Most corporate banking resumes fail because they bury credit and deal impact under generic responsibilities. That costs you in applicant tracking system screening and fast recruiter scans, especially when competition is high.

A strong resume puts outcomes first, so you show what you delivered. Knowing how to make your resume stand out starts with highlighting revenue or fee growth, portfolio size and risk reduction, deal volume and close rate, turnaround time, and client retention. Quantify approvals, covenants, and compliance results.

Key takeaways

- Lead every experience bullet with measurable outcomes like revenue, deal size, or risk reduction.

- Use reverse-chronological format for senior roles to showcase progressive responsibility clearly.

- Tailor resume language to mirror each job posting's exact terminology and priorities.

- Anchor every listed skill to a specific deal, project, or measurable result.

- Place certifications like CFA or FRM near education to reinforce credibility fast.

- Write a three- to four-line summary highlighting your title, domain focus, and top metric.

- Use Enhancv's tools to tighten bullet points and align your resume with specific roles.

Job market snapshot for corporate bankings

We analyzed 136 recent corporate banking job ads across major US job boards. These numbers help you understand industry demand, salary landscape, skills in demand at a glance.

What level of experience employers are looking for corporate bankings

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 5.9% (8) |

| 3–4 years | 8.1% (11) |

| 5–6 years | 8.8% (12) |

| 7–8 years | 6.6% (9) |

| 9–10 years | 6.6% (9) |

| 10+ years | 9.6% (13) |

| Not specified | 60.3% (82) |

Corporate banking ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 100.0% (136) |

Top companies hiring corporate bankings

| Company | Percentage found in job ads |

|---|---|

| PNC Financial Services Group, Inc. | 16.2% (22) |

| Citizens Financial Group, Inc. | 14.0% (19) |

| JPMorgan Chase & Co. | 9.6% (13) |

| Old National Bank | 7.4% (10) |

Role overview stats

These tables show the most common responsibilities and employment types for corporate banking roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a corporate banking

| Responsibility | Percentage found in job ads |

|---|---|

| Financial analysis | 44.9% (61) |

| Financial modeling | 19.1% (26) |

| Portfolio management | 18.4% (25) |

| Credit analysis | 16.2% (22) |

| Credit decisions | 16.2% (22) |

| Office support tools | 16.2% (22) |

| Risk assessments | 16.2% (22) |

| Coaching others | 15.4% (21) |

| Credit analysis and verification | 15.4% (21) |

| Decision making | 15.4% (21) |

| Effective communications | 15.4% (21) |

| Managing multiple priorities | 15.4% (21) |

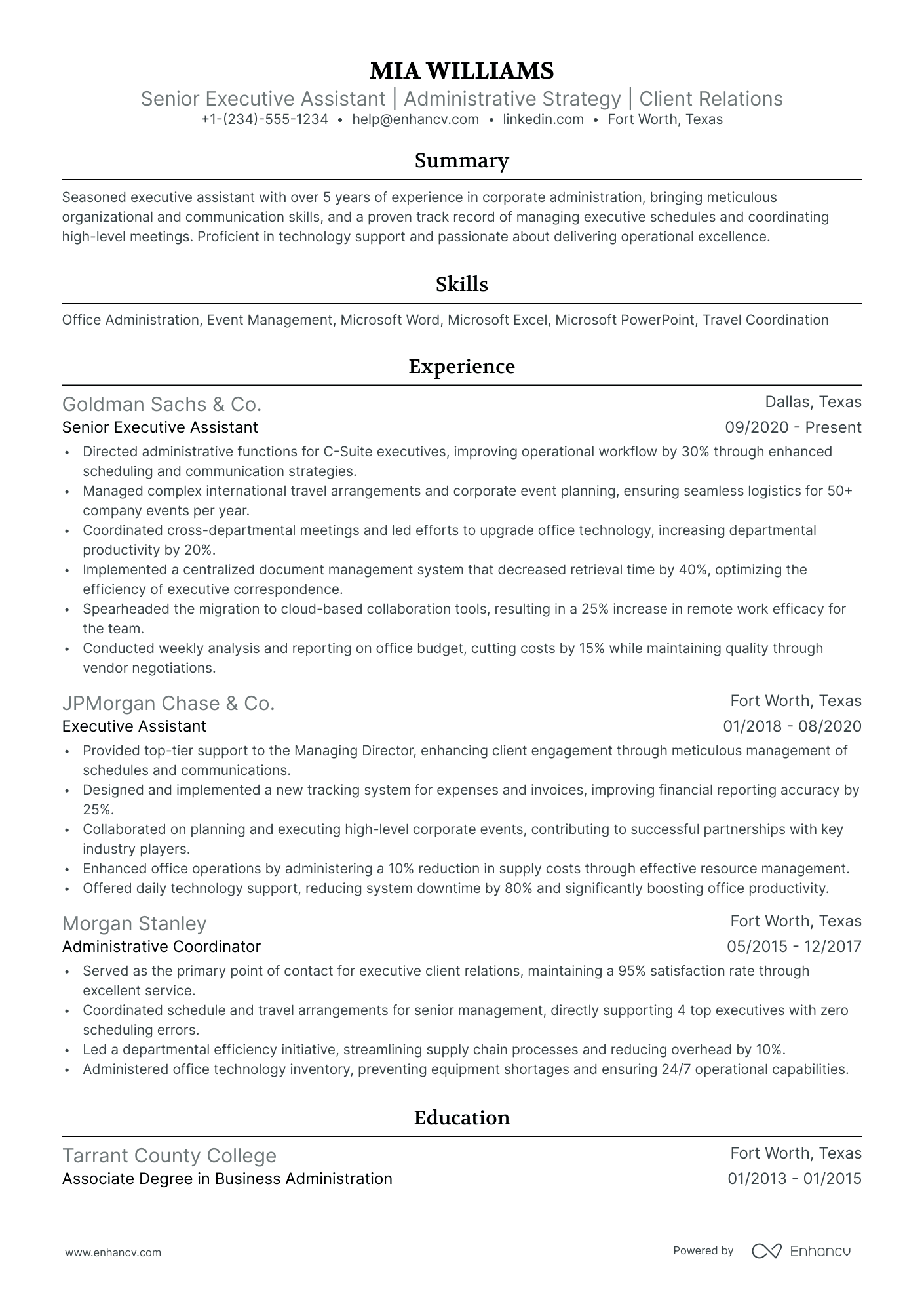

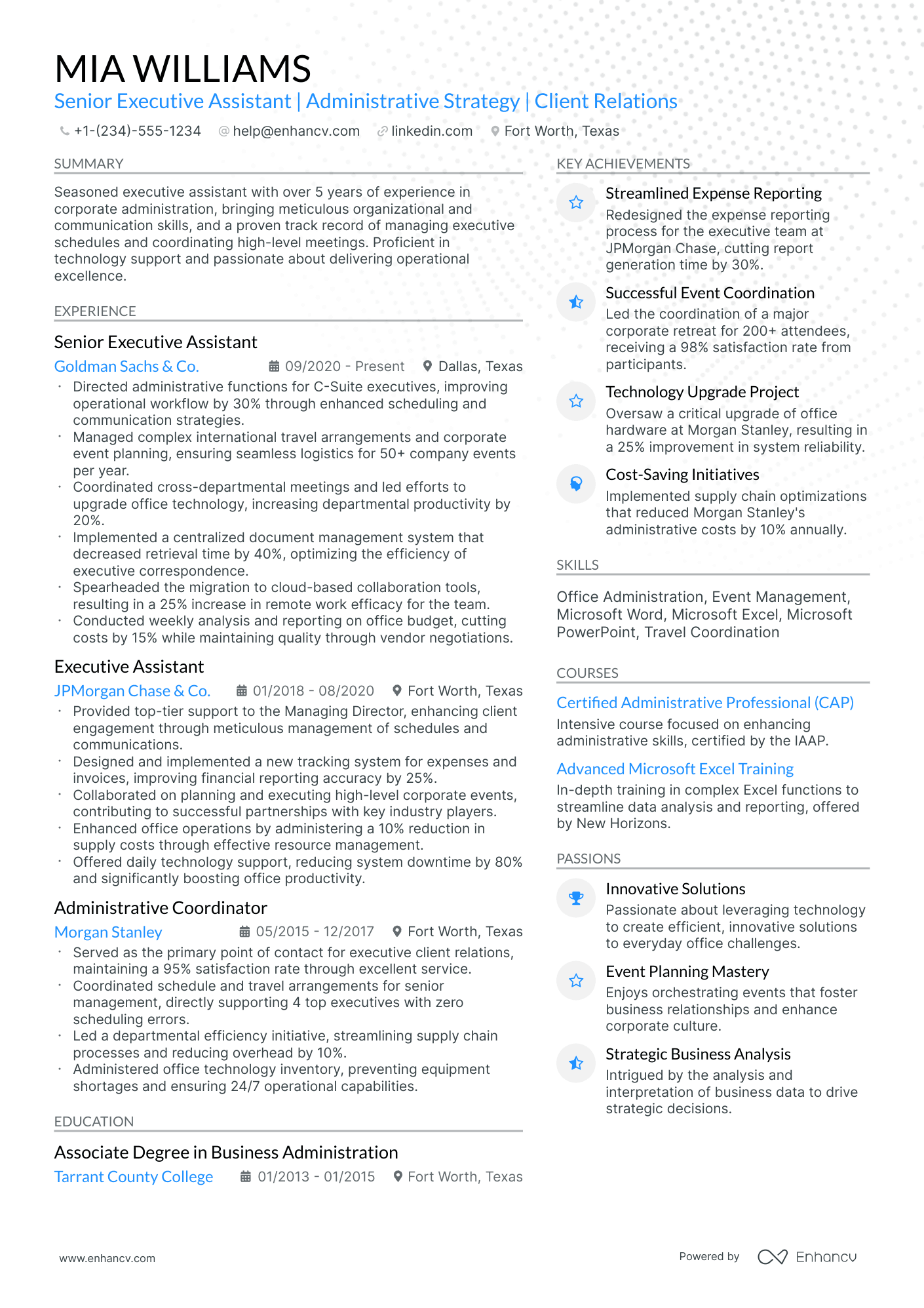

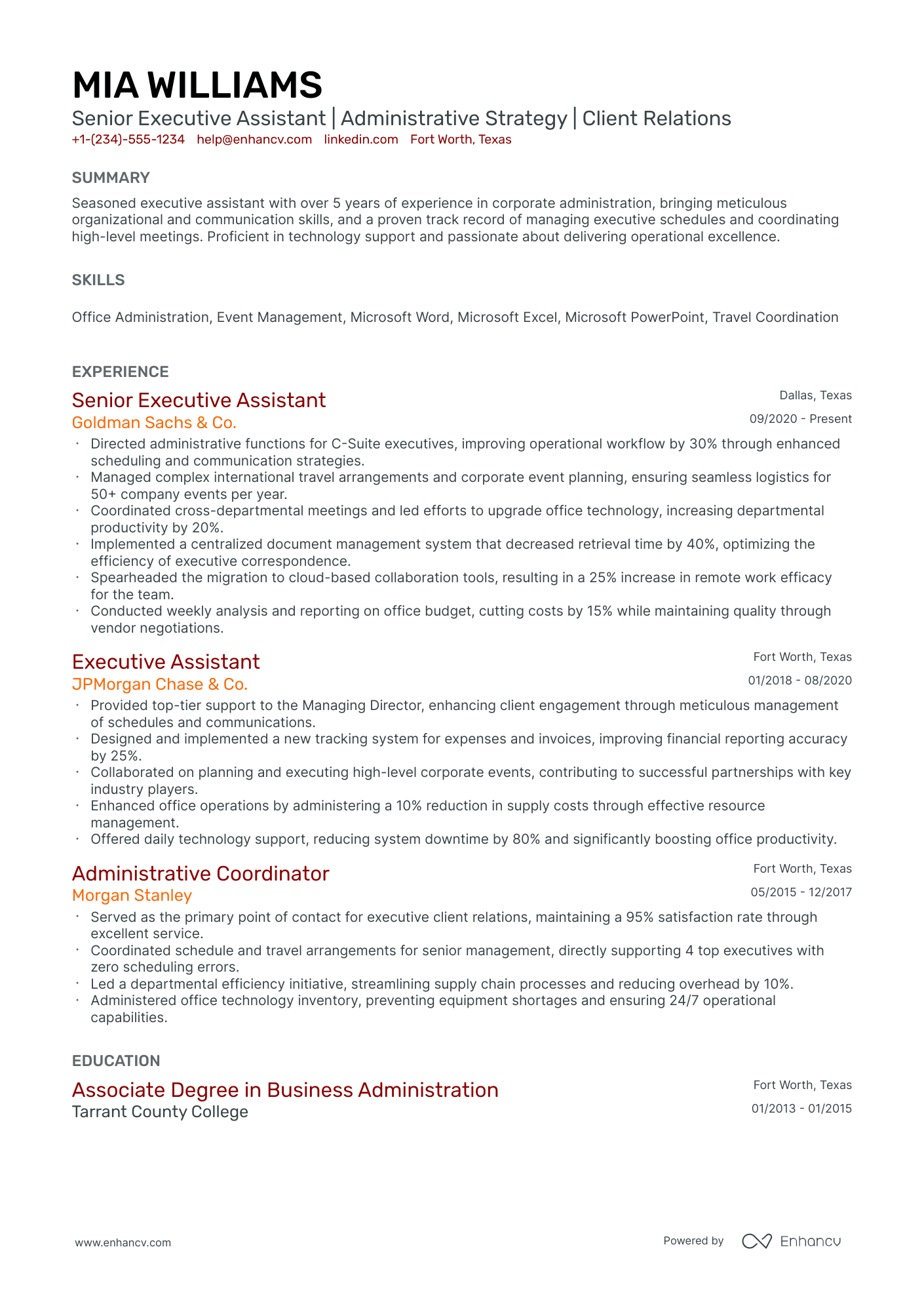

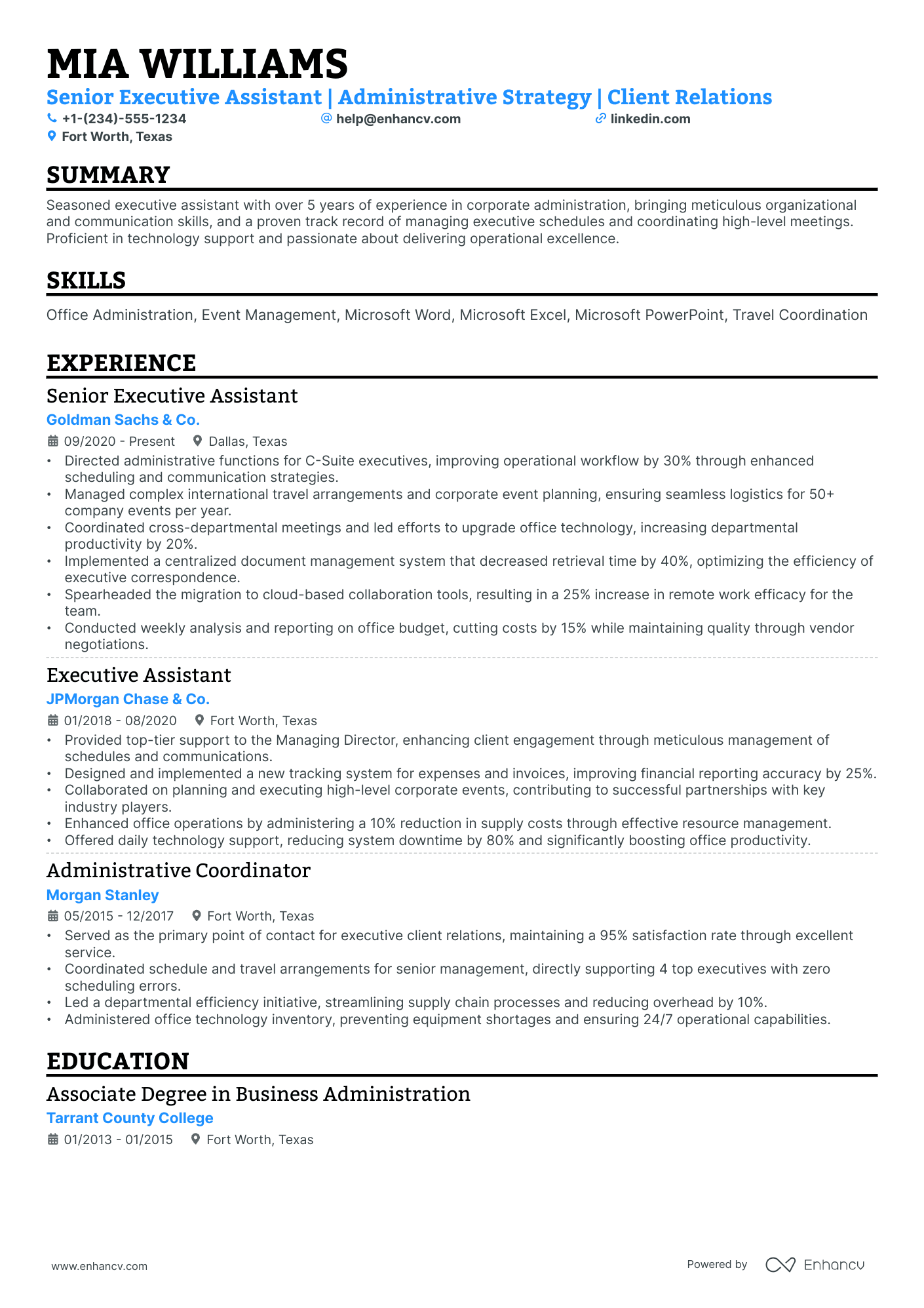

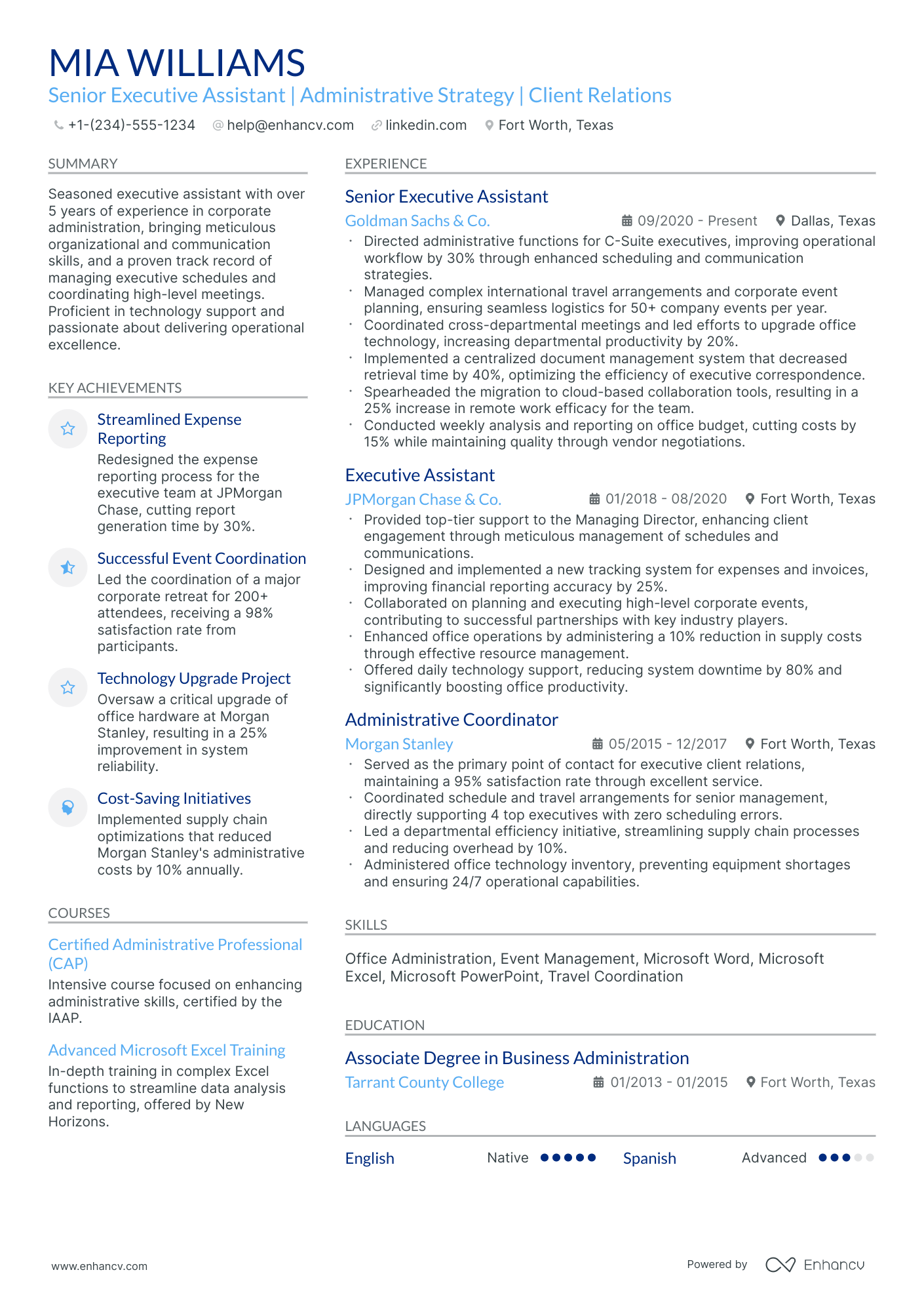

How to format a corporate banking resume

Recruiters evaluating corporate banking resumes prioritize evidence of deal execution, client relationship management, credit analysis depth, and progressive responsibility across increasingly complex transactions. Your resume format must surface these signals immediately—burying them beneath skills lists or non-linear layouts risks losing visibility with both human reviewers and applicant tracking systems.

I have significant experience in corporate banking—which format should I use?

Use a reverse-chronological format to present your corporate banking career in a clear, progression-driven narrative. Do:

- Lead each role entry with scope indicators—portfolio size, client tier (middle-market, large-cap, multinational), and direct reports or cross-functional teams managed.

- Highlight domain-specific expertise including credit structuring, syndicated lending, cash management, debt capital markets, and platforms such as Moody's CreditLens, Bloomberg Terminal, or Salesforce CRM.

- Quantify business impact through deal volume, revenue generated, portfolio growth, or risk metrics improved.

I'm junior or switching into corporate banking—what format works best?

A hybrid format works best, letting you lead with relevant skills and financial competencies while still providing a chronological work history that demonstrates practical application. Do:

- Place a focused skills section near the top covering credit analysis, financial modeling, loan documentation, and regulatory frameworks such as Basel III or IFRS 9.

- Include internships, rotational programs, case competitions, or transitional roles in adjacent fields (commercial lending, equity research, risk advisory) that demonstrate transferable banking knowledge.

- Connect every listed skill or project to a concrete action and a measurable or observable result.

Why hybrid and functional resumes don't work for senior corporate banking roles

Hybrid formats fragment your career trajectory, making it harder for reviewers to assess how your leadership scope, deal complexity, and client accountability grew over time. Functional formats are worse—they strip away the institutional and timeline context that senior banking roles demand, diluting evidence of progression from analyst-level execution to portfolio-level ownership and strategic decision-making. Avoid both formats entirely if you have five or more years of progressive corporate banking experience, as they will undercut the seniority signals hiring committees actively screen for.

- Edge-case exception: A functional format may be acceptable only if you're transitioning into corporate banking from a closely adjacent field (e.g., private credit, treasury management) or returning after an extended career gap—but even then, every listed skill must be anchored to a specific project, deal, or measurable outcome rather than presented in isolation.

Once you've established a clean, professional layout, the next step is filling it with the right sections to showcase your qualifications effectively.

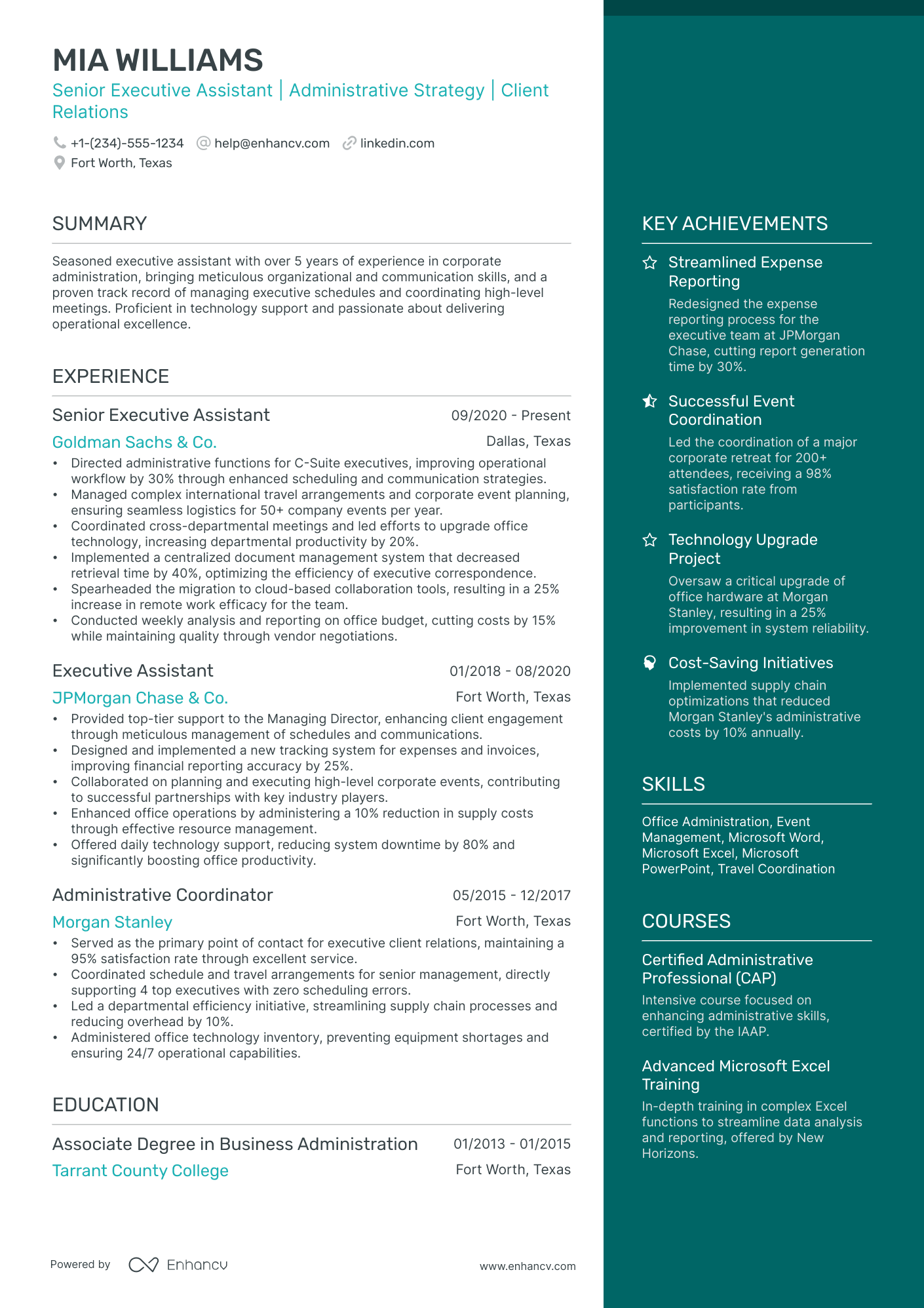

What sections should go on a corporate banking resume

Recruiters expect a clean, finance-first resume that highlights deal exposure, client impact, and measurable results. Understanding what to put on a resume for corporate banking roles ensures you prioritize the right content.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize revenue impact, portfolio size, credit risk outcomes, deal scope, and your role in originating, structuring, underwriting, and executing transactions.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right structure and supporting sections, you can focus on writing your corporate banking experience in a way that fits that framework.

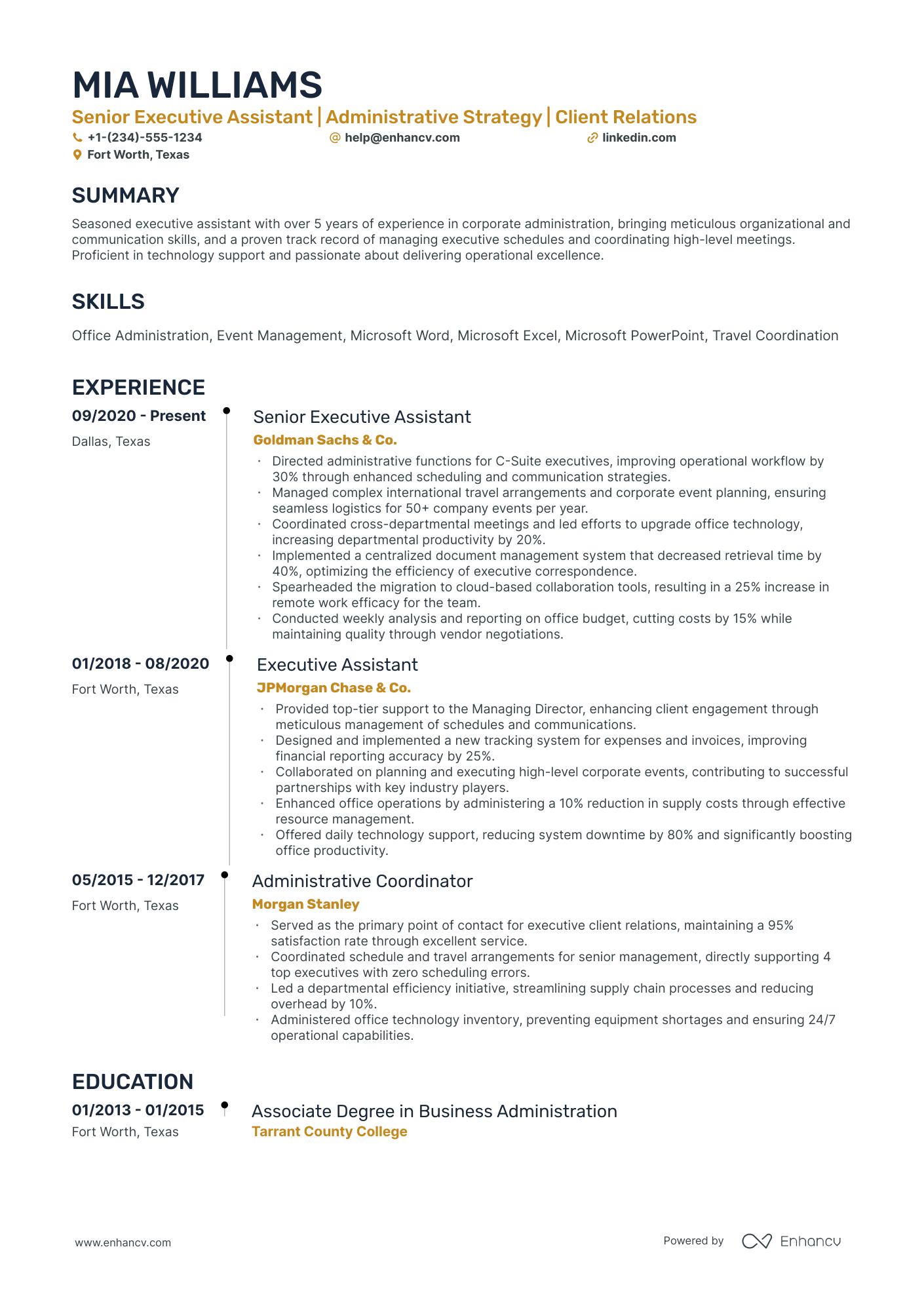

How to write your corporate banking resume experience

The work experience section of your corporate banking resume should highlight the deals you've closed, the financial structures you've built, and the measurable outcomes you've delivered for institutional clients. Hiring managers in corporate banking prioritize demonstrated impact—revenue generated, portfolios managed, risk mitigated—over descriptive task lists that merely outline day-to-day responsibilities.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the client portfolios, lending products, credit facilities, syndicated deals, or industry verticals you were directly accountable for managing or originating.

- Execution approach: the financial modeling techniques, credit analysis frameworks, risk assessment methodologies, or regulatory compliance tools you used to structure transactions and inform lending decisions.

- Value improved: changes to portfolio quality, credit risk exposure, deal turnaround time, client retention, underwriting accuracy, or covenant structuring that strengthened the bank's position or the client relationship.

- Collaboration context: how you worked with credit committees, risk management teams, treasury departments, legal counsel, relationship managers, or C-suite clients to advance complex transactions and maintain compliance.

- Impact delivered: outcomes expressed through loan book growth, fee income contribution, default rate reduction, deal volume, or strategic client acquisition rather than routine banking activities.

Experience bullet formula

A corporate banking experience example

✅ Right example - modern, quantified, specific.

Senior Corporate Banking Relationship Manager

JPMorgan Chase | Chicago, IL

2021–Present

Managed a $1.2B middle-market portfolio across manufacturing, logistics, and business services with integrated lending, treasury, and risk solutions.

- Originated and closed $410M in new credit commitments across revolving credit facilities, term loans, and asset-based lending, increasing portfolio revenue 18% year over year through risk-adjusted pricing and cross-sell of treasury services.

- Structured and renewed thirty-two facilities using Moody’s Analytics RiskAnalyst, Bloomberg, and internal credit models, reducing approval cycle time 22% by standardizing covenant packages and underwriting memos in the credit workflow system.

- Partnered with treasury management and payments product teams to implement host-to-host file transmission, SWIFT, and API-based cash reporting for twelve clients, lifting operating deposit balances 14% and cutting payment exception rates 28%.

- Led quarterly portfolio stress testing and covenant monitoring in Salesforce and the loan servicing platform, lowering past-due exposure 35% by triggering early-warning reviews and executing proactive amendments with credit risk and legal.

- Coordinated with client finance leaders, credit risk, loan operations, and counsel to close nine syndicated transactions totaling $260M, improving documentation accuracy to 99% and reducing post-close remediation hours 30%.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match the specific role you're targeting.

How to tailor your corporate banking resume experience

Recruiters evaluate corporate banking resumes through both human review and applicant tracking systems (ATS). Tailoring your resume to the job description helps you pass both screenings.

Ways to tailor your corporate banking experience:

- Match credit analysis platforms and financial modeling tools listed in the posting.

- Mirror the exact terminology used for loan structuring or syndication processes.

- Reflect portfolio size and revenue KPIs the role prioritizes.

- Highlight regulatory compliance frameworks referenced such as Basel III or SOX.

- Emphasize industry verticals like energy or healthcare when the role specifies them.

- Align your deal execution workflow language with the job description phrasing.

- Incorporate risk assessment methodologies the posting names as requirements.

- Reference cross-functional collaboration with treasury or capital markets teams when relevant.

Tailoring means aligning your real accomplishments with what the role demands, not forcing keywords where they don't belong.

Resume tailoring examples for corporate banking

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| "Structure and execute syndicated loan facilities for investment-grade and sub-investment-grade clients, coordinating with credit risk, legal, and compliance teams." | Worked on loan transactions and helped manage client relationships across departments. | Structured and executed over $2.5B in syndicated loan facilities for investment-grade and sub-investment-grade borrowers, coordinating directly with credit risk, legal, and compliance teams to ensure timely close. |

| "Perform detailed financial modeling and credit analysis using Moody's RiskCalc and Bloomberg Terminal to assess counterparty risk for corporate lending portfolios exceeding $500M." | Conducted financial analysis and created models to support lending decisions. | Built discounted cash flow and leverage models in Moody's RiskCalc and Bloomberg Terminal to assess counterparty risk across a $750M corporate lending portfolio, reducing credit losses by 12% year over year. |

| "Manage day-to-day client coverage for Fortune 500 corporate banking relationships, driving cross-sell of treasury management, FX hedging, and debt capital markets products." | Maintained client accounts and identified opportunities for additional services. | Managed primary coverage for eight Fortune 500 corporate banking relationships, cross-selling treasury management, FX hedging, and debt capital markets products that generated $18M in incremental annual revenue. |

Once you’ve aligned your experience with the role’s priorities, quantify your corporate banking achievements to show the measurable impact behind those contributions.

How to quantify your corporate banking achievements

Quantifying your achievements proves business impact in corporate banking and builds credibility with hiring teams. Focus on revenue, risk, compliance, deal volume, turnaround time, and accuracy—plus portfolio size, client retention, and credit quality.

Quantifying examples for corporate banking

| Metric | Example |

|---|---|

| Revenue growth | "Generated $4.2M in annual fee and interest revenue by expanding wallet share across 12 middle-market clients using Salesforce pipeline tracking." |

| Risk reduction | "Reduced criticized exposure by 18% ($27M) by tightening covenant monitoring and escalating early-warning triggers in Moody's RiskAnalyst." |

| Cycle time | "Cut credit approval turnaround from 12 to seven business days by standardizing underwriting templates and coordinating weekly deal huddles with credit and legal." |

| Compliance accuracy | "Achieved 99.6% documentation accuracy across 85 loan closings by implementing a closing checklist and reconciling exceptions in nCino." |

| Volume handled | "Managed $620M portfolio across 34 corporate clients while processing 160+ annual reviews and renewals with zero missed deadlines." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points for your experience section, the next step is ensuring your skills section effectively showcases the hard and soft skills that corporate banking employers prioritize.

How to list your hard and soft skills on a corporate banking resume

Your skills section matters in corporate banking because it signals your ability to evaluate credit risk, structure deals, and manage client relationships, and recruiters and an ATS (applicant tracking system) scan this section for role match—aim for a balanced mix of hard skills and soft skills. corporate banking roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Credit analysis, underwriting

- Financial statement analysis

- Cash flow modeling, forecasting

- Loan structuring, pricing

- Debt capital markets execution

- Syndicated loans, club deals

- Covenant analysis, compliance monitoring

- Portfolio management, risk grading

- Know your customer, anti-money laundering

- Bloomberg, Refinitiv Eikon

- Microsoft Excel, PowerPoint

- Salesforce, DealCloud

Soft skills

- Lead client discovery calls

- Translate needs into solutions

- Present credit recommendations clearly

- Partner with product specialists

- Coordinate legal and credit stakeholders

- Negotiate terms and covenants

- Manage competing deal priorities

- Escalate risks early and directly

- Write concise credit narratives

- Own deliverables end-to-end

- Make data-backed tradeoffs

- Build trust with treasurers and CFOs

How to show your corporate banking skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how banking professionals weave competencies throughout their documents.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Corporate banking director with 12 years structuring syndicated loans and credit facilities for Fortune 500 clients. Skilled in financial modeling, risk assessment, and relationship management. Grew portfolio revenue 34% while maintaining a sub-1% default rate.

- Signals senior-level expertise immediately

- Names role-relevant tools and methods

- Leads with a concrete metric

- Highlights client relationship soft skills

Experience example

Vice President, Corporate Banking

Meridian Capital Group | Chicago, IL

March 2019–Present

- Structured $2.1B in syndicated credit facilities using cash flow modeling, collaborating with risk and legal teams to accelerate closings by 18%.

- Led a six-person analyst team that underwrote 40+ leveraged transactions annually, reducing portfolio loss provisions by 22%.

- Partnered with treasury solutions and sales teams to cross-sell deposit products, generating $4.6M in incremental annual fee income.

- Every bullet includes measurable proof

- Skills surface naturally through real outcomes

Once you’ve tied your abilities to real outcomes and responsibilities, the next step is to apply that approach to a corporate banking resume when you don’t have direct experience.

How do I write a corporate banking resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Finance case competitions

- Credit analysis class projects

- Student-managed investment fund

- Corporate finance modeling coursework

- Treasury or accounting internships

- Commercial banking job shadowing

- Pro bono financial consulting

If you're building a resume without work experience, focus on:

- Financial modeling with Excel outputs

- Credit memos and risk rationale

- Industry research tied to ratios

- Deal support tasks and accuracy

Resume format tip for entry-level corporate banking

Use a skills-based resume format because it highlights corporate banking skills, projects, and coursework before limited work history. Do:

- Lead with a corporate banking skills section.

- Add two to three project bullets.

- Quantify results with clear metrics.

- Mirror keywords from job postings.

- List relevant tools under skills.

- Built a three-statement model in Excel for a $250M revenue manufacturer, analyzed leverage and coverage ratios, and recommended a $15M revolver with two risk mitigants.

Even without direct experience, your education section can carry significant weight on a corporate banking resume—so presenting it strategically is essential.

How to list your education on a corporate banking resume

Your education section helps hiring teams confirm you have the foundational knowledge corporate banking demands. It validates your academic background in finance, accounting, or economics quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to corporate banking:

Example education entry

Bachelor of Science in Finance

New York University, Stern School of Business — New York, NY

Graduated 2022 | GPA: 3.8/4.0

- Relevant Coursework: Corporate Valuation, Credit Risk Analysis, Financial Modeling, Mergers & Acquisitions

- Honors: Magna Cum Laude, Dean's List (all semesters)

How to list your certifications on a corporate banking resume

Certifications on your resume show your commitment to learning, prove tool proficiency, and signal industry relevance in corporate banking. They also help recruiters confirm you meet role requirements fast.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they're older, less relevant, or you already have strong corporate banking experience.

- Place certifications above education when they're recent, highly relevant to corporate banking, or they fill a skills gap for the role.

Best certifications for your corporate banking resume

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Treasury Professional (CTP)

- Certified Public Accountant (CPA)

- Chartered Alternative Investment Analyst (CAIA)

- Bloomberg Market Concepts (BMC)

- Series 79 (Investment Banking Representative)

Once you’ve positioned your credentials where recruiters can find them quickly, use your corporate banking resume summary to tie those qualifications to your value at a glance.

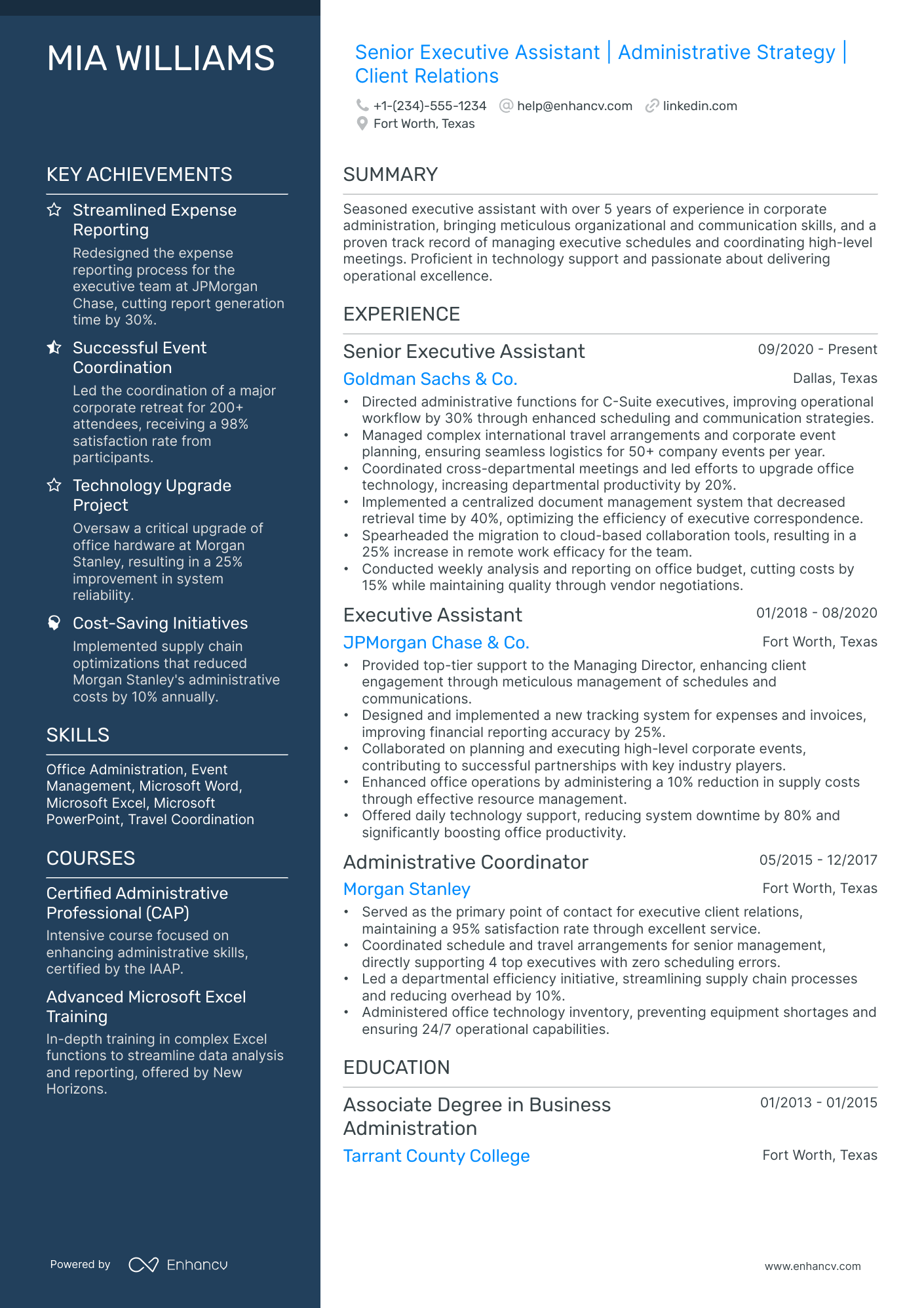

How to write your corporate banking resume summary

Your resume summary is the first thing a recruiter reads. A sharp, specific opening signals you understand corporate banking and can deliver results.

Keep it to three to four lines, with:

- Your title and total years of corporate banking experience.

- Domain focus such as credit analysis, debt structuring, or relationship management.

- Core skills like financial modeling, risk assessment, or loan syndication.

- One or two measurable achievements tied to portfolio growth or deal execution.

- Soft skills demonstrated through real outcomes, such as client retention or cross-functional coordination.

PRO TIP

At the junior level, lead with relevant skills, tools, and early wins that show you can contribute fast. Avoid vague claims like "passionate team player" or "motivated self-starter." Instead, anchor every line in something specific and verifiable.

Example summary for a corporate banking

Corporate banking analyst with two years of experience in credit risk and financial modeling. Supported $120M in loan originations and reduced underwriting turnaround time by 15% through improved documentation workflows.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your corporate banking expertise at a glance, make sure the header above it presents your contact details clearly so recruiters can actually reach you.

What to include in a corporate banking resume header

A resume header is the top section with your identity and contacts, and it drives visibility, credibility, and recruiter screening in corporate banking.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters confirm your experience fast and supports screening against role requirements.

Don't include a photo on a corporate banking resume unless the role is explicitly front-facing or appearance-dependent.

Keep your corporate banking header consistent with your application, use one professional name format, and match your job title to the posting.

Corporate banking resume header

Jordan Taylor

Corporate Banking Analyst | Credit Analysis, Financial Modeling, Client Coverage

New York, NY

(212) 555-01XX

your.name@enhancv.com

github.com/yourname

yourwebsite.com

linkedin.com/in/yourname

With your identifying details and key links clearly presented at the top, the next step is to add additional sections that reinforce your qualifications and round out the rest of your corporate banking resume.

Additional sections for corporate banking resumes

When your core sections look similar to other applicants, additional sections can set you apart and reinforce your credibility in corporate banking. For example, listing language skills can demonstrate your ability to work with multinational clients and cross-border teams.

- Languages

- Certifications and licenses

- Industry publications

- Professional affiliations

- Volunteer experience in financial literacy

- Awards and honors

- Conference presentations

Once you've strengthened your resume with the right supplementary sections, the next step is pairing it with a cover letter that reinforces your candidacy.

Do corporate banking resumes need a cover letter

Corporate banking resumes don't always need a cover letter, but it helps in competitive roles or firms that expect one. If you're unsure what a cover letter is and when it adds value, it can make a difference when your resume needs context, or when hiring teams compare similar backgrounds.

Use these guidelines to decide when to include one and what to say:

- Explain role and team fit by linking your experience to the group's focus, such as credit, treasury, syndications, or relationship management.

- Highlight one or two outcomes with numbers, such as improved underwriting turnaround time or reduced exceptions through better covenant tracking.

- Show you understand the product and users by referencing how corporate banking clients use credit facilities, cash management, and liquidity tools.

- Address career transitions or non-obvious experience by connecting your prior work to corporate banking skills, such as risk, analysis, and client communication.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you choose to submit a cover letter, using AI to improve your corporate banking resume helps you tailor your content faster and more consistently for each role.

Using AI to improve your corporate banking resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight results. But overuse strips authenticity. Once your content is clear and role-aligned, step away from AI. For practical prompt ideas, check out this guide on ChatGPT resume writing.

Here are 10 practical prompts to strengthen specific sections of your corporate banking resume:

Strengthen your summary

Quantify experience bullets

Tighten action verbs

Align skills section

Refine project descriptions

Improve education relevance

Clarify certification entries

Remove redundant phrasing

Tailor for specific roles

Check consistency throughout

Conclusion

A strong corporate banking resume proves impact with measurable outcomes, highlights role-specific skills, and follows a clear structure that’s easy to scan. Use concise bullets, consistent formatting, and precise language to show results, judgment, and client focus.

Hiring teams still prioritize clarity, accountability, and performance, and they’ll keep doing so as expectations evolve. When your corporate banking resume connects outcomes to core responsibilities, it signals readiness for today’s roles and the next step.