Many financial advisor resume submissions fail because they list products and duties without proving client impact. That gets filtered by ATS screening and missed in fast recruiter scans. With high competition, vague claims can't earn interviews.

A strong resume shows what changed because of your advice. Knowing how to make your resume stand out starts with highlighting assets under management growth, retention gains, new household acquisition, and risk reduction. Add scope like number of relationships managed, revenue influenced, and compliance audit results.

Key takeaways

- Quantify client impact—assets under management growth, retention rates, and revenue—in every experience bullet.

- Use reverse-chronological format for experienced advisors and hybrid format for career changers.

- Tailor each resume to the job posting by mirroring its tools, compliance frameworks, and KPIs.

- Place certifications like CFP or Series 65 where recruiters verify them fastest—near education.

- Demonstrate skills through measurable outcomes in your experience section, not just a skills list.

- Replace vague duty descriptions with specific metrics using tools like Enhancv's Bullet Point Generator.

- Stop using AI once your resume accurately reflects real experience—never fabricate or inflate claims.

Job market snapshot for financial advisors

We analyzed 895 recent financial advisor job ads across major US job boards. These numbers help you understand regional hotspots, career growth patterns, top companies hiring at a glance.

What level of experience employers are looking for financial advisors

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 11.8% (106) |

| 3–4 years | 20.3% (182) |

| 5–6 years | 2.5% (22) |

| 7–8 years | 0.9% (8) |

| 9–10 years | 0.2% (2) |

| 10+ years | 1.0% (9) |

| Not specified | 63.5% (568) |

Financial advisor ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 98.7% (883) |

| Healthcare | 1.1% (10) |

Top companies hiring financial advisors

| Company | Percentage found in job ads |

|---|---|

| Edward Jones | 26.6% (238) |

| ATB Financial | 12.4% (111) |

| Thrivent Financial for Lutherans | 11.8% (106) |

| LPL Financial Services | 8.0% (72) |

| TD Bank | 5.7% (51) |

| Citizens Financial Group, Inc. | 3.8% (34) |

| Country Financial | 3.8% (34) |

| Ameriprise Financial | 3.2% (29) |

| Corebridge Financial Inc. | 2.6% (23) |

| Wells Fargo | 1.6% (14) |

Role overview stats

These tables show the most common responsibilities and employment types for financial advisor roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a financial advisor

| Responsibility | Percentage found in job ads |

|---|---|

| Series 66 | 44.8% (401) |

| Series 7 | 44.6% (399) |

| Sales | 24.8% (222) |

| Sie | 22.8% (204) |

| Financial services | 18.3% (164) |

| Finra | 16.2% (145) |

| Sec | 15.6% (140) |

| Licensing | 14.9% (133) |

| Certification | 14.7% (132) |

| Financial planning | 14.6% (131) |

| Series 63 | 14.6% (131) |

| Salesforce | 13.2% (118) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 81.2% (727) |

| Remote | 15.9% (142) |

| Hybrid | 2.9% (26) |

How to format a financial advisor resume

Recruiters evaluating financial advisor candidates prioritize evidence of client portfolio growth, assets under management, regulatory compliance knowledge, and the ability to build long-term client relationships. A clean, well-structured resume format ensures these signals surface quickly during both automated screening and the initial human review.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to present your deepest and most relevant financial advisory experience first. Do:

- Lead each role entry with your scope of responsibility—number of client accounts managed, portfolio size, and advisory team oversight.

- Highlight proficiency in role-specific tools and domains such as financial planning software (e.g., eMoney Advisor, MoneyGuidePro), investment analysis platforms, retirement planning, tax optimization, and compliance frameworks like SEC or FINRA regulations.

- Quantify outcomes tied to revenue generation, client retention, or portfolio performance rather than listing generic duties.

I'm junior or switching into this role—what format works best?

Use a hybrid format to position your strongest financial skills and credentials at the top while still showing a clear work history underneath. Do:

- Place a focused skills section near the top of your resume featuring certifications (Series 7, Series 66, CFP), financial modeling competencies, and client relationship management tools.

- Include internships, academic projects, or transitional experience—such as banking, insurance, or accounting roles—that demonstrate relevant analytical and client-facing capabilities.

- Connect every action to a measurable result, even at a small scale, to show your understanding of outcome-driven advising.

Why not use a functional resume?

A functional format strips away the timeline of your career development, making it difficult for hiring managers to verify where and when you built your advisory skills—something especially important in a compliance-driven industry like financial services.

- A functional resume may be acceptable if you're making a career change into financial advising from a related field (e.g., accounting, banking, or insurance) or re-entering the workforce after a significant gap, but only if you tie every listed skill directly to specific projects, client outcomes, or measurable results.

Once your layout and formatting choices are in place, the next step is deciding which sections to include so each one reinforces your qualifications effectively.

What sections should go on a financial advisor resume

Recruiters expect a financial advisor resume to show client outcomes, assets managed, and compliant, repeatable processes. Understanding what to put on a resume helps you prioritize the right information for this role.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize measurable impact—assets under management growth, client retention, revenue, portfolio performance versus benchmarks, and the scope of books of business you managed.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized the key resume components, focus next on writing your experience section to show how you delivered results in each role.

How to write your financial advisor resume experience

The experience section is where you prove you've delivered real results as a financial advisor—through the strategies you've implemented, the tools and methods you've applied, and the measurable outcomes you've produced for clients and firms. Hiring managers prioritize demonstrated impact over descriptive task lists, so every bullet should connect your responsibilities to tangible financial results. Building a targeted resume ensures each entry speaks directly to the role you're pursuing.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the client portfolios, financial products, market segments, planning processes, or advisory teams you were directly accountable for as a financial advisor.

- Execution approach: the financial planning software, investment analysis frameworks, risk assessment methodologies, or compliance tools you used to inform recommendations and deliver advisory work.

- Value improved: changes to portfolio performance, client retention, planning accuracy, risk mitigation, regulatory compliance, or service accessibility that resulted from your advisory efforts.

- Collaboration context: how you coordinated with compliance officers, portfolio managers, tax professionals, estate attorneys, or other stakeholders to deliver comprehensive financial guidance.

- Impact delivered: outcomes expressed through client growth, assets under management, revenue contributions, or improved financial outcomes for the individuals and organizations you served—framed as results rather than activity.

Experience bullet formula

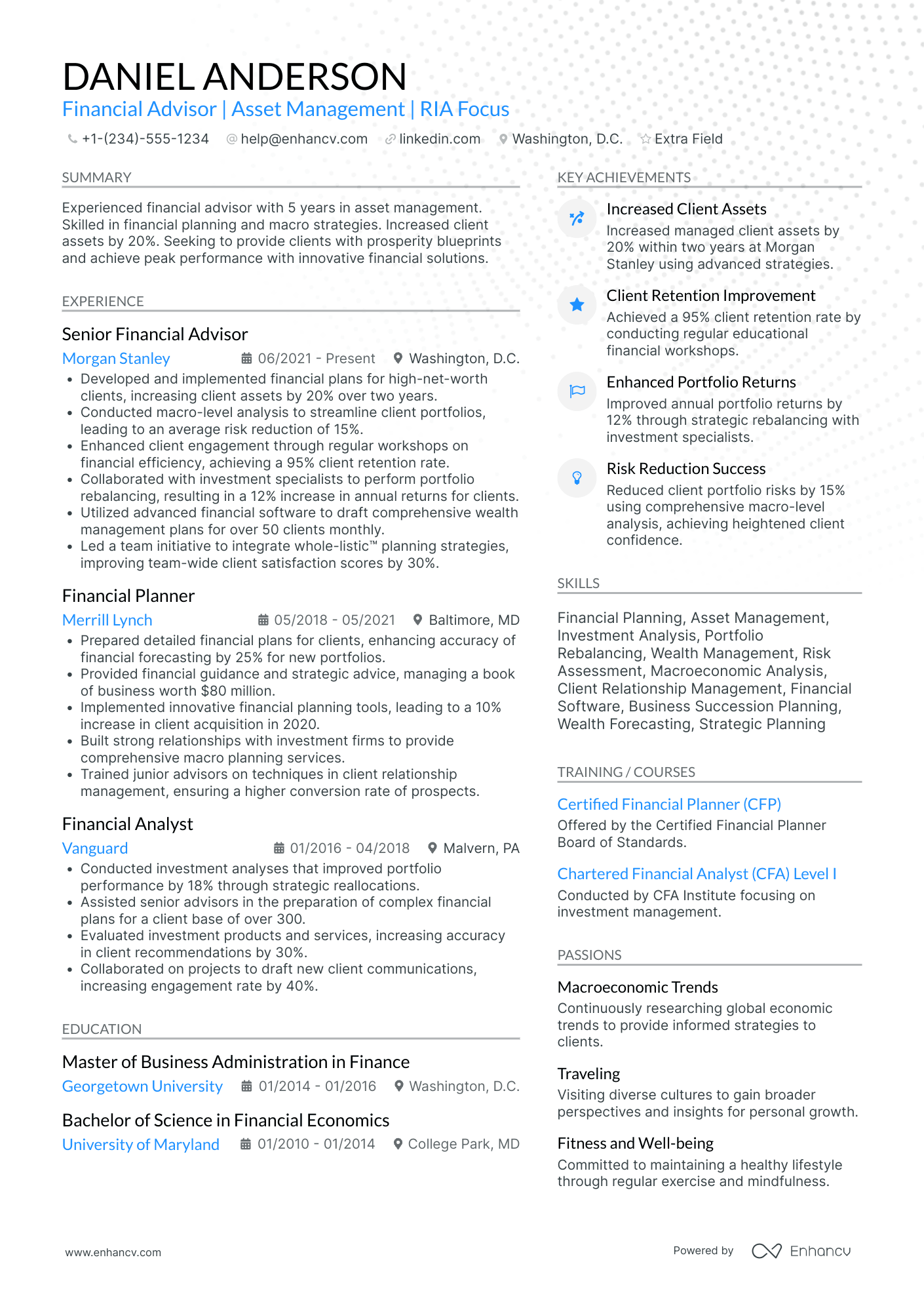

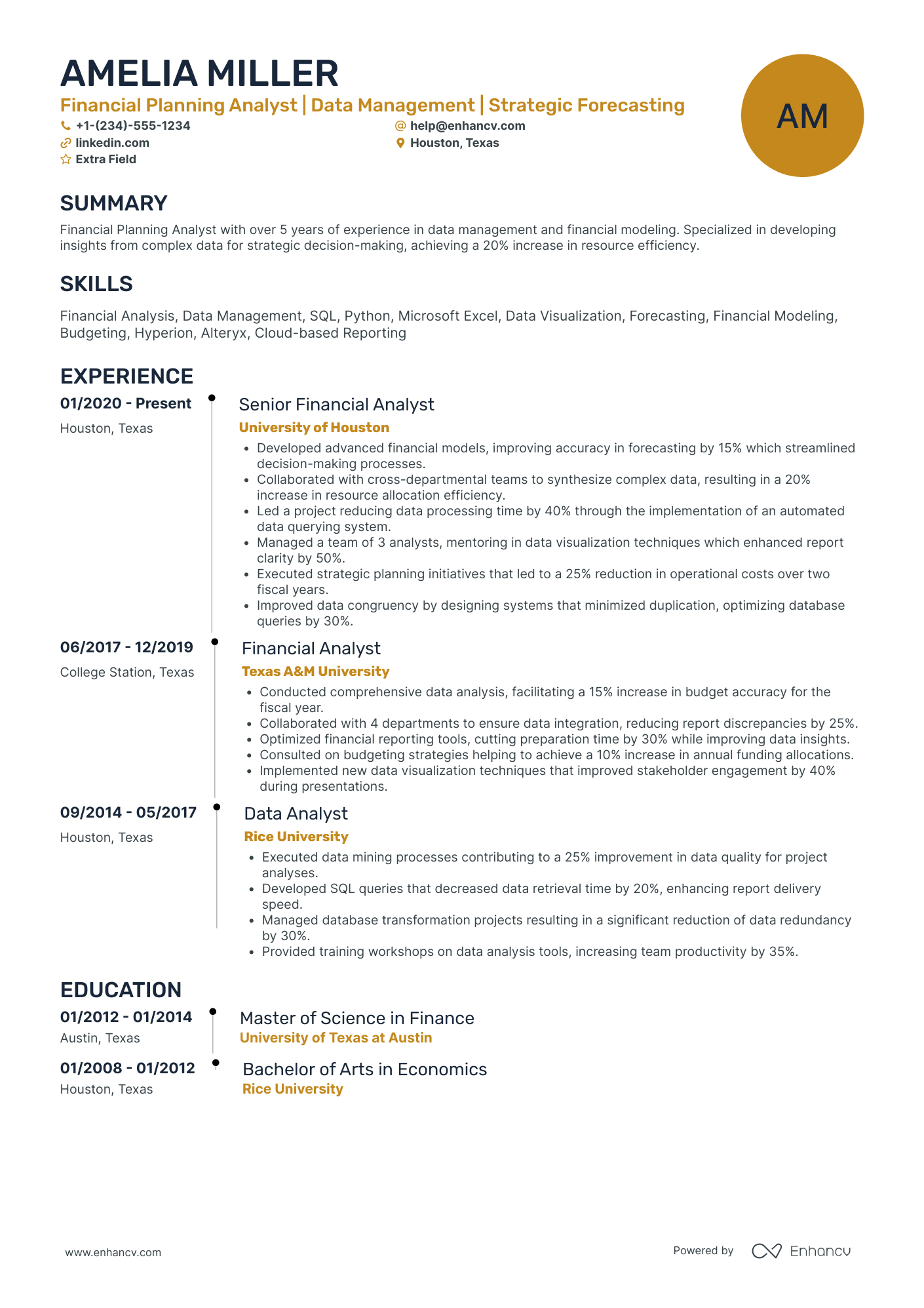

A financial advisor experience example

✅ Right example - modern, quantified, specific.

Senior Financial Advisor

NorthBridge Wealth Partners | Austin, TX

2021–Present

Fee-only registered investment advisor serving high-net-worth families and business owners across Texas.

- Expanded assets under management from $85M to $132M by leading goals-based planning, portfolio construction, and referral campaigns tracked in Salesforce Financial Services Cloud.

- Reduced portfolio drift by 38% and cut rebalance time by 45% by implementing model portfolios and automated rebalancing workflows in Orion Advisor Tech with tax-aware thresholds.

- Increased after-tax returns by an estimated 0.60% annually for taxable clients by executing tax-loss harvesting and asset location strategies using Morningstar Direct and Schwab Advisor Center reporting.

- Improved client retention from 92% to 96% by standardizing quarterly review agendas, producing eMoney Advisor plan updates, and coordinating estate and tax deliverables with attorneys and certified public accountants.

- Lowered compliance exceptions by 30% by partnering with the chief compliance officer to tighten documentation in Riskalyze (Nitrogen), update Investment Policy Statement templates, and audit trade notes in the customer relationship management system.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours based on the specific role you're targeting.

How to tailor your financial advisor resume experience

Recruiters evaluate your financial advisor resume through both applicant tracking systems and manual review, so tailoring your resume to the job description is essential. Tailoring ensures the specific skills, tools, and qualifications a firm prioritizes stand out immediately.

Ways to tailor your financial advisor experience:

- Match financial planning software and CRM platforms named in the posting.

- Mirror the exact compliance standards or regulatory frameworks referenced.

- Use the same terminology for portfolio management strategies or methodologies.

- Reflect client retention or asset growth KPIs the role prioritizes.

- Highlight relevant industry experience such as retirement or wealth management.

- Emphasize fiduciary responsibility or suitability obligations when specified.

- Align your experience with the advisory model described in the listing.

- Reference team-based or independent client service workflows they mention.

Tailoring means framing your real accomplishments to reflect what the role demands, not forcing unrelated keywords into your experience section.

Resume tailoring examples for financial advisor

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Develop comprehensive financial plans using eMoney Advisor, including retirement projections, estate strategies, and tax optimization for high-net-worth clients. | Helped clients with their financial planning needs and goals. | Built comprehensive financial plans in eMoney Advisor for 120+ high-net-worth clients, integrating retirement projections, estate strategies, and tax optimization that reduced average client tax liability by 18%. |

| Prospect and acquire new client relationships through referral networks, COI partnerships, and seminar-based marketing to grow AUM by $15M annually. | Responsible for bringing in new business and building client relationships. | Grew assets under management by $22M in one year by cultivating referral networks with 30+ CPAs and estate attorneys, hosting 12 quarterly investment seminars that converted 35% of attendees into clients. |

| Ensure full compliance with SEC and FINRA regulations while managing discretionary portfolios and conducting annual suitability reviews for 200+ accounts. | Made sure all work followed company rules and industry regulations. | Managed discretionary portfolios across 200+ accounts while maintaining zero compliance deficiencies across three consecutive SEC and FINRA audits, completing annual suitability reviews on a 60-day cycle. |

Once your experience aligns with the role’s priorities, the next step is to quantify your financial advisor achievements so hiring managers can see the impact behind each bullet.

How to quantify your financial advisor achievements

Quantifying your achievements shows how your advice improved client outcomes and reduced risk. Track assets under management growth, revenue, retention, portfolio performance versus benchmarks, compliance accuracy, and planning turnaround time.

Quantifying examples for financial advisor

| Metric | Example |

|---|---|

| Revenue growth | "Generated $420K in annualized advisory fees in 12 months by converting 38 of 120 prospects using Salesforce, Calendly, and a three-meeting planning process." |

| Client retention | "Improved client retention from 91% to 96% by launching quarterly review cadences for 85 households and documenting action plans in Redtail CRM." |

| Risk reduction | "Reduced portfolio drawdown by 3.2% versus a 60/40 benchmark during 2022 by rebalancing monthly and adding Treasury ladders for 40 retirees." |

| Compliance accuracy | "Passed two SEC audits with zero findings by standardizing Reg BI disclosures and achieving 100% documentation completion across 210 client files in DocuSign." |

| Cycle time | "Cut financial plan turnaround from 10 business days to four by templating eMoney reports and batching data collection for 25 plans per month." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points for your experience section, you'll want to apply that same precision to presenting your hard and soft skills.

How to list your hard and soft skills on a financial advisor resume

Skills matter because financial advisors win trust, manage risk, and drive assets under management; recruiters and ATS scan your skills section to confirm role fit and compliance readiness, so aim for a balanced mix of hard skills and client-facing soft skills. financial advisor roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Financial planning analysis

- Portfolio construction, rebalancing

- Asset allocation models

- Risk profiling, suitability

- Retirement planning strategies

- Tax-aware investing

- Estate planning basics

- Insurance needs analysis

- Investment policy statements

- Morningstar Direct, Bloomberg Terminal

- Salesforce, Redtail CRM

- FINRA and SEC compliance

Soft skills

- Lead structured discovery meetings

- Translate goals into plans

- Explain tradeoffs and risk

- Present recommendations clearly

- Handle objections with evidence

- Build long-term client trust

- Coordinate with CPAs and attorneys

- Document advice and decisions

- Prioritize high-impact follow-ups

- Set expectations and timelines

- Stay calm during volatility

- Own outcomes and next steps

How to show your financial advisor skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how advisors present competencies effectively.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Senior financial advisor with 12 years guiding high-net-worth clients through retirement and estate planning. Skilled in portfolio optimization using Morningstar and Monte Carlo simulations. Grew client assets under management by 35% over four years.

- Signals senior-level depth immediately

- Names industry-standard tools

- Leads with a measurable outcome

- Implies strong client relationship skills

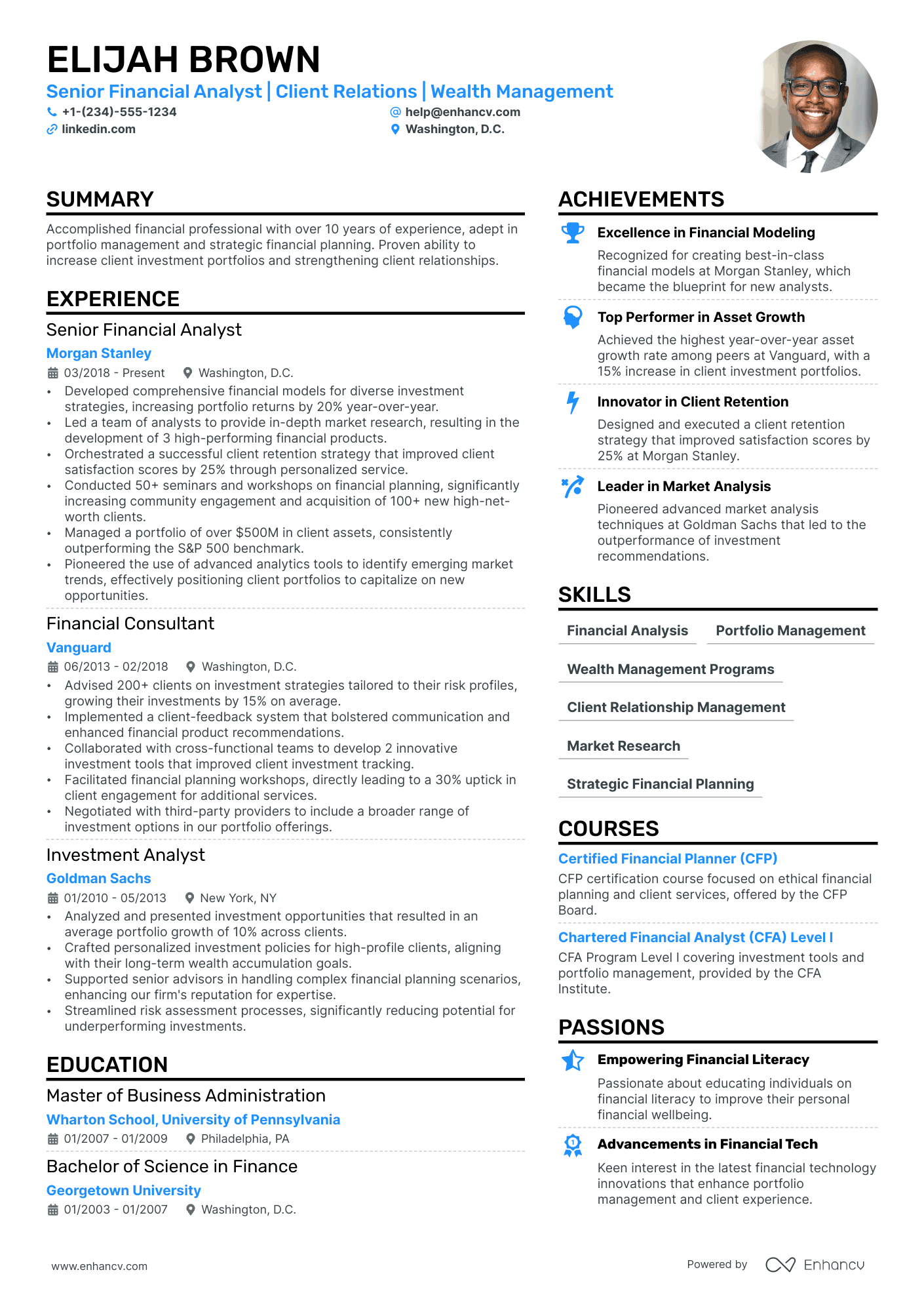

Experience example

Senior Financial Advisor

Lakeview Wealth Partners | Charlotte, NC

March 2018–Present

- Managed $120M in client assets using diversified allocation strategies, increasing average portfolio returns by 14% year over year.

- Collaborated with tax attorneys and estate planners to build comprehensive retirement plans, improving client retention rates to 96%.

- Leveraged eMoney Advisor and Riskalyze to deliver data-driven recommendations, reducing clients' off-target risk exposure by 22%.

- Every bullet contains measurable proof

- Skills surface naturally through outcomes

Once you’ve demonstrated your financial advisor skills through relevant examples, the next step is to apply that approach to writing a financial advisor resume with no experience so you can highlight transferable strengths credibly.

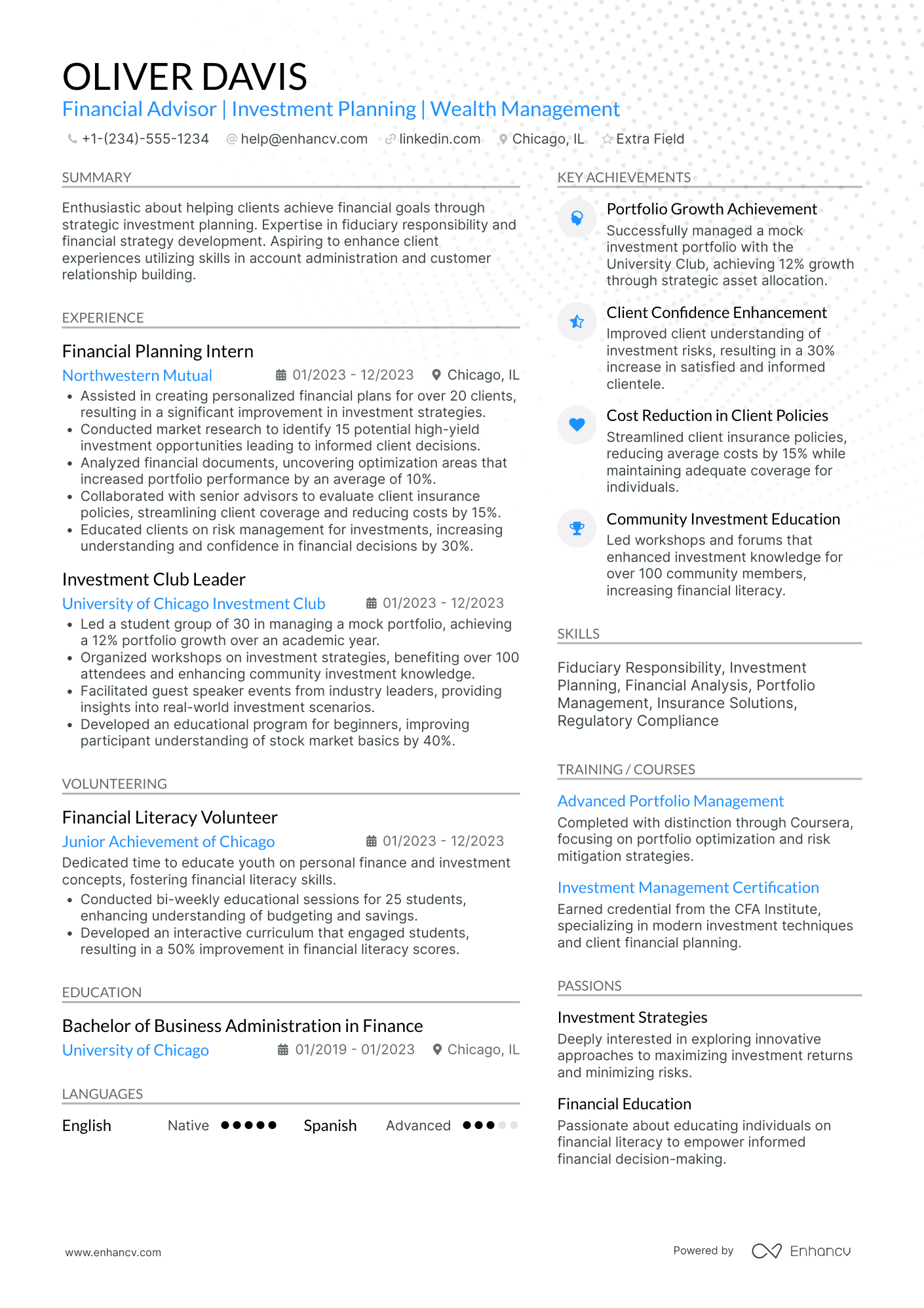

How do I write a financial advisor resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Personal portfolio performance tracking

- CFP coursework and case studies

- Student-managed investment fund participation

- Pro bono budgeting for nonprofits

- Finance internship with client exposure

- Volunteer tax preparation experience

- Mock client discovery and plans

- Series 65 exam preparation

If you're building a resume without work experience, focus on:

- Quantified results and outcomes

- Client-facing practice and documentation

- Compliance awareness and ethics training

- Financial planning tools proficiency

Resume format tip for entry-level financial advisor

Use a combination resume format because it highlights relevant skills and projects before work history, while still showing a clear timeline. Do:

- Lead with a summary tied to licenses, exams, and target clients.

- Add a projects section with outcomes, assumptions, and tools used.

- List tools: Excel, CRM, Monte Carlo, and financial planning software.

- Quantify results: savings rates, debt payoff, and portfolio returns.

- Include compliance items: privacy, suitability, and documentation.

- Built a Monte Carlo retirement plan in Excel for a mock client, testing three asset allocations and improving projected success rate from 72% to 84%.

Even without direct experience, your educational background can serve as one of the strongest sections on your resume—so let's make sure you present it effectively.

How to list your education on a financial advisor resume

Your education section helps hiring teams confirm you have the foundational knowledge needed. It signals relevant training in finance, economics, or related fields that support your financial advisor career.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for a financial advisor resume.

Example education entry

Bachelor of Science in Finance

University of Michigan, Ann Arbor, MI

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Portfolio Management, Financial Planning, Investment Analysis, Risk Management, Tax Strategy

- Honors: Magna Cum Laude, Dean's List (six semesters)

How to list your certifications on a financial advisor resume

Certifications on a resume show a financial advisor's commitment to learning, proficiency with planning tools, and relevance to current regulations, products, and client needs.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they're older, less relevant, or supplemental to your core financial advisor qualifications.

- Place certifications above education when they're recent, highly relevant, or required for the financial advisor roles you target.

Best certifications for your financial advisor resume

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Chartered Financial Consultant (ChFC)

- Certified Investment Management Analyst (CIMA)

- Chartered Retirement Planning Counselor (CRPC)

- Accredited Investment Fiduciary (AIF)

- Financial Risk Manager (FRM)

Once you’ve positioned your credentials where recruiters can quickly verify them, move on to your financial advisor resume summary to show how those qualifications translate into value.

How to write your financial advisor resume summary

Your resume summary is the first thing a recruiter reads. A strong one instantly signals you're qualified and worth interviewing for a financial advisor role.

Keep it to three to four lines, with:

- Your title and total years of relevant experience.

- The domain you specialize in, such as wealth management or retirement planning.

- Core skills like portfolio analysis, risk assessment, or financial modeling.

- One or two measurable achievements, such as assets under management grown or client retention rates.

- Soft skills tied to outcomes, like relationship building that increased referrals.

PRO TIP

At this level, focus on clarity, relevant skills, and early wins that prove your value. Highlight specific tools you've used and tangible results, even if modest. Avoid vague phrases like "passionate self-starter" or "results-driven professional." Recruiters want proof, not personality descriptions.

Example summary for a financial advisor

Financial advisor with two years of experience in retirement planning. Built a $4M client portfolio through targeted outreach. Skilled in risk assessment, financial modeling, and CRM platforms.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your strongest qualifications, make sure the header above it presents your contact details correctly so recruiters can actually reach you.

What to include in a financial advisor resume header

A resume header is the top section with your identity and contact details, and it boosts visibility, credibility, and recruiter screening for a financial advisor.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Don't include a photo on a financial advisor resume unless the role is explicitly front-facing or appearance-dependent.

Keep your header on one to two lines, match the job title to the posting, and use links that open to complete, updated profiles.

Example

Financial advisor resume header

Jordan M. Parker

Financial advisor | Retirement planning and wealth management

Austin, TX

(512) 555-01XX

your.name@enhancv.com github.com/yourname yourwebsite.com linkedin.com/in/yourname

Once your contact details and key identifiers are in place at the top, add the additional sections for financial advisor resumes to round out the rest of your application.

Additional sections for financial advisor resumes

When your core qualifications match other candidates, additional sections can set you apart by showcasing role-specific credibility and depth.

- Languages

- Professional affiliations and memberships

- Publications and thought leadership

- Volunteer financial literacy work

- Conference presentations and speaking engagements

- Awards and industry recognition

Once you've rounded out your resume with the right supplementary sections, it's worth pairing it with a strong cover letter to maximize your impact.

Do financial advisor resumes need a cover letter

A cover letter isn't required for every financial advisor role, but it often helps. If you're wondering what a cover letter is and when to use one, it can make a difference in competitive searches or firms that expect client-facing polish. Skip it when the application says not to include one.

Use a cover letter to add context your resume can't:

- Explain role or team fit: Link your client segment experience, planning approach, and collaboration style to the firm's model and expectations.

- Highlight one or two relevant projects or outcomes: Share a specific result, such as retention gains, referral growth, or improved plan adoption, and how you achieved it.

- Show understanding of the product, users, or business context: Reference the firm's advisory offering, typical client needs, and how you support trust, compliance, and long-term relationships.

- Address career transitions or non-obvious experience: Clarify a move between channels, a gap, or transferable skills, such as business development, portfolio work, or service leadership.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even when you decide a separate letter won’t add value to your application, using AI to improve your financial advisor resume helps you strengthen the document hiring teams will focus on most.

Using AI to improve your financial advisor resume

AI can sharpen your resume's clarity, structure, and impact. It helps refine language and highlight measurable results. But overuse dulls authenticity. Once your content reads clearly and fits the role, step away from AI. For guidance on which AI is best for writing resumes, focus on tools that enhance rather than fabricate.

Here are 10 practical prompts to strengthen specific sections of your financial advisor resume:

Strengthen your summary

Quantify experience bullets

Align skills with job posts

Improve action verbs

Refine certification details

Clarify project descriptions

Tighten education entries

Remove filler language

Tailor for compliance roles

Check tone and consistency

Conclusion

A strong financial advisor resume shows measurable outcomes, role-specific skills, and a clear structure. Lead with results like assets gathered, retention, revenue growth, or plan adoption. Support them with client management, portfolio strategy, compliance, and relationship-building skills.

Keep each section easy to scan, with consistent formatting and focused bullets. This approach proves you can deliver results now and adapt to today’s and near-future hiring market. With a clear, results-driven resume, you’re ready to compete with confidence.