As a tax accountant, articulating your complex experience with tax laws and accounting principles in a clear and concise manner on a resume can be challenging. Our guide provides strategic tips and examples, ensuring you present your expertise effectively to potential employers.

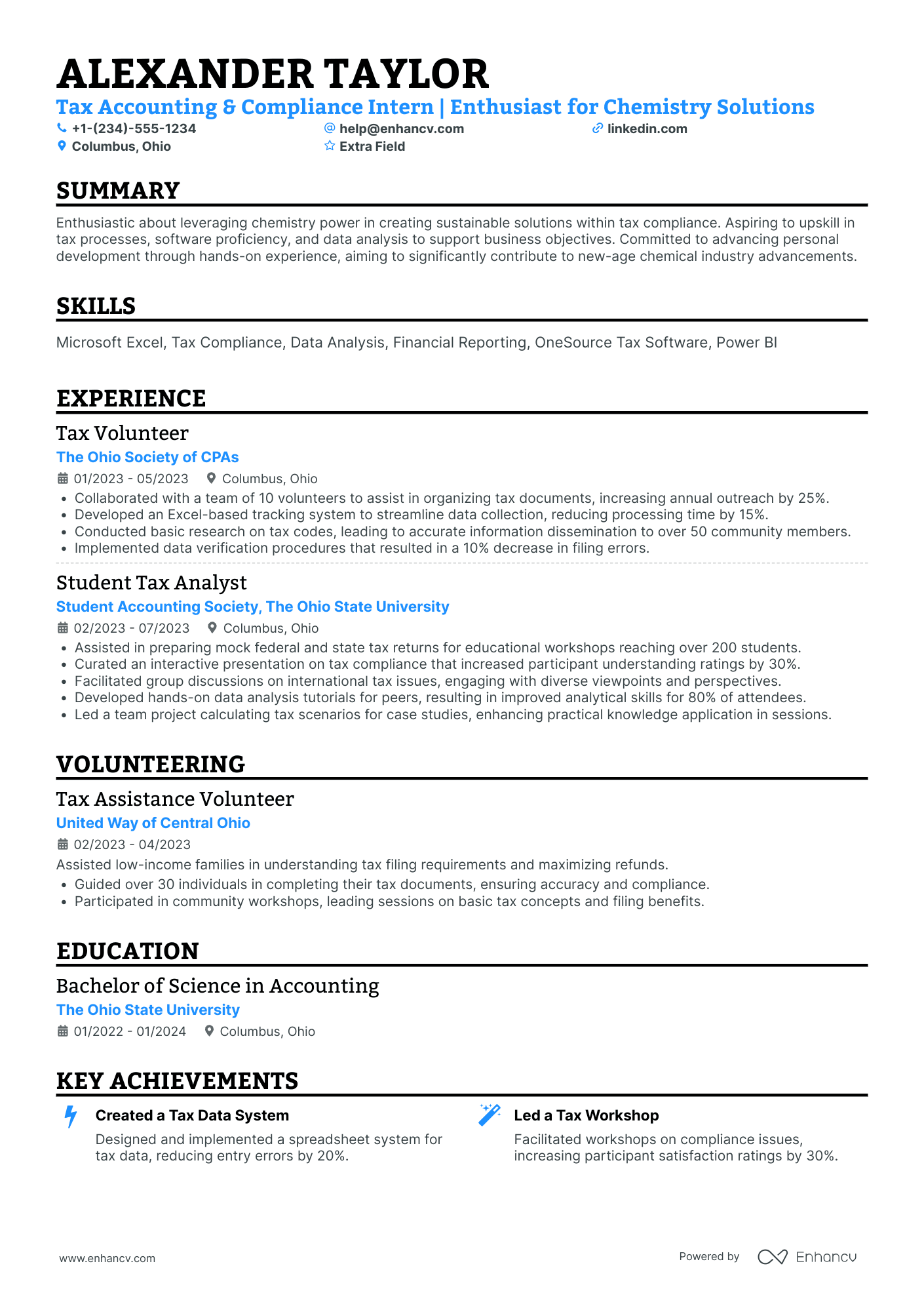

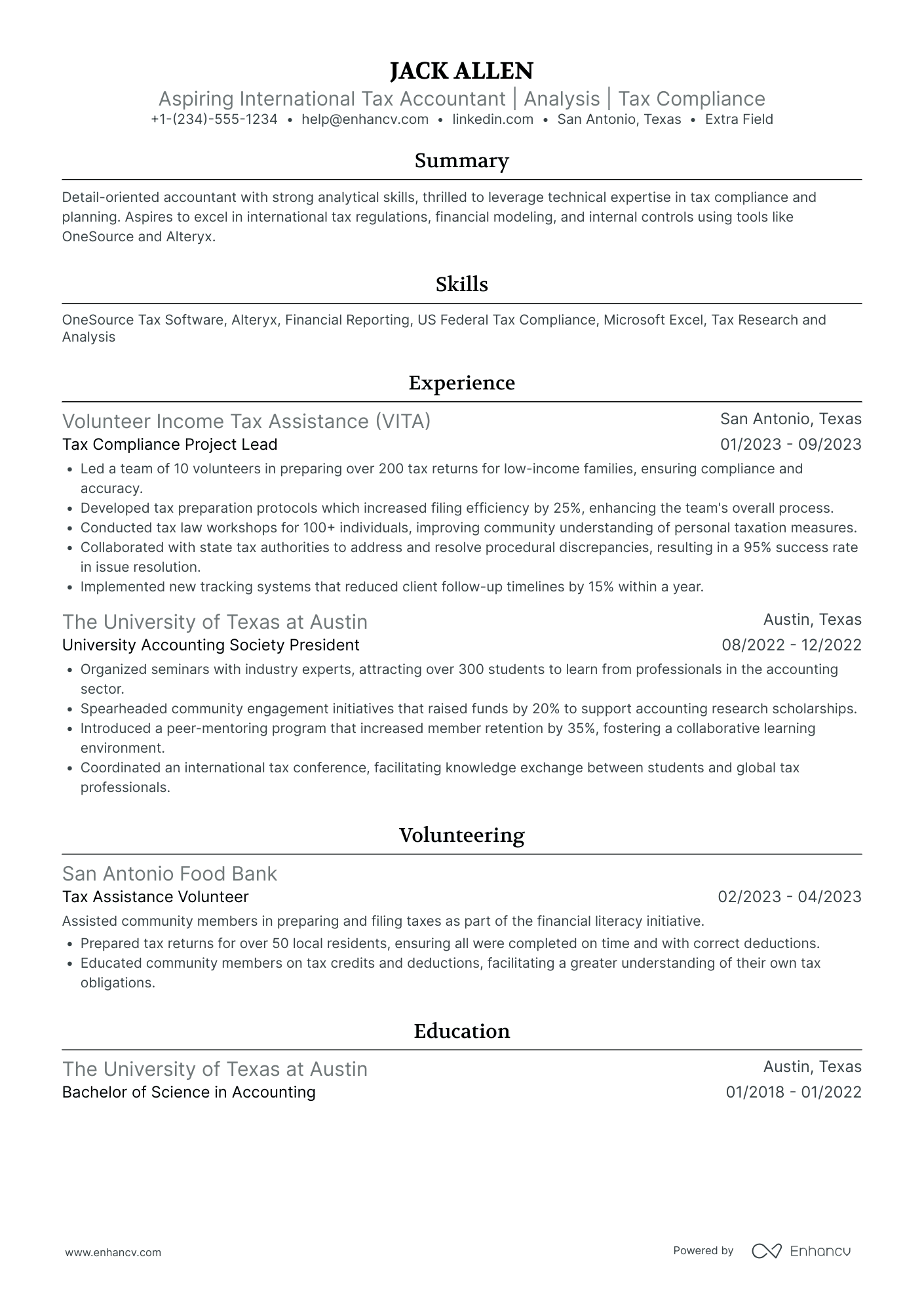

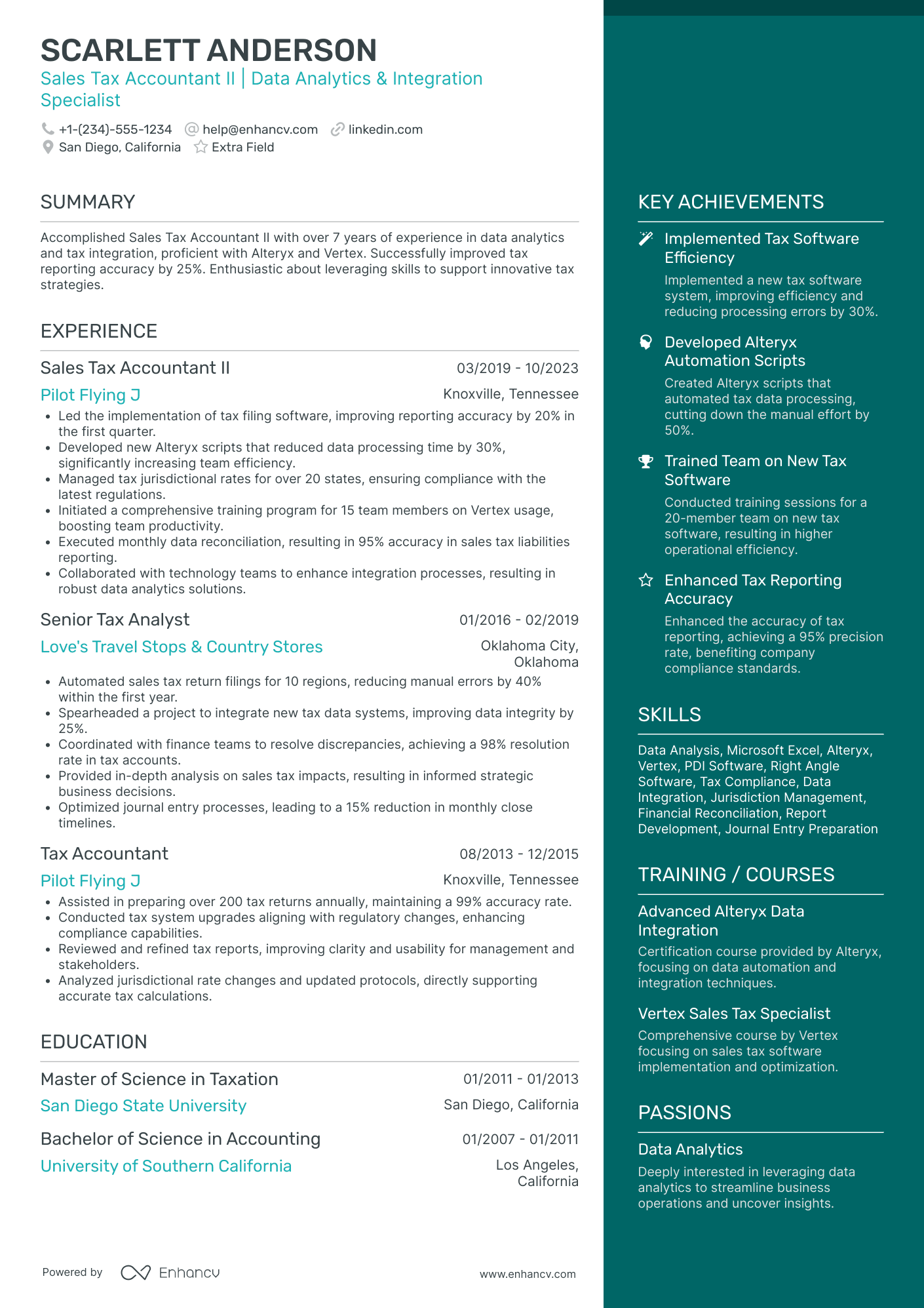

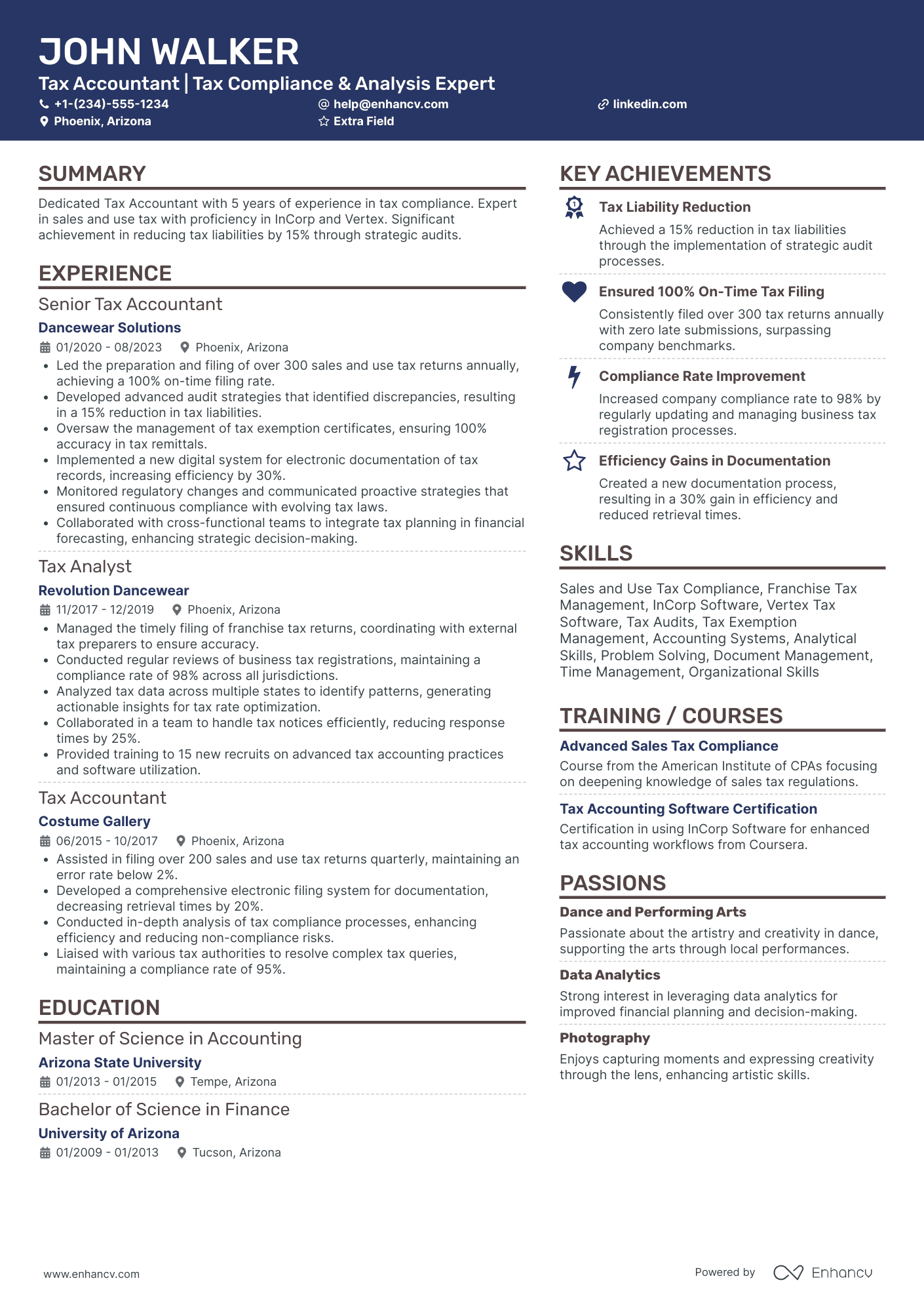

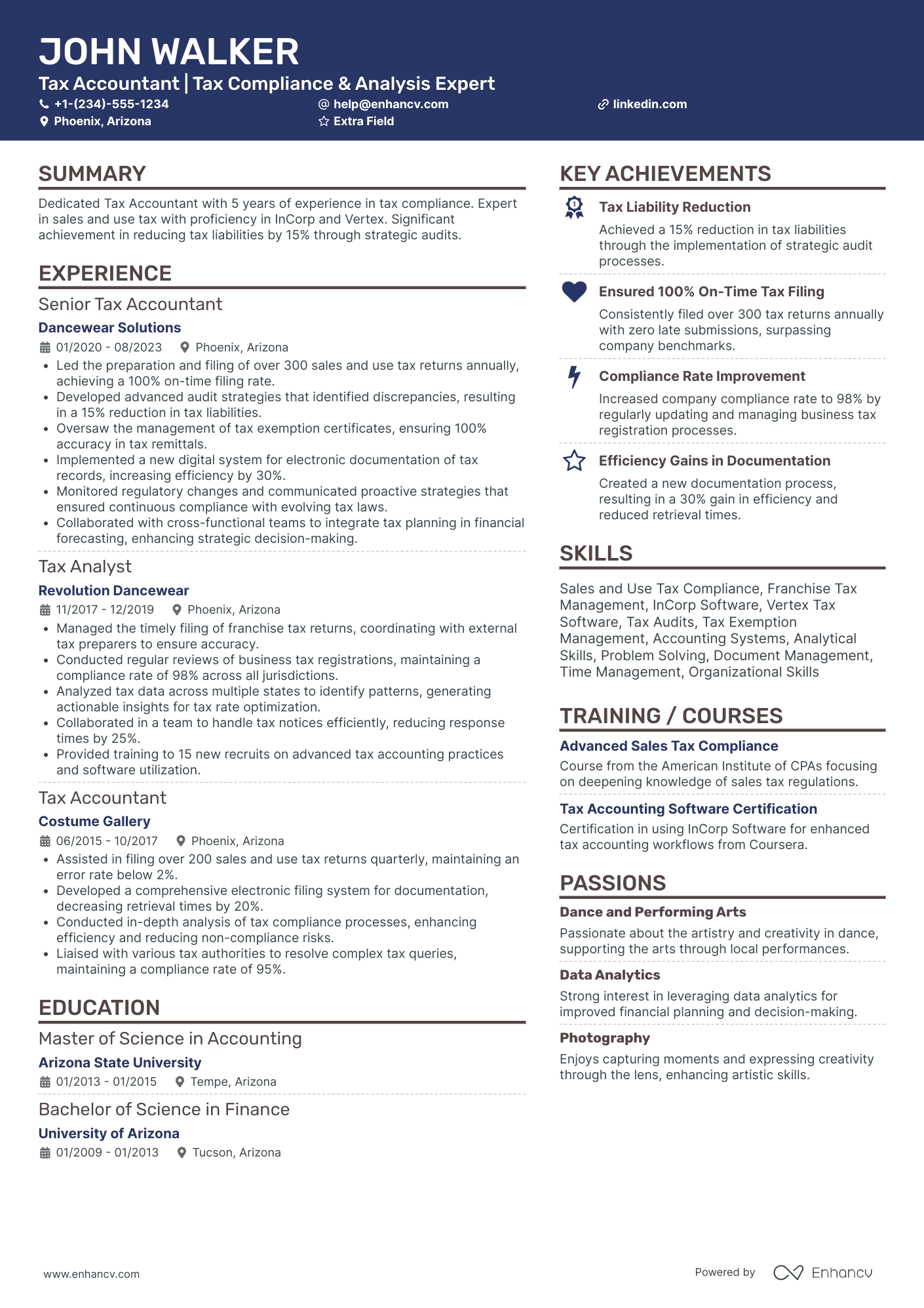

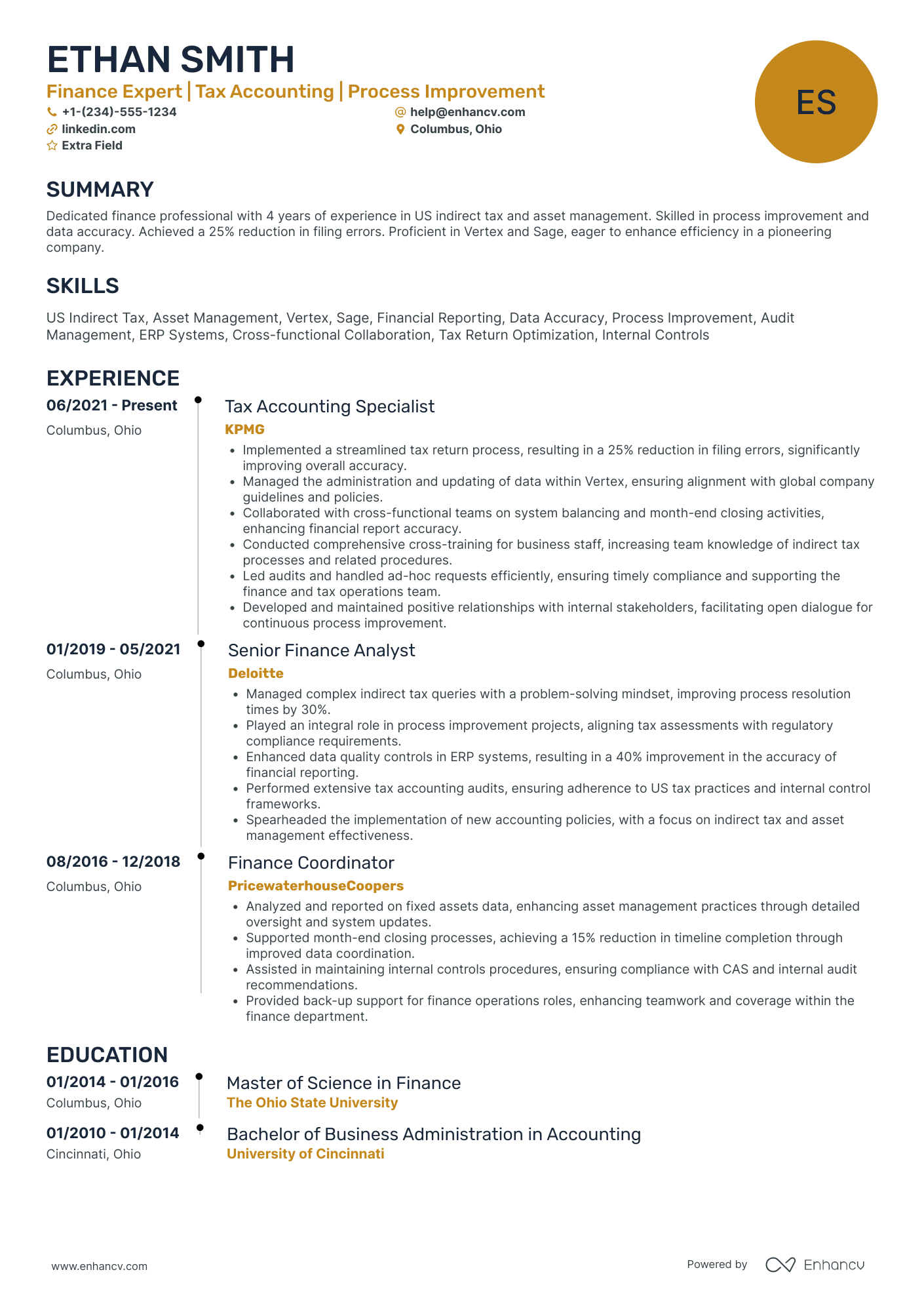

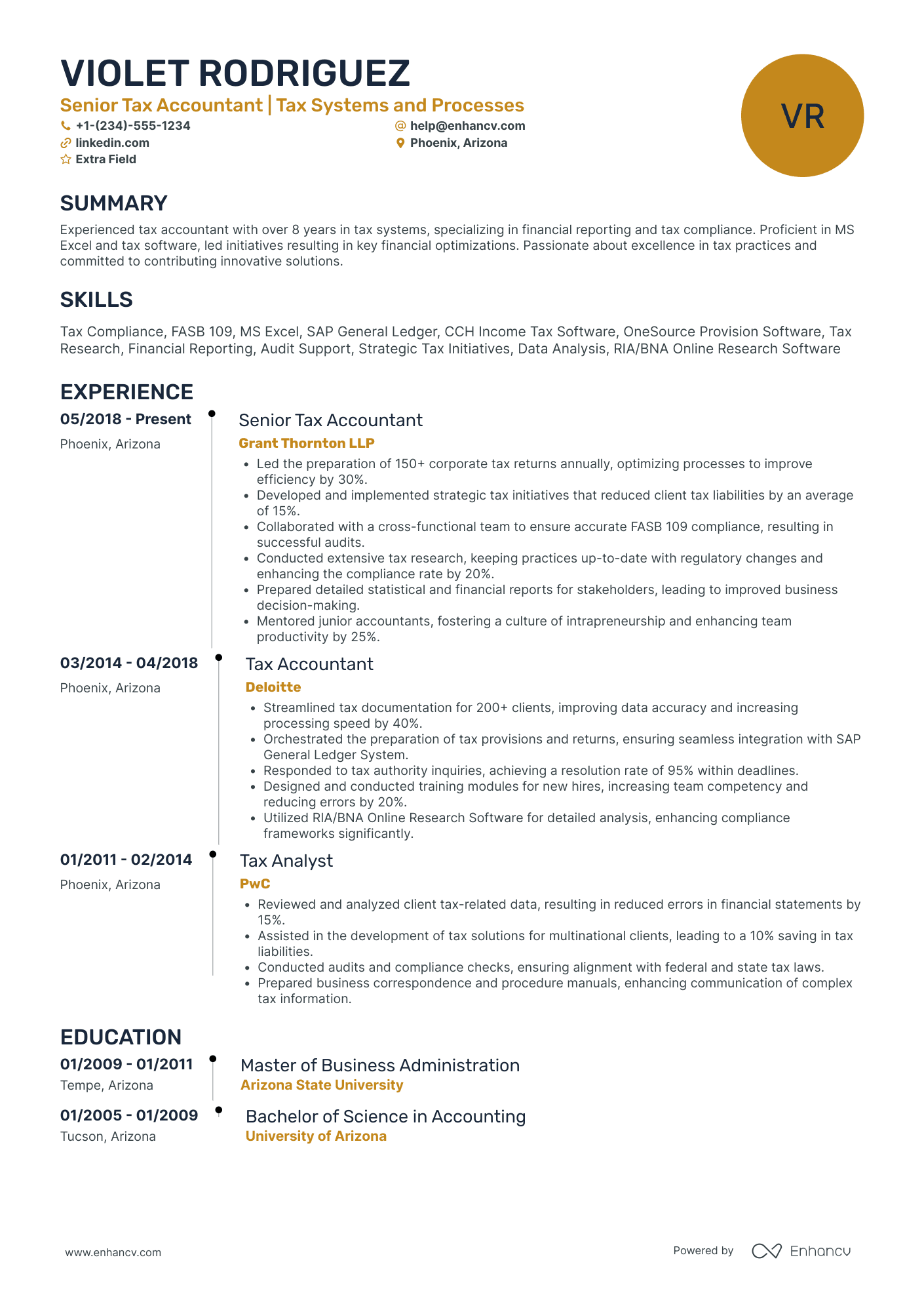

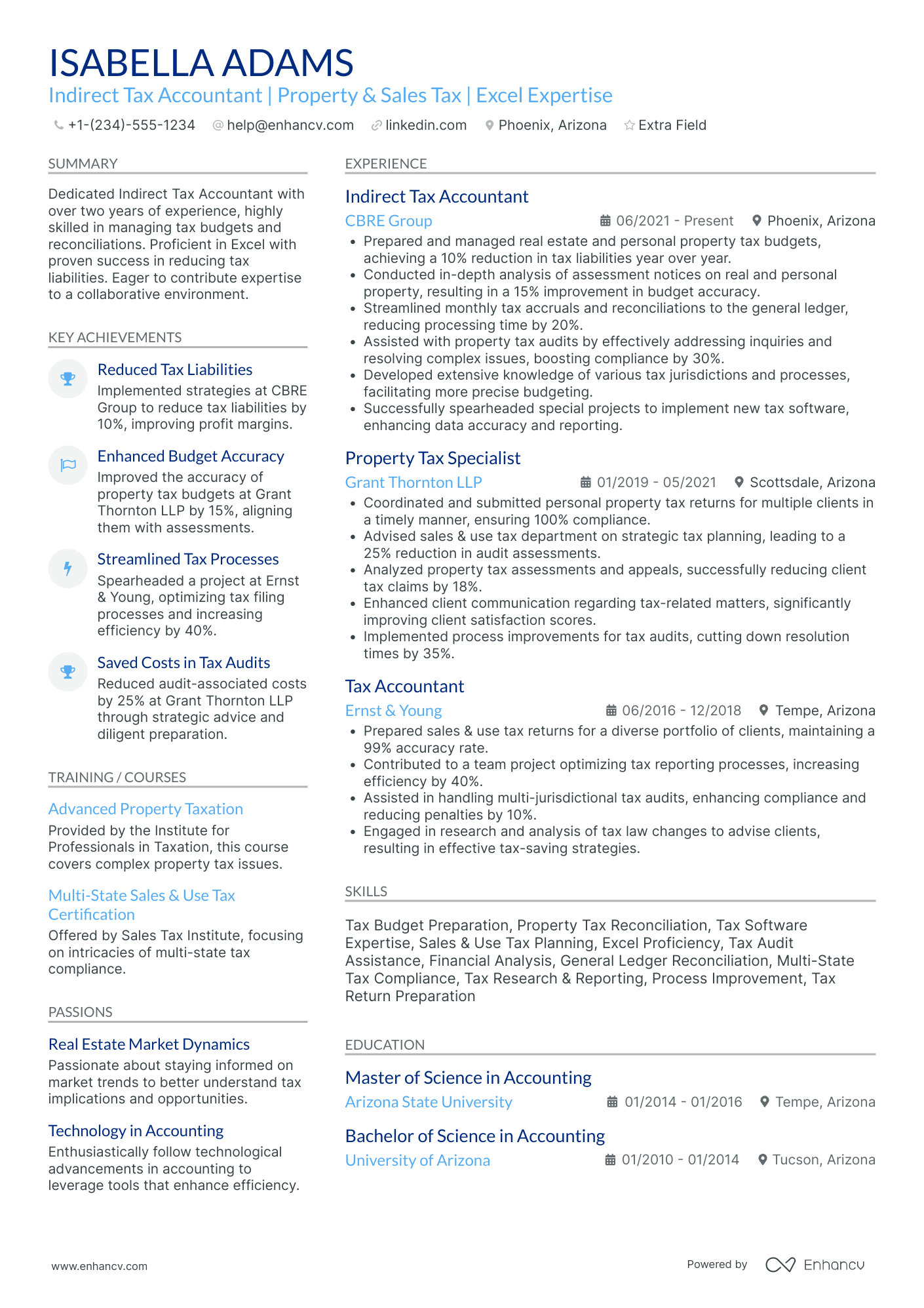

- Find different tax accountant resume examples to serve as inspiration to your professional presentation.

- How to use the summary or objective to highlight your career achievements.

- How to create the experience section to tell your story.

- Must have certificates and what to include in the education section of your resume.

If the tax accountant resume isn't the right one for you, take a look at other related guides we have:

Tax accountant resume format made simple

You don't need to go over the top when it comes to creativity in your tax accountant resume format .

What recruiters care about more is the legibility of your tax accountant resume, alongside the relevancy of your application to the role.

That's why we're presenting you with four simple steps that could help your professional presentation check all the right boxes:

- The reverse-chronological resume format is the one for you, if you happen to have plenty of relevant (and recent) professional experience you'd like to showcase. This format follows a pretty succinct logic and puts the focus on your experience.

- Keep your header simple with your contact details; a headline that details the role you're applying for or your current job; and a link to your portfolio.

- Ensure your resume reaches an up-to-two-page limit, only if you happen to be applying for a more senior role or you have over a decade of relevant experience.

- Save your tax accountant resume as a PDF to retain its structure and presentation.

Each market has its own resume standards – a Canadian resume layout may differ, for example.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Essential sections that should make up your tax accountant resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the tax accountant role

What recruiters want to see on your resume:

- Proficiency in tax preparation software (e.g., Intuit ProConnect, Drake Software, or ATX Tax)

- Demonstrated knowledge of tax regulations and compliance guidelines specific to the region or country

- Experience with tax research and the ability to provide tax planning and advisory services

- Detail-oriented with a high degree of accuracy in preparing and filing tax documents

- Relevant certifications such as Certified Public Accountant (CPA) or Enrolled Agent (EA)

Writing your tax accountant resume experience

Within the body of your tax accountant resume is perhaps one of the most important sections - the resume experience one. Here are five quick tips on how to curate your tax accountant professional experience:

- Include your expertise that aligns to the job requirements;

- Always ensure that you qualify your achievements by including a skill, what you did, and the results your responsibility led to;

- When writing each experience bullet, ensure you're using active language;

- If you can include a personal skill you've grown, thanks to your experience, this would help you stand out;

- Be specific about your professional experience - it's not enough that you can "communicate", but rather what's your communication track record?

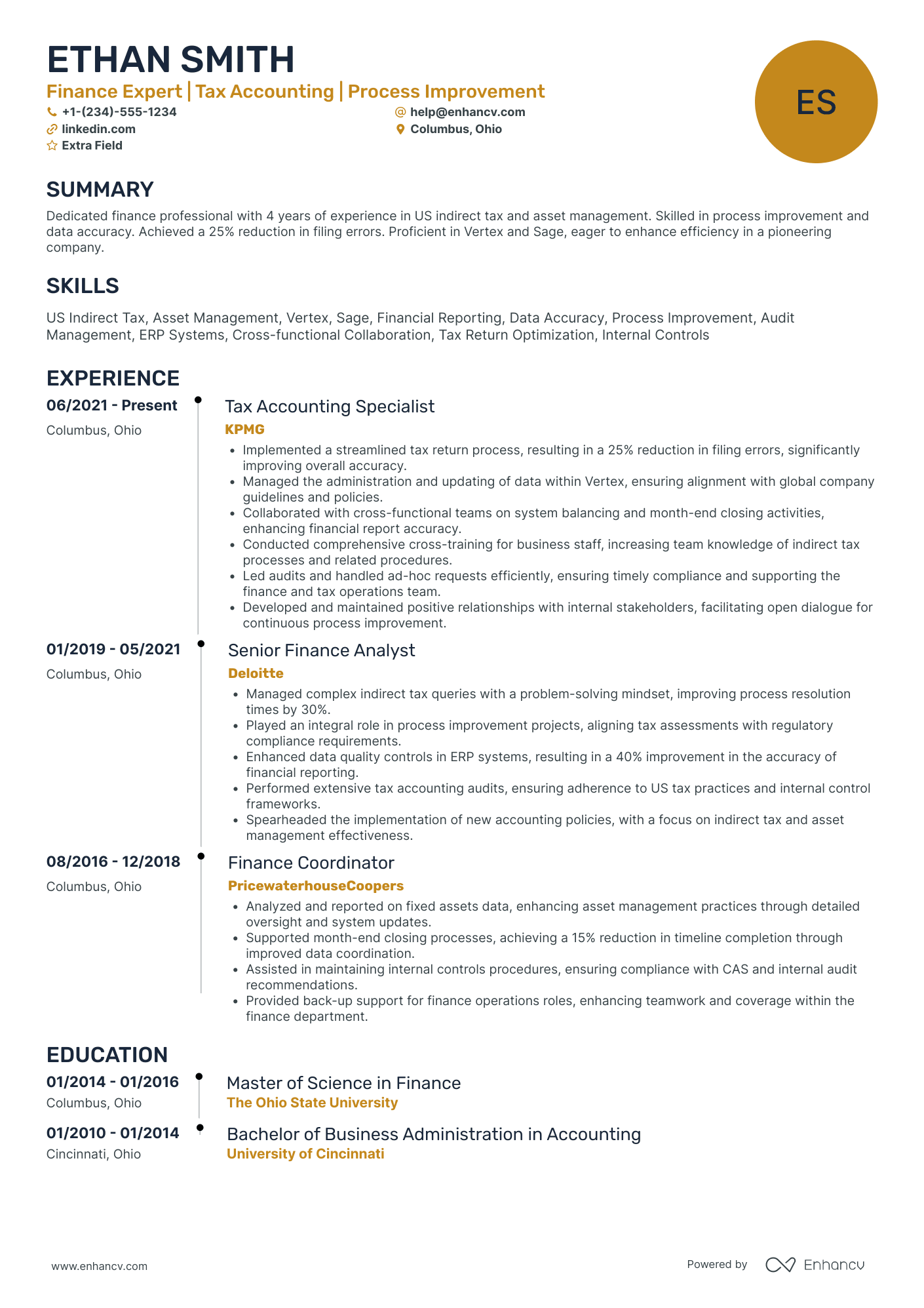

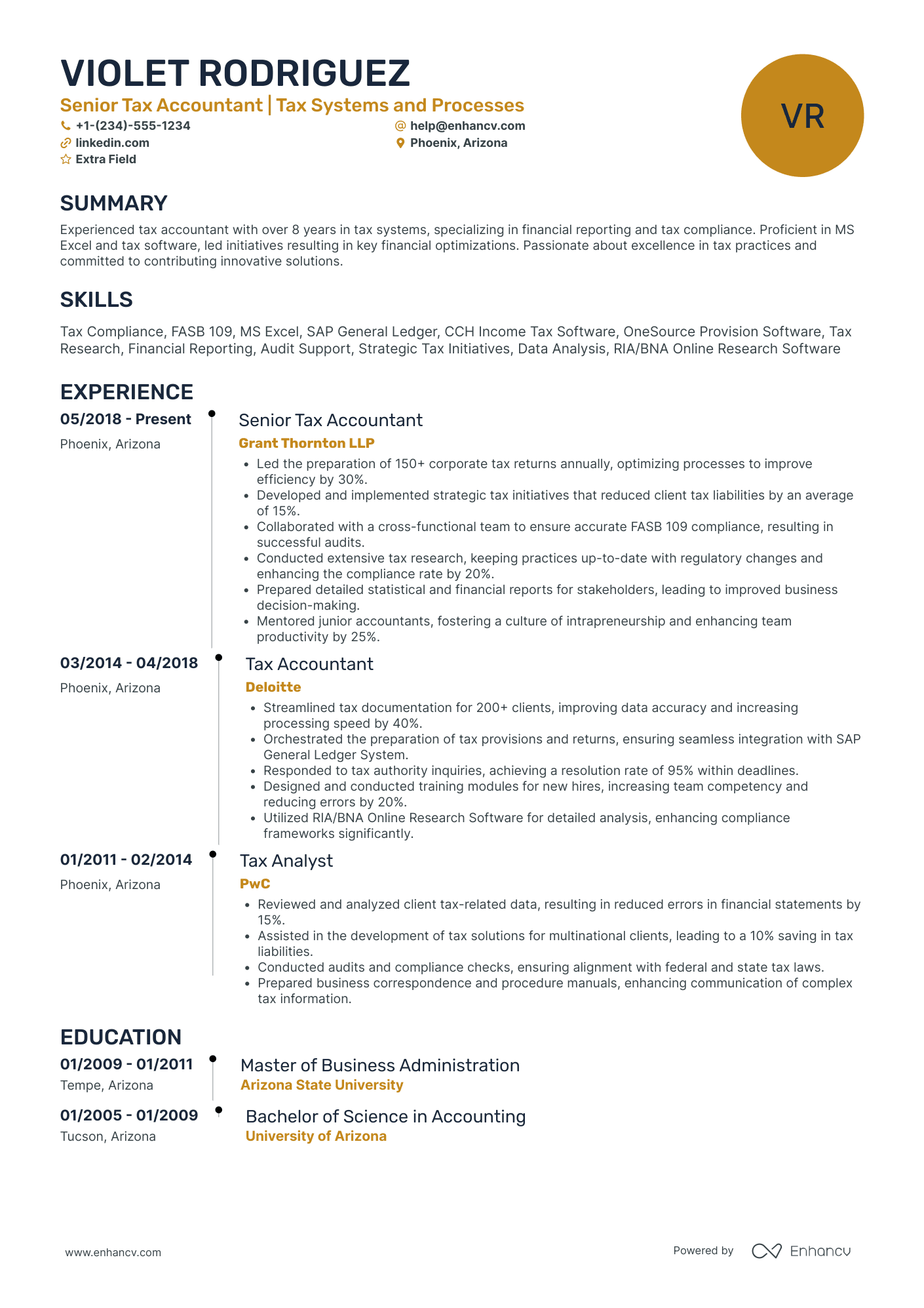

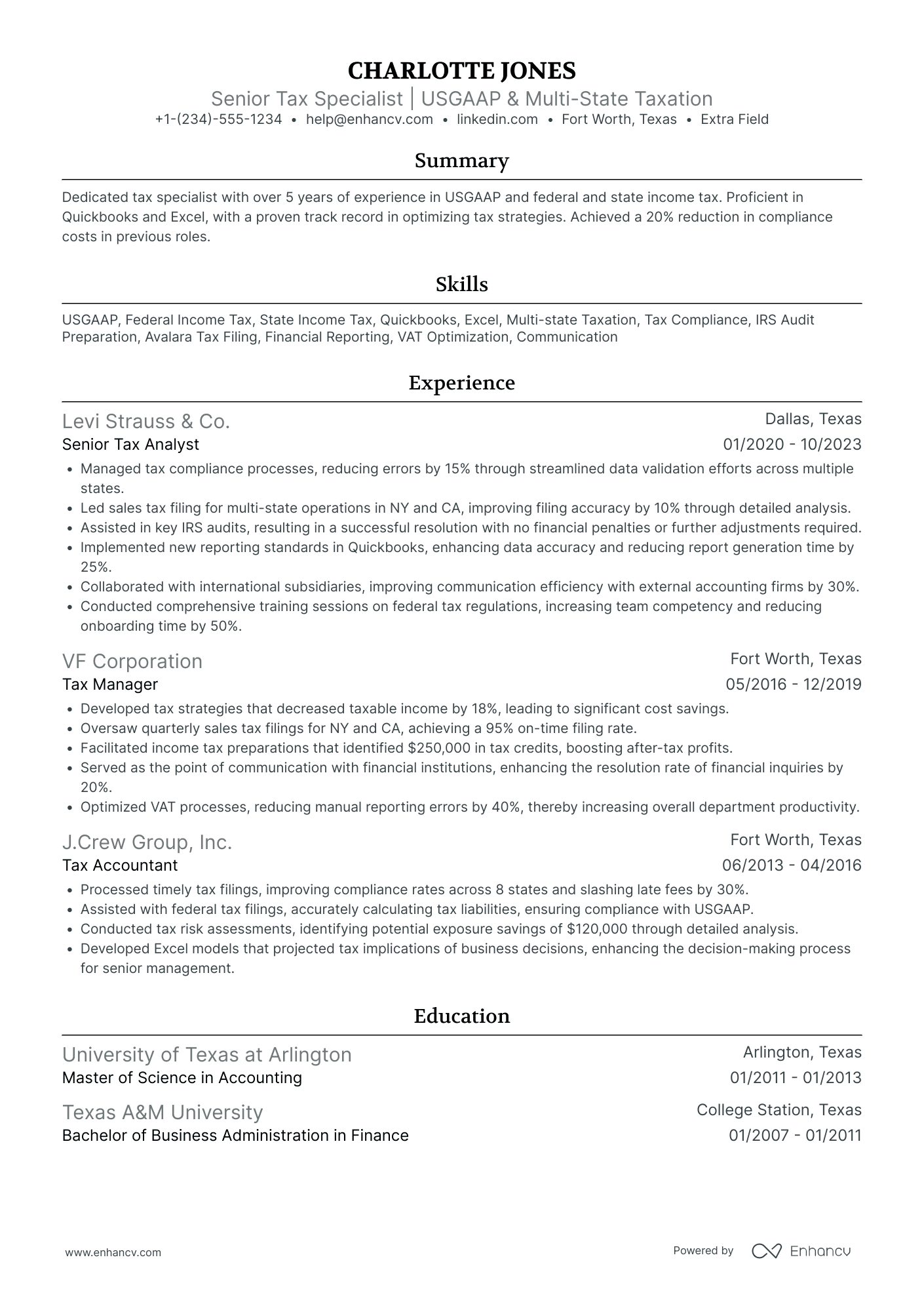

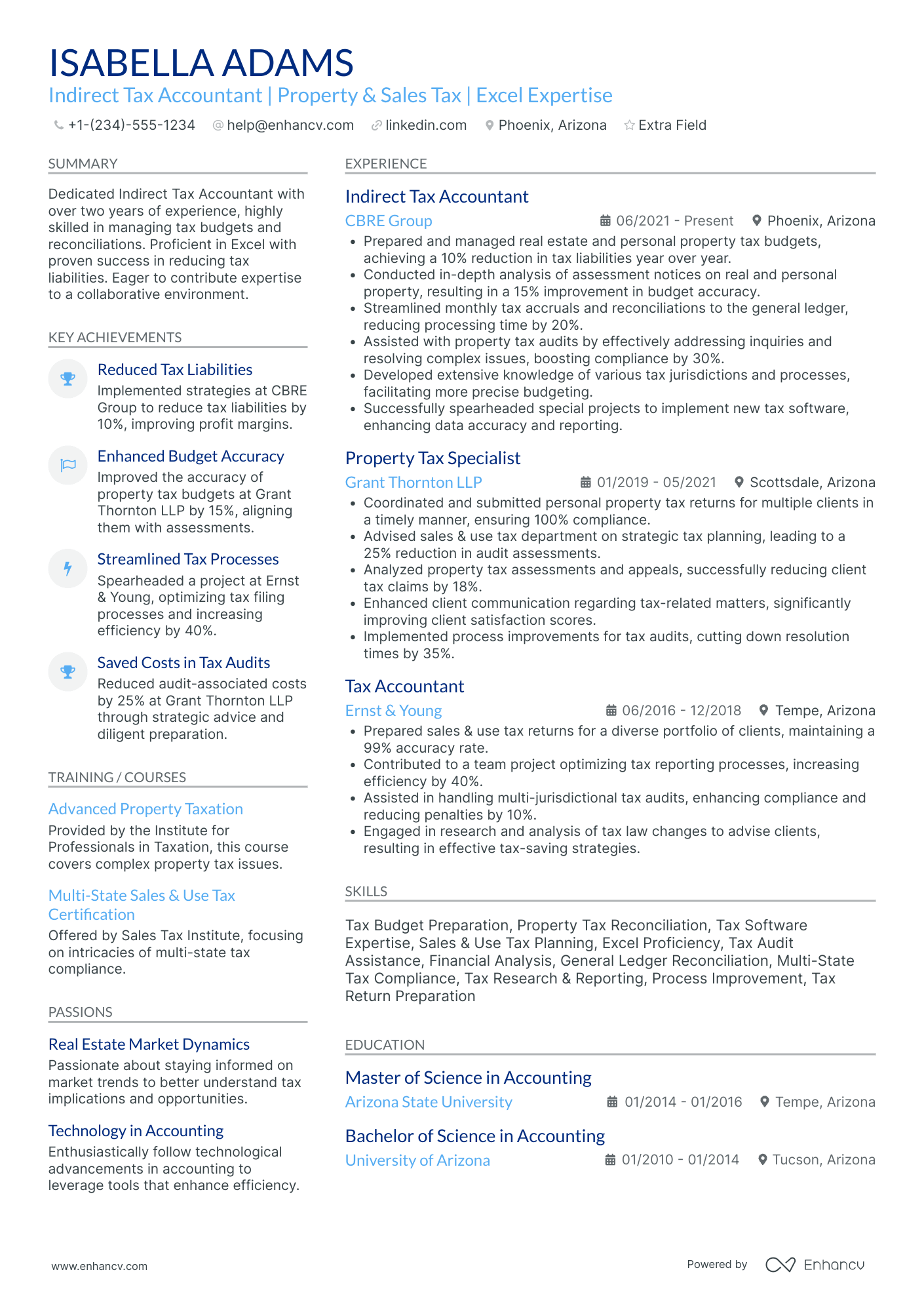

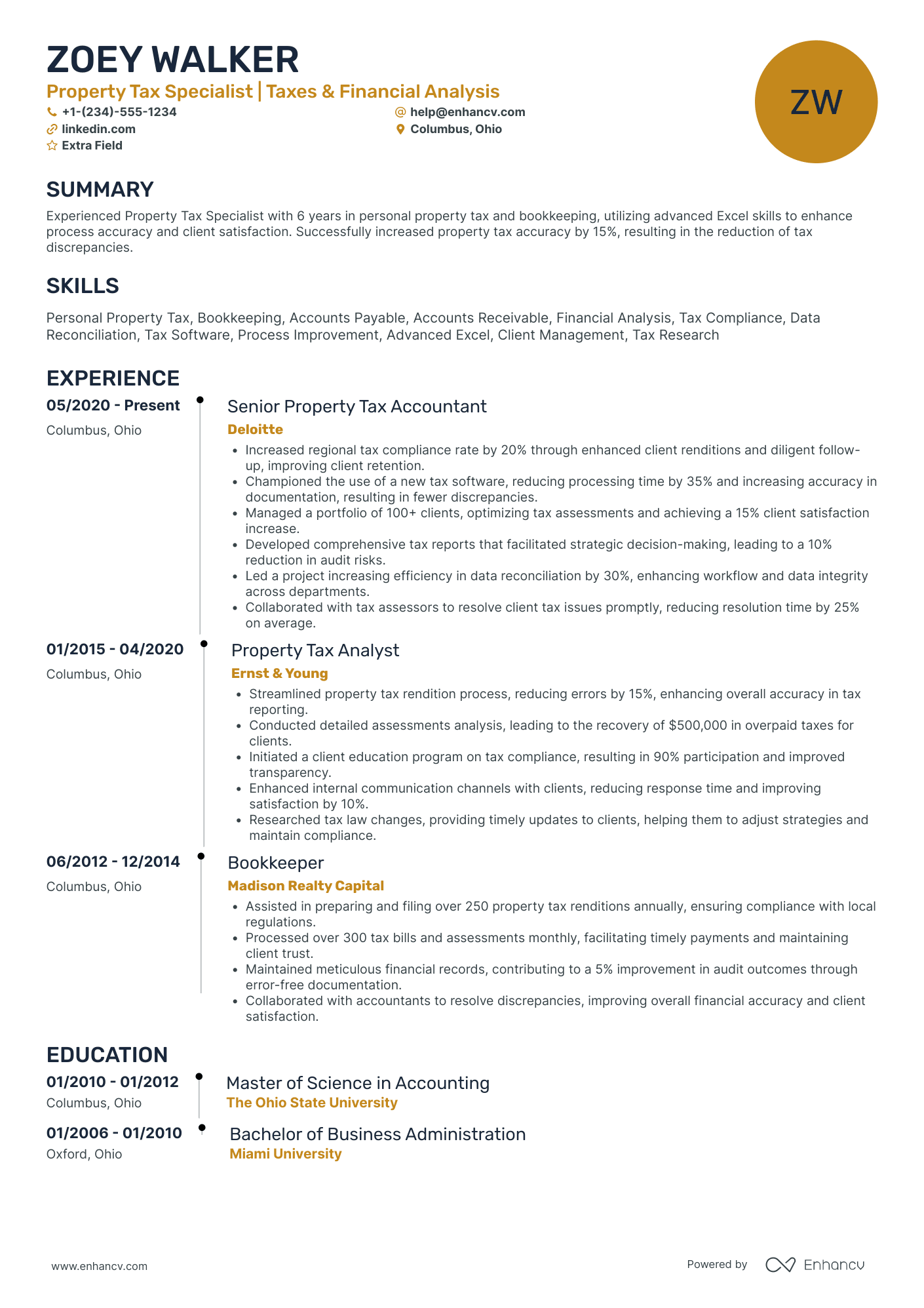

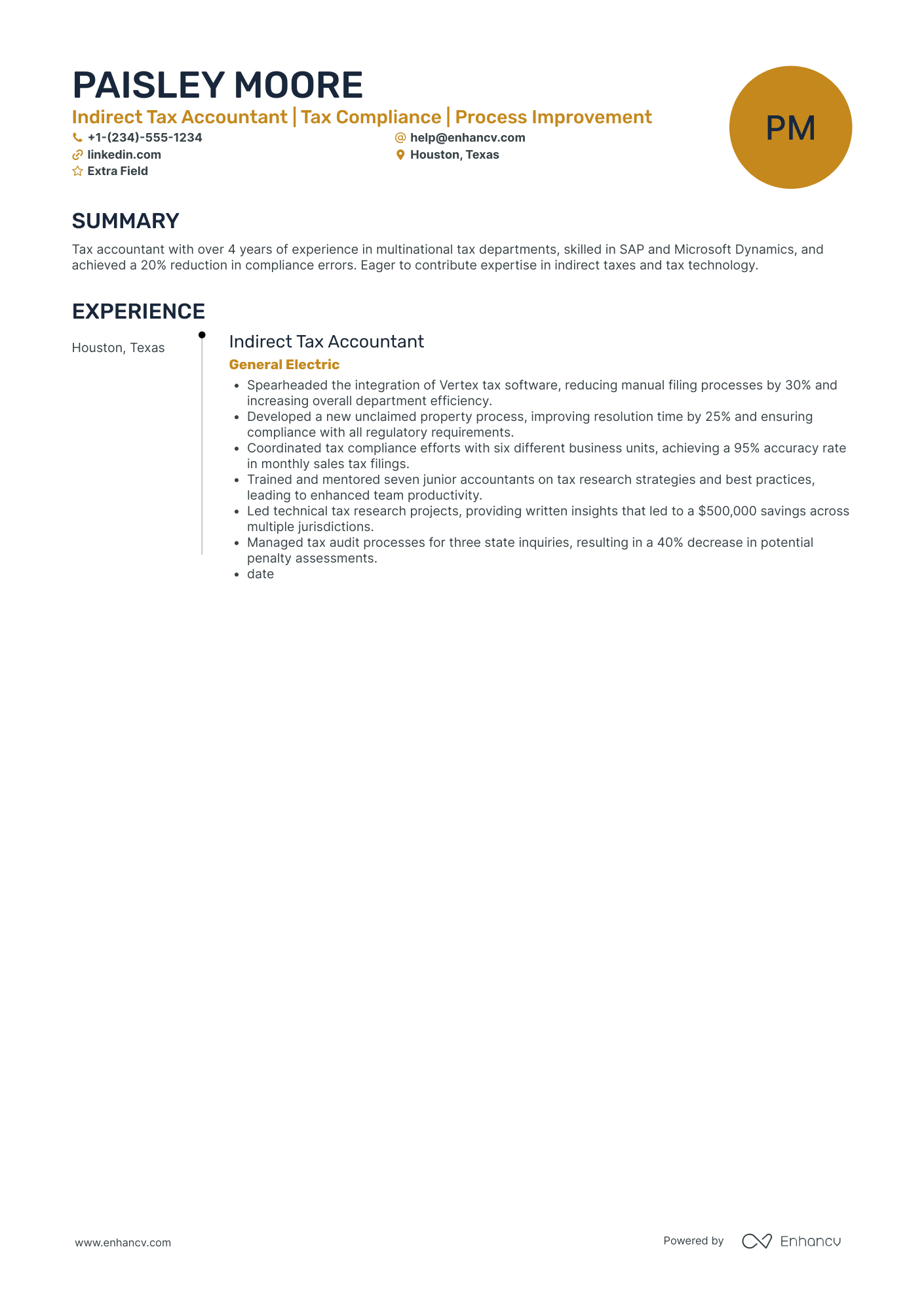

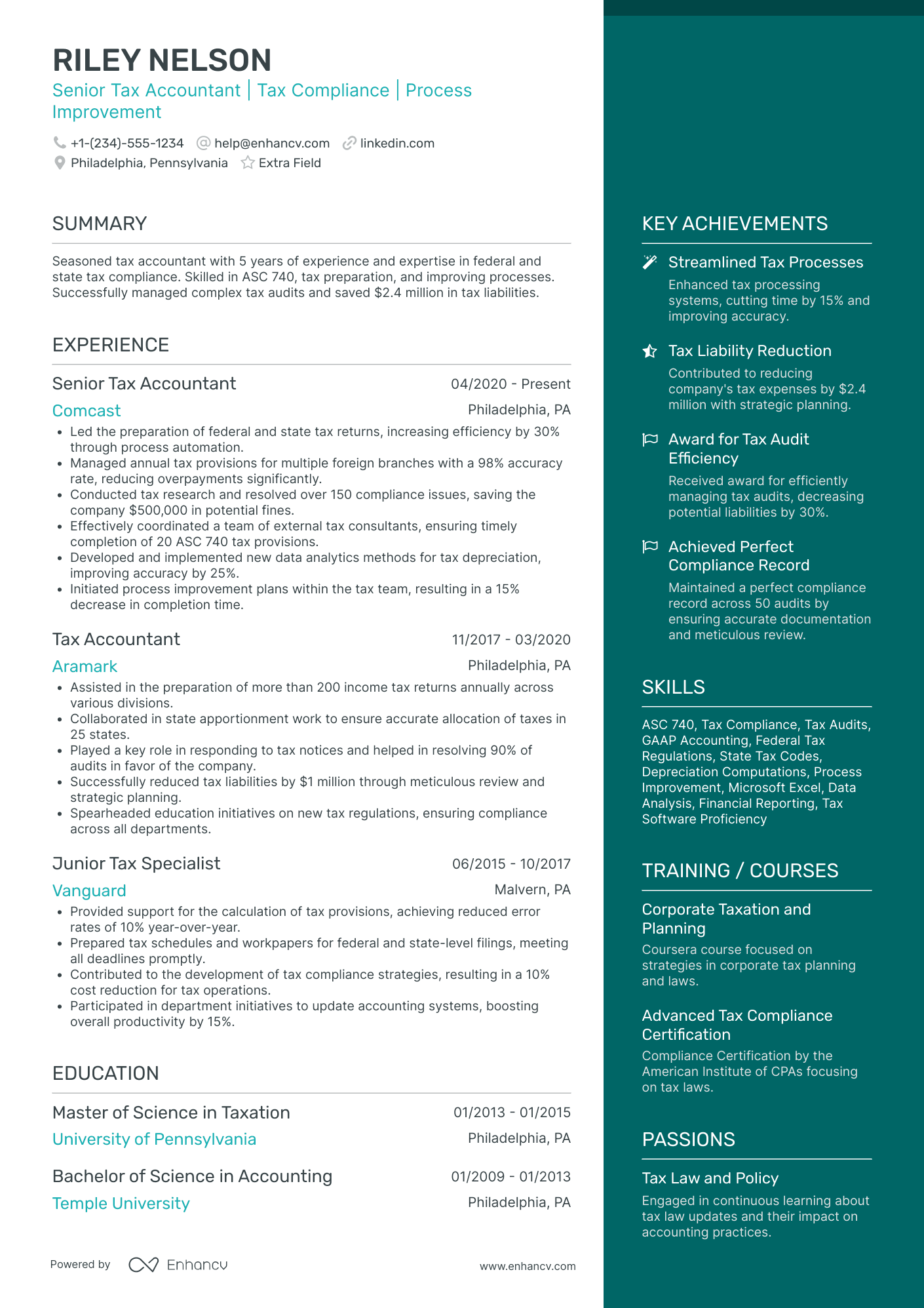

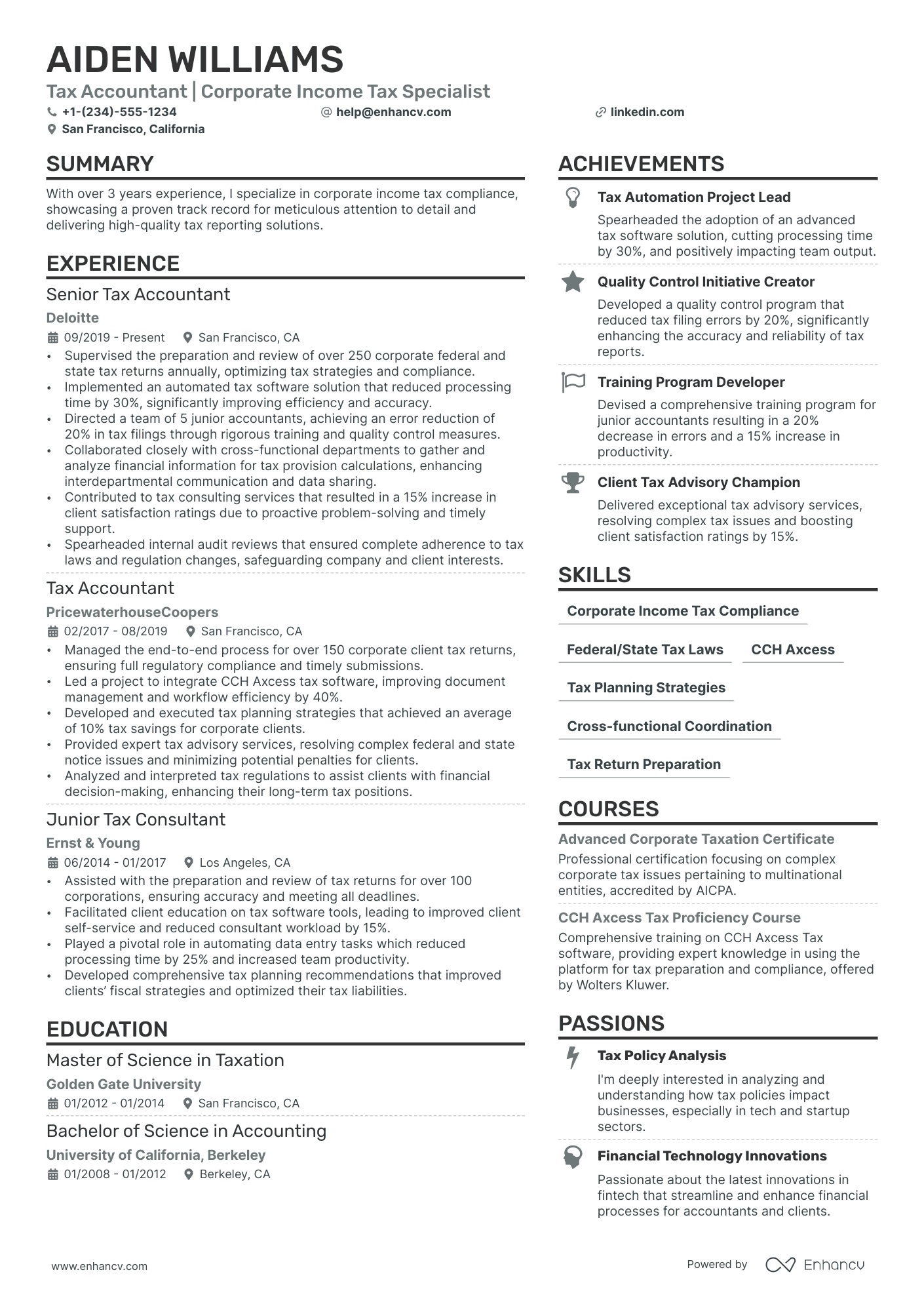

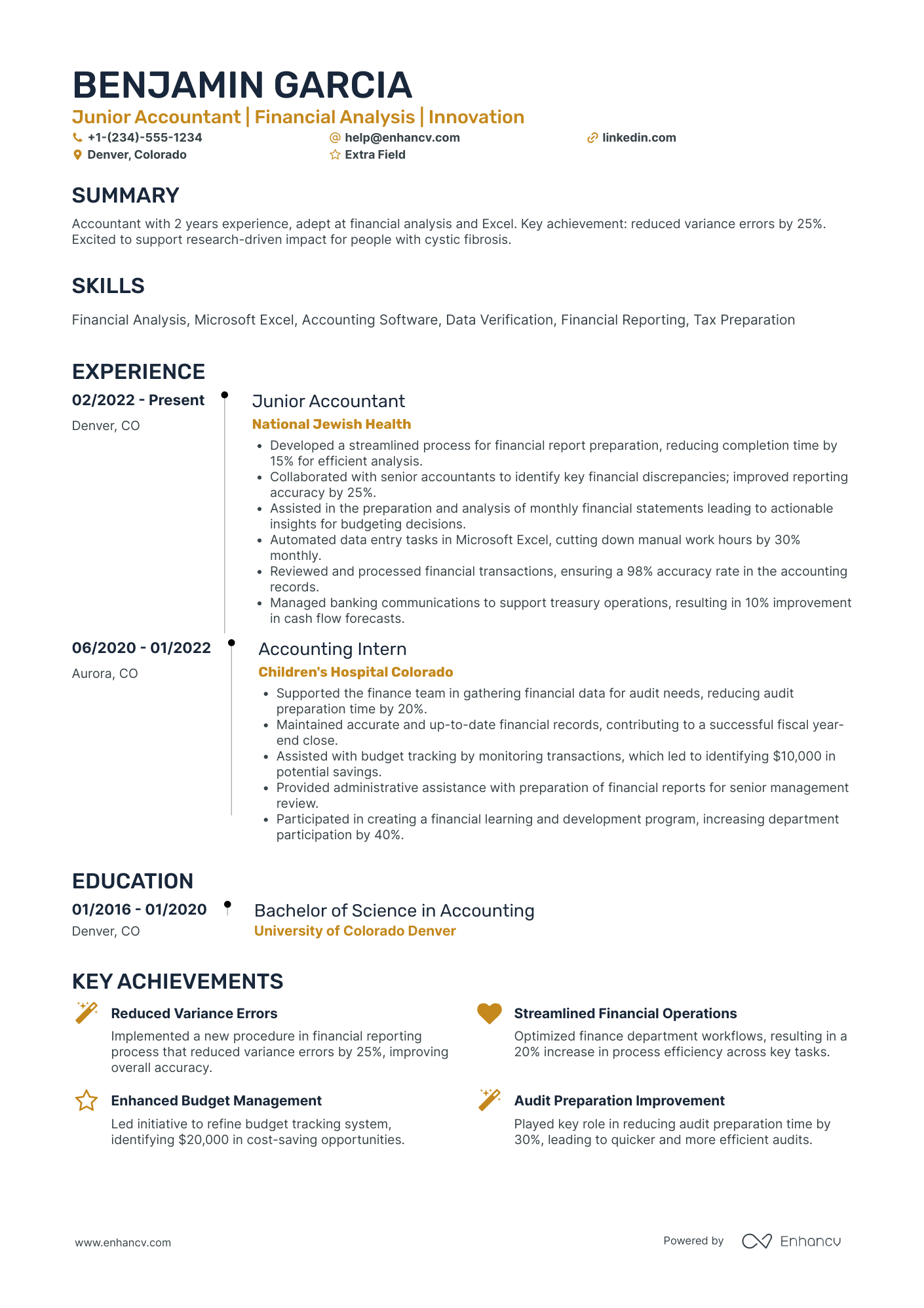

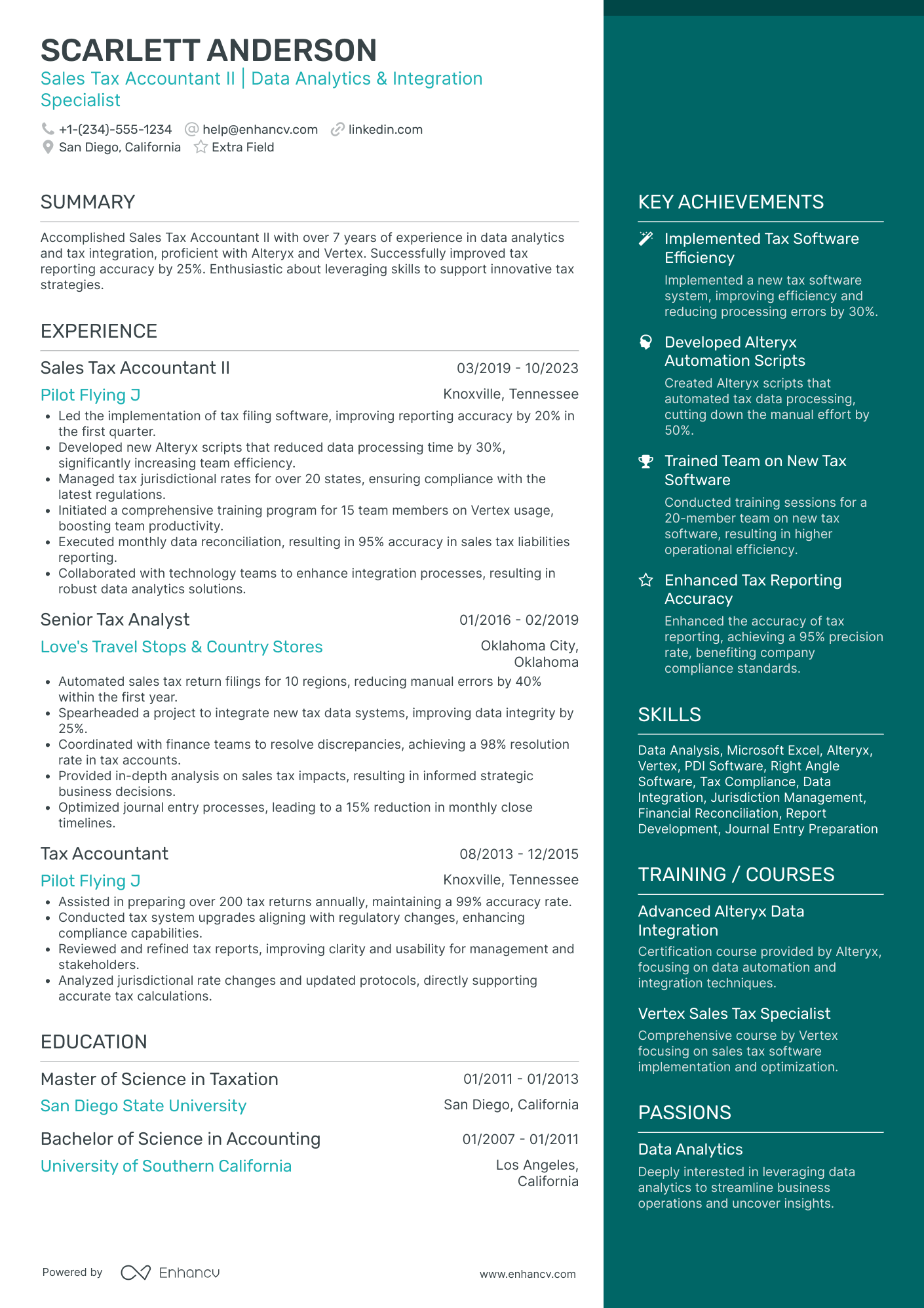

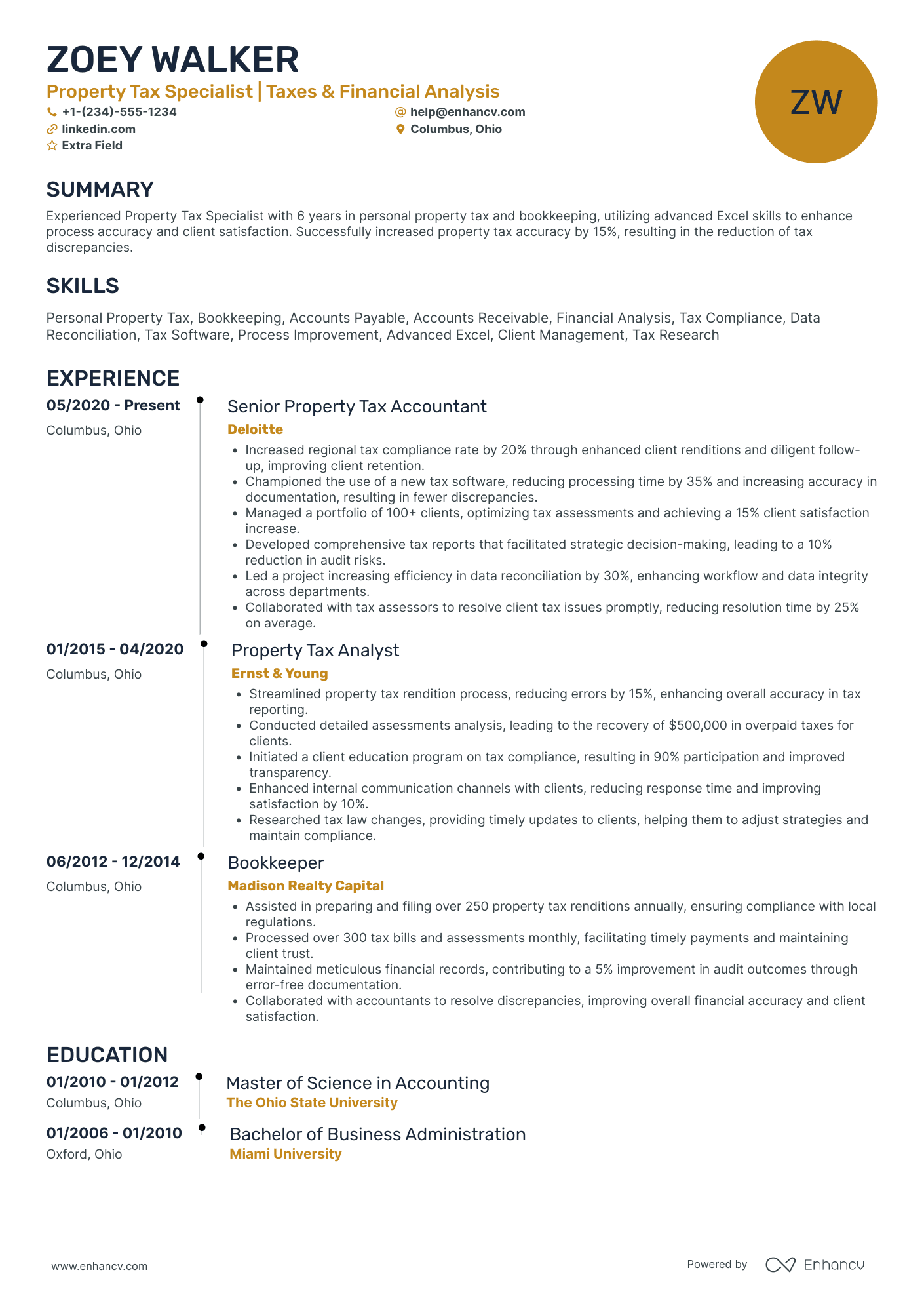

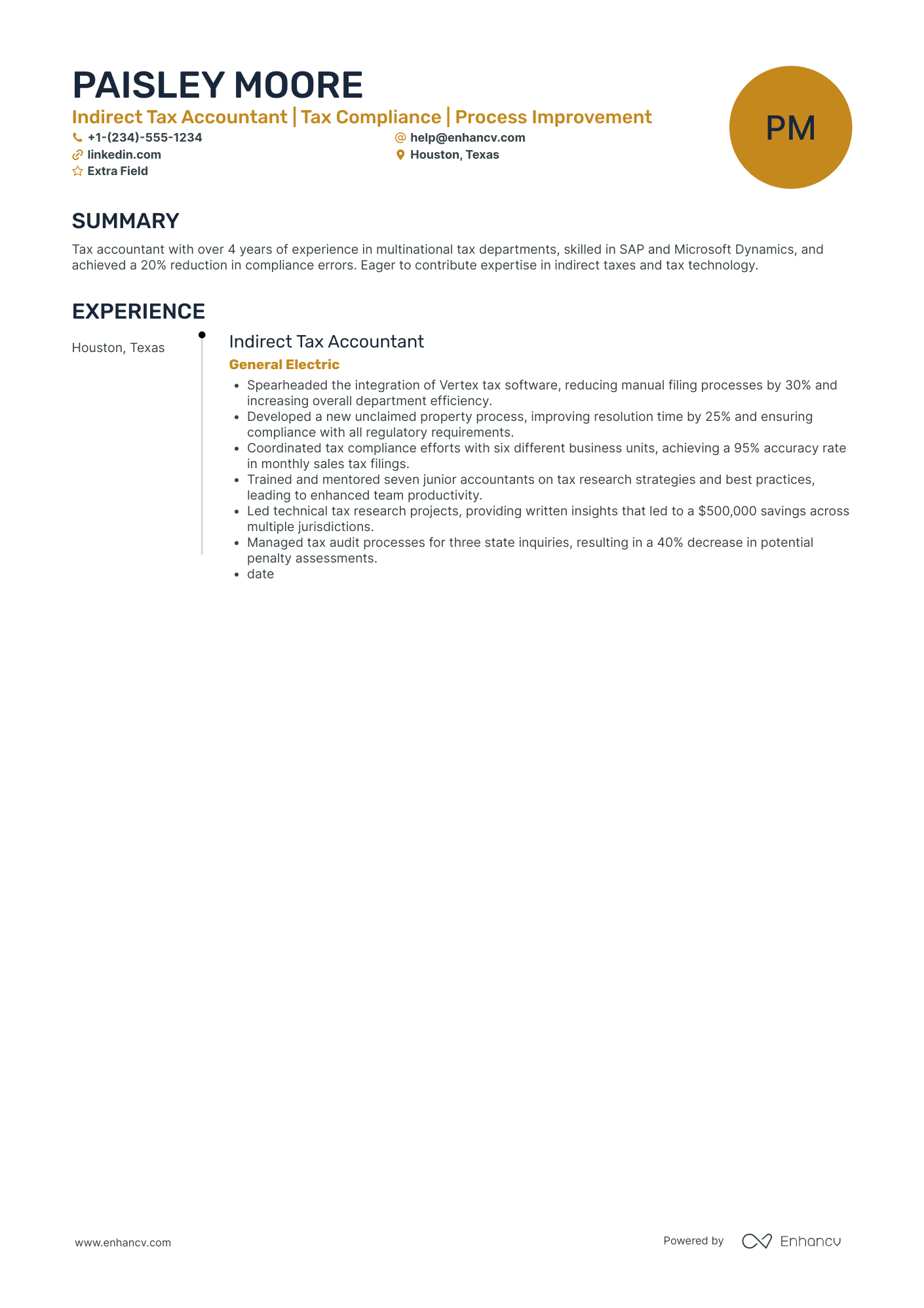

Wondering how other professionals in the industry are presenting their job-winning tax accountant resumes? Check out how these tax accountant professionals put some of our best practices into action:

- Managed a diverse client portfolio, ensuring compliance with federal, state, and local tax laws and streamlining tax processes for improved efficiency.

- Implemented an advanced tax software solution that increased the tax team's productivity by 30%, allowing for more timely and accurate filings.

- Spearheaded the tax strategy for a major corporate merger, overseeing due diligence and integration of tax structures, contributing to a seamless transition.

- Conducted detailed research on complicated tax issues for small business clients, leading to an average of 15% in tax savings per client.

- Trained junior staff on tax regulations and best practices, enhancing the overall quality and knowledge of the tax department.

- Collaborated on a multi-disciplinary team to develop an in-house tax compliance program, significantly reducing third-party consultant costs.

- Serve as the lead tax accountant overseeing international taxation matters, including compliance with international tax laws and treaty benefits.

- Advised on tax implications for a $50M corporate acquisition and directed the tax diligence processes, maximizing transaction value.

- Pioneered a tax minimization strategy that leveraged foreign tax credits, yielding a 10% reduction in the effective tax rate for the company.

- Prepared accurate quarterly and annual tax provision calculations for publicly traded clients, in accordance with ASC 740 standards.

- Managed tax compliance projects for high-net-worth individuals, providing comprehensive tax planning and filing services.

- Developed and maintained strong client relationships, consistently achieving a 95% client retention rate throughout tenure.

- Lead critical tax automation initiatives, adopting AI and machine learning to identify tax savings opportunities for clients.

- Conduct regular training sessions on evolving tax laws and regulations for staff to ensure company-wide up-to-date tax knowledge and practices.

- Address complex tax transactions for prominent tech startups, fostering their growth and aiding in the successful launch of two IPOs.

- Orchestrated the reconciliation of tax accounts for multi-state corporations, resolving discrepancies and ensuring tax accuracy.

- Assisted with IRS audits, preparing and presenting supporting documentation that resulted in zero changes to previously filed returns.

- Engaged in community outreach programs offering tax assistance to underserved populations, enhancing the firm's community presence and reputation.

- Coordinated the transition to a new tax software that reduced processing time by 25% and increased data reliability.

- Played a key role in a strategic tax planning initiative that optimized the company's SALT (State and Local Tax) position, saving approximately $300,000 annually.

- Liaised with legal teams to ensure tax efficiency in contract negotiations and compliance with evolving tax laws.

- Facilitated the electronic tax filing process, leading to a 50% reduction in paper usage and promoting the firm's sustainability goals.

- Engaged in comprehensive tax risk assessments for potential mergers and acquisitions, preparing detailed reports for executive decision-making.

- Leveraged tax analytics tools to interpret big data and provide actionable insights, which directly influenced the company's financial strategies.

- Provided expert testimony for tax-related legal proceedings, reinforcing the company's positions and contributing to favorable outcomes.

- Led the initiative for obtaining tax credits for green energy investments, which amounted to over $1 million in savings for the fiscal year.

- Adapted the tax reporting process to align with international standards (IFRS), ensuring compliance for overseas operations.

- Authored and maintained the company's tax policy manual, serving as a key reference and training tool for the accounting department.

- Optimized Tax Cuts and Jobs Act (TCJA) tax planning strategies for clients, leading to an average 20% reduction in liability for targeted tax areas.

- Developed a custom tax credit tracking system that significantly improved the accuracy of tax credits claimed and reduced processing times.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for tax accountant professionals.

Top Responsibilities for Tax Accountant:

- Prepare detailed reports on audit findings.

- Report to management about asset utilization and audit results, and recommend changes in operations and financial activities.

- Collect and analyze data to detect deficient controls, duplicated effort, extravagance, fraud, or non-compliance with laws, regulations, and management policies.

- Inspect account books and accounting systems for efficiency, effectiveness, and use of accepted accounting procedures to record transactions.

- Supervise auditing of establishments, and determine scope of investigation required.

- Confer with company officials about financial and regulatory matters.

- Examine and evaluate financial and information systems, recommending controls to ensure system reliability and data integrity.

- Inspect cash on hand, notes receivable and payable, negotiable securities, and canceled checks to confirm records are accurate.

- Examine records and interview workers to ensure recording of transactions and compliance with laws and regulations.

- Prepare, examine, or analyze accounting records, financial statements, or other financial reports to assess accuracy, completeness, and conformance to reporting and procedural standards.

Quantifying impact on your resume

- Detail the dollar value of tax savings you've achieved for clients through strategic tax planning and optimization.

- Specify the number of tax returns you prepare annually to demonstrate experience and efficiency.

- Highlight the size of client portfolios you manage, which shows your capability to handle complex financial data.

- Quantify the percentage of audit defenses you've won or favorable outcomes reached to establish your expertise and success rate.

- Present the number of accounting software platforms you are proficient in to illustrate your technical skills.

- Illustrate the scale of tax-related issues you've resolved, showing your problem-solving abilities and depth of knowledge.

- Include the number of regulatory updates you’ve stayed current with, indicating your dedication to ongoing professional development.

- Exemplify your leadership by quantifying the size of the teams you've supervised or trained in tax-related matters.

Action verbs for your tax accountant resume

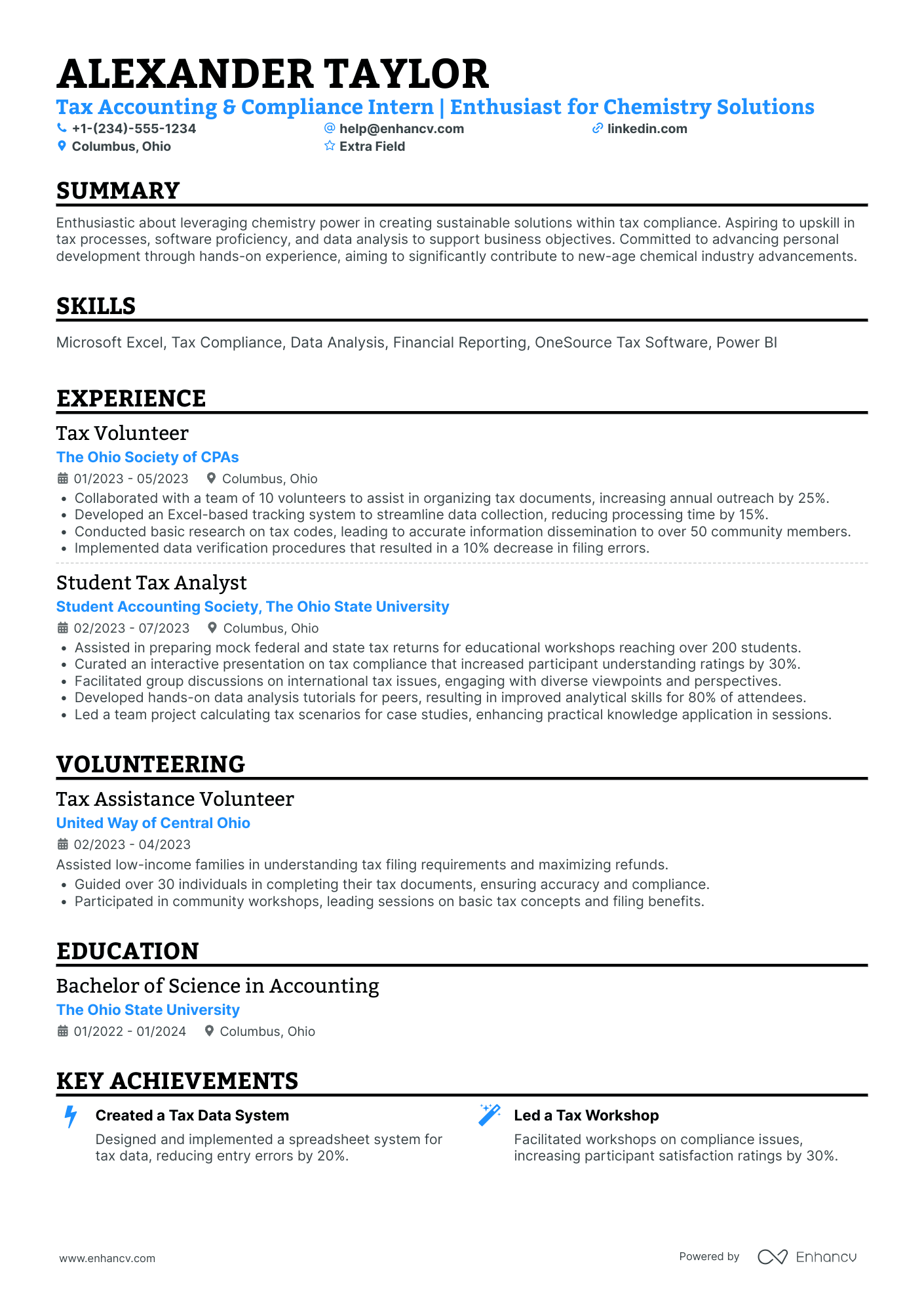

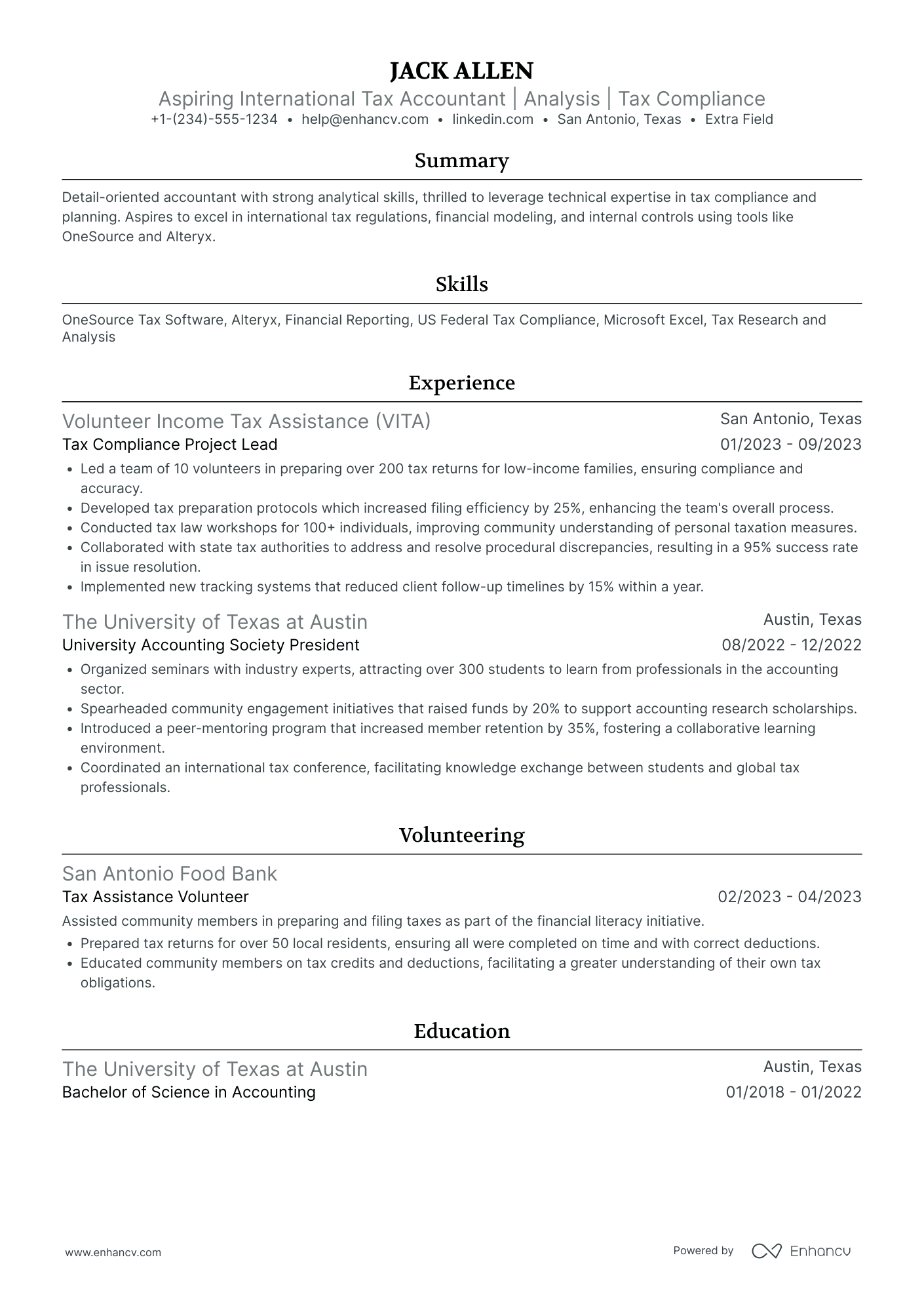

What to do if you don't have any experience

It's quite often that candidates without relevant work experience apply for a more entry-level role - and they end up getting hired.

Candidate resumes without experience have these four elements in common:

- Instead of listing their experience in reverse-chronological format (starting with the latest), they've selected a functional-skill-based format. In that way, tax accountant resumes become more focused on strengths and skills

- Transferrable skills - or ones obtained thanks to work and life experience - have become the core of the resume

- Within the objective, you'd find career achievements, the reason behind the application, and the unique value the candidate brings about to the specific role

- Candidate skills are selected to cover basic requirements, but also show any niche expertise.

Recommended reads:

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

The right balance between hard skills and soft skills for your tax accountant resume

Wondering what the perfect tax accountant resume looks like? The candidate's profile meets job requirements by balancing both hard skills and soft skills across their resume.

- Hard skills are all the technologies you're apt at using . Prove you have the right technical background by listing key industry hardware/software in your tax accountant resume skills section and noteworthy certifications.

- Soft skills are both your personal, mindset, communication, analytical, and problem-solving talents . Use your tax accountant resume achievements section to show how you've used a particular soft skill to reach a tangible outcome.

When writing about your unique skill set, always make sure to refer back to the job advert to see what are the key requirements. This ensures you've tailored your resume so that it matches closer to what the ideal candidate profile is.

Top skills for your tax accountant resume:

Proficient in tax preparation software (e.g., TurboTax, H&R Block)

Knowledge of accounting software (e.g., QuickBooks, Sage)

Familiarity with Excel and data analysis tools

Understanding of tax regulations and compliance

Experience with financial reporting

Ability to conduct tax research

Knowledge of IRS guidelines and tax laws

Experience with e-filing and electronic tax submissions

Familiarity with tax planning strategies

Ability to prepare and review tax returns

Attention to detail

Analytical thinking

Problem-solving skills

Strong communication skills

Time management

Organizational skills

Client relationship management

Ability to work under pressure

Adaptability to changing regulations

Team collaboration

Next, you will find information on the top technologies for tax accountant professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Tax Accountant’s resume:

- Intuit QuickBooks

- Sage 50 Accounting

- Google Docs

- Microsoft Word

- Oracle E-Business Suite Financials

- Tropics workers' compensation software

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Education section and most popular tax accountant certifications for your resume

Your resume education section is crucial. It can indicate a range of skills and experiences pertinent to the position.

- Mention only post-secondary qualifications, noting the institution and duration.

- If you're still studying, highlight your anticipated graduation date.

- Omit qualifications not pertinent to the role or sector.

- If it provides a chance to emphasize your accomplishments, describe your educational background, especially in a research-intensive setting.

Recruiters value tax accountant candidates who have invested their personal time into their professional growth. That's why you should include both your relevant education and certification . Not only will this help you stand out amongst candidates, but showcase your dedication to the field. On your tax accountant resume, ensure you've:

- Curated degrees and certificates that are relevant to the role

- Shown the institution you've obtained them from - for credibility

- Include the start and end dates (or if your education/certification is pending) to potentially fill in your experience gaps

- If applicable, include a couple of job advert keywords (skills or technologies) as part of the certification or degree description

If you decide to list miscellaneous certificates (that are irrelevant to the role), do so closer to the bottom of your resume. In that way, they'd come across as part of your personal interests, instead of experience. The team at Enhancv has created for you a list of the most popular tax accountant certificates - to help you update your resume quicker:

The top 5 certifications for your tax accountant resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Enrolled Agent (EA) - Internal Revenue Service (IRS)

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Chartered Tax Advisor (CTA) - Chartered Institute of Taxation (CIOT)

- Certified Tax Coach (CTC) - American Institute of Certified Tax Coaches (AICTC)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for tax accountant professionals.

Top US associations for a Tax Accountant professional

- AACSB

- AICPA and CIMA

- American Accounting Association

- Association for Financial Professionals

- Association of Government Accountants

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Recommended reads:

Adding a summary or objective to your tax accountant resume

One of the most crucial elements of your professional presentation is your resume's top one-third. This most often includes:

- Either a resume summary - your career highlights at a glance. Select the summary if you have plenty of relevant experience (and achievements), you'd like recruiters to remember about your application.

- Or, a resume objective - to showcase your determination for growth. The perfect choice for candidates with less experience, who are looking to grow their career in the field.

If you want to go above and beyond with your tax accountant resume summary or resume objective, make sure to answer precisely why recruiters need to hire you. What is the additional value you'd provide to the company or organization? Now here are examples from real-life tax accountant professionals, whose resumes have helped them land their dream jobs:

Resume summaries for a tax accountant job

- Seasoned tax accountant with over 15 years of experience in managing complex tax issues for large financial firms. Demonstrates a proven track record of success in reducing company tax liabilities through strategic planning and effective audit representation. Expertise in federal and state tax regulations, with significant achievements in the area of non-profit taxation compliance.

- Meticulous financial analyst transitioning into tax accountancy, holding a solid 10-year background in financial forecasting and budget planning. Possesses a comprehensive understanding of tax code implications on business operations and investments. Acquired expertise in advanced Excel modeling, combined with a robust analytical skillset to ensure precise tax preparation and compliance.

- Former healthcare manager with an MBA and 8 years of experience overseeing facility operations now pivoting toward tax accountancy. Brings to the table exceptional organizational skills and a detail-oriented approach to financial scrutiny, coupled with a deep understanding of tax implications for healthcare organizations and proficiency in revenue cycle management software.

- Highly skilled tax expert with 12 years of dedicated experience in international tax operations for a Fortune 500 company. Specialized in crafting tax strategies that align with global business initiatives, leading to a commendable reduction in the firm’s effective tax rate. Certified Public Accountant with extensive knowledge of tax treaty benefits and cross-border taxation challenges.

- Ambitious graduate eager to launch a career in tax accounting, with a strong foundation in accounting principles gained from a Bachelor's degree in Accounting and Finance. Keen to apply theoretical knowledge to practical scenarios, with a specific interest in developing sophisticated tax strategies that contribute to effective fiscal management and cost savings for future employers.

- Enthusiastic professional with a fresh perspective, pursuing an entry-level tax accountant position. Armed with a recent certification in taxation and hands-on internship experience, I am ready to utilize my passion for numbers and meticulous attention to detail to support a company’s financial accuracy and regulatory compliance while continuously expanding my tax knowledge and skills.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for tax accountant professionals

Local salary info for Tax Accountant.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $79,880 |

| California (CA) | $92,160 |

| Texas (TX) | $78,900 |

| Florida (FL) | $76,480 |

| New York (NY) | $101,090 |

| Pennsylvania (PA) | $75,370 |

| Illinois (IL) | $78,280 |

| Ohio (OH) | $75,550 |

| Georgia (GA) | $78,970 |

| North Carolina (NC) | $79,920 |

| Michigan (MI) | $76,190 |

Additional valuable tax accountant resume sections to stand out

When assessing candidate applications, recruiters are often on the lookout for elements that go beyond meeting standard requirements and technical expertise.

This is where extra sections could play a key role in showcasing your unique skill set and personality.

Make sure to include sections dedicated to:

- How you spend your free time, outside of work. The interests resume section also goes to show your personality and transferrable skills; and may also serve to fill in gaps in your experience;

- Most innovative work. The projects resume section brings focus to what you're most proud of within the field;

- How you're able to overcome language barriers. The language resume section is always nice to have, especially if communication would be a big part of your future role;

- Industry-wide recognitions. Remember that the awards resume section should highlight your most noteworthy accolades and prizes.

Key takeaways

Securing your ideal job starts with crafting a compelling tax accountant resume. It should not only highlight your professional strengths but also reflect your personality. Key aspects to remember include:

- Choose a clear, easily editable format, allowing more time to focus on the content of your resume;

- Emphasize experience relevant to the job, focusing on your impact on the team;

- Opt for a resume summary if you have extensive professional experience, and a resume objective if you're just starting out;

- Include technical skills in the skills section and interpersonal skills in the achievements section;

- Recognize the importance of various resume sections (e.g., My Time, Projects) in showcasing both your professional abilities and personal traits.

Tax Accountant resume examples

By Experience

By Role