As a finance manager, your responsibilities include highly detail-oriented tasks, like budget management or data analysis. At the same time, you need to have a vision for big-picture projects such as long-term financial strategies to promote growth. And yet, as opposed to leaders, who are all about vision and direction, managers are the people who get the job done and ensure people are focused and on task.

Balancing your operative knowledge and managerial experience is what seals the deal. Being able to highlight both effectively in a resume can be tricky. We’ve thought about it, and collected the best tips with real examples!

Key takeaways

- The reverse-chronological format provides a comprehensive overview of your professional journey.

- A clear, straightforward design with modern elements like a splash of color and a memorable font can make you stand out even more.

- Pepper your experience section with quantifiable achievements and tangible results to instantly engage the recruiter.

- Make a separate section for your hard skills, and intersperse your soft skills throughout your resume.

- A strong educational background is crucial and will never go out of style.

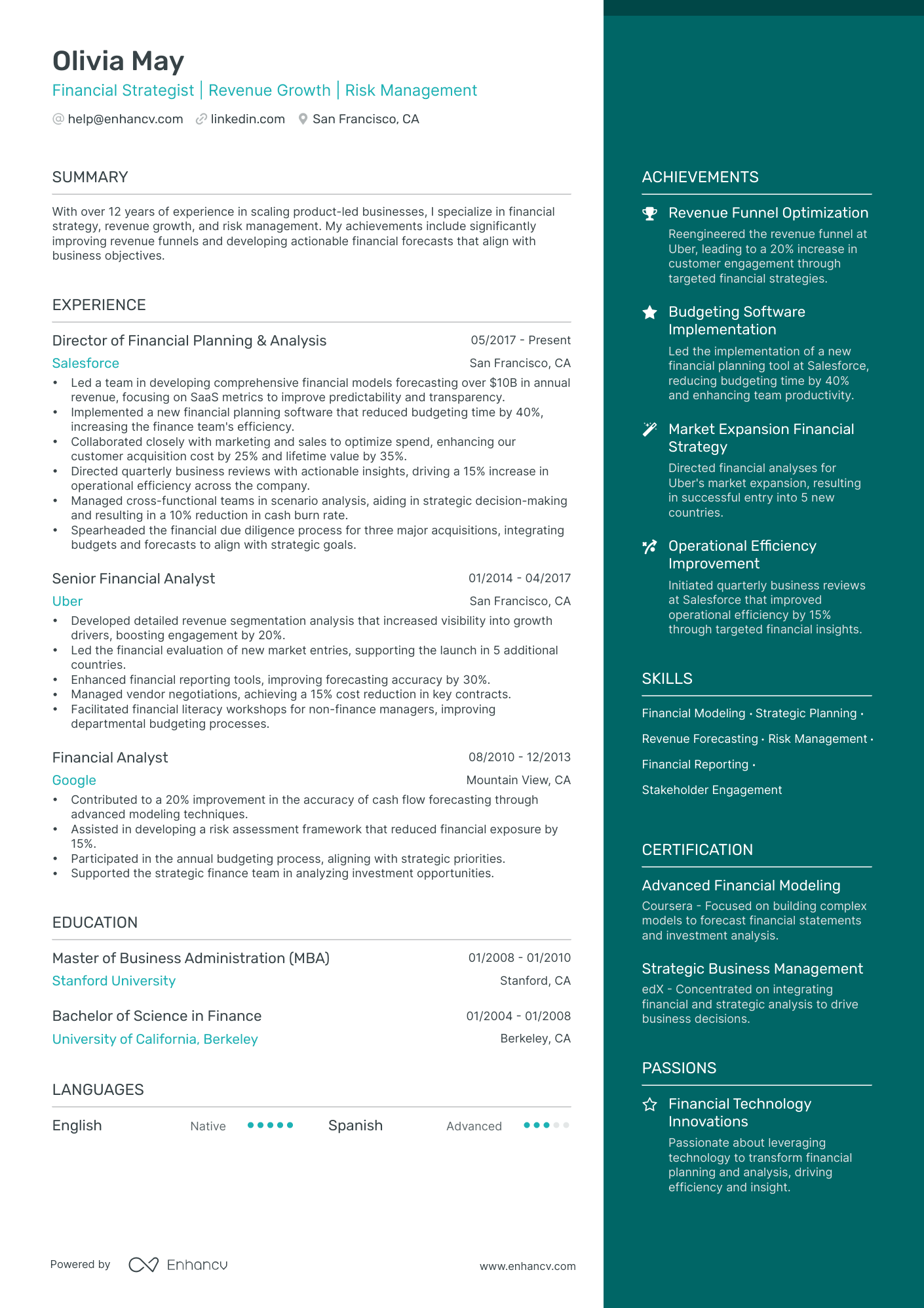

Let’s review a resume example for a finance manager. It’ll help you get the gist of the key resume components.

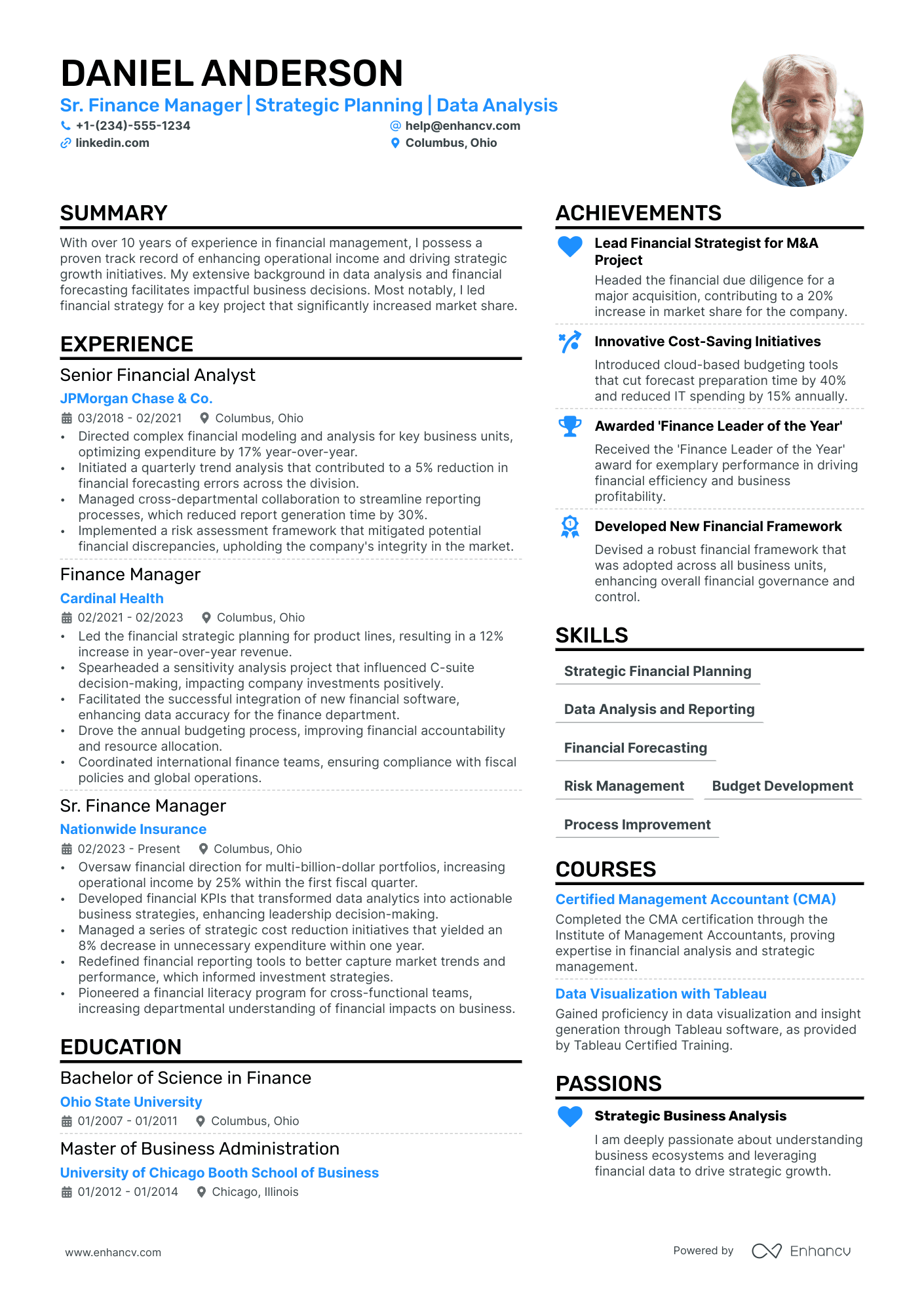

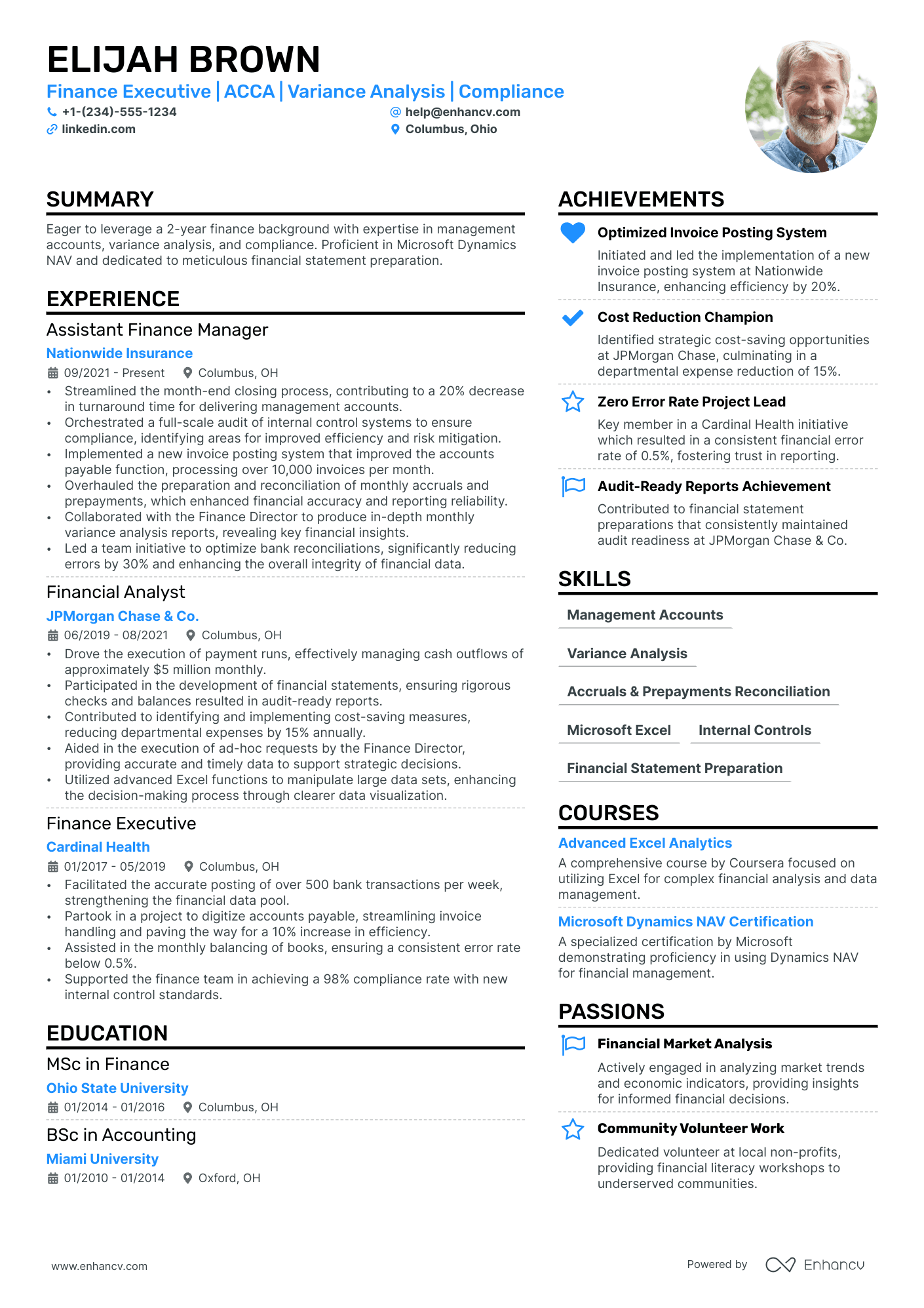

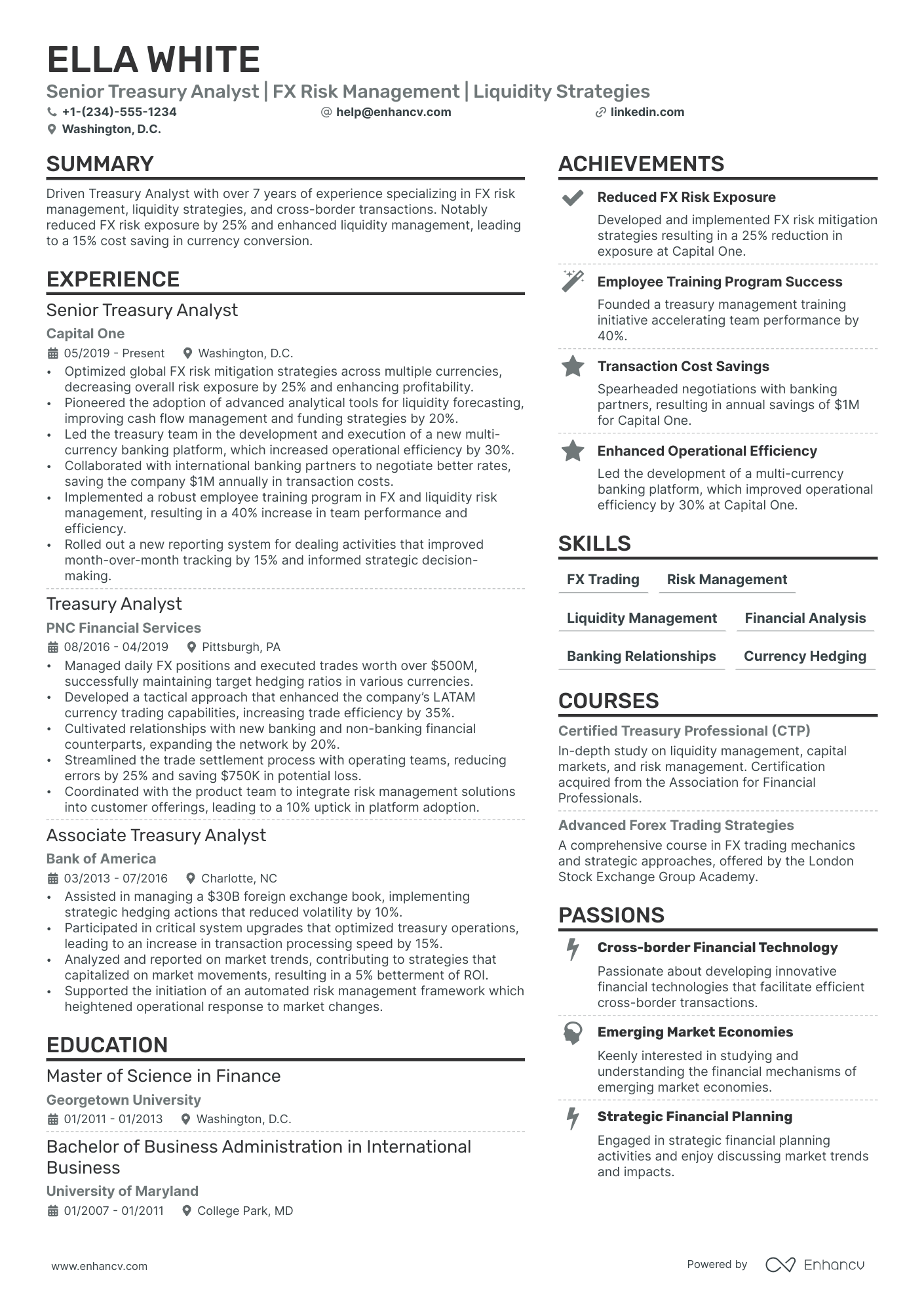

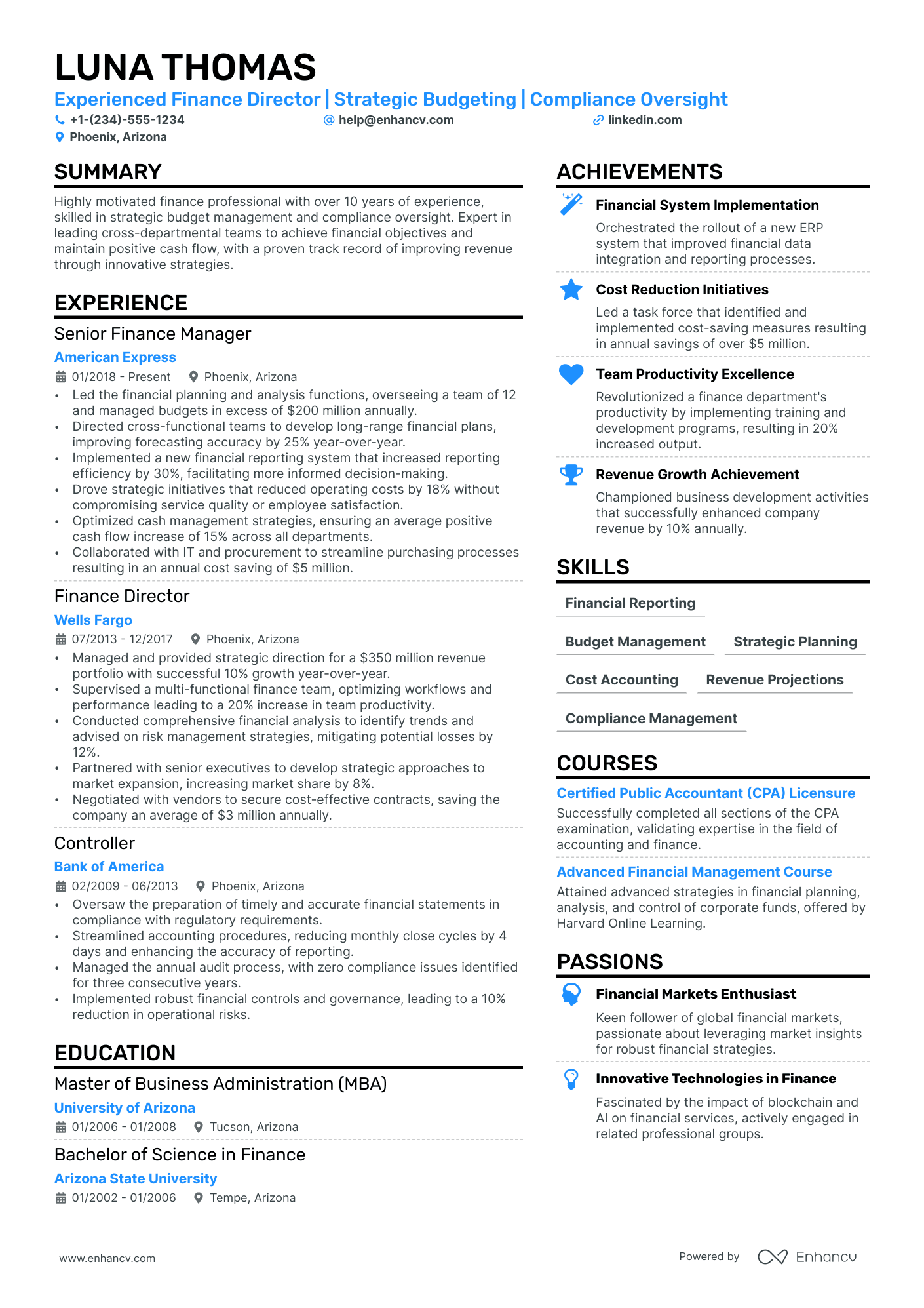

Finance manager resume sample

Use this finance manager resume sample as a template for your own application!

Logan Smith

finance manager

logan.smith@email.com | LinkedIn | San Francisco, CA

Summary

Dedicated and results-driven finance manager with over 10 years of experience in managing the financial health of organizations to promote success and growth while maintaining legal financial practices. Proficient in financial planning, reviewing financial documents for tax compliance, and collaborating with departments to achieve monetary goals. Demonstrated ability to improve financial operations, streamline processes, and foster growth in diverse business environments.

Experience

finance manager

Salesforce, San Francisco, CA

March 2016 – Present

- Developed and implemented financial strategies to improve revenue by 20%.

- Conducted financial analysis and forecasting to support business growth.

- Ensured compliance with tax regulations and internal policies.

- Collaborated with other departments to set and achieve financial targets.

- Managed budgeting, accounting, and auditing processes.

Financial Analyst

Wells Fargo, San Francisco, CA

June 2011 – February 2016

- Performed detailed financial analysis and reporting for senior management.

- Assisted in the development of the annual budget and quarterly forecasts.

- Monitored financial performance and identified areas for improvement.

- Ensured accuracy and compliance of financial documents with regulatory standards.

- Supported strategic planning and decision-making processes.

Education

Bachelor of Science in Finance

University of California, Berkeley

Graduated: 2011

Certifications

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

Skills

- Financial Planning and Analysis

- Budgeting and Forecasting

- Tax Compliance

- Financial Reporting

- Strategic Planning

- Risk Management

- Financial Modeling

- Cross-functional Collaboration

Languages

- English (Native)

- Spanish (Proficient)

You can use this template to build your own resume, or, if you want to start from scratch, follow our tips below.

How to format a finance manager resume

The right resume format can highlight your financial expertise and leadership skills in a clear, organized manner, allowing hiring managers to swiftly recognize your value. Furthermore, a polished, well-structured resume demonstrates your meticulous attention to detail and professional standards, which are essential traits in the finance industry.

Resume format

Generally, the reverse-chronological format works best for manager positions. It gives a comprehensive overview of your work history, starting with the most recent experience. It’s a great way to show how your perseverance developed you professionally.

Resume designs

- Resume length: Concise is best, so use the 1-page resume for an overview of your achievements. If you’re very experienced, you can opt for 2 pages.

- Margins: A 1” margin on each side is ideal. Our resume builder ensures your margins are never <0.5”.

- Columns: A two-column design will help you save space.

- Colors on a resume: A little color accentuates important info without looking unprofessional.

- Resume font: Fonts like Rubik, Calibri, or Bitter bode well with a serious finance manager role.

Contact information

Ensure your resume has a clear header with your name, job title, and contact information. Generally, omit the photo to appear more professional.

Adjust your resume layout based on the market – Canadian resumes, for example, may follow a unique format.

PRO TIP

Contrary to popular belief, our tests showed that fonts, colors, columns, and resume length don’t affect ATS (Applicant Tracking Systems) parsing. Focus on matching job description language and formatting details like dates and bullet symbols as those may affect your application.

File formatting

Keep your resume layout in place with a PDF format. Use a clear naming convention, like FirstName_LastName_JobTitle.

Top sections on a resume

Don’t miss a key section of your resume:

- Experience overview

- Core competencies

- Educational qualifications and certifications

- Resume summary

- Аdditional sections

We’ll discuss them in more detail below.

The Enhancv resume builder makes sure no key sections are missing on your resume!

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Now that you’ve got the design, begin by filling it in with important information, starting with your experience.

How to write your finance manager resume experience

To craft an engaging finance manager resume experience, highlight your accomplishments with specific metrics, such as improved budget accuracy or cost savings achieved. Emphasize your leadership skills by showcasing successful team management and project outcomes.

Start with the basics when crafting your work history section:

- Start with your most recent and relevant experience first.

- Include job titles, company names, locations, and dates of employment for each position.

- List your achievements in concise but relevant bullet points. Use specific numbers to demonstrate your impact.

And don’t forget, your role as finance manager entails more than raising and allocating funds, profit planning, and reviewing documents. As Dina, finance manager at Sephora, highlights:

Being a financial manager is much more than just finance. We support our different business partners and we’re proactive about initiatives that drive our company’s successes.

Dina, Finance Manager at Sephora

To present yourself as someone who’s success-driven:

- Display knowledge of legal financial practices, tax compliance, and regulatory requirements.

- Use strong action verbs, like "Managed," "Led," "Developed," "Implemented," and "Reviewed" to emphasize your proactive approach and leadership skills.

- Demonstrate cross-functional collaboration to show how you work effectively with various business partners across departments.

- Illustrate a proven track record of proactively identifying, leading, and implementing initiatives that drive financial performance and business growth.

Targeting the job posting

Arguably the most important thing you can do for a successful experience section is tailor it to the job posting. Why?

Recruiters only have limited time to go through applications. You could ease their load by incorporating keywords from the job description into your resume to show them you’re a good fit.

Let’s see how that works. Here’s a real example of a financial manager job description.

Financial manager

Requirements

- 4 – 6 Years of work experience in Corporate Finance, Financial Services, Management Consulting, or other Corporate Strategy roles

- Expert-level capabilities in Microsoft Office and G Suite

- Advanced quantitative and qualitative analytical ability

- Strong strategic problem-solving skills with the ability to prioritize issues and analysis

- Ability to work independently, usually within sophisticated and often ambiguous environments, to build rigorous, fact-based recommendations

- Self-motivated with a passion for taking ownership of your work and delivering outcomes

- BA or BS in Finance, Accounting, or quantitative field (e.g., economics, statistics, etc.)

Responsibilities

- Manage forecasting and budgeting for the Direct-to-Consumer subscription business.

- Perform timely and detailed variance analysis on financial performance and business KPIs.

- Build and improve FP&A processes and tools to enhance data tracking and KPI monitoring.

- Partner with key stakeholders with ongoing and ad-hoc reporting and analysis.

- Collaborate on highly visible and cross-functional projects to help allocate resources and aid in strategic decision-making.

- Model financial impacts of business initiatives and provide recommendations that aid decision-making.

- Perform deep-dive analyses that drive actionable insights and recommendations for growth and optimization.

And here’s a sample experience section tailored to that exact job ad.

- •Managed forecasting and budgeting for a $50M Direct-to-Consumer subscription business

- •Performed detailed variance analysis on financial performance and key business KPIs, ensuring timely and accurate reporting

- •Built and enhanced FP&A processes and tools, improving data tracking and KPI monitoring by 20%

- •Partnered with key stakeholders to deliver ongoing and ad-hoc reporting and analysis, aiding in strategic decision making

- •Collaborated on cross-functional projects to allocate resources efficiently, leading to a 15% reduction in operational costs

- •Modeled financial impacts of business initiatives, providing actionable recommendations to senior management

- •Conducted deep-dive analyses, generating insights and recommendations that drove growth and optimization initiatives

Including these makes it work:

- Direct job alignment: Shows relevant experience and matches key job responsibilities like forecasting, variance analysis, and FP&A process improvement.

- Quantifiable results: Highlights specific achievements, including managing a $50M business, improving KPI monitoring by 20%, and reducing costs by 15%.

- Strategic impact: Demonstrates collaboration with stakeholders, cross-functional projects, and providing actionable recommendations, showcasing strategic problem-solving and independence.

Remember to use tangible results in your experience section—it’s much more engaging than the plain listing of duties and responsibilities.

How to quantify your experience on resume

Illustrate how your contributions have benefited your workplace, using measurable results to emphasize your achievements. Just ensure these metrics tell a compelling story, and aren’t just numbers.

Examples of quantified achievements

- Spearheaded financial reporting that resulted in a 20% reduction in reporting errors over a two-year period.

- Optimized budget allocation to achieve a 15% cost reduction while maintaining operational efficiency.

- Implemented a new financial forecasting model that improved accuracy by 30%, directly influencing strategic decisions.

- Led a team to secure $5 million in cost savings through strategic vendor negotiations and process improvements.

- Managed cash flow to reduce outstanding receivables by 25%, significantly enhancing liquidity and operational stability.

In addition to highlighting your experience, you can showcase your abilities in the skills section.

How to list your hard and soft skills on your resume

One of the most efficient ways to show your well-roundedness is through your skills section. As a financial manager, you’ve got concrete and in-depth expertise—that’s the operative knowledge we mentioned earlier. You also have management and people skills, which are much needed in this role.

Your skills can be put into two groups—hard and soft. Hard skills refer to industry-specific knowledge that can be measured and tested. It’s best to put those in a separate section on your resume. Choose the most relevant for you—you can use our list below or skills you find valuable.

Best hard skills for your finance manager resume

- Financial reporting

- Budget management

- Risk analysis

- Tax planning

- Auditing

- ERP systems proficiency

- Knowledge of GAAP/IFRS

- Data analysis

- Business Intelligence tools

- Financial modeling

- SAP

- Oracle Finance

- MS Excel advanced functions

- Accounting software (QuickBooks, Xero)

- Business valuation

- Cash flow management

- Financial software (Finacle)

- Portfolio management

- SQL data retrieval

Precisely because these capabilities can be easily tested and proven, don’t exaggerate your proficiency. It’s never a good idea to lie on your resume.

Soft skills are best dispersed throughout the experience and education sections of your resume. Simply listing them won’t mean much to hiring managers. Instead, demonstrate you’re a culture fit for the company by supplying concrete examples.

Best soft skills for your finance manager resume

- Leadership

- Communication

- Problem-solving

- Decision making

- Time management

- Attention to detail

- Negotiation

- Analytical thinking

- Adaptability

- Conflict resolution

- Initiative

- Teamwork

- Assertiveness

- Creativity

- Organizational skills

- Patience

- Empathy

- Persistence

- Stress management

Many of your unique skills are likely honed through your educational background. Now, let's explore how to effectively organize your education and certifications section.

How to list your certifications and education on your resume

An education section highlights your expertise in financial principles and accounting, assuring employers of your technical competence. It also demonstrates your commitment to continuous learning, essential for staying updated with evolving finance trends and regulations.

The main components of this section include:

- Degree name: Clearly state your degree, e.g., "Bachelor of Science in Finance."

- Institution: Include the name of the university, college, or institution where you earned the degree.

- Location: Mention the city and state.

- Years attended: Specify the year graduated. No need to specify the month.

- GPA: Include your GPA if it's 3.5 or above, e.g., "GPA: 3.8/4.0." Keep in mind that for jobs at the managerial level, GPA isn’t the most impressive accomplishment, and can be skipped.

Let’s put this knowledge into practice. This sample education section targets the job description we discussed above:

- •Graduated with Honors

- •Relevant coursework: Corporate Finance, Financial Accounting, Statistical Analysis, Business Strategy

- •Led a student-managed investment fund, achieving a 12% annual return

- •Completed a senior thesis on risk management strategies in financial markets

Here’s what makes this entry impressive:

- Relevant coursework and skills: The listed courses such as Corporate Finance, Financial Accounting, Statistical Analysis, and Business Strategy directly align with the core competencies required for a finance manager. This demonstrates a solid foundation in essential financial principles and analytical skills.

- Leadership and practical experience: Leading a student-managed investment fund and achieving a 12% annual return showcases practical experience in managing investments and making strategic financial decisions. This highlights leadership abilities and real-world application of finance knowledge, which are crucial for a finance manager role.

- Research and analytical capability: Completing a senior thesis on risk management strategies in financial markets indicates a deep understanding of risk assessment and mitigation. This is a valuable skill for finance managers, who need to navigate and manage financial risks effectively

Another way to show your aptitude on your resume is getting certified or additionally trained. Consider listing certifications such as:

Best certifications for your finance manager resume

Now that we’ve highlighted your certifications and education, let’s move on to crafting a compelling summary that shows your key skills and achievements.

How to write your finance manager resume summary

A resume summary for an experienced finance manager should show financial analysis, budgeting, forecasting, and strategic planning expertise. It needs to showcase achievements in cost savings, revenue growth, and process improvements, alongside strong leadership, analytical skills, and a proven track record of driving financial performance and supporting business goals.

Your summary should be about 3 – 5 sentences long. Focus on how you can contribute to the business. Use industry-specific language to better align with the job posting.

Let’s look at a well-written resume summary example that targets the job ad above.

This summary highlights over 5 years of expertise in corporate finance, specializing in financial planning, analysis, and forecasting for direct-to-consumer businesses. It showcases quantifiable achievements, strong problem-solving abilities, and a passion for driving growth through strategic financial modeling and decision support.

Finally, our additional section suggestions can take your finance manager to the next level.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Additional sections for a finance manager resume

Optional sections on your resume can provide important information that will impress employers. Take a look at our suggestions, tailored to the finance manager position.

- Key achievements: You could talk about significant successes that helped you and the company you worked for grow. You can also incorporate these in your experience section, but if you’ve got impressive accomplishments, dedicate a separate section to them.

- Projects: A finance manager might develop a comprehensive investment strategy for their family, balancing risk and optimizing returns to meet long-term goals like retirement or children's education. This personal project sharpens your professional skills in investment management and financial planning.

- Awards and recognitions: Have you received industry awards and internal recognitions for excellence in financial management? Highlight your track record of professional excellence and impactful contributions on your resume!

- Volunteer work: Reflects your commitment to social responsibility and community engagement, which can enhance your leadership profile.

- Languages: As a finance manager, you’ll probably speak to international partners and clients. Displaying your language proficiency on your resume can emphasize your communication skills to recruiters.

In conclusion

In conclusion, crafting a resume for a finance manager should highlight your analytical skills, financial expertise, and leadership abilities. Focus on a clear, concise, and impactful presentation of your achievements and qualifications to demonstrate your value to potential employers.

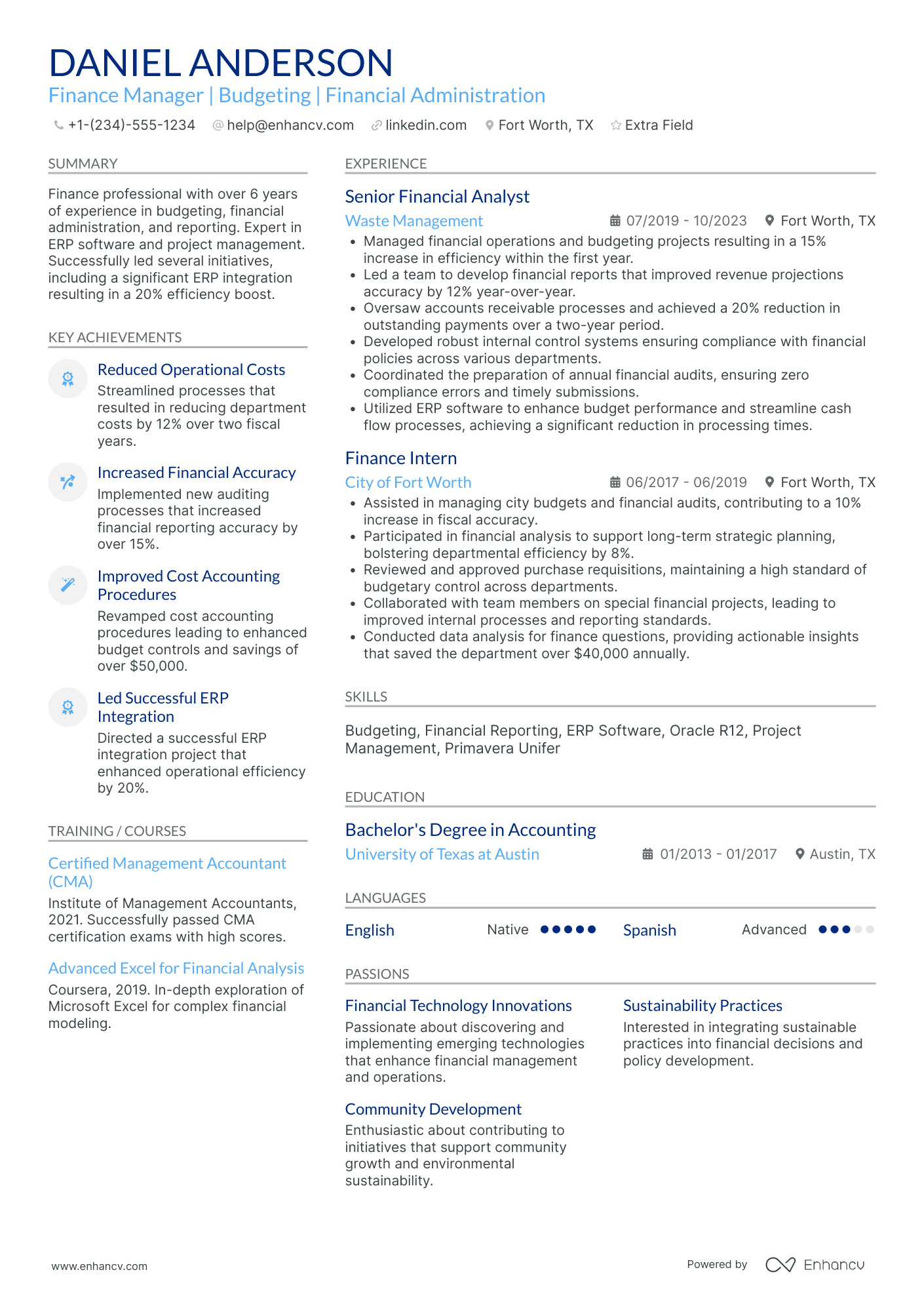

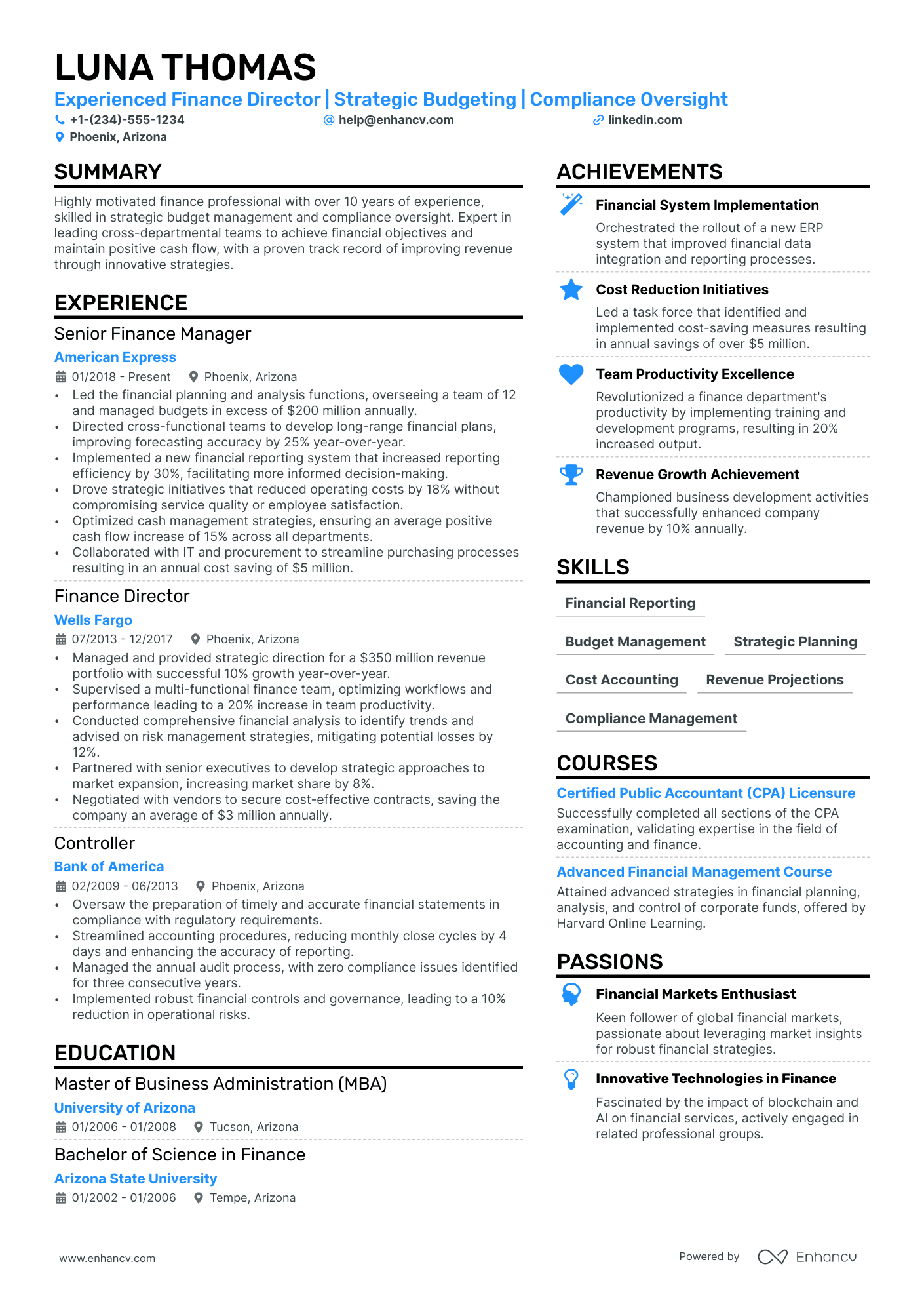

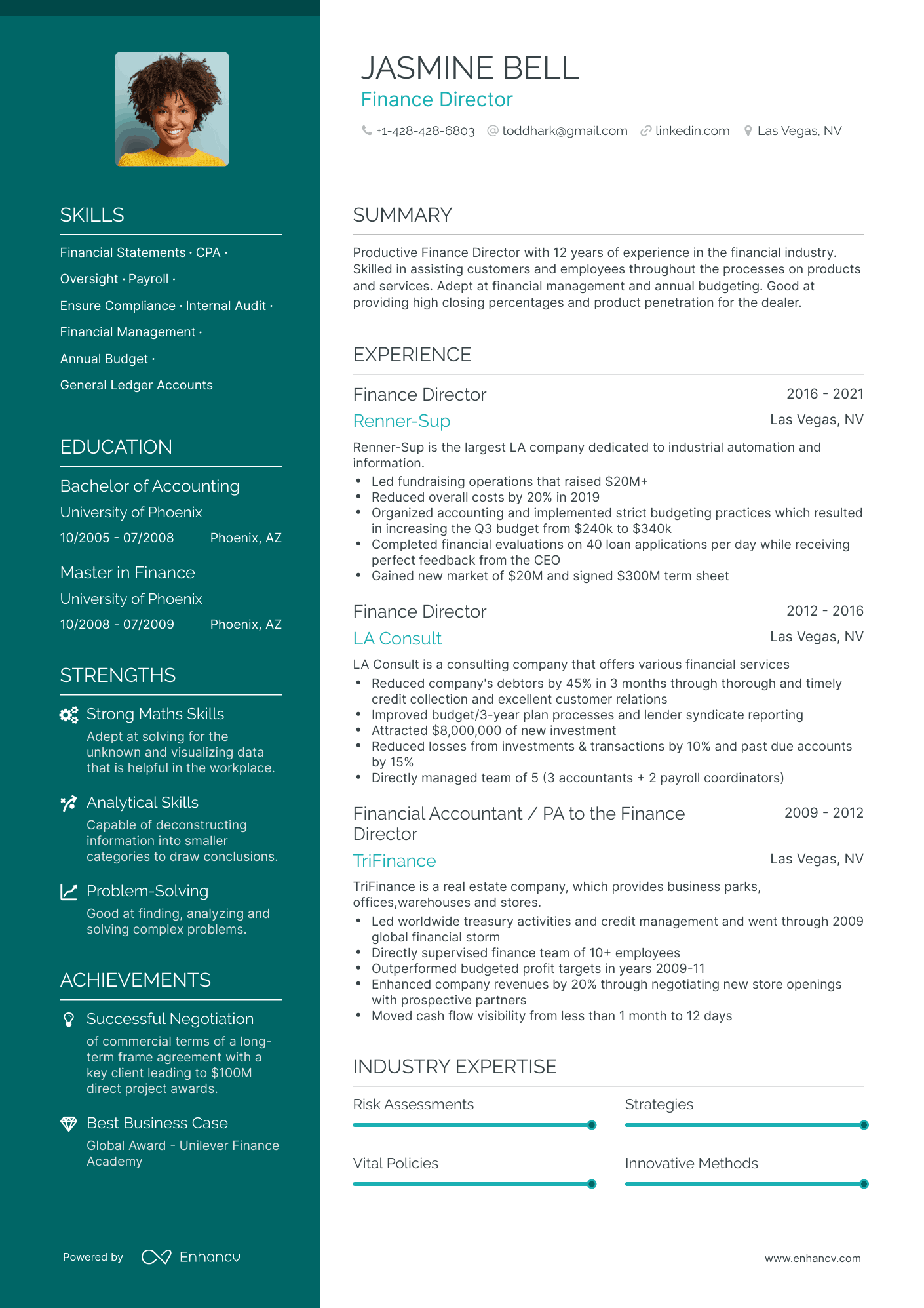

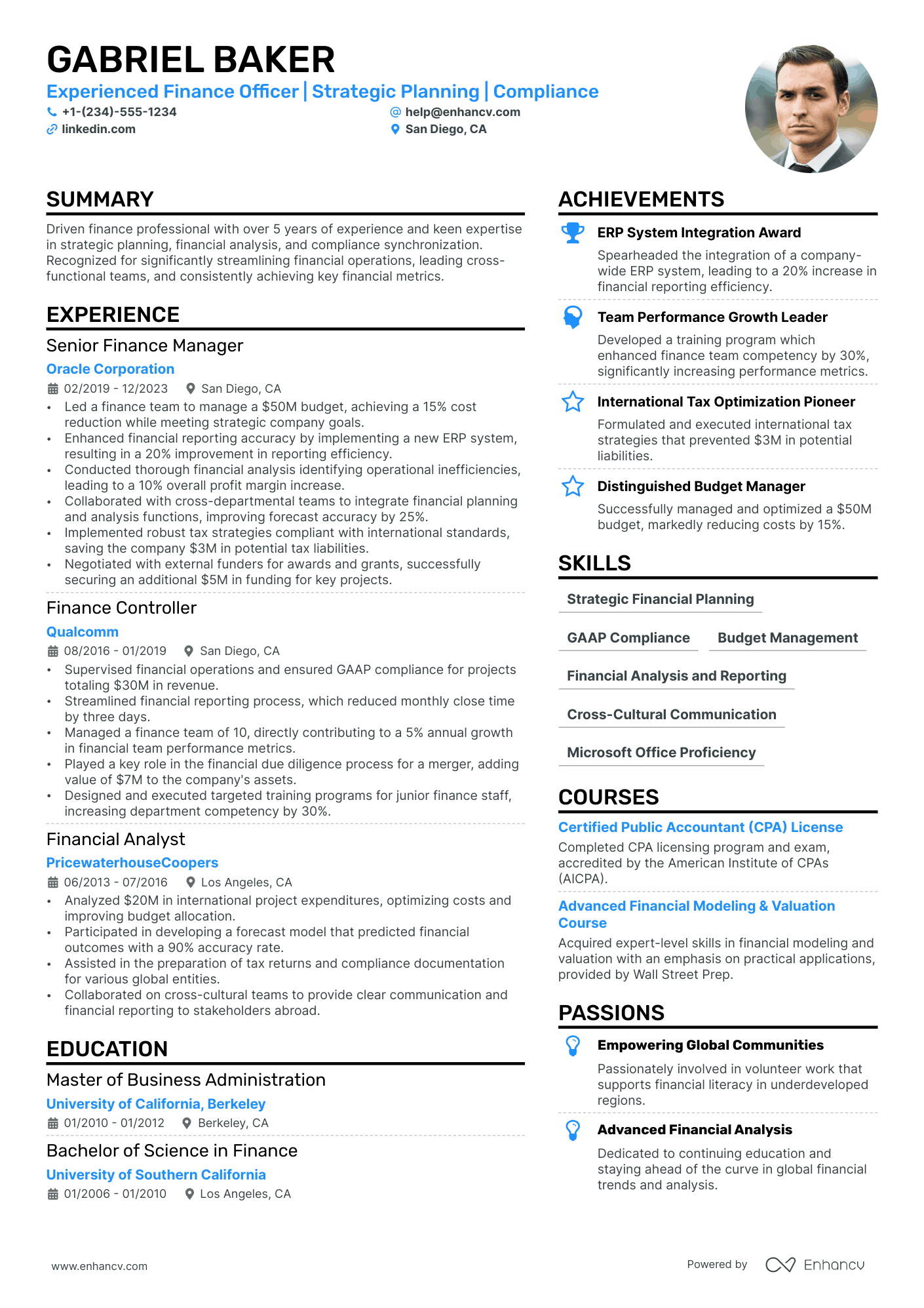

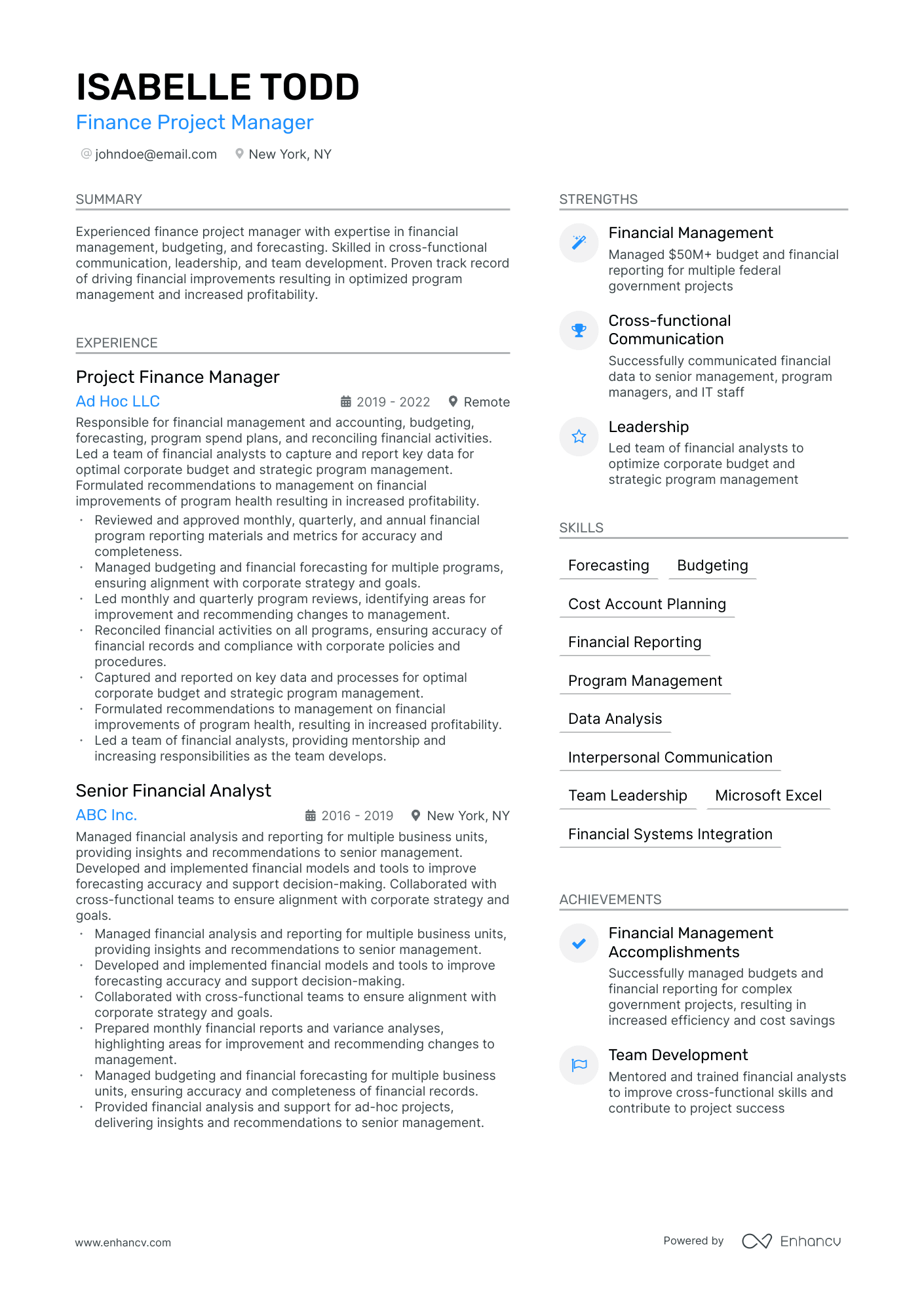

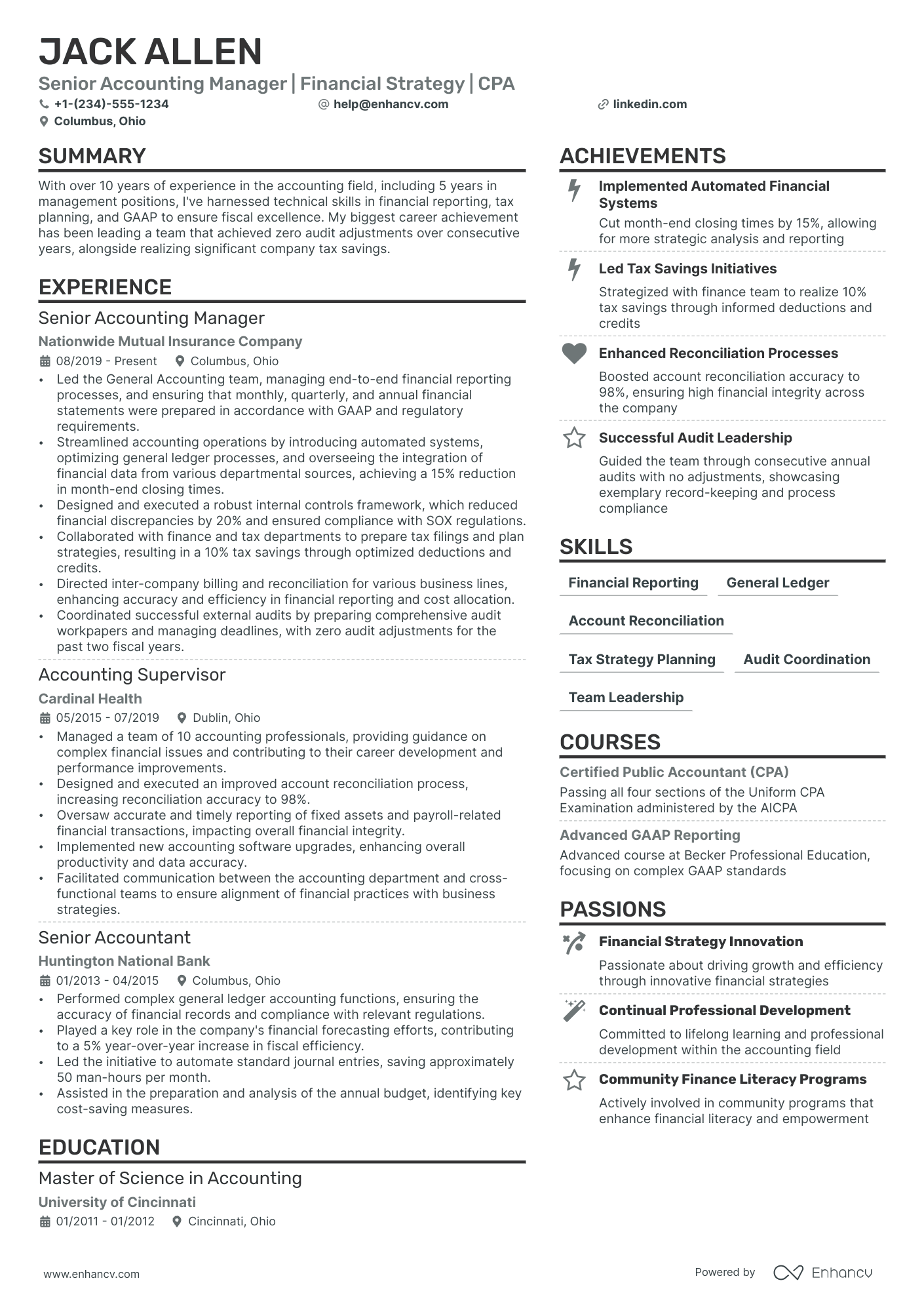

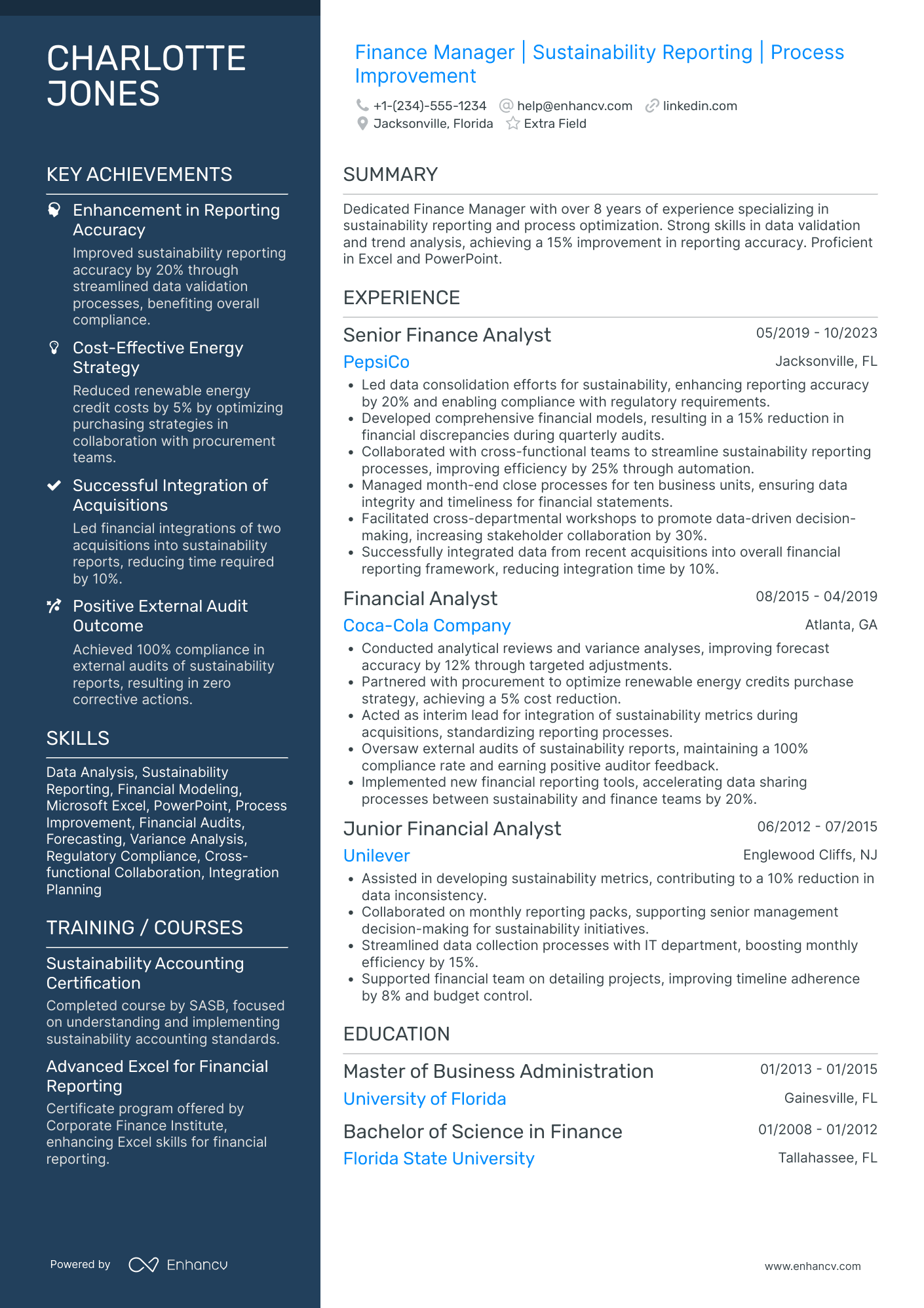

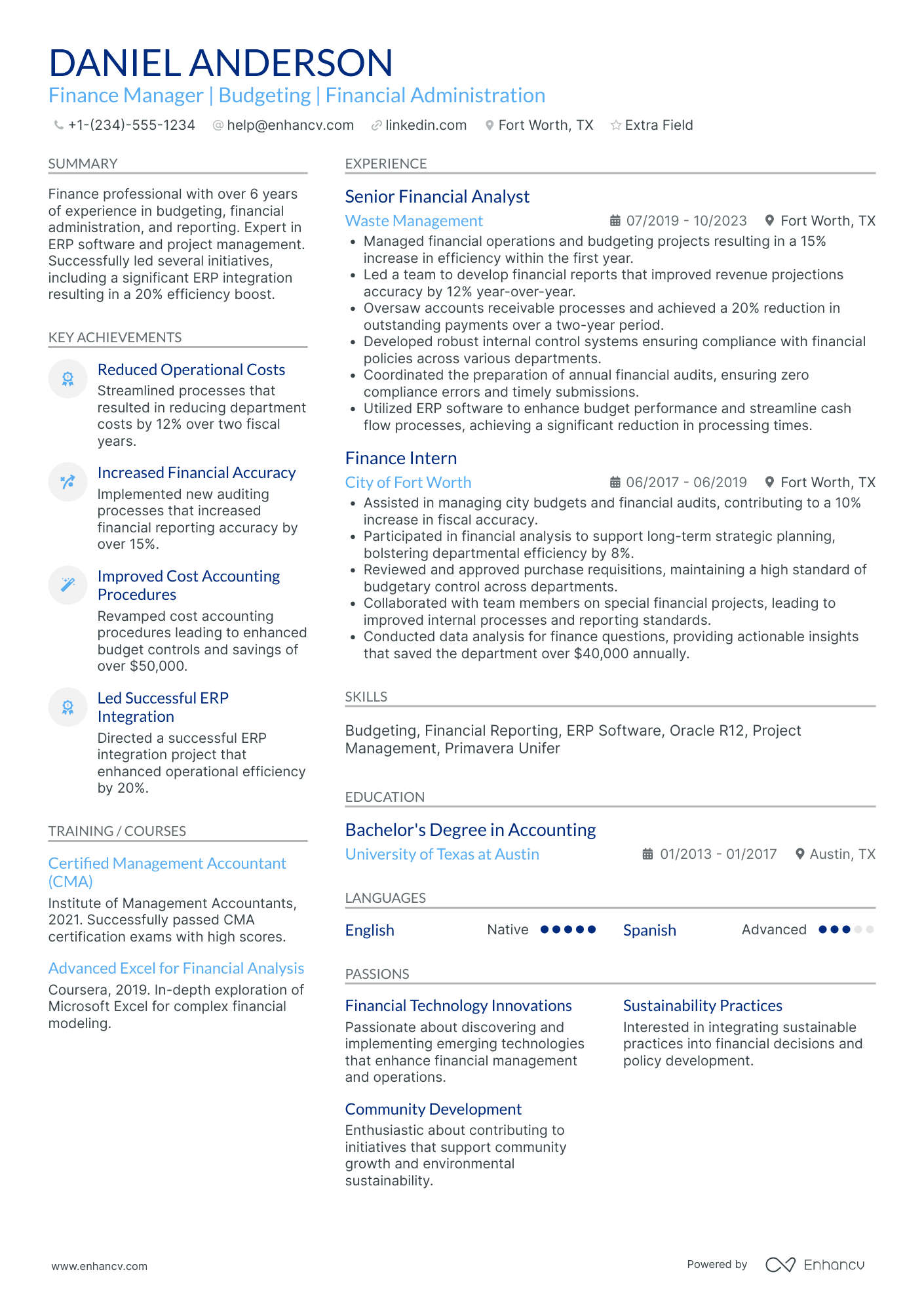

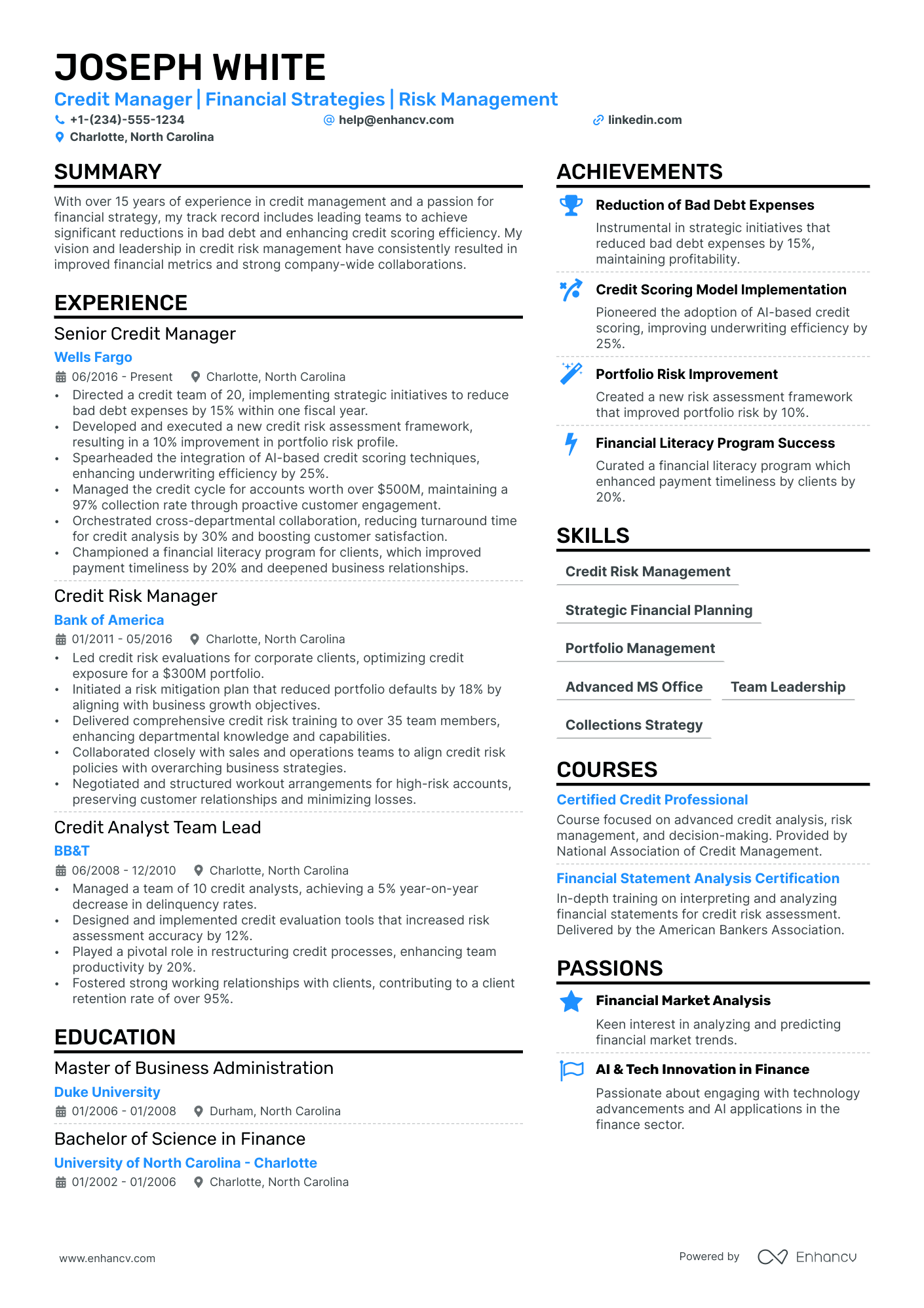

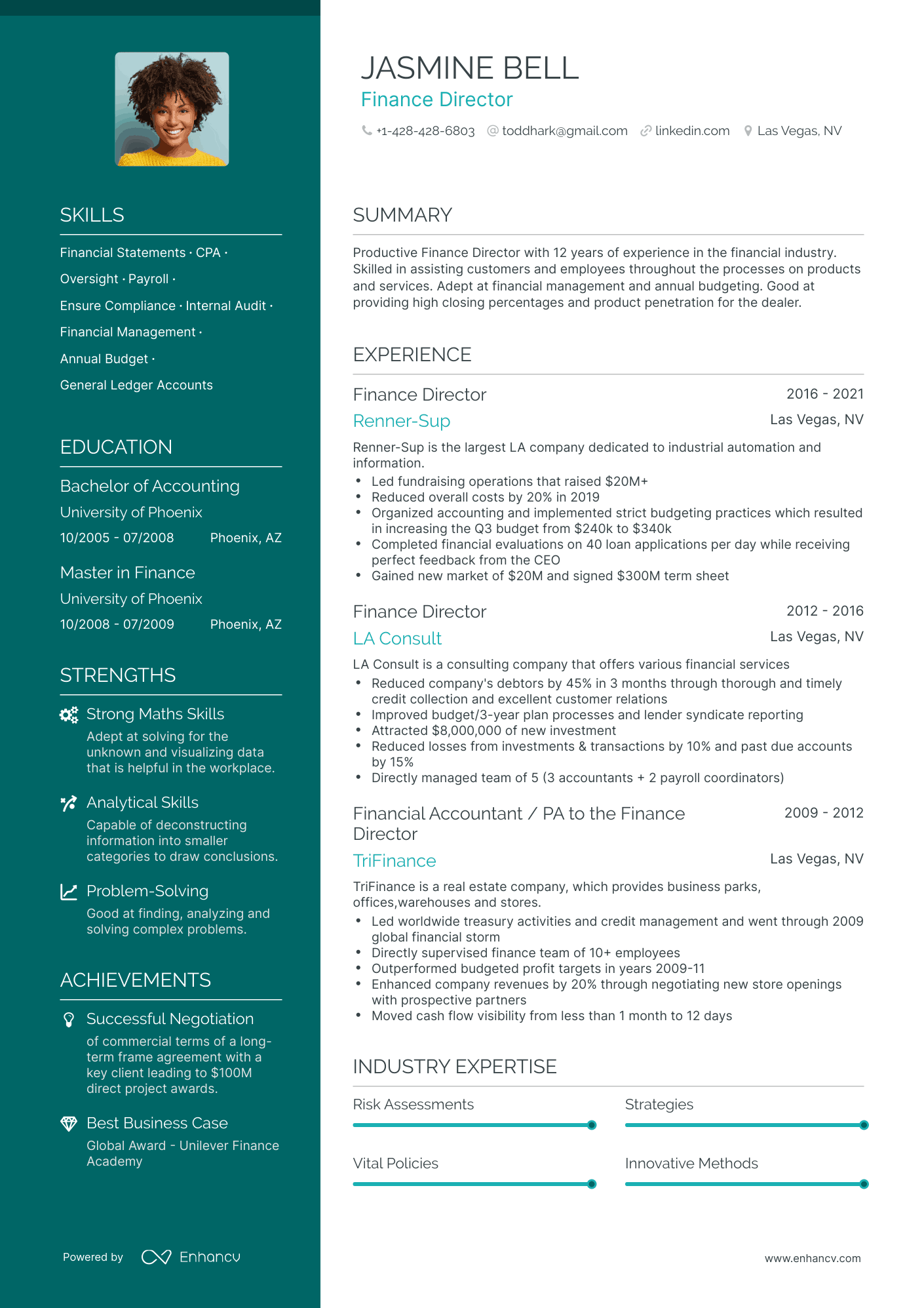

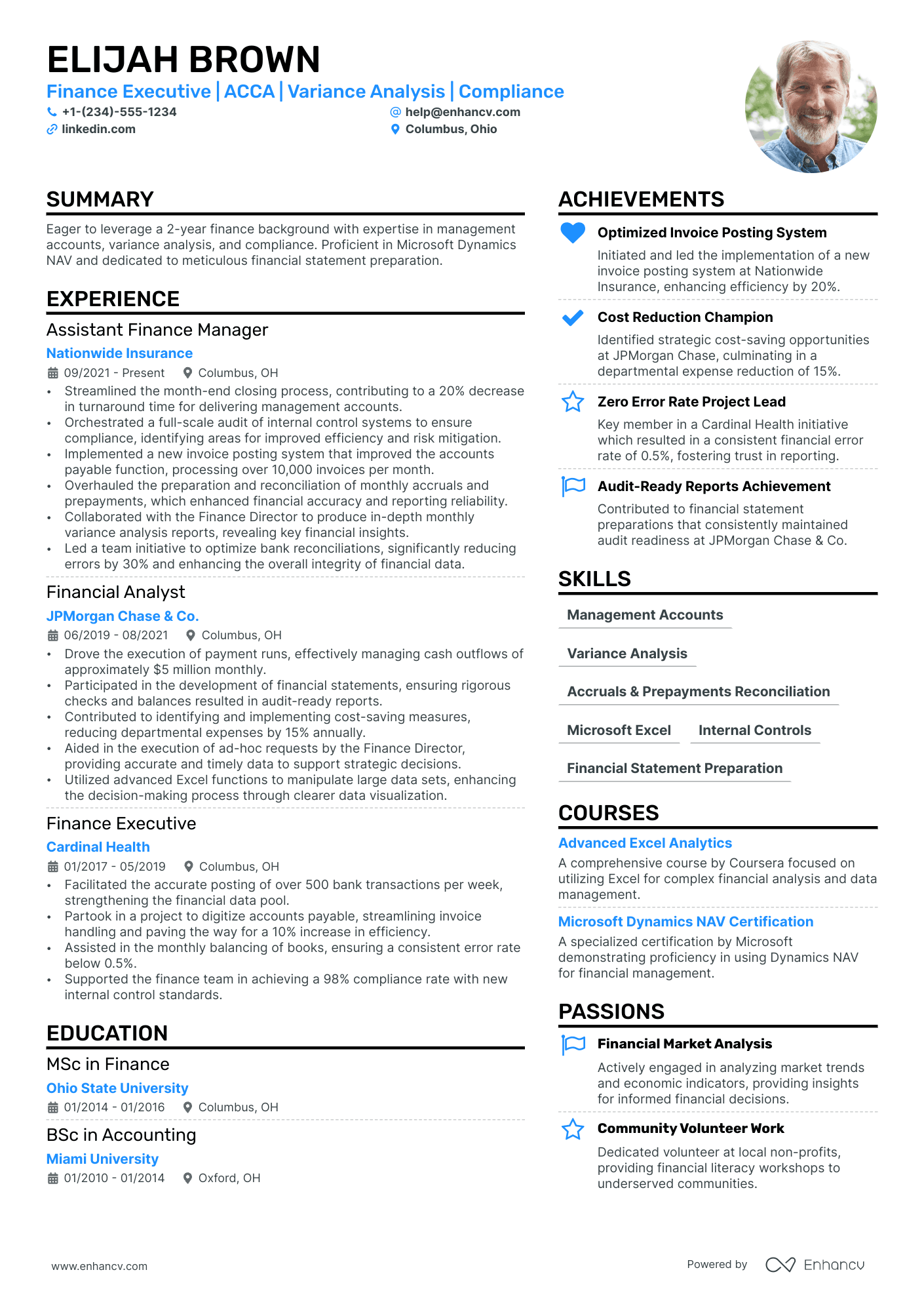

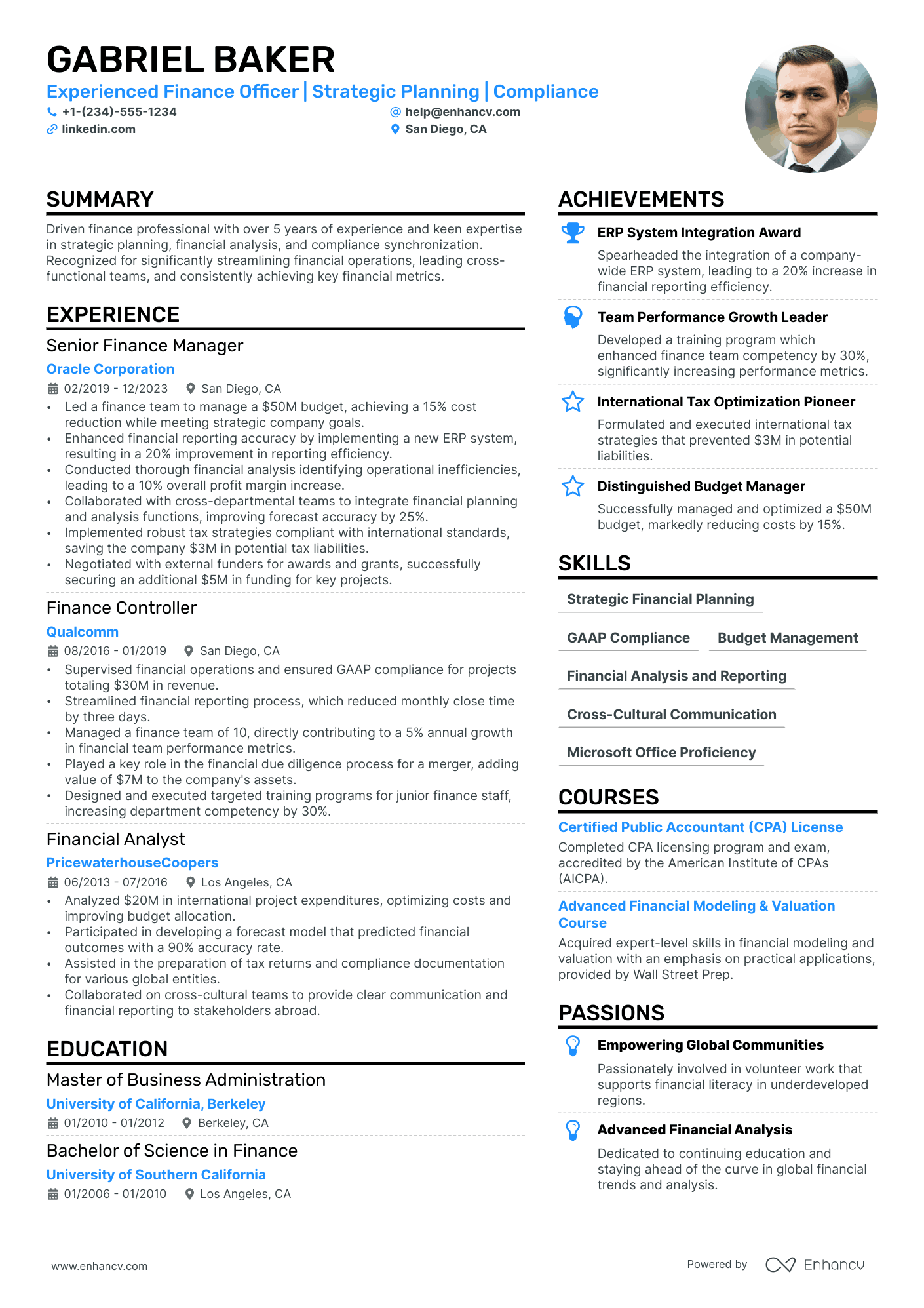

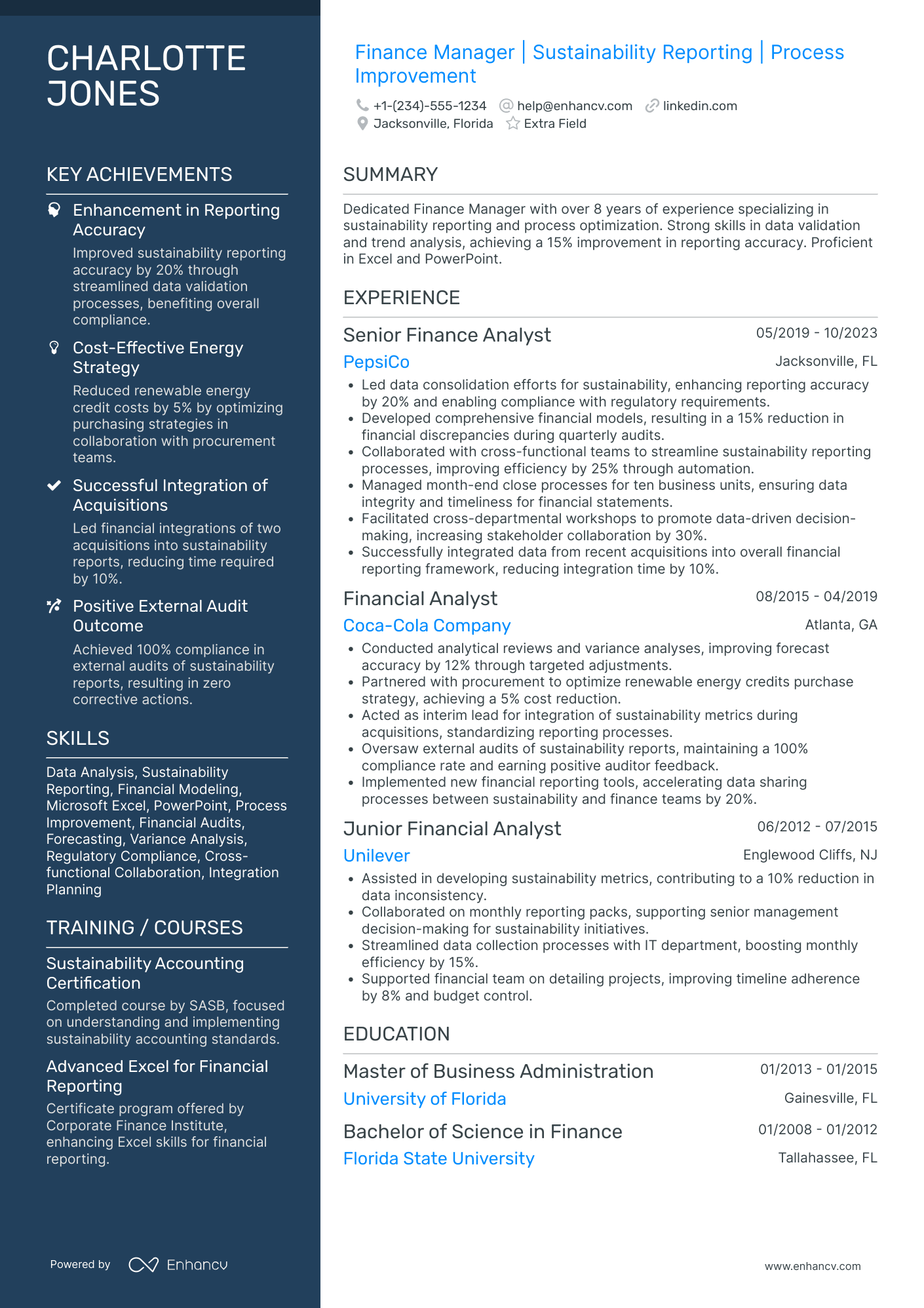

Finance Manager resume examples

By Experience

By Role