How to build a job-winning investment banking analyst resume

When companies “go public” and start selling stock, investment banks make it happen.

Investment banks specialize in handling complex financial transactions. Investment banking analyst is the entry-level position into this lucrative career path.

These are the workhorses of the industry who put in long hours of grunt work doing research and preparing reports.

You are the workhorse they want.

You can work endless hours, get a few hours of sleep, drink some coffee and head back into the office for more.

You also have the right education and knowledge to write pitch books that make closing deals a cinch.

You are the next Nathanial Rothschild ready to talk your way into the best deals.

Your investment banking analyst must back that up if you want an interview. Investment banks depend on their analysts to research whether investments are worthwhile.

Your resume must show that you’re a financial whiz. It should also say how you have outstanding people skills and can master the art of the deal.

After all, investment banking analyst is an entry-level position. Recruiters want candidates with the hunger to climb that corporate ladder after a few years.

You want the chance to move up to a position like vice president, director or managing director.

Are you ready for the challenge?

Is your resume ready?

Don’t sweat it. We’re here to show you how to write a winning investment banking analyst resume.

“The one common element among our analysts is that they’re passionate, bordering on obsessive, about the sectors they cover.”

This investment banking analyst resume guide will show you:

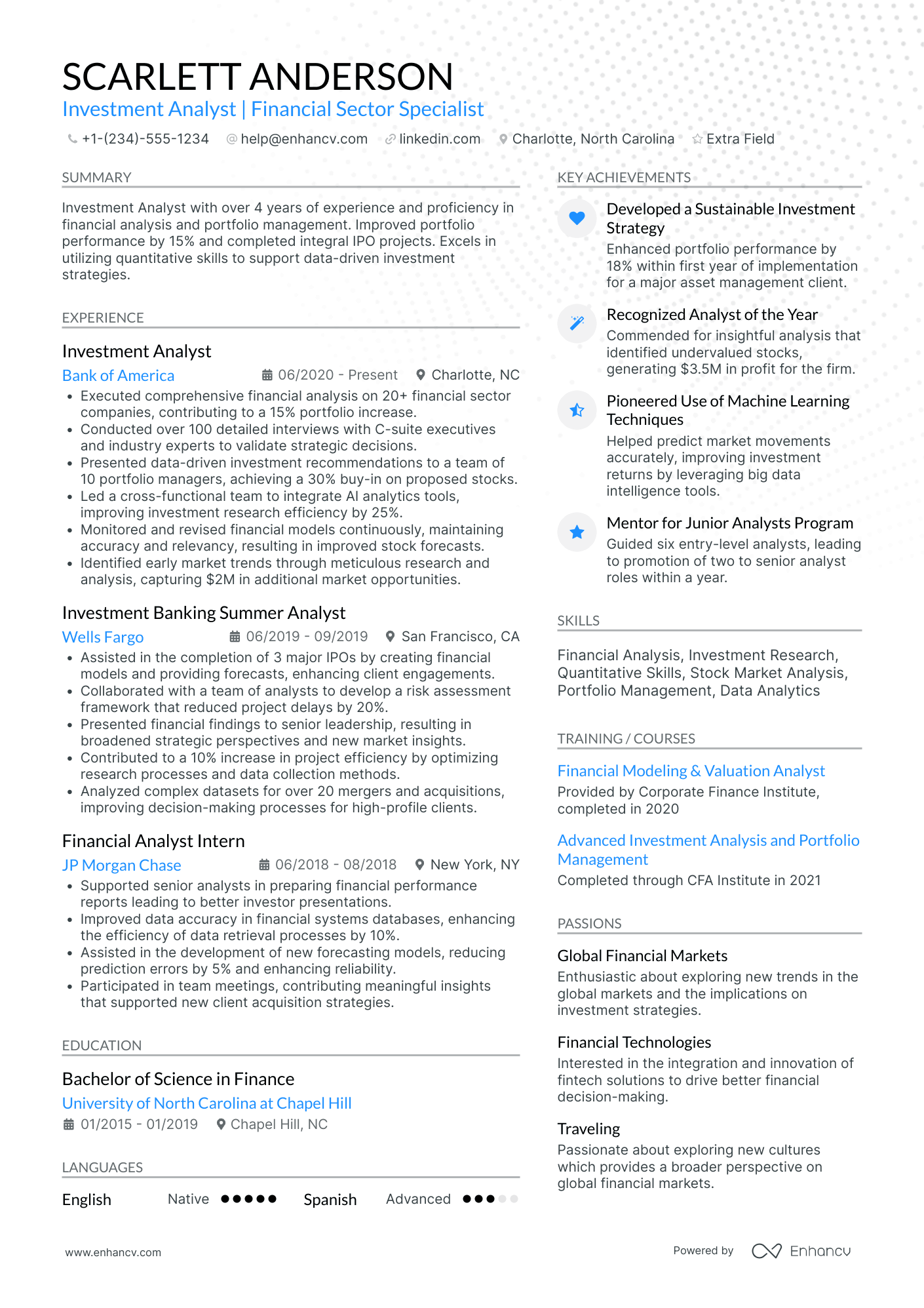

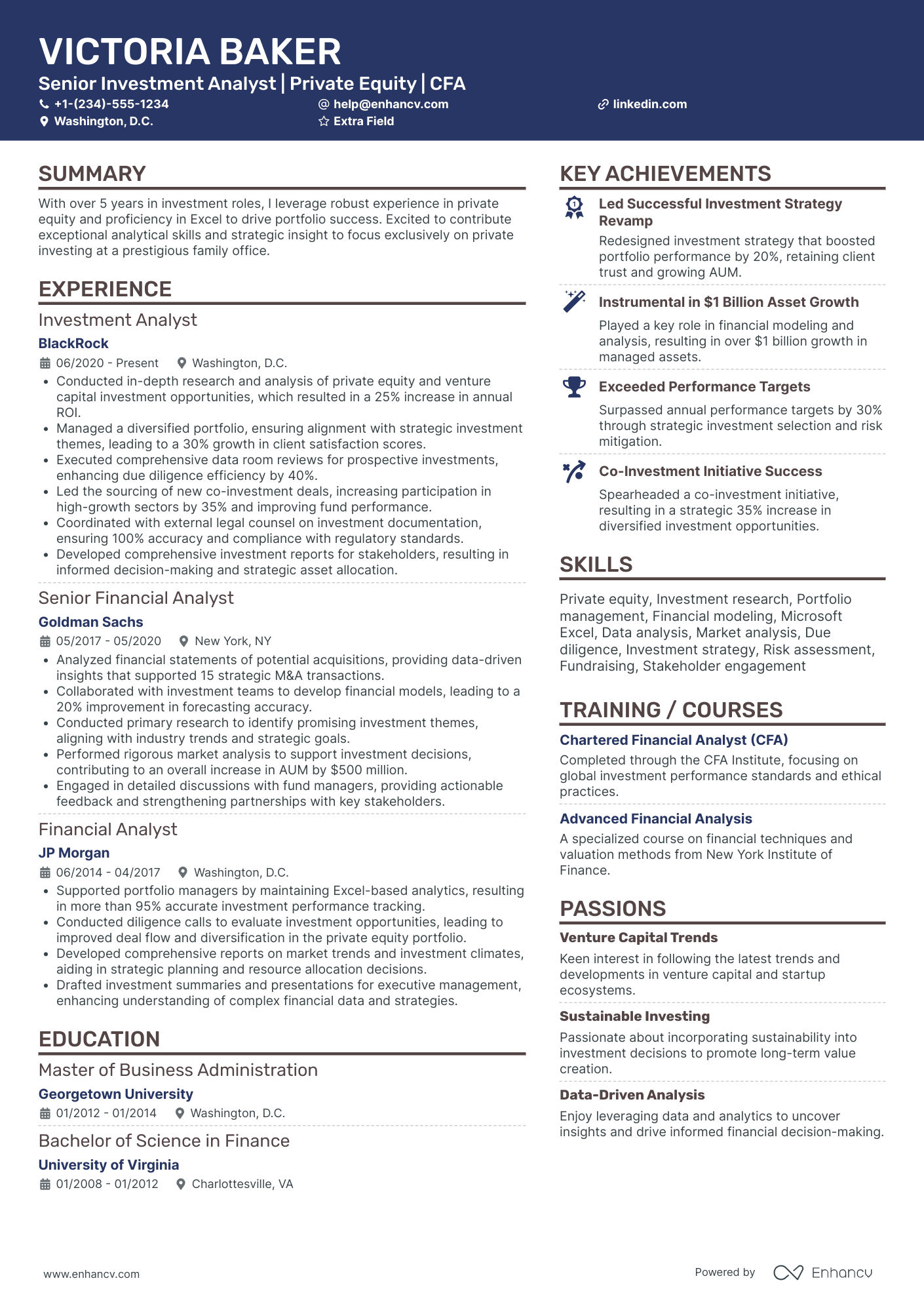

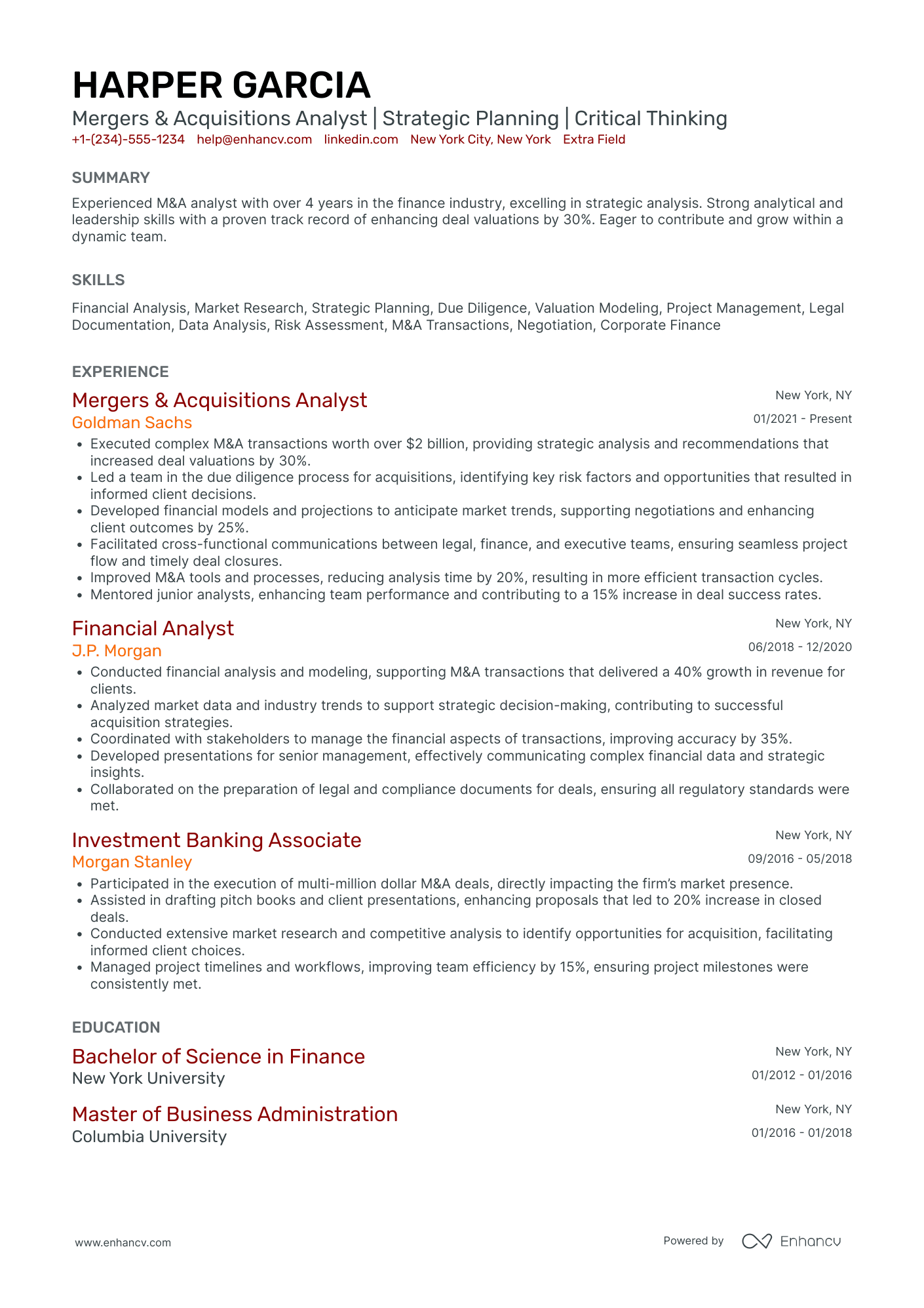

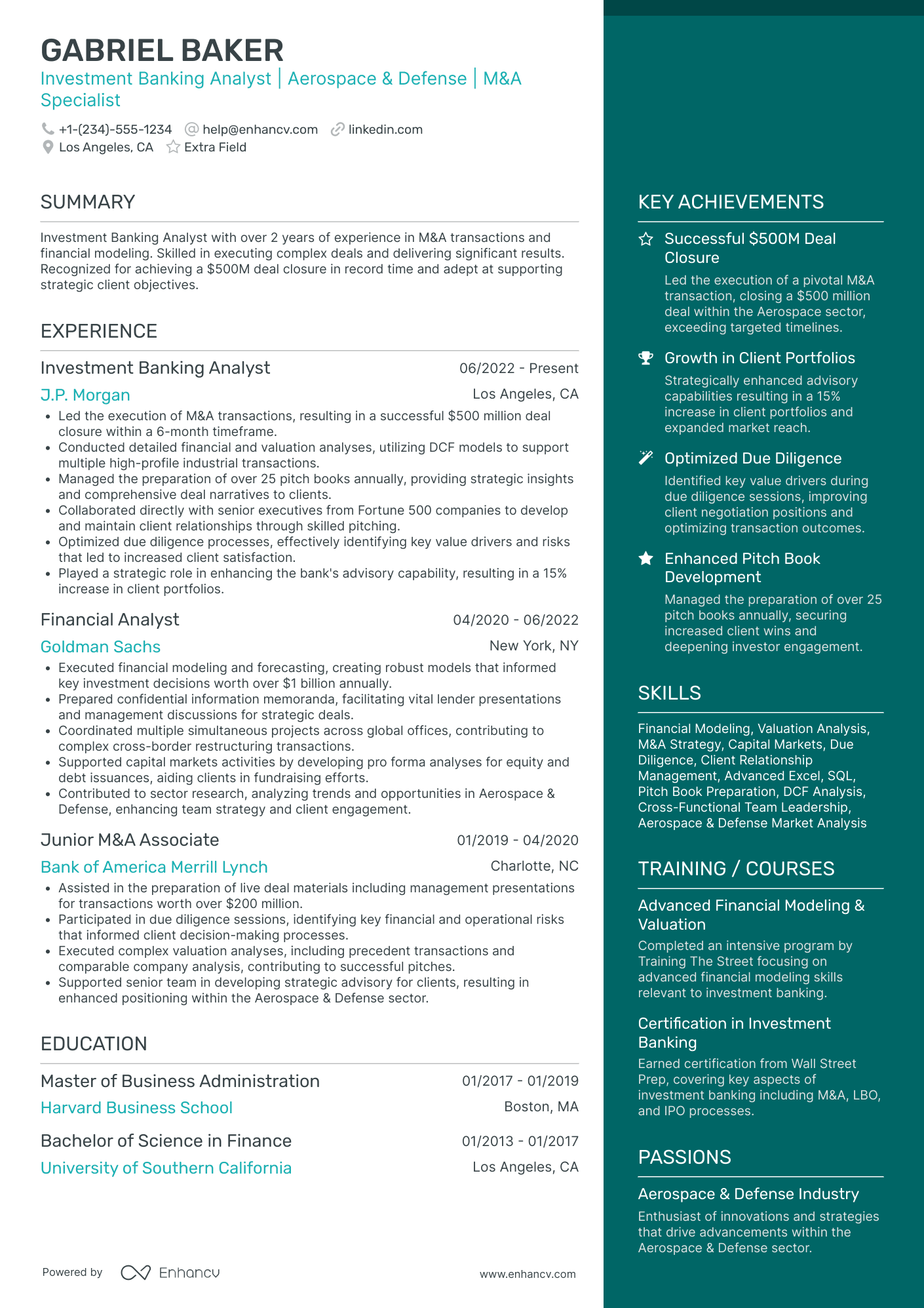

- 8 investment banking analyst resume examples and samples that prove how you research the deal.

- How you balance your financial knowledge with people skills.

- How to show you have the right industry know-how.

- What education is expected and how to list it on your resume.

- How to include keywords from the job description.

- How to land the interview that turns you into an investment banking analyst.

Looking for related resumes?"?

How to write an investment banking analyst resume

You prepare pitches that make potential clients beg to do business with you.

Your resume shows how you’ve developed these mad skills in finance.

Candidates need deep insight into changing financial consumer demographics.

You need superior analytical and problem-solving skills as well as interpersonal skills.

Industry skills include performing evaluation analysis, building financial models and writing investment memorandums.

Include your right mix of industry skills, soft skills and knowledge on your investment banking analyst resume. Be ready to discuss how you learned those skills. Analyst jobs often require a college education.

Prove that you have the right work ethic.

Prove on your resume that you have the right work ethic. Investment banking analyst is one of the most demanding jobs in investment banking.

Here's what your investment banking analyst resume needs to have

- Do you have the right skills to analyze potential business deals?

- Can you communicate your research to others?

- What financial industry background led you to this field?

- How will you help investment banks prepare the perfect pitches?

The most important sections of an investment banking analyst resume:

- Detailed resume header

- Impactful resume summary

- Resume experience

- Education and certifications

- A mix of technical and soft skills

Each investment banking analyst resume section should make your pitch about why you’re the best fit in their investment bank. Let’s see how to do this.

Sell yourself with your investment banking analyst resume header

Your effort to impress in person starts with that first handshake. When you write your resume, it starts with your investment banking analyst resume header.

This is where you start explaining why they should pay attention to you and offer you an interview.

This isn’t the way to do it.

What’s wrong with this? It sounds like any other candidate.

There is no redeeming information to convince the recruiter to keep reading.

Let’s make a few changes to show what we mean.

Investment bank recruiters now know you’re an experienced financial analyst. They see you have a LinkedIn profile and assume you believe in the necessity to market yourself.

This is the first step towards convincing them that you’re the best candidate to market their employer.

It seems small, but details matter in a job that’s all about impressing others.

How to deliver your elevator speech in your investment banking analyst resume summary

Now you’ve met the recruiter. Let’s deliver your elevator speech.

That’s one way to look at your investment banking analyst resume summary. You need to quickly summarize why you’re the best candidate.

It’s like you’re writing a pitch book on yourself.

Include keywords from the job description. Keep it tight and focus on your qualifications including your financial knowledge and soft skills.

This investment banking analyst resume summary isn’t the pitch to make.

The recruiter forgot who you are before he finished reading. Here is why:

- You give no details about your experience.

- You include a topic that has nothing to do with the job.

- You do not share any accomplishments.

Employers want to know what you can do for them. They want to know how you can make a difference like writing a pitch book to get that dream client.

This summary offers nothing to tell them that.

Let’s look at another.

If this was your summary, you’d have the recruiter’s attention.

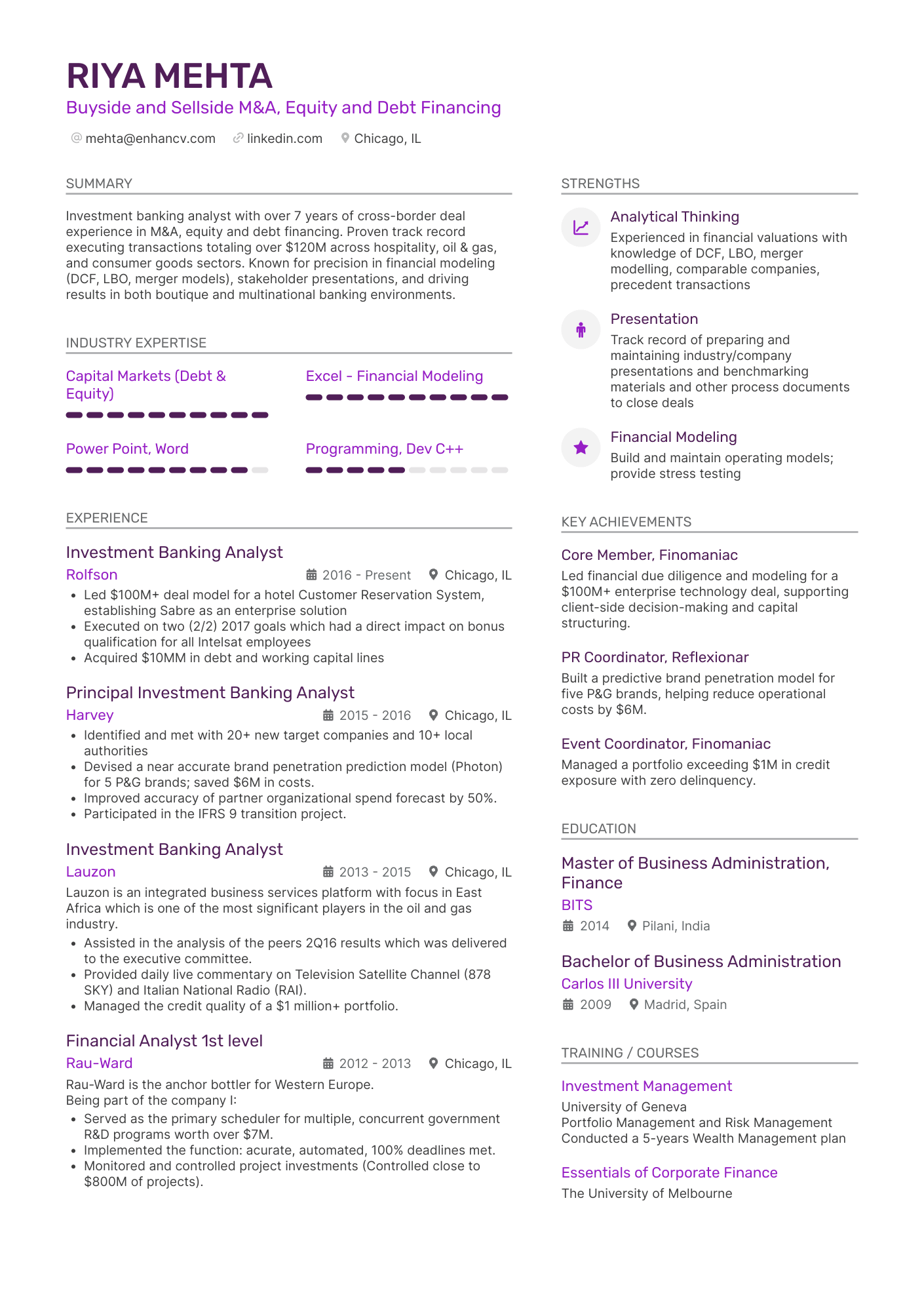

This investment professional resume summary gives data such as how many years of experience the job candidate has. It mentions skills like relationship management that will help you as an investment banker.

It still does not mention any accomplishments or quantitative data. It also tells what type of job you want rather than what you can do for the company.

This makes it more of a resume objective than a resume summary.

A summary should focus on what skills and experience you offer, not what type of job you want.

Investment banking analyst is an entry-level position. Recruiters may accept people straight out of college.

You may be tempted to skip writing a summary because you lack the right experience.

Do not skip this important step. Mine experience you have like internships that gave you real-world skills.

Let’s look at one more.

This example shows more of the candidate’s skills. It includes quantitative data, how large of a fund the candidate co-managed.

It also shows that the candidate has experience making pitches similar to what the job may require.

Pro tip

Start your pitch in your summary section. Carry it through and elaborate in your experience section. This is where you start showing that you are the workhorse of finance they need. Use quantitative data when possible. Include terminology used in banking. Make every word matter in both your summary and experience sections.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Put the spotlight on your investment banking analyst experience section

investment banking analysts help senior bankers close deals.

Some of what you do like revising presentations may seem mind-numbing.

It requires extreme sacrifice. You may work 70 plus hours a week or pull an all-nighter to revise a pitch book.

Why do it? You want a chance to move up to more lucrative positions like director or careers like venture capital.

Can you cut it as an investment banking analyst? You must prove that in your investment banking analyst resume experience section.

Investment banking analyst jobs require experience in quantitative analysis, statistics and information modeling.

Show that you have experience researching and editing reports and making presentations.

Many candidates get this experience by working internships while in college. They may also work in roles related to banking like financial analysts.

Think of what you’ve done and see if it matches up with the job description. Look for key phrases like “performing financial analysis” and “client management.”

Include quantitative data. If you are a financial analyst, how big of portfolios did you analyze?

Let’s look at a few examples.

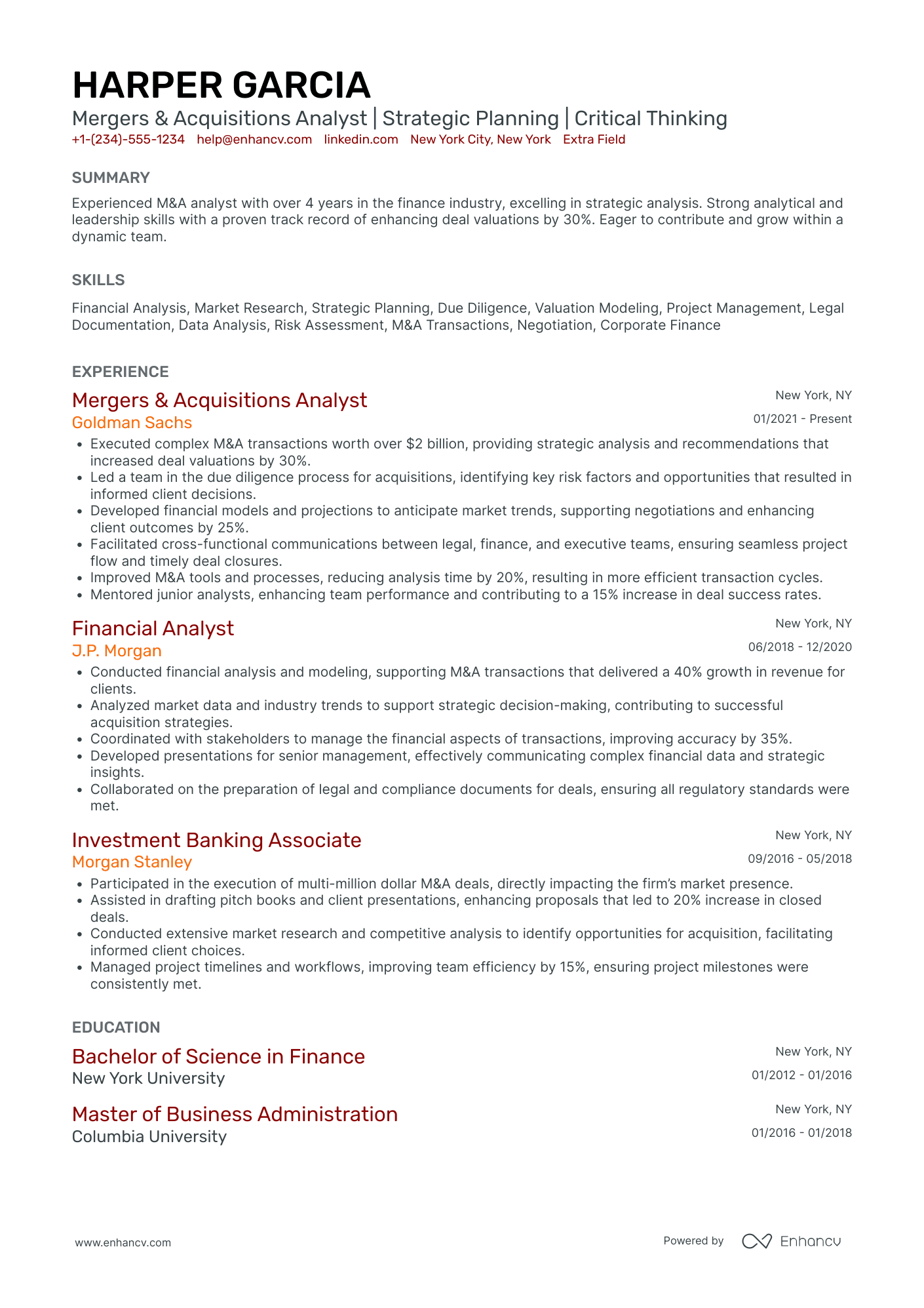

- •Prepared sales and delivery presentations that served client interaction.

- •Worked with analysts and senior management to understand the process of valuation in a corporate finance context.

- •Helped perform due diligence on potential acquirers for clientele role.

This example shows that the candidate can handle tasks like delivering presentations. It does not say how the candidate’s work benefited the company.

Key phrases like “delivery presentations” and “client interaction” are valuable but in the right context. Remember to show how your work made a difference.

Let’s look at another example.

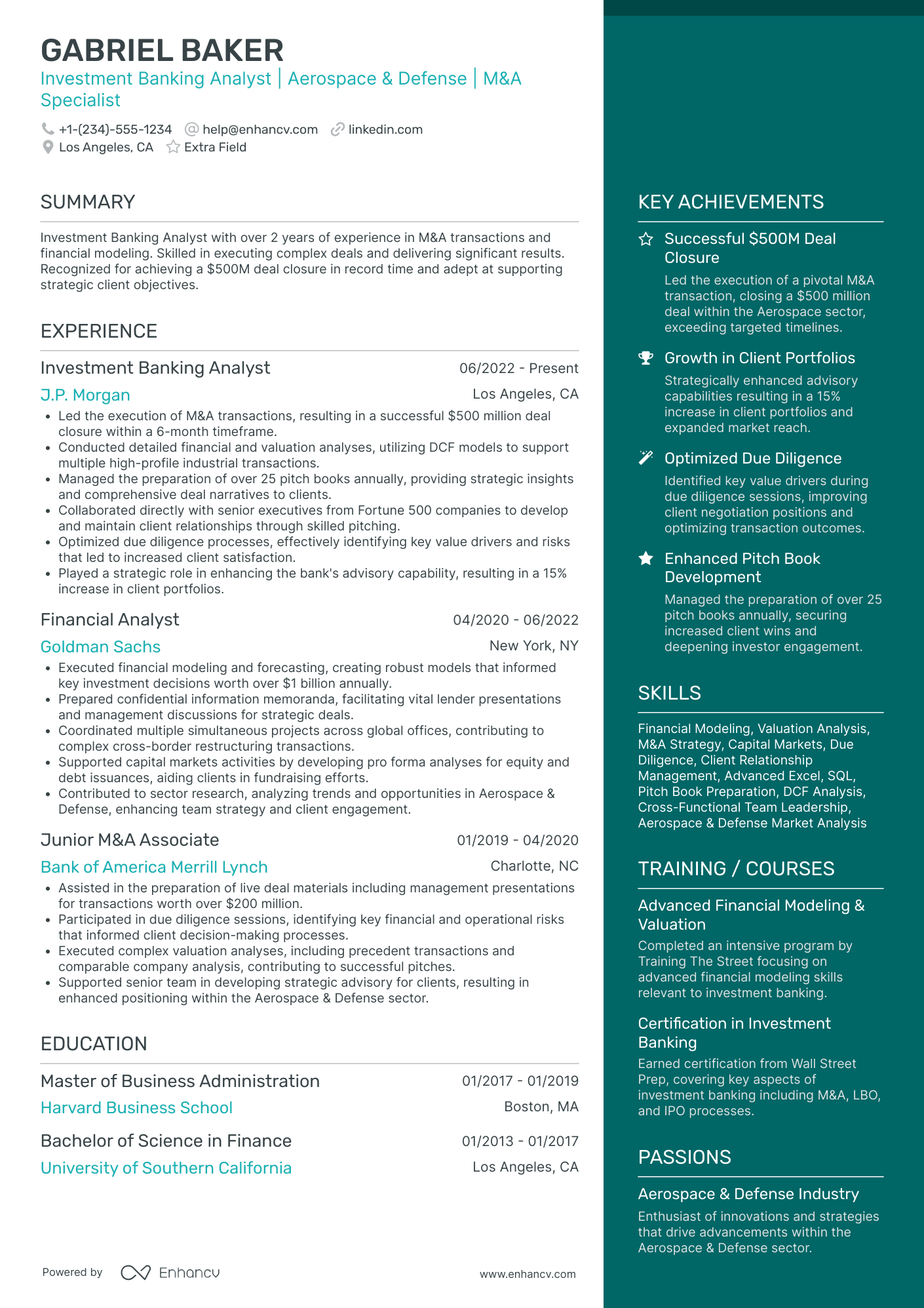

- •Developed new customer relationships and expanded existing ones.

- •Exceeded monthly sales goals consistently.

- •Received numerous exceptional service alerts for transactions with new members and existing members.

- •Provided solutions to complex lending issues such as mortgages, consumer loan products and business products.

- •Submitted consumer lending applications with a 95% approval rate.

- •Main point of contact for members and other departments in regards to lending and servicing needs.

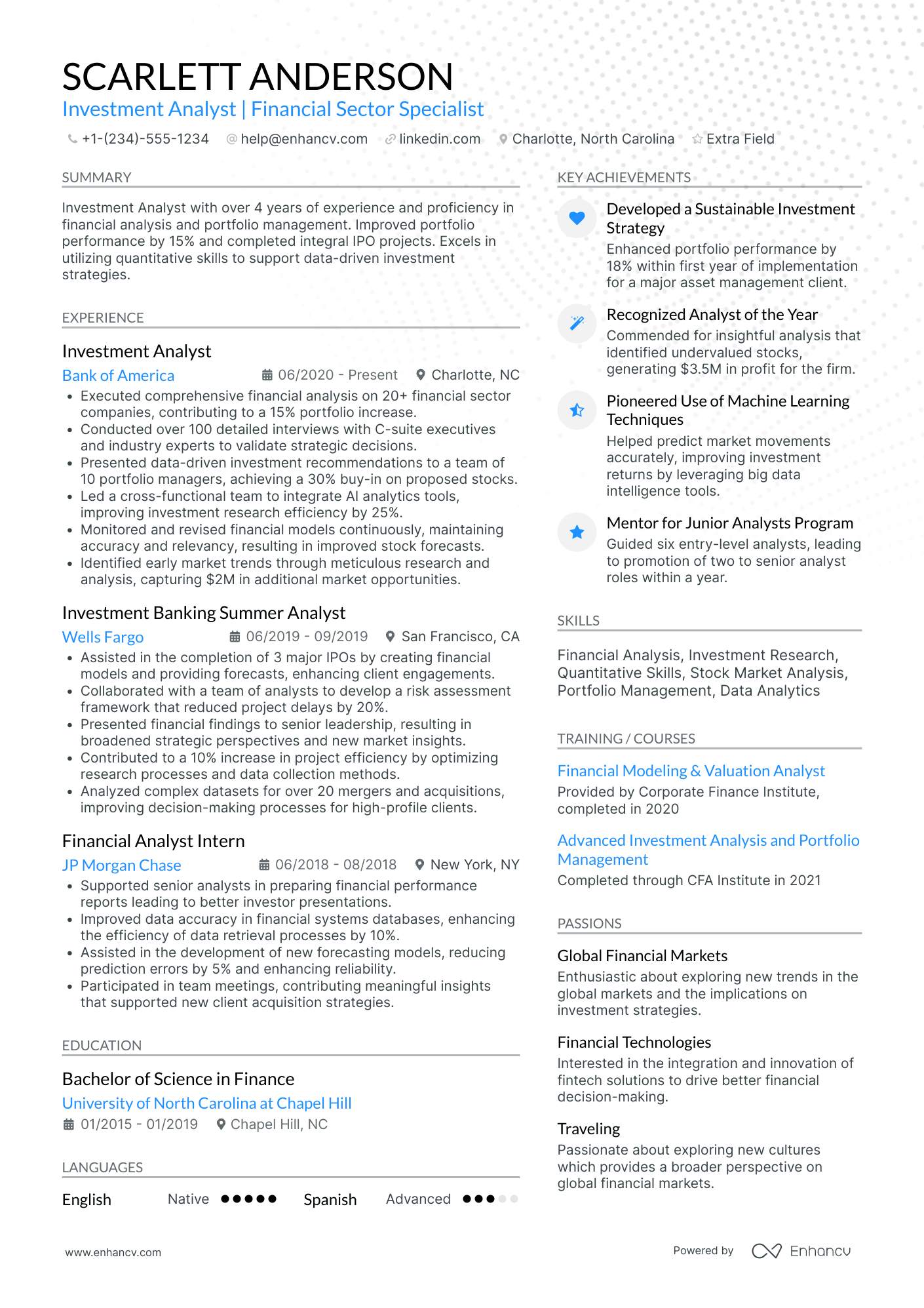

This candidate shows her value to the bank. She lists achievements like exceeding monthly goals.

Recruiters want candidates hungry to succeed. She shows that she is by providing quantitative data like her 95 percent approval rate.

How do you explain your job duties on your investment banking analyst resume?

Investment banking analysts do a lot of preparatory work to help upper-level bankers succeed. Basic responsibilities include:

- Assessing needs of clients

- Reviewing and analyzing financial data

- Preparing presentations and pitch books

- Building financial models for different corporate situations

- Performing administrative tasks

- Candidates for entry-level investment banking jobs often come from career paths like financial analyst and chartered accountant.

List duties that would be similar to what an investment banking analyst may do.

Look through the job description to see what would be expected of you if you are hired. Include duties on your resume that are similar to these.

Many investment banking analysts start out with internships or opportunities like summer analyst.

If you have not had opportunities like an internship, find connections with what work you have done. Does your job include analyzing financial data?

Do you prepare reports or pitch deals to clients?

Investment banking is a very competitive field. Finding a job is extremely difficult.

Your chances increase if you have the right experience and the right education. In fact, you sometimes can land a job as an investment banking analyst with just the right education.

Let’s discuss how to impress recruiters with your education.

Frame your investment banking analyst education on your resume

You can become an investment banking analyst straight out of college if you have the right education.

Hiring managers search for candidates with at least a bachelor’s degree in a field like finance, accounting, business or economics.

Having a master’s degree in a field like business administration or finance may give you an edge.

Your education section needs to be especially strong if you lack experience.

Many people interested in becoming investment bankers will seek internships in college.

There is still a chance to become an investment banking analyst if you do not have a business-related degree.

Recruiters may select well-rounded students whom they believe could easily learn the right skills. That is because many investment banks offer their own training programs.

If accepted, these programs offer training for required licensing and registration exams and on-the-job experience. You learn how to prepare financial models and client pitches.

Much of the program focuses on introducing you to the bank’s culture. After all, you will be part of a team convincing clients to work with your bank.

You may also want to seek a professional certification to increase your chances of being hired as an investment banker.

A highly respected certification is the Chartered Financial Analyst certification offered by the CFA Institute. It shows that you have a strong understanding of advanced investment analysis and portfolio management.

The primary purpose of framing your education is to show how you learned your skills. Your skills will be your closing pitch to the recruiter.

List your must-have investment banking analyst resume skills

The art of making the deal is huge when it comes to investment banking. You’ll eventually be the one making those deals.

First you’ve got to prove that you can spot a good deal.

Investment banking analysts must have strong analytical skills. You must look at every possible angle while analyzing a potential deal like a merger.

Analytical work you will do includes building financial models like:

- Discounted Cash Flow

- Comparable Companies and Comparable Transactions

- Merger and Acquisition models

- Leveraged Buyout models

Soft skills like communication and relationship building skills will also be important. You must introduce potential buyers and sellers and sell both sides on the deal.

Under communication, include linguistic skills. Knowing another language can be a benefit as an investment banker.

Industry requirements include strong math and accounting skills. You do not want to fudge a deal because of a math mistake. Your hard skills need to be on point.

Add on experience with Excel and PowerPoint, two programs that will help you analyze potential deals and design pitch books. Those fall under the category, technical skills.

Add discipline to the list of needed skills. There will be days when you may not sleep at all because of all the work you must get done.

Can you work an 80-hour week and still pay close attention to details? You must have the discipline to do so.

Here is a list of skills for you to use for your resume skills section.

“Attention to detail will never win you that new deal that results in $50 million of fees. But a lack of attention to detail can easily derail projects. Or at least make you look stupid in front of everyone.”

17 skills to include on an investment banking analyst resume

- Statistics

- Financial valuation modeling

- Quantitative analysis

- Presentation building

- Research

- Problem-solving

- Relationship building

- Entrepreneurial

- Intellectual

- Communication

- Leadership

- Networking

- Linguistic

- Mathematical

- Accounting

- Negotiation

- Influencing

How do you market yourself on your investment banking analyst resume? We’ve shown you how to write an investment banking analyst resume that will impress recruiters and investment bankers alike. Let’s recap the main points.

- Showcase why you’re the best candidate

- Match your qualifications to the job description

- Prove you can handle the work involved

- Promote your education and skills

- Pay close attention to details

Remember you want to show that you’re the financial workhorse the bank needs. Above all else, write to impress.

Investment Banking Analyst resume examples

By Experience

By Role