As a business analyst (BA), you understand the importance of quality assurance and requirement gathering. You know how to manage and analyze data, but SQL and basic programming skills alone won’t help you when looking for your next job in business analysis.

In a LinkedIn post, professor of business analytics Yulia Kosarenko emphasizes the importance of communication for business analysts. Your ultimate goal is to ensure a shared understanding among all stakeholders to address business problems effectively. You’re the vital link in promoting effective information flow within an organization.

So, if you’re used to bridging the gaps between technical solutions and business needs, your resume should reflect just that. After reading our extensive guide, you’ll be able to write your business analyst resume as if you wrote the BABOK.

Here’s what else we’ll cover:

- Which resume format to choose to best describe your previous experience.

- How to pick the right combination of technical and soft skills relevant to your role and how to list them.

- What to do when your target business analyst job is in a different industry.

- How to optimize your resume just like you do the business you’re working for and meet specific recruiters’ requirements.

- How to craft a business analyst resume summary that speaks volumes about your achievements and career goals.

Before we continue, look at some more related resume guides if you’re looking for something more specific.

- Business Data Analyst Resume

- Business Intelligence Resume

- Statistical Data Analyst

- Operations Analyst Resume

- Business analyst Cover Letter

How to format a business analyst resume

For business analysts, the best resume format typically emphasizes their technical skills and ability to manage and communicate effectively within a business context.

The most suitable formats generally are:

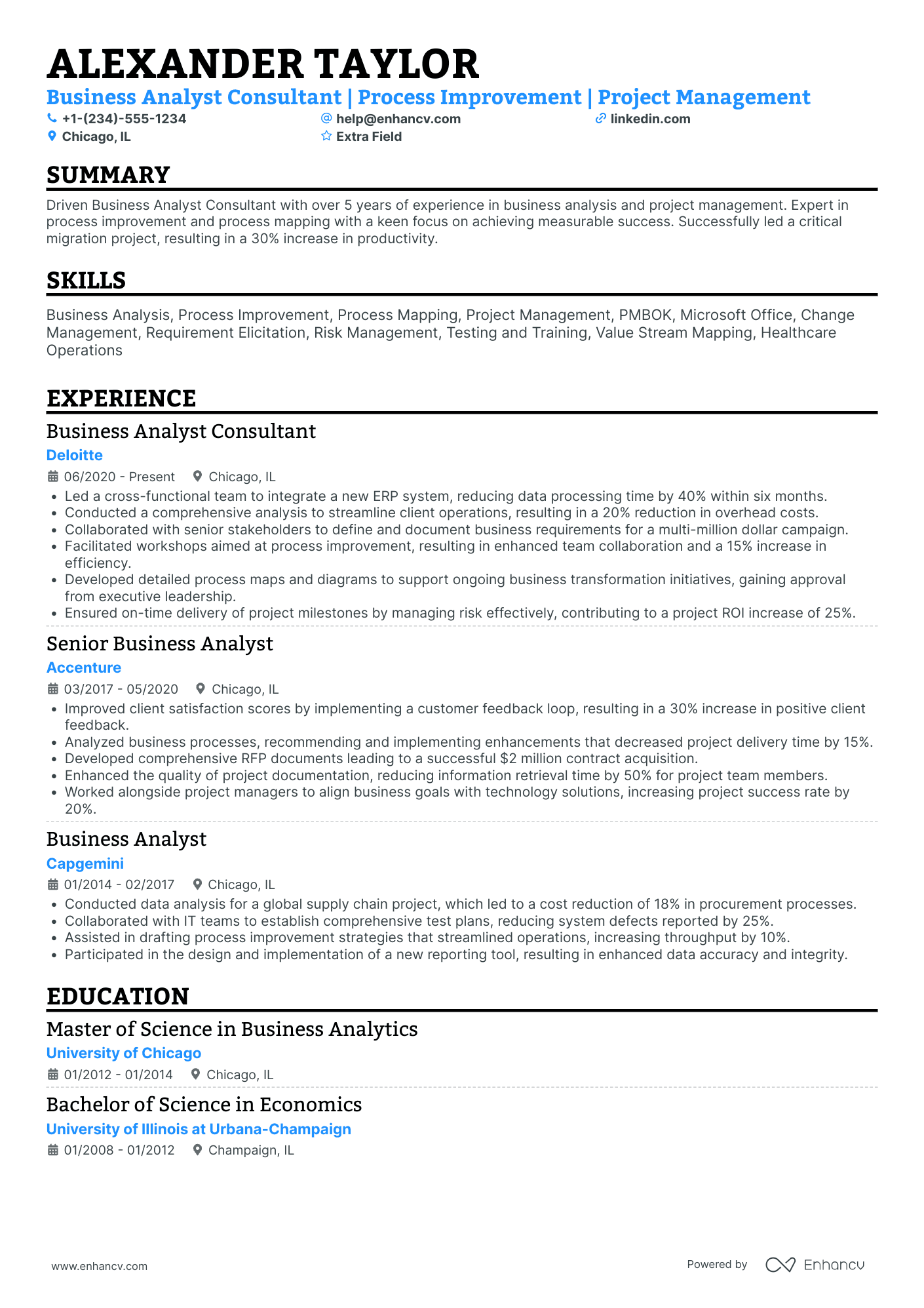

- Reverse-chronological resume: This is the most traditional and widely accepted format. It lists your work experience in reverse chronological order, starting with your most recent job at the top. This format is particularly effective if you have a solid work history without significant gaps and if your recent roles are relevant to the business analysis positions you are applying for.

- Functional resume: This format focuses on your skills and experience, rather than your chronological work history. It's useful if you are changing careers, have gaps in employment, or want to highlight specific skills that are directly applicable to the job you're applying for. For a business analyst, this could mean emphasizing competencies in areas like requirements gathering, stakeholder engagement, data analysis, and project management.

- Combination (hybrid) resume: This format blends the reverse-chronological and functional formats. It allows you to showcase your relevant skills at the top of the resume while also providing a detailed work history in reverse chronological order. This can be particularly beneficial for a business analyst role as it highlights pertinent skills upfront while also detailing your professional experience and achievements.

Targeting Canada? – Keep in mind their resume layout may differ from others.

PRO TIP

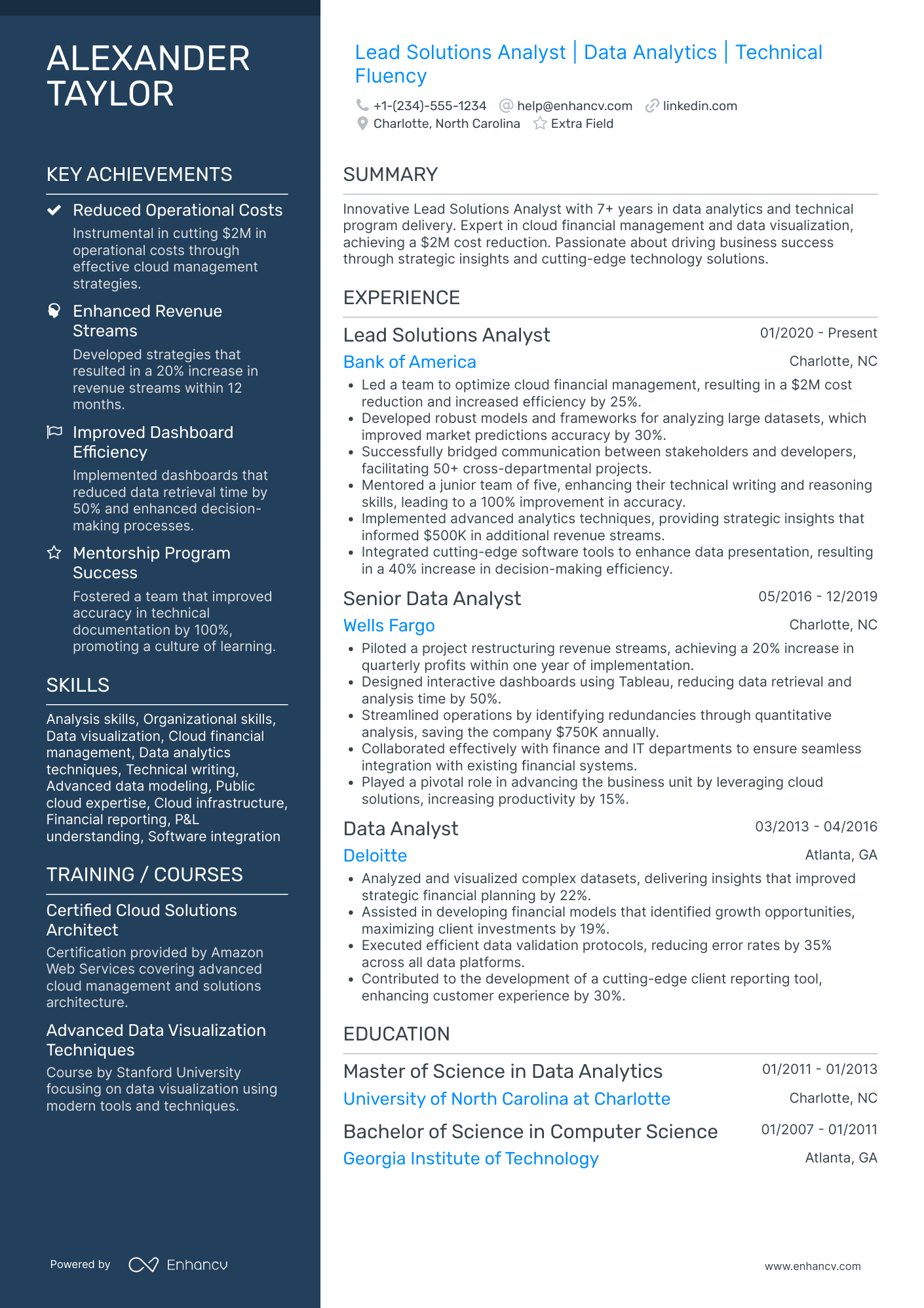

High-complexity roles such as financial analyst, data analyst, and business intelligence analyst require advanced skills, so the combination resume format is often the best choice. It allows you to highlight both your deep analytical skills and your extensive experience in managing complex business processes.

Resume design tips

Here’s a tailored guide for business analysts to optimize their resumes for applicant tracking systems (ATS) and recruiter preferences:

- ATS scans: Many recruiters use ATS to scan resumes for keywords from the job description, filtering out candidates who don’t match. To ensure your resume passes these scans, include relevant keywords related to business analysis, such as "data analysis" or "project management." This increases your chances of making it through the initial automated screening.

- Resume margins: The ideal margin size for a resume is between 0.5 and 1 inch on all sides. Adjusting your margins can help frame your content neatly, making it more readable.

- Resume font: Use fonts that are easy to read and ATS-friendly. Recommended fonts for business analysts include Arial, Lato, or even the more traditional Times New Roman in size 10-12 pt. These fonts help maintain the visual hierarchy and keep the recruiter’s attention focused on your qualifications.

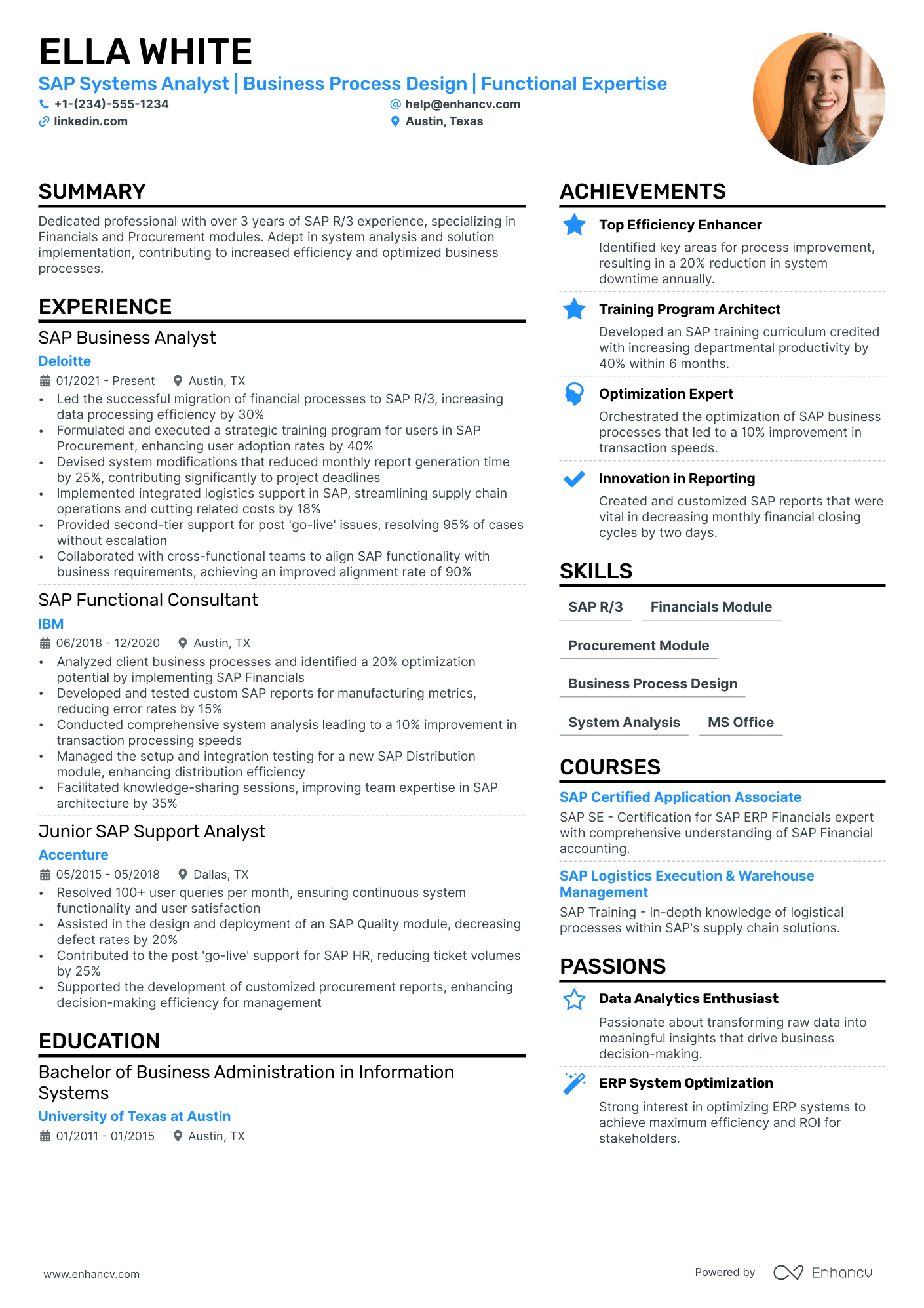

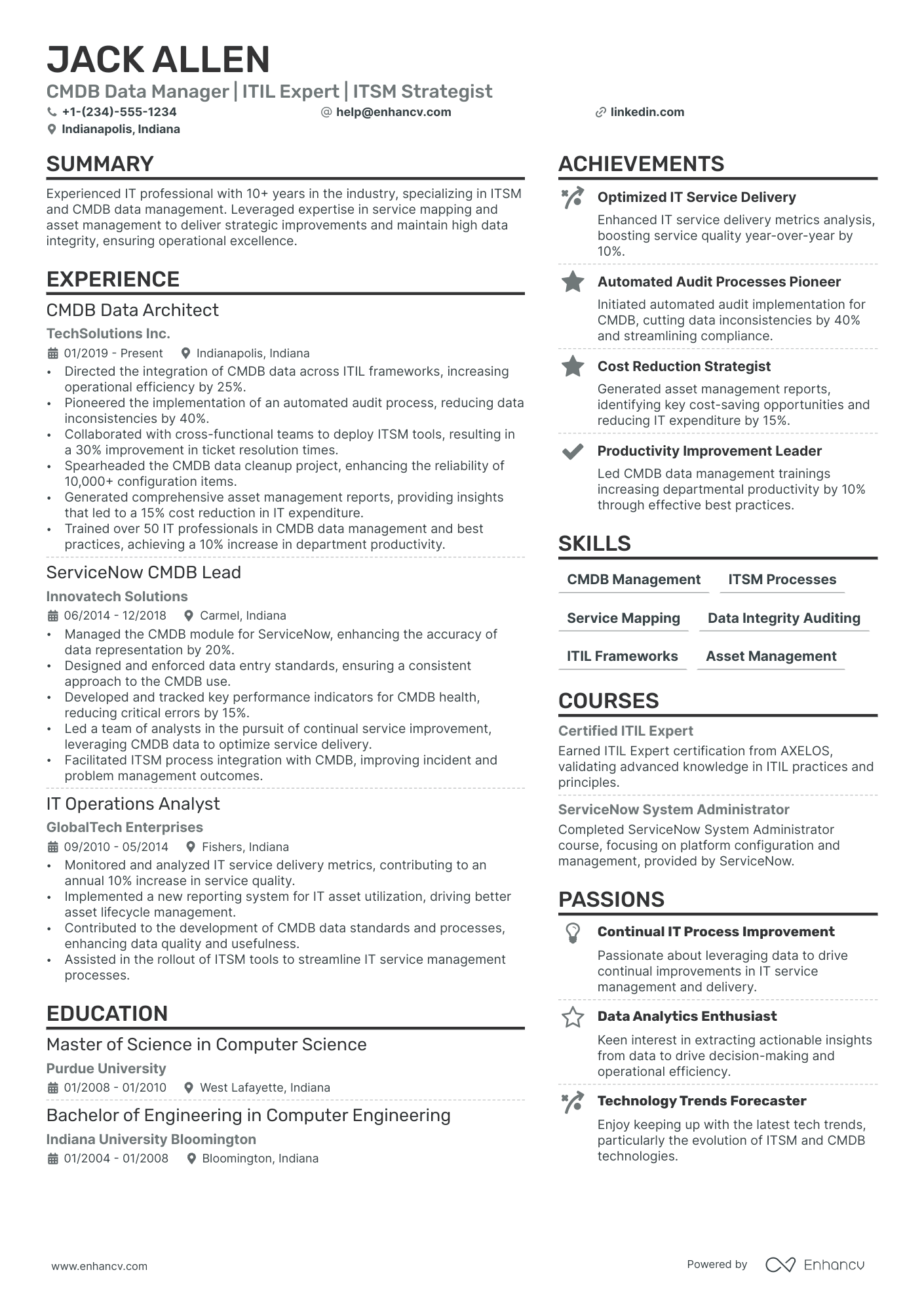

- Resume templates: To save time from building your resume from scratch, use one of Enhancv’s ready-made professional templates. You can choose from any of the single- and double-column layouts that can accommodate complex business analysis projects or technical skills clearly.

- Resume length: Aim for a one-page resume, especially if you have less than 10 years of experience. This length is usually enough to briefly communicate your qualifications and achievements.

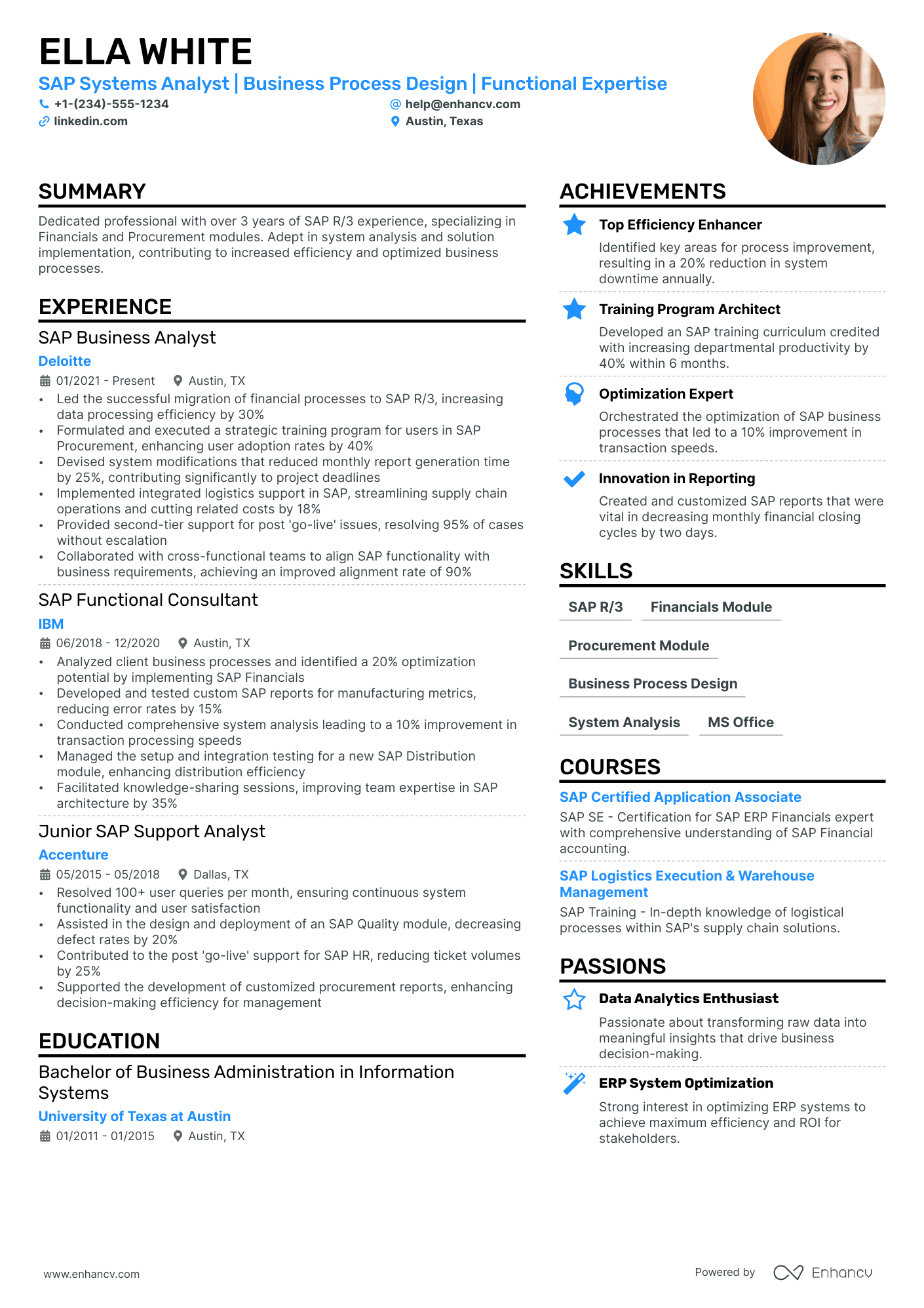

- Resume header: Include your name, job title (e.g., Functional Analyst), email address, LinkedIn profile link, and a US phone number. The resume header is also a great place to highlight your area of expertise (finance, IT, healthcare, SAP, e-commerce) or an important certification you hold.

- Resume photo: It is generally advised not to include a photo on your resume as photos can interfere with ATS processing. Plus, they’re frowned upon in most US states.

- File formatting and naming convention: Save your resume as a PDF to preserve the layout across different viewing platforms. Name the file clearly with your full name, title, and the word 'resume', such as 'JohnDoe_BusinessDataAnalyst_Resume.pdf'. This helps hiring managers easily find and recognize your resume among many others.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

No matter which resume format you choose, make sure you include the 5 sections below.

The top sections on a business analyst's resume

- Professional summary: Captures your core competencies quickly.

- Technical skills: Highlights specific analytical tools and software.

- Relevant experience: Showcases your role-specific achievements.

- Key projects: Details impact and scope of major initiatives.

- Education and certifications: Establishes your formal qualifications.

These sections belong there for a reason. Hiring managers will gather key insights from the way you build your resume and the information you put there.

What recruiters want to see on your BA resume

- Proficiency in data analysis tools: Crucial for understanding and interpreting business data effectively.

- Experience with requirements gathering: Key to developing solutions that meet business needs.

- Demonstrated problem-solving skills: Essential for identifying and addressing business challenges.

- Ability to manage stakeholders: Important for ensuring alignment and facilitating effective communication.

- Project management experience: Valued for leading projects from conception to successful implementation.

Now, let’s move on to the longest and arguably most important part of your resume—the experience section.

How to write your ba resume experience section

No matter how you list your work experience, it needs to convey two things: relevance and measurable achievements. You might be a top performer at work, but as we mentioned earlier, you need to be able to sell yourself to recruiters by crafting the right narrative.

Follow our tips for creating relevant and quantifiable entries on your business analyst resume.

Find the right balance between jargon and layman's terms

In big companies, a recruiter might do a paper screening to pre-qualify applicants first. But for startups or small businesses, a manager or a senior business analyst will be the one reviewing your application.

How will this affect your resume?

There’s a chance one person reading it may only have a vague understanding of your role. Some recruiters are only given a list of skills or keywords to look for when pre-qualifying applicants. Worse still, they may not even understand the jargon at all.

Where do you stand then?

I don’t recommend including jargon in your resume for the sake of familiarity. Context and results are much more important as they help employers understand your work better.

Austin Belcak, Job Search and Founder of Cultivated Culture

Examine the job ad to hone in on the skills, tools, and projects the employer wants to see. This way, you don’t have to worry about a recruiter who’s just basing their decisions on a keyword checklist. You’ll also pass the scrutiny of a potential manager who understands the minutiae of your work.

PRO TIP

Aim to use the industry-accepted terms on your business analyst resume. For example, your previous employer might’ve conducted "beta tests" to get feedback before launching a software or service. Beta test might’ve been the popular jargon within your company, but other companies refer to this process as "data testing," or "end-user testing." It’s also generally known as "user acceptance testing."

Show results

Companies hire you to improve their performance so you have easy access to whether your work helped or not. There’s no excuse not to share the tangible outcome of your efforts.

If you’re having trouble pinpointing the outcome of your work, ask yourself "So what?" What happened because of the market research study you did? What happened as a result of the sales forecast you wrote?

Keep asking yourself "So what" until you get to the bottom of the situation.

Now that you know what to do, it’s time to see what those changes look like in an actual resume.

- •Improved warehouse stocking process for products of Amazon FBA sellers.

- •Fixed process for defective items stocked.

- •Analyzed shipping and stocking trends for different products.

- •Analyze product listing data of FBA sellers.

What’s wrong with the example above? Anyone who reads it will ask, "So what???"

So what if they poured through thousands of product listings on Amazon? What came out of that? Did it benefit the sellers or buyers in any way? Did it benefit Amazon?

Context is important. It shows why your task was crucial and how it impacted stakeholders. Otherwise, you might as well be a theoretical number cruncher.

Belcak analyzed hundreds of resumes from his audience and students. From this, he found that the most effective bullets consist of:

- 45% industry terms

- 15% action words

- 15% measurable results

- 25% common words

Here’s what the business analyst resume sample above looks like if rewritten based on this formula:

- •Overhauled warehouse product stocking process for Amazon FBA sellers, minimizing cataloging errors by 10% and improving fulfillment speed by 15%.

- •Minimized defective items stocked by 18% after implementing a stricter quality control and shipment acceptance process.

- •Conducted an exploratory analysis of 5-year product trends for 10K SKUs to detect potential trends and in-demand FMCG to boost revenue by 715M a month.

- •Improved product ranking factors and listing requirements to minimize returns by 26%.

All bullets above show results, not just in money earned or saved but in other aspects of the business, too.

Belcak’s finding suggests allocating 45% of words to industry terms. This isn’t limited to jargon. Product stocking and quality control are both used in the retail industry and yet you don’t have to work in that industry to know what it means.

Below are some more tips on finding the answer to your “so what’s” when building your resume.

How to quantify impact on a business analyst resume

- Include the percentage increase in efficiency due to your workflow optimizations, demonstrating your ability to streamline operations.

- Detail the dollar amount saved through cost-reduction strategies you implemented, showcasing your impact on profitability.

- Specify the growth in user adoption rates after you improved a system, illustrating your effectiveness in user engagement.

- Quantify the reduction in processing time by implementing new software solutions, highlighting your contributions to operational speed.

- Report the increase in customer satisfaction scores following enhancements you made, showing your focus on customer experience.

- Mention the size of the data sets you analyzed, emphasizing your capability to handle complex data analysis.

- State the decrease in error rates after your quality assurance measures, proving your attention to detail and accuracy.

- Provide the annual growth rate of revenue streams that you developed or enhanced, underscoring your strategic impact on business growth.

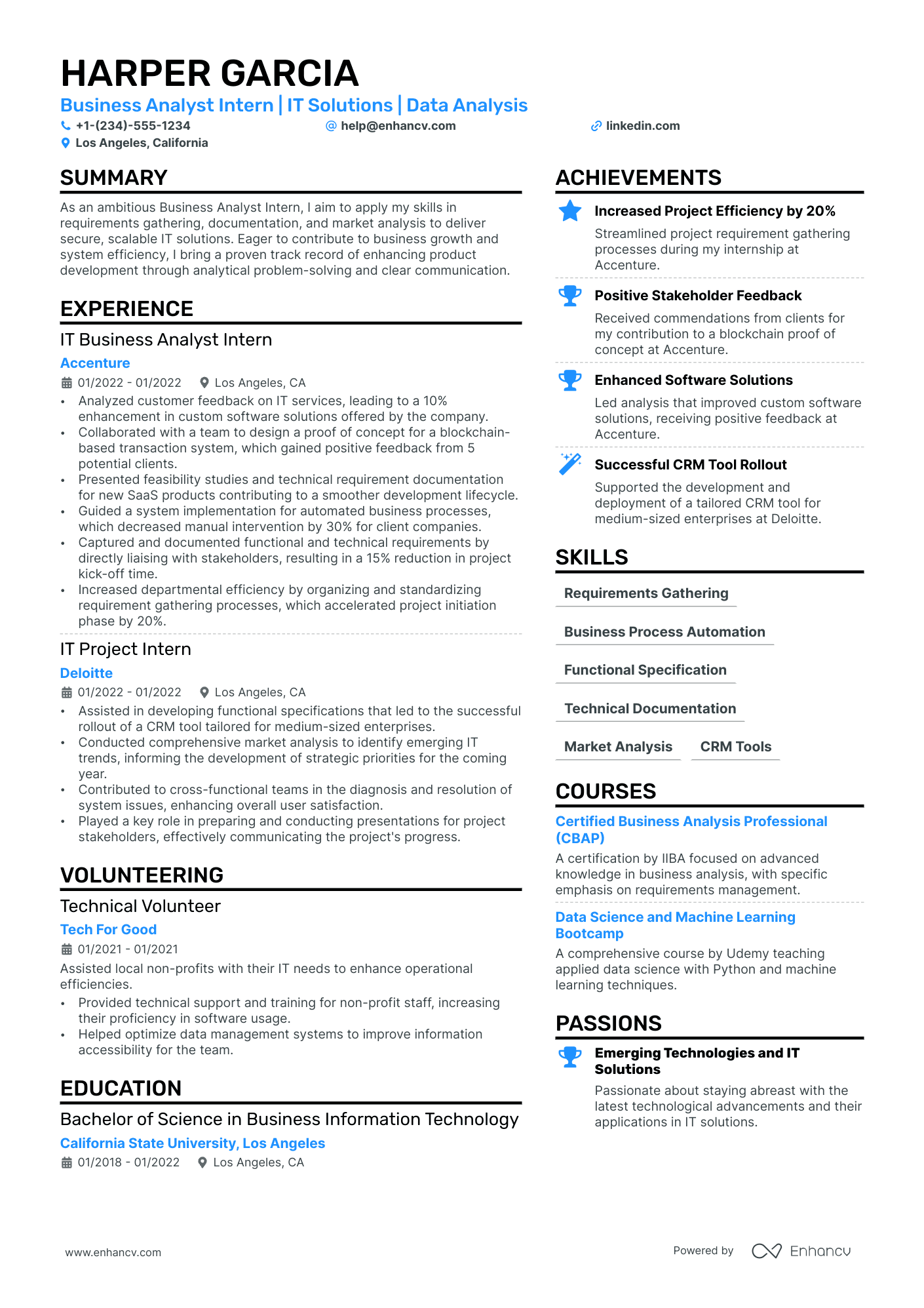

The same quantifiable achievements can be applied to entry-level analyst resumes as well. Follow our tips below for creating a resume with little prior experience.

How do I write a business analyst resume with no direct experience

Here’s a little secret. Those job ads that require one to two years of professional experience are testing you.

Recruiters receive up to 250 applications for one job posting. So if you don’t apply because you don’t have all their "requirements," there’s less work for them. Job ads that "require" one to 2 years for fresh graduates are flexible. The work experience requested here isn’t limited to corporate settings.

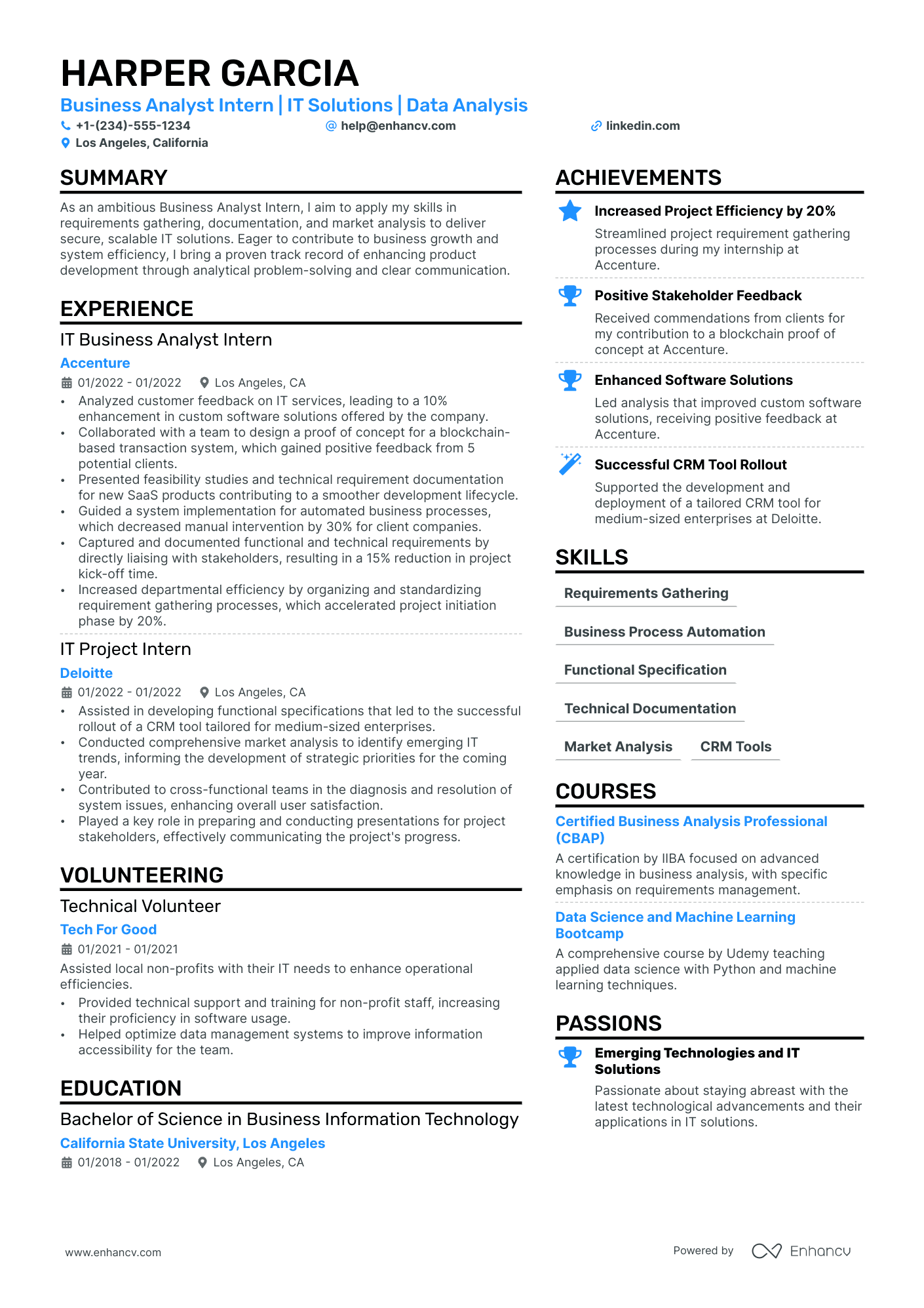

The key to nailing your first experience section is to feature coursework, extra-curricular activities, volunteer work, and side projects that are relevant to the target position. Here’s an example.

Business analysts often have a degree in Business Administration. Their coursework usually covers the gamut of business communications, financing, operations, and policies.

Find out which of the job requirements are similar to your coursework and college projects, then write about that.

For instance, if you see phrases like "develop performance benchmarks" or "improve operational workflow," then write about your coursework in business policy or business process improvement. That’s relevant experience right there.

Don’t underplay non-analyst roles or side projects, either. If while waitressing, you tested different phrases you can say to increase your tip and shared it with other waitstaff, that’s another relevant accomplishment.

Just choose the right words when describing it. For example:

"Increased customer satisfaction by X% after testing and iterating several customer-centric spiels."

Where an increased percentage of customer satisfaction refers to an increase in tips, the customer-centric spiels are the friendly or complimenting stuff you said.

According to dataquest.io, business analyst career prospects are excellent. The job offers the potential for higher pay through the development of area-specific expertise. Areas with high-earning opportunities include quantitative analysis, information security analysis, test analysis, and network analysis.

Looking to build an intern resume for a business analyst position? Follow the steps in our article 5 Intern Resume Examples and Guide for 2026.

How to list your hard and soft skills on your resume

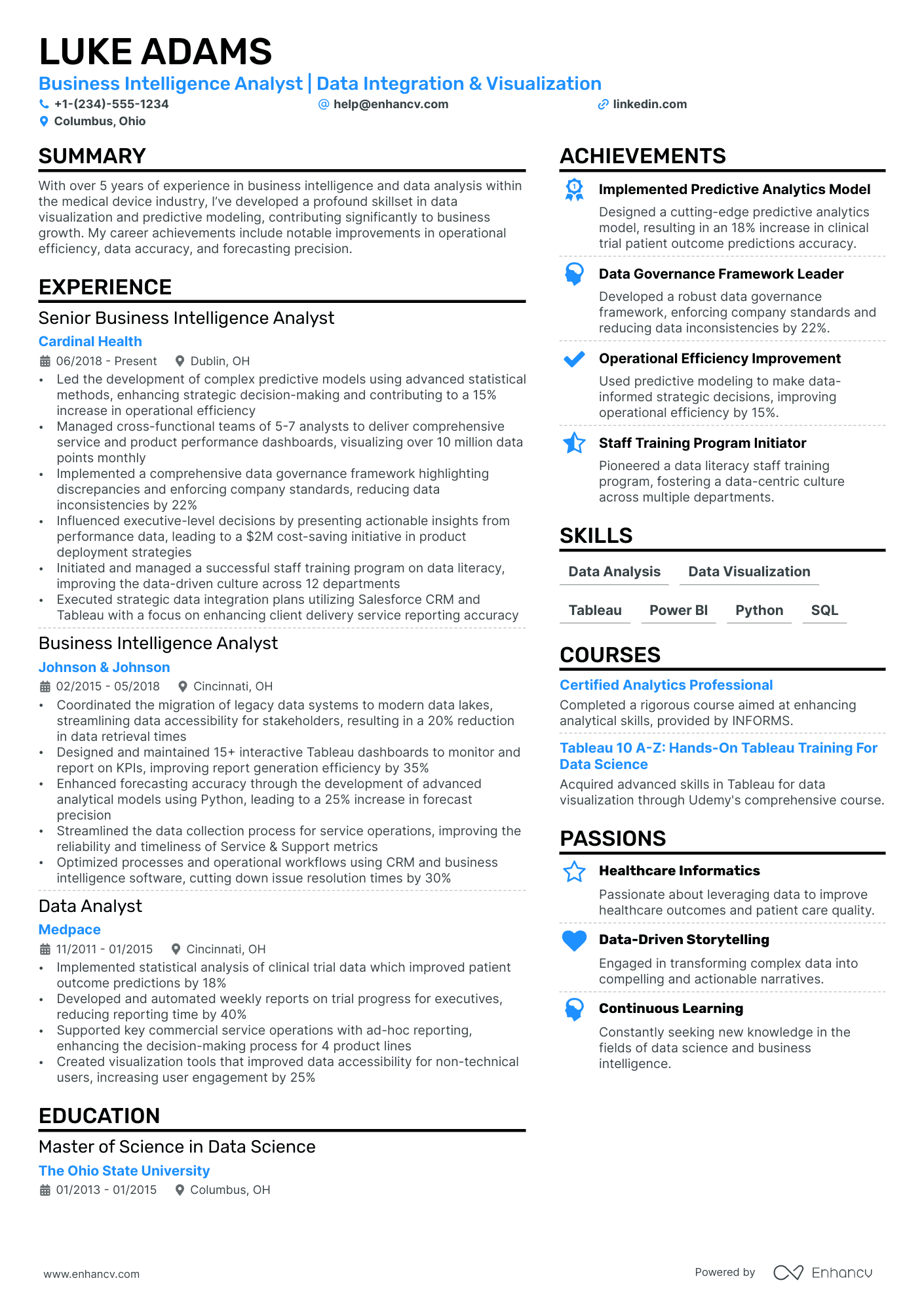

Some business analysts work in finance, technology, or healthcare. Some business analysts are only expected to analyze numbers. Other business analysts also oversee the implementation of their proposed solutions.

Don’t let this discourage you from applying to roles not related to your current work. Think of it as having a bigger market for your diverse skill set. For instance, if your IT business analyst resume explains how your skills are transferable in finance or warehouse operations, it shouldn’t be a problem.

If you have the skills, your resume can be tailored to fit a particular specialization.

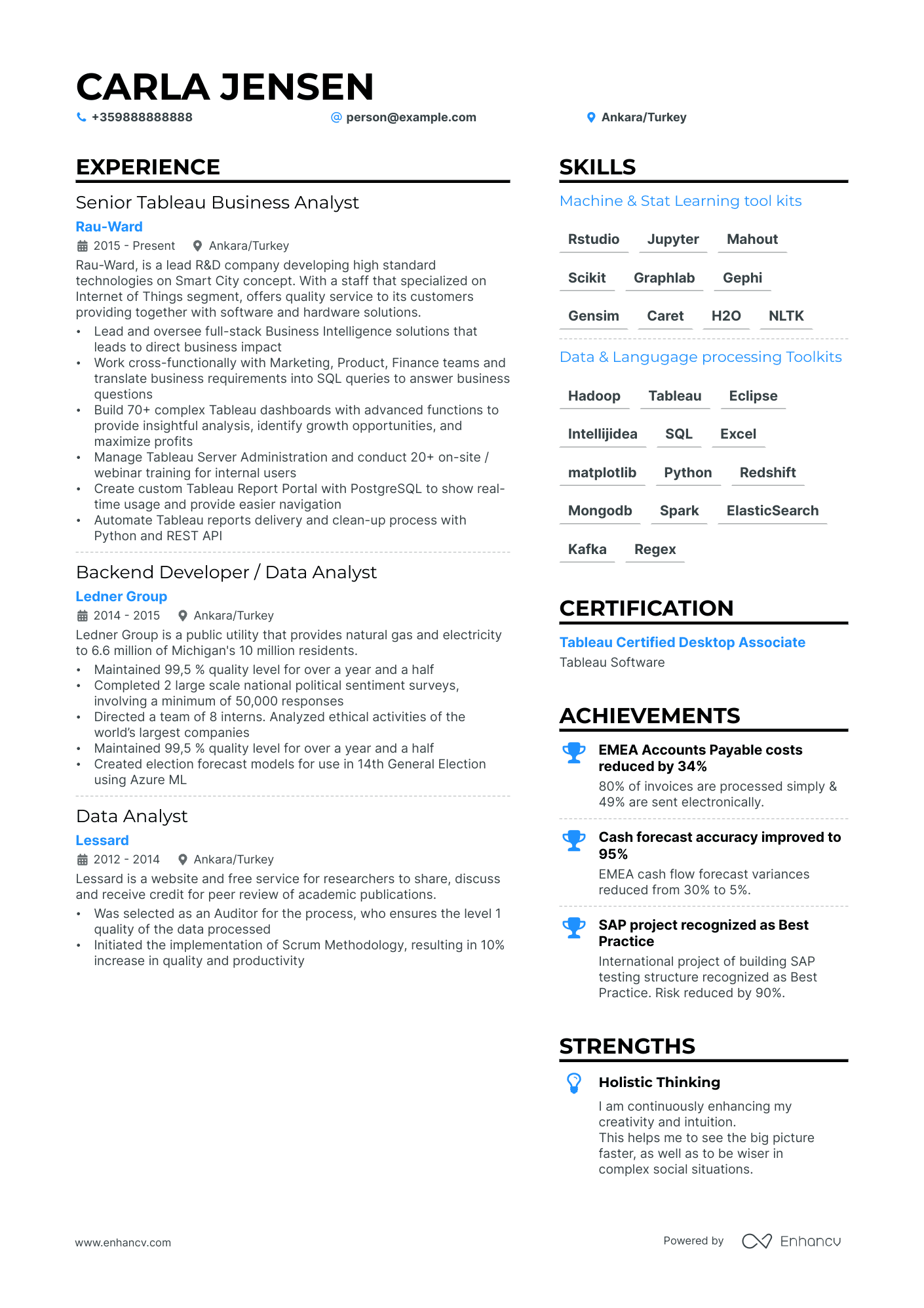

The key is to start with the job ad. Prioritize the skills mentioned there by listing them at the top of your skills section. You can even divide them up by business function, or simply by soft and hard skills.

First, start by listing your technical skills—the specific set of hard skills needed for business analysis in most work settings. Make sure you list them in a separate section so recruiters can easily spot them.

The best hard skills for your business analyst resume

- SQL

- Python

- Tableau

- Microsoft Excel

- R

- SAS

- Power BI

- SPSS

- Salesforce

- SAP

- Microsoft Access

- VBA

- JIRA

- Oracle BI

- Google Analytics

- Microsoft Dynamics

- QlikView

- Hadoop

- MATLAB

- Scrum methodologies

To save space, consider listing the skills you honed directly after each job entry or even within it.

This should be the way to go with your soft skills, too. A recruiter won’t believe you’re a good collaborator simply because it’s listed as a soft skill on your resume.

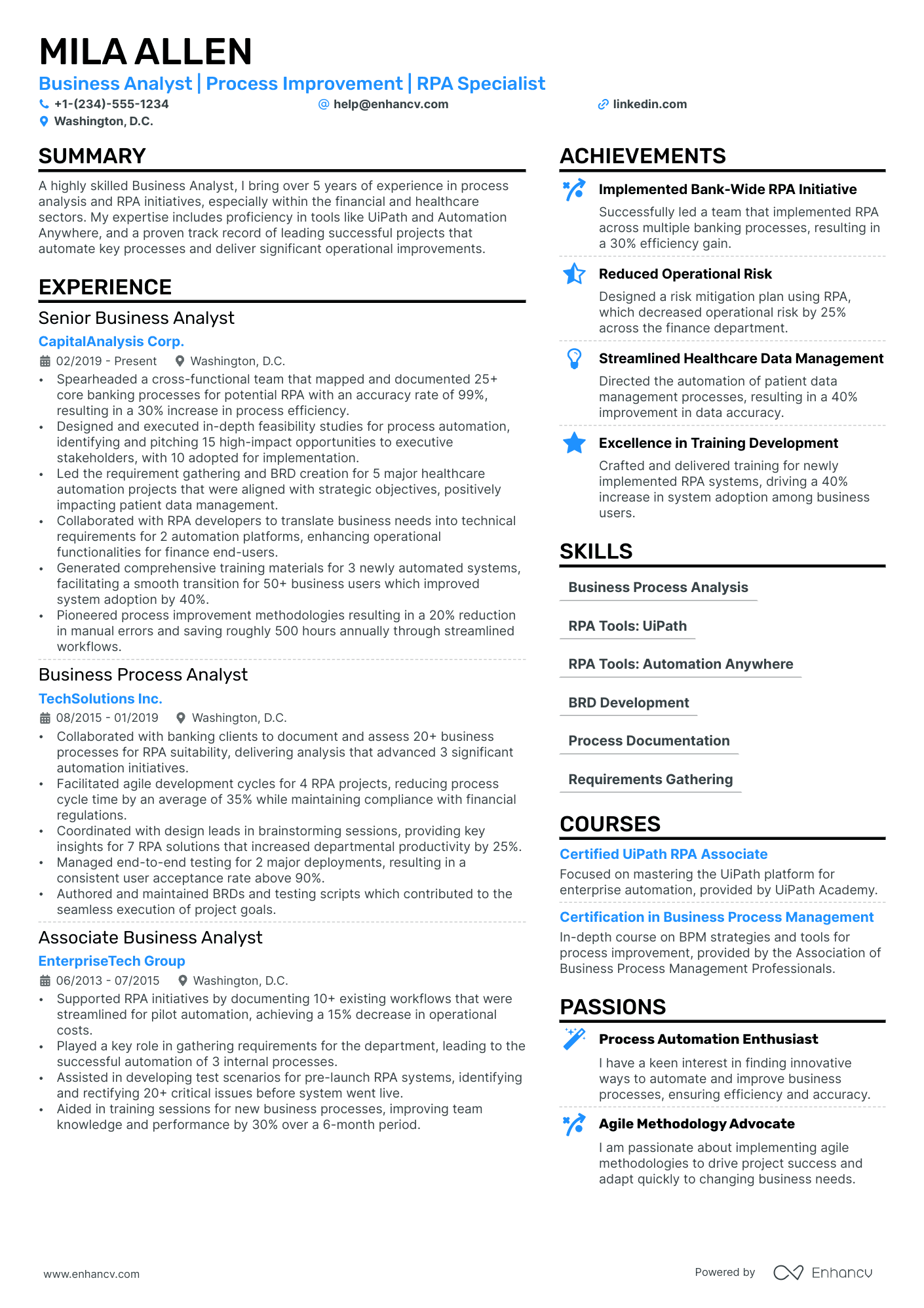

You have to prove it. Describe a situation where you used those skills at work. Either do it in the experience section or put them in a strengths section, like so:

Here’s a list of the most common soft skills that business analysts can include in their resume.

The best soft skills for your business analyst resume

- Communication

- Problem-solving

- Critical thinking

- Stakeholder management

- Teamwork

- Adaptability

- Organizational skills

- Negotiation

- Conflict resolution

- Analytical thinking

- Decision-making

- Creativity

- Time management

- Leadership

- Attention to detail

- Empathy

- Strategic thinking

- Initiative

- Persuasion

- Listening skills

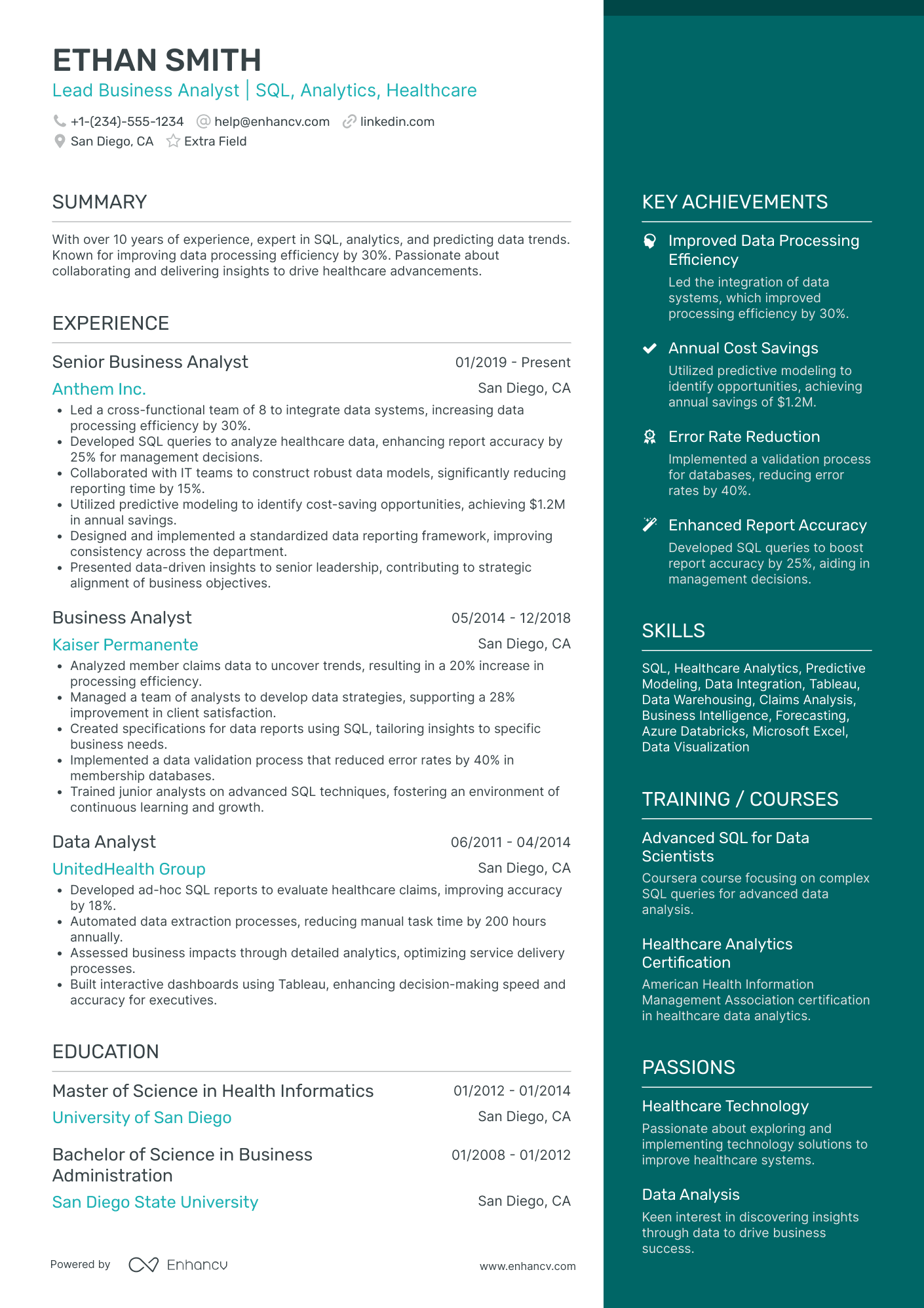

Should i add an education & certifications section to my resume

Most business analyst jobs require a degree in disciplines such as business administration, marketing, finance, information systems, or operations management.

Candidates applying for a senior or management role are often required to have a Master’s in data science or business analytics. Senior roles usually perform complex and cross-functional analysis. High-level mathematics combined with machine learning taught in these courses equip candidates with the skill set required for such demanding tasks.

If you’re an experienced business analyst, list your degree, school’s name, and location. Don’t list the year you graduated if it was more than 10 years ago.

If you’re a fresh graduate looking to enter the industry, you may want to list academic achievements such as your GPA, a Cum Laude, or other awards.

Here’s an example of a business analyst’s education section:

Certifications can add even more value to your professional profile. Yes, they cost money and they take time to complete. You don’t have to invest in them when you’re straight out of college.

However, when you’re ready to level up your career, a comprehensive course and a worldwide recognized certification from any of these institutes can definitely change the game for you.

Top certifications for your business analysis resume

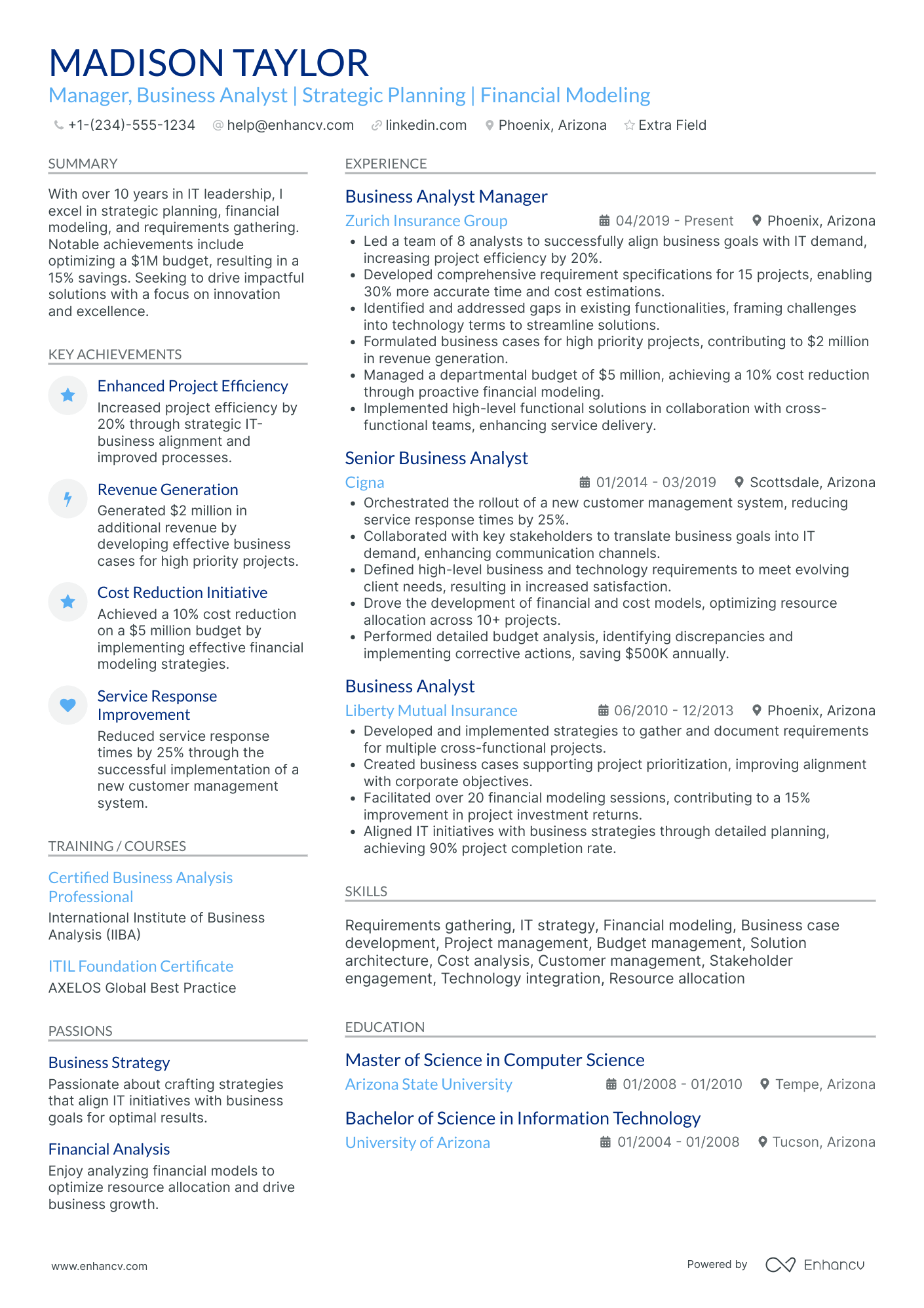

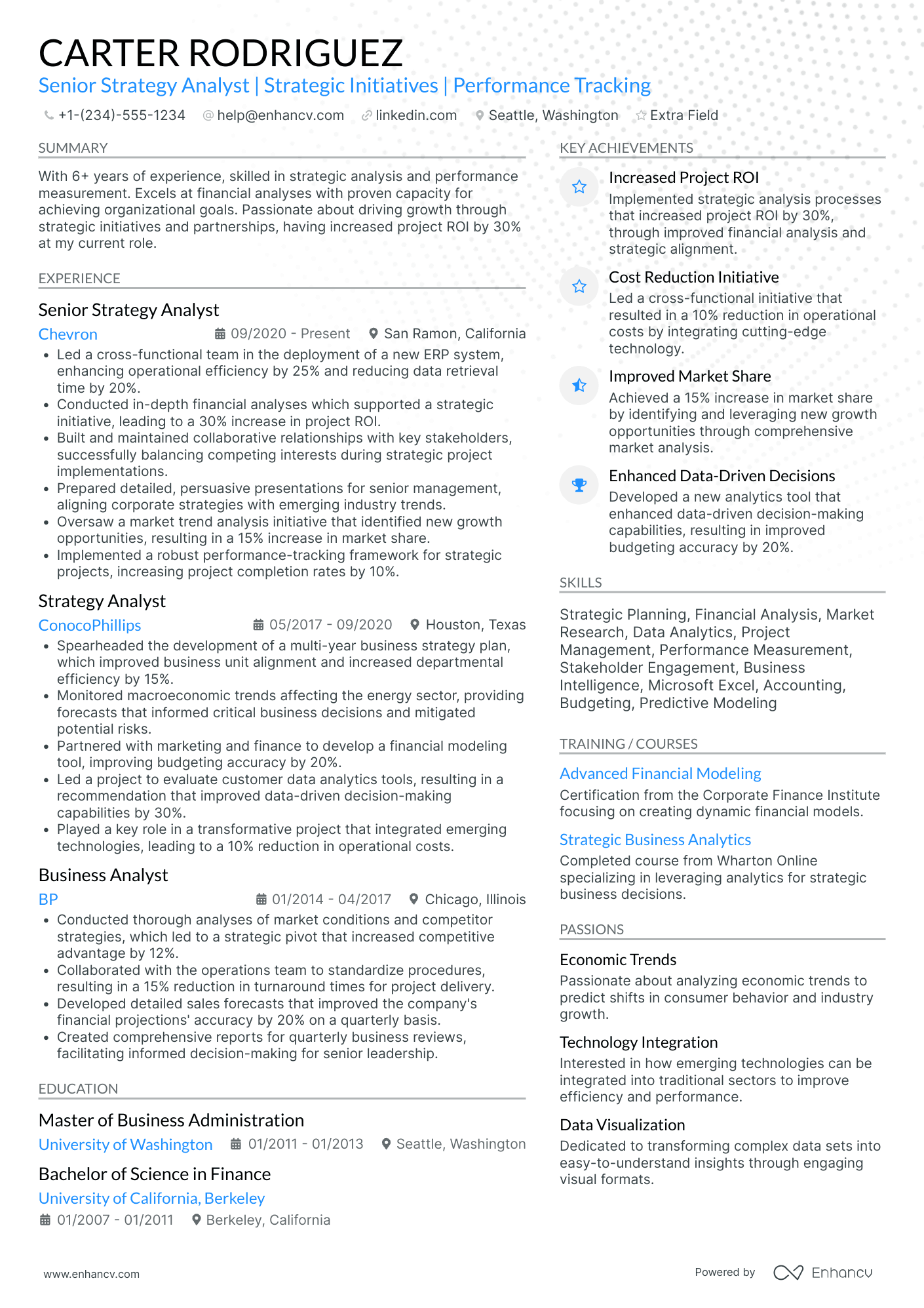

How to write a targeted resume summary or objective

business analysts can work in a variety of work settings, so your biggest concern should be adapting your personal statement to the specific field. Even within the same industries, companies have different processes and terminology. Because of this, specificity is important when writing your business analyst resume.

Enhance the specificity of your resume by strategically incorporating keywords from the job description into your resume content.

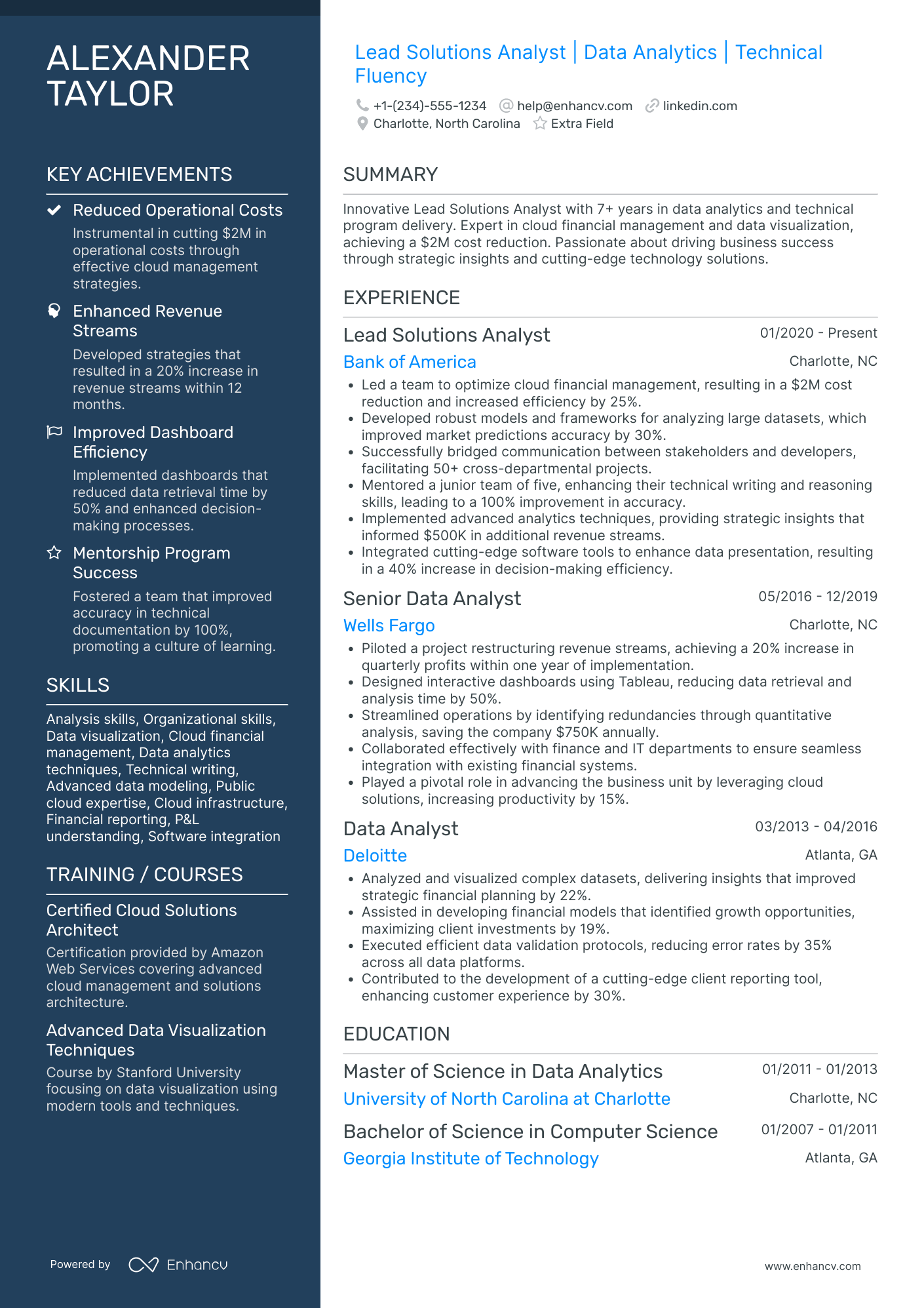

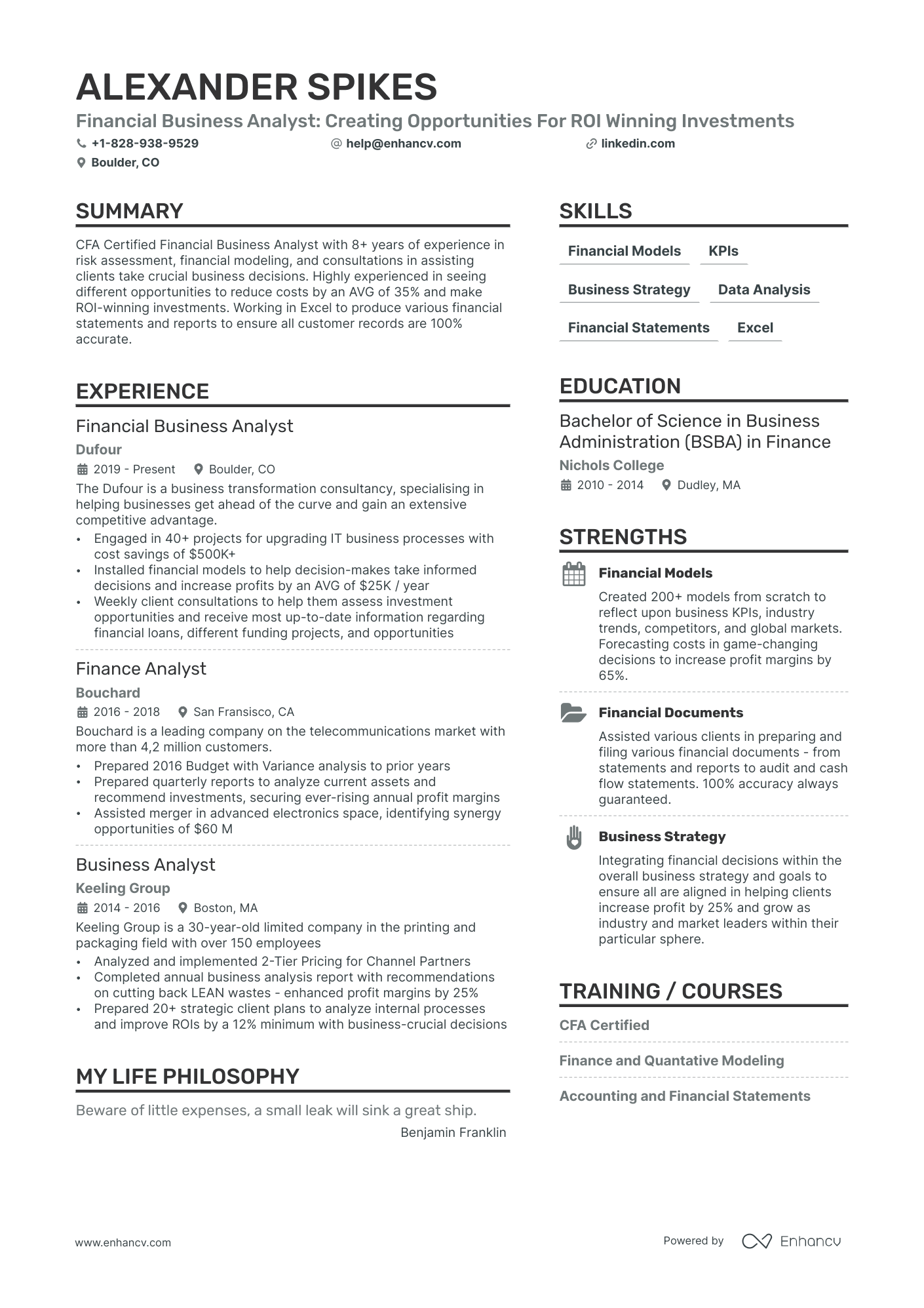

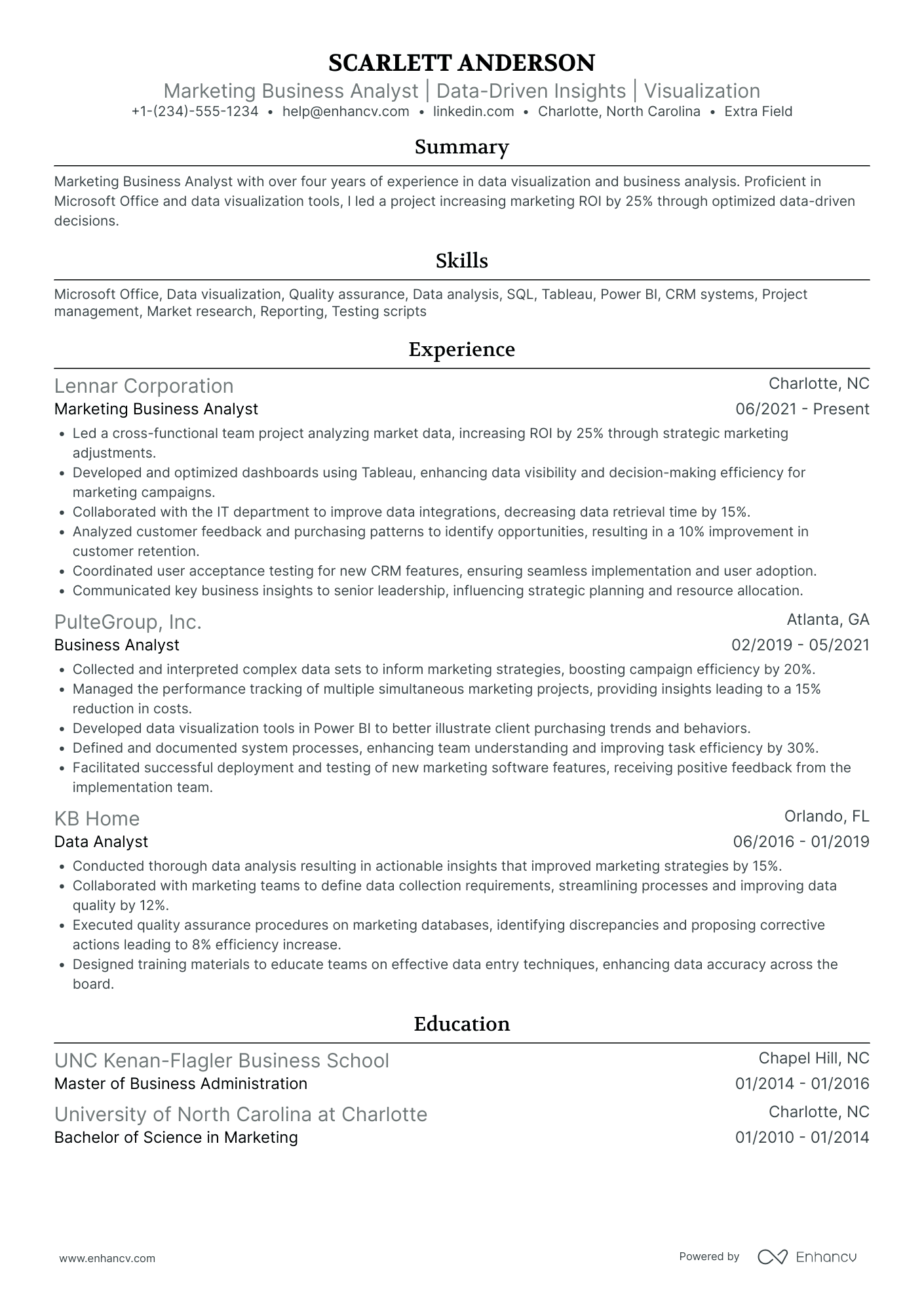

Candidates with a solid work history and specific skill sets that match the job description should opt for a resume summary. It’s 3 to 5 sentences long and provides a concise overview of your professional achievements and experience. It shows employers how your background aligns with the job requirements.

Let’s look at two examples.

This summary shows the specific tasks you’re familiar with, but there’s no gravitas. No impact.

Here’s what the improved version does best:

- Highlights industry-specific experience: The summary clearly specifies the candidate's expertise in the medical supplies and equipment industry, which helps to immediately align their background with potential job opportunities in that sector.

- Showcases relevant certifications and technical skills: By mentioning certifications and proficiency with specific tools, the summary shows the candidate's commitment to professional development and their capability to handle industry-relevant technologies.

- Quantifies achievements: The inclusion of quantified achievements (e.g., reducing processing times by 30% and cutting operational costs by 15%) provides concrete evidence of the candidate's impact and effectiveness in their previous roles.

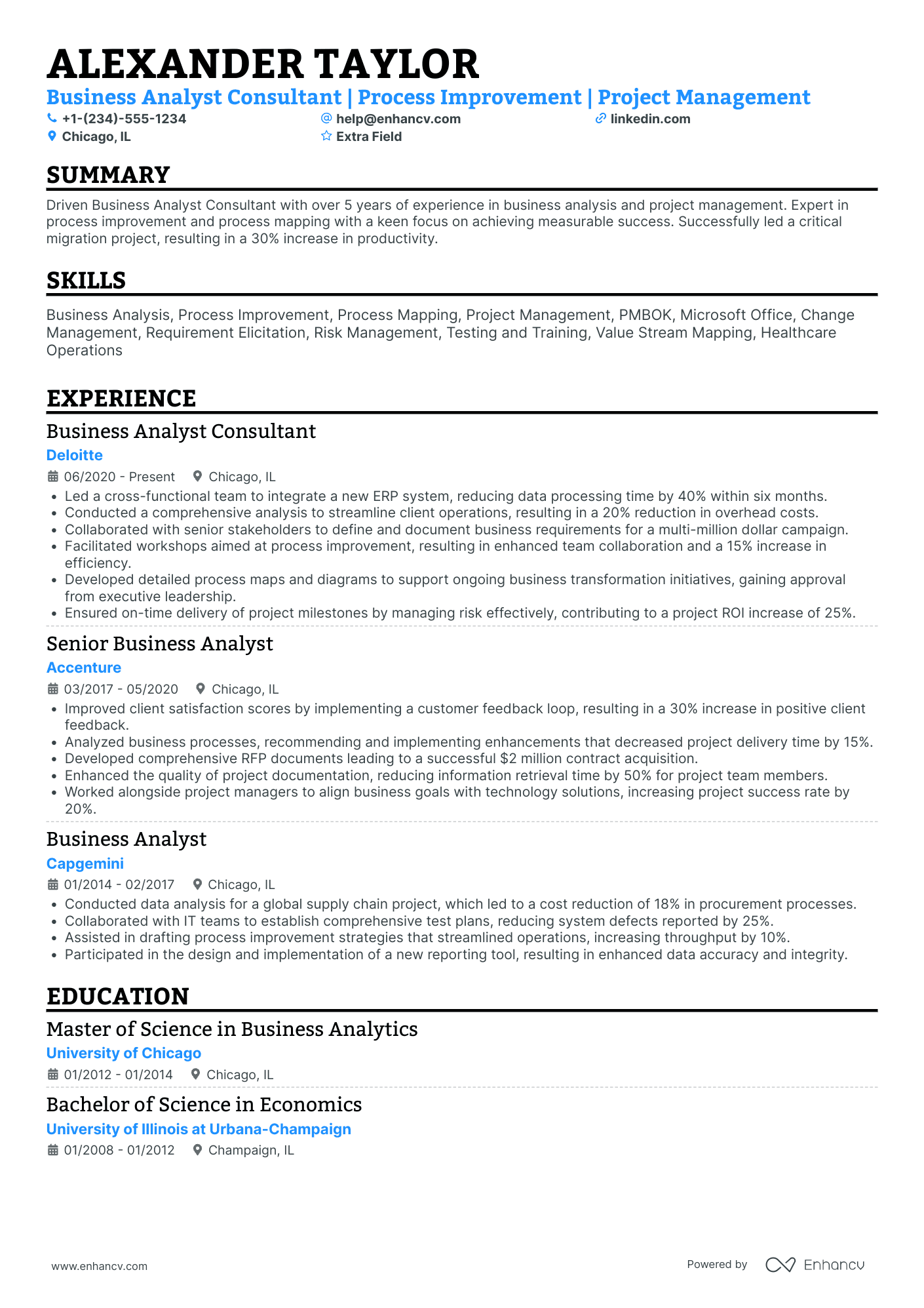

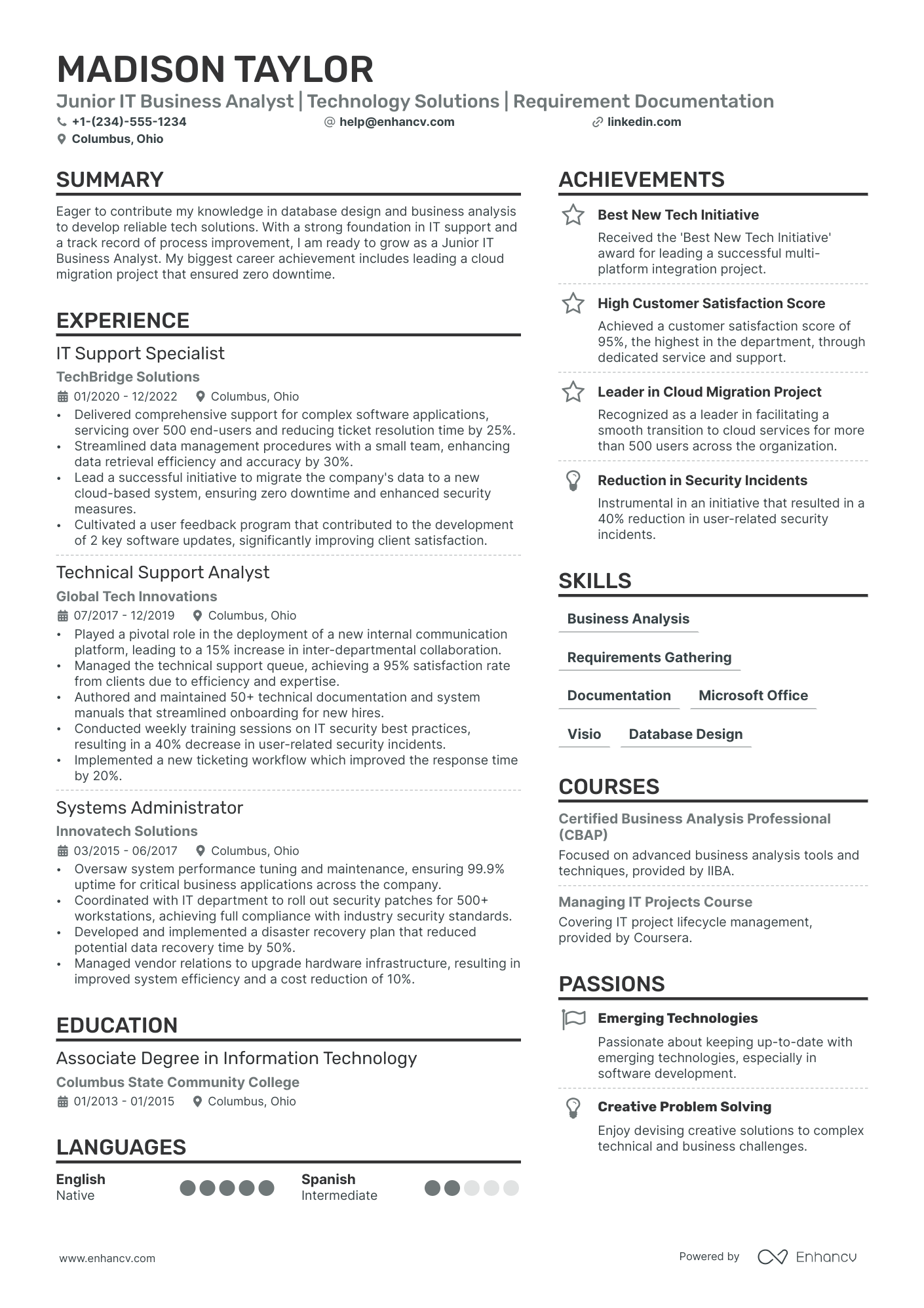

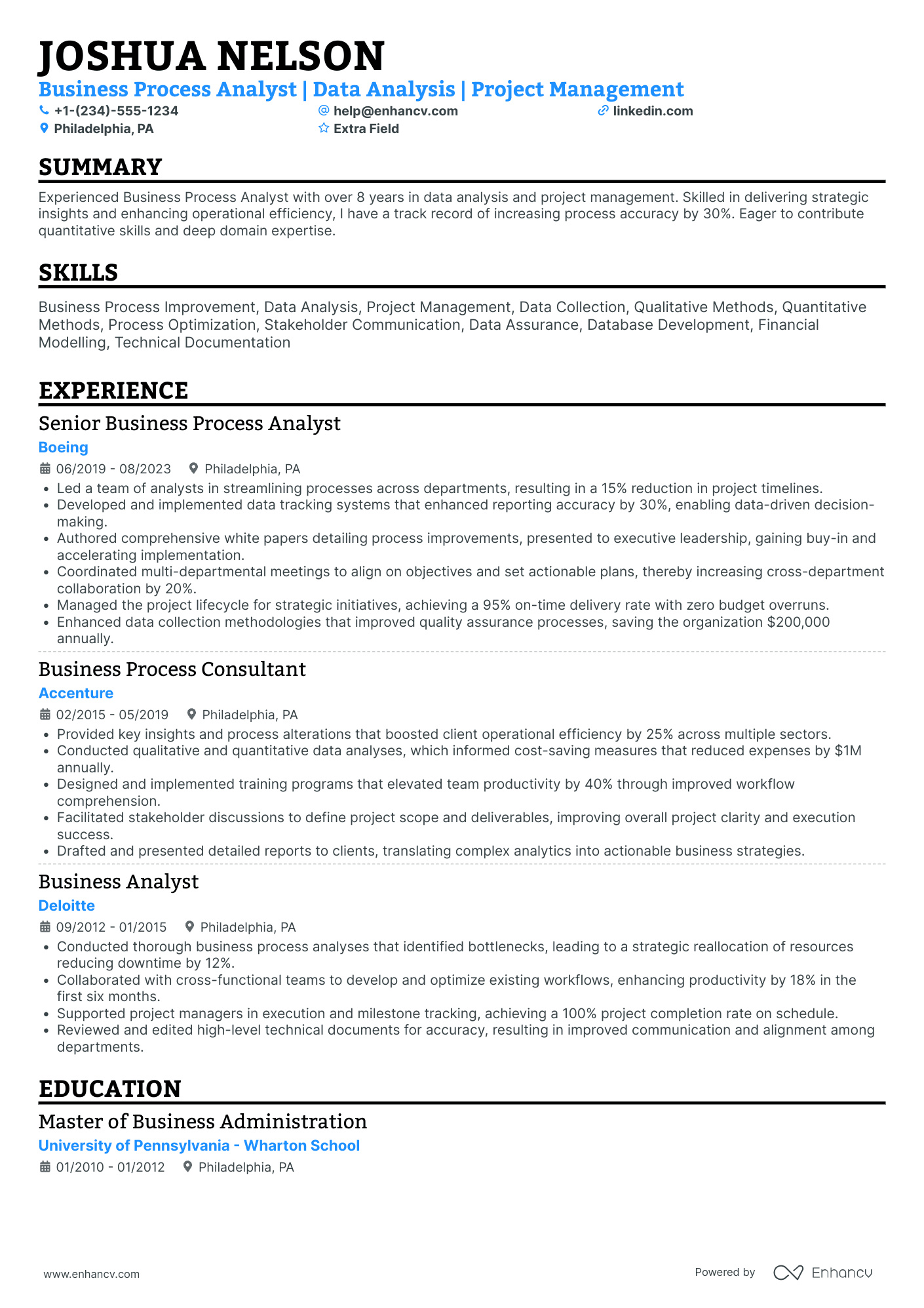

The resume objective is slightly different from the summary.

Firstly, it’s suitable for business analysts with less than 3 years of experience or those changing industries. Secondly, the objective statement is more focused on your value proposition rather than your previous experience.

Look at a good example of a BA resume objective:

The best way to approach your resume objective is to start with a descriptive word, list your top skills and industry knowledge, and finish by expressing your motivation to contribute to the target company.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Other sections to include in a business analyst resume

If you’re a recent graduate or making a career change, odds are your work history is low on business analyst experience. Including additional sections in your resume is a good opportunity to showcase relevant skills. Here are some ideas:

- Professional development: Include any workshops, seminars, or courses you've attended that are relevant to business analysis. This highlights your commitment to continual learning and staying current in your field.

- Awards and recognitions: Mention any accolades received in your career, which can serve as a testament to your excellence and recognition by peers or industry leaders.

- Publications: If you have written articles, books, or studies relevant to business analysis or the industries you have worked in, include them. This can establish you as an authority in your field.

- Languages: List any additional languages you speak fluently. Language skills can be particularly valuable in global companies or roles that require interaction with international te

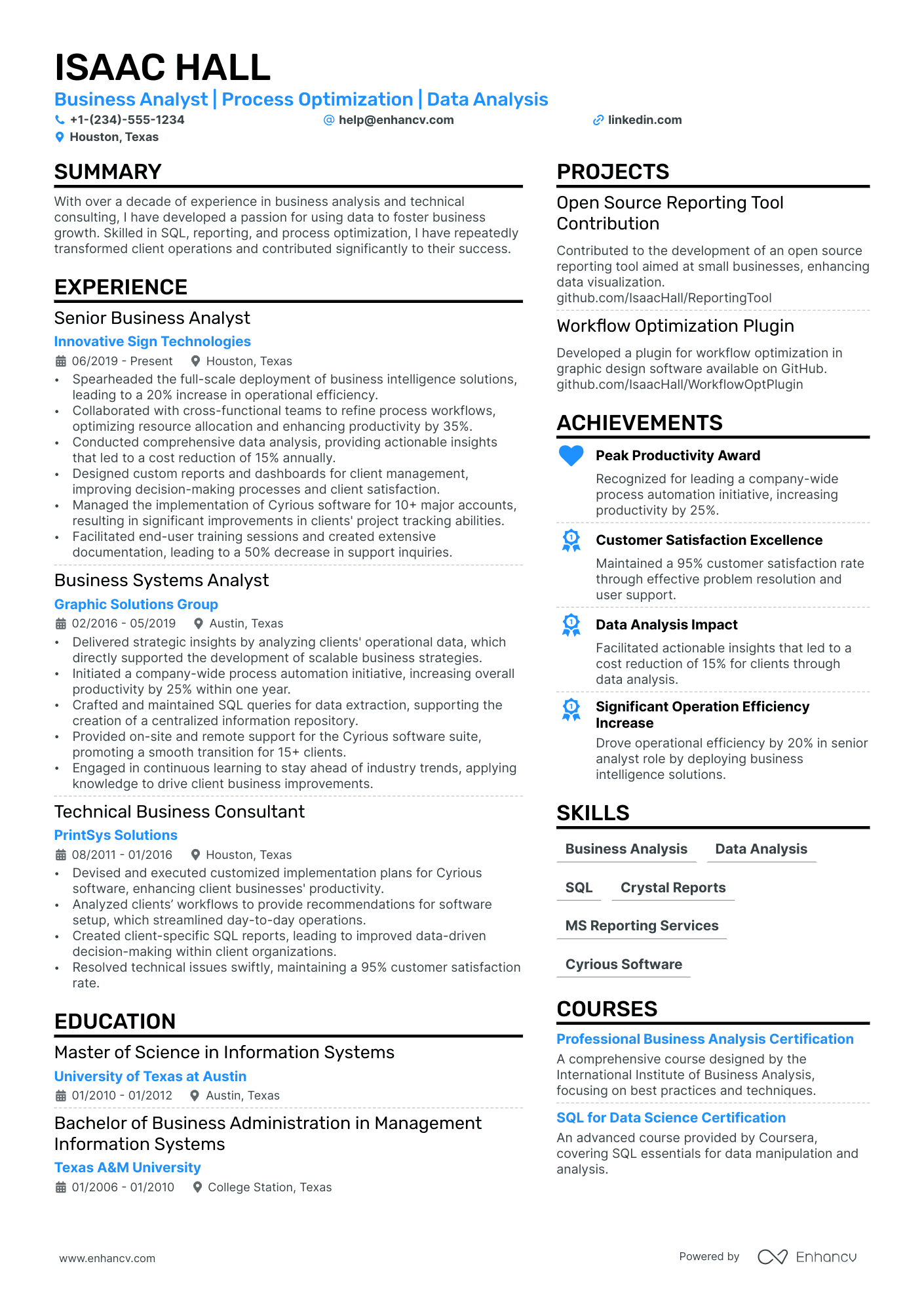

- Projects: Detail specific projects where you played a key role, showcasing your ability to manage complex tasks and deliver results. This demonstrates your practical experience and success in real-world applications.

A projects section example on a BA resume

The projects section of your resume closely resembles the experience section, as both aim to highlight your contributions and provide concrete evidence of your success. Typically, you would place your projects in a separate section if they were conducted as side gigs or over a limited time.

- •Led a team of 5 to redesign supply chain processes, reducing operational costs by 20%.

- •Implemented a new inventory management system using SAP, increasing stock visibility and reducing excess inventory by 30%.

- •Developed and executed training programs for over 100 staff members across multiple departments to ensure smooth adoption of new processes.

Key takeaways

If you're ready to make your business analyst resume shine, these guidelines are tailored just for you:

- Choose the right resume format: Think about which format suits you best. The idea is to highlight your best assets, whether that's your skills or your job history.

- ATS optimization: When crafting your resume, remember to sprinkle in those keywords that align with the job description. Also, keep things clean and legible with simple fonts and adequate margins—no one likes a cluttered resume.

- Quantify your impact: Numbers speak louder than words. When you list your past job achievements, make sure to quantify your impact.

- List your skills: Don’t hold back on detailing your technical prowess, like your know-how in SQL or Python, and definitely don’t forget to mention your soft skills—things like your knack for problem-solving or your ability to keep stakeholders happy.

- Education and certifications: Lay out your educational background clearly, and if you’ve gone the extra mile to nab some certifications, make sure they’re front and center. These are real assets and make your resume pop.

- Crafting a killer summary or objective: Here’s where you get to shine. Tailor your resume summary or objective to mirror what the job ad is asking for. Highlight your key skills and how they’re just what the job requires.

- Don’t forget the extras: If you've managed major projects, taken extra courses, or are multilingual, these deserve a shoutout on your resume too. These sections can really help paint a fuller picture of what you bring to the table.

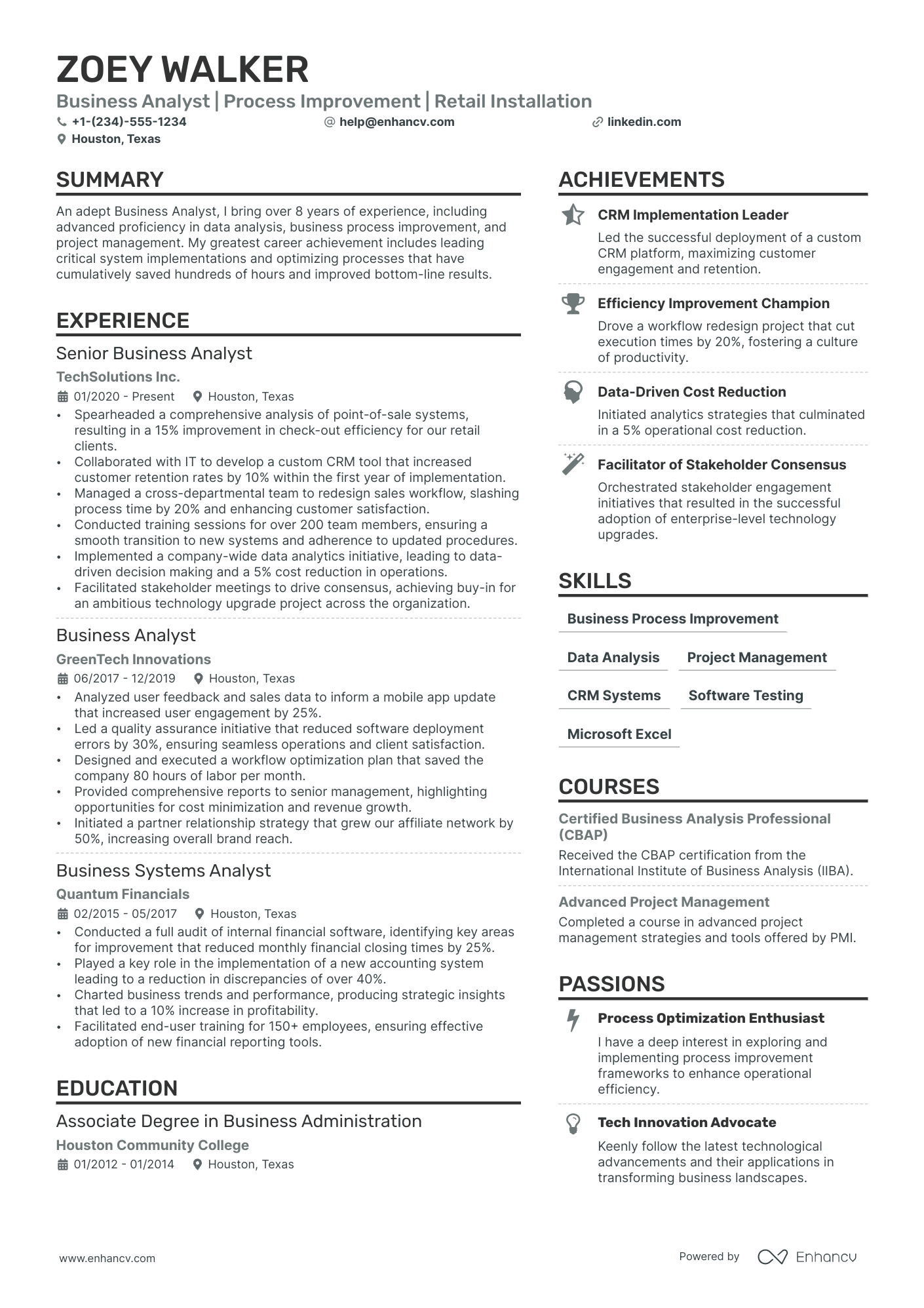

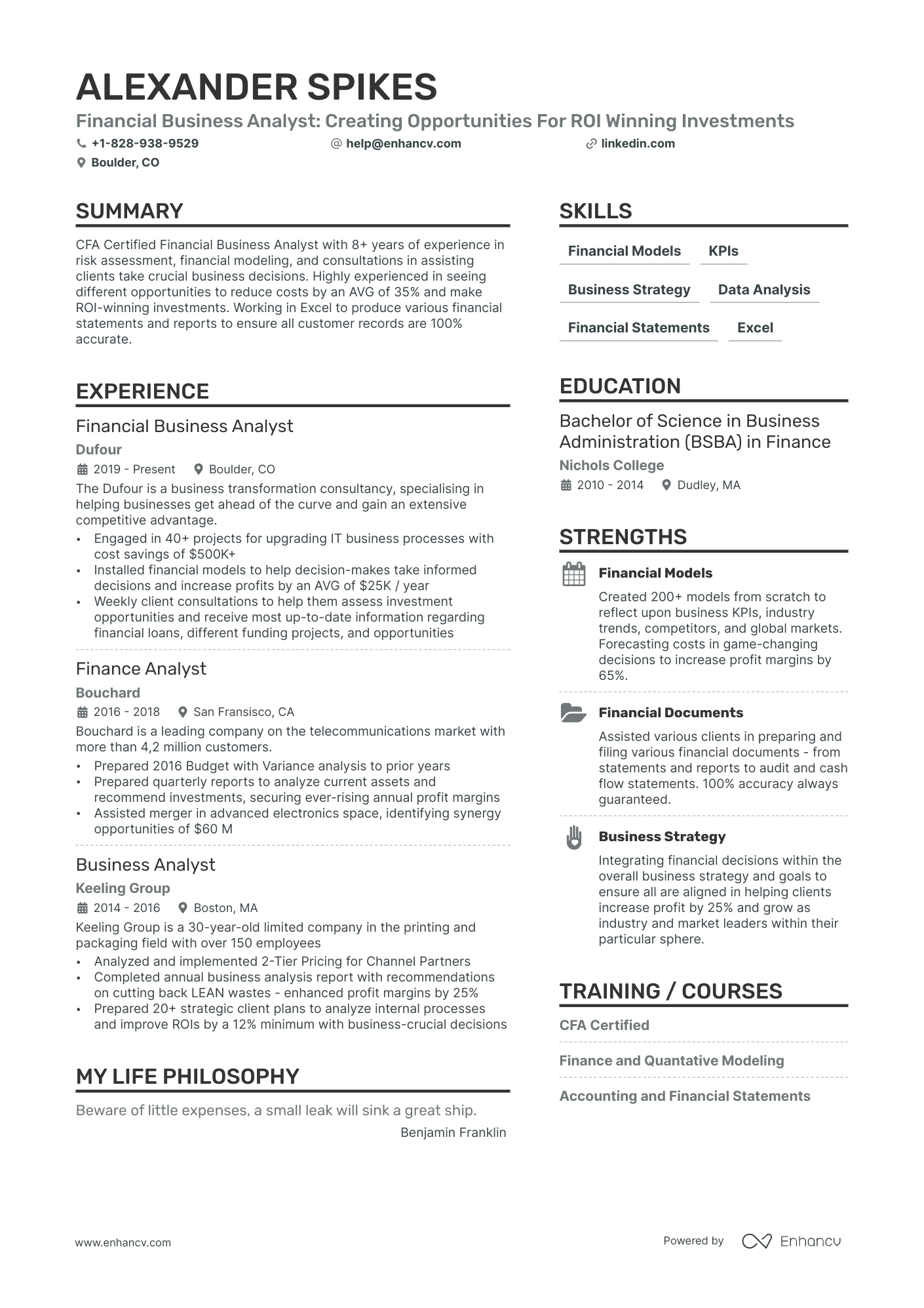

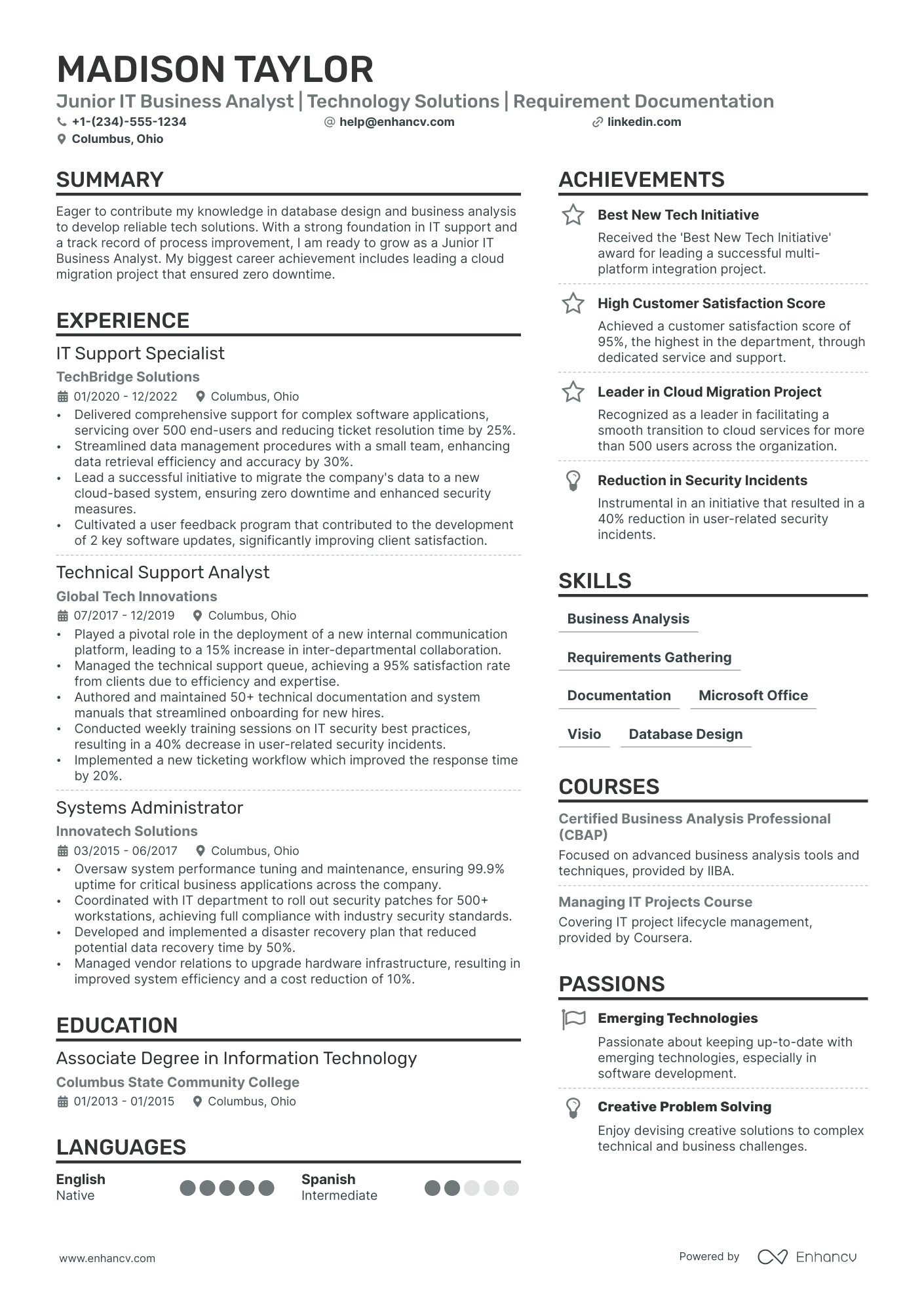

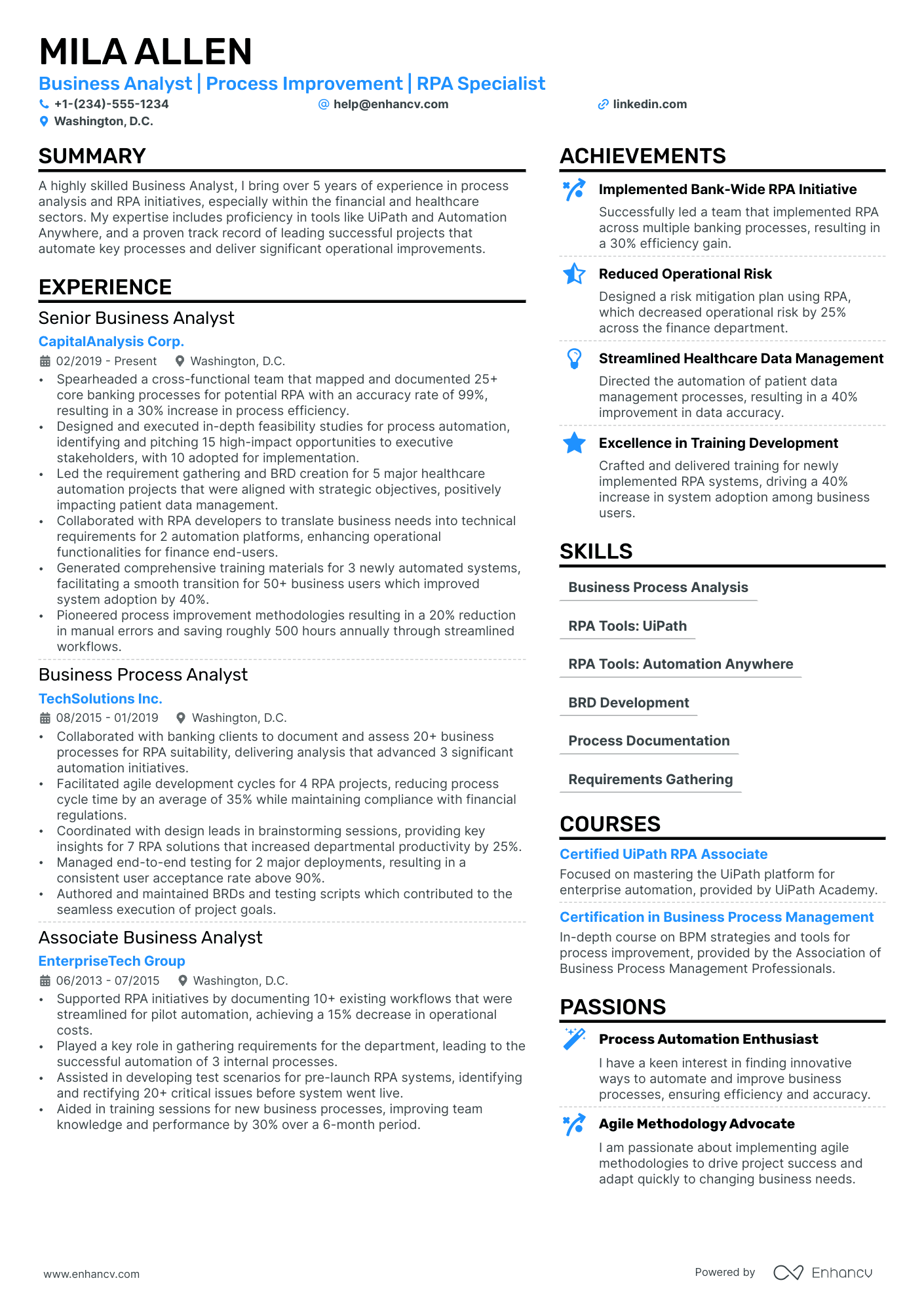

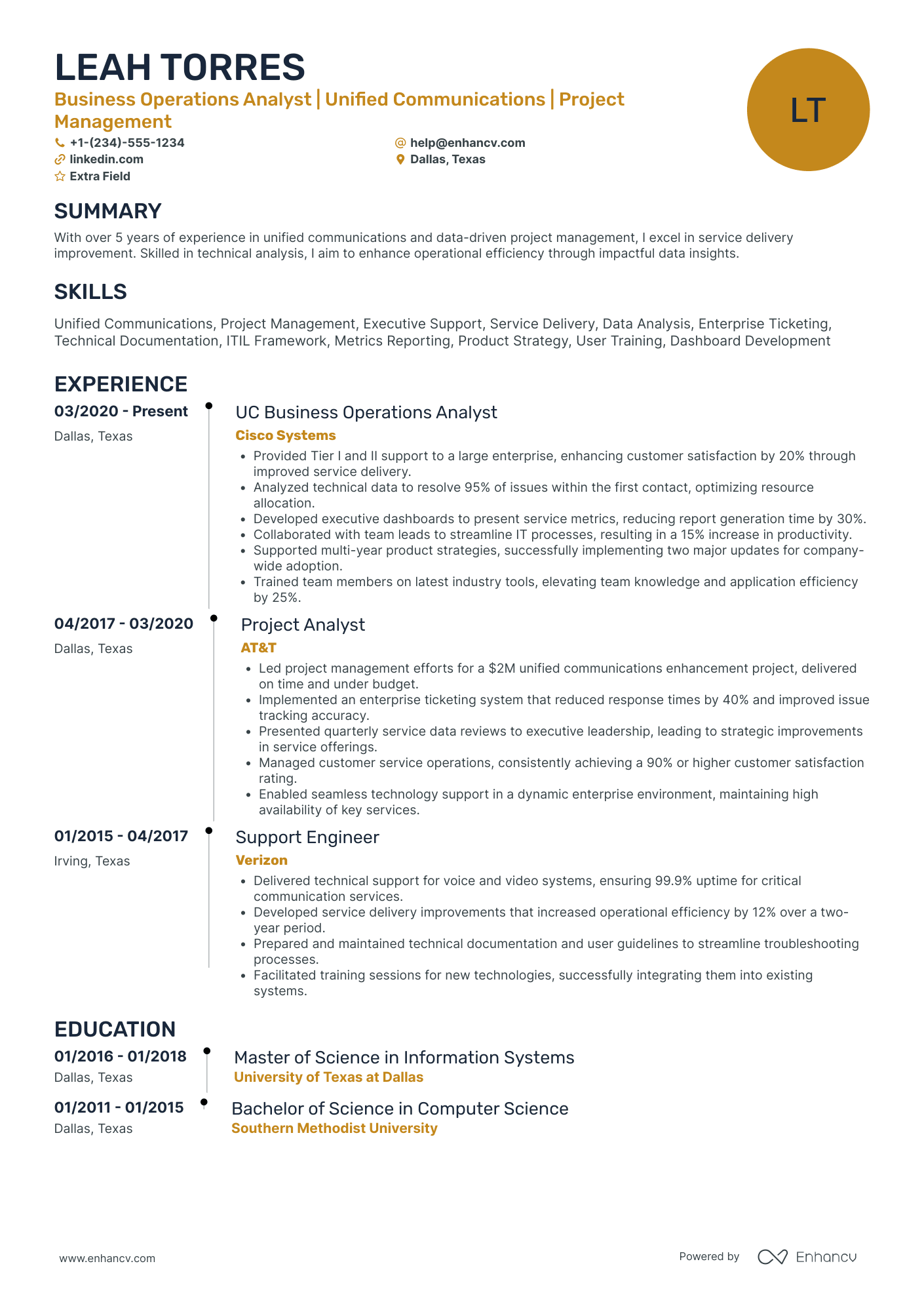

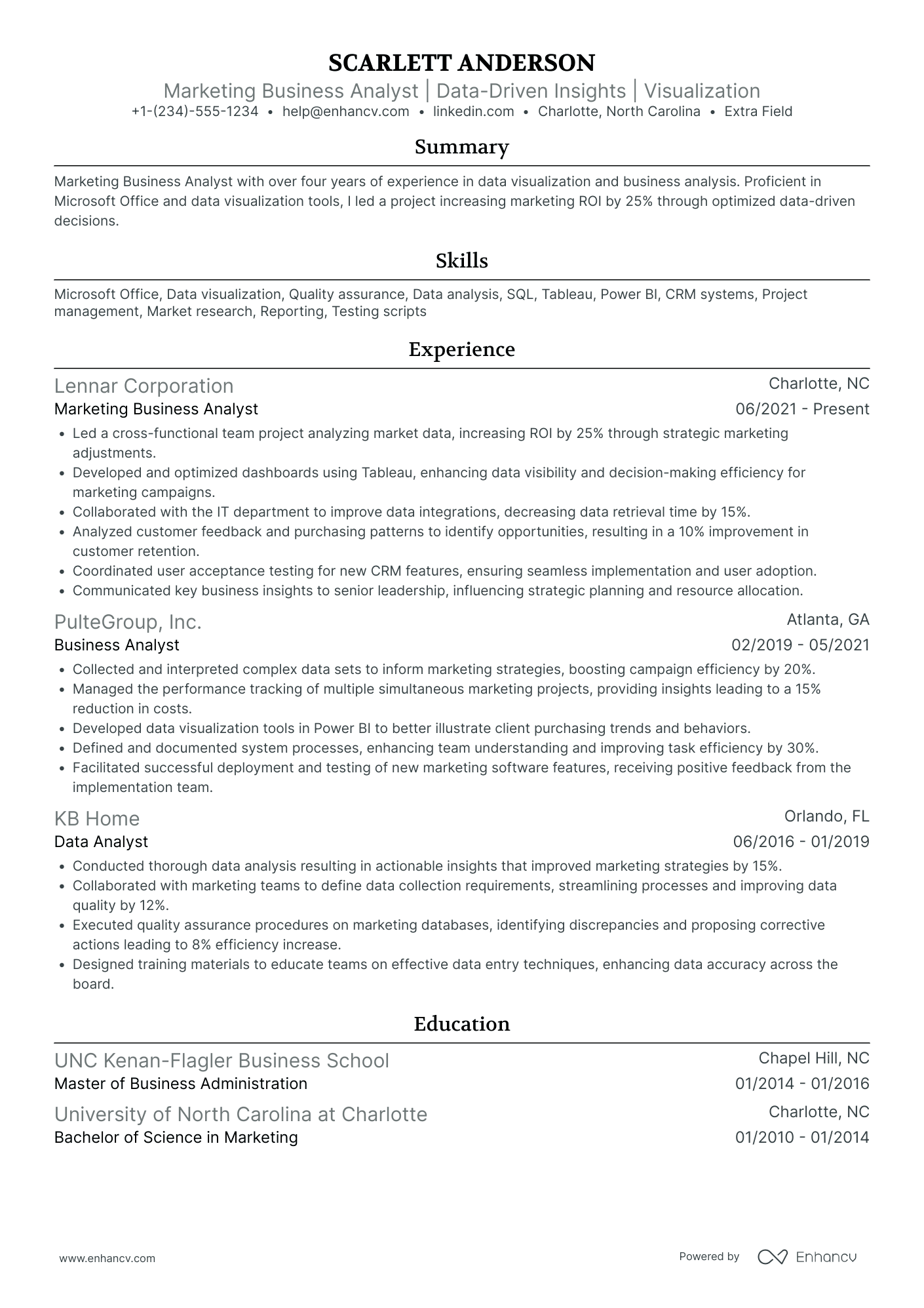

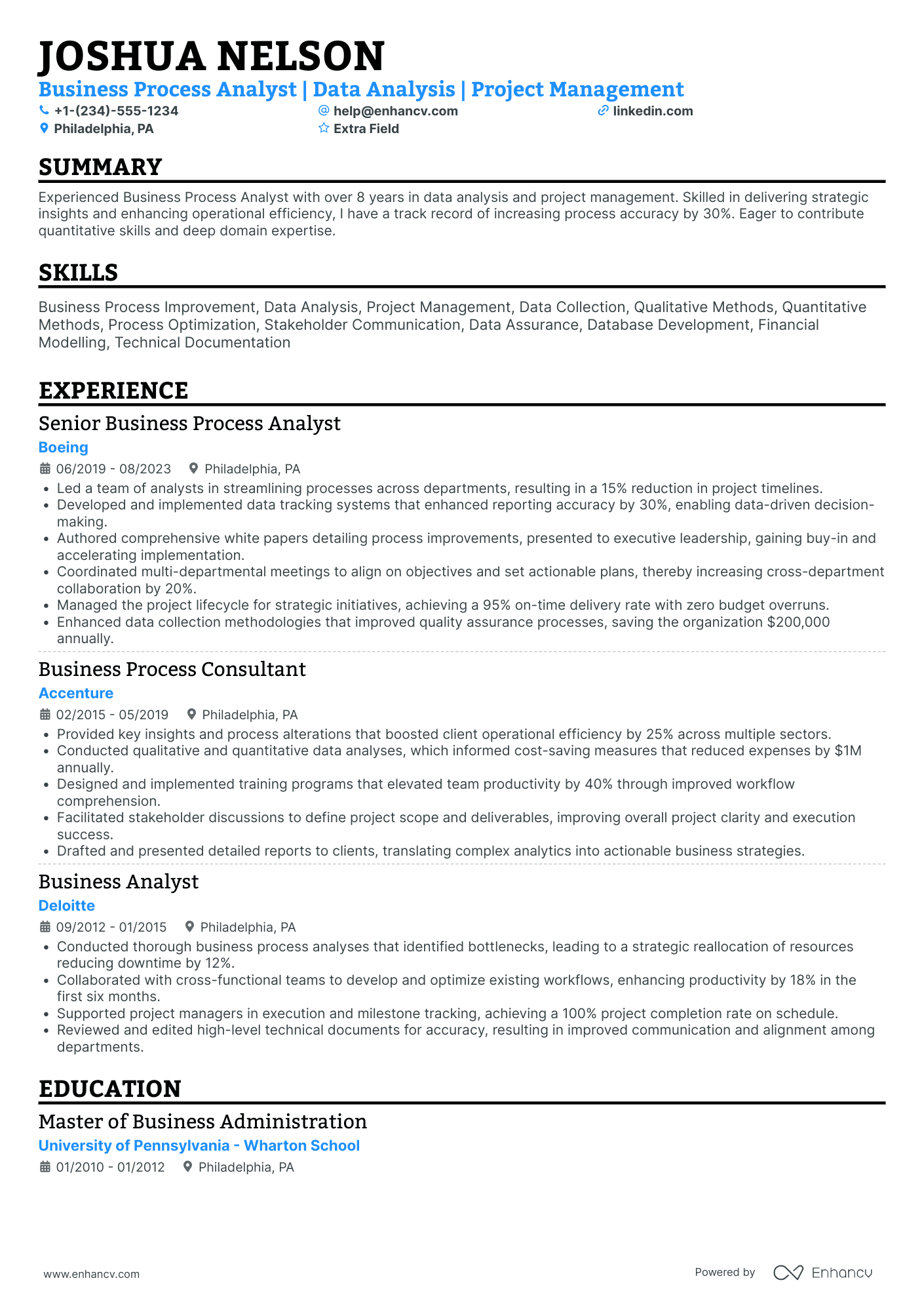

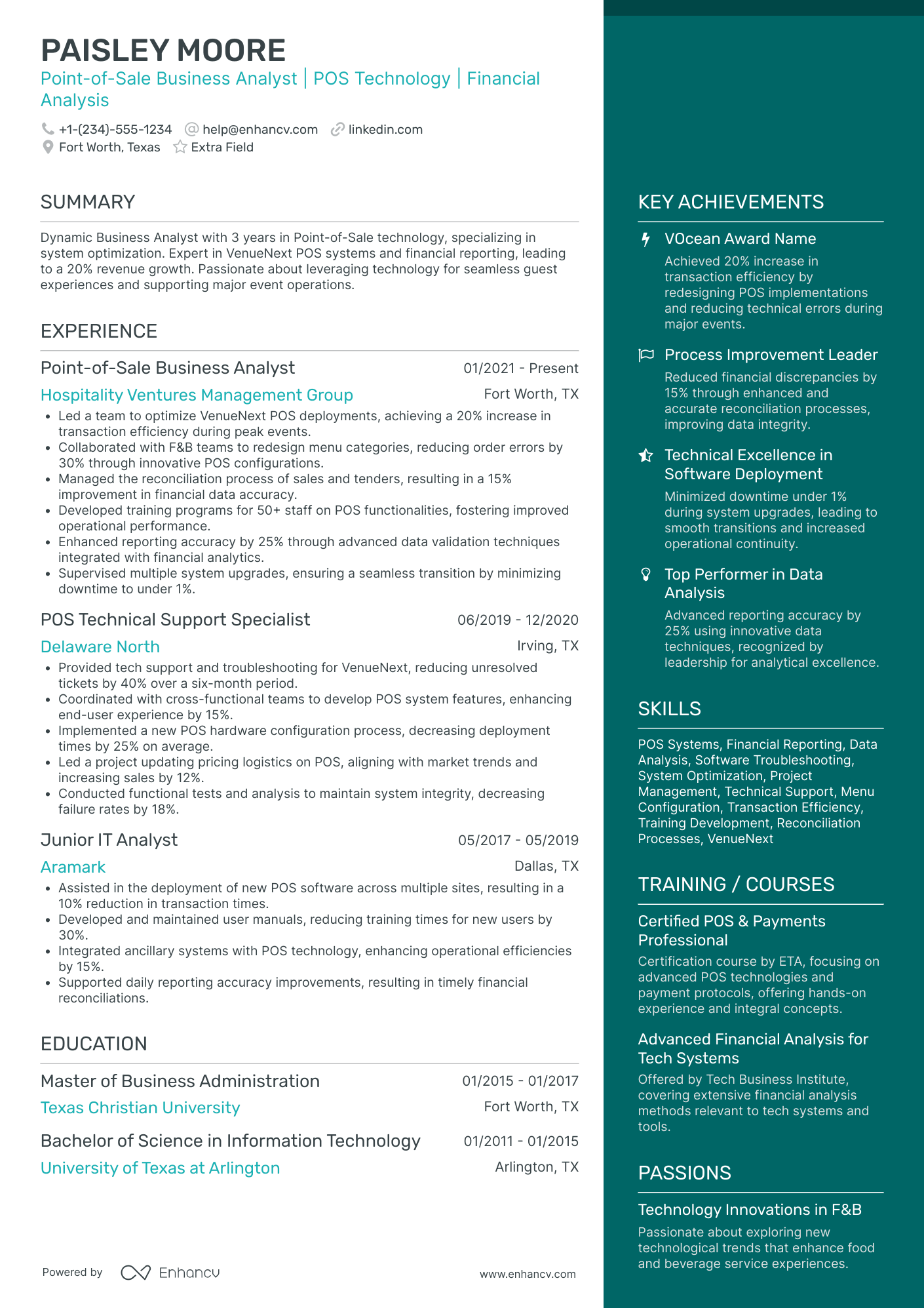

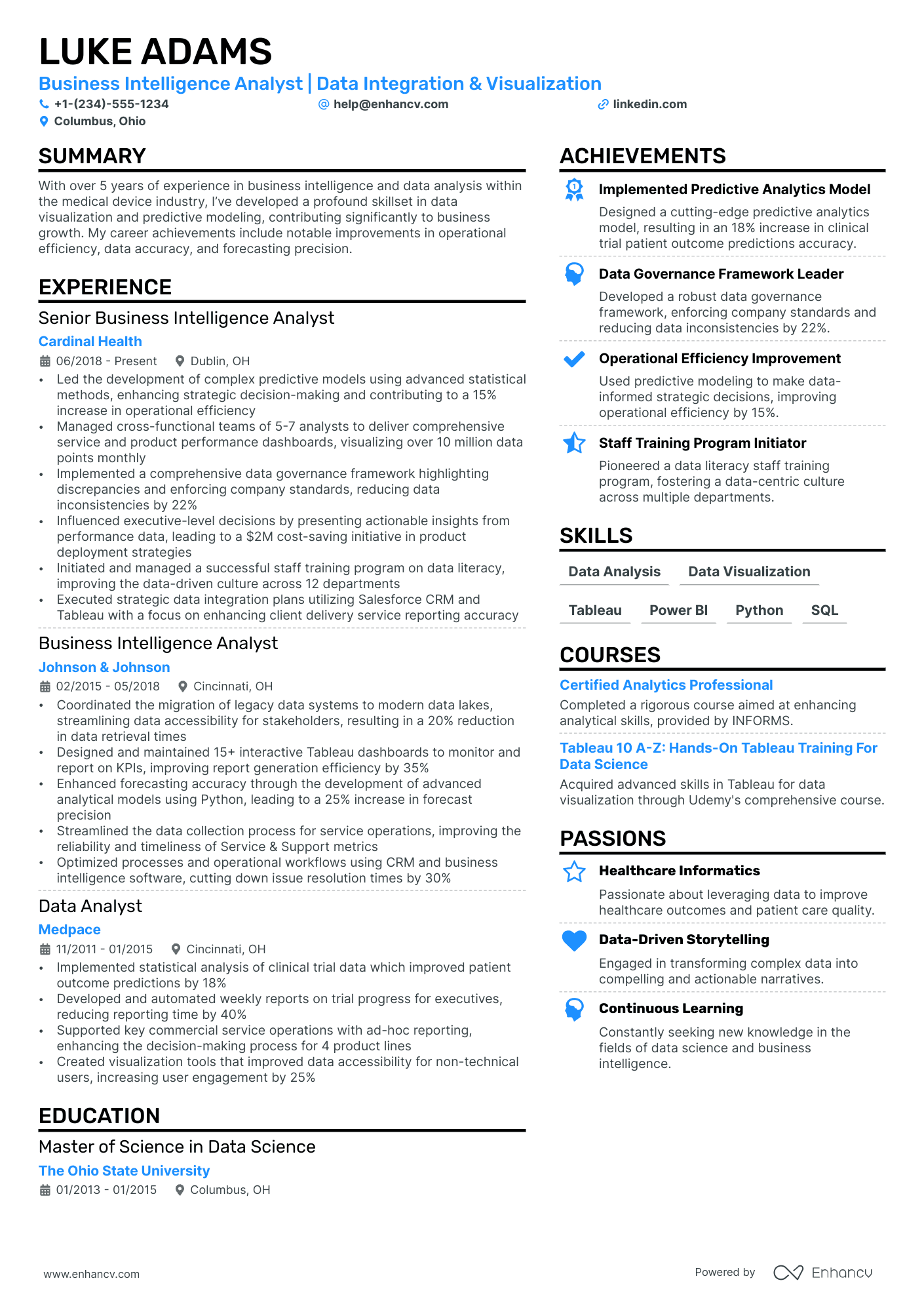

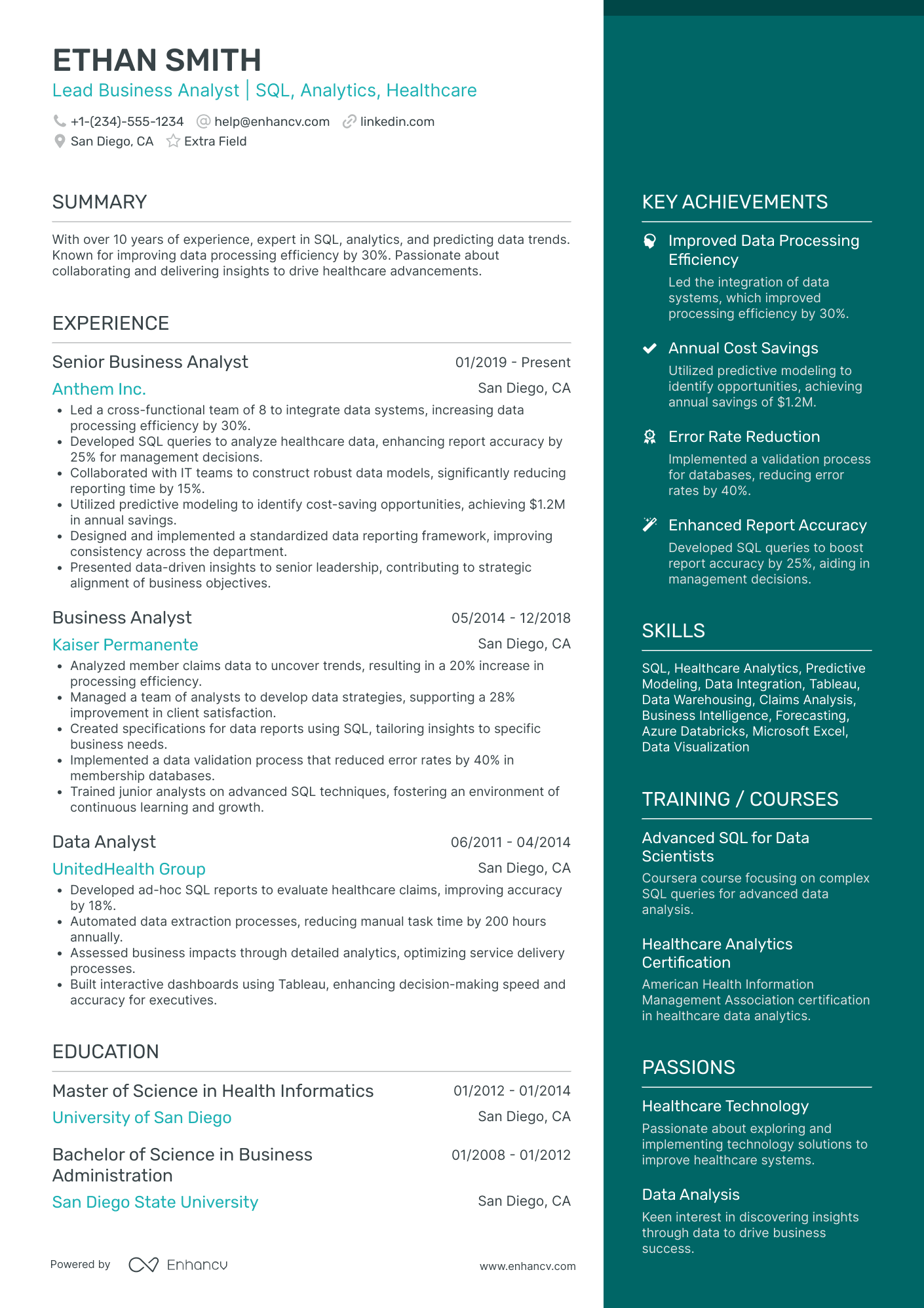

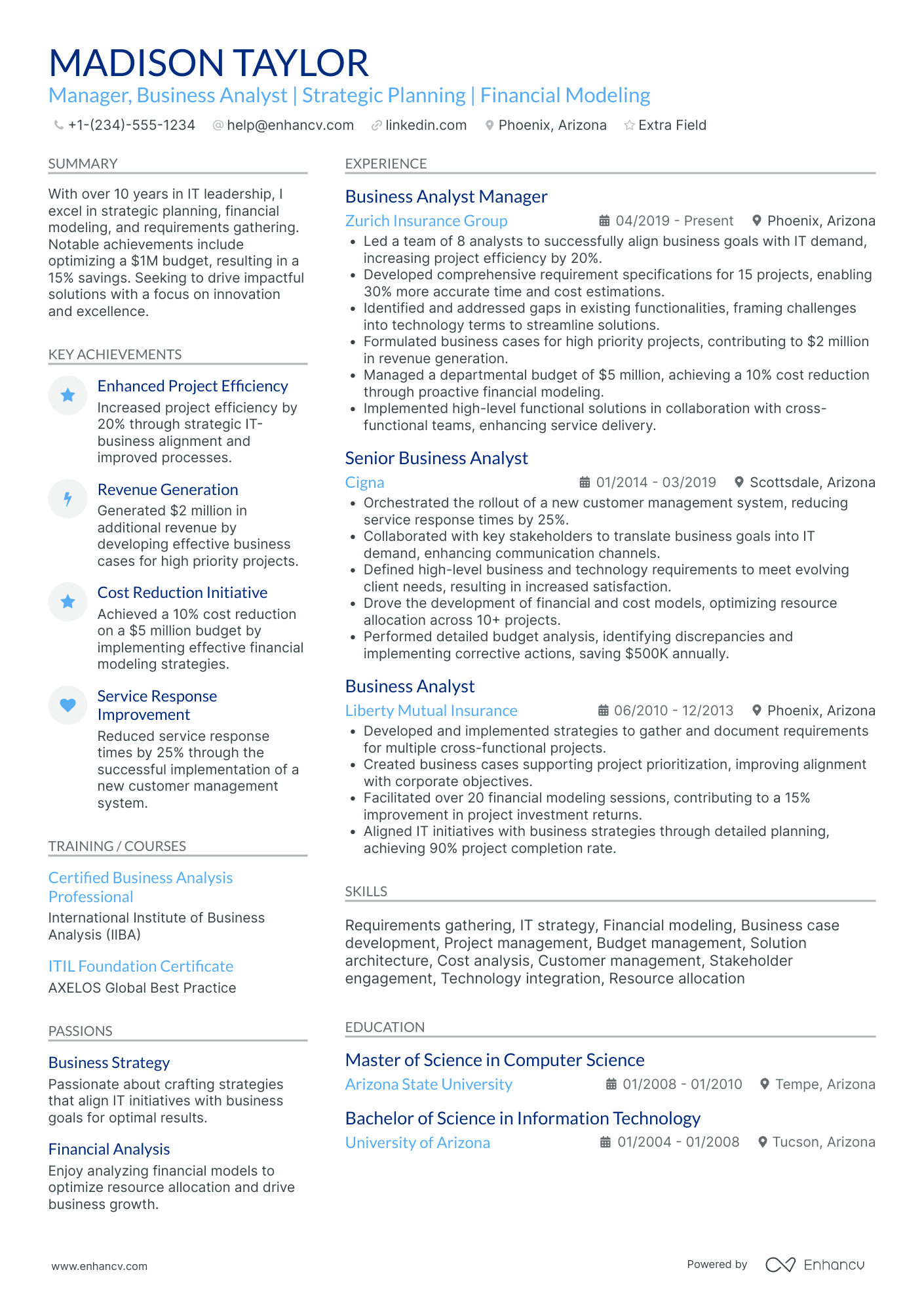

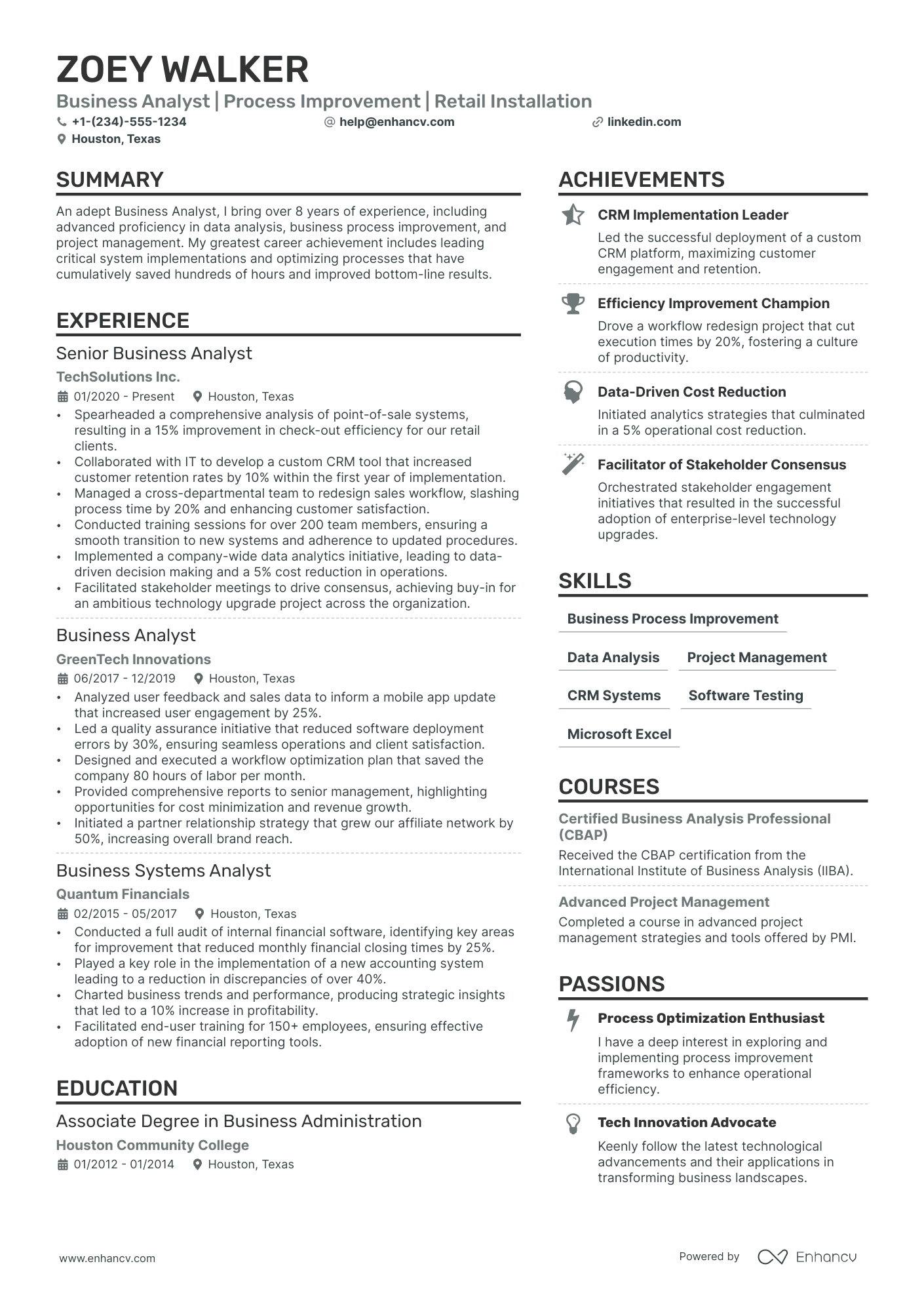

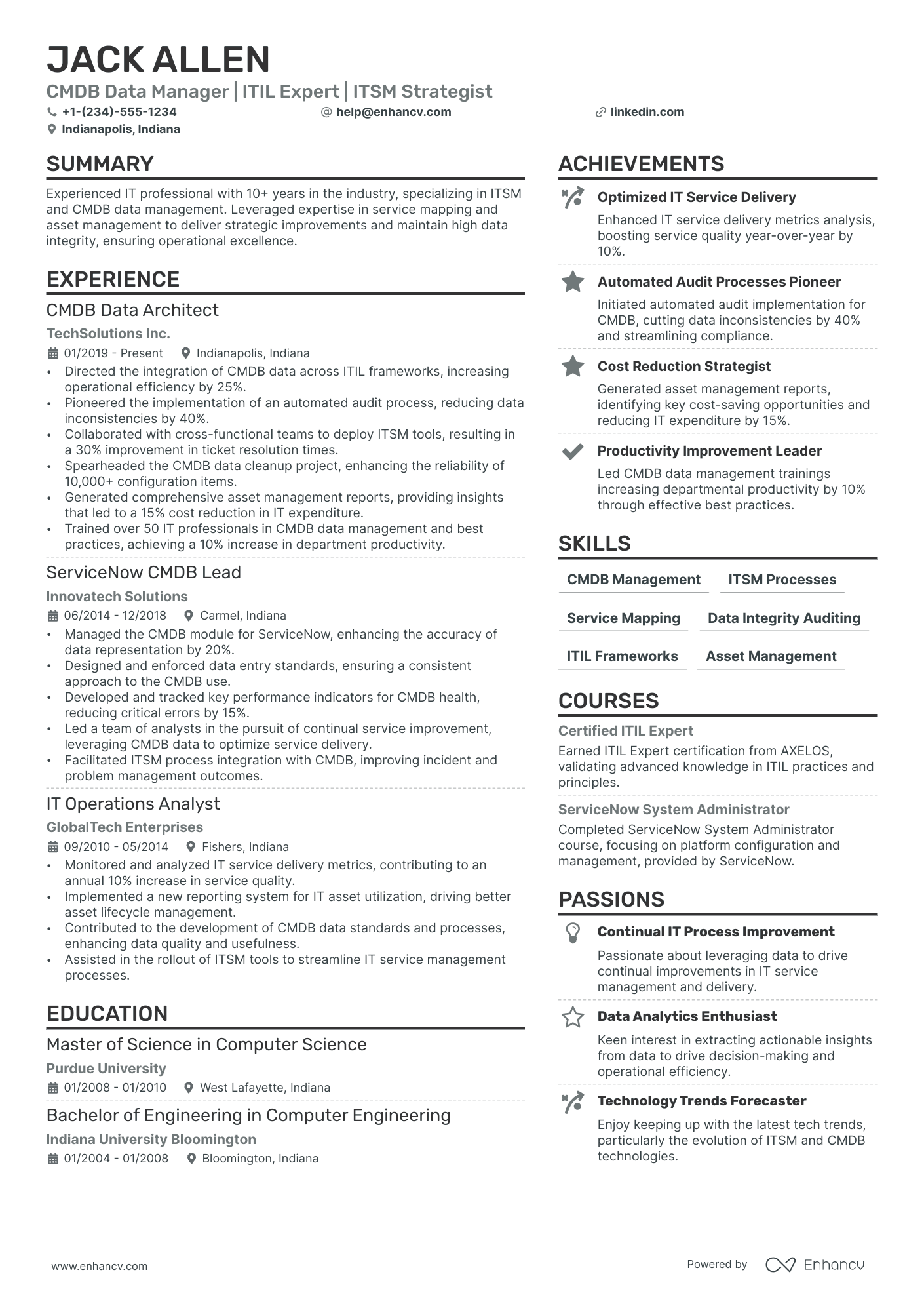

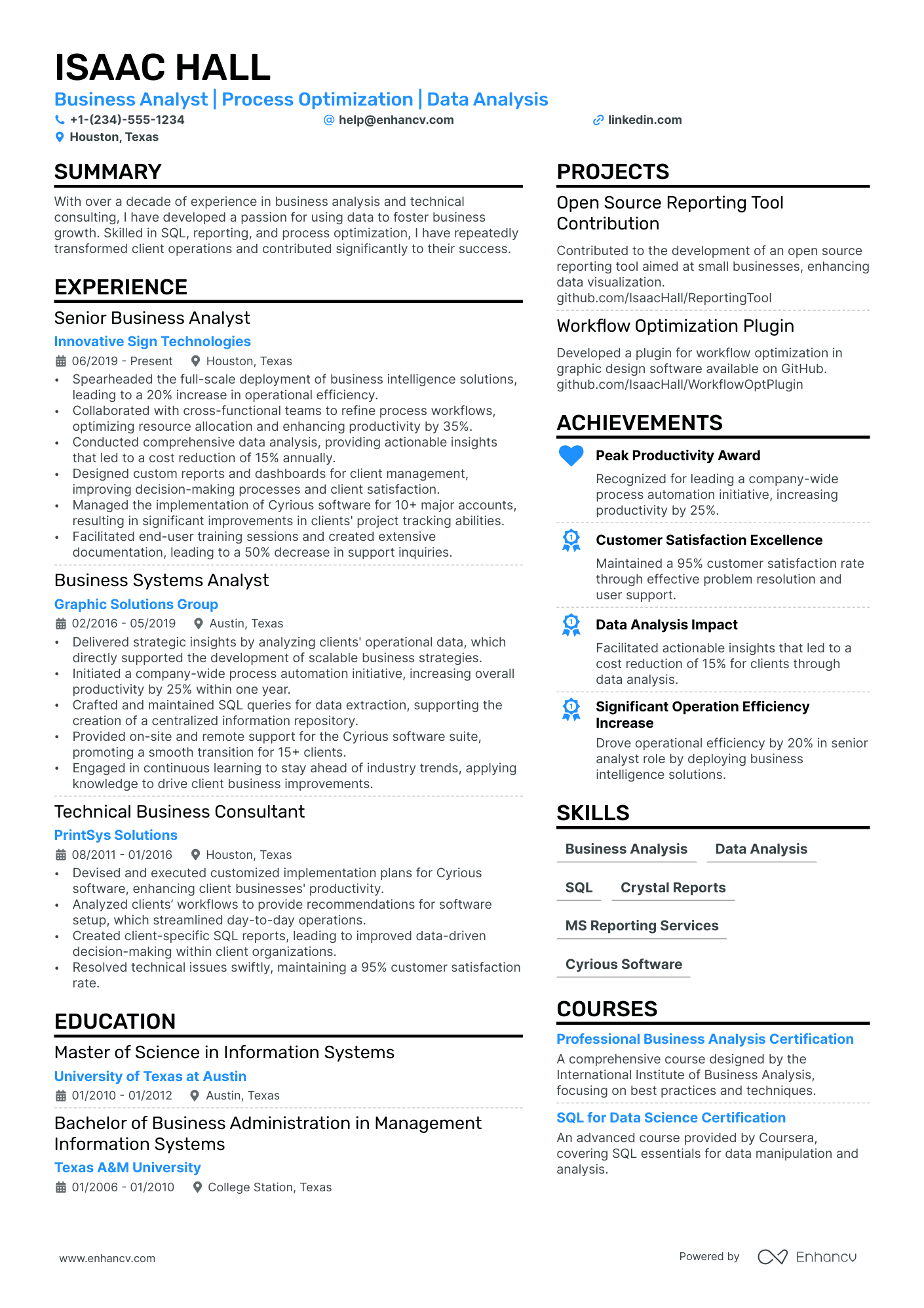

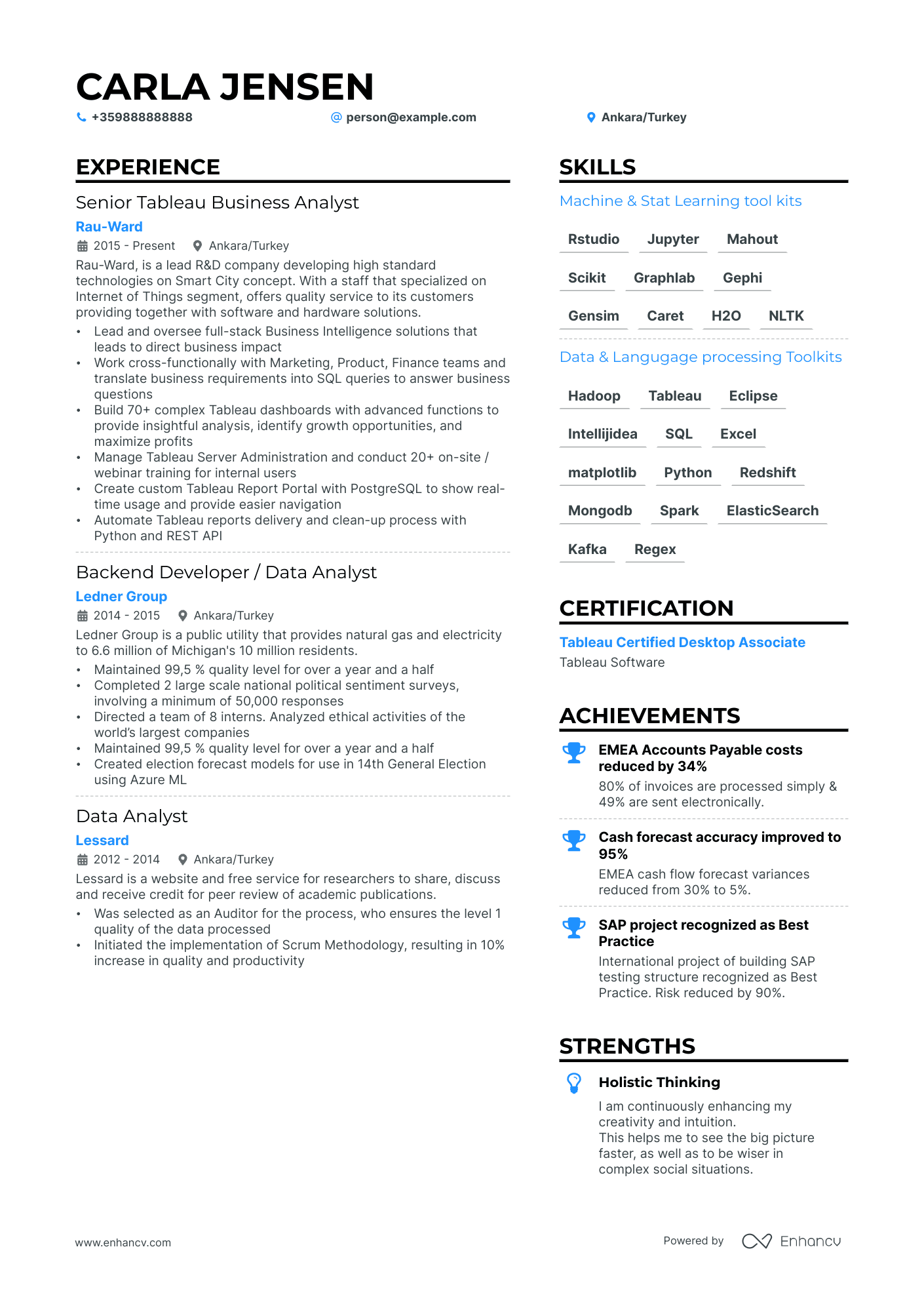

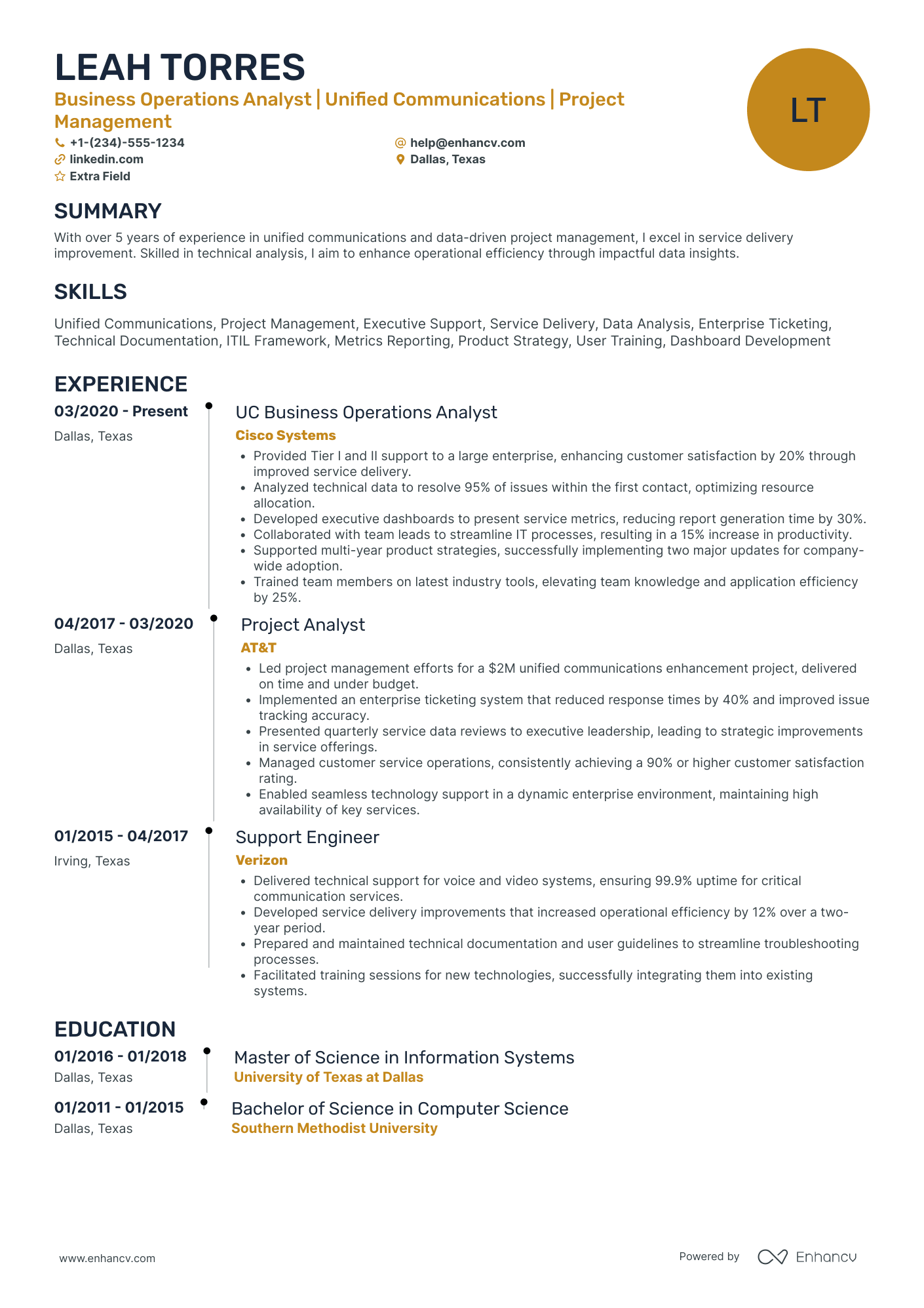

Business Analyst resume examples

By Experience

By Role