Many claims manager resume drafts fail because they read like policy manuals, not decision records. They bury impact behind duties, so ATS filters miss key terms and recruiters scan past them in seconds.

A strong resume shows how you improved outcomes, not how you stayed busy. Knowing how to make your resume stand out means you should highlight reduced cycle time, lower leakage, stronger subrogation recoveries, fewer reopened files, higher audit scores, and stable severity trends across a defined claim volume.

Key takeaways

- Quantify claims outcomes like cycle time, leakage, and recovery rates instead of listing duties.

- Use reverse-chronological format for experienced candidates and hybrid format for career changers.

- Tailor every resume to the job posting's exact tools, KPIs, and compliance frameworks.

- Anchor each skill to a measurable result in your experience or summary section.

- Place certifications like AIC or CPCU where they'll reinforce your strongest qualifications.

- Write a three- to four-line summary that leads with team impact and concrete achievements.

- Use Enhancv to turn vague responsibilities into specific, recruiter-ready bullet points faster.

Job market snapshot for claims managers

We analyzed 89 recent claims manager job ads across major US job boards. These numbers help you understand employer expectations, industry demand, experience requirements at a glance.

What level of experience employers are looking for claims managers

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 6.7% (6) |

| 3–4 years | 2.2% (2) |

| 5–6 years | 7.9% (7) |

| 7–8 years | 3.4% (3) |

| 9–10 years | 21.3% (19) |

| 10+ years | 23.6% (21) |

| Not specified | 56.2% (50) |

Claims manager ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 82.0% (73) |

| Real Estate & Construction | 12.4% (11) |

Top companies hiring claims managers

| Company | Percentage found in job ads |

|---|---|

| Gilbane Building Company | 12.4% (11) |

| CNA Financial Corp. | 11.2% (10) |

Role overview stats

These tables show the most common responsibilities and employment types for claims manager roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a claims manager

| Responsibility | Percentage found in job ads |

|---|---|

| Microsoft office | 23.6% (21) |

| Excel | 18.0% (16) |

| Microsoft office suite | 14.6% (13) |

| Cost analysis | 12.4% (11) |

| Ecms | 12.4% (11) |

| Federal acquisition regulation | 12.4% (11) |

| Microsoft excel | 12.4% (11) |

| Construction process | 11.2% (10) |

| Data analytics | 11.2% (10) |

| Microsoft word | 11.2% (10) |

| Outlook | 11.2% (10) |

| P6 | 11.2% (10) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| Hybrid | 48.3% (43) |

| On-site | 41.6% (37) |

| Remote | 10.1% (9) |

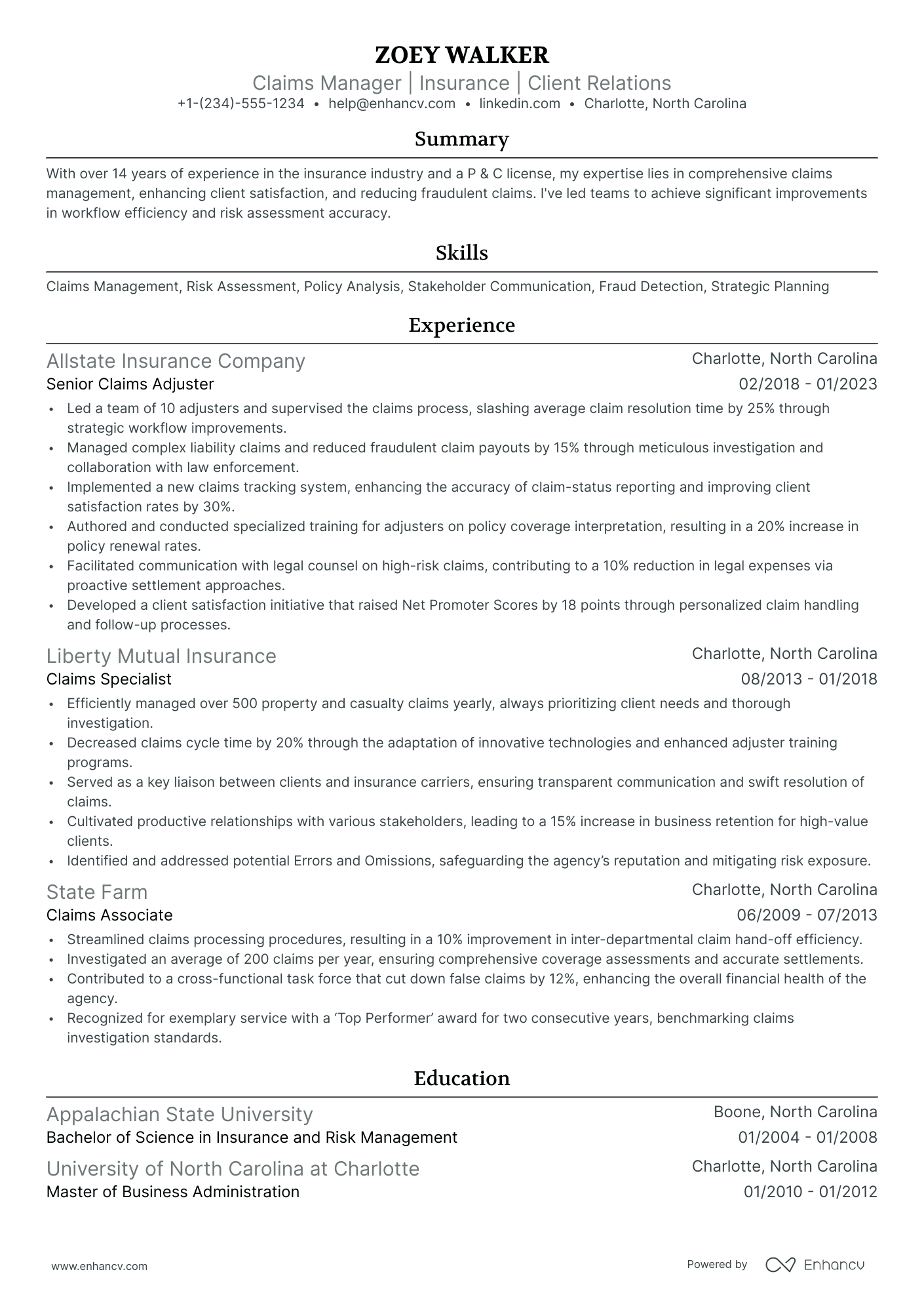

How to format a claims manager resume

Recruiters evaluating claims manager resumes prioritize evidence of claims oversight, team leadership, regulatory compliance, and loss-ratio improvement. Choosing the right resume format ensures these signals surface quickly during both automated screening and manual review.

I have significant experience as a claims manager—which format should I use?

Use a reverse-chronological format to present your career trajectory and growing scope of responsibility in claims operations. Do:

- Lead with your most recent role and emphasize scope: team size, claim volume managed, and authority over settlement decisions.

- Highlight domain expertise in claims adjudication platforms (e.g., Guidewire ClaimCenter, Xactimate), regulatory frameworks, and litigation management.

- Quantify outcomes tied to cost control, cycle-time reduction, or fraud detection improvements.

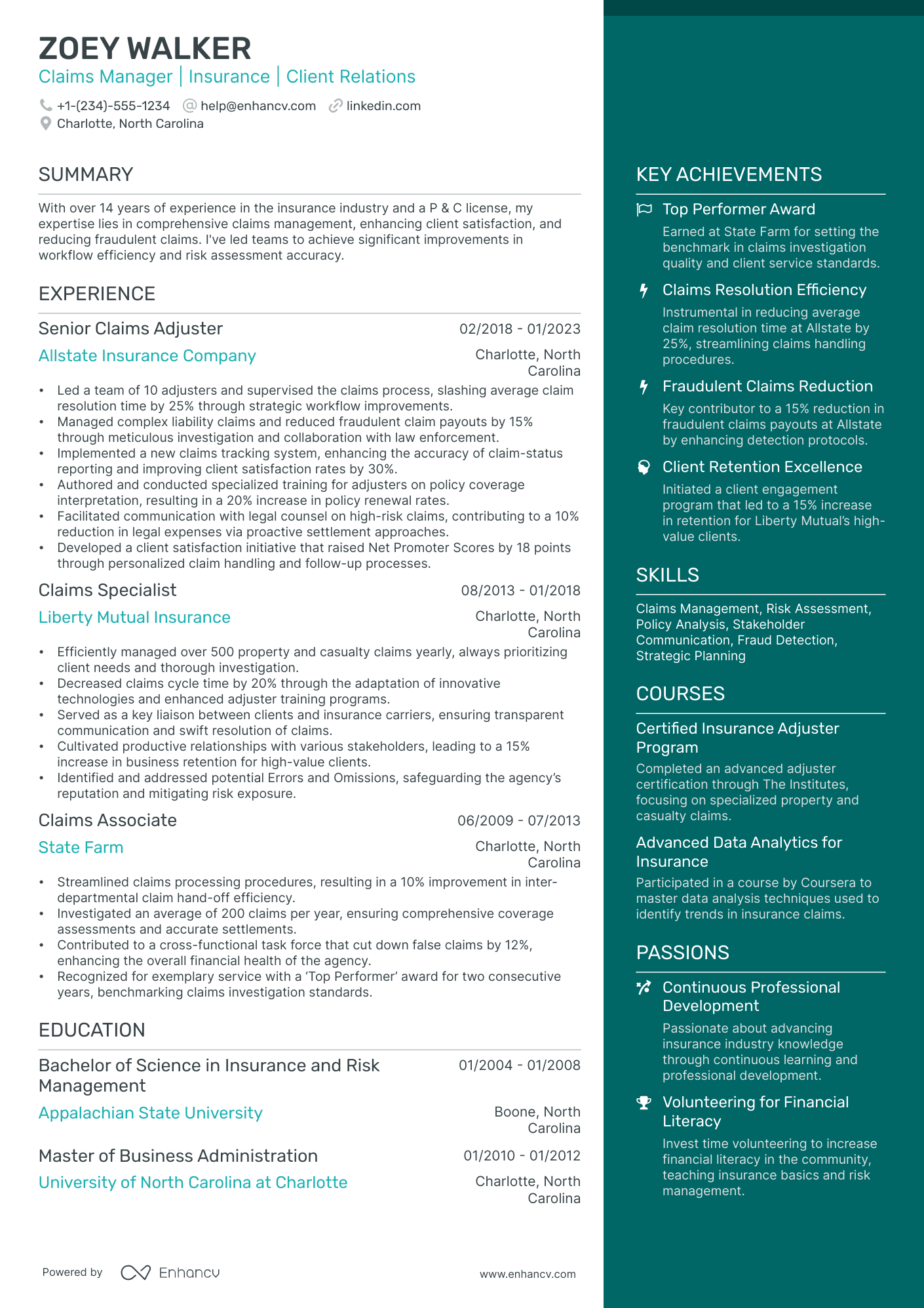

I'm junior or switching into a claims manager role—what format works best?

A hybrid format works best, letting you feature transferable skills prominently while still showing relevant work history in context. Do:

- Place a skills section near the top that highlights claims-specific competencies such as subrogation, coverage analysis, and dispute resolution.

- Include projects, certifications (e.g., AIC, CPCU coursework), or transitional experience that demonstrates claims knowledge even outside a formal manager title.

- Connect every skill or project to a concrete action and a measurable result.

Why not use a functional resume?

A functional format strips away the timeline and context that hiring managers need to evaluate your readiness for claims management responsibilities, making it harder to verify your progression toward leadership.

- Career changers with strong insurance or risk-management backgrounds who can tie analytical, negotiation, or regulatory skills directly to claims scenarios.

- Candidates with resume gaps who completed relevant certifications (AIC, SCLA) or handled freelance claims consulting during the gap period.

Once your layout and formatting choices are in place, the next step is deciding which sections to include so each one reinforces your qualifications.

What sections should go on a claims manager resume

Recruiters expect a claims manager resume to clearly show leadership in claims operations, compliance, and measurable performance results. Understanding which resume sections to include helps you structure your document for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize claim volume and complexity, cycle-time and cost improvements, team size, compliance outcomes, and quantified results.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right components, focus next on writing your claims manager experience section so it supports that structure with clear, results-driven detail.

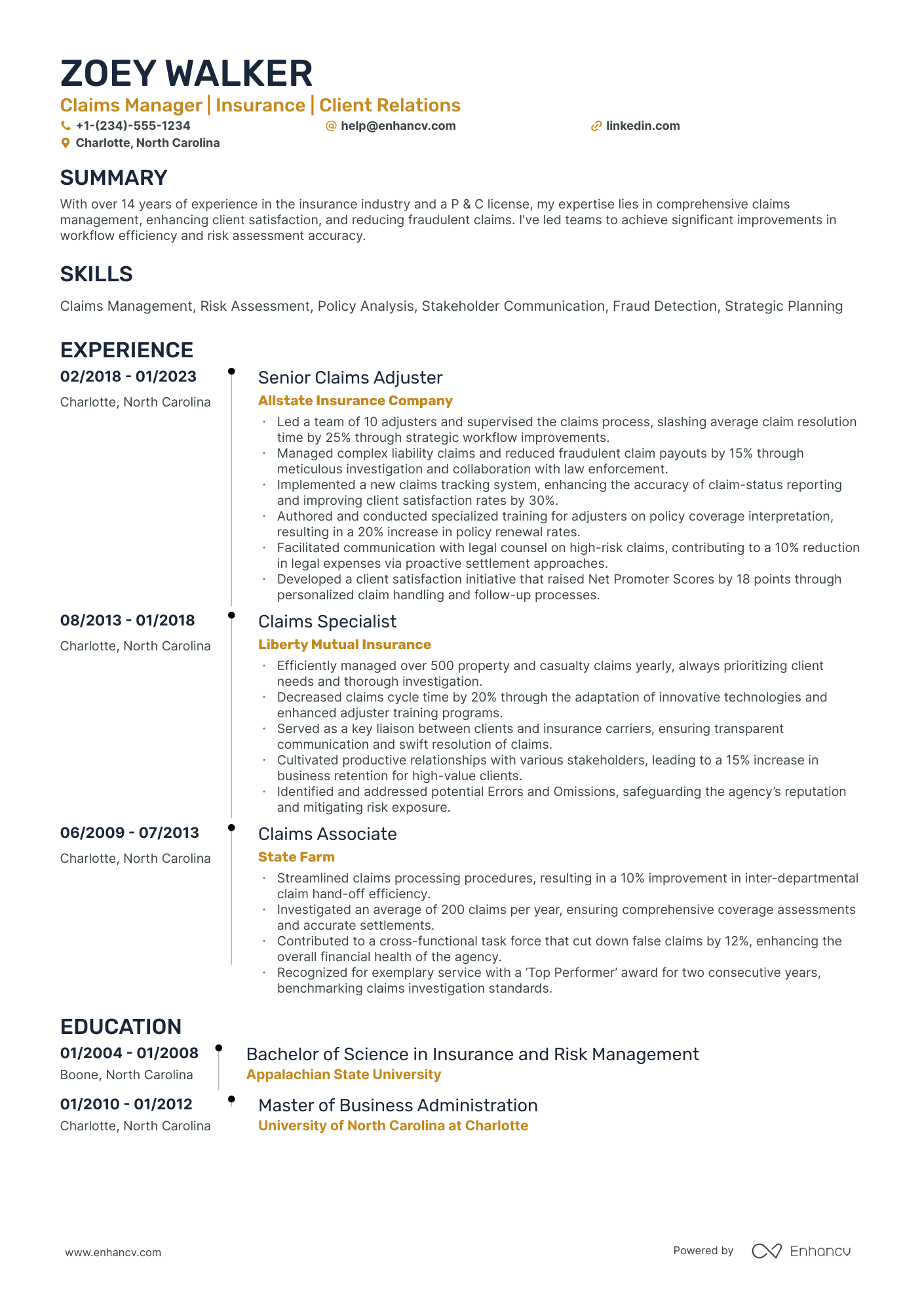

How to write your claims manager resume experience

The experience section is where you prove you've delivered results—not just performed duties—in claims management. Hiring managers want to see the tools and methods you've applied, the outcomes you've produced, and the scope of work you've owned, so always prioritize demonstrated impact over descriptive task lists.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the claims portfolios, lines of business, policy types, or teams you were directly accountable for as a claims manager.

- Execution approach: the claims management systems, investigation frameworks, regulatory guidelines, or adjudication methods you used to evaluate claims, make settlement decisions, and drive resolution.

- Value improved: the changes you brought to claims accuracy, cycle time, loss ratios, reserve adequacy, fraud detection, or policyholder satisfaction within your operation.

- Collaboration context: how you partnered with underwriters, legal counsel, third-party adjusters, medical providers, reinsurers, or regulatory bodies to resolve complex or disputed claims.

- Impact delivered: the tangible results your work produced—expressed through settlement outcomes, cost containment, portfolio performance, compliance posture, or team productivity rather than day-to-day activity.

Experience bullet formula

A claims manager experience example

✅ Right example - modern, quantified, specific.

Claims Manager

BlueHaven Insurance Group | Phoenix, AZ

2021–Present

Regional property and casualty insurer processing over 40,000 personal lines claims annually across four states.

- Directed end-to-end triage and resolution in Guidewire ClaimCenter, cutting average cycle time from 18.4 to 13.1 days (29%) while maintaining a 97% service-level agreement adherence rate.

- Implemented severity-based segmentation and desk adjusting playbooks using Lean Six Sigma methods, reducing reopen rates from 8.6% to 5.2% and improving first-contact resolution by 17%.

- Partnered with legal, special investigations unit, and data analytics teams to deploy fraud flags in SAS and Power BI dashboards, increasing confirmed fraud referrals by 22% and avoiding $1.3M in indemnity leakage.

- Negotiated performance scorecards with five independent adjusting firms and three restoration vendors, improving estimate accuracy by 14% and reducing supplement frequency by 19% through Xactimate standards and audit sampling.

- Led a cross-functional initiative with product, engineering, and customer experience teams to automate customer updates via Salesforce Service Cloud and SMS workflows, decreasing inbound status calls by 31% and raising customer satisfaction score from 4.2 to 4.6.

Now that you've seen how a strong experience section looks in practice, let's break down how to customize yours for each specific job posting.

How to tailor your claims manager resume experience

Recruiters evaluate claims manager resumes through both human review and applicant tracking systems, so tailoring your resume to the job description is essential. Aligning your background with the specific role ensures your qualifications stand out in both screening methods.

Ways to tailor your claims manager experience:

- Mirror the claims management software and platforms named in the posting.

- Match the exact terminology used for adjudication and settlement processes.

- Reflect specific loss ratio or cycle time KPIs the employer prioritizes.

- Highlight regulatory compliance frameworks referenced in the job description.

- Include relevant insurance lines or industry domains the role requires.

- Emphasize fraud detection or subrogation methods when the posting mentions them.

- Align your leadership scope with the team structure they describe.

- Reference quality assurance or audit workflows the employer values.

Tailoring means aligning your real accomplishments with what the employer asks for—not forcing keywords where they don't belong.

Resume tailoring examples for claims manager

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| "Oversee auto and property claims using Guidewire ClaimCenter, ensuring compliance with state regulatory requirements and maintaining a closure rate above 90%." | Managed insurance claims and ensured they were processed in a timely manner. | Managed auto and property claims end-to-end in Guidewire ClaimCenter, maintaining a 93% closure rate while ensuring full compliance with state regulatory requirements across 12 jurisdictions. |

| "Lead a team of 8–10 adjusters, conduct quarterly file audits, and reduce claims leakage through root cause analysis and corrective action plans." | Supervised a team and helped improve department performance. | Led a team of nine adjusters, conducted quarterly file audits identifying $1.2M in claims leakage, and implemented corrective action plans through root cause analysis that reduced leakage by 18% year over year. |

| "Negotiate complex liability settlements exceeding $500K, collaborate with SIU on fraud referrals, and report key metrics to senior leadership using Tableau dashboards." | Handled large settlements and worked with other departments on investigations. | Negotiated liability settlements averaging $750K, partnered with the Special Investigations Unit on 40+ fraud referrals annually, and built Tableau dashboards tracking cycle time, severity, and litigation rates for senior leadership review. |

Once you’ve aligned your experience with the role’s requirements, quantify your claims manager achievements to show the measurable impact of that work.

How to quantify your claims manager achievements

Quantifying your achievements proves impact beyond "handled claims." Focus on cycle time, accuracy, compliance, cost control, risk reduction, and customer outcomes across claim volume, severity, and complex cases.

Quantifying examples for claims manager

| Metric | Example |

|---|---|

| Cycle time | "Cut average claim closure time from 18 to 12 days by redesigning triage rules in Guidewire and standardizing adjuster checklists across a 22-person team." |

| Accuracy rate | "Reduced payment leakage by 9% by tightening reserve reviews, auditing top twenty loss codes monthly, and coaching adjusters on documentation standards." |

| Compliance | "Achieved 98% on-time statutory filings across five states by implementing a weekly compliance dashboard and escalating exceptions within 24 hours." |

| Cost savings | "Lowered outside counsel spend by $410K annually by shifting 30% of litigated files to early settlement and renegotiating panel counsel rate cards." |

| Risk reduction | "Decreased reopened claims from 7.2% to 4.6% by adding quality checks at closure and tracking root causes in Excel and Power BI." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points to showcase your experience, the next step is ensuring your resume also highlights the right hard and soft skills employers expect from a claims manager.

How to list your hard and soft skills on a claims manager resume

Your skills section shows you can manage claim outcomes, compliance, and team performance, and recruiters and an ATS (applicant tracking system) scan this section to match role keywords; aim for a hard-skills-heavy mix with targeted soft skills.

claims manager roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Claim lifecycle management

- Coverage analysis and policy interpretation

- Liability and damages evaluation

- Negotiation and settlement authority

- Subrogation strategy and recovery

- Fraud detection and referral workflows

- Litigation management, counsel oversight

- Reserving practices and reserve adequacy

- Regulatory compliance, audit readiness

- Claim system administration, workflow rules

- KPI reporting, loss trend analysis

- Medical bill review and utilization review

Soft skills

- Triage and prioritize claim inventory

- Make timely, defensible decisions

- Communicate coverage decisions clearly

- De-escalate high-conflict disputes

- Coach adjusters through complex claims

- Align stakeholders on claim strategy

- Lead cross-functional case reviews

- Hold vendors accountable to service levels

- Document rationale and escalation paths

- Manage deadlines under heavy volume

- Challenge assumptions with evidence

- Drive consistent process adherence

How to show your claims manager skills in context

Skills shouldn't live only in a bulleted list on your resume. Explore resume skills examples to see how they can be demonstrated effectively in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what that looks like in practice.

Summary example

Claims manager with 12 years in property and casualty insurance. Skilled in Guidewire ClaimCenter, litigation management, and reserve analysis. Led a team that reduced average cycle time by 18% while maintaining 97% customer satisfaction scores.

- Reflects senior-level experience clearly

- Names industry-specific tools and platforms

- Includes a concrete, measurable metric

- Highlights leadership as a soft skill

Experience example

Senior Claims Manager

Ridgepoint Insurance Group | Charlotte, NC

March 2018–Present

- Reduced claim settlement cycle time by 22% after implementing Guidewire ClaimCenter workflow automation across a 15-member adjusting team.

- Partnered with underwriting and legal departments to establish new subrogation protocols, recovering $2.4M in previously written-off losses annually.

- Designed a fraud detection scoring model using ISO ClaimSearch data, cutting fraudulent payouts by 31% within the first year.

- Every bullet includes measurable proof

- Skills surface naturally through real outcomes

Once you’ve demonstrated your claims manager strengths through relevant examples and outcomes, the next step is adapting that approach for a claims manager resume with no experience.

How do I write a claims manager resume with no experience

How do I write a claims manager resume with no experience?

Even without full-time experience, you can demonstrate readiness for a claims role. Writing a resume without work experience means focusing on transferable skills and relevant activities such as:

- Claims internship or job shadowing

- Insurance coursework case study projects

- Customer dispute resolution experience

- Call center claims intake practice

- Volunteer fraud documentation support

- Compliance training and audits

- Billing and reimbursement coordination

- Data analysis in spreadsheets

Focus on:

- Claims workflow knowledge and terminology

- Documentation accuracy and compliance records

- Metrics: cycle time, accuracy, volume

- Systems exposure: Excel, CRM, ticketing

Resume format tip for entry-level claims manager

Use a combination resume format because it highlights claims-related skills and projects first, while still showing work history and transferable experience. Do:

- Add a Skills section with claim-specific keywords.

- Include tools used: Excel, CRM, ticketing.

- Quantify outcomes: volume, accuracy, turnaround.

- Describe workflows: intake, triage, documentation.

- List relevant training with completion dates.

- Built an Excel claims intake tracker for a compliance training project, reducing documentation errors by 18% across 120 mock claims cases.

Even without direct experience, your education section can demonstrate the foundational knowledge and relevant coursework that qualify you for a claims manager role.

How to list your education on a claims manager resume

Your education section helps hiring teams confirm you have the foundational knowledge needed for claims management. It validates your understanding of insurance principles, risk assessment, and business operations.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to a claims manager resume.

Example education entry

Bachelor of Science in Insurance and Risk Management

Temple University, Philadelphia, PA

Graduated 2018

GPA: 3.7/4.0

- Relevant Coursework: Property & Casualty Insurance, Claims Administration, Business Law, Risk Analysis

- Honors: Magna Cum Laude, Dean's List (all semesters)

How to list your certifications on a claims manager resume

Certifications show your commitment to learning, proficiency with claims tools and processes, and alignment with current insurance regulations and standards as a claims manager.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when your degree is recent and most relevant to your current claims manager work.

- Place certifications above education when they are recent, highly relevant, or required for the claims manager roles you target.

Best certifications for your claims manager resume

Associate in Claims (AIC) Chartered Property Casualty Underwriter (CPCU) Associate in Risk Management (ARM) Certified Fraud Examiner (CFE) Associate in General Insurance (AINS) Certified Insurance Counselor (CIC) Associate in Management (AIM)

Once you’ve positioned your credentials where hiring teams can spot them, move to your claims manager resume summary to connect those qualifications to your value in a quick, results-focused overview.

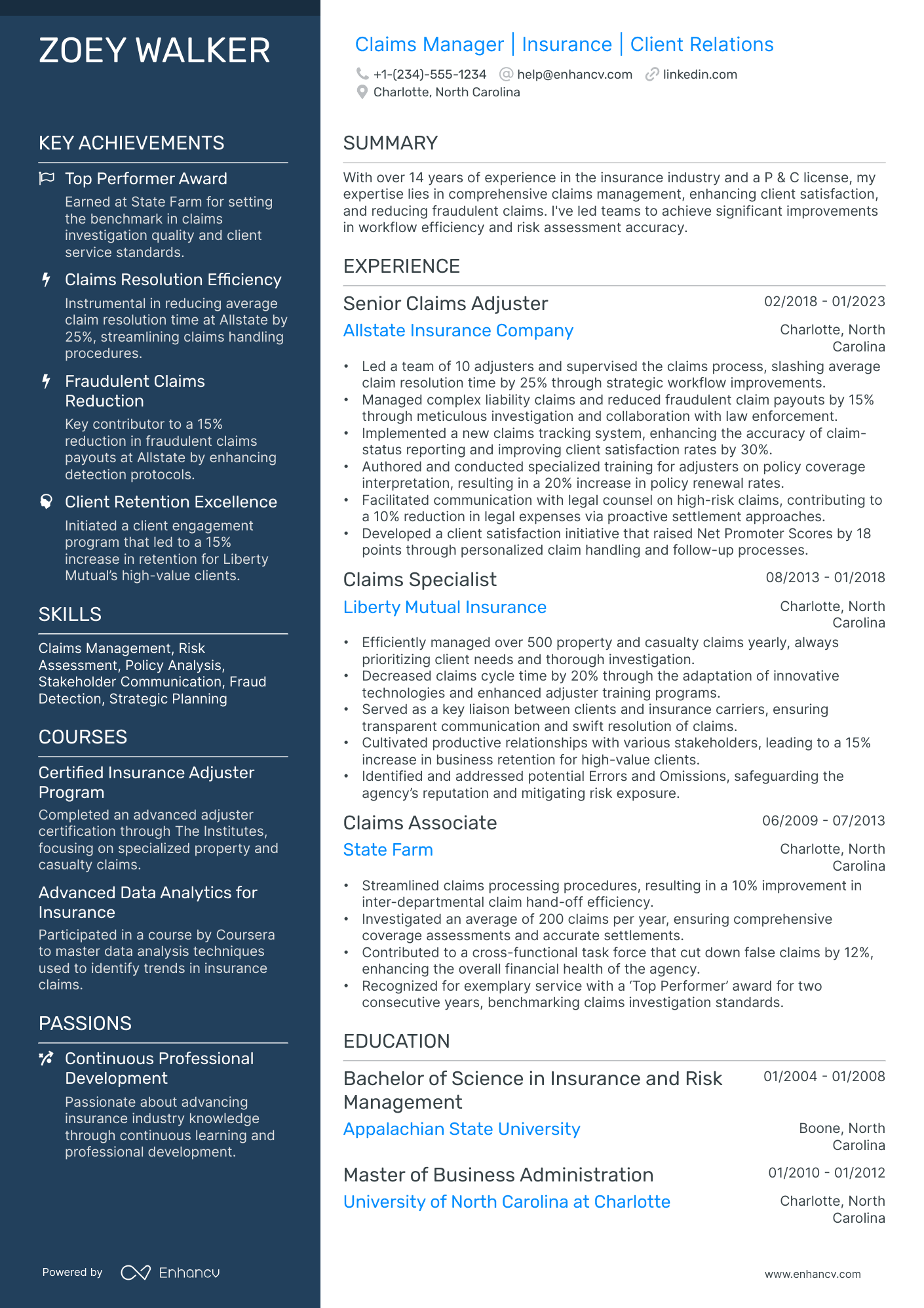

How to write your claims manager resume summary

Your resume summary is the first thing a recruiter reads, so it needs to earn attention fast. A strong opening frames you as a qualified claims manager before the rest of your resume fills in the details.

Keep it to three to four lines, with:

- Your title and total years of claims management experience.

- The industry or domain you specialize in, such as property, casualty, or workers' compensation.

- Core skills like claims adjudication, litigation management, or reserve analysis.

- One or two measurable achievements, such as reduced cycle times or improved loss ratios.

- Soft skills tied to real outcomes, like team leadership that cut turnover or negotiation that lowered settlement costs.

PRO TIP

At the manager level, lead with outcomes and team impact rather than task descriptions. Highlight how your decisions improved efficiency, reduced costs, or strengthened compliance. Avoid vague phrases like "results-driven professional" or "passionate about excellence." Recruiters want proof, not personality statements.

Example summary for a claims manager

Claims manager with eight years in property and casualty insurance, overseeing a 12-member team. Reduced average claim cycle time by 22% through workflow automation and improved triage protocols.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary is ready to make a strong first impression, ensure the header above it presents your contact details clearly so recruiters can reach you without any friction.

What to include in a claims manager resume header

A resume header lists your key identification and contact details, helping a claims manager stand out in searches, build credibility, and pass recruiter screening fast.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

Including a LinkedIn link lets recruiters verify your experience quickly and supports faster screening.

Do not include a photo on a claims manager resume unless the role is explicitly front-facing or appearance-dependent.

Keep your header keyword-aligned with the job posting and place it at the top so recruiters can contact you in seconds.

Example

Claims manager resume header

Jordan Taylor

Claims Manager | Property & Casualty Claims Operations

Dallas, TX

(214) 555-01XX | jordan.taylor@enhancv.com | github.com/yourname | yourwebsite.com | linkedin.com/in/yourname

Once your contact details and role identifiers are set up to position you clearly, add the following optional sections to strengthen your claims manager resume where they add value.

Additional sections for claims manager resumes

When your core qualifications match other applicants, well-chosen additional sections can set your claims manager resume apart with role-specific credibility.

- Languages

- Professional affiliations (e.g., CLM or CPCU designations)

- Industry publications

- Volunteer experience in disaster relief or community advocacy

- Continuing education and compliance training

- Awards and recognitions in claims performance

Once you've rounded out your resume with the right supplementary sections, it's worth turning your attention to the cover letter that'll accompany it.

Do claims manager resumes need a cover letter

A cover letter isn't required for a claims manager, but it often helps. Understanding what a cover letter is and when to use one matters most in competitive roles, regulated environments, or when hiring teams expect one. It can also help when your resume doesn't clearly show fit.

Use a cover letter to add context your resume can't:

- Explain role and team fit: Match your experience to the claim types, volume, and escalation model the claims manager role requires.

- Highlight one or two outcomes: Share a specific project and result, such as cycle time reduction, leakage prevention, or improved quality audit scores.

- Show business and user understanding: Reference the product, policyholder needs, compliance requirements, and how claims decisions affect retention and loss ratios.

- Address career transitions: Connect non-obvious experience, a gap, or an industry change to the claims manager responsibilities and tools.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Once you’ve decided whether to include a cover letter to support your application, you can use AI to strengthen your claims manager resume and improve its impact.

Using AI to improve your claims manager resume

AI can sharpen your resume's clarity, structure, and overall impact. It helps you find stronger phrasing and tighten loose sentences. But overuse dulls authenticity. Once your content feels clear and aligned with the claims manager role, step away from AI. For practical prompt ideas, see this guide on ChatGPT resume writing.

Here are ten practical prompts you can copy, paste, and adapt right now:

- Strengthen summary focus: "Rewrite my claims manager resume summary to emphasize leadership in claims resolution, team oversight, and policyholder satisfaction in under four sentences."

- Quantify experience bullets: "Add specific metrics like settlement amounts, caseload volume, or cycle times to each claims manager experience bullet on my resume."

- Tighten skills relevance: "Remove any skills on my claims manager resume that don't directly relate to insurance claims handling, regulatory compliance, or team management."

- Clarify job titles: "Make sure each job title in my claims manager resume experience section clearly reflects my actual role and responsibility level."

- Improve action verbs: "Replace weak or repeated verbs in my claims manager experience bullets with strong, specific action verbs tied to measurable outcomes."

- Align with job posting: "Compare my claims manager resume summary and experience bullets against this job description and flag any missing keywords or qualifications."

- Refine certifications section: "Reorder and format my claims manager resume certifications section to highlight the most industry-relevant credentials first."

- Sharpen project descriptions: "Rewrite the project entries on my claims manager resume to clearly state my role, the challenge, and the measurable result."

- Trim education details: "Remove outdated or irrelevant coursework from my claims manager resume education section and keep only what supports the target role."

- Eliminate filler language: "Identify and remove vague phrases like 'responsible for' or 'assisted with' throughout my claims manager resume and replace them with direct statements."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong claims manager resume proves impact with measurable outcomes, such as cycle-time reductions, accuracy gains, cost containment, and improved customer satisfaction. It highlights role-specific skills, including claim strategy, compliance, investigations, vendor management, and team leadership, in clear, direct language.

Keep the structure easy to scan with a focused summary, relevant experience, and skills aligned to the role. This approach shows you’re ready for today’s hiring market and near-future expectations in claims operations.