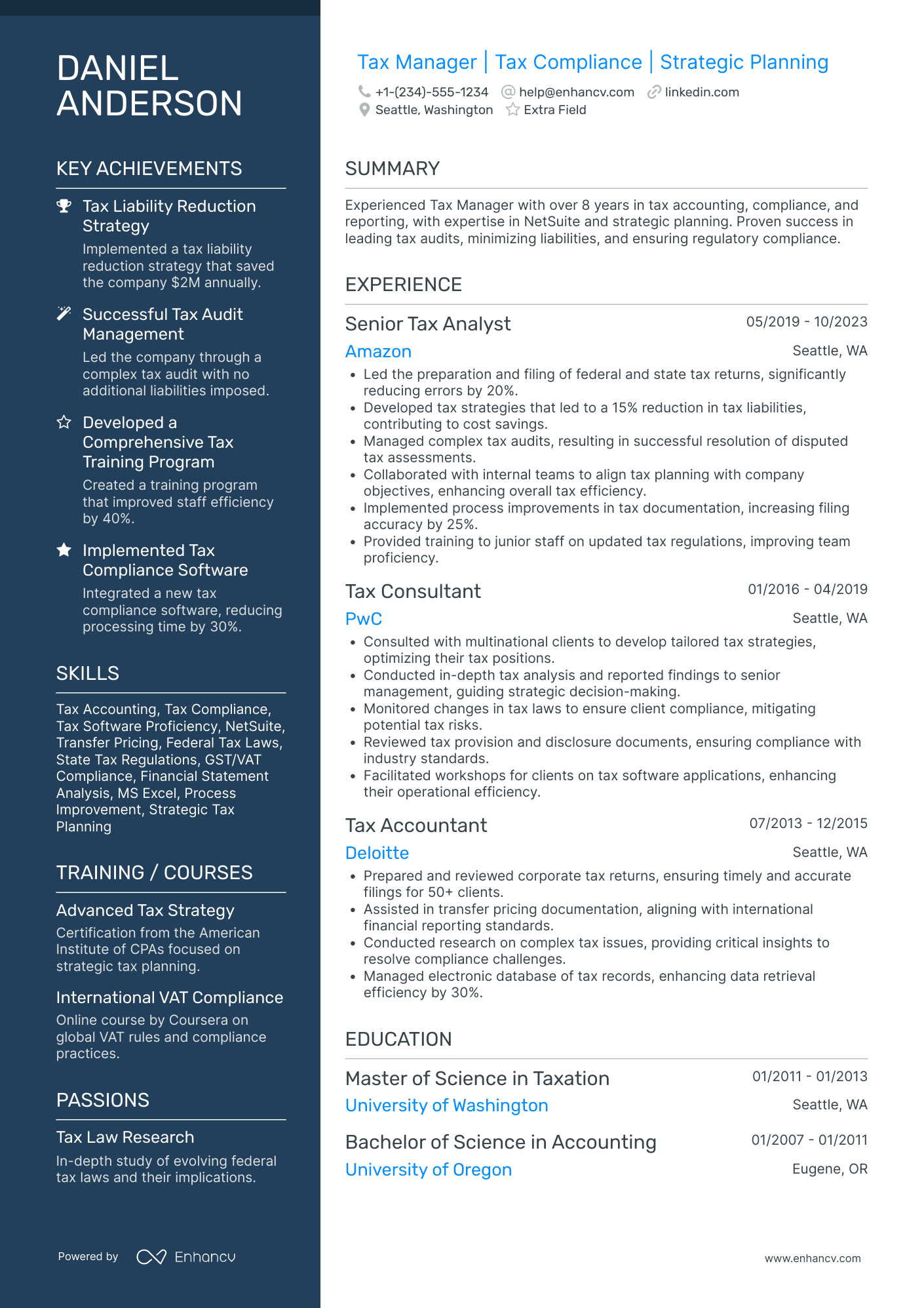

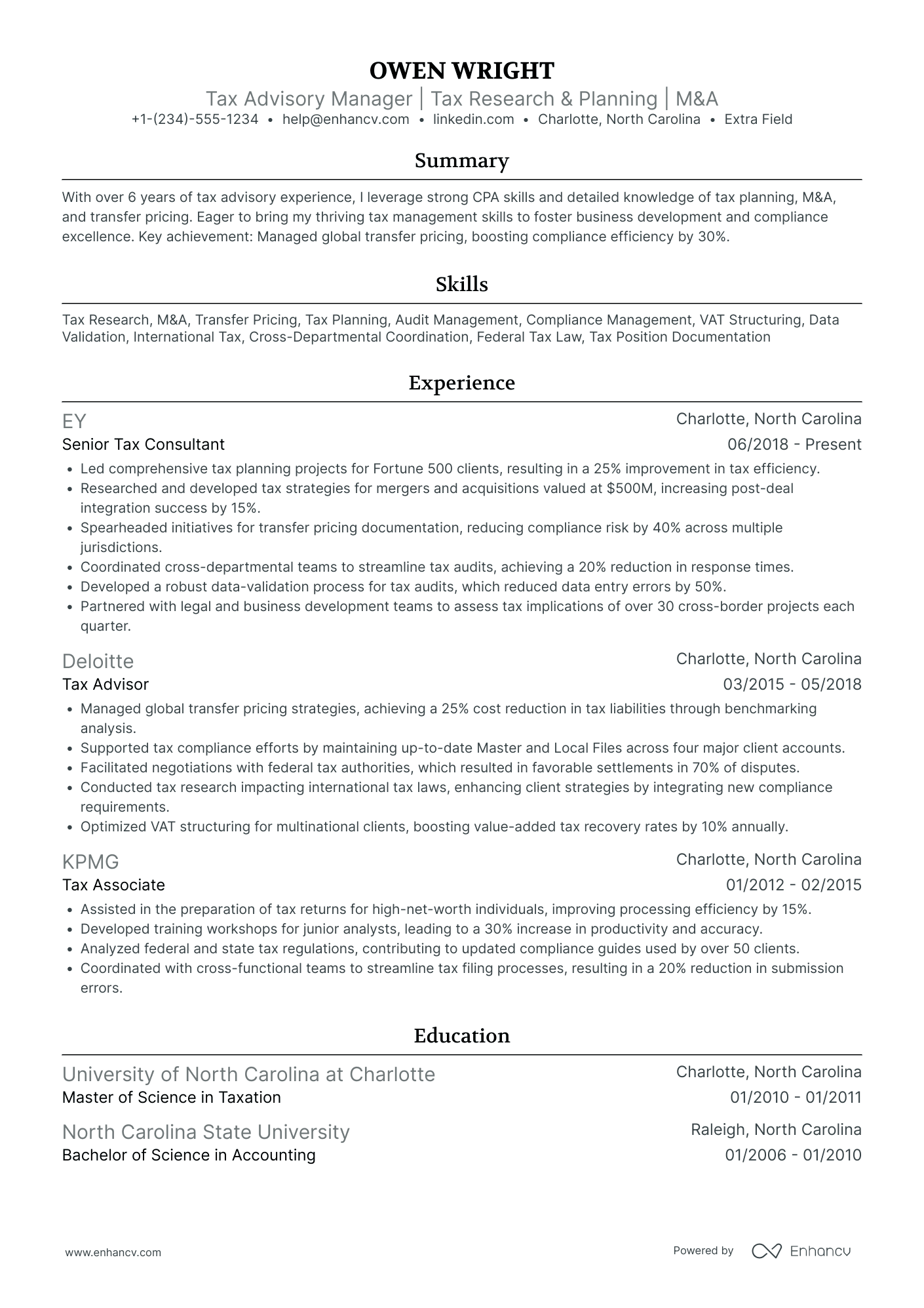

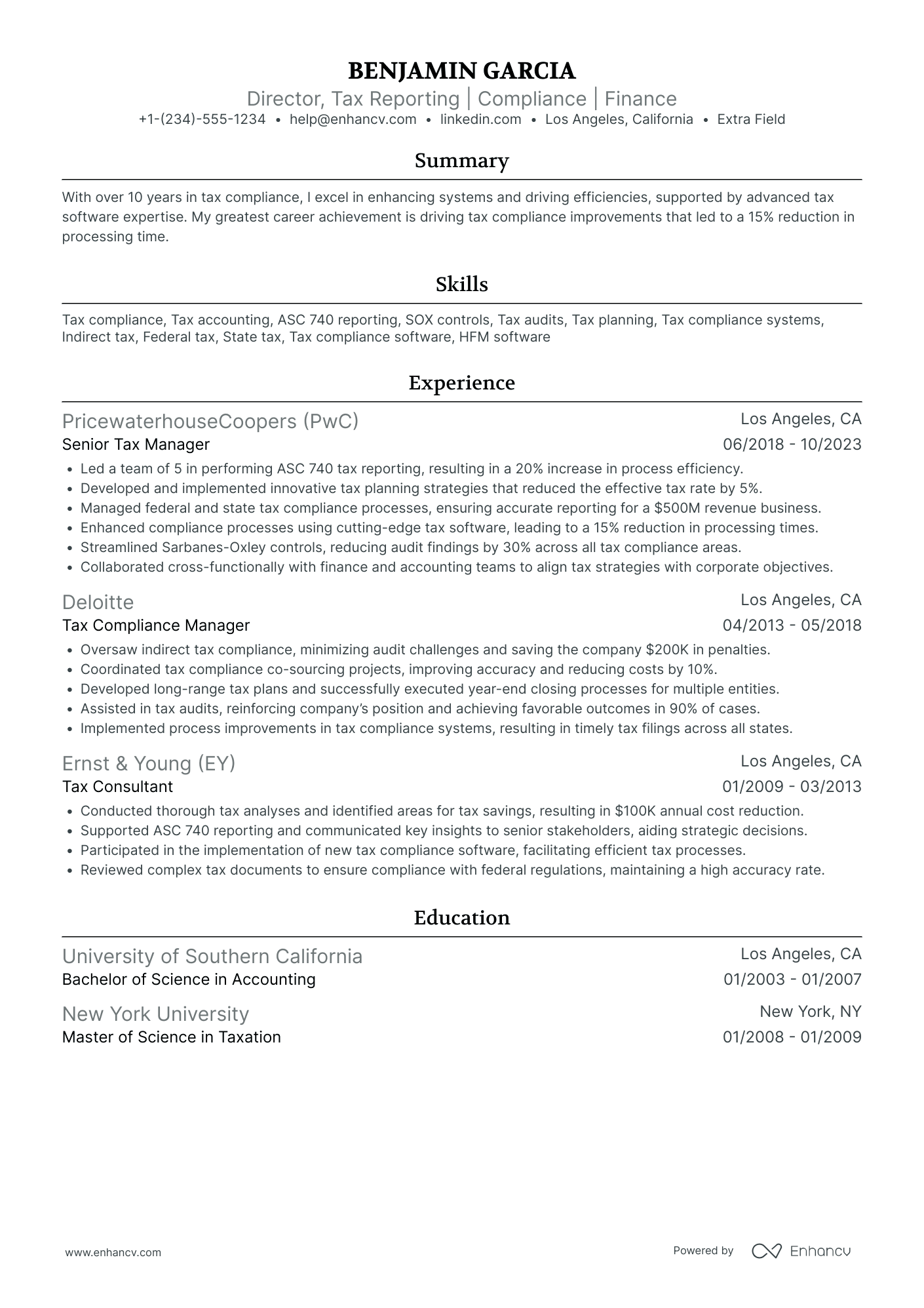

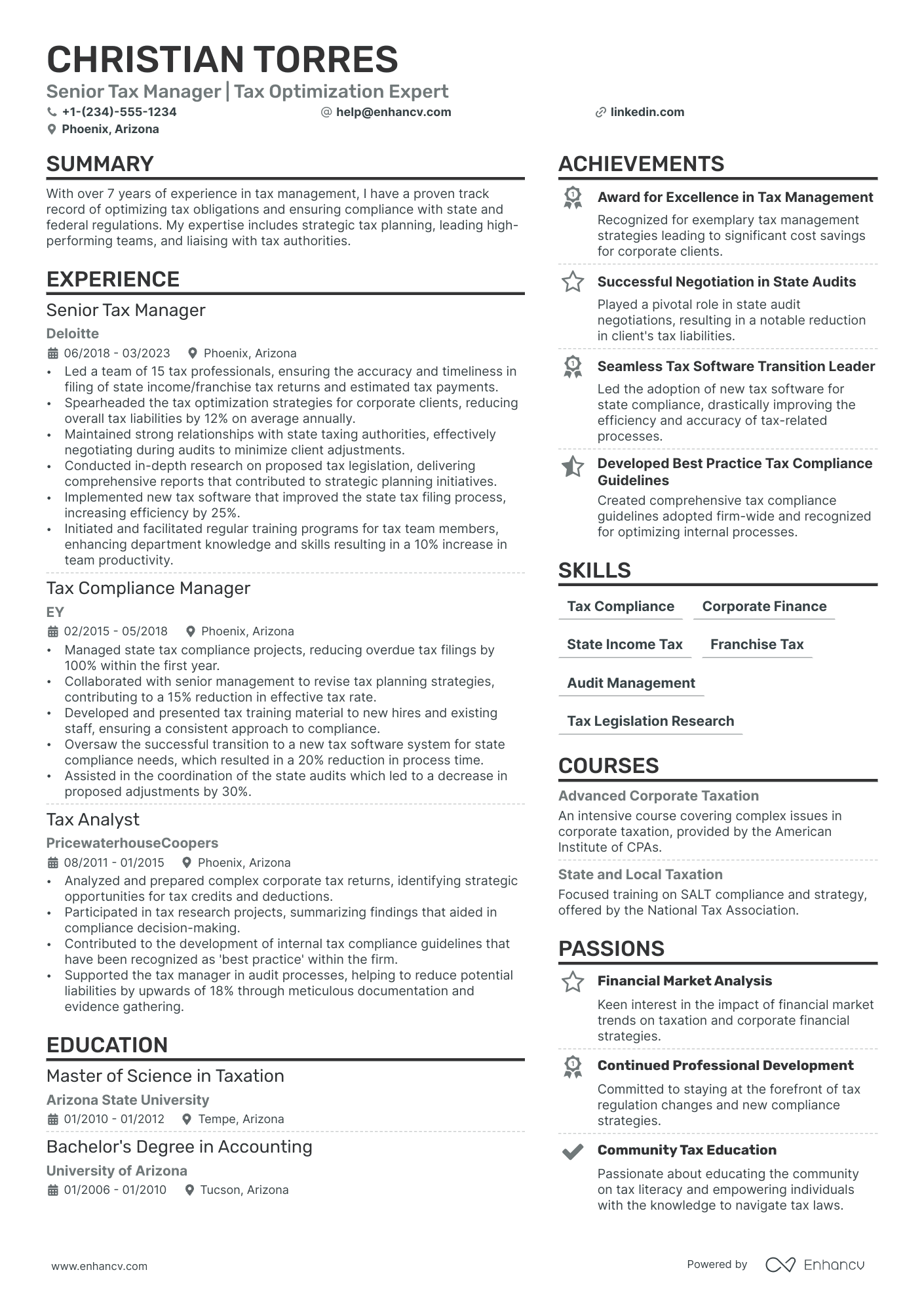

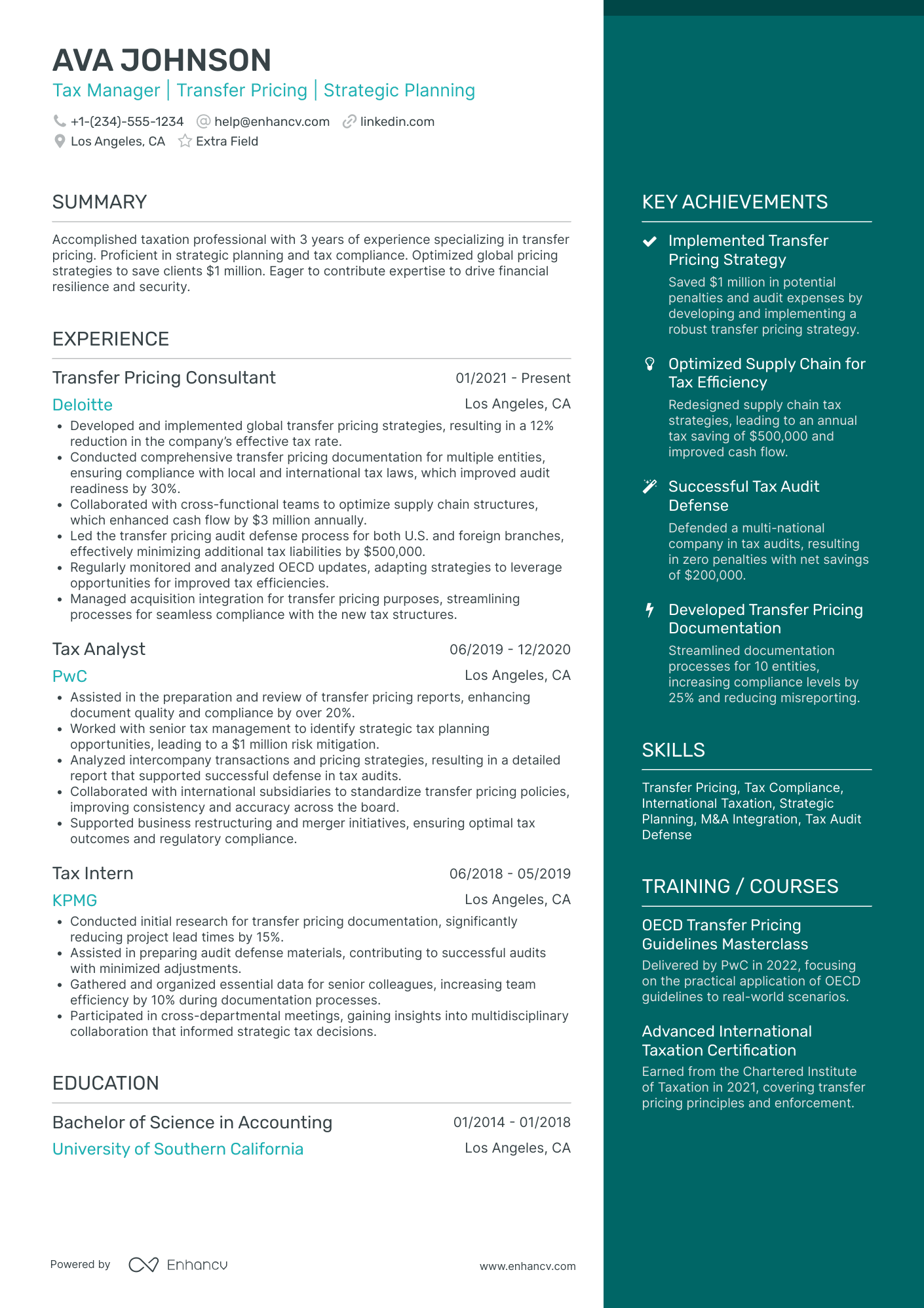

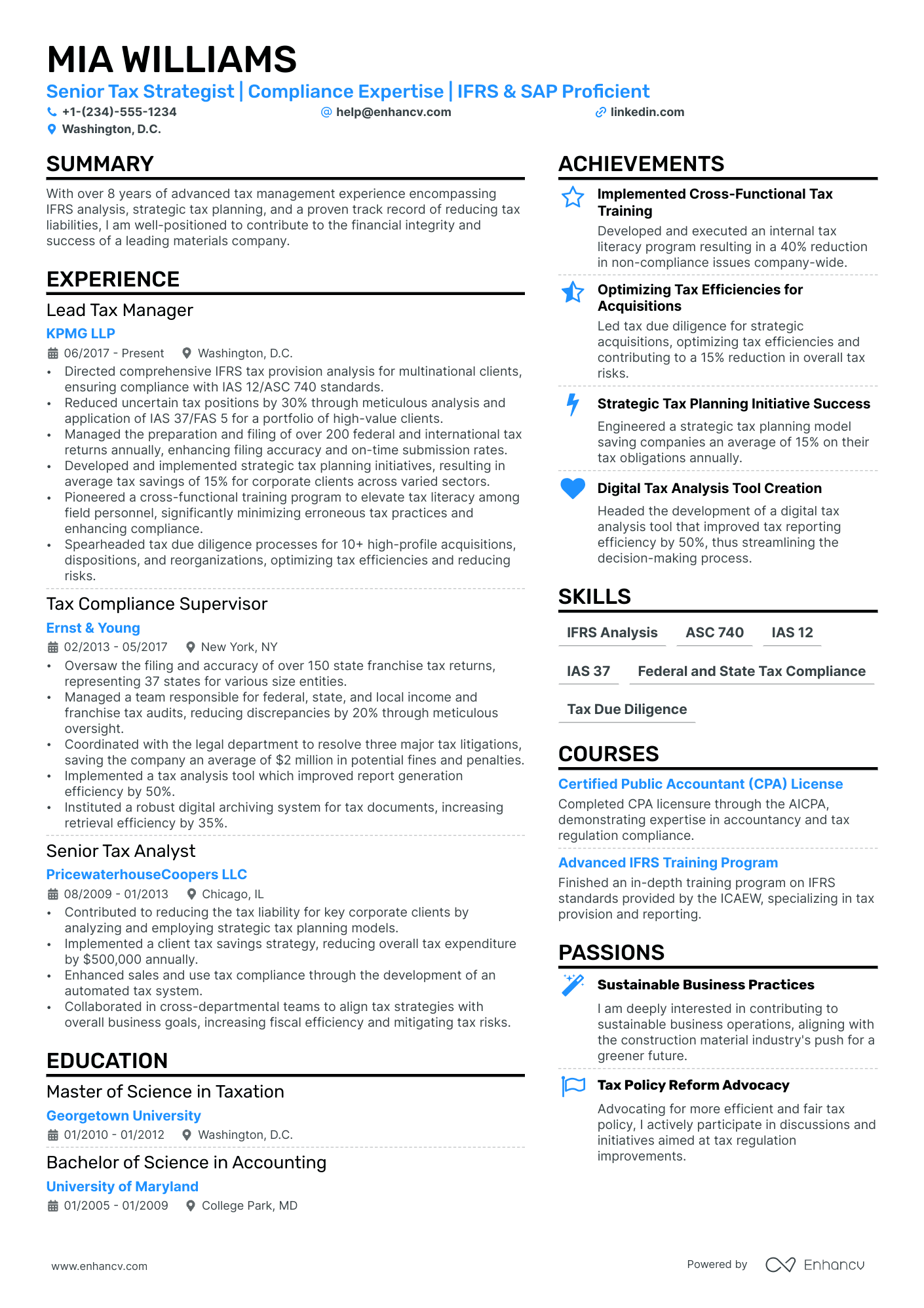

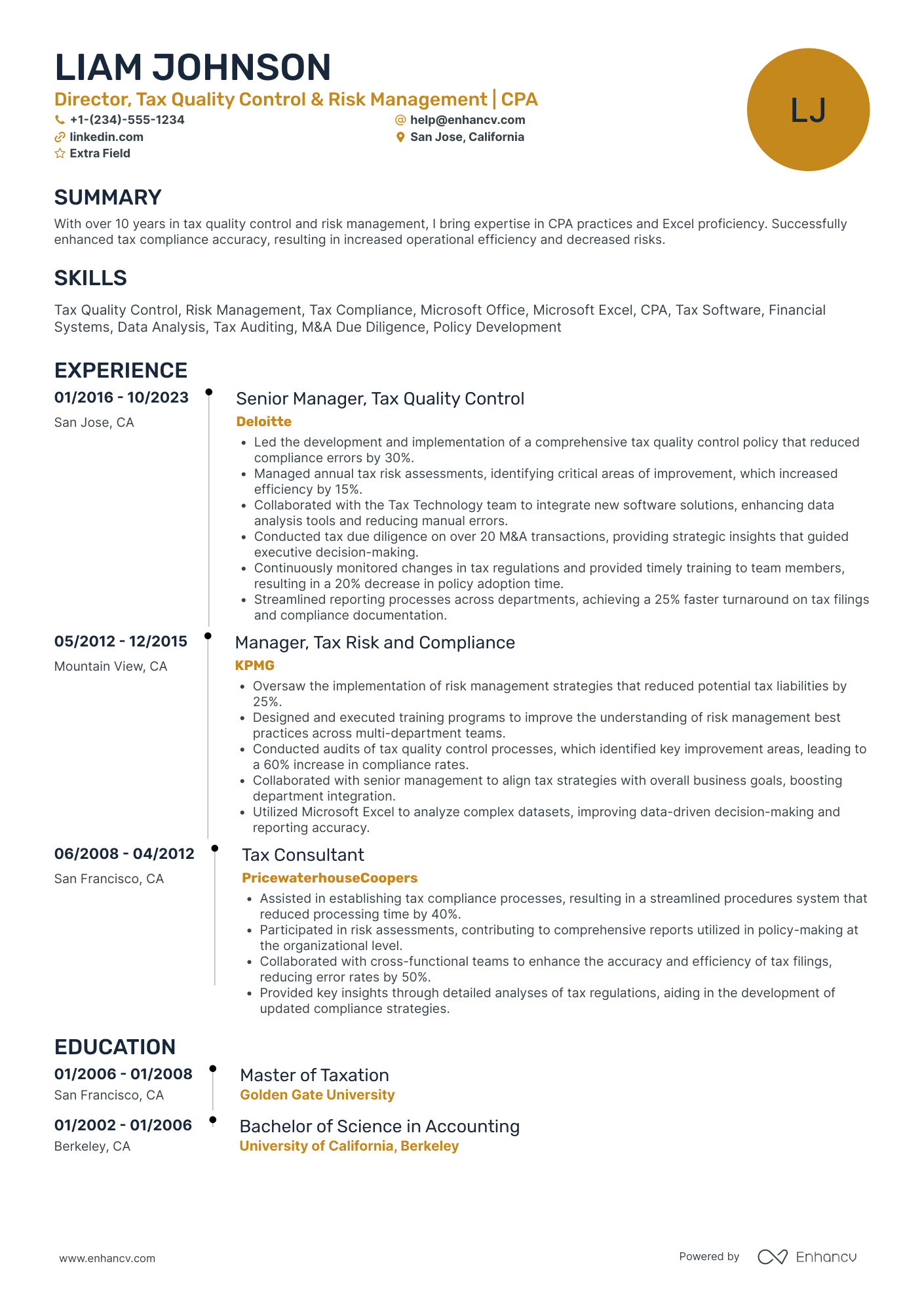

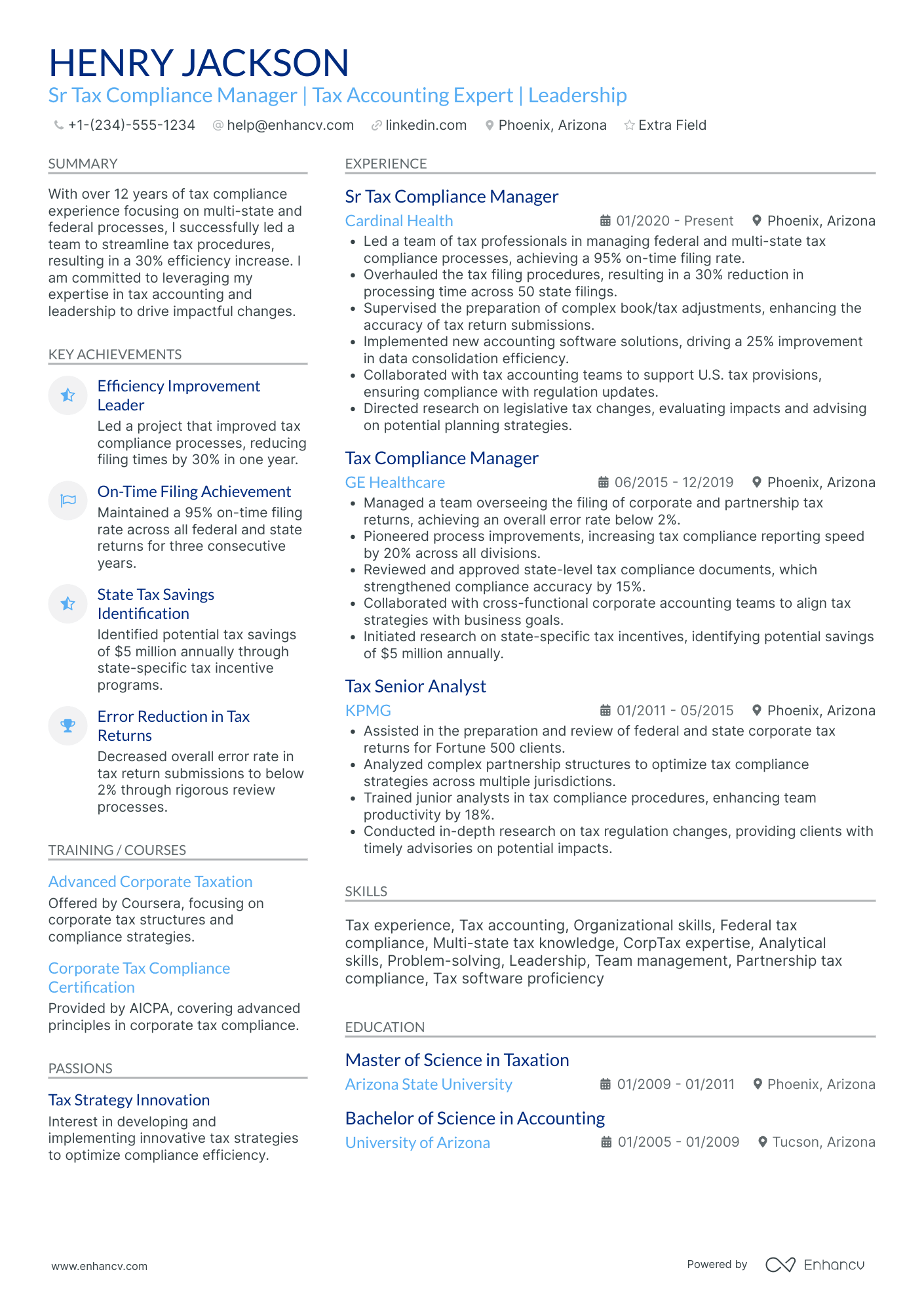

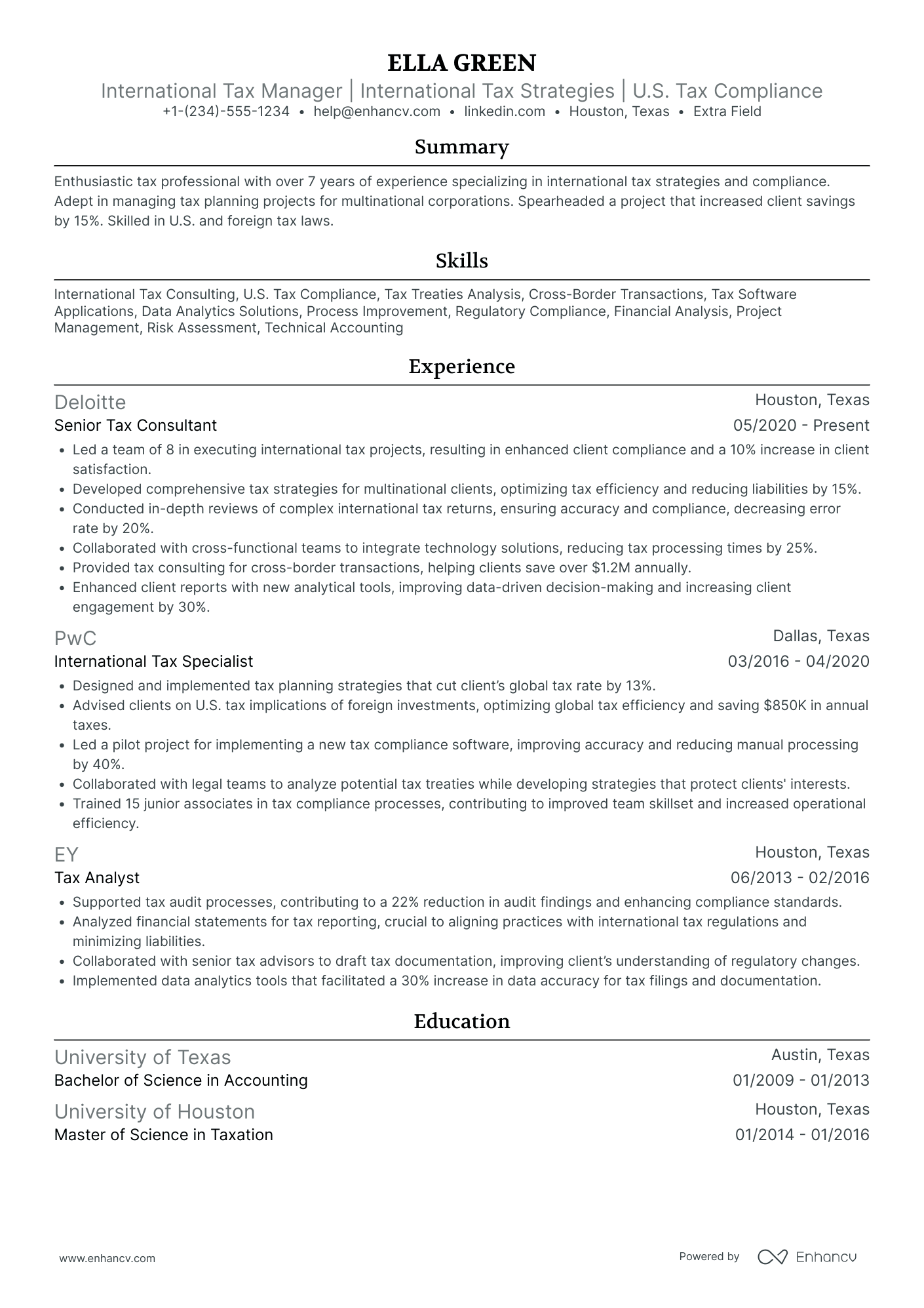

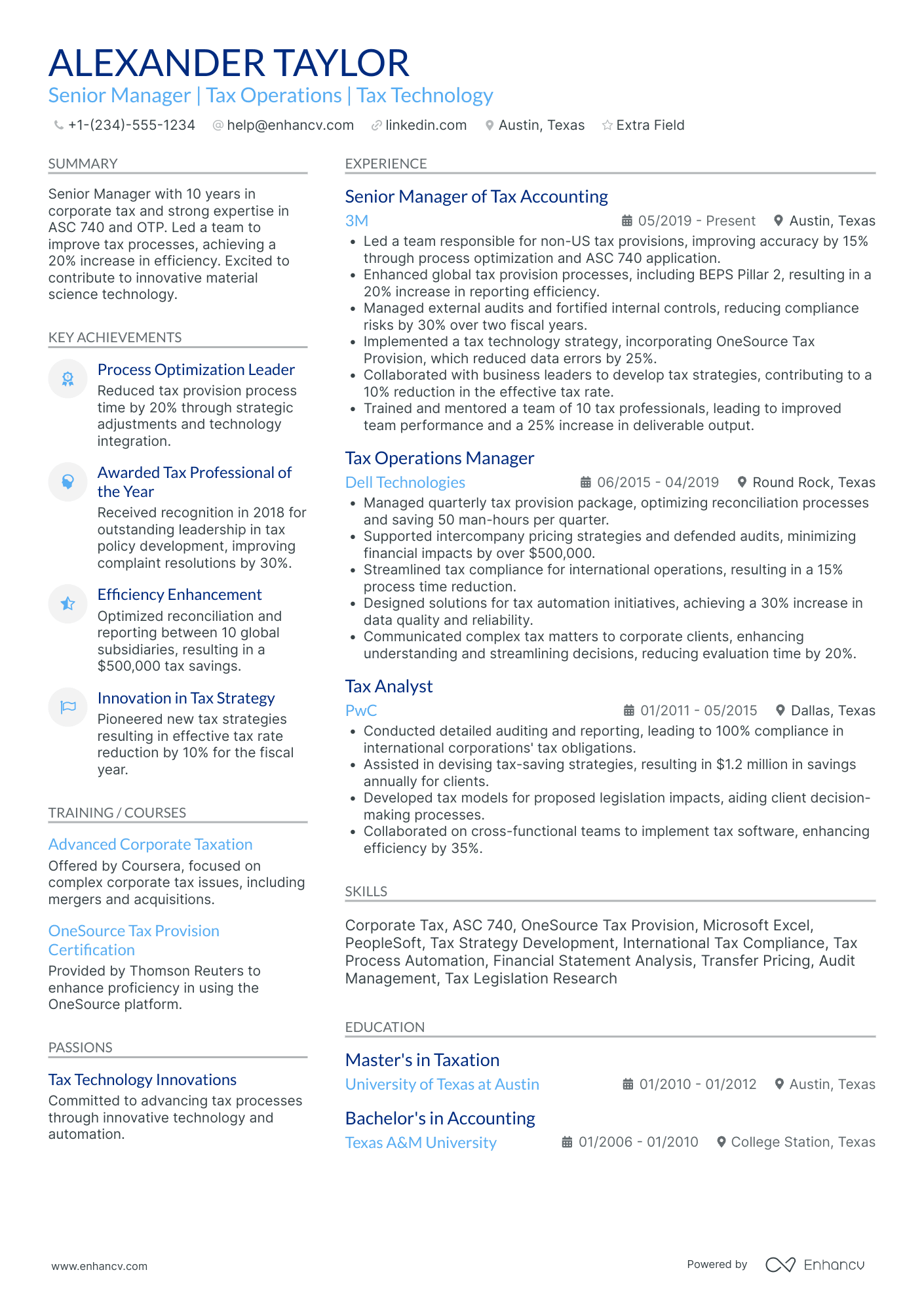

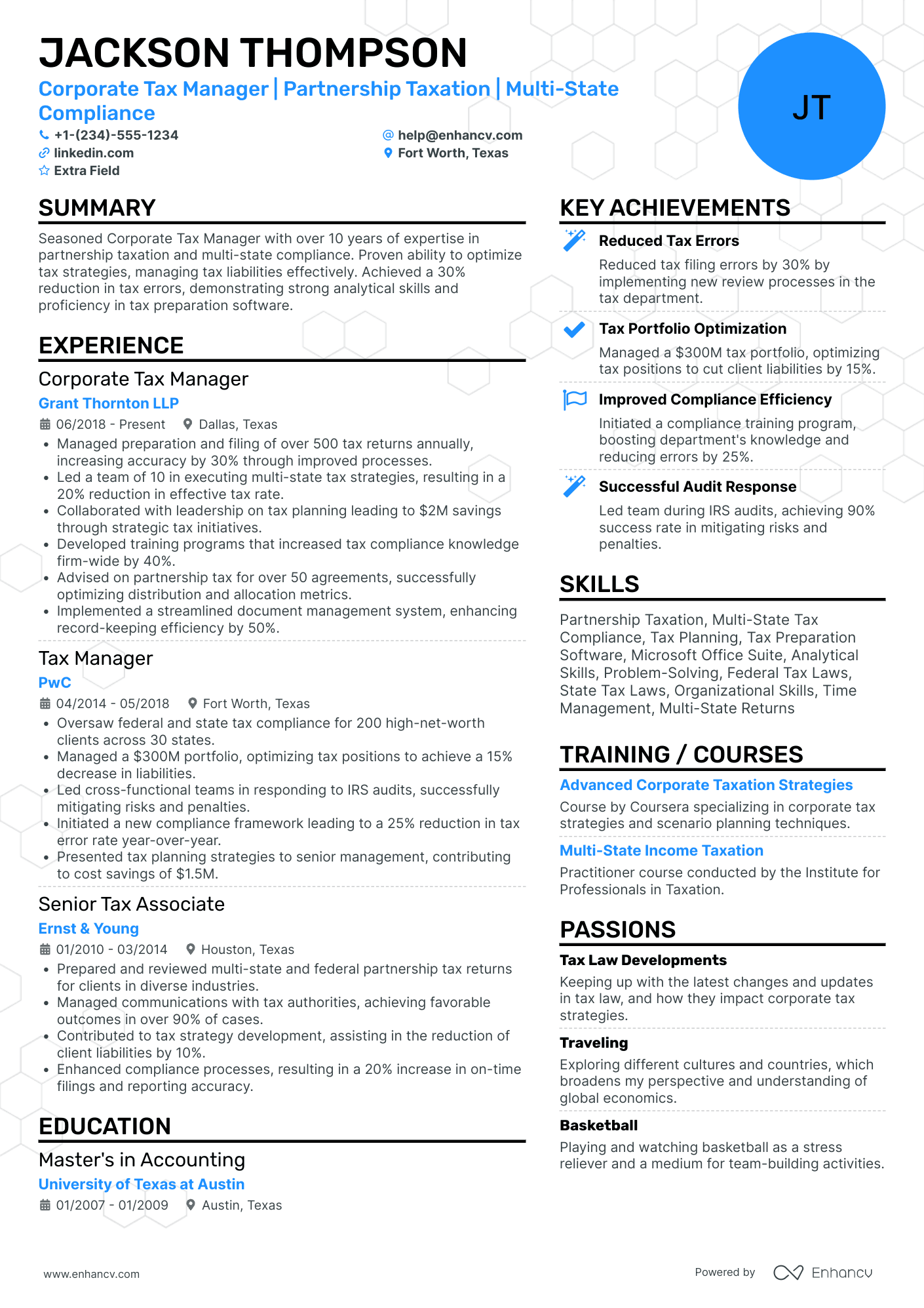

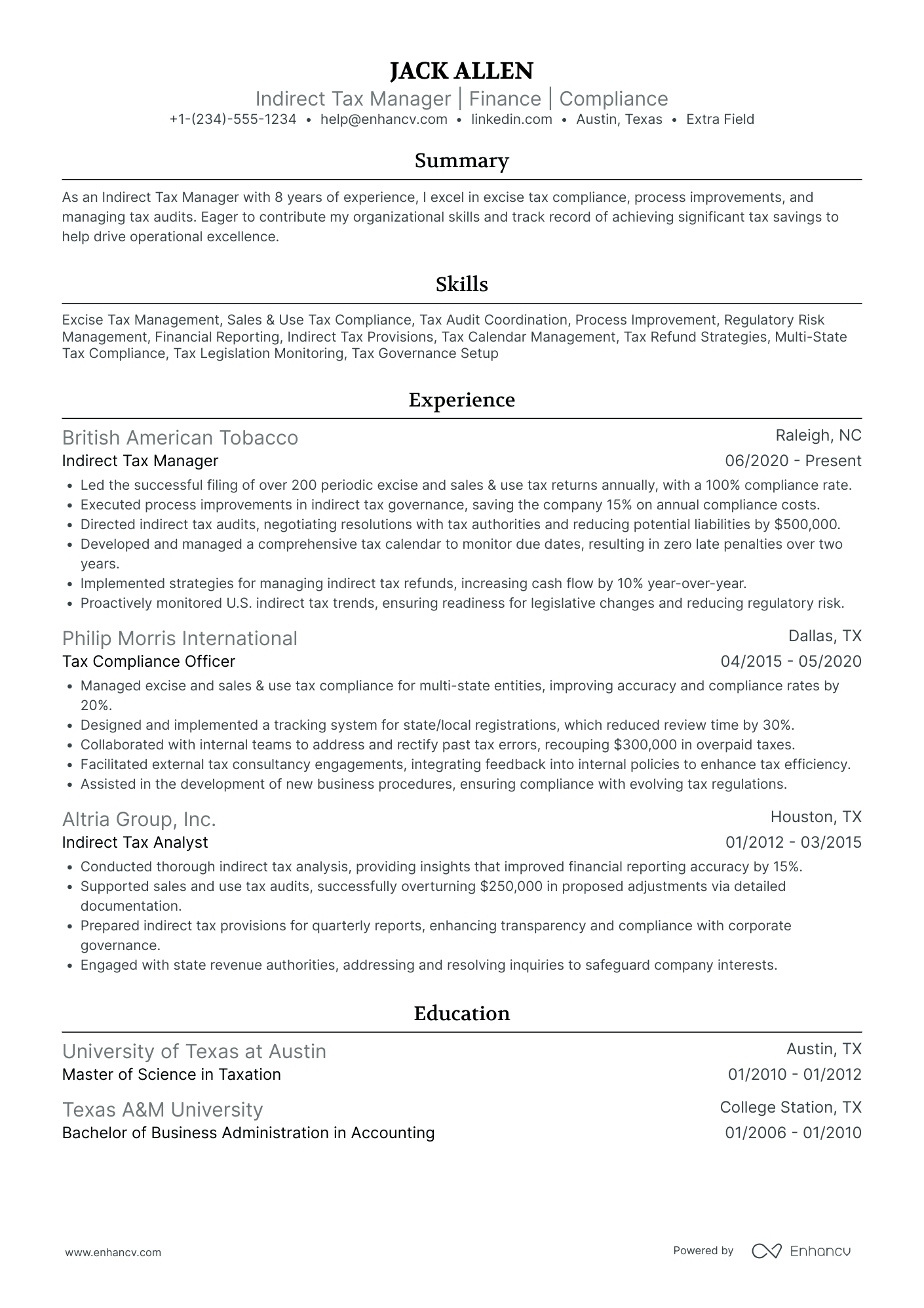

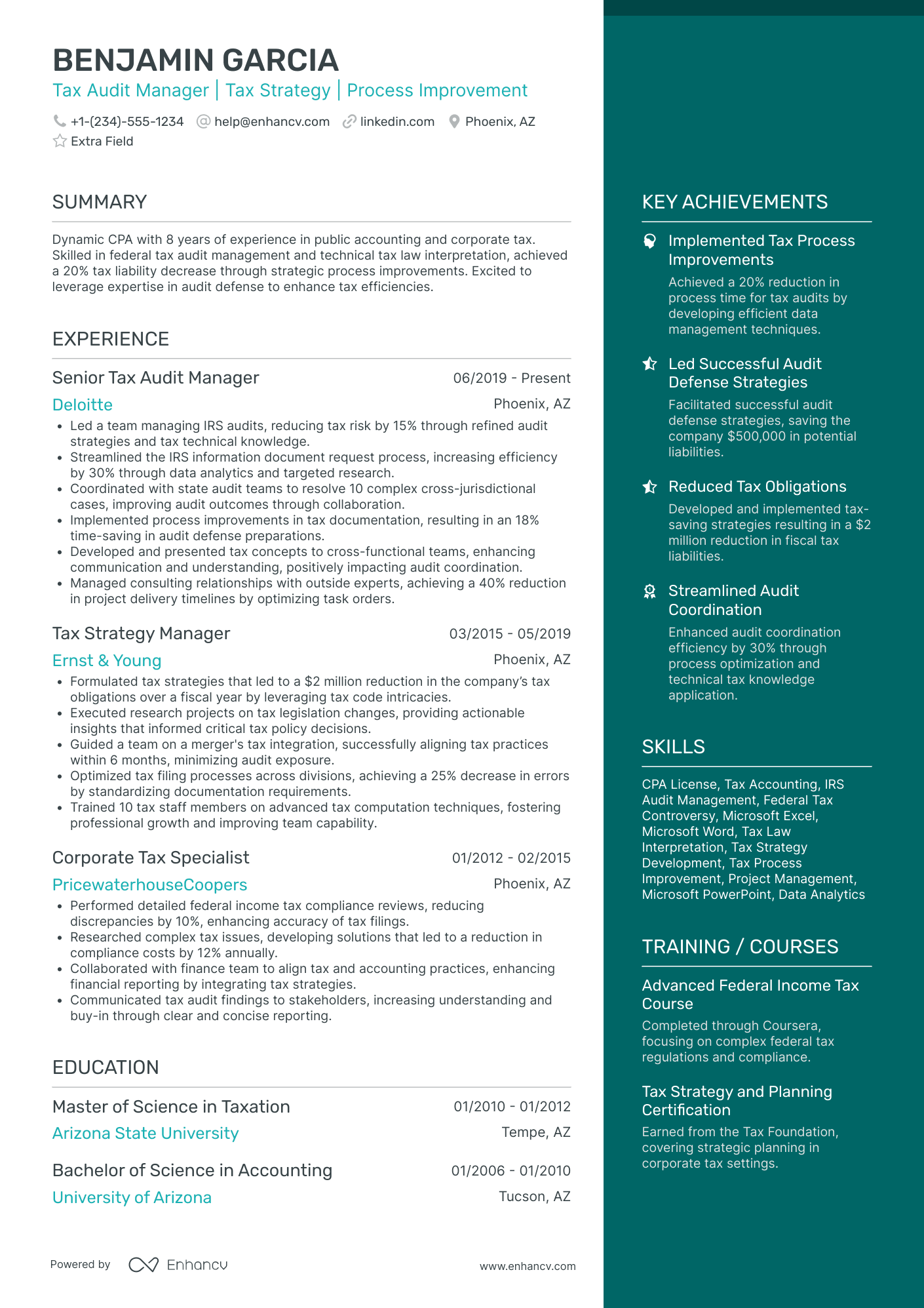

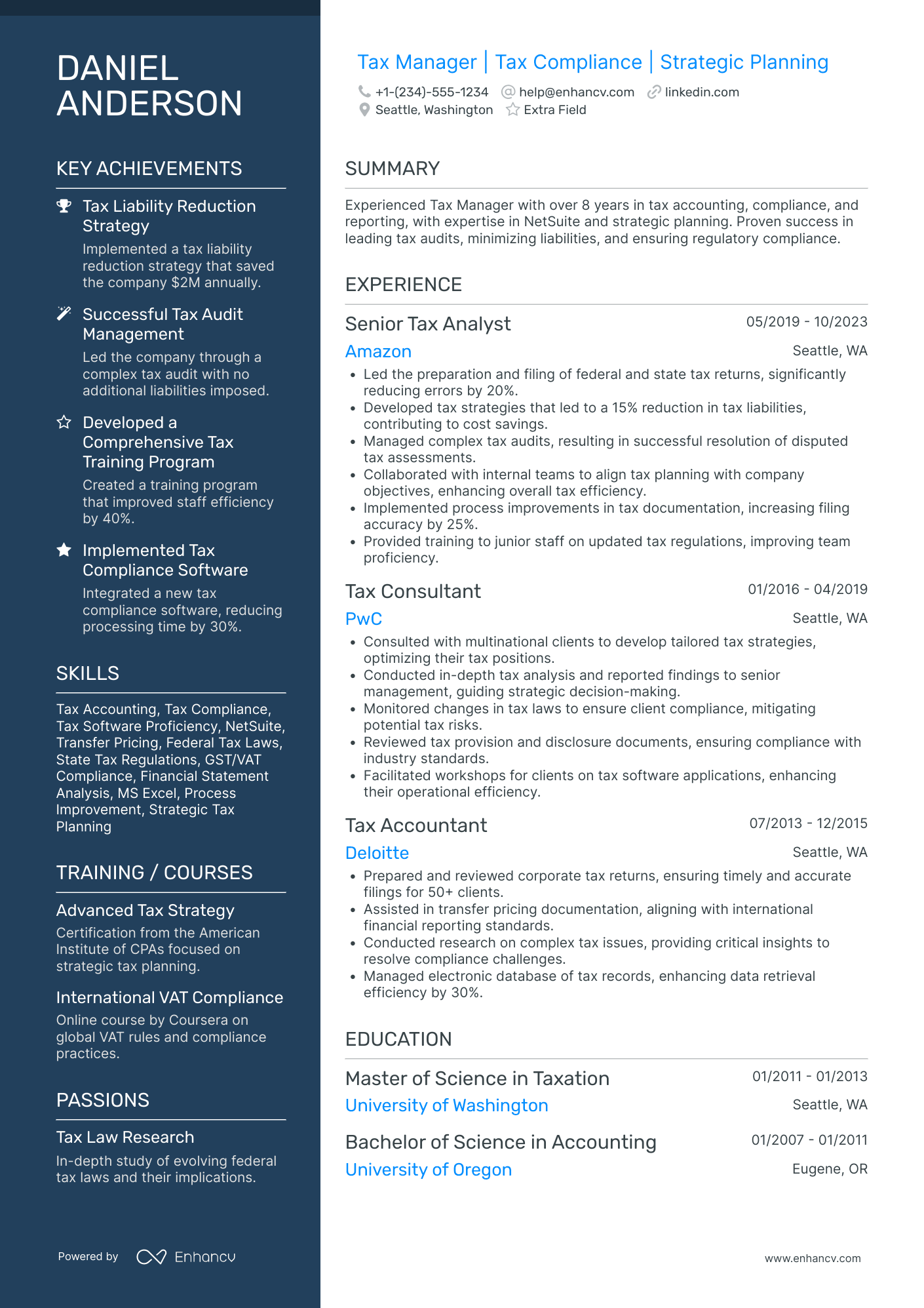

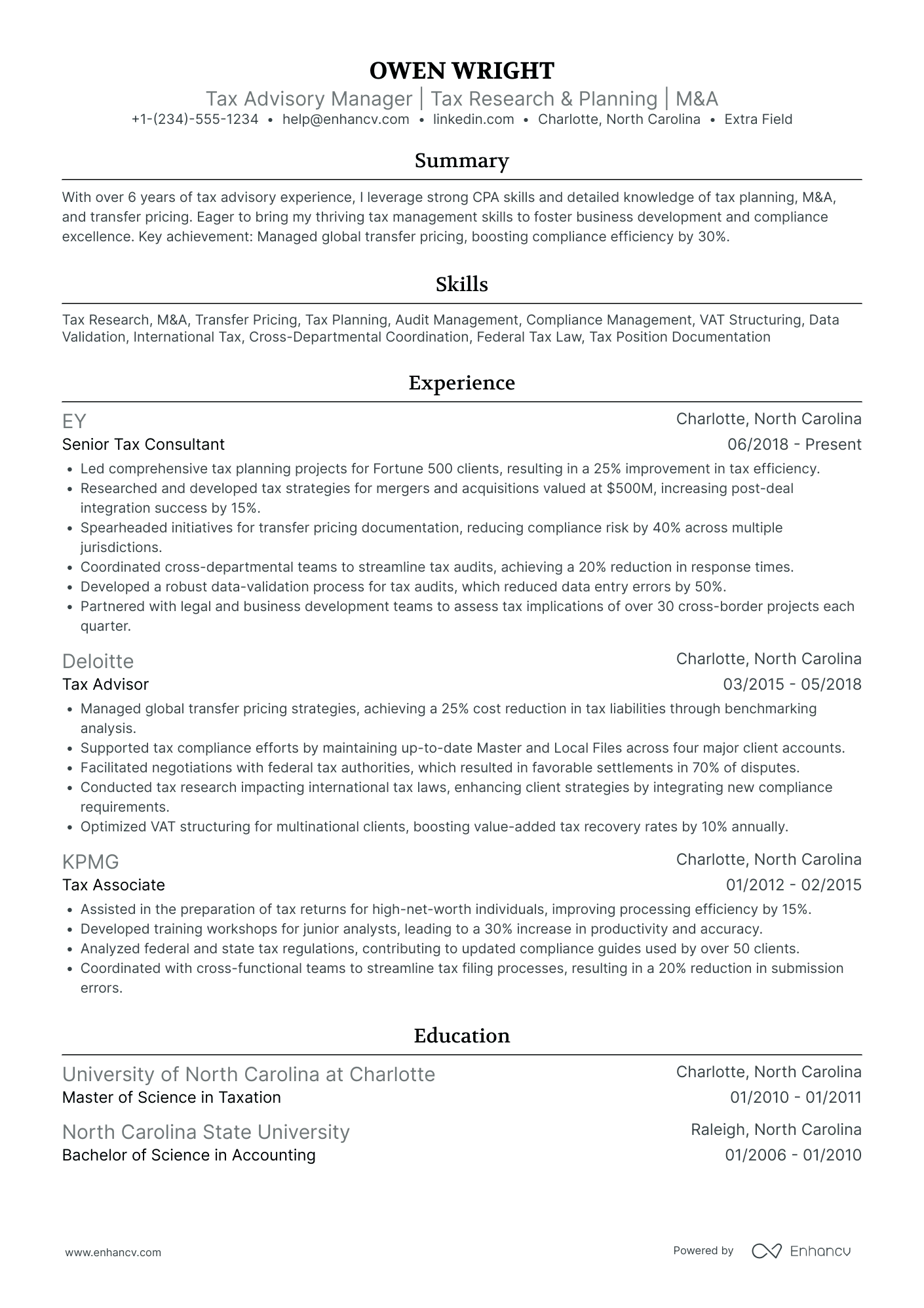

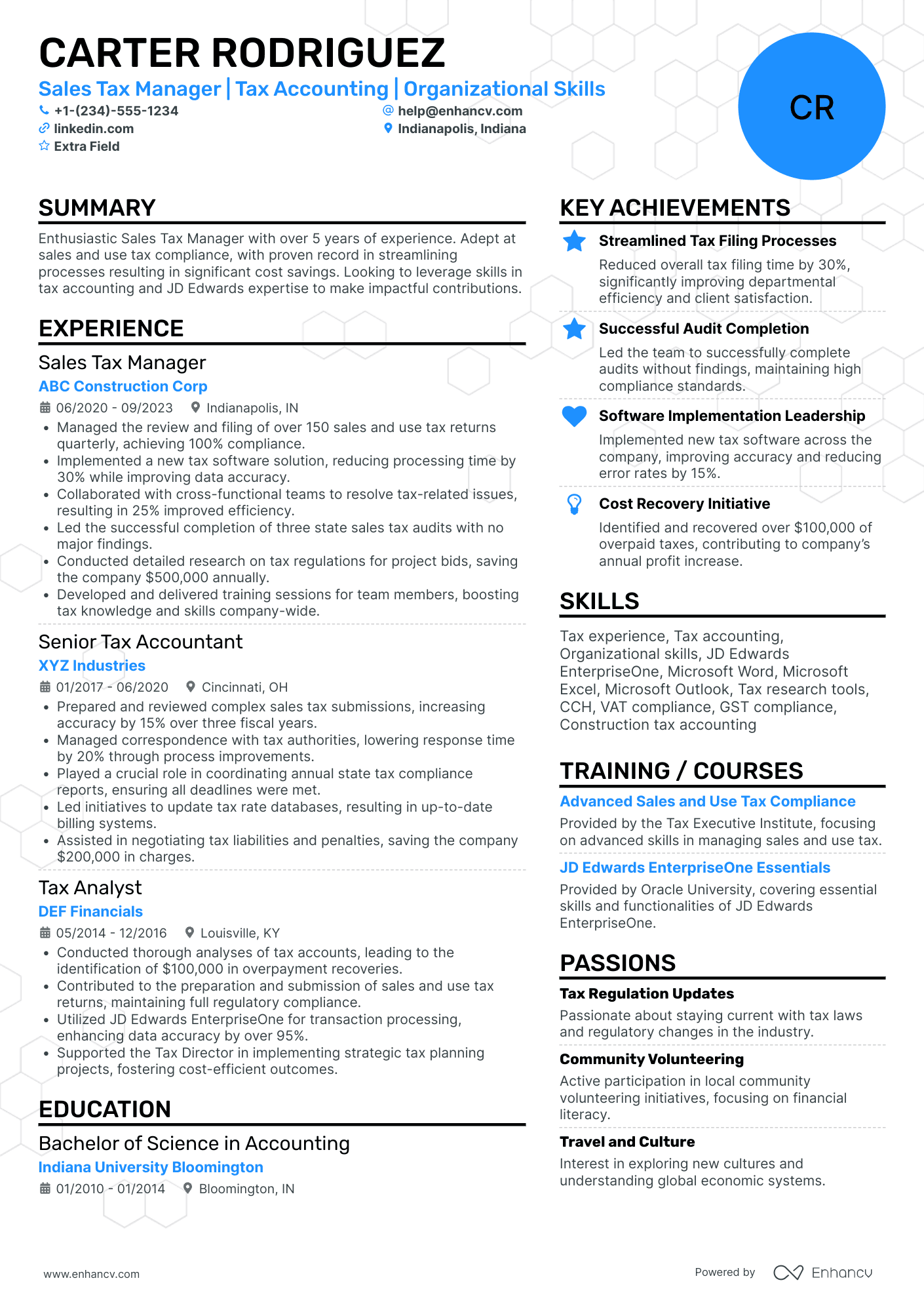

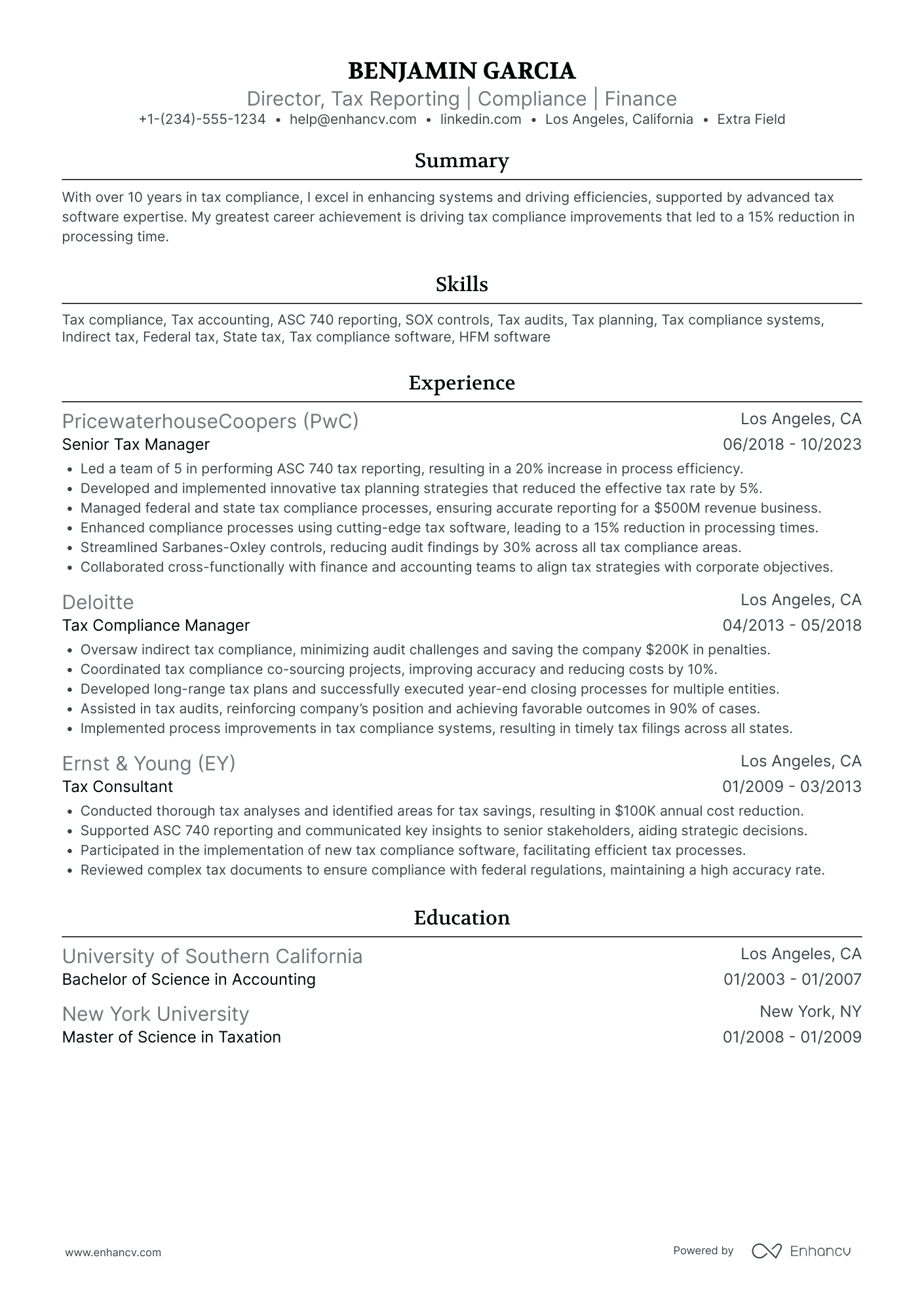

Tax Manager resume examples

By Experience

By Role