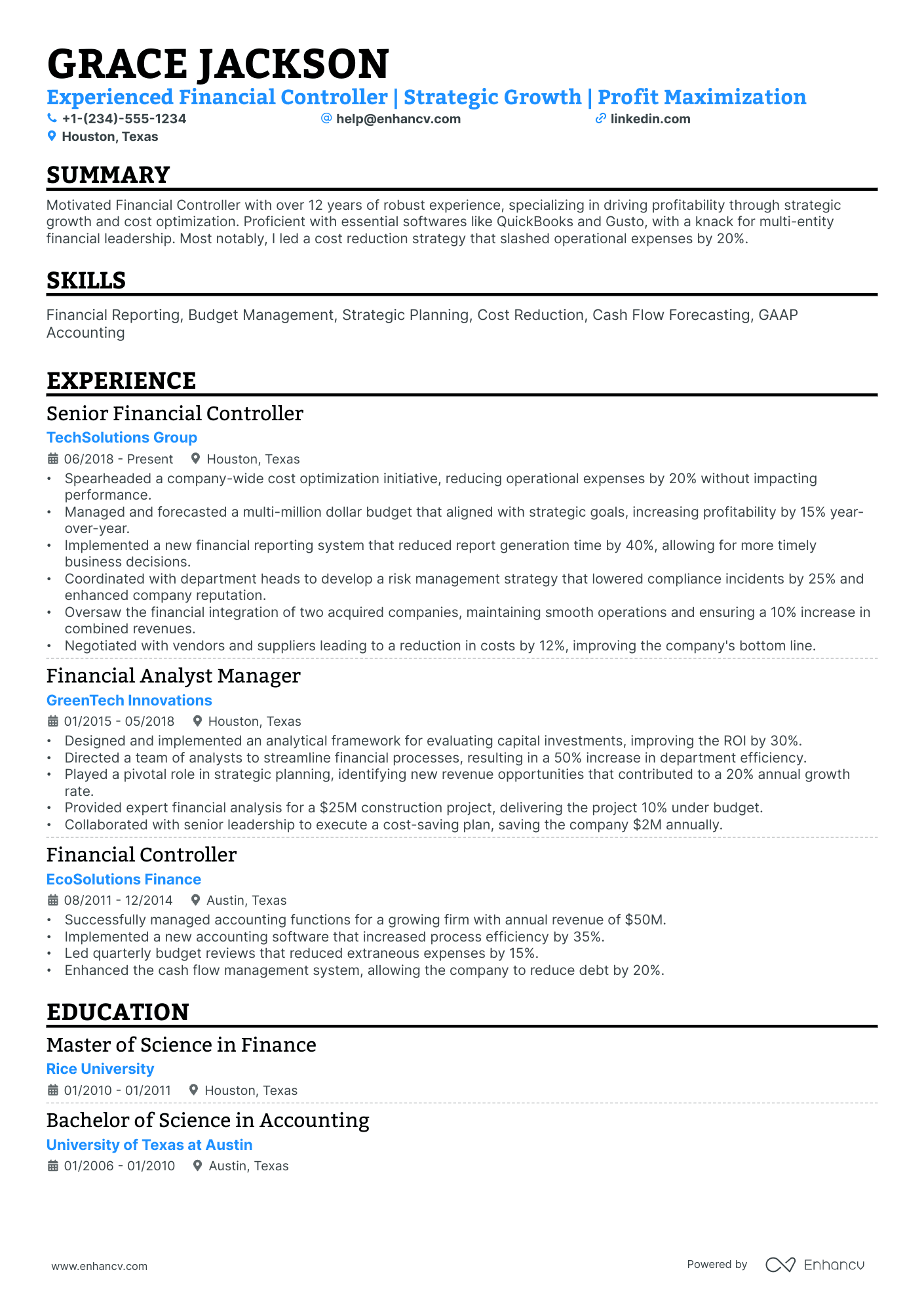

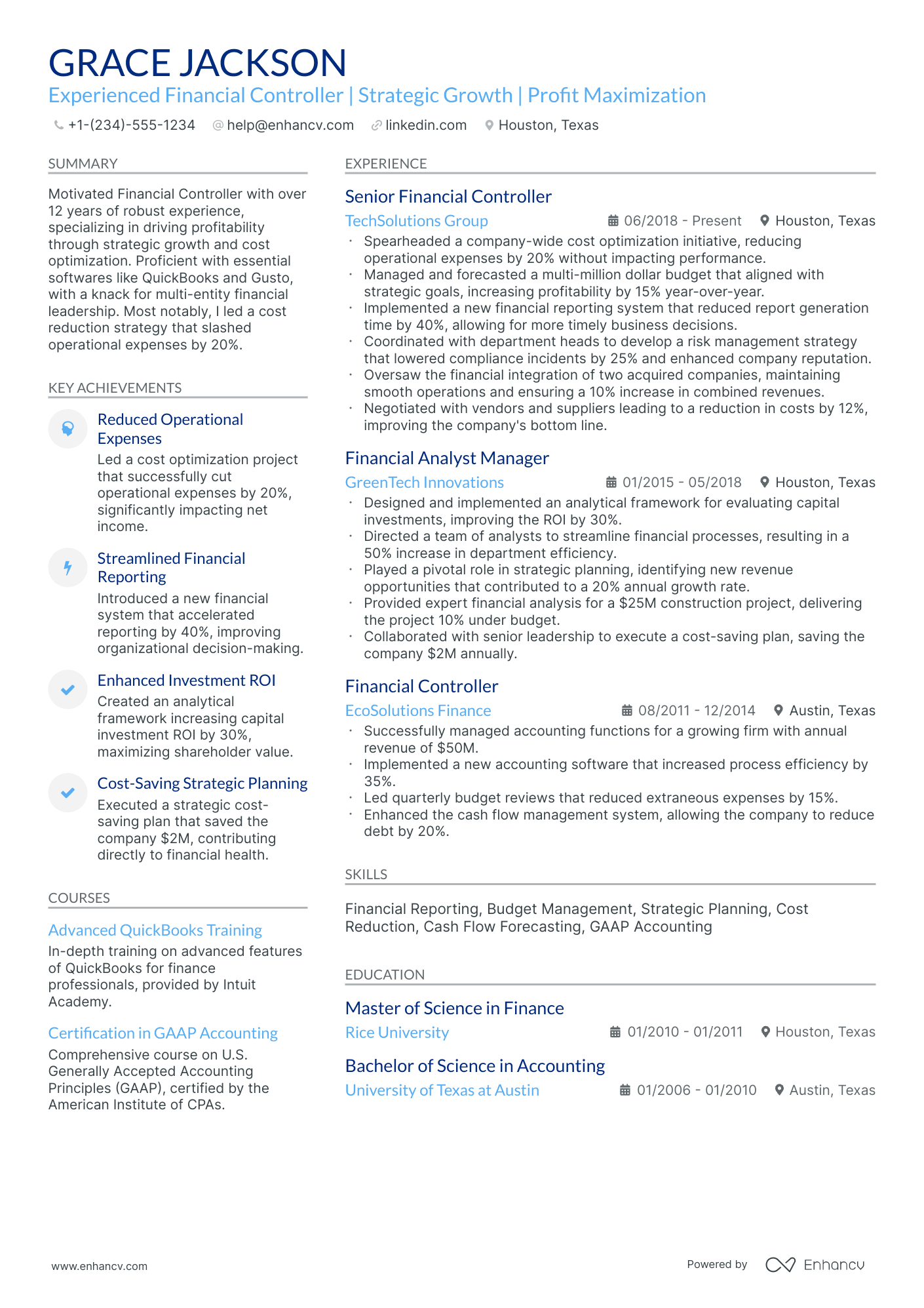

As a financial controller, articulating your complex financial management and strategic planning skills within the confines of a concise resume can be a daunting challenge. Our guide is designed to help you effectively highlight your expertise, ensuring that every line on your resume underscores your value and unique contributions to potential employers.

- Get inspired from our financial controller resume samples with industry-leading skills, certifications, and more.

- Show how you can impact the organization with your resume summary and experience.

- Introducing your unique financial controller expertise with a focus on tangible results and achievements.

If the financial controller resume isn't the right one for you, take a look at other related guides we have:

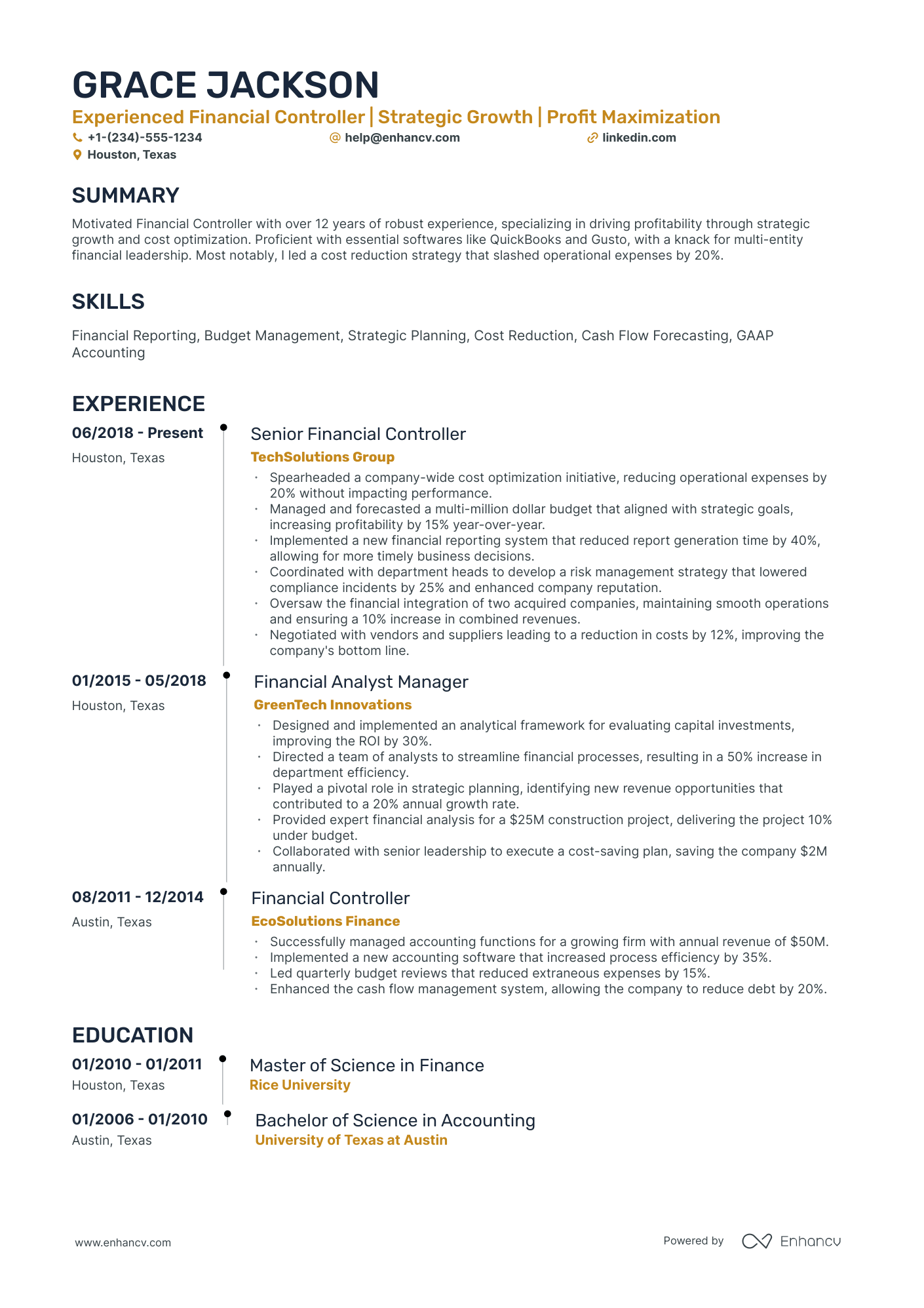

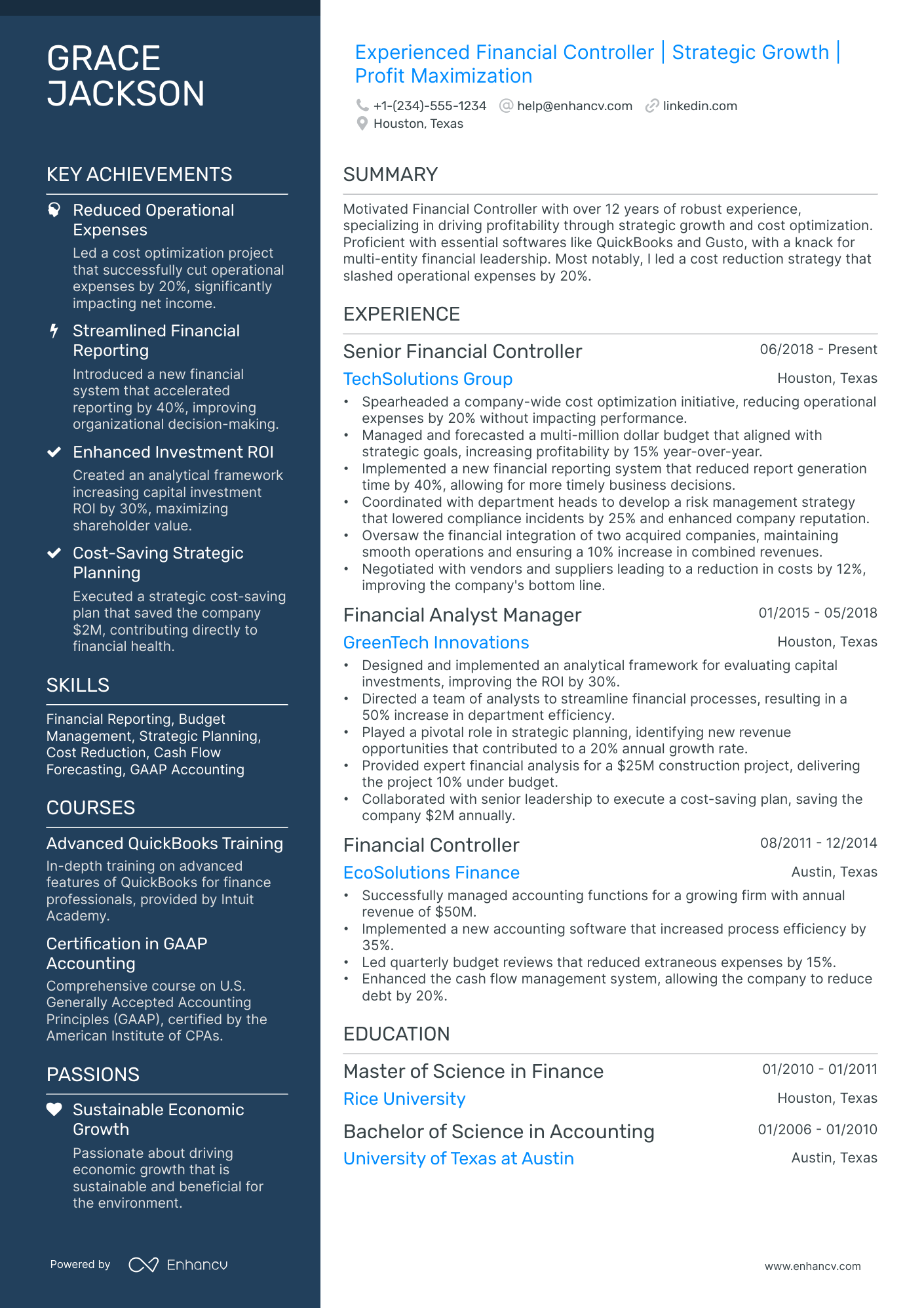

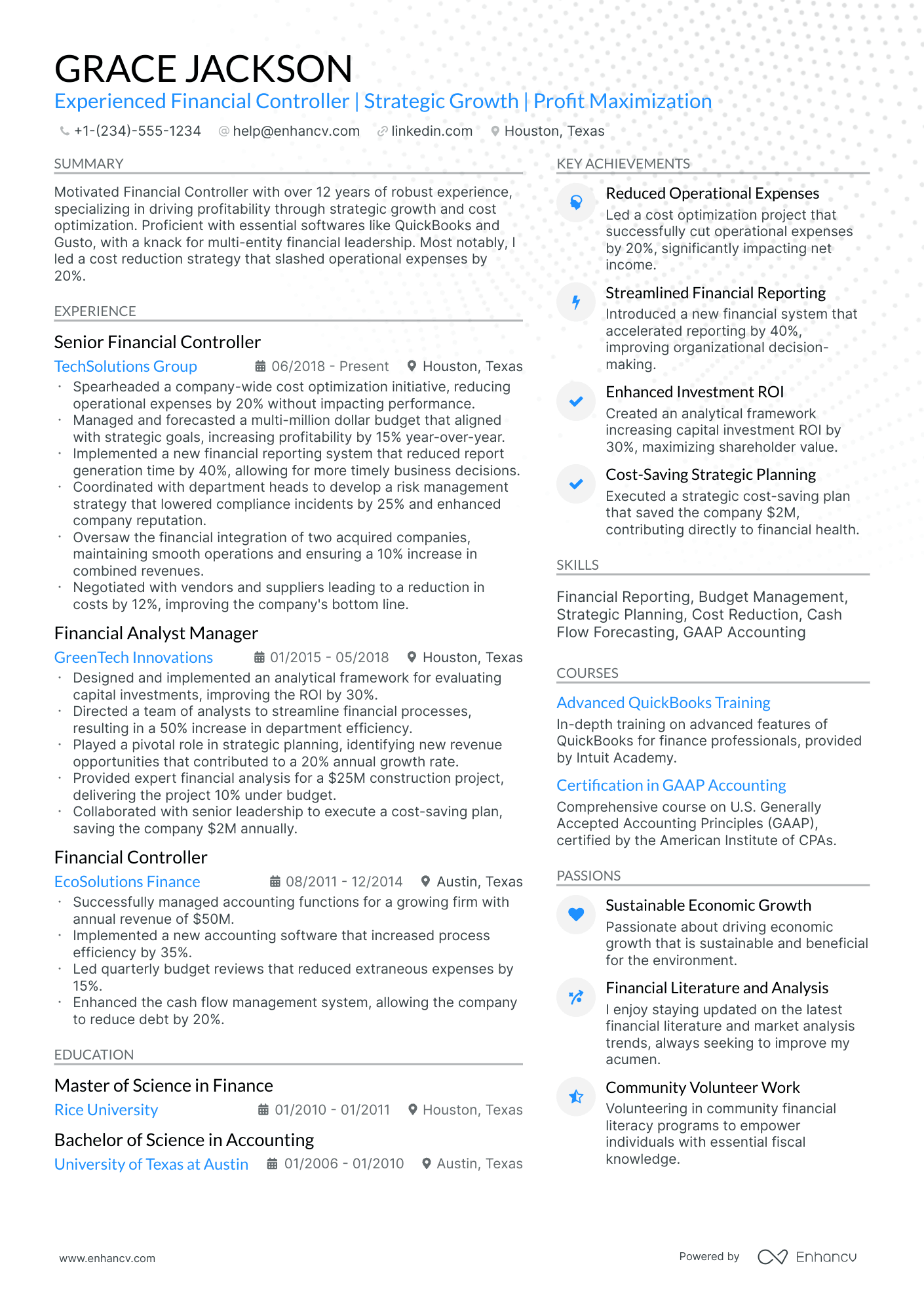

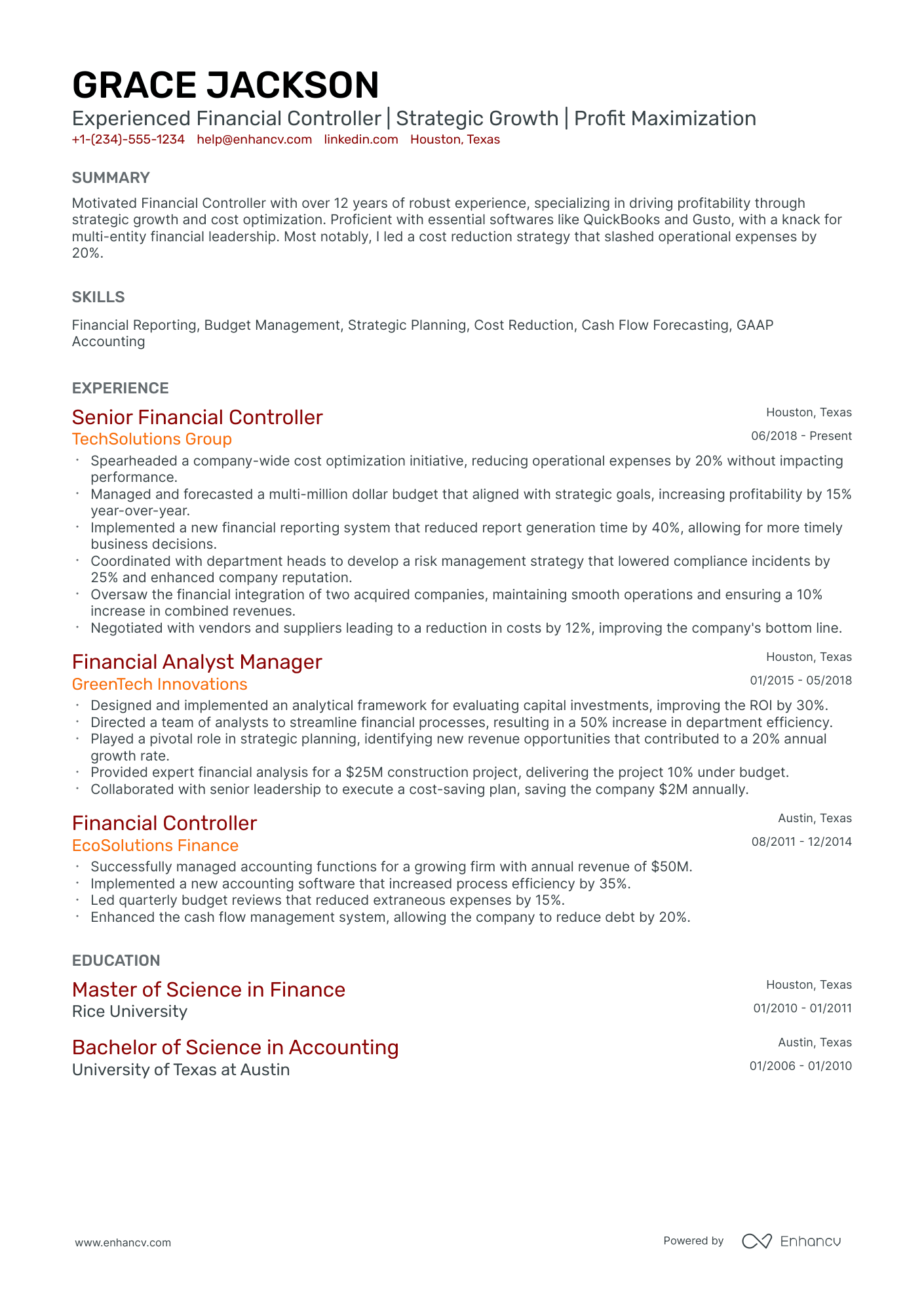

Professional financial controller resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Be aware of location-based layout differences – Canadian resumes, for instance, might differ in format.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

The six in-demand sections for your financial controller resume:

- Top one-third should be filled with a header, listing your contact details, and with a summary or objective, briefly highlighting your professional accolades

- Experience section, detailing how particular jobs have helped your professional growth

- Notable achievements that tie in your hard or soft skills with tangible outcomes

- Popular industry certificates to further highlight your technical knowledge or people capabilities

- Education to showcase your academic background in the field

What recruiters want to see on your resume:

- Proven experience in finance management, including preparing financial reports, budgets, and forecasts.

- Demonstrated knowledge of accounting principles, industry standards, and regulatory requirements.

- Strong analytical and strategic thinking skills, with the ability to provide insight on financial health and operational performance.

- Proficiency with financial software, ERP systems, and advanced Excel skills.

- Leadership experience with the capacity to manage finance teams and collaborate effectively with other departments.

Quick formula for writing your financial controller resume experience section

Have you ever wondered why recruiters care about your financial controller expertise?

For starters, your past roles show that you've obtained the relevant on-the job training and expertise that'd be useful for the role.

What is more, the resume work experience section isn't just your work history , but:

- shows what you're capable of achieving based on your past success;

- proves your skills with (oftentimes, tangible) achievements;

- highlights the unique value of what it's like to work with you.

To ensure your resume work experience section is as effective as possible, follow this formula:

- start each bullet with a powerful, action verb , followed up by your responsibilities, and your workplace success.

The more details you can include - that are relevant to the job and linked with your skill set - the more likely you are to catch recruiters' attention.

Additionally, you can also scan the job advert for key requirements or buzzwords , which you can quantify across your experience section.

Not sure what we mean by this? Take inspiration from the financial controller resume experience sections below:

- Spearheaded a comprehensive budgeting process overhaul for cross-departmental use, improving forecasting accuracy by 30% at Deloitte.

- Negotiated with software vendors to implement a new financial ERP system, enhancing reporting capabilities while achieving a 20% cost reduction.

- Supervised and mentored a team of 10 junior financial analysts, increasing departmental productivity by 40% and reducing report turnaround time by 25%.

- Led the initiative to develop a new risk assessment model that reduced financial discrepancies by 45% at PricewaterhouseCoopers.

- Managed quarterly and annual financial audits, collaborating with external auditors to ensure compliance with GAAP and corporate policies.

- Authored the company’s financial control and compliance manual, which serves as a key resource for internal accounting processes.

- Orchestrated a financial turnaround strategy that improved cash flow by 50% in two years at KPMG.

- Executed a company-wide cost-reduction program, identifying inefficiencies and saving $5M annually.

- Oversaw the integration of financial systems post-merger, ensuring a smooth transition with zero downtime.

- Conducted in-depth financial analysis to inform a $10M investment decision, resulting in a 15% ROI within the first year at Ernst & Young.

- Implemented a new forecasting tool that reduced the monthly financial closing cycle by three days.

- Streamlined accounts receivable processes, which decreased outstanding receivables by 20% and improved cash position.

- Developed a financial controls framework that reduced operational risk by 35% at BDO International.

- Collaborated with IT to deploy a custom finance dashboard, providing real-time KPIs that supported strategic decision-making.

- Coordinated with cross-functional teams to deliver a cost savings program that cut departmental expenses by 10% annually.

- Established a new internal audit process at Grant Thornton, identifying 25% more potential areas for cost savings compared to previous practices.

- Drove the selection and implementation of cutting-edge financial analysis software, which automated 60% of manual reporting tasks.

- Engaged in strategic planning sessions to align financial forecasts with company growth targets, achieving an average 8% year-over-year revenue increase.

- Introduced a predictive modeling approach to financial forecasting at Baker Tilly, which was critical in securing a $25M line of credit for business expansion.

- Played a pivotal role in Baker Tilly's global expansion by establishing financial control systems in three new international markets.

- Implemented a shared-services model that consolidated multiple financial operations into a central system, cutting overhead costs by 12%.

- Drove financial policy standardization across several mergers at Crowe LLP, ensuring compliance and operational efficiency while managing a team of 15.

- Formulated a disaster recovery plan for the finance department that reduced potential financial data recovery time from days to hours.

- Launched a continuous improvement program that identified and corrected inefficiencies in financial reporting, increasing data accuracy by over 90%.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for financial controller professionals.

Top Responsibilities for Financial Controller:

- Evaluate needs for procurement of funds and investment of surpluses and make appropriate recommendations.

- Delegate authority for the receipt, disbursement, banking, protection, and custody of funds, securities, and financial instruments.

- Develop and maintain relationships with banking, insurance, and external accounting personnel to facilitate financial activities.

- Monitor financial activities and details, such as cash flow and reserve levels, to ensure that all legal and regulatory requirements are met.

- Receive, record, and authorize requests for disbursements in accordance with company policies and procedures.

- Develop internal control policies, guidelines, and procedures for activities, such as budget administration, cash and credit management, and accounting.

- Coordinate and direct the financial planning, budgeting, procurement, or investment activities of all or part of an organization.

- Receive cash and checks and make deposits.

- Prepare or direct preparation of financial statements, business activity reports, financial position forecasts, annual budgets, or reports required by regulatory agencies.

- Monitor and evaluate the performance of accounting and other financial staff, recommending and implementing personnel actions, such as promotions and dismissals.

Quantifying impact on your resume

- Highlight your experience in developing financial controls and processes that led to cost reductions, specifying the exact percentage or dollar amount saved.

- Quantify the size of the budgets you have managed, emphasizing your capability to handle substantial financial resources efficiently.

- Detail how your financial forecasting improved decision-making or profitability, including specific metrics such as increased revenue or margin percentages.

- Showcase your proficiency in cash flow management by indicating how you optimized working capital, citing the resulting improvement in liquidity ratios.

- Outline projects where you identified and mitigated financial risks, and quantify the potential losses that were prevented as a result.

- Describe any system implementations or upgrades you led, mentioning how they increased productivity or accuracy in financial reporting.

- Illustrate your role in tax planning and compliance, highlighting any reductions in tax liabilities or improvements in compliance metrics you achieved.

- Include instances of cross-departmental collaboration on financial initiatives, detailing the financial impact or efficiencies gained from your involvement.

Action verbs for your financial controller resume

What to do if you don't have any experience

It's quite often that candidates without relevant work experience apply for a more entry-level role - and they end up getting hired.

Candidate resumes without experience have these four elements in common:

- Instead of listing their experience in reverse-chronological format (starting with the latest), they've selected a functional-skill-based format. In that way, financial controller resumes become more focused on strengths and skills

- Transferrable skills - or ones obtained thanks to work and life experience - have become the core of the resume

- Within the objective, you'd find career achievements, the reason behind the application, and the unique value the candidate brings about to the specific role

- Candidate skills are selected to cover basic requirements, but also show any niche expertise.

Recommended reads:

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Financial controller resume skills section: writing about your hard skills and soft skills

Recruiters always care about the skill set you'd bring about to the financial controller role. That's why it's a good idea to curate yours wisely, integrating both hard (or technical) and soft skills. Hard skills are the technology and software you're apt at using - these show your suitability for the technical aspect of the role. They are easy to track via your experience, certifications, and various resume sections. Your soft skills are those personality traits you've gained over time that show how you'd perform in the specific team, etc. Soft skills are more difficult to qualify but are definitely worth it - as they make you stand out and show your adaptability to new environments. How do you build the skills section of your resume? Best practices point that you could:

- Include up to five or six skills in the section as keywords to align with the advert.

- Create a specific technical skills section to highlight your hard skills aptitude.

- Align the culture of the company you're applying to with your soft skills to determine which ones should be more prominent in your skills section.

- Make sure you answer majority of the job requirements that are in the advert within your skills section.

A financial controller's resume requires a specific skill set that balances both industry-specific hard skills with personal, soft skills. Discover the perfect mix for the financial controller role from our list:

Top skills for your financial controller resume:

Financial Reporting

Budgeting and Forecasting

Financial Analysis

GAAP/IFRS Compliance

Accounting Software (e.g., SAP, Oracle, QuickBooks)

Tax Compliance

Cash Flow Management

Data Analysis Tools (e.g., Excel, Tableau)

ERP Systems

Risk Management

Leadership

Communication

Problem-Solving

Attention to Detail

Analytical Thinking

Time Management

Team Collaboration

Adaptability

Strategic Thinking

Decision Making

Next, you will find information on the top technologies for financial controller professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Financial Controller’s resume:

- Microsoft Dynamics

- SAP software

- Microsoft PowerPoint

- Intuit QuickBooks

- Sage 50 Accounting

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

How to include your education and certifications on your resume

We're taking you back to your college days with this part of our guide, but including your relevant higher education is quite important for your resume.

Your degree shows recruiters your dedication to the industry, your recent and relevant know-how, and some form of experience in the field.

Your financial controller resume education should:

- Include your applicable degrees, college (-s) you've graduated from, as well as start and end dates of your higher education;

- Skip your high school diploma. If you still haven't graduated with your degree, list that your higher education isongoing;

- Feature any postgraduate diplomas in your resume header or summary - this is the perfect space to spotlight your relevant MBA degree;

- Showcase any relevant coursework, if you happen to have less professional experience and think this would support your case in being the best candidate for the role.

As far as your job-specific certificates are concerned - choose up to several of the most recent ones that match the job profile, and include them in a dedicated section.

We've saved you some time by selecting the most prominent industry certificates below.

The top 5 certifications for your financial controller resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Management Accountant (CMA) - Institute of Management Accountants (IMA)

- Certified Internal Auditor (CIA) - Institute of Internal Auditors (IIA)

- Chartered Global Management Accountant (CGMA) - American Institute of CPAs (AICPA) & Chartered Institute of Management Accountants (CIMA)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for financial controller professionals.

Top US associations for a Financial Controller professional

- Association for Financial Professionals

- AICPA and CIMA

- American Payroll Association

- Association of Government Accountants

- Association of Public Treasurers of the United States and Canada

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Recommended reads:

The ideal financial controller candidate resume summary or objective

You may have heard that your resume top one-third plays an important part in your application.

It basically needs to show strong alignment with the job advert, your unique skill set, and your expertise.

Both the resume summary and resume objective could be used to ensure you've shown why you're the best candidate for the role.

Use the:

- Resume objective to pinpoint your current successes, that are applicable to the field, and your vision for your career. Remember to state how you see yourself growing within this new career opportunity.

- Resume summary as an instrument to pinpoint what is most applicable and noteworthy form your professional profile. Keep your summary to be no more than five sentences long.

At the end of the day, the resume summary or objective is your golden opportunity to shine a light on your personality as a professional and the unique value of what it's like to work with you.

Get inspired with these financial controller resume examples:

Resume summaries for a financial controller job

- Accomplished financial controller with over 12 years of progressive experience within the financial sector of multinational corporations. Adept at strategic planning, financial reporting, and risk management, with a significant achievement in reducing costs by 20% through rigorous financial control measures and optimizations.

- Driven professional with an effective 7-year tenure in financial management roles, transitioning into a financial controller capacity. Strong analytical skills, expertise in regulatory compliance, and comprehensive knowledge of accounting software, committed to enhancing financial integrity and business performance.

- Results-oriented Certified Public Accountant seeking to leverage 10 years of auditing and management experience into the financial controller field. Proven track record of improving financial processes and implementing robust controls within diverse industries, focusing on accuracy and sustainability of financial information.

- As a seasoned Financial Analyst with 5 years of comprehensive experience in financial forecasting and budgeting, I am eager to apply my analytical skills and in-depth knowledge of accounting principles to a financial controller capacity, contributing to effective financial governance and strategic decision-making.

- Seeking to apply my enthusiasm for finance and robust quantitative skills acquired through a Master's degree in Finance and recent certification as a CFA, to a financial controller position. Eager to develop hands-on experience in financial reporting, cost management, and enhance corporate financial strategy.

- Eager to kick-start my career in finance by securing an entry-level financial controller position. Bringing forth a strong academic background in Business Administration, hands-on internship experience in financial analysis, and a deep-seated interest in helping organizations manage their finances effectively and efficiently.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for financial controller professionals

Local salary info for Financial Controller.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $156,100 |

| California (CA) | $169,780 |

| Texas (TX) | $155,380 |

| Florida (FL) | $135,780 |

| New York (NY) | $215,430 |

| Pennsylvania (PA) | $137,770 |

| Illinois (IL) | $149,900 |

| Ohio (OH) | $131,610 |

| Georgia (GA) | $159,620 |

| North Carolina (NC) | $146,860 |

| Michigan (MI) | $131,770 |

Other financial controller resume sections to support your expertise and skills

Recruiters are always on the lookout for that financial controller candidate who brings about even more value to the role.

This can be either via their personality or additional accreditations they have across the industry.

Add to your resume any of the four sections that fit your profile:

- Projects for your most impressive, cutting-edge work;

- Awards or recognitions that matter the most;

- Publications further building up your professional portfolio and accreditations;

- Hobbies and interests to feature the literature you read, how you spend your time outside of work, and other personality traits you deem may help you stand out .

Key takeaways

At the end of our guide, we'd like to remind you to:

- Invest in a simple, modern resume design that is ATS friendly and keeps your experience organized and legible;

- Avoid just listing your responsibilities in your experience section, but rather focus on quantifiable achievements;

- Always select resume sections that are relevant to the role and can answer job requirements. Sometimes your volunteering experience could bring more value than irrelevant work experience;

- Balance your technical background with your personality traits across various sections of your resume to hint at how much time employers would have to invest in training you and if your profile would be a good cultural fit to the organization;

- Include your academic background (in the form of your relevant higher education degrees and certifications) to show recruiters that you have the technical basics of the industry covered.