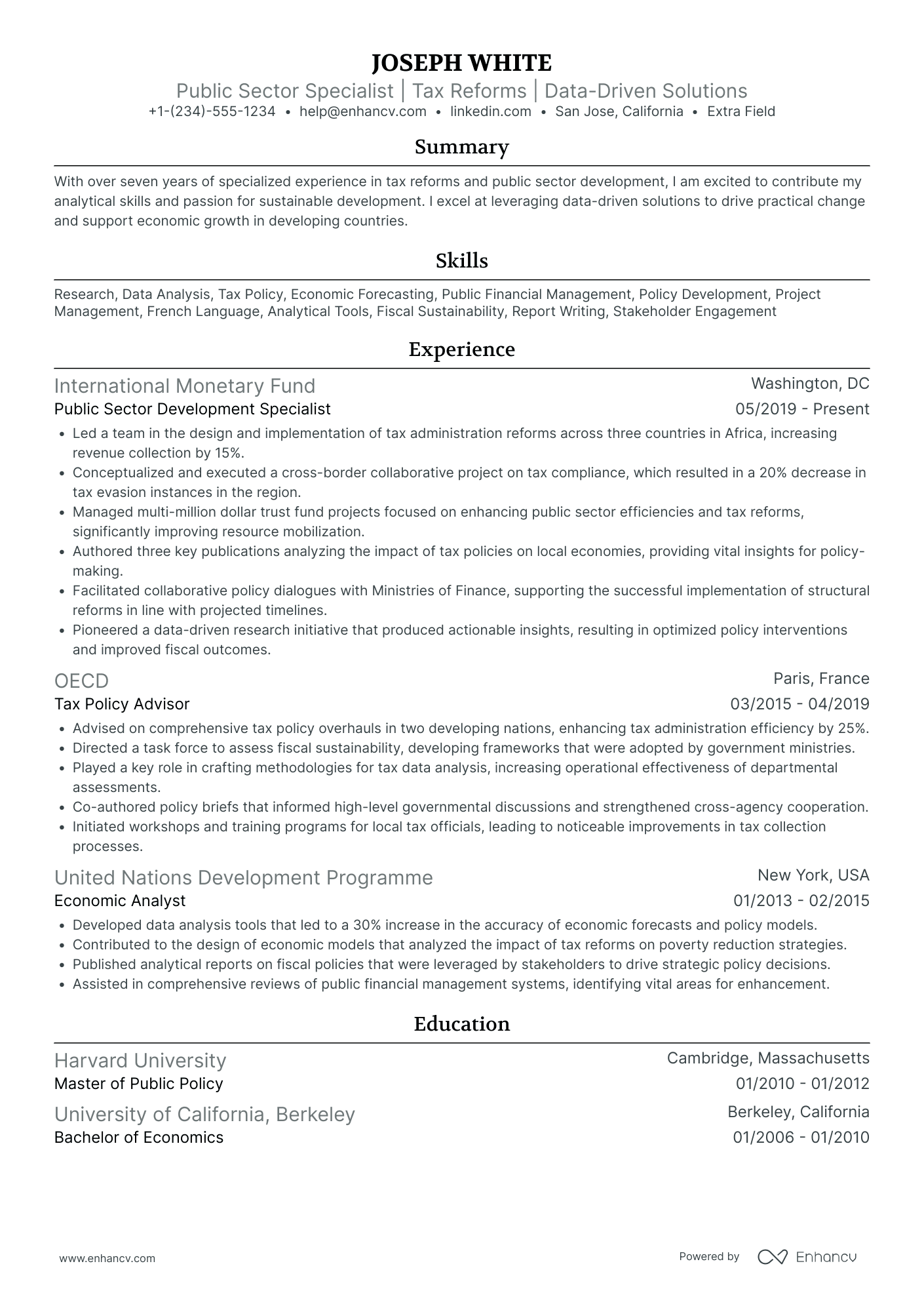

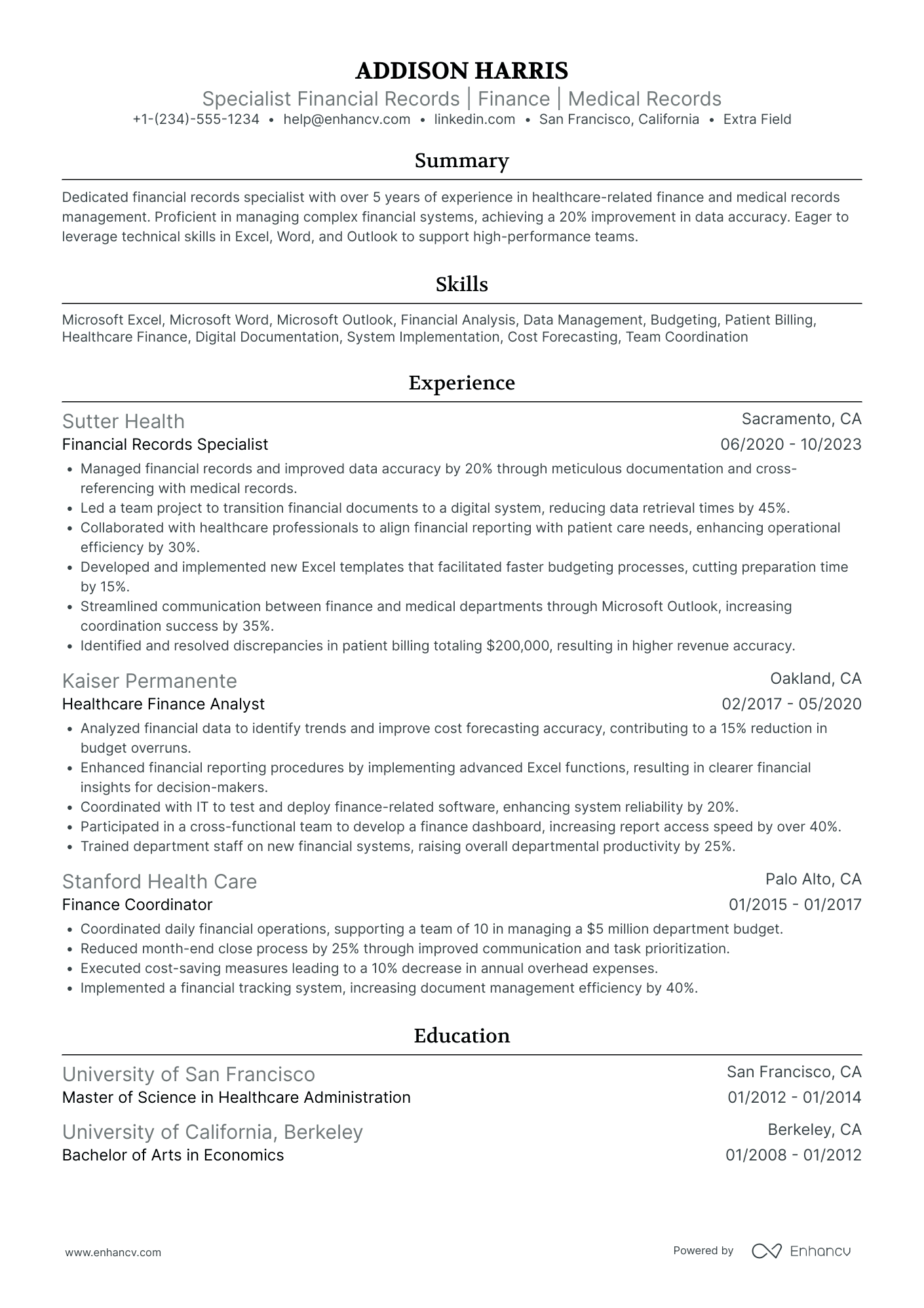

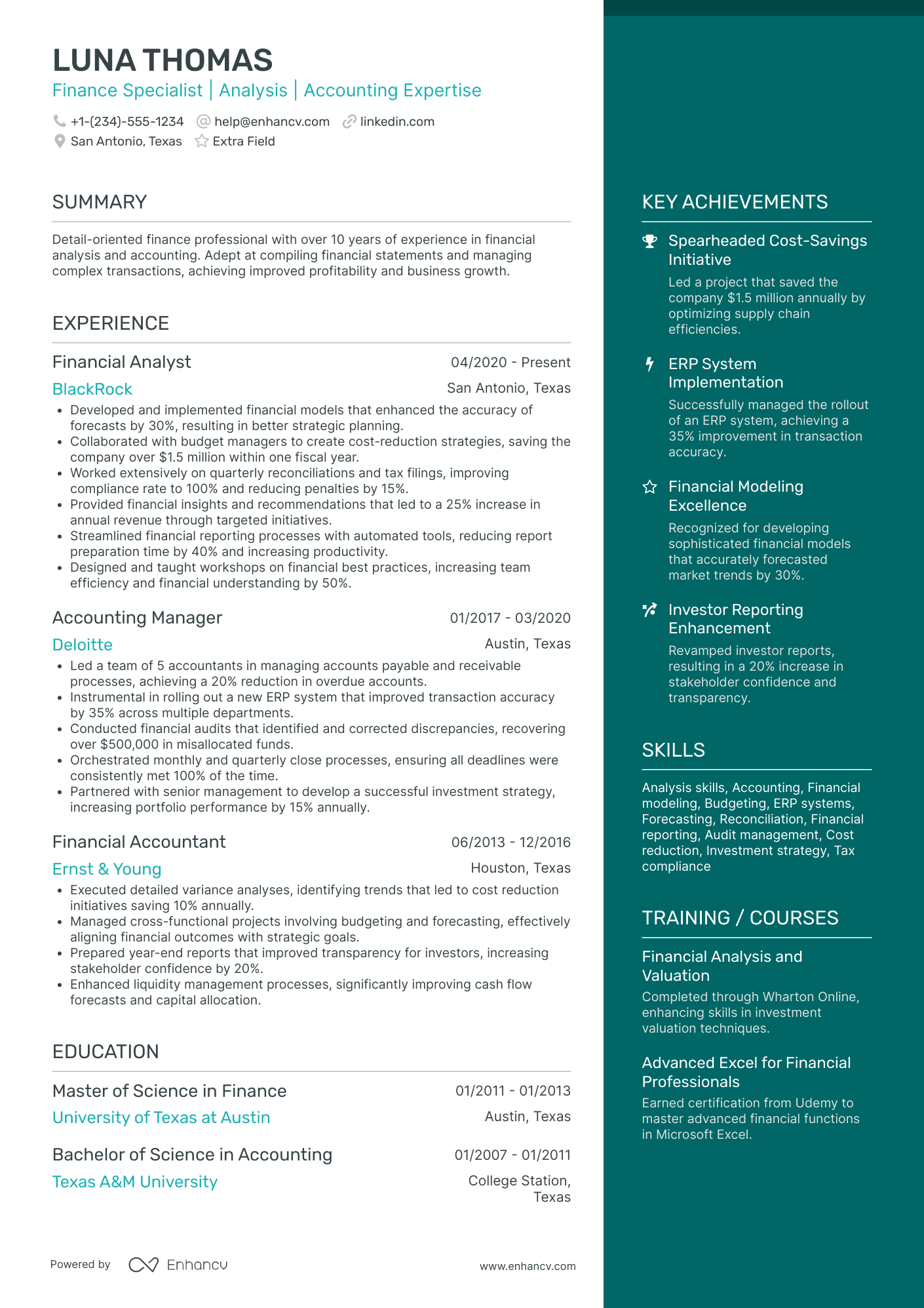

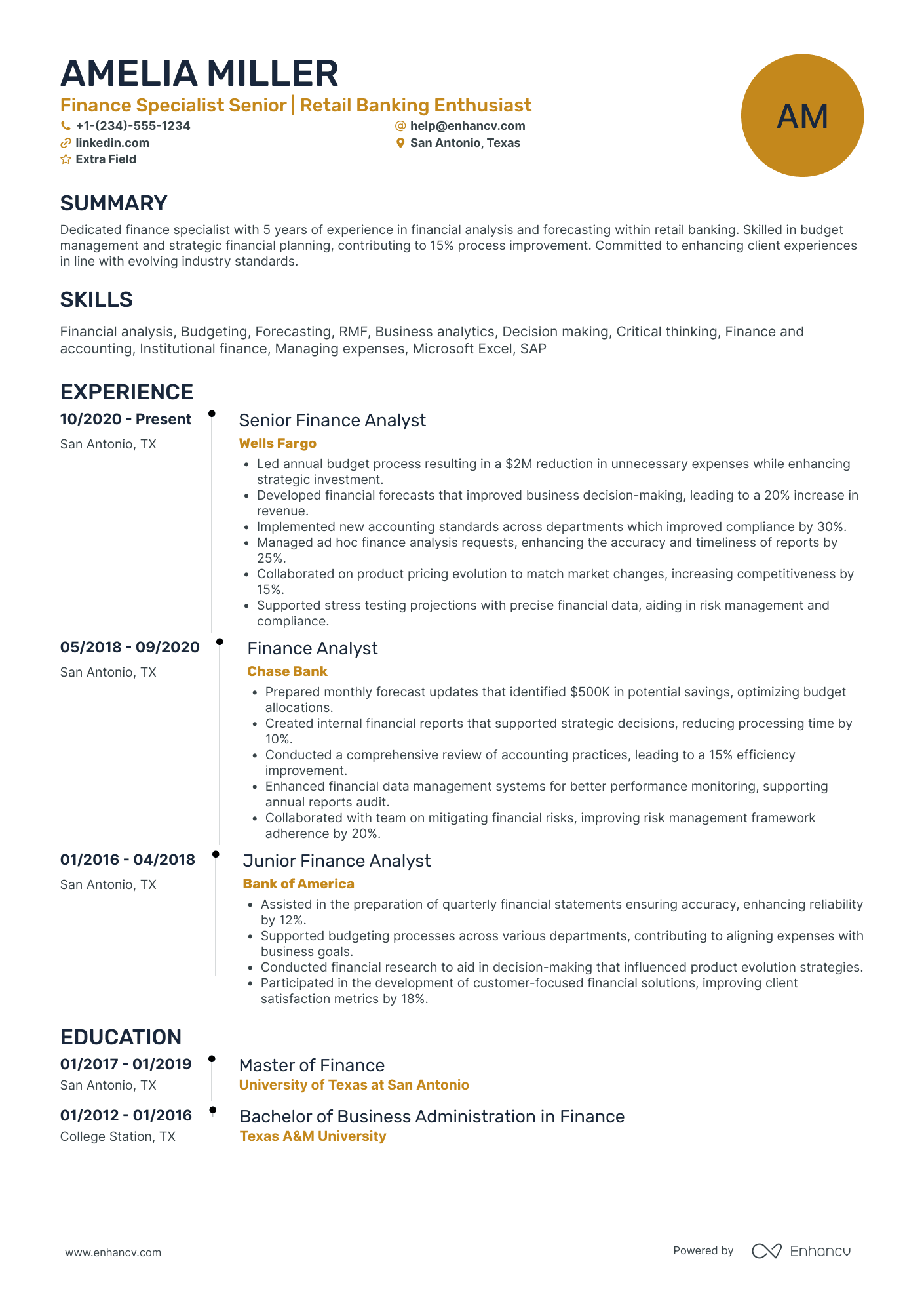

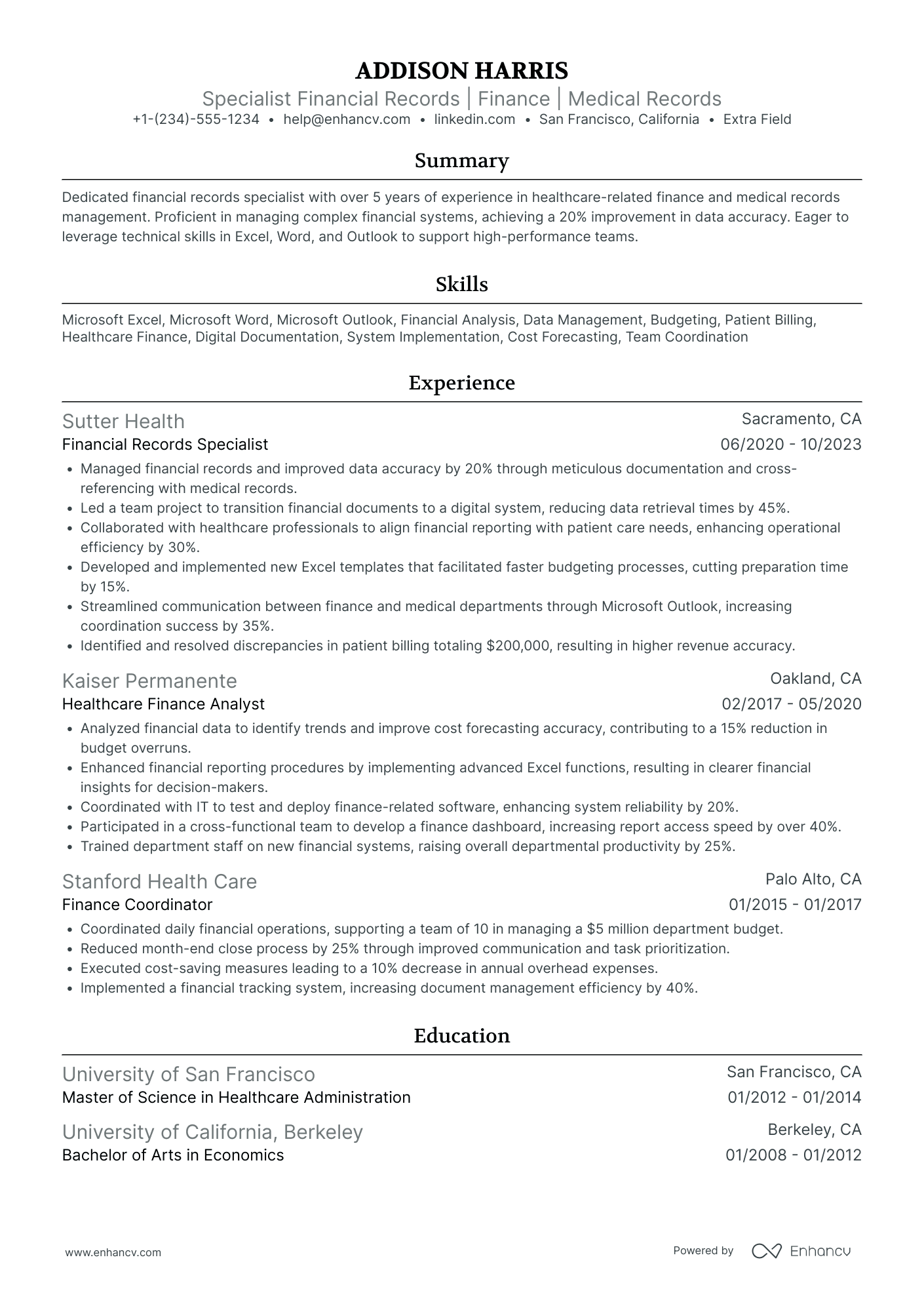

As a finance specialist, articulating complex financial strategies and accomplishments within the limited space of a resume can be a daunting challenge. Our guide provides you with concise, impactful language and formatting techniques to ensure your expertise is communicated effectively, capturing the attention of hiring managers.

- Sample industry-leading examples to learn how to write your best resume yet.

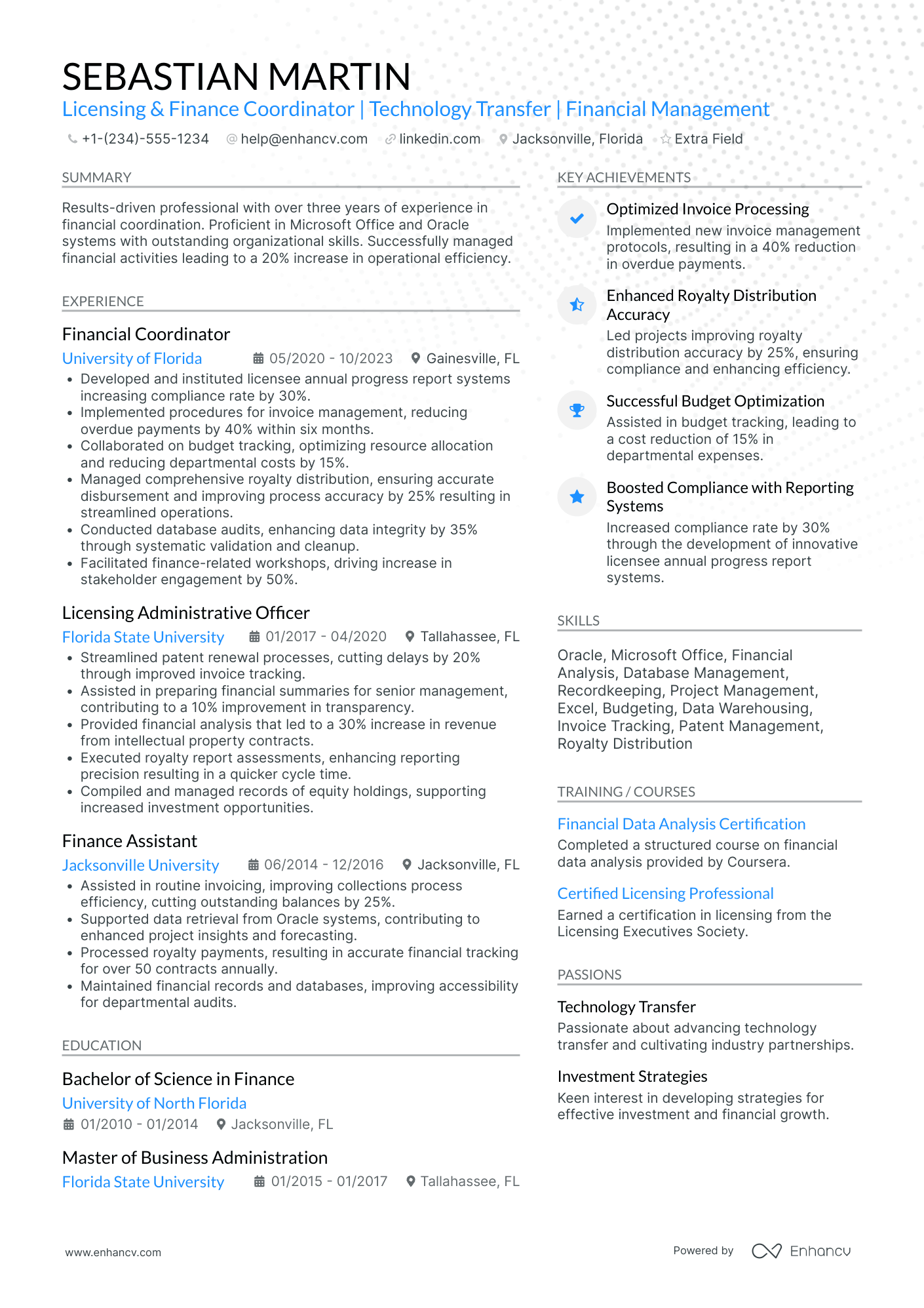

- Improve the experience, education, and achievements section of your resume with insights from resume-writing professionals.

- Curate your technical expertise and personality to stand out amongst the pool of candidates.

- Succinctly focus on your unique skill set all through your finance specialist resume.

If the finance specialist resume isn't the right one for you, take a look at other related guides we have:

Is there a correct way to format your finance specialist resume?

This is a tricky question. While skimming over your resume, recruiters will be looking at your experience and the message your profile conveys. That's why your resume format needs to be clear and concise, serving to supplement and organize your experience. Professional best practices point that the best finance specialist resumes:

- Follow the reverse chronological order, where the most recent experience items are presented first . This is to keep your expertise succinct and to show recruiters your career growth over the years;

- Have a clearly defined header that includes all relevant contact information and a portfolio or a LinkedIn link. In some countries, it is acceptable to include a professional photo , so that your application is more memorable;

- Feature the most important finance specialist resume sections towards the top, e.g. summary, skills, and experience. That way, recruiters can immediately find information that is relevant to the role;

- Take up no more than two pages - and two pages are the exception for more experienced professionals. Keep your expertise to the point and use your finance specialist resume real estate wisely .

- Selecting modern, yet simple fonts, e.g. Rubik, Lato, etc., would help your application stand out;

- Many candidates stick with the tried-and-tested Arial or Times New Roman, but you'd want your finance specialist resume to be a bit more unique;

- The ATS can read all serif and sans-serif fonts, so you should avoid fancy, formal script (or cursive) fonts.

Customize your resume for the market – a Canadian format, for example, might vary in structure.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Don't forget to include these six sections on your finance specialist resume:

- Header and summary for your contact details and to highlight your alignment with the finance specialist job you're applying for

- Experience section to get into specific technologies you're apt at using and personal skills to deliver successful results

- Skills section to further highlight how your profile matches the job requirements

- Education section to provide your academic background

- Achievements to mention any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Quantitative Skills: Evidence of strong mathematical and analytical abilities to manage financial data and create forecasts.

- Financial Software Proficiency: Familiarity with financial software and systems like SAP, Oracle, QuickBooks, or advanced Excel skills.

- Regulatory Knowledge: Understanding of relevant financial regulations and compliance standards, such as GAAP, IFRS, or industry-specific legislation.

- Strategic Planning: Demonstrated experience in financial modeling, budgeting, and strategic planning to inform business decisions.

- Risk Management: Skills in assessing, managing, and mitigating financial risks within a company or for clients.

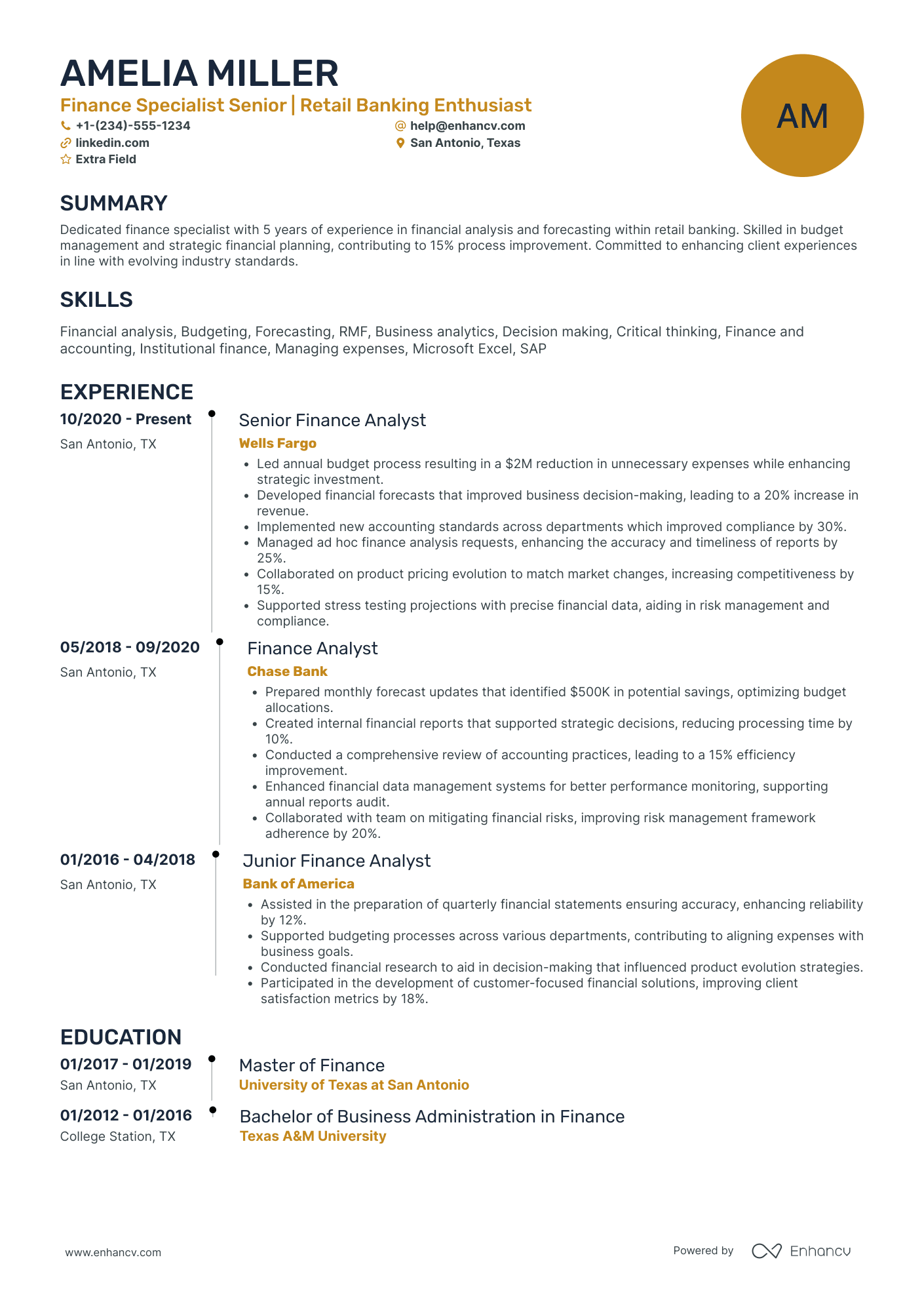

Guide to your most impressive finance specialist resume experience section

When it comes to your resume experience , stick to these simple, yet effective five steps:

- Show how your experience is relevant by including your responsibility, skill used, and outcome/-s;

- Use individual bullets to answer how your experience aligns with the job requirements;

- Think of a way to demonstrate the tangible results of your success with stats, numbers, and/or percentages ;

- Always tailor the experience section to the finance specialist role you're applying for - this may sometimes include taking out irrelevant experience items;

- Highlight your best (and most relevant) achievements towards the top of each experience bullet.

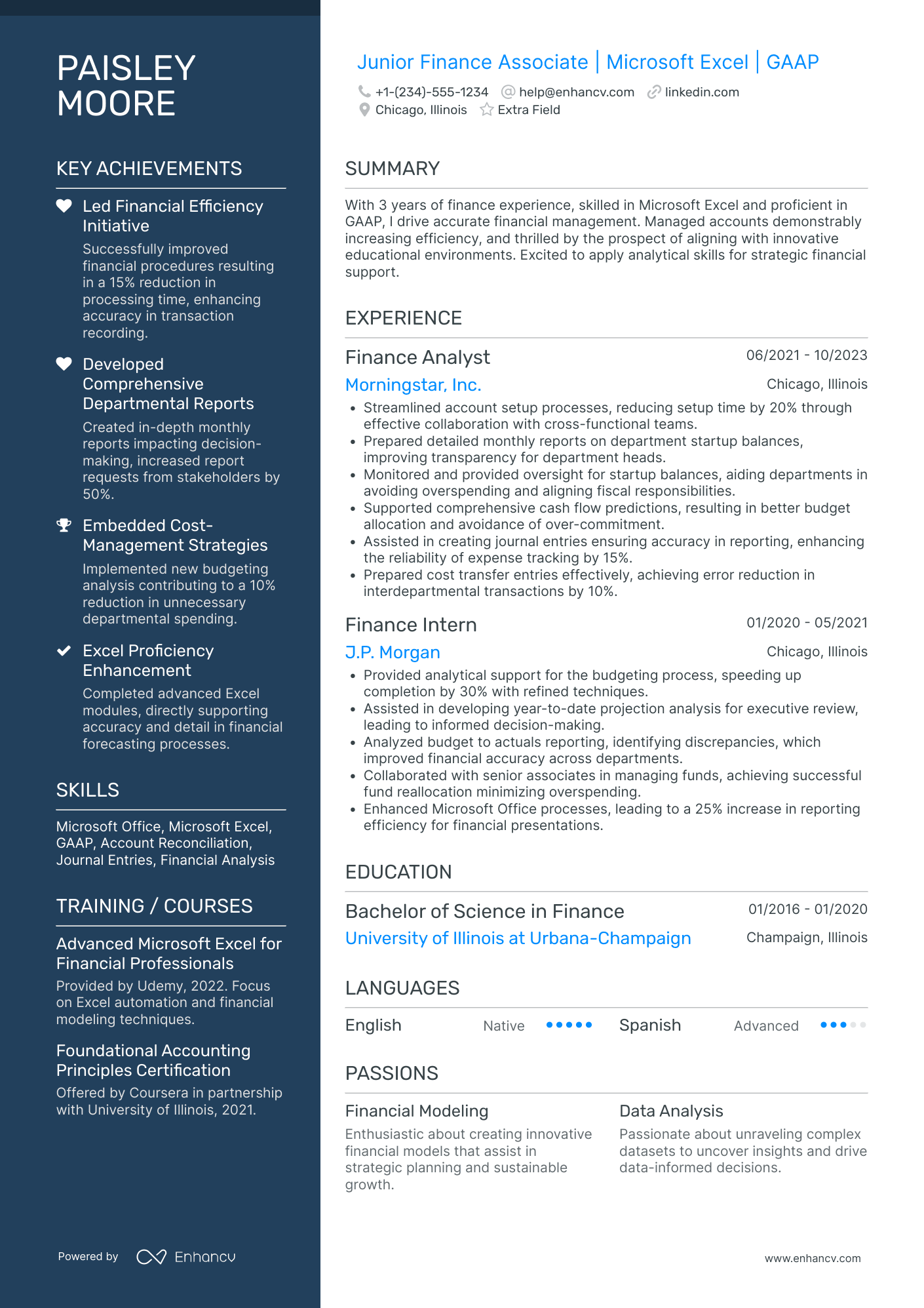

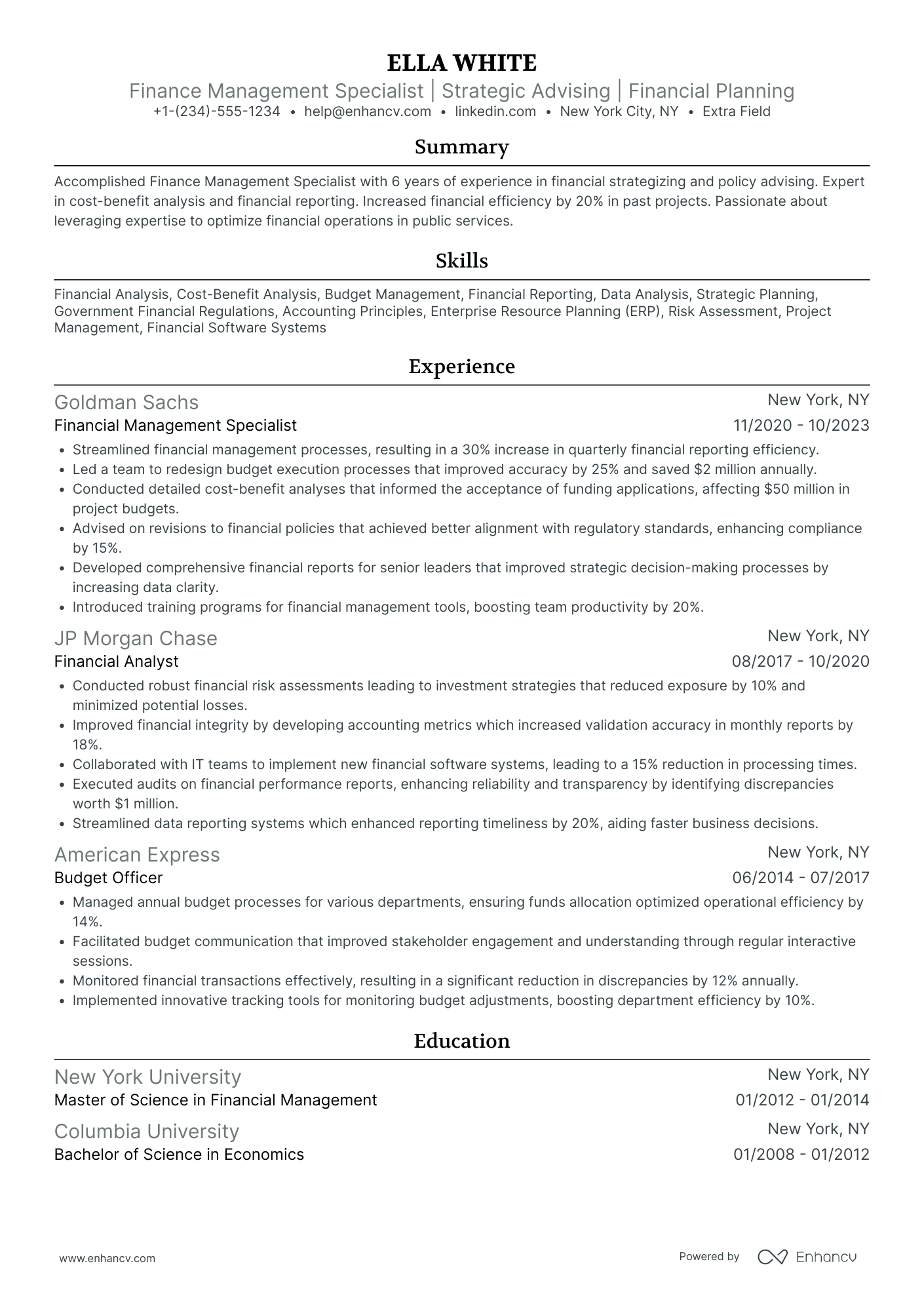

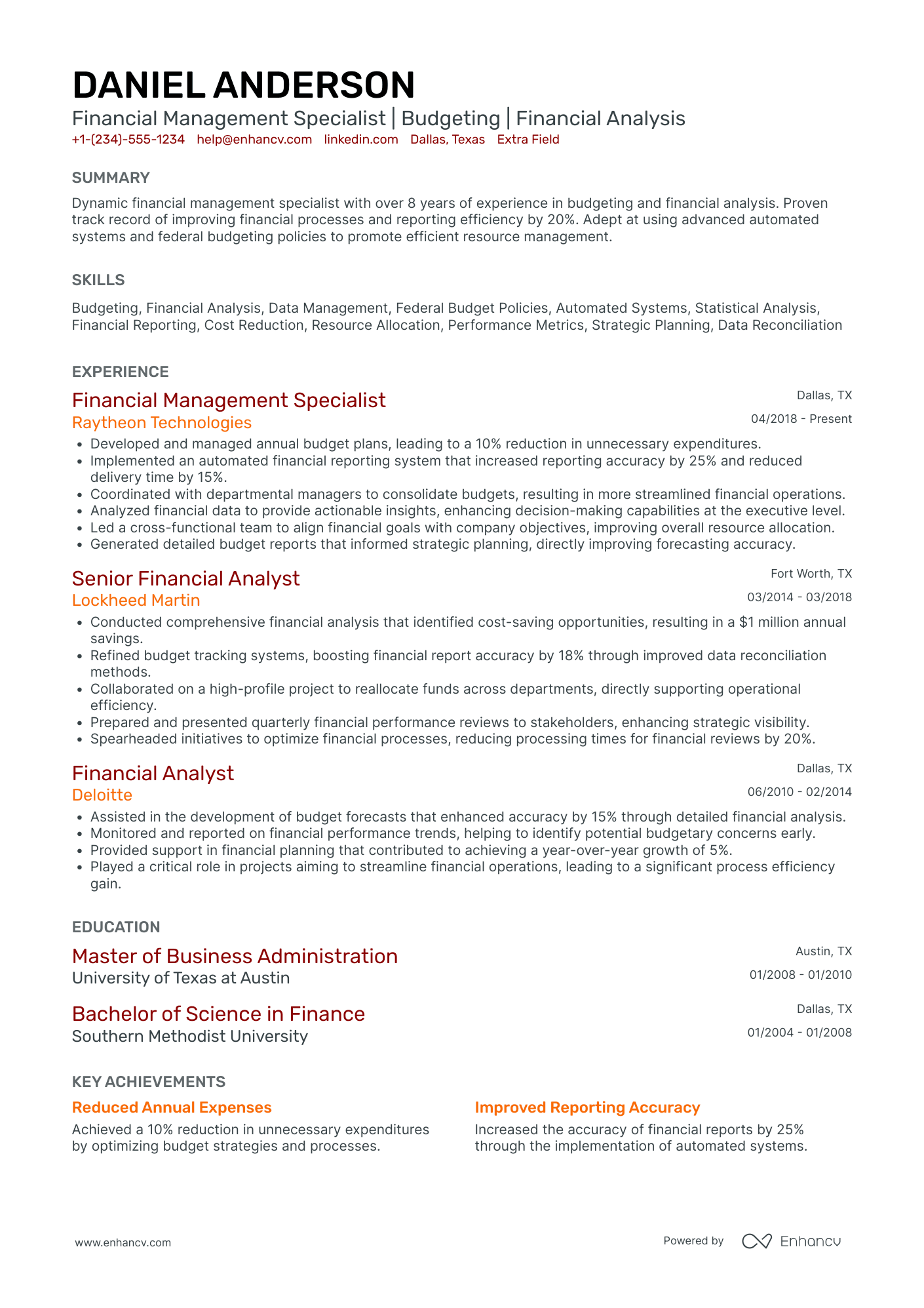

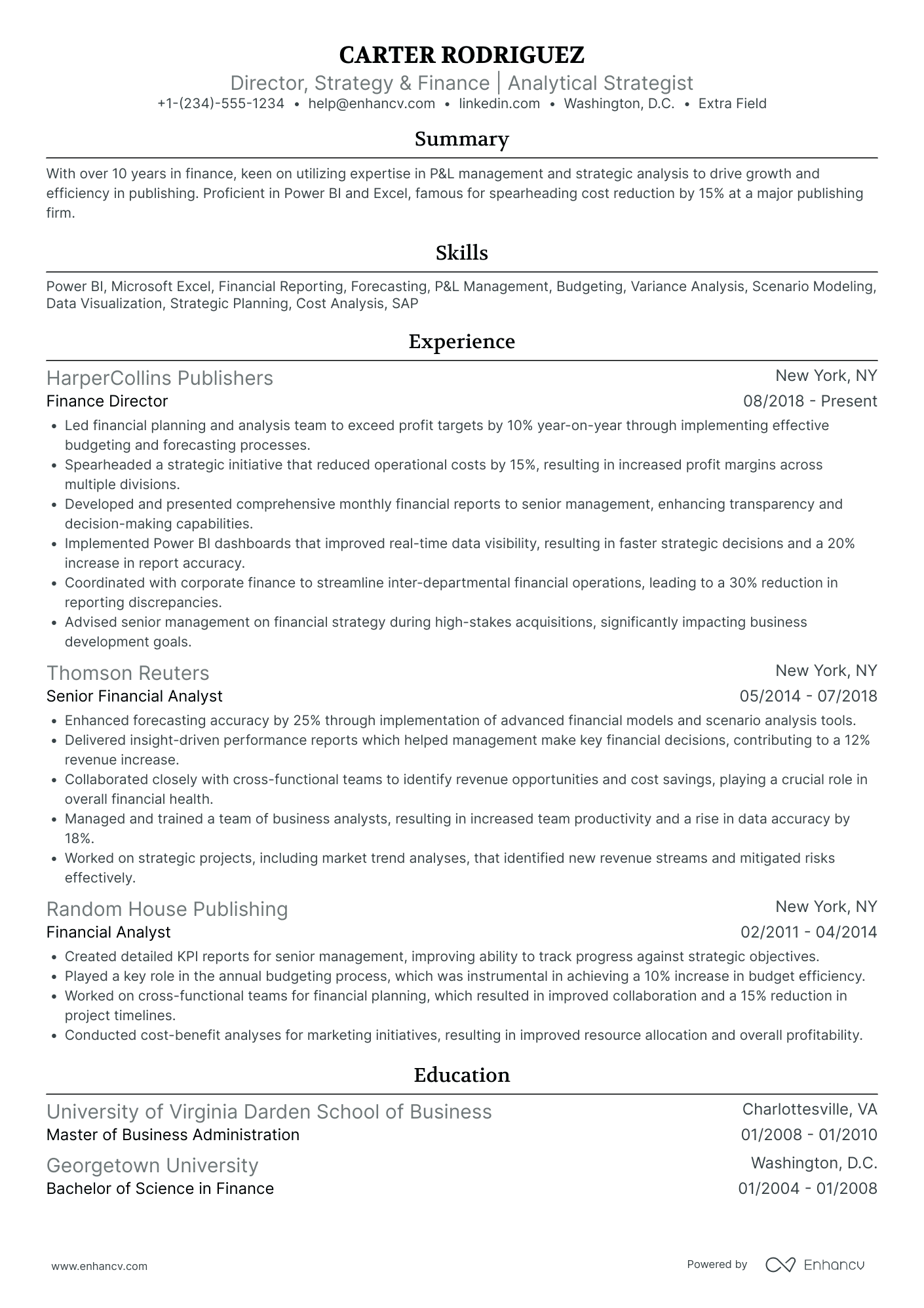

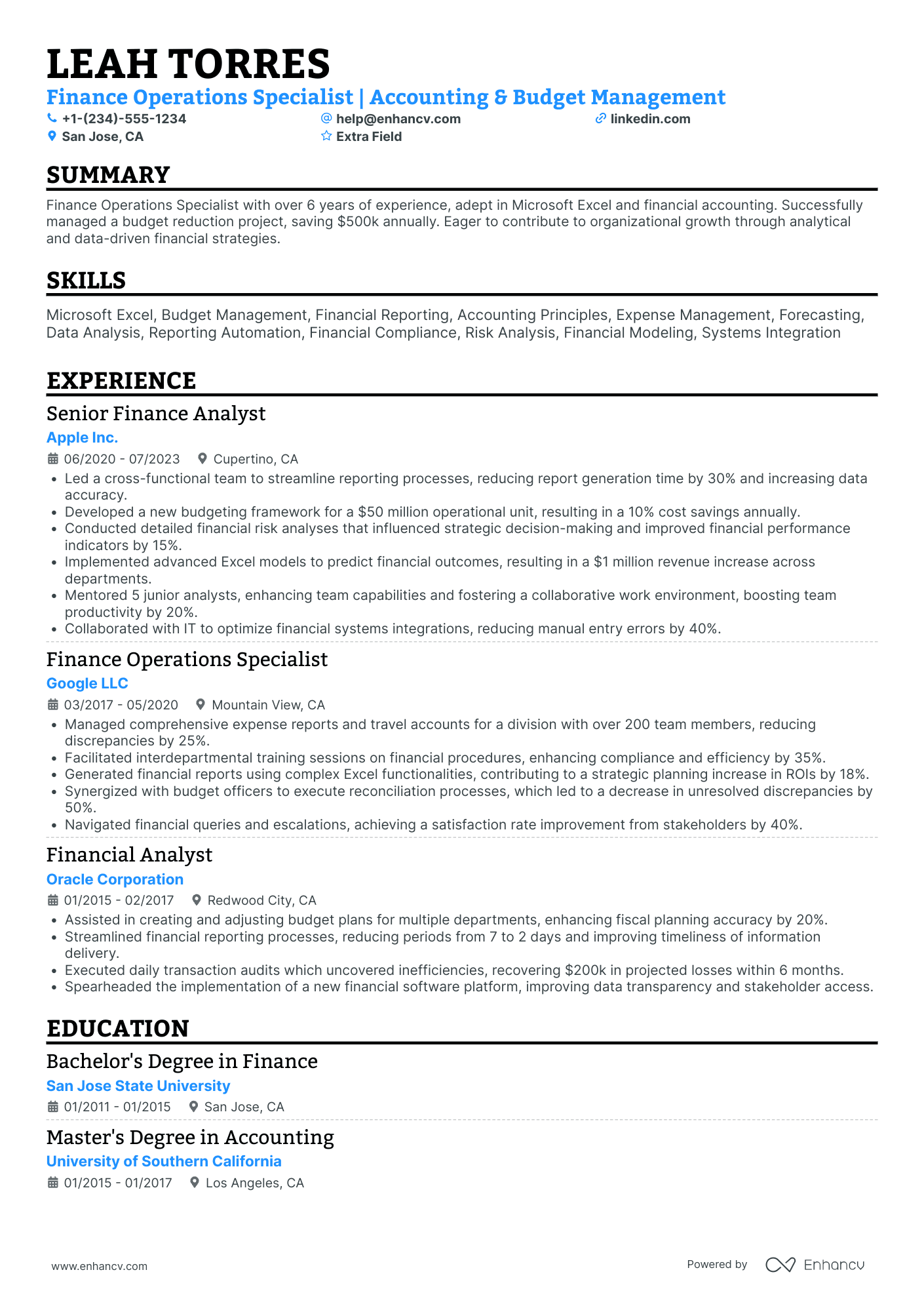

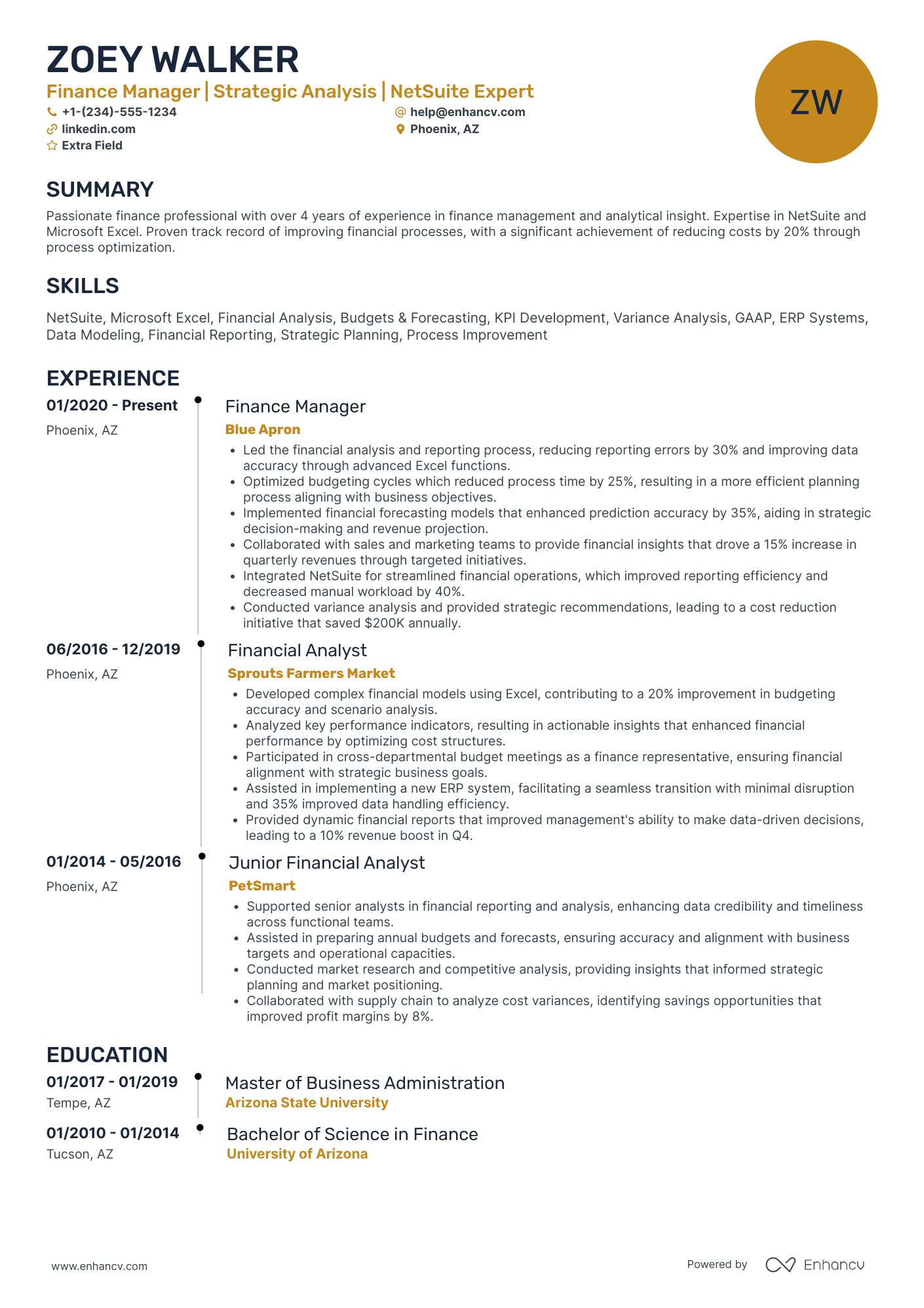

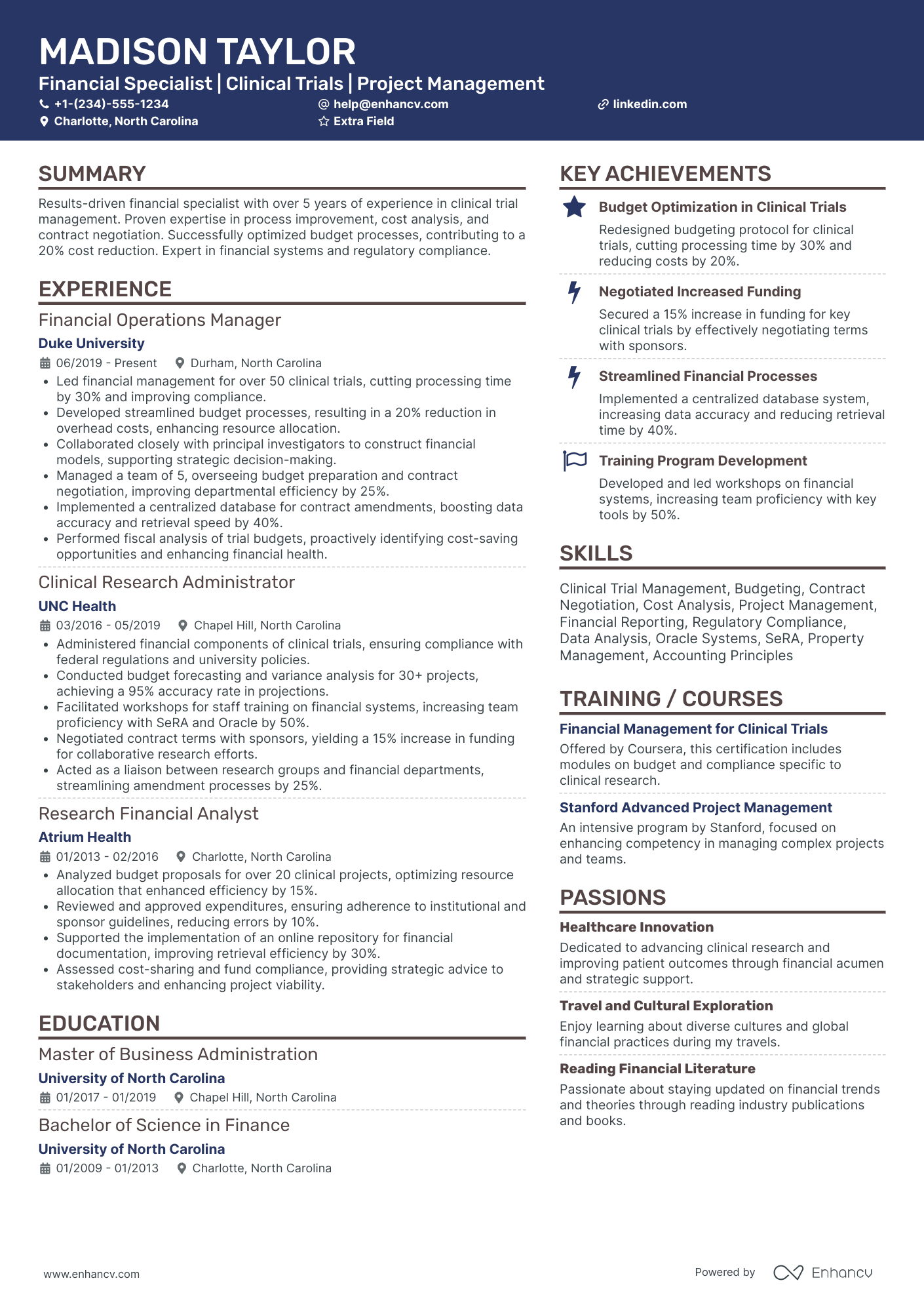

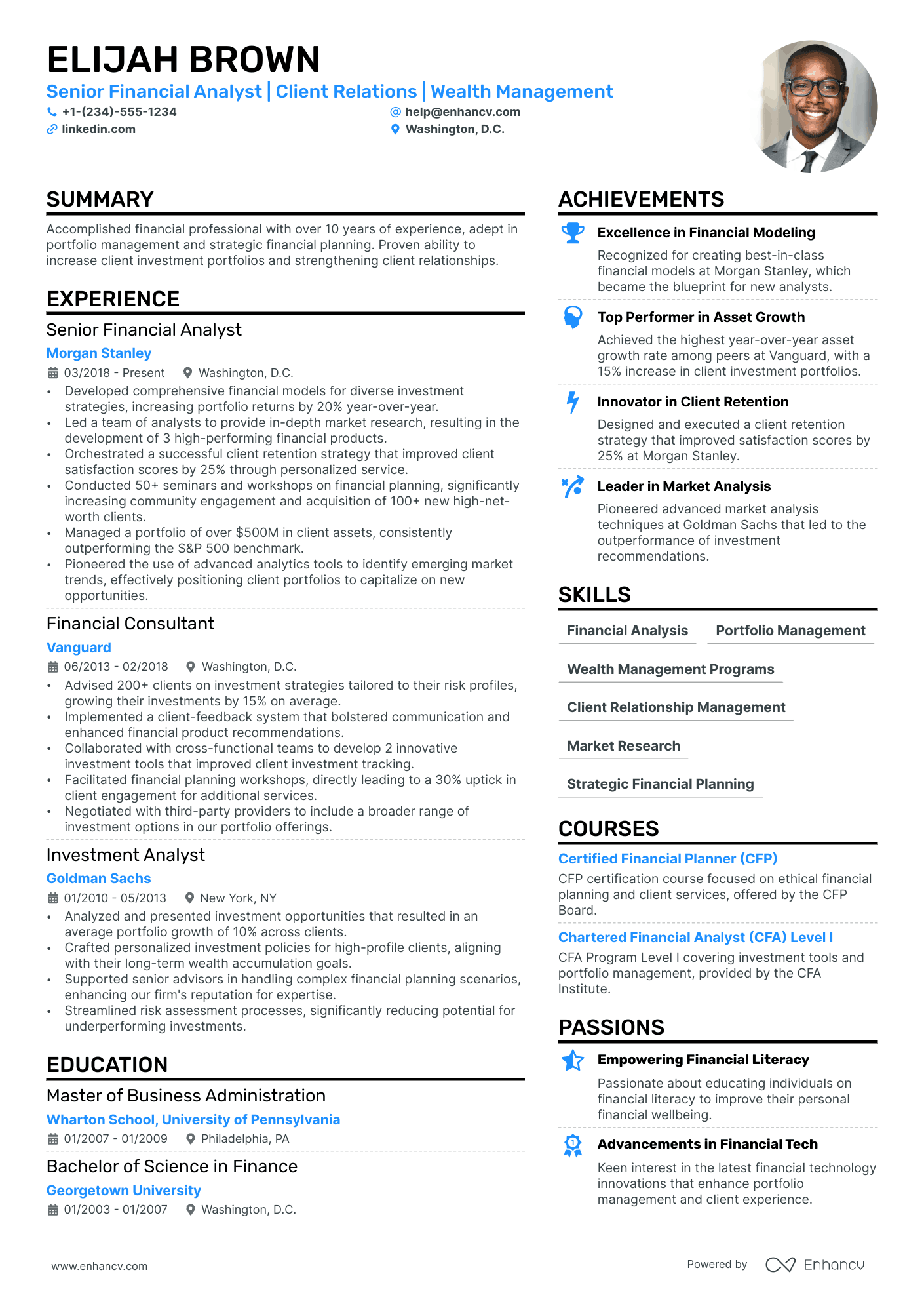

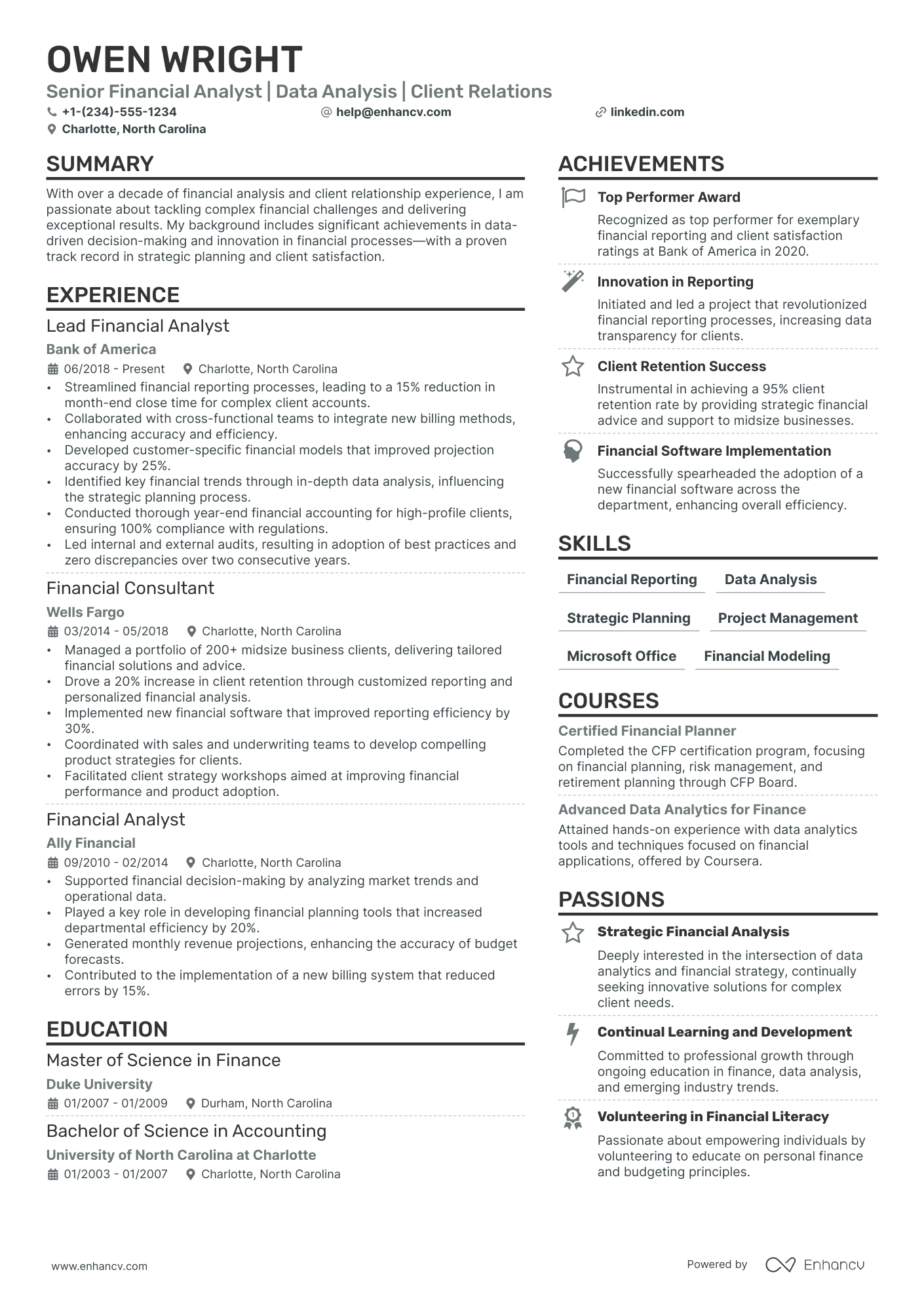

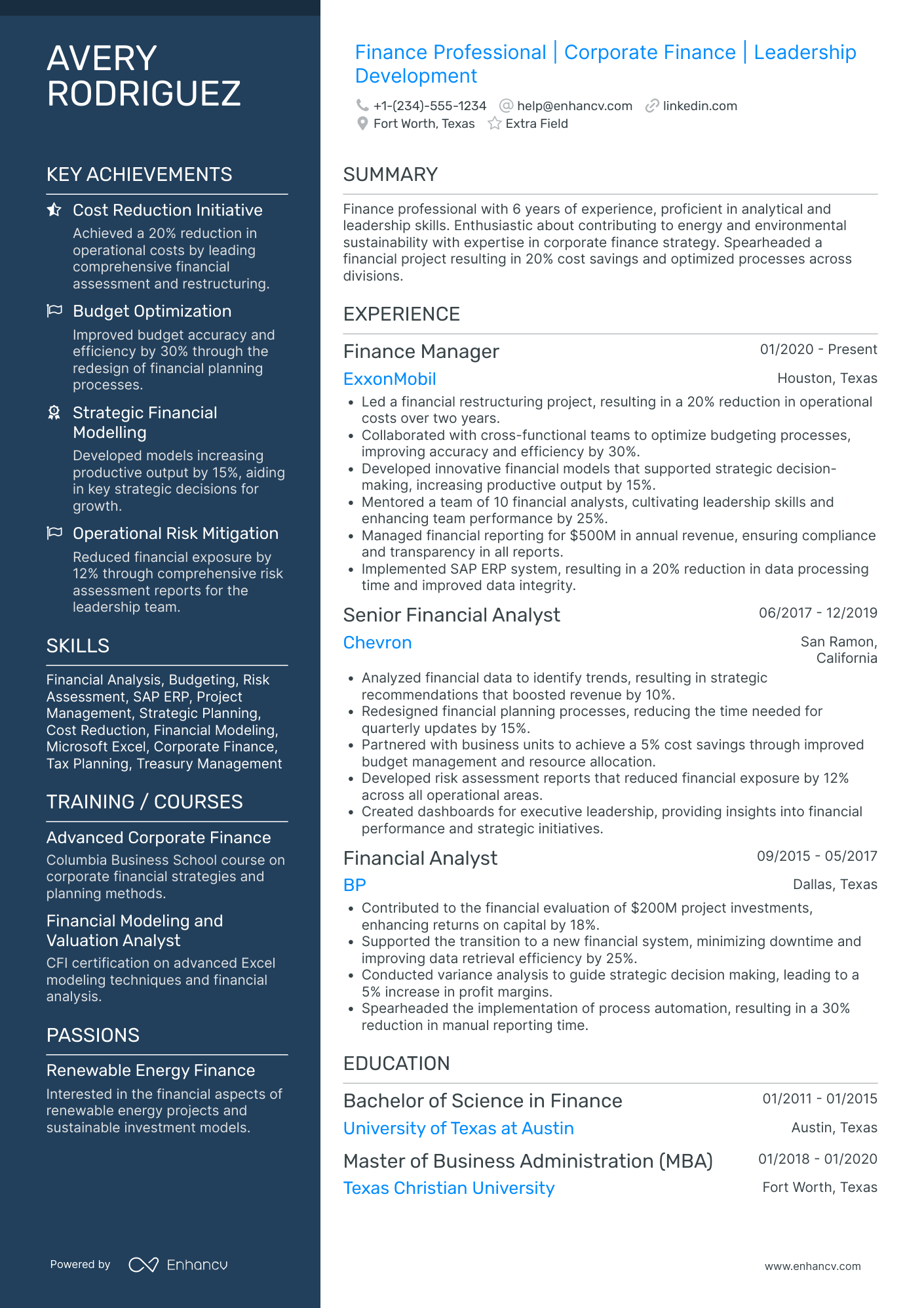

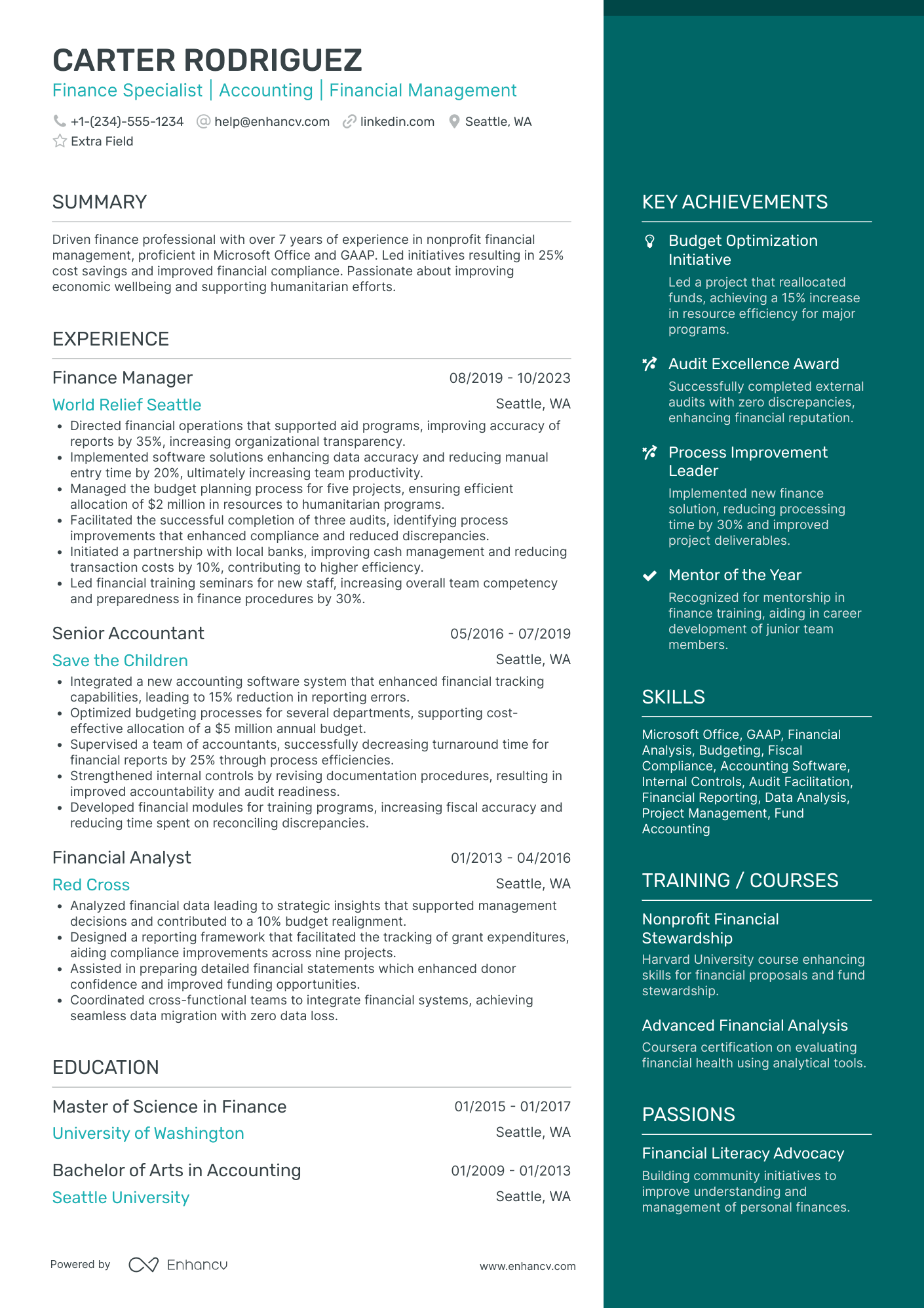

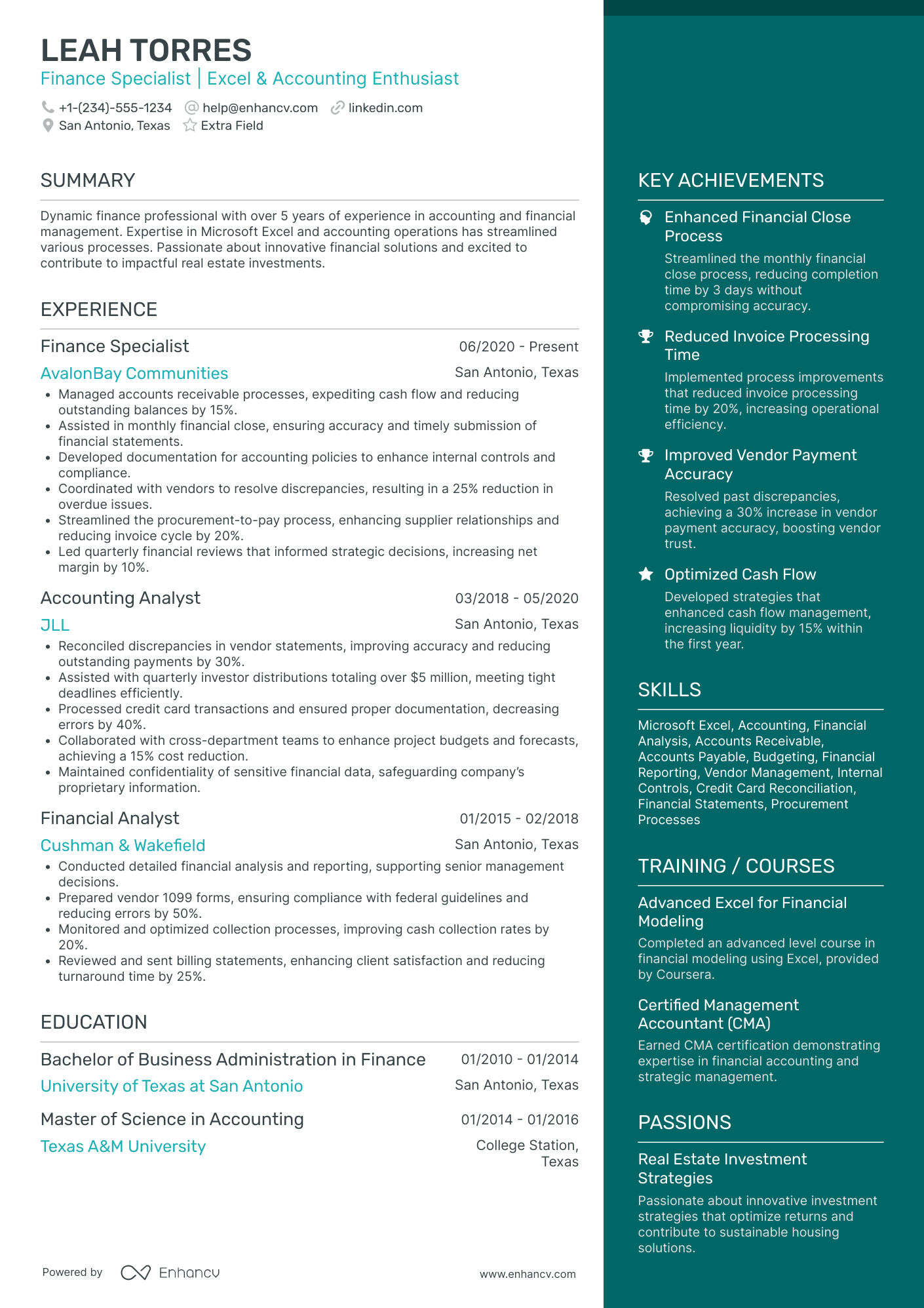

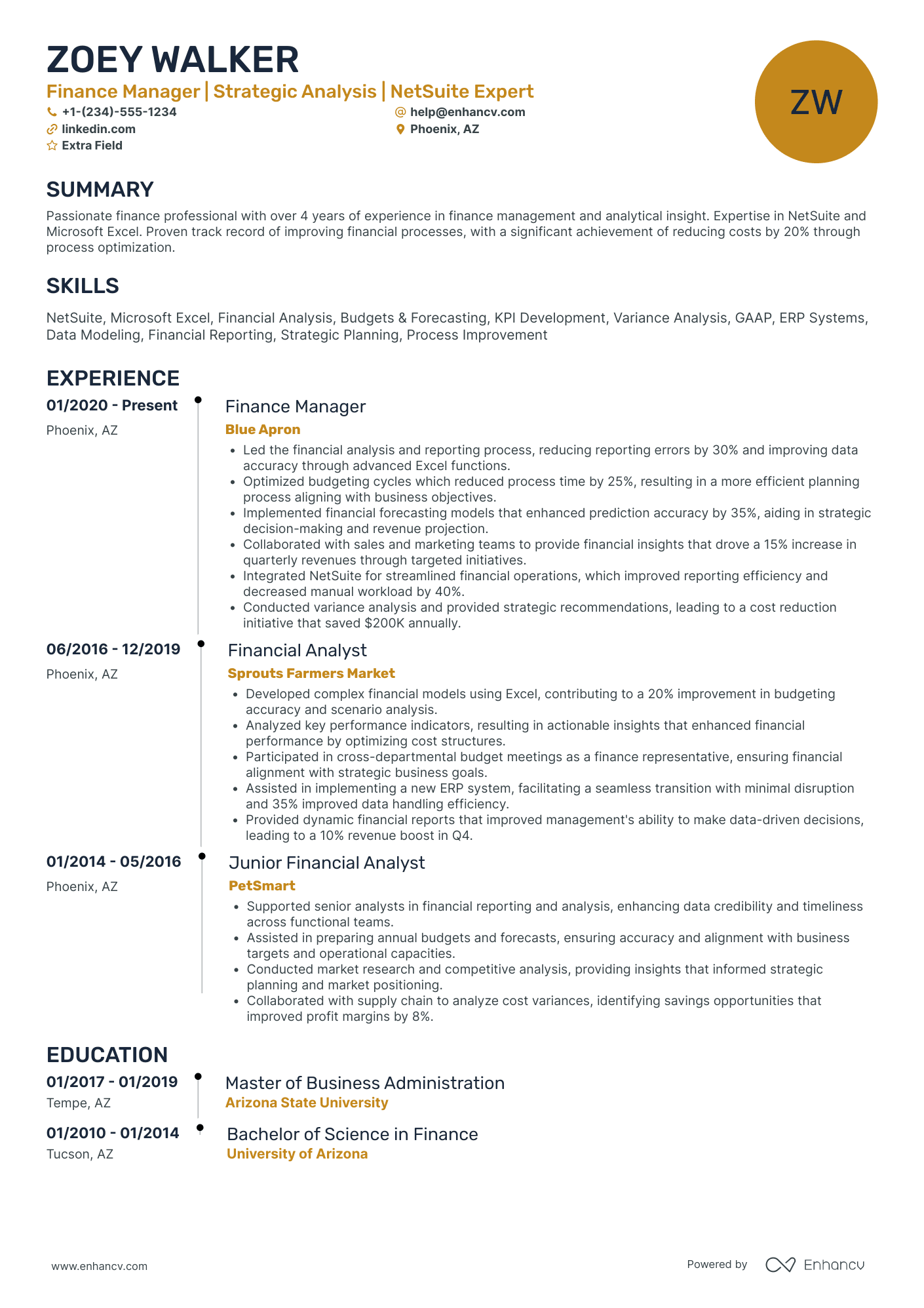

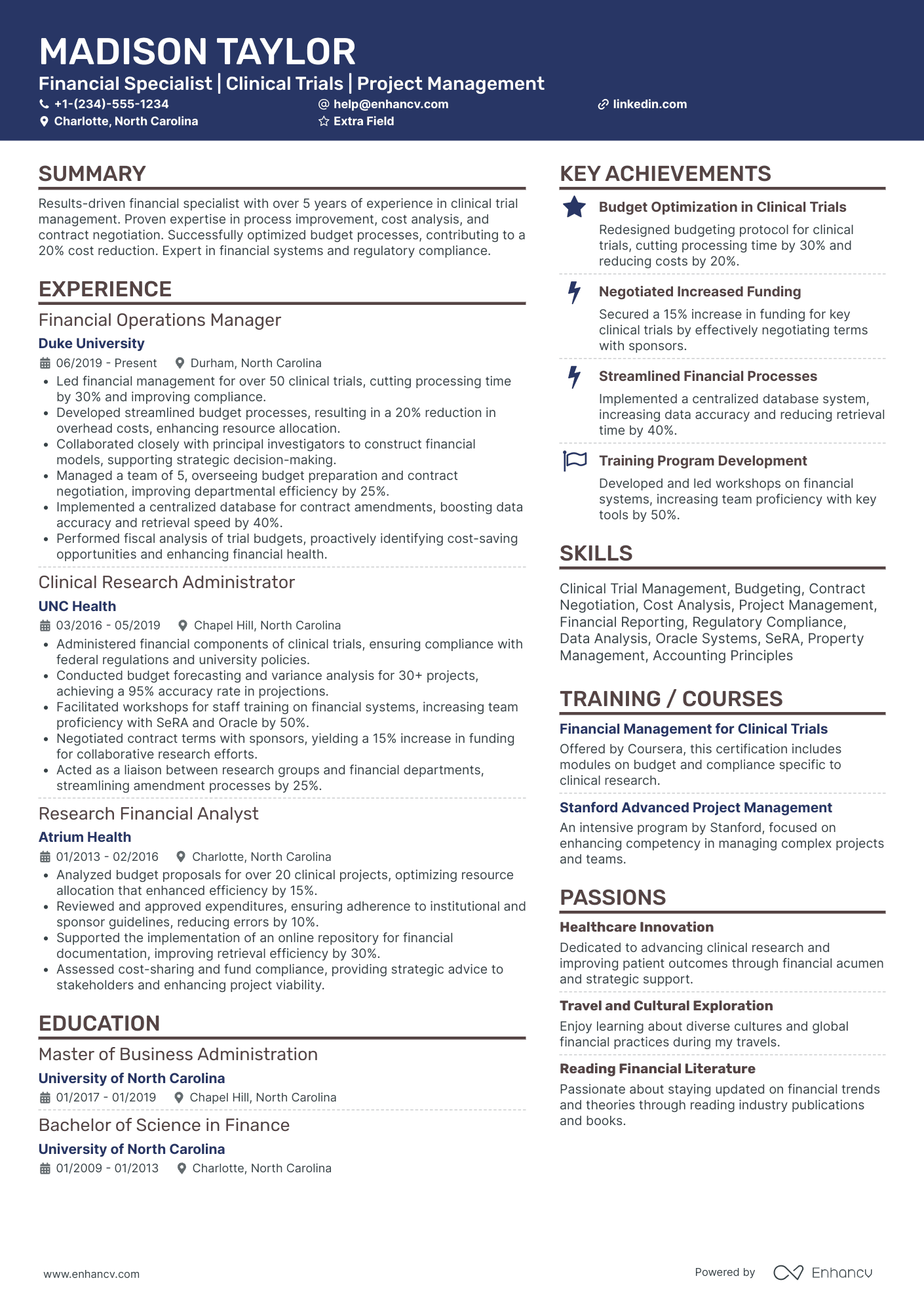

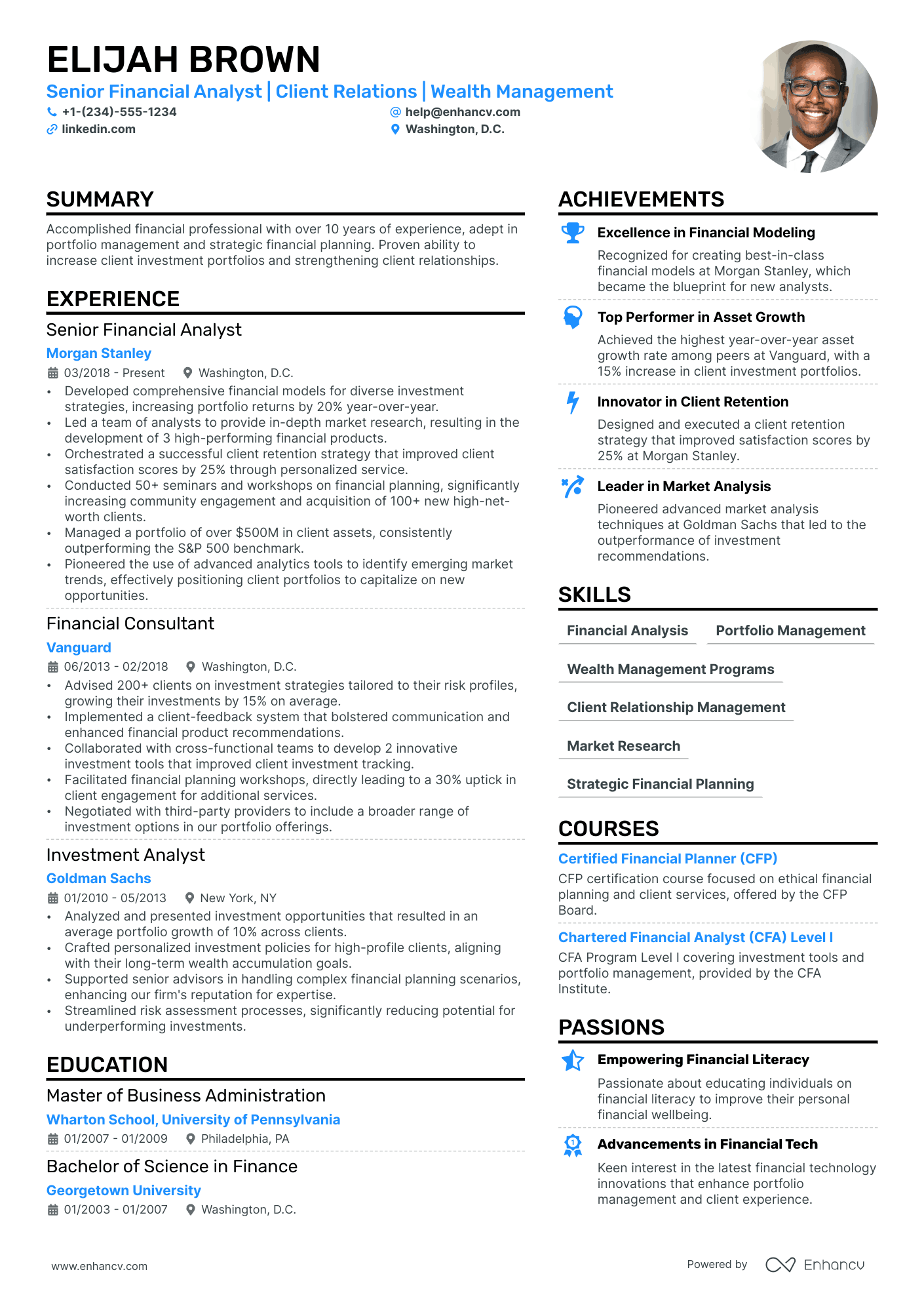

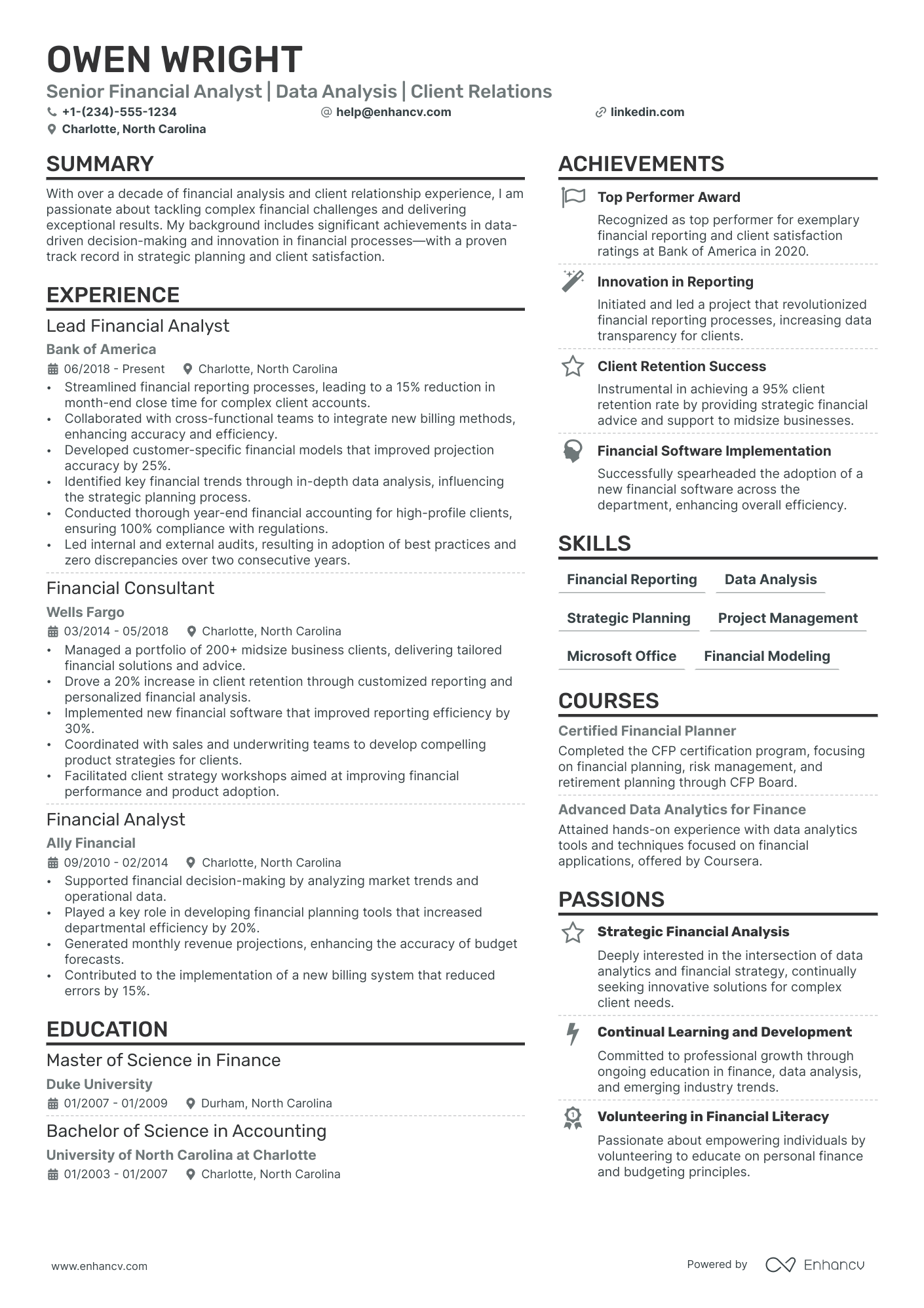

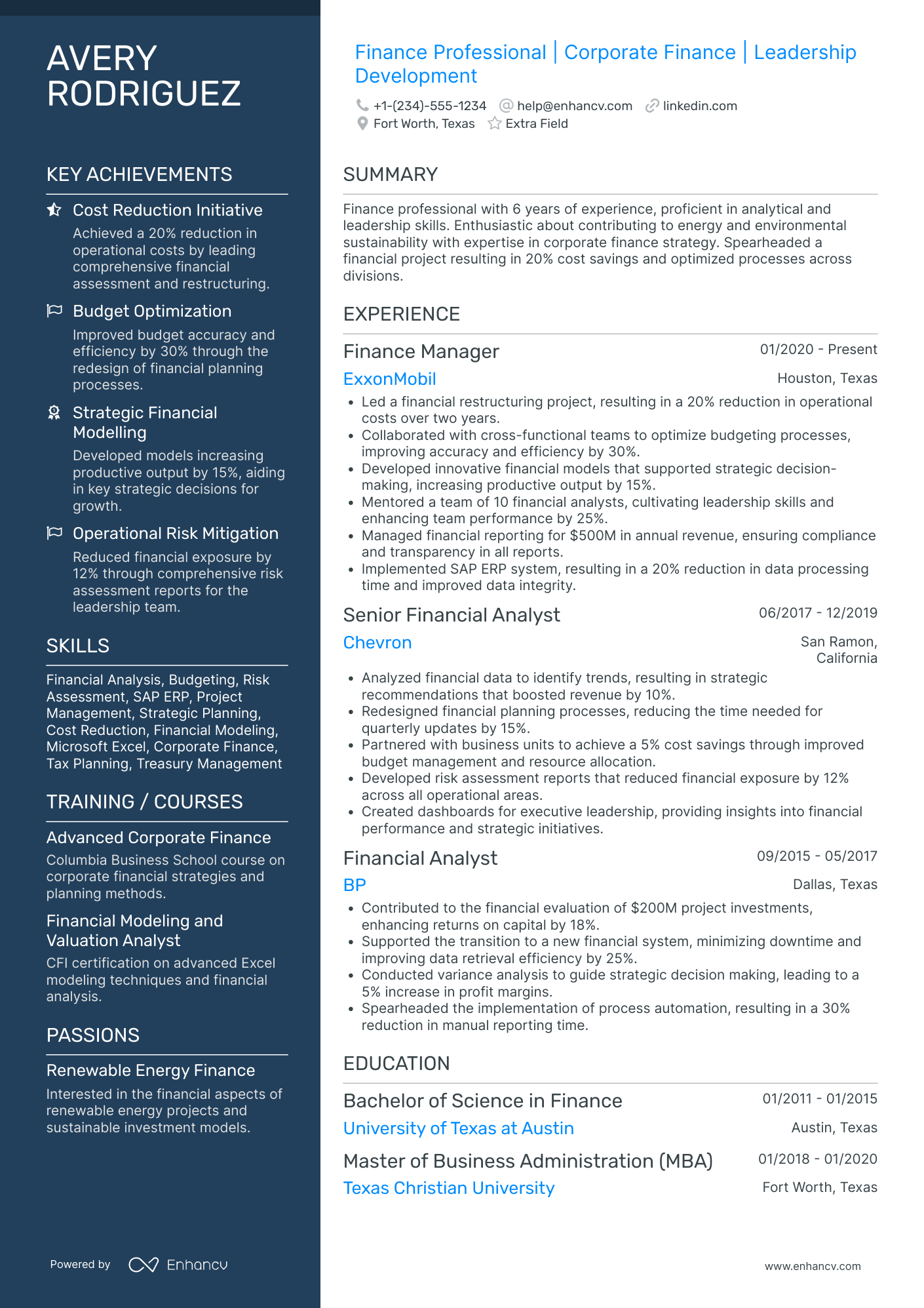

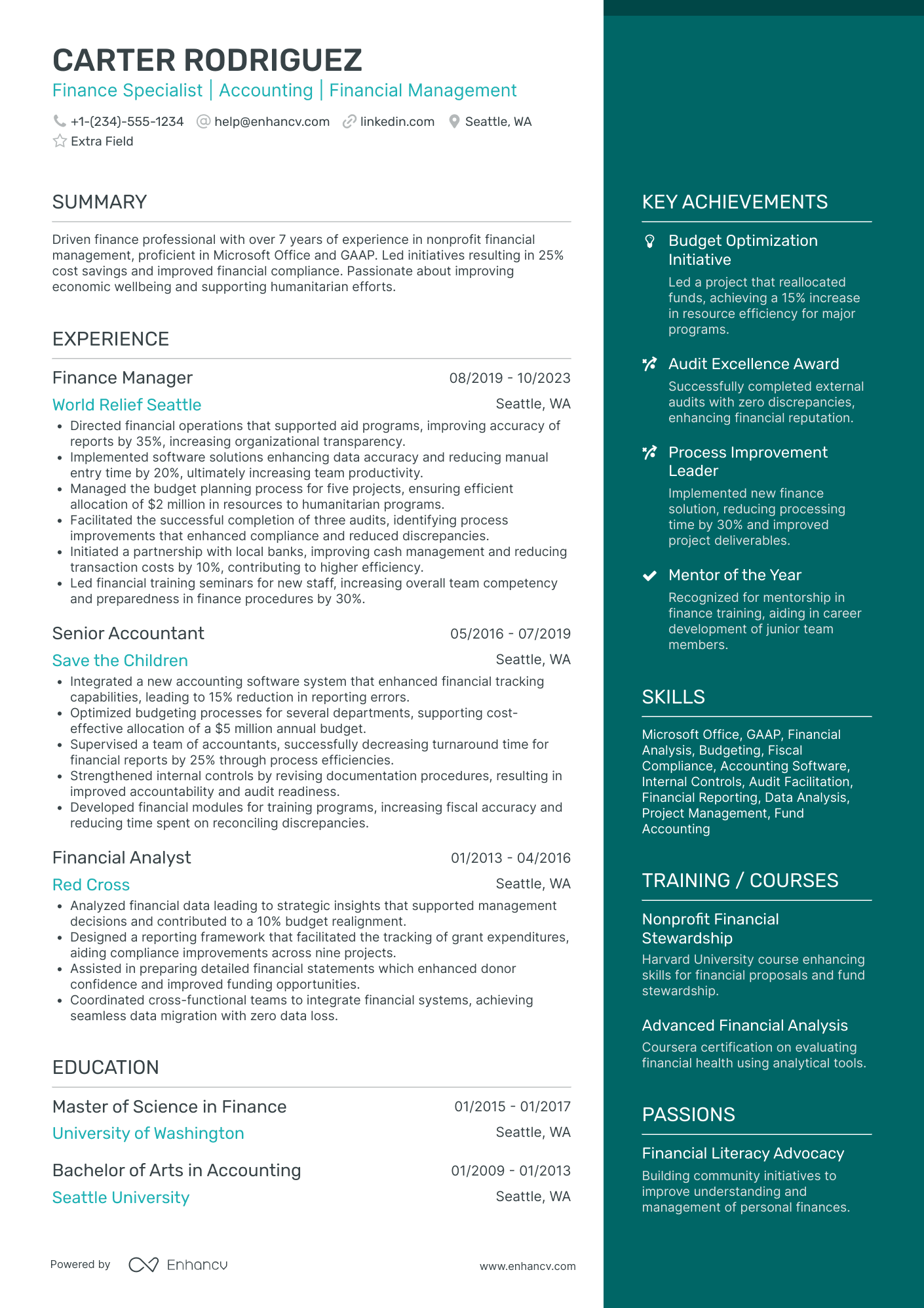

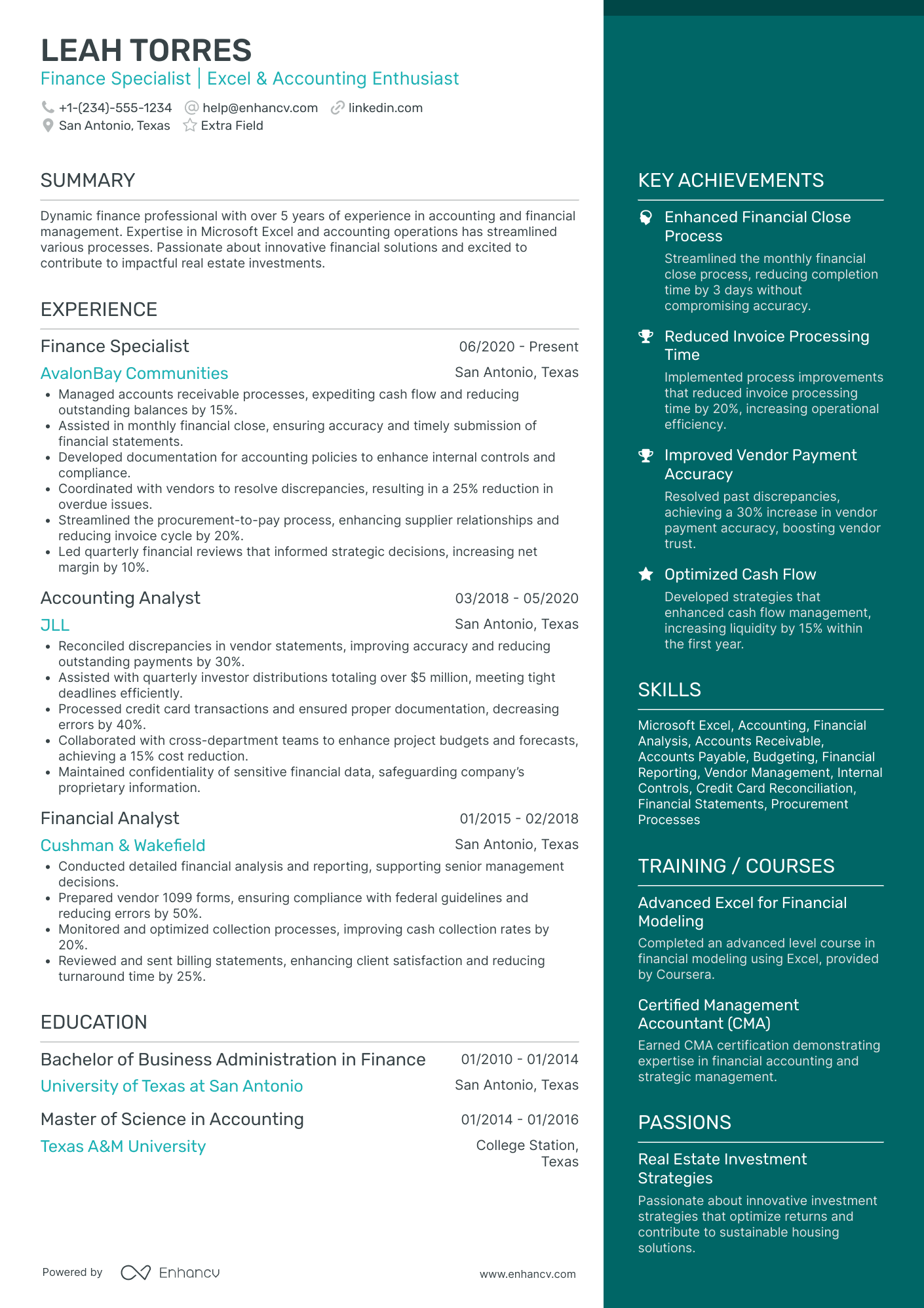

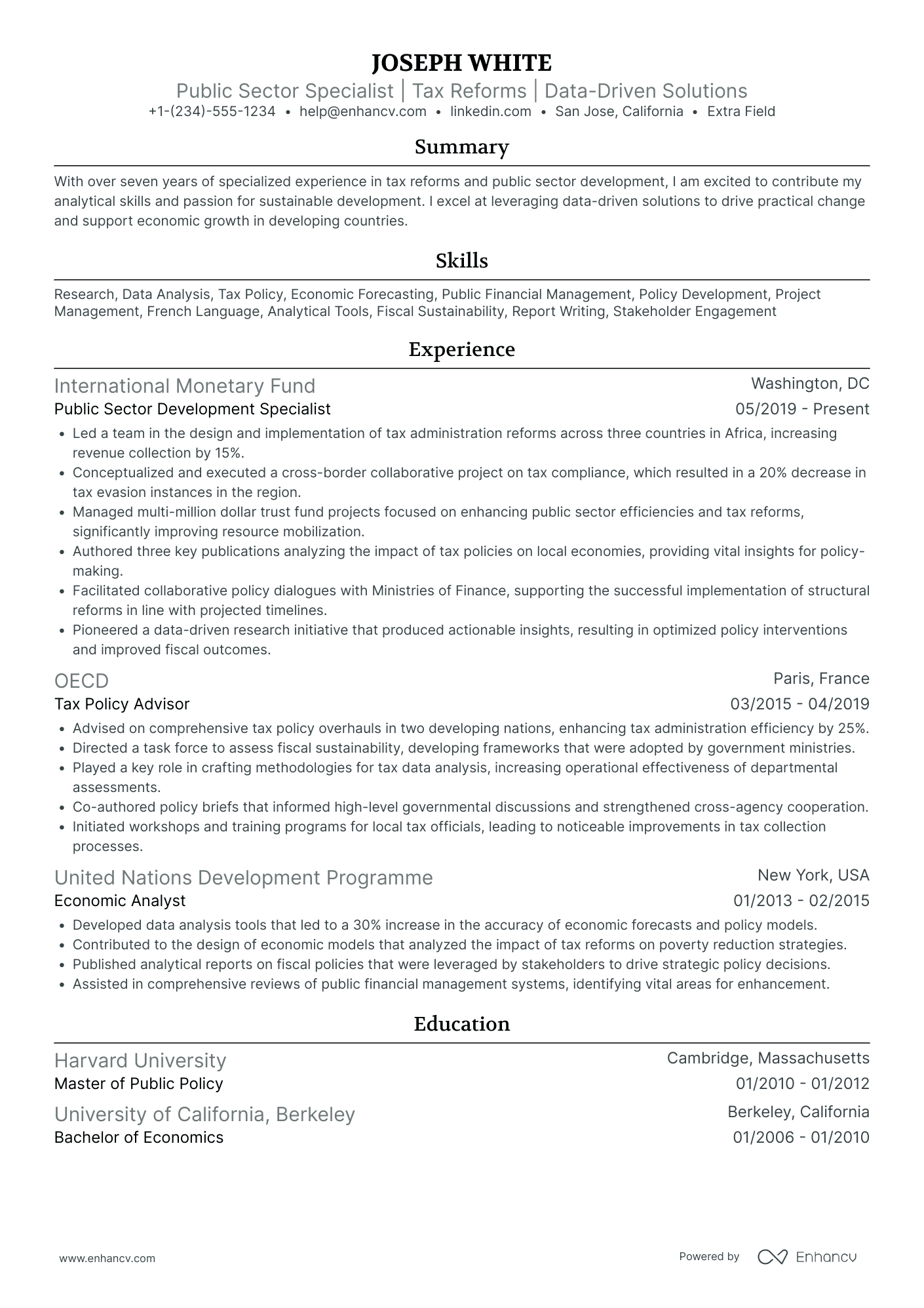

You're not alone if you're struggling with curating your experience section. That's why we've prepared some professional, real-life finance specialist resume samples to show how to best write your experience section (and more).

- Managed and executed the month-end close process for a portfolio exceeding $500M in assets, ensuring timely and accurate financial reporting.

- Implemented a new financial analysis framework that improved budget forecast accuracy by 20%, allowing for better strategic decision-making.

- Negotiated terms with external suppliers leading to a cost reduction of 10% annually, positively impacting the company's profit margin.

- Led a cross-functional team in a $200M corporate restructuring initiative that streamlined operations and enhanced fiscal efficiency.

- Developed and presented financial performance reports to key stakeholders, highlighting trends, risks, and opportunities, influencing business strategies.

- Coordinated with IT department to roll out a new ERP system that improved data accuracy and reduced time spent on manual financial processes by 35%.

- Performed comprehensive financial modeling for a range of M&A transactions, which were pivotal in driving $300M in successful deal closures.

- Played a key role in developing investor presentations that secured $50M in capital investments for expansion projects.

- Worked closely with the financial planning team to re-evaluate investment strategies, leading to a more diversified portfolio with a 15% higher projected ROI.

- Oversaw the reconciliation of financial statements for international transactions, contributing to maintaining the accuracy of $250M in monthly turnover.

- Implemented risk management policies that reduced financial discrepancies by 30%, ensuring more reliable financial operations.

- Collaborated with the compliance team to adhere to new regulatory requirements, averting potential fines and penalties.

- Conducted thorough due diligence on potential investment opportunities, which led to a 25% growth in the company’s investment portfolio.

- Created sophisticated financial models to predict market trends, providing valuable insights that shaped the company's investment strategies.

- Facilitated quarterly earnings calls and communicated complex financial information to investors, contributing to a 40% increase in investor confidence.

- Directed initiative to optimize supply chain financing, resulting in a 15% improvement in cash flow and enhanced operational efficiency.

- Collaborated with sales and marketing teams to align financial targets with business development plans, generating a 10% increase in annual revenue.

- Analyzed market conditions to advise on pricing strategies, playing a significant role in improving product profitability by 5% across the board.

- Initiated the adoption of financial analytics software that shortened the time frame for report generation by 50% and increased data accuracy.

- Provided expert financial system support during the merger with a major competitor, ensuring a seamless integration of financial processes.

- Organized training programs for over 100 employees on the newly implemented financial systems, significantly enhancing user competency levels.

- Led the finance team in a transition to cloud-based accounting software, which reduced operating costs by 20% and improved collaboration among remote teams.

- Played a pivotal role in the strategic planning and financial analysis of a new product line, which ultimately achieved a market share increase of 5% within its first year.

- Managed the allocation of a $10M budget for technology upgrades across the finance department, effectively enhancing overall productivity by 40%.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for finance specialist professionals.

Top Responsibilities for Finance Specialist:

- Make bids or offers to buy or sell securities.

- Monitor markets or positions.

- Agree on buying or selling prices at optimal levels for clients.

- Keep accurate records of transactions.

- Buy or sell stocks, bonds, commodity futures, foreign currencies, or other securities on behalf of investment dealers.

- Complete sales order tickets and submit for processing of client-requested transactions.

- Report all positions or trading results.

- Interview clients to determine clients' assets, liabilities, cash flow, insurance coverage, tax status, or financial objectives.

- Discuss financial options with clients and keep them informed about transactions.

- Identify opportunities or develop channels for purchase or sale of securities or commodities.

Quantifying impact on your resume

- Highlight specific percentages by which you have increased revenue or reduced costs through your financial strategies and actions.

- Quantify the size of budgets or portfolios you have managed to demonstrate your capability with large-scale financial responsibilities.

- Detail the number of projects you’ve led or contributed to that have had significant financial impact on your organization.

- Showcase how many reports or financial statements you have prepared or overseen to establish your expertise in financial documentation.

- Mention the specific number of compliance or regulatory audits you've navigated successfully to underline your attention to legal and financial governance.

- Illustrate your efficiency by detailing the percentage reduction in time or resources required for financial processes due to improvements you implemented.

- State the numerical rating or ranking you achieved in performance appraisals, particularly if they benchmark you against peers in your industry.

- Include any quantifiable achievements in financial software or tools you’ve implemented that have led to improvements in financial operations.

Action verbs for your finance specialist resume

Four quick steps for candidates with no resume experience

Those with less or no relevant experience could also make a good impression on recruiters by:

- Taking the time to actually understand what matters most to the role and featuring this within key sections of their resume

- Investing resume space into defining what makes them a valuable candidate with transferrable skills and personality

- Using the resume objective to showcase their personal vision for growth within the company

- Heavily featuring their technical alignment with relevant certifications, education, and skills.

Remember that your resume is about aligning your profile to that of the ideal candidate.

The more prominently you can demonstrate how you answer job requirements, the more likely you'd be called in for an interview.

Recommended reads:

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

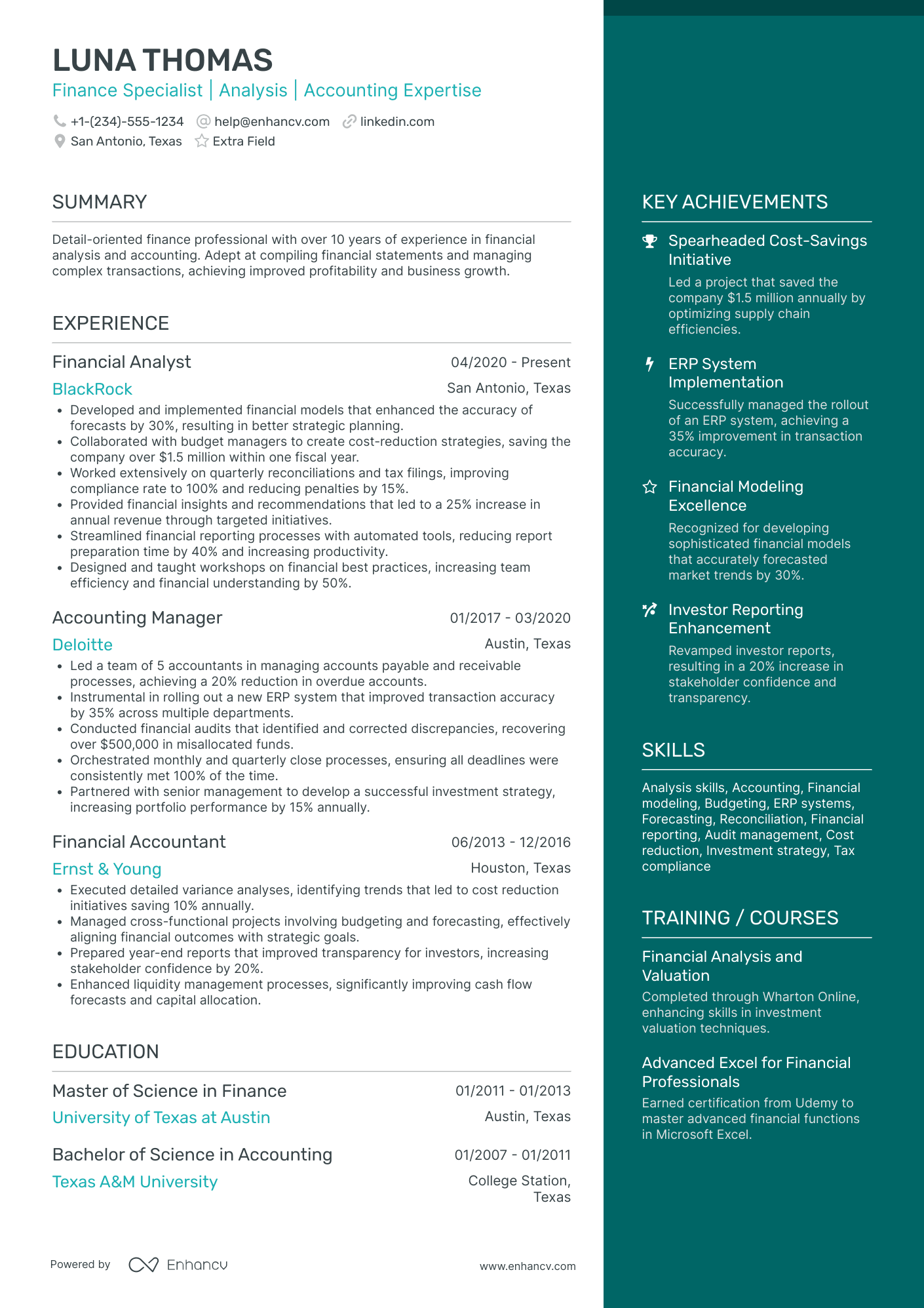

Finance specialist skills and achievements section: must-have hard and soft skills

A key principle for your finance specialist resume is to prominently feature your hard skills, or the technologies you excel in, within the skills section. Aim to list several hard skills that are in line with the job's requirements.

When it comes to soft skills, like interpersonal communication abilities and talents, they're trickier to quantify.

Claiming to be a good communicator is one thing, but how can you substantiate this claim?

Consider creating a dedicated "Strengths" or "Achievements" section. Here, you can describe how specific soft skills (such as leadership, negotiation, problem-solving) have led to concrete achievements.

Your finance specialist resume should reflect a balanced combination of both hard and soft skills, just as job requirements often do.

Top skills for your finance specialist resume:

Financial Analysis

Accounting Software (e.g., QuickBooks, SAP)

Excel Advanced Functions

Data Visualization Tools (e.g., Tableau, Power BI)

Budgeting and Forecasting

Tax Preparation Software

Financial Reporting

Risk Management Tools

ERP Systems

Financial Modeling

Analytical Thinking

Attention to Detail

Problem-Solving

Communication Skills

Time Management

Team Collaboration

Adaptability

Critical Thinking

Negotiation Skills

Ethical Judgment

Next, you will find information on the top technologies for finance specialist professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Finance Specialist’s resume:

- Oracle PeopleSoft

- SAP software

- Microsoft PowerPoint

- Oracle E-Business Suite Financials

- Web-based trading systems

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

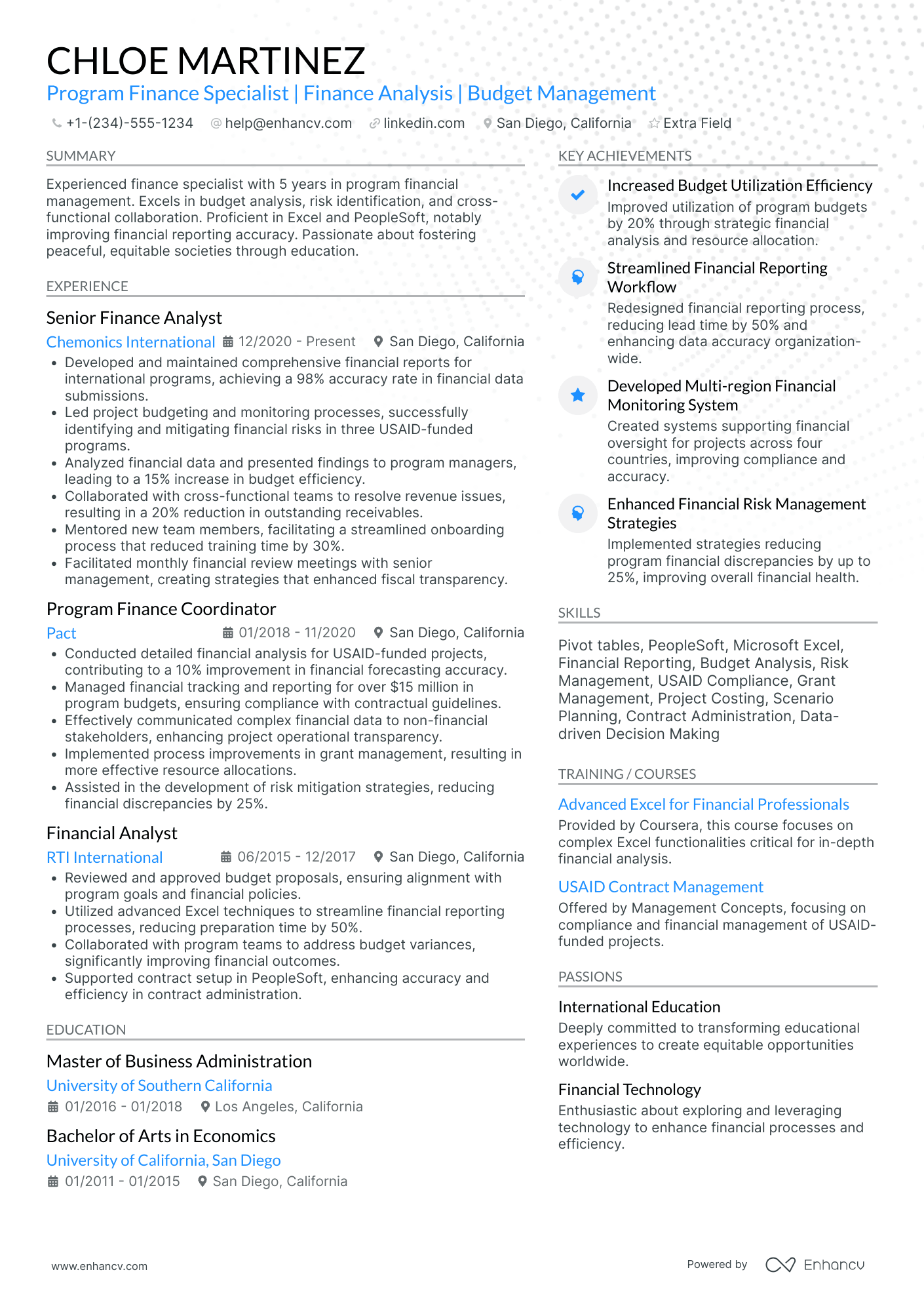

Finance specialist-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained

- The more recent your professional certificate is, the more prominence it should have within your certification sections. This shows recruiters you have recent knowledge and expertise

At the end of the day, both the education and certification sections hint at the initial and continuous progress you've made in the field.

And, honestly - that's important for any company.

Below, discover some of the most recent and popular finance specialist certificates to make your resume even more prominent in the applicant pool:

The top 5 certifications for your finance specialist resume:

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for finance specialist professionals.

Top US associations for a Finance Specialist professional

- AICPA and CIMA

- Association for Financial Professionals

- Certified Financial Planner Board of Standards

- CFA Institute

- Financial Industry Regulatory Authority

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Recommended reads:

Professional summary or objective for your finance specialist resume

finance specialist candidates sometimes get confused between the difference of a resume summary and a resume objective.

Which one should you be using?

Remember that the:

- Resume objective has more to do with your dreams and goals for your career. Within it, you have the opportunity to showcase to recruiters why your application is an important one and, at the same time, help them imagine what your impact on the role, team, and company would be.

- Resume summary should recount key achievements, tailored for the role, through your career. Allowing recruiters to quickly scan and understand the breadth of your finance specialist expertise.

The resume objectives are always an excellent choice for candidates starting off their career, while the resume summary is more fitting for experienced candidates.

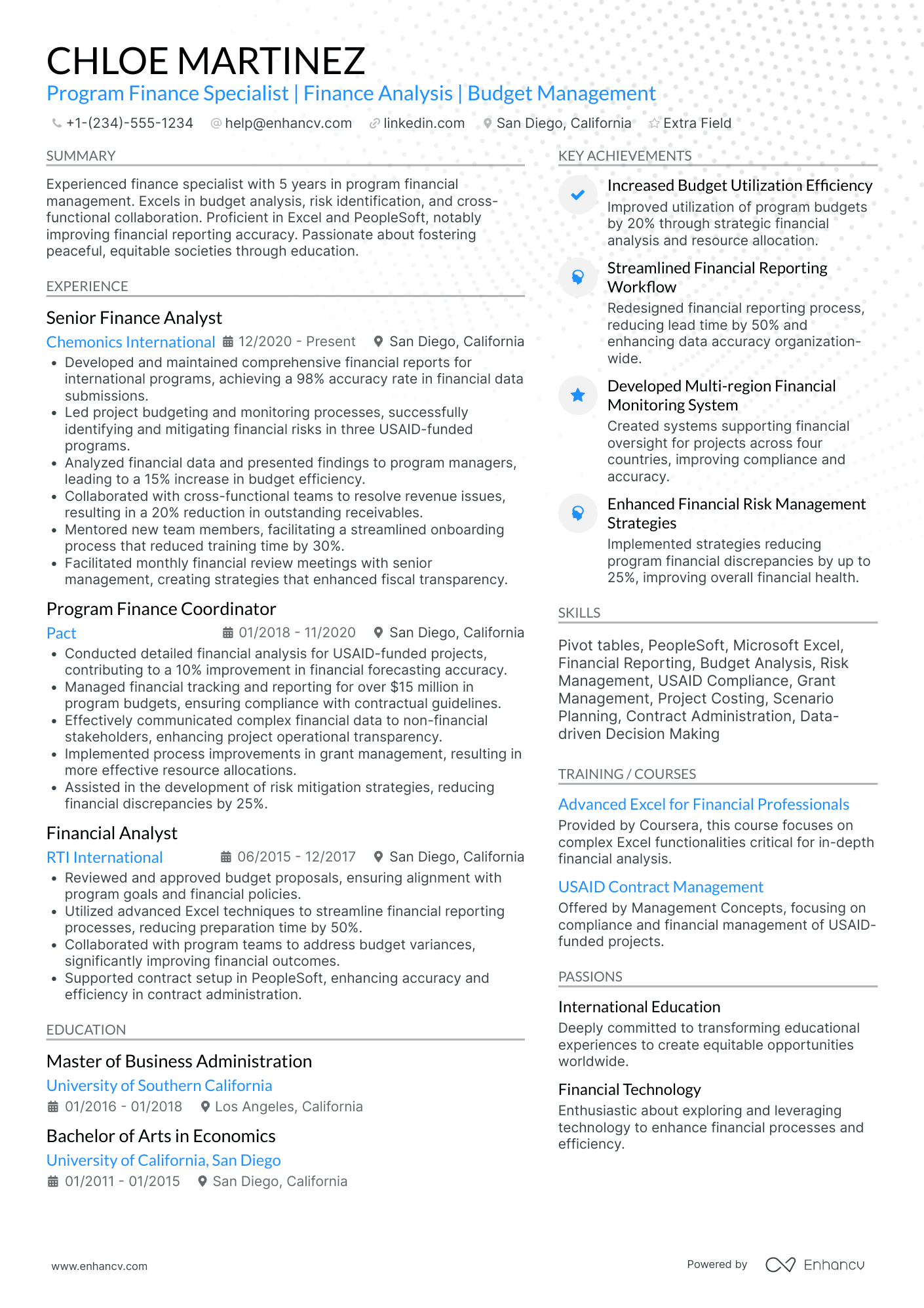

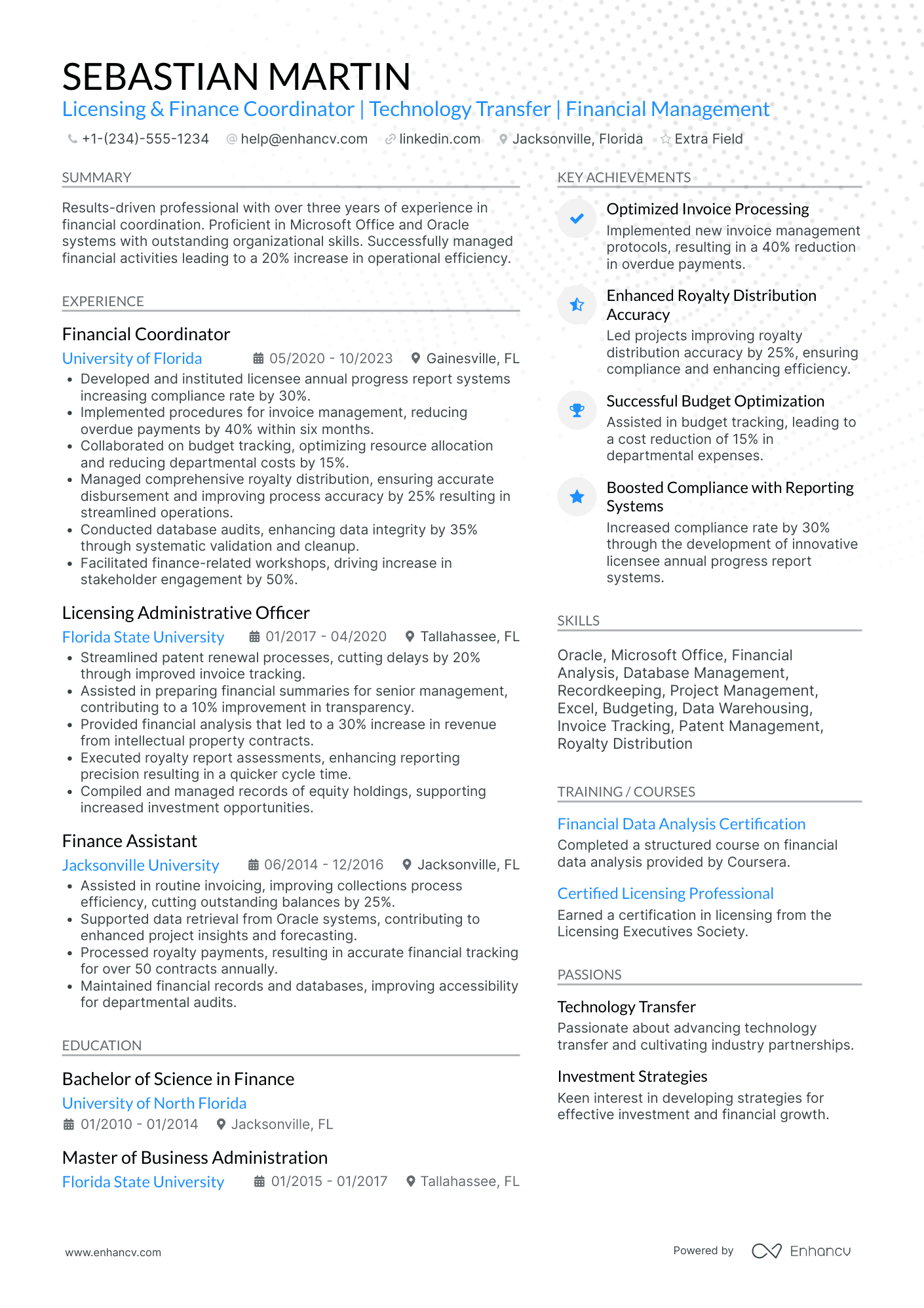

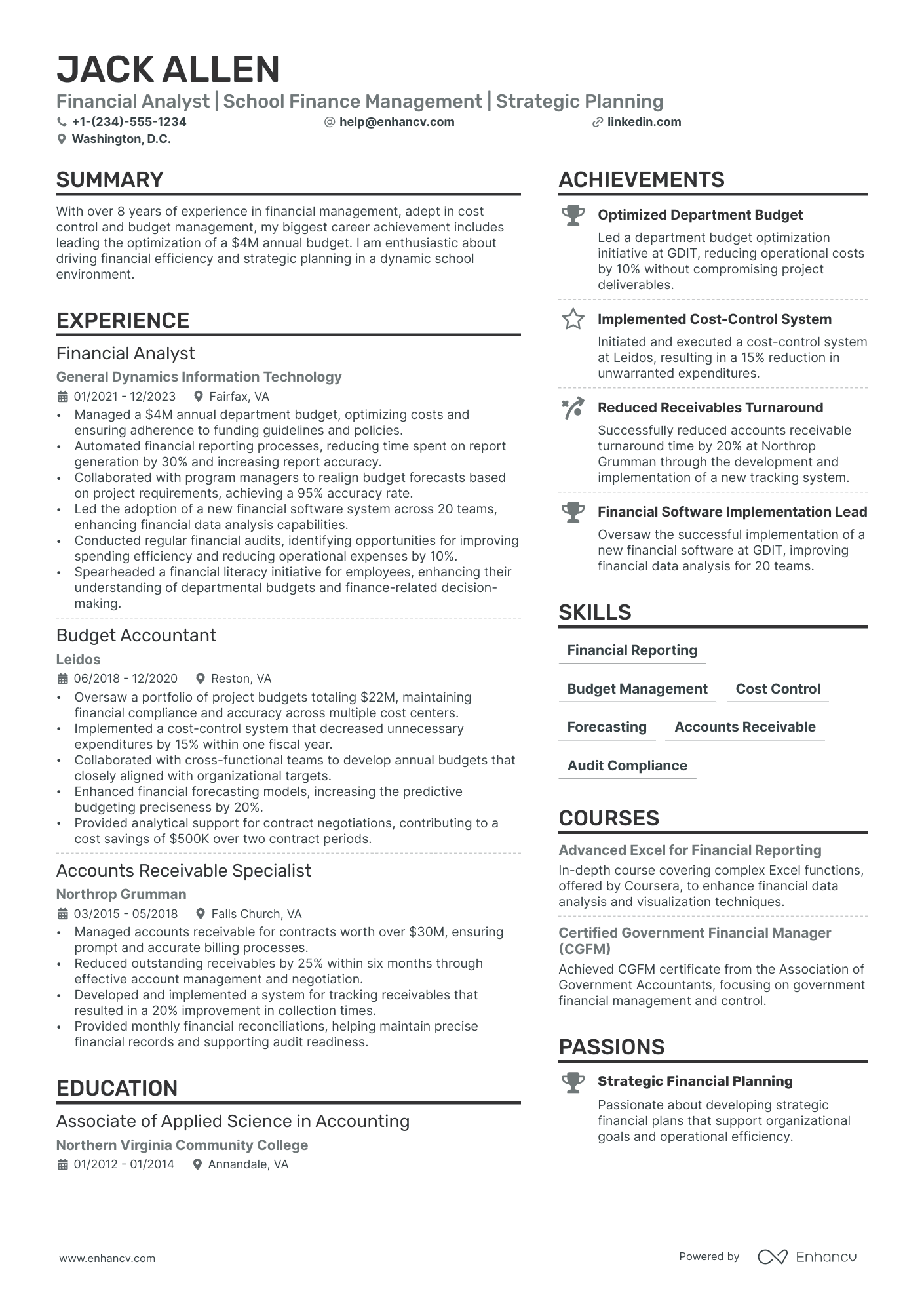

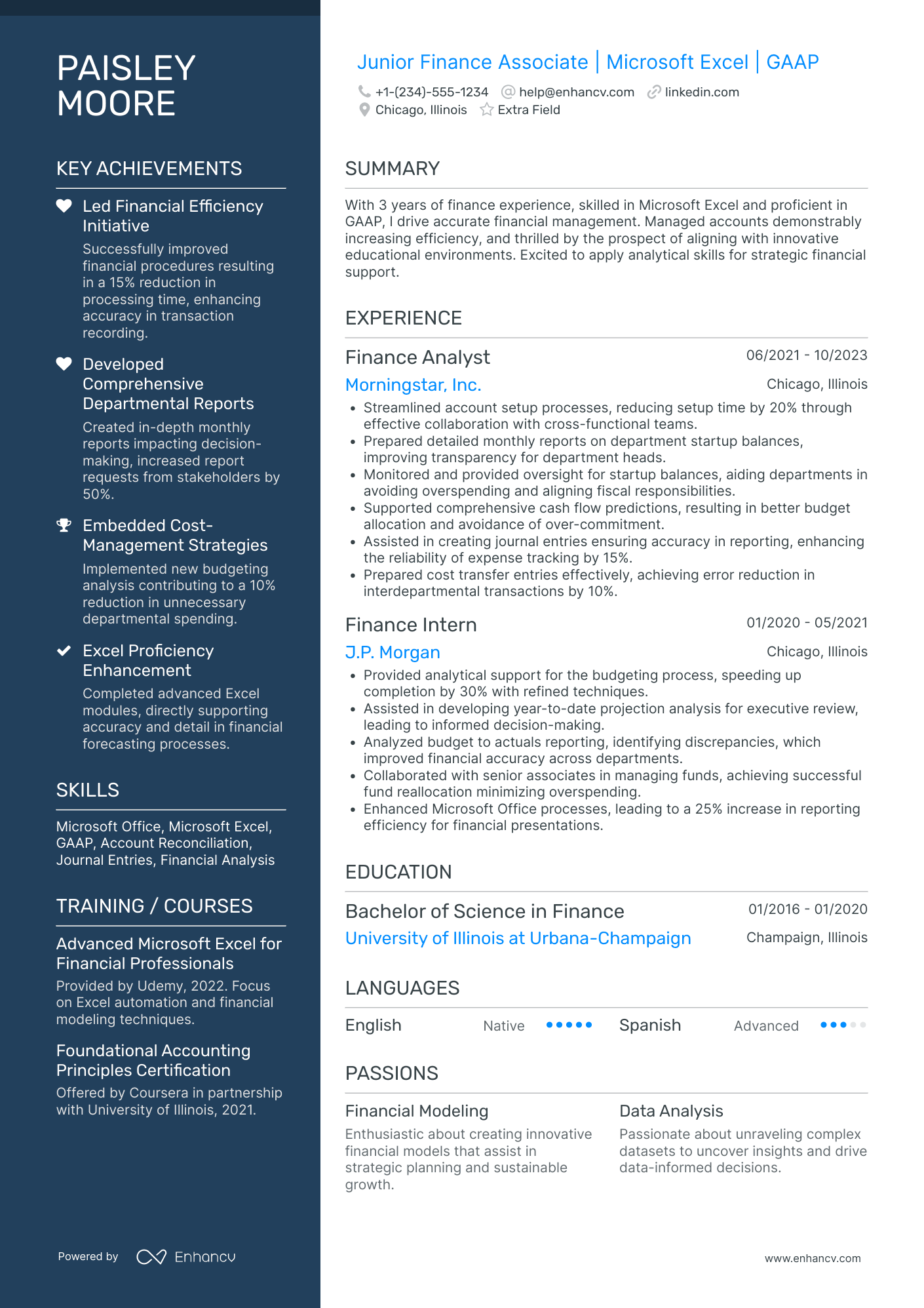

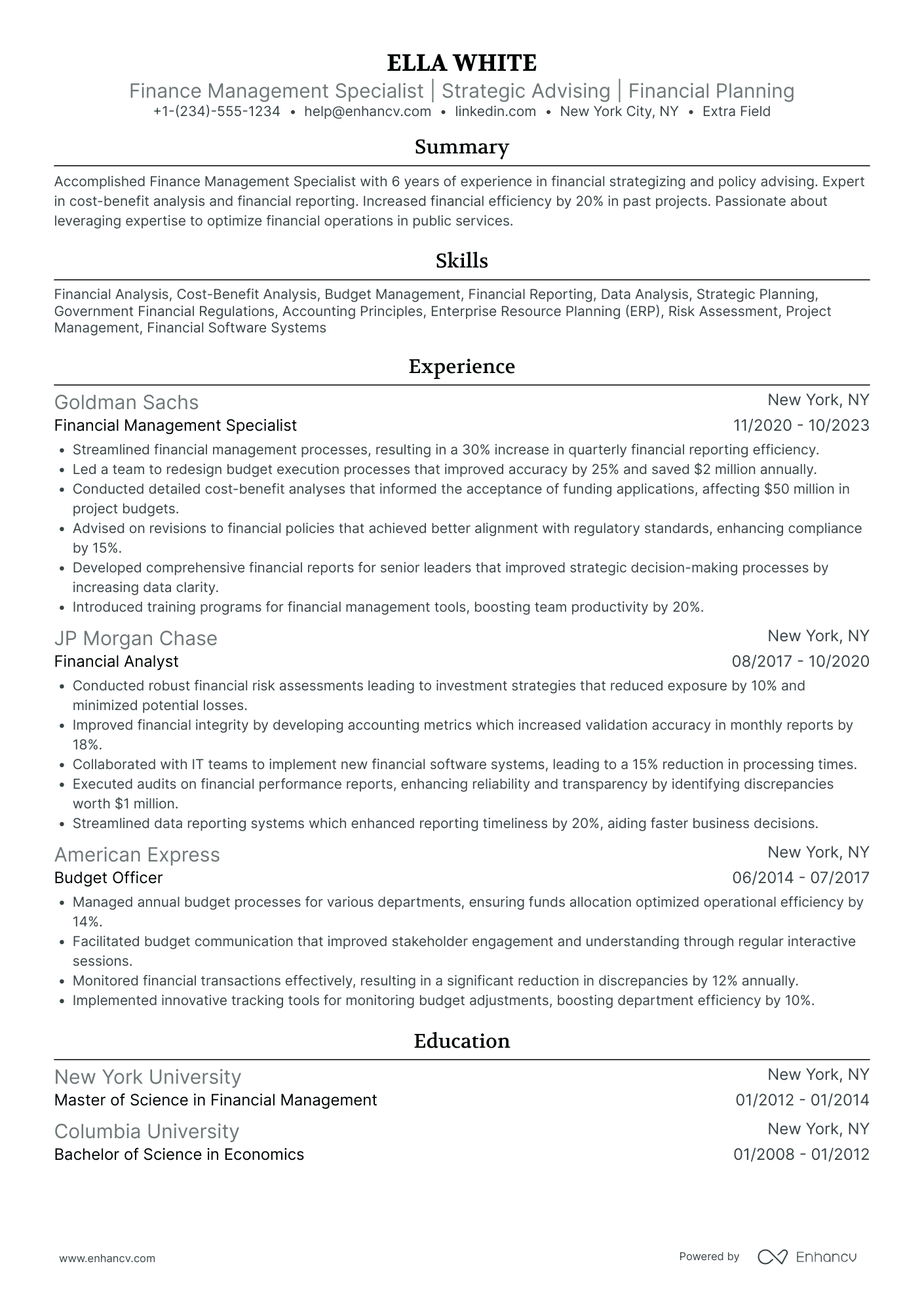

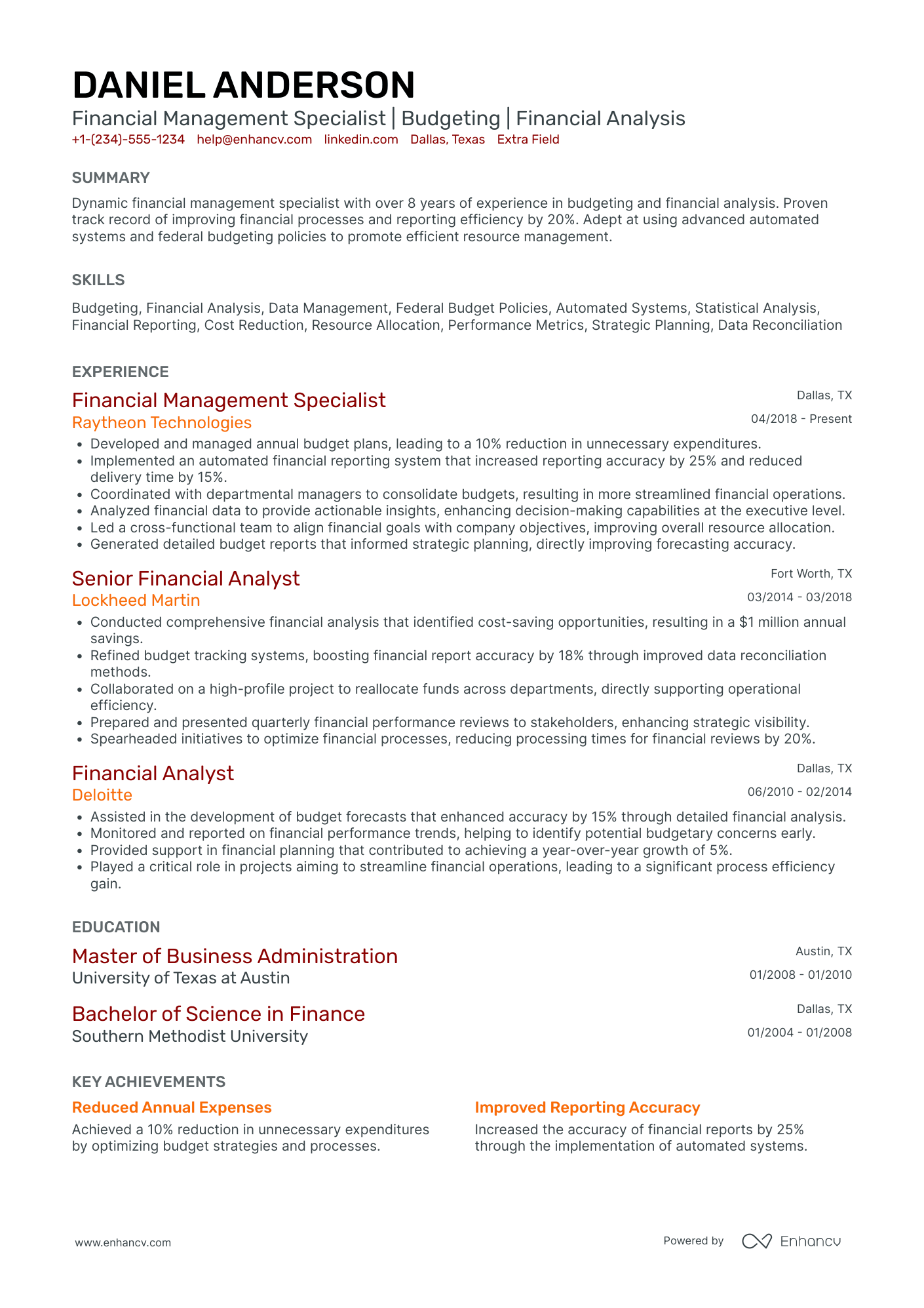

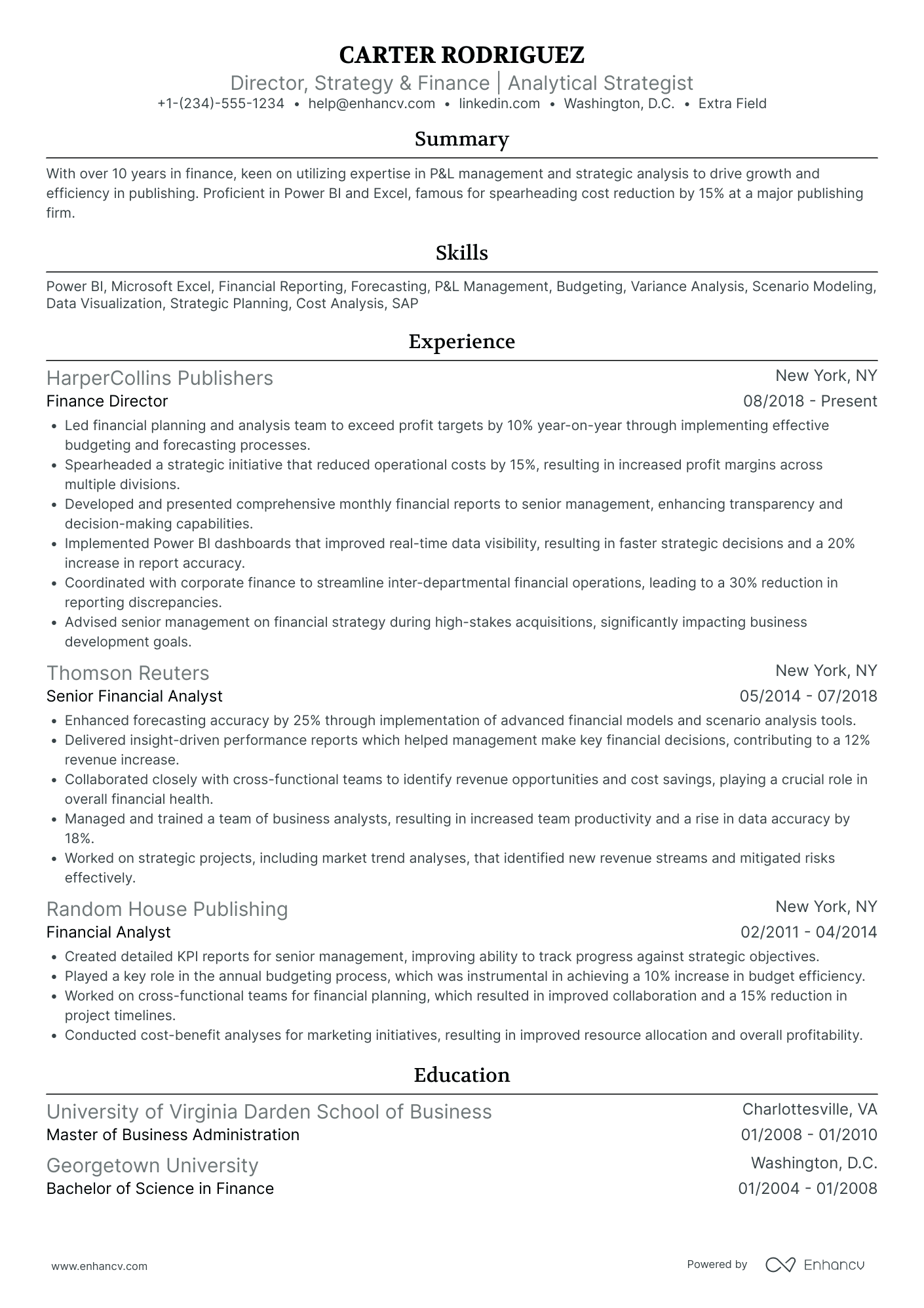

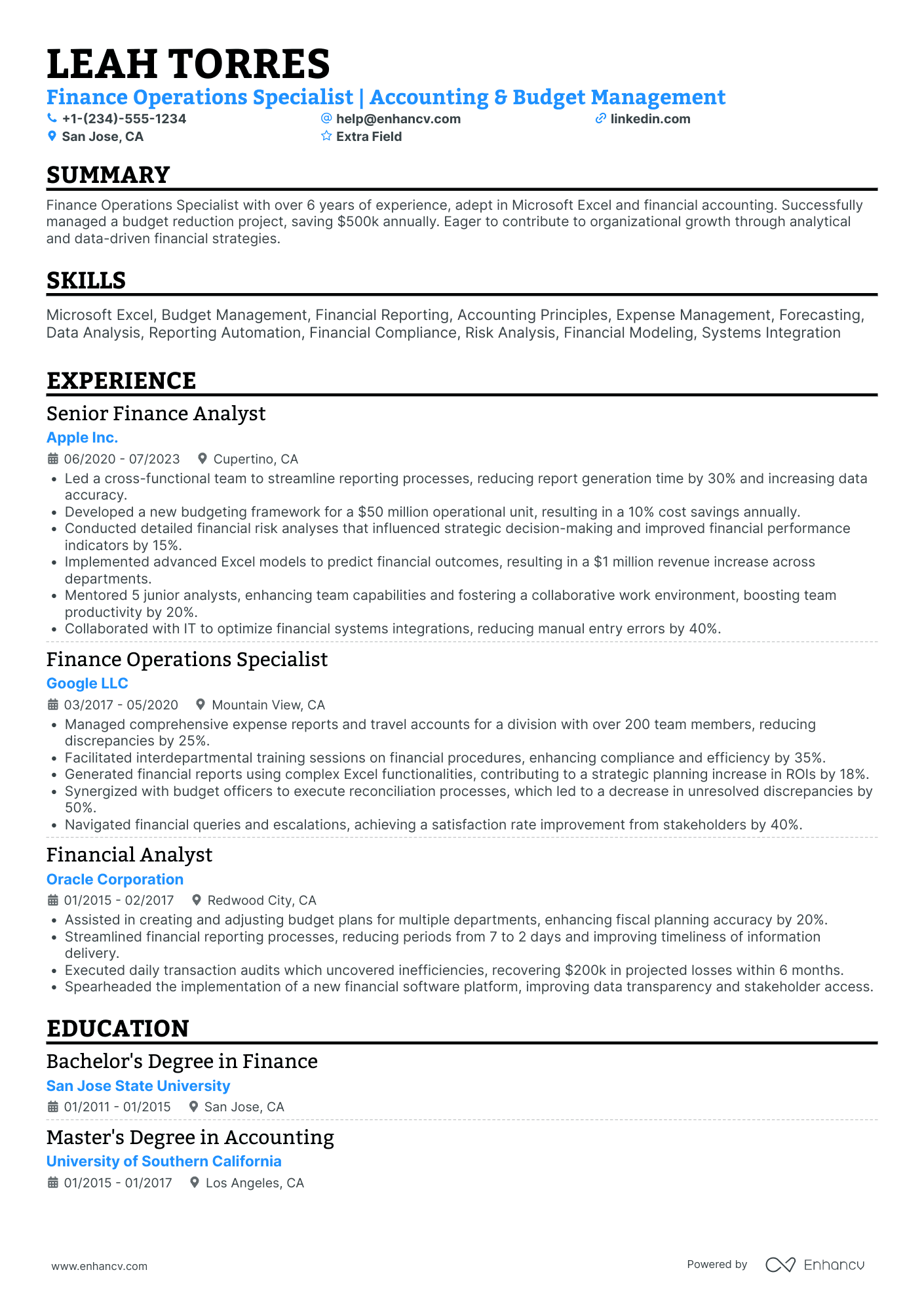

No matter if you chose a summary or objective, get some extra inspiration from real-world professional finance specialist resumes:

Resume summaries for a finance specialist job

- With a solid 8-year track record in corporate finance at a Fortune 500 company, my expertise spans complex financial modeling, risk management, and fiscal analysis. Recognized with the CFO's Award for Excellence in 2020, I adeptly drive profitability through strategic forecasting and meticulous budgeting, whilst consistently ensuring compliance with regulatory standards.

- Highly accomplished finance manager with over 12 years of experience in the banking sector, where I led a team responsible for a portfolio of $500M in assets. Specializing in investment strategies, I have a proven history of maximizing returns and cutting costs, notably increasing departmental efficiency by 20% last fiscal year through innovative process optimization.

- As a seasoned software developer looking to pivot into finance, I bring a unique analytical skill set with 10 years of experience in creating data-driven solutions. My recent certification in financial analysis, coupled with a robust understanding of market trends and technologies, equips me to transition seamlessly into a financially-focused role.

- Transitioning from a successful 6-year military career to finance, I possess a strong foundation in discipline, leadership, and strategic planning. With a recent MBA concentration in Finance and a demonstrated aptitude for quantitative analysis, I am well-prepared to adopt and excel in financial analysis and investment management practices.

- Eager to launch a finance career, I bring an enthusiastic, analytical mindset honed through a rigorous Bachelor’s in Economics. With internships at top-tier accounting firms where I assisted in tax preparation and financial forecasting, my objective is to apply my academic knowledge and practical experience to excel in a dynamic finance environment.

- Recent Finance graduate with a cumulative GPA of 3.7, seeking to apply educational background and internship experience with a leading financial advisory firm. With a passion for market research and data interpretation, my goal is to contribute to the strategic financial decisions and to gain hands-on experience in a challenging and growth-oriented setting.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for finance specialist professionals

Local salary info for Finance Specialist.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $76,900 |

| California (CA) | $76,230 |

| Texas (TX) | $71,400 |

| Florida (FL) | $60,510 |

| New York (NY) | $163,640 |

| Pennsylvania (PA) | $61,850 |

| Illinois (IL) | $80,250 |

| Ohio (OH) | $59,190 |

| Georgia (GA) | $63,050 |

| North Carolina (NC) | $65,910 |

| Michigan (MI) | $74,260 |

Miscellaneous finance specialist resume sections for a more personalized approach

Your finance specialist resume can reflect even more upon your personality and best qualities - that is if you decide on including a couple of additional resume sections to support your application.

Some of the best-accepted industry-wide choices include the:

- Resume projects - getting into the outcomes of your most important work, so far;

- Languages on your resume - detailing your proficiency level;

- Special recognitions - dedicated to your most prominent industry awards;

- Hobbies and interests - defining how you spend your free time.

Key takeaways

- Your resume layout plays an important role in presenting your key information in a systematic, strategic manner;

- Use all key resume sections (summary or objective; experience; skills; education and certification) to ensure you’ve shown to recruiters just how your expertise aligns with the role and why you're the best candidate;

- Be specific about listing a particular skill or responsibility you've had by detailing how this has helped the role or organization grow;

- Your personality should shine through your resume via the interests or hobbies, and strengths or accomplishments skills sections;

- Certifications go to provide further accreditation to your technical capabilities, so make sure you've included them within your resume.

Finance Specialist resume examples

By Experience

By Role