If AI advances, will it automate entry-level finance jobs?

What happens to the finance market if the economy dips?

How will cryptocurrency popularity impact the industry?

These questions reflect common concerns in banking. It's true that working in a bank can be stressful with all the risk and compliance issues. The industry is always changing, and keeping up can be a challenge.

Despite these concerns, job opportunities in finance are still projected to grow by 3.65% over the next 10 years, indicating that adapting to ongoing changes will be crucial for success.

For a career in banking, your resume must be as clear and detailed as a financial statement.

This guide will walk you through the process step-by-step. By the end, you'll have a banking resume that reflects your financial skills and impresses hiring managers. Here’s a quick look.

Key takeaways

- The reverse-chronological format provides a clear view of your banking career progression.

- A clean design with light colors and an eye-catching font can help your banking resume get noticed.

- Emphasize your experience section with measurable achievements and specific results to grab hiring managers' attention.

- Use metrics to showcase the impact of your banking work.

- Dedicate a section to your technical banking skills, and seamlessly incorporate your soft skills throughout the resume.

- A relevant educational background is important in banking and will always be appreciated.

Starting with the basics, here are the core principles for successful resume formatting.

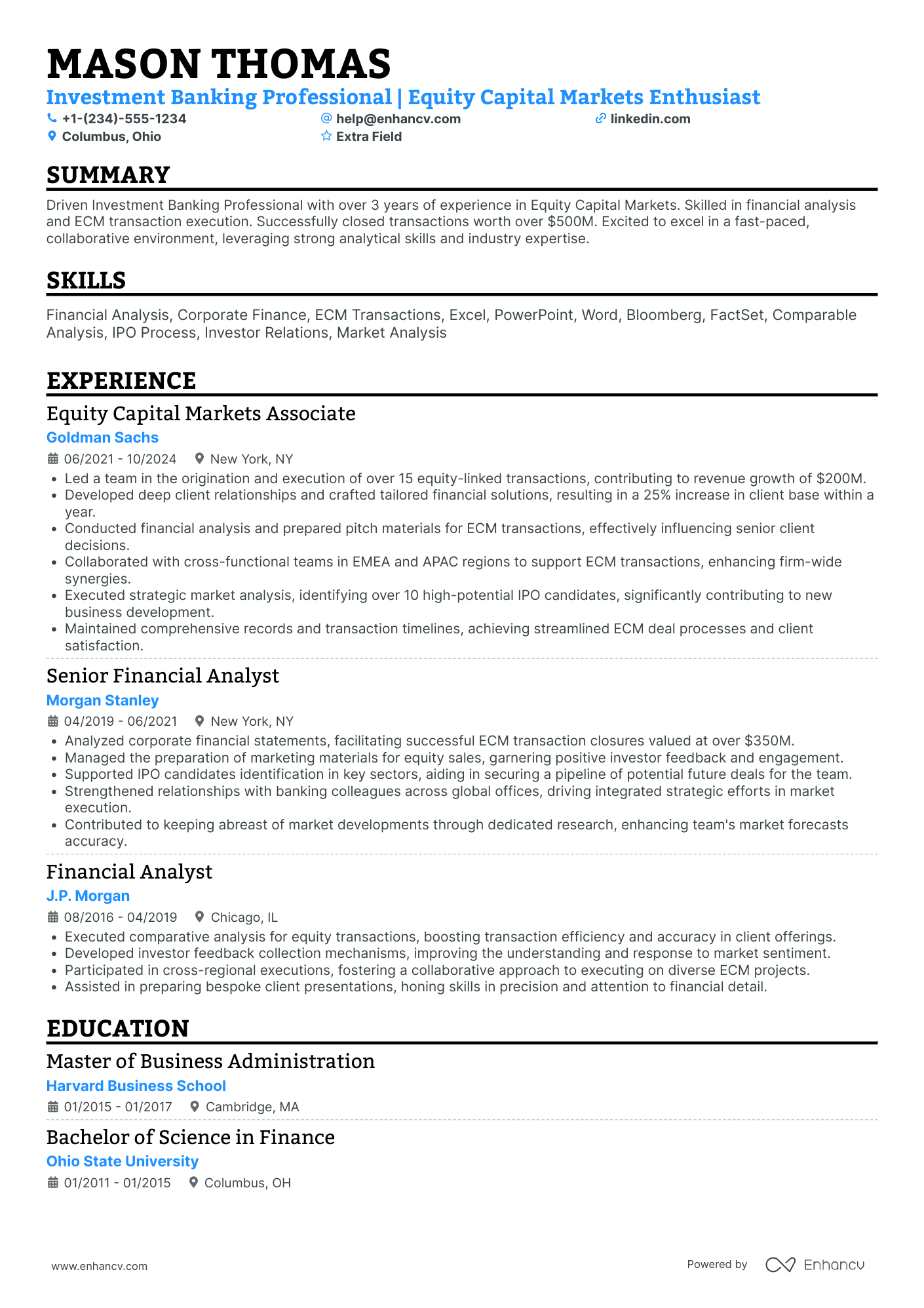

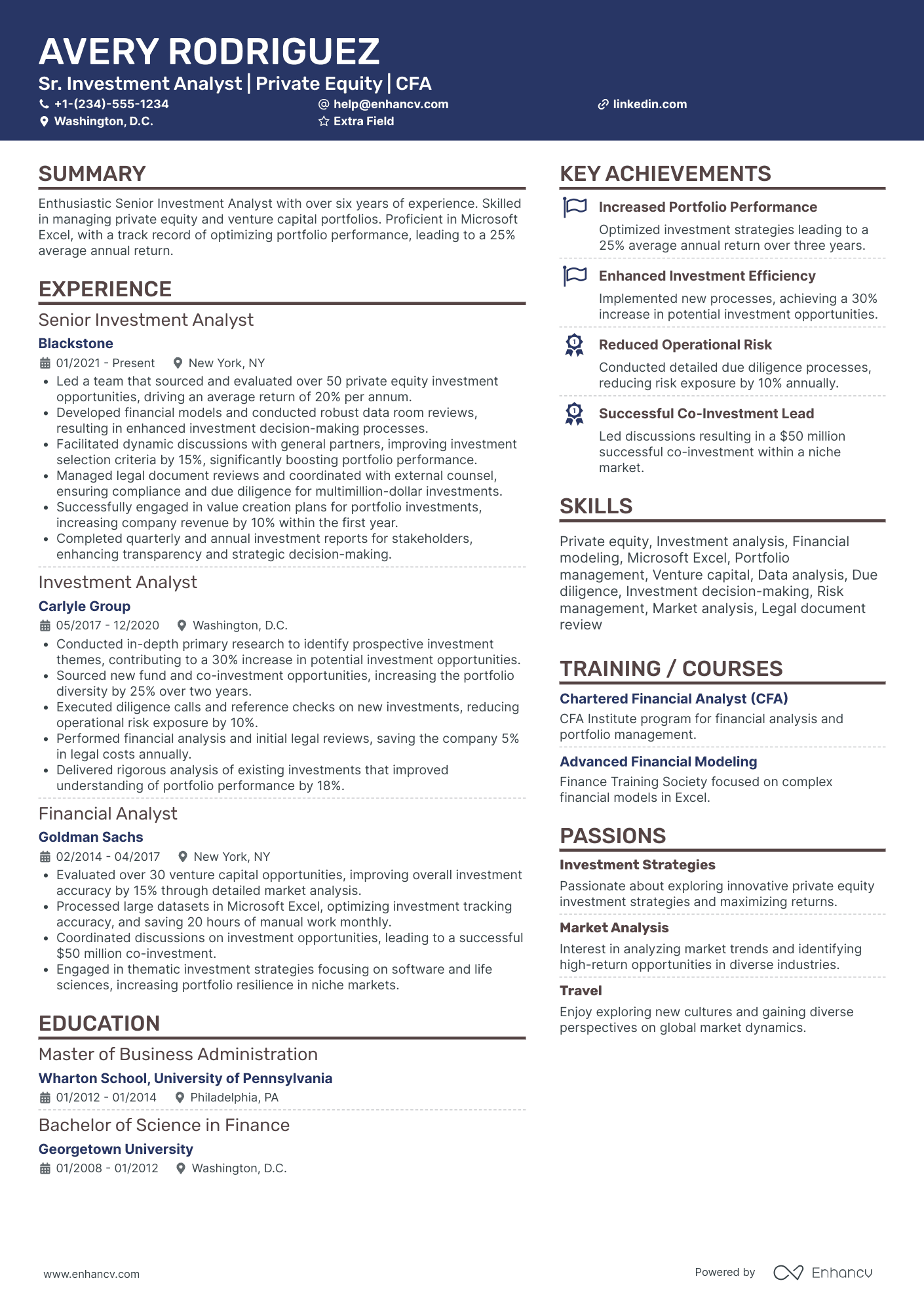

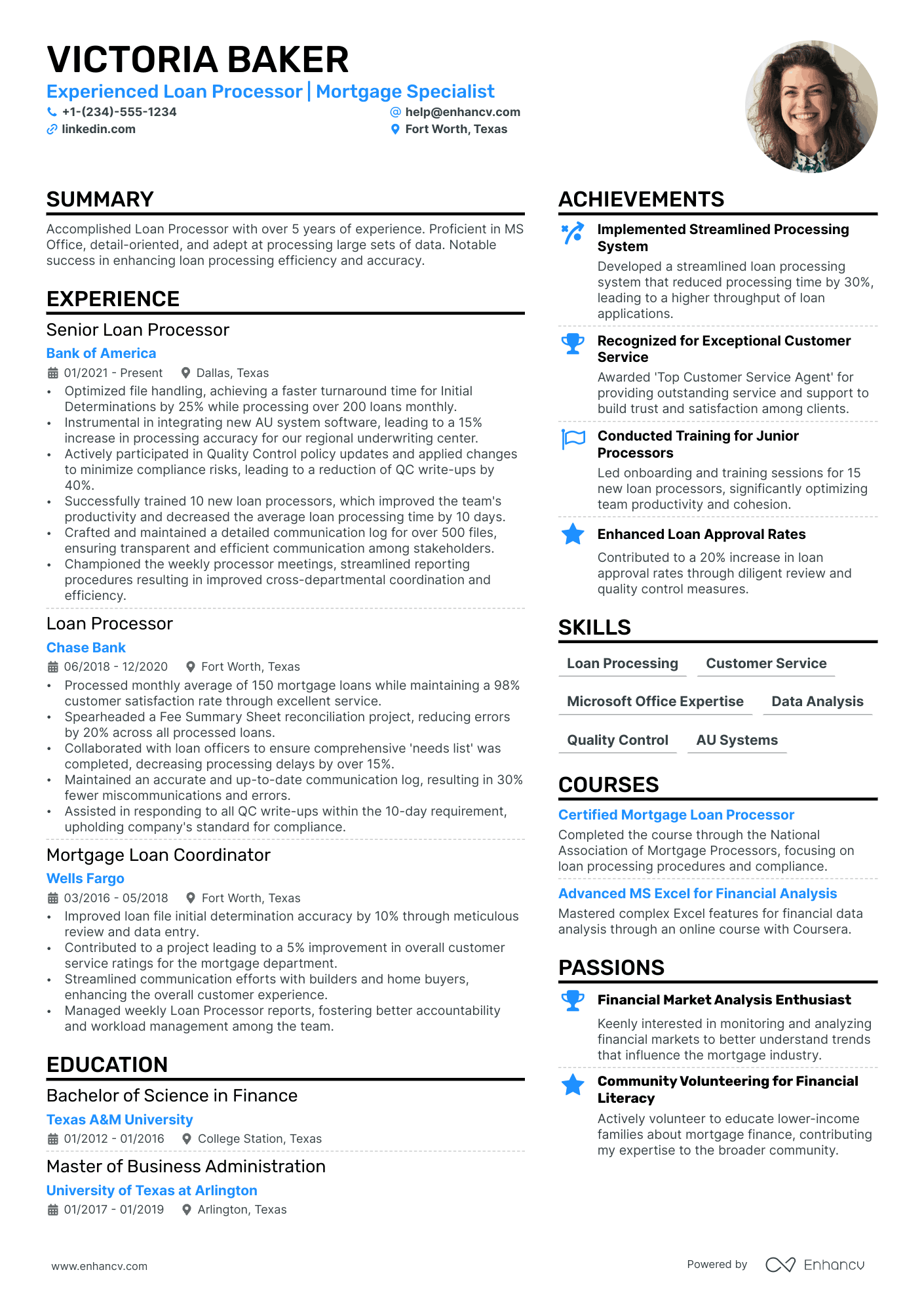

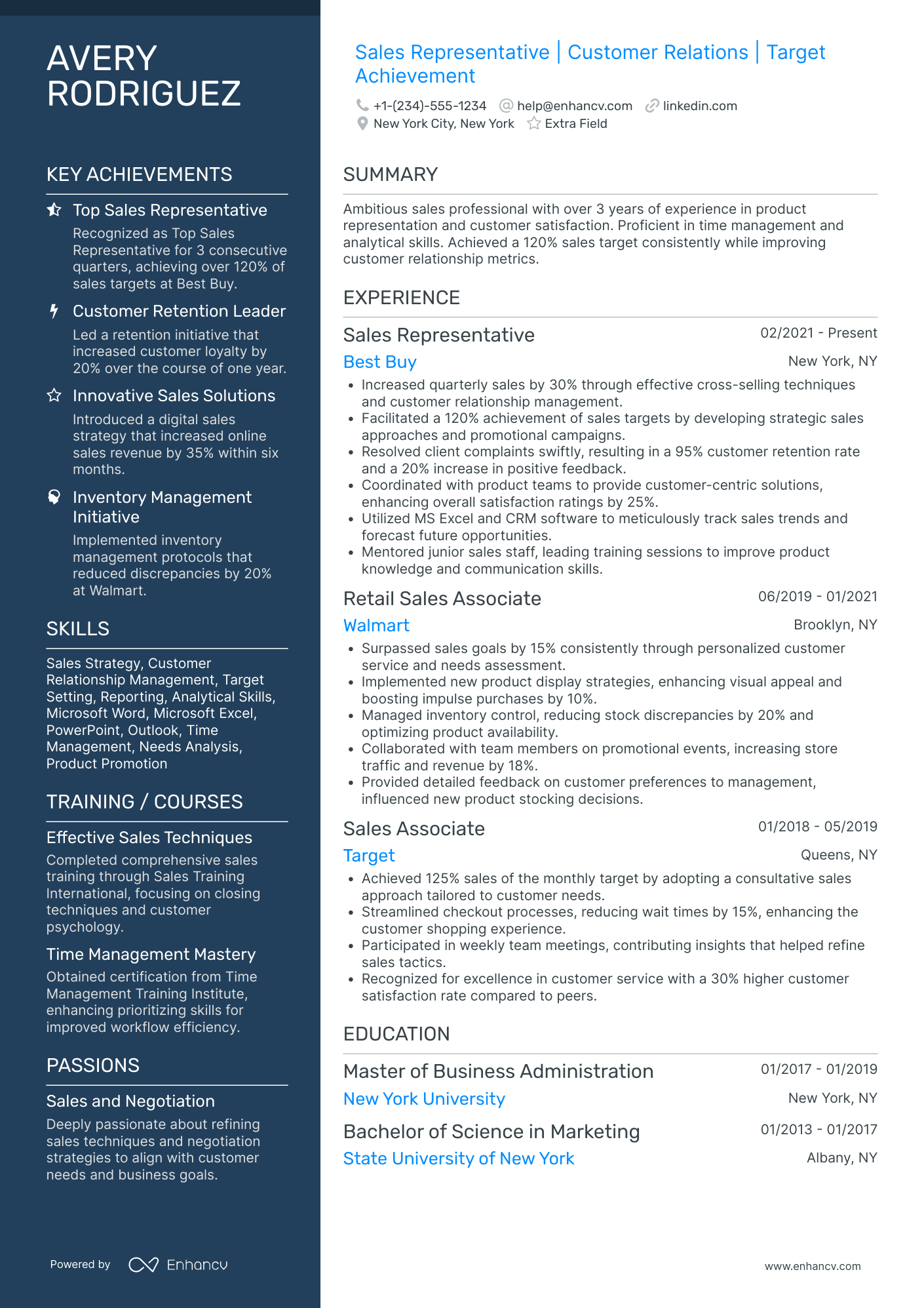

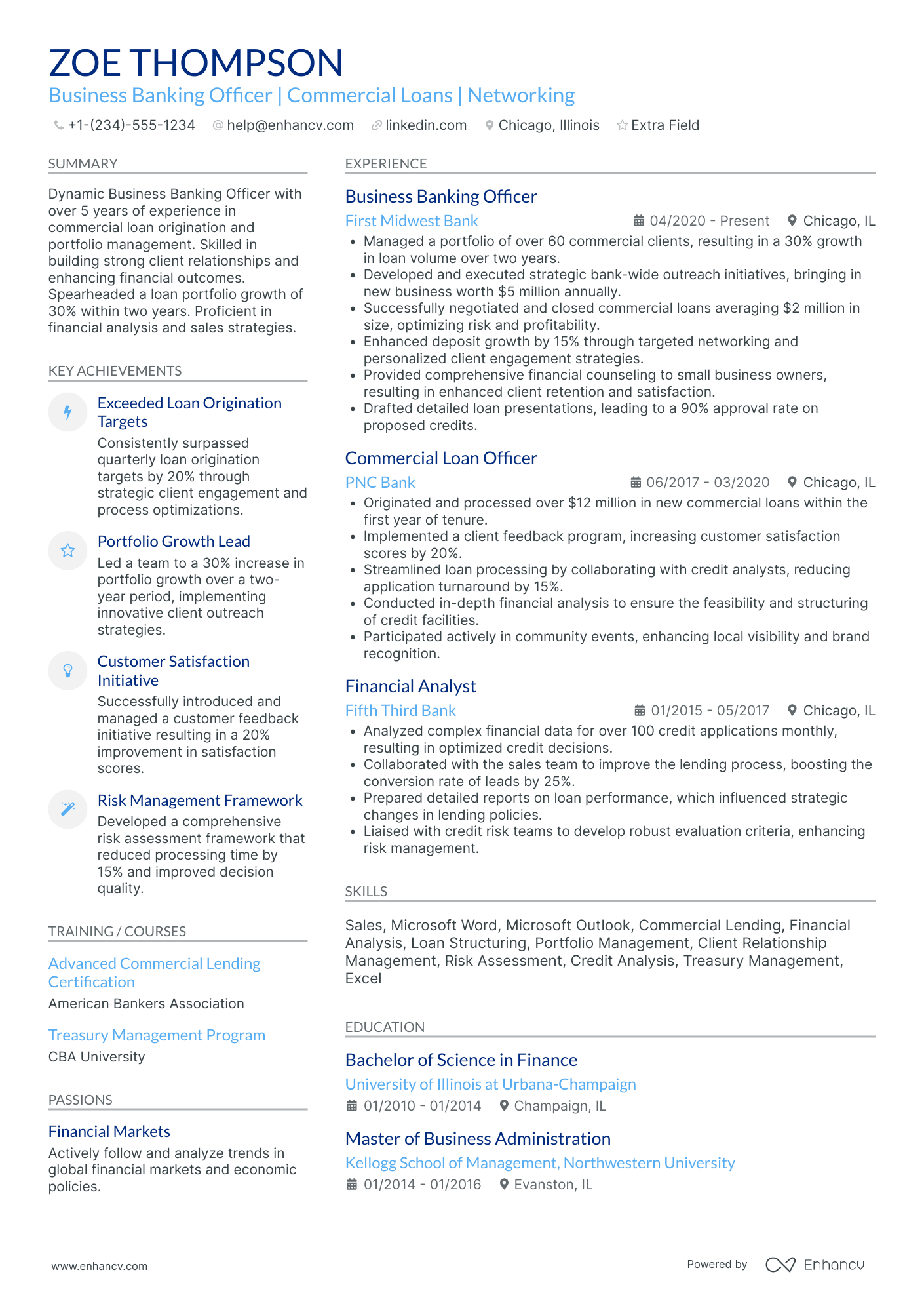

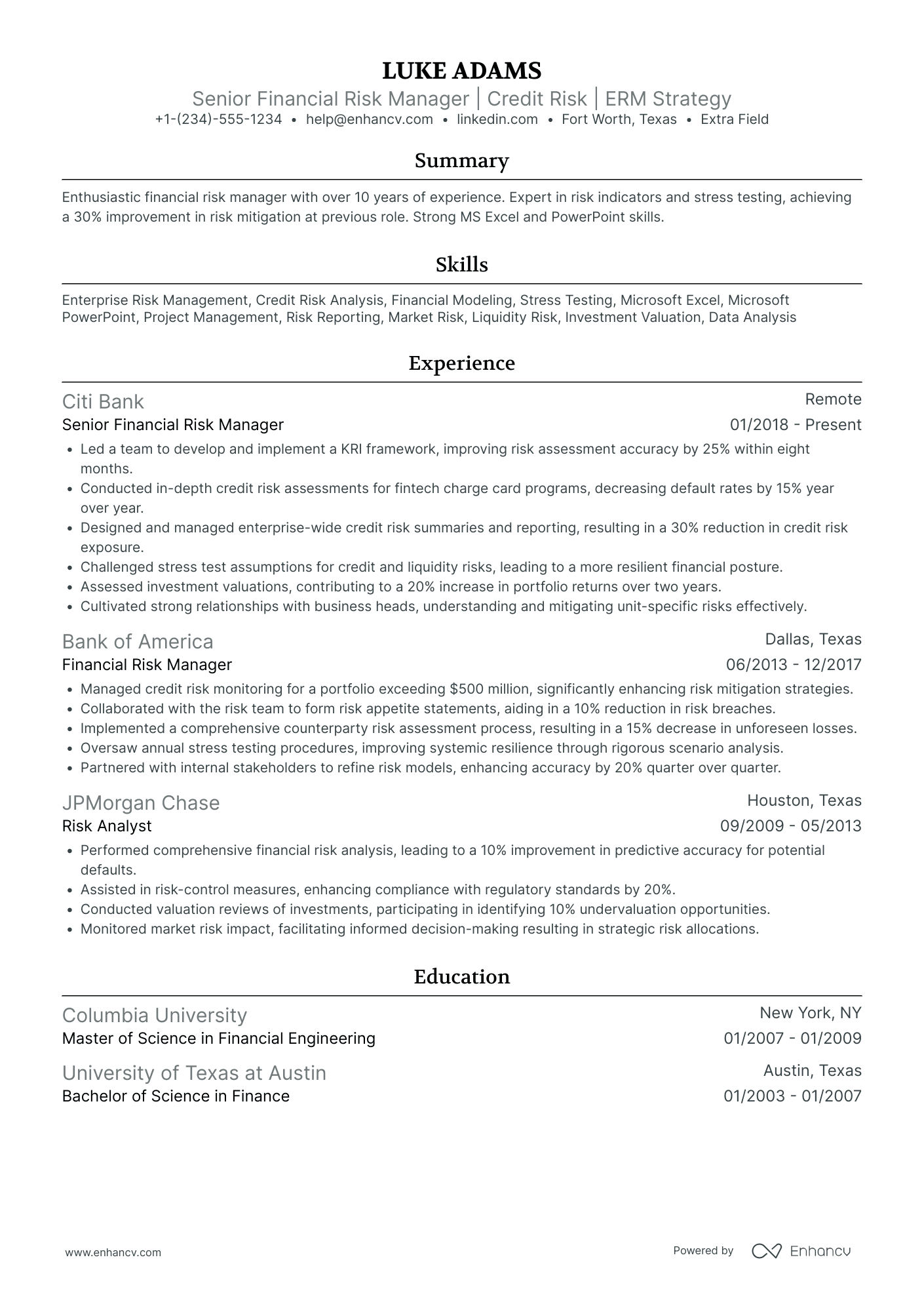

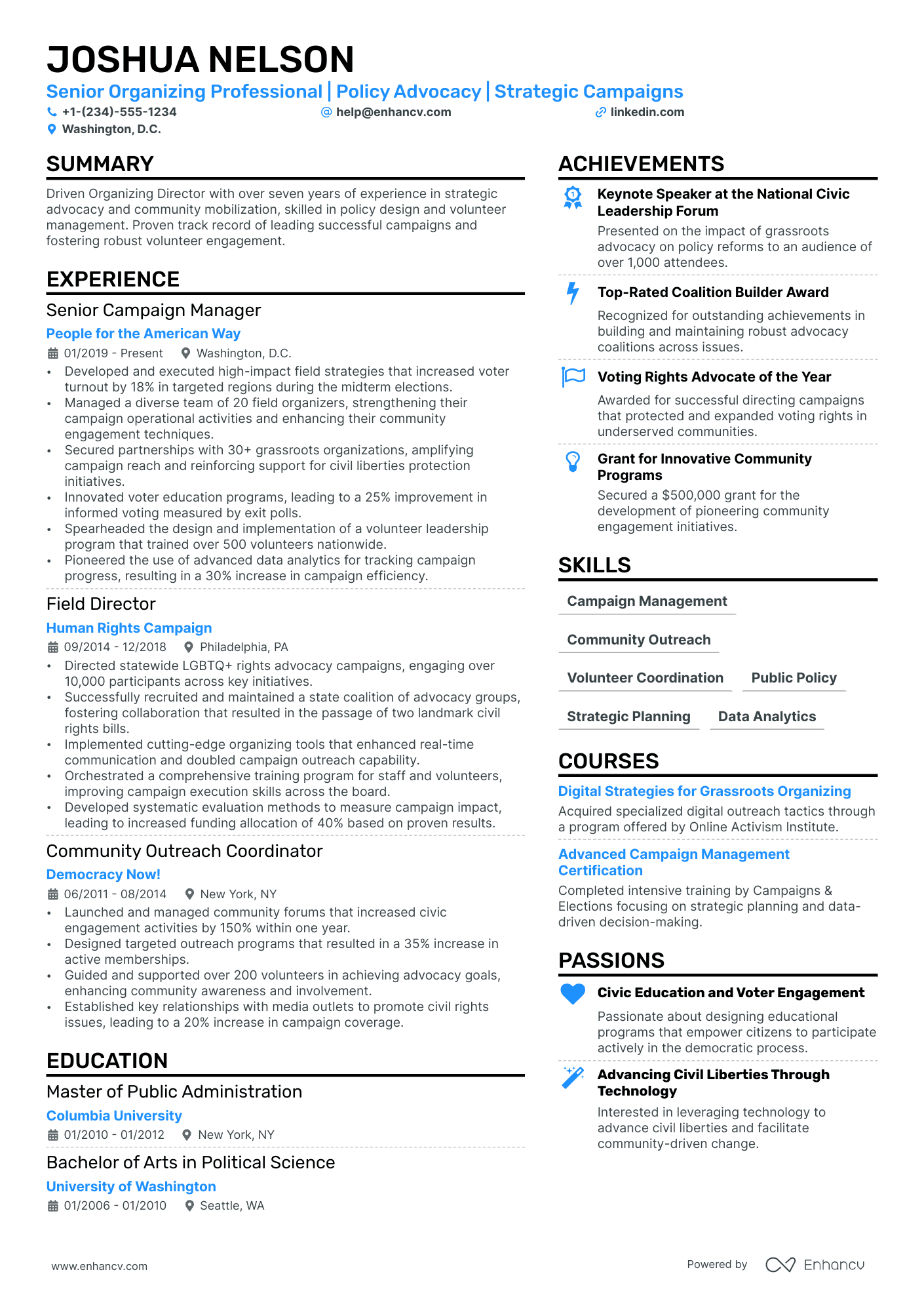

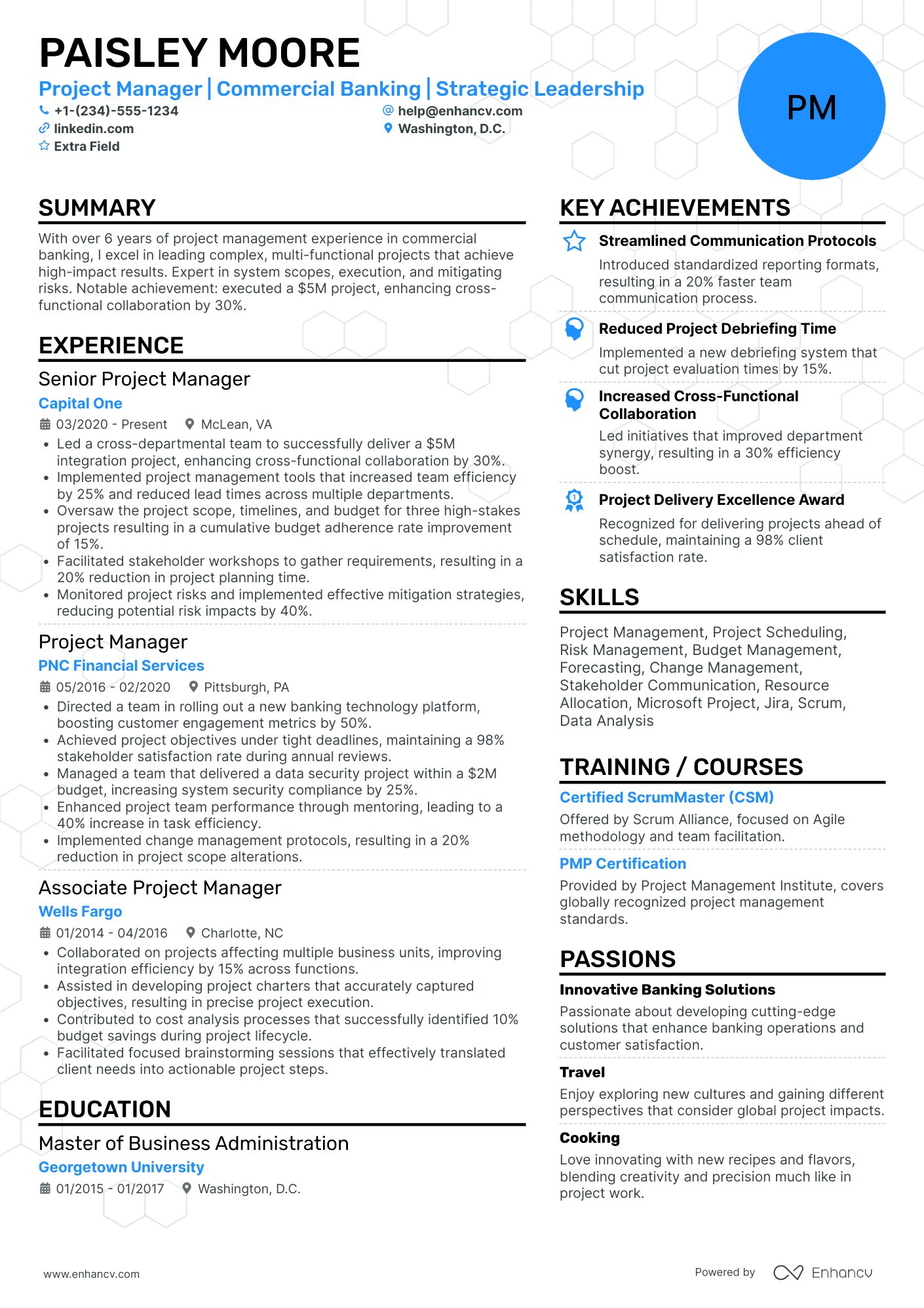

Banking resume sample

Tailor this banking resume sample or design your own easily using the Enhancv resume builder.

James Jones

Banker

jamesjones@email.com | LinkedIn | Washington, D.C.

Summary

Customer-focused banking professional with over 1 year of experience as a Bank Teller. Proven expertise in handling customer transactions, managing accounts, and providing financial advice. Adept at building long-term relationships and recommending products based on customer needs. Strong sales initiative with a commitment to delivering exceptional service and sensible advice.

Experience

Bank Teller

Wells Fargo, Washington, D.C.

06/2022 - Present

- Processed customer transactions, handled account maintenance, and managed cash inventories.

- Identified financial needs and recommended suitable products, contributing to a 15% increase in product adoption.

- Originated new deposit accounts, including checking, savings, money market, CDs, and IRAs.

- Provided advice on consumer loan products, resulting in a 10% increase in loan originations.

- Educated customers on digital banking services, leading to a 20% increase in e-statement adoption.

Customer Service Representative

Bank of America, Washington, D.C.

01/2020 - 05/2022

- Assisted customers with account inquiries, transaction processing, and resolving issues, achieving a 95% customer satisfaction rate.

- Promoted financial products and services, resulting in a 25% increase in cross-sell opportunities.

- Conducted account reviews and identified discrepancies, improving account accuracy by 10%.

- Trained new hires on customer service protocols and company policies, enhancing team performance.

- Handled large volumes of customer transactions, ensuring compliance with company standards and regulations.

Education

Bachelor of Science in Finance

George Washington University, Washington, D.C.

Graduated: 2022

- Related coursework: Financial Accounting, Managerial Accounting, Corporate Finance, Investment Analysis, Money and banking, Business Law, Financial Markets and Institutions

Certifications

- Certified banking & Credit Analyst (CBCA)

- Certified Financial Services Auditor (CFSA)

Skills

- Consultative sales

- Product knowledge

- Effective questioning

- Prospecting and referring

- Relationship building

- Basic mathematical computations

- Typing and computer skills

Languages

- English (Fluent)

- Spanish (Intermediate)

How to format a banking resume

When crafting your banking resume, consider 3 main formats: reverse chronological, functional, and combination. The reverse chronological format is typically the most effective for banking professionals.

This layout arranges your job history beginning with your most recent role, highlighting your professional development and hands-on experience. It's perfect for applicants with a continuous banking career, reflecting their advancement and relevant abilities.

Here's the ideal order for your resume sections, which we'll cover in detail later:

- Header

- Summary/objective

- Professional experience

- Education

- Certifications

- Key skills

- Languages

Recruiters favor this format for its logical and easy-to-follow arrangement.

Let's get into the details.

Resume designs

- Use 1-inch margins for easy reading and a two-column template for a clean look.

- Pick simple fonts like Rubik or Lato, sized 10 to 12 points, and use soft colors to highlight your skills.

- For those with less than 10 years of experience, a one-page resume is ideal, while senior professionals can opt for two pages.

Contact information

- Ensure your name is spelled the same across all application documents.

- Match your resume's job title with the one you're applying for. For instance, if the job is for a Bank Teller, use that exact title on your resume to streamline the hiring process.

- Use a resume headline to highlight your main skills and experiences, especially useful in the diverse banking field.

- Include a professional email and a link to your updated LinkedIn profile.

- To adhere to US resume standards and avoid biases, don't include a photo of yourself.

File format

- Write a clear file name such as "JamesJonesbankingResume.pdf" to help recruiters locate your resume quickly.

- Always save your resume as a PDF unless specified otherwise, as PDFs keep your formatting intact and are ATS-friendly.

Adjust your resume layout based on the market – Canadian resumes, for example, may follow a unique format.

PRO TIP

Don't think that the ATS is your enemy. It's designed to help recruiters find the best candidates. To ensure your resume gets noticed, use the same keywords as in the job description, format dates and bullet points properly, and avoid overloading with keywords. Make your resume clear for both systems and people.

Curious if your resume is ATS-friendly? Try our free AI tool below!

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

With the resume format clarified, let's talk about your banking work experience.

How to write your banking resume experience

Listing your professional experience on a banking resume is key because it shows off your practical skills, builds trust, and highlights your expertise in managing finances. It shows potential employers your real-world banking knowledge.

Make sure to focus on your big wins with numbers to back them up, like improving financial efficiency, reducing costs, and boosting accuracy.

Keep your resume tidy by using bullet points and listing your work history in reverse chronological order. Adapt your resume to the specific job requirements to convince the recruiter you’re the person they are looking for.

The right way to tailor your banking resume to the job description

Adapting your resume to fit the job offer puts your most important qualifications in the spotlight. This tactic makes you more noticeable and can enhance your visibility to recruiters. By pointing out the exact skills and experiences needed, you make it clear why you’re an excellent match for the position.

Known as a targeted resume, this method needs a precise approach. Check out these tips to get it right:

- Carefully read the job offer and include the required skills and qualifications in your applications.

- Underline parts of your past jobs that fit the job’s needs, like skills with accounting software, financial analysis, or budget management.

- Provide measurable results to demonstrate the impact of your work, such as "decreased expenses by 10%."

- Focus on job titles and duties that closely match the job you're applying for, even if it means emphasizing specific parts of your past roles.

Here's a banking job offer we'll use to tailor our work experience section. Take a look at the banker position below.

Banker

Duties

- Process customer transactions, customer initiated account maintenance, and all other tasks associated with customer requests. Report suspicious transactions or unusual occurrences to the supervisor.

- Efficiently gather customer information, identify financial needs, and educate customers on products and services. Recommend products based on the customer’s needs.

- Originate new deposit accounts including checking, savings, ATM/Debit Cards, money market, CDs, IRAs and commercial accounts.

- Originate and provide advice on consumer loan products including personal loans, installment loans, home equity loans and lines of credit.

- Originate business deposit accounts, associated services and refer additional products and services to Treasury Management or Business Banker.

- Process basic life events including distribution of customers’ estates to beneficiaries from any deposit account. Recommend referrals to the trust department when appropriate.

- Educate customers on digital banking services and encourage electronic banking and e-statement adoption.

- Develop long-standing relationships with customers by providing Exceptional Service and Sensible Advice through knowledge of bank products and services such as business, commercial and mortgage lending as well as trust services.

- Participate in all office marketing and sales projects and promotions.

- Partner with branch advisors to uncover customer needs and cross-sell opportunities.

- Effectively use risk management tools to mitigate risk and minimize exposure to loss. Report unusual activity following established procedures.

- Maintain established controls such as identification procedures, check holds, and all other pertinent verification necessary to transact business.

- Conduct and document periodic risk reviews and run reports as needed.

- Perform all work in compliance with established regulations, policies, and established procedures.

- Maintain customer privacy and protect bank operations by keeping information private and confidential.

- Participate in ongoing skill, sales training, compliance, risk management and security training as required for the position and apply knowledge in daily tasks.

- Other duties as assigned.

Qualifications & Skills

- High school diploma or equivalent.

- 1+ years of experience as a Bank Teller or the equivalent combination of banking, payment processing and professional sales experience in a service-oriented environment preferred.

- Must successfully complete consumer lending training and consistently demonstrate the required level of mastery of the lending products and processes.

- Strong sales initiative and ability to develop ongoing customer relationships.

- Present a professional image and communicate effectively with the public, co-workers, management, customers and others in a courteous, positive and professional manner.

- Ability to read, process, understand and apply written training material content to daily activity.

- Ability to follow detailed instructions and a wide range of procedures requiring sound judgment.

- Ability to perform basic mathematical computations using various business machines and/or computers.

- Must have proficient typing and computer skills.

Here's how we've tailored the section for this role.

- •Processed customer transactions, managed account maintenance, and reported suspicious activities to supervisors.

- •Gathered customer information, identified financial needs, and recommended suitable products, boosting customer satisfaction by 15%.

- •Opened new deposit accounts, including checking, savings, and business accounts, and provided advice on consumer loan products.

- •Educated customers on digital banking services, leading to a 25% increase in e-statement adoption.

- •Maintained strong internal controls and ensured compliance with all relevant accounting standards and tax regulations.

This tailored resume meets the job ad requirements because it:

- Underscores transaction management and account maintenance, showing comprehensive banking experience.

- Emphasizes gathering customer information and recommending products, leading to a 15% boost in customer satisfaction.

- Demonstrates impact with metrics: increasing e-statement adoption by 25%, which aligns with the emphasis on digital banking.

- Covers essential skills: processing transactions, managing account maintenance, opening new accounts, and providing loan advice.

- Suggests strong internal controls and regulatory compliance, key for minimizing risk and ensuring adherence to standards.

How to quantify your experience on a resume

Adding numbers and results to your resume is super important because it makes your achievements real. Try to include specific metrics to show the impact you've made.

Examples of using numbers on a banker resume

- Mention the total amount of transactions handled monthly, like processing $2M in client transactions each month.

- Highlight the percentage increase in customer satisfaction scores due to improved service, such as boosting customer satisfaction by 15%.

- Detail the reduction in loan processing time, like cutting loan approval time by 20% through streamlined procedures.

- Specify the number of new accounts opened and their impact, like opening 50+ new accounts monthly, contributing to a 10% growth in deposits.

- Quantify the success in fraud detection, such as identifying and preventing $500K in fraudulent activities annually.

New to banking? You can still boost your resume. See how below.

How do i write a banking resume with no experience

Generally, moving up to a bank branch is pretty easy if you are a quick learner. If you like helping people, you'll enjoy the work. As we see in the job offer above, you need only a high school diploma to enter the field. Of course, if you want to develop and advance in your career, you will need a bachelor's degree.

To write a banking resume with no experience, focus on the following tips:

- Opt for a functional resume format to prove your skills and educational achievements.

- Choose a traditional template to keep a professional look even with limited experience.

- Feature academic coursework and relevant projects that demonstrate your understanding of banking principles and your problem-solving skills.

- Highlight technical skills and familiarity with banking software like SAP banking or Fiserv by mentioning your technical training or relevant courses.

- Emphasize transferable skills gained from summer jobs or internships, such as financial analysis or data entry.

- Mention any practical experience with financial documents, like creating balance sheets or income statements.

- Include volunteer work or extracurricular activities that involve banking responsibilities or teamwork.

Resume objective for entry-level bankers

For an entry-level banking resume, an objective statement is crucial as it showcases your career aspirations and enthusiasm for entering the field, even with limited experience.

To craft an impressive objective statement:

- Mention your career goals or the specific banking position you want.

- Customize it for the role and employer, using keywords from the job listing to show you meet their needs.

- Highlight important skills or qualifications to assure hiring managers you are the right fit.

- Show how your abilities can help the bank and contribute to its success.

Let's explore an example of an effective objective statement.

Now that we’ve covered your job history, let’s take a look at your banking skills.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

How to list your hard and soft skills on your resume

Including both soft and hard skills in your banking application is essential. A skills section on a resume for banking demonstrates your proficiency with numbers and your ability to interact effectively with people, making you an ideal candidate for the job.

Let's break it down:

- Hard skills are your technical abilities. These are the skills you've learned through education and experience, like using banking software, processing financial transactions, and managing customer accounts.

- Soft skills underline how you interact with others. These include communication, teamwork, and problem-solving abilities.

Consider adding these specific skills to your resume.

Best hard skills for your banking resume

- QuickBooks

- Microsoft Excel

- SAP

- Oracle Financials

- Peachtree

- Hyperion

- Intuit TurboTax

- Xero

- Sage 50

- IBM Cognos

- Microsoft Access

- Netsuite

- Tally

- Yardi

- FreshBooks

- Zoho Books

- JD Edwards

- Microsoft Dynamics GP

- Wave Accounting

Interpersonal skills are also highly valued by HRs. These should be woven into different sections of your resume, like the summary or experience sections, where they can be clearly demonstrated and quantified. For example, you might highlight customer service skills with a statement like: "Resolved customer issues efficiently, boosting client satisfaction by 30%."

Best soft skills for your banking resume

- Customer service

- Attention to detail

- Problem-solving

- Communication

- Multitasking

- Patience

- Adaptability

- Analytical thinking

- Time management

- Negotiation skills

- Conflict resolution

- Teamwork

- Decision making

- Stress management

- Active listening

- Critical thinking

- Motivation

- Responsibility

- Empathy

Now that we've covered the essential skills for banking, let's turn our attention to certifications and education. These credentials are vital in demonstrating your commitment and expertise in the industry.

How to list your certifications and education on your resume

In your resume’s education section, highlight the key banking and technical skills you’ve gained. Make sure this part of your resume is tailored to fit the job description, similar to how you customize your work experience. Employers use this section to confirm that your education supports your listed skills.

Key elements to include in your education section:

- Degree and major

- University name

- Graduation date

- Relevant coursework

- Honors and awards

Here’s an example that’s aligned with the job description you’re targeting.

- •Completed coursework in Financial Accounting, Taxation, and Auditing.

- •Participated in the Accounting Club and served as the Treasurer.

- •Graduated with honors.

- •Conducted a senior project on event management and customer service.

This example impresses because:

- It includes a Bachelor's Degree in Finance, showing a strong educational foundation.

- Lists degree, institution, location, and date range for a complete educational history.

- Highlights relevant coursework, achievements, and extracurricular activities.

- Mentioning a strong GPA indicates academic excellence.

- Adding certifications can improve qualifications and career prospects.

You can enhance your banking resume by including a strong certifications section. Although not every banking role requires specific certifications, having them can elevate your credentials and open up more career prospects.

Best certifications for your banking resume

With education in place, let's emphasize your banking strengths in a summary.

How to write your banking resume summary

The summary is a vital part of a banker’s resume, offering a brief yet impactful snapshot of your career highlights. Its purpose is to captivate hiring managers by highlighting the most significant aspects of your professional journey.

Enhance your resume summary with these actionable tips:

- Underscore your years of experience in banking to demonstrate your expertise.

- Emphasize key skills relevant to the role, such as financial analysis, customer service, or risk management.

- Quantify your accomplishments to provide concrete evidence of your contributions.

- Customize your summary to match the language and requirements of the job listing, showcasing why your background makes you a perfect fit.

Take a look at this excellent example.

This summary presents important banking experience and certifications, showing significant accomplishments to illustrate impact. It utilizes dynamic action words and quantifiable results to portray the candidate's proactive approach.

With this guidance, you can develop a standout resume. Leverage Enhancv’s resume builder to personalize your content and format with ease.

Additional sections for a banker resume

Optional sections in a resume for banking professionals can show a broader range of skills and experiences, setting you apart by presenting unique aspects of your professional journey.

Here’s a list of the top resume additions:

- Professional affiliations: Indicate your involvement in the banking community, enhancing your credibility and showing ongoing professional development.

- Awards: List any industry or academic awards you’ve received, underscoring your excellence and recognition in the field of banking.

- Hobbies and interests: Reflect on your personality and suggest a well-rounded character, potentially aligning personal passions with financial trends and innovations.

- Language skills: Illustrate your ability to communicate in multiple languages, which is valuable in diverse teams and global banking projects.

In conclusion

Use this guide's essential tips to design an exceptional banking resume. Emphasize your skills, experiences, and unique traits to capture the interest of hiring managers and advance in your banking career.

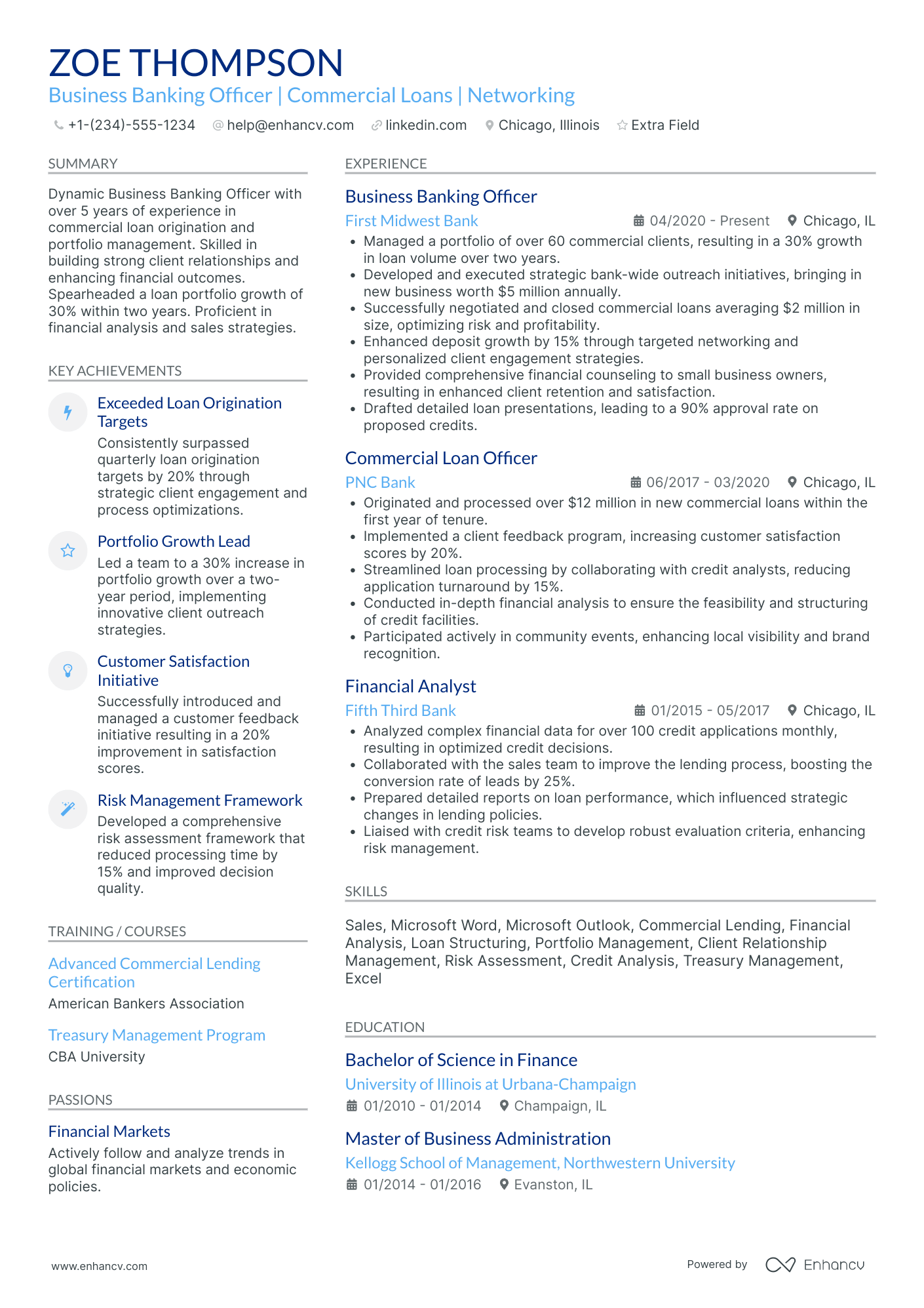

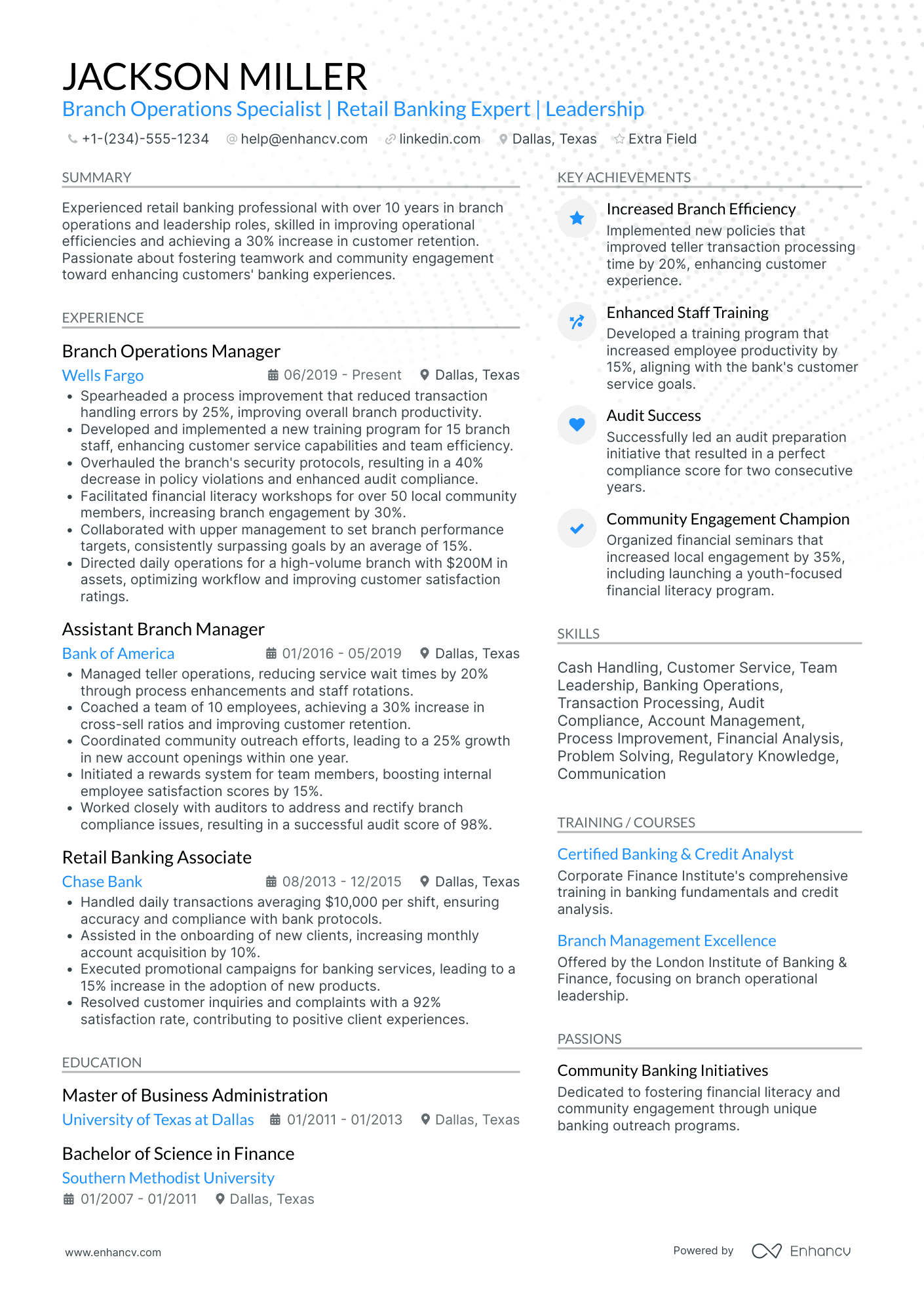

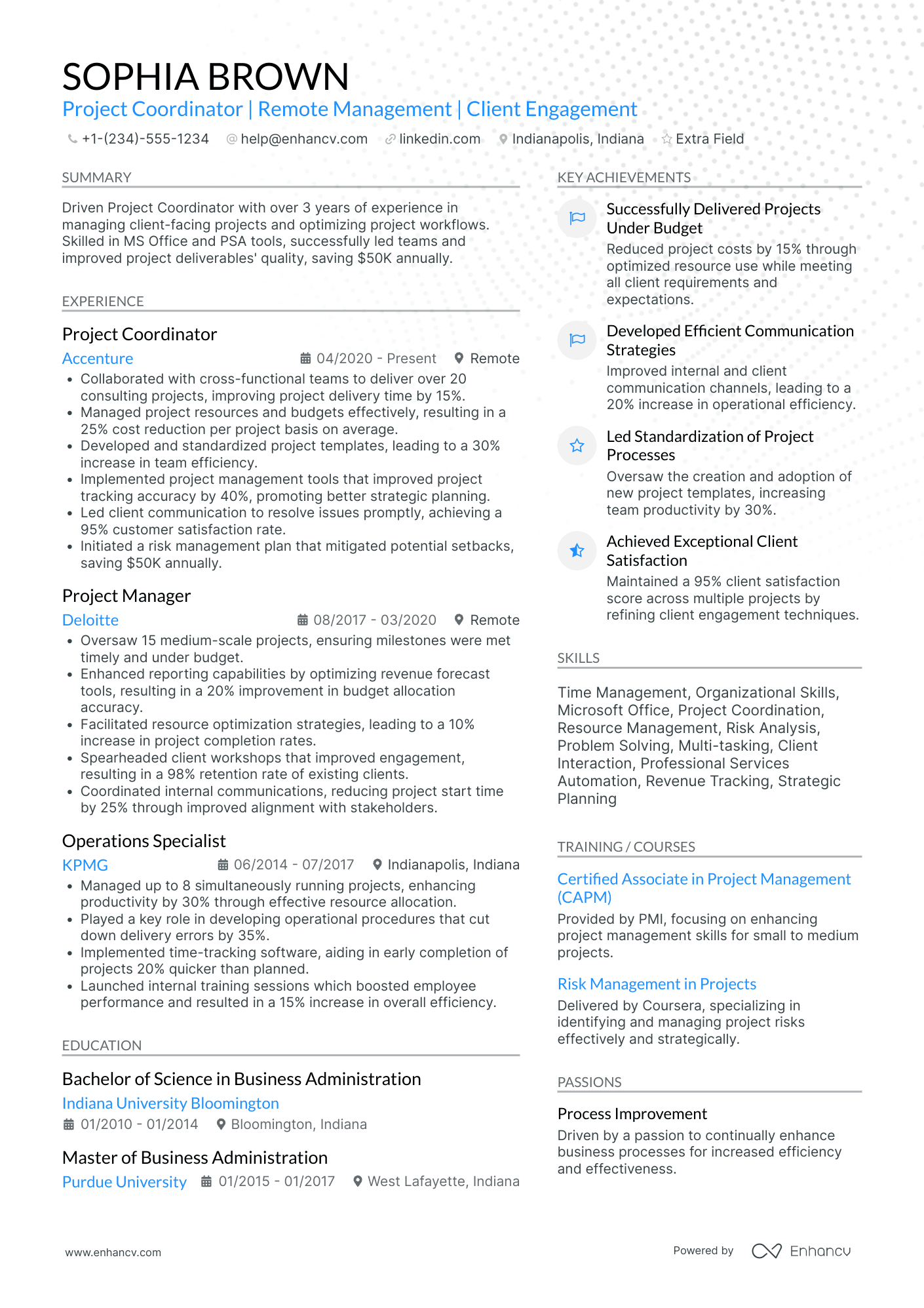

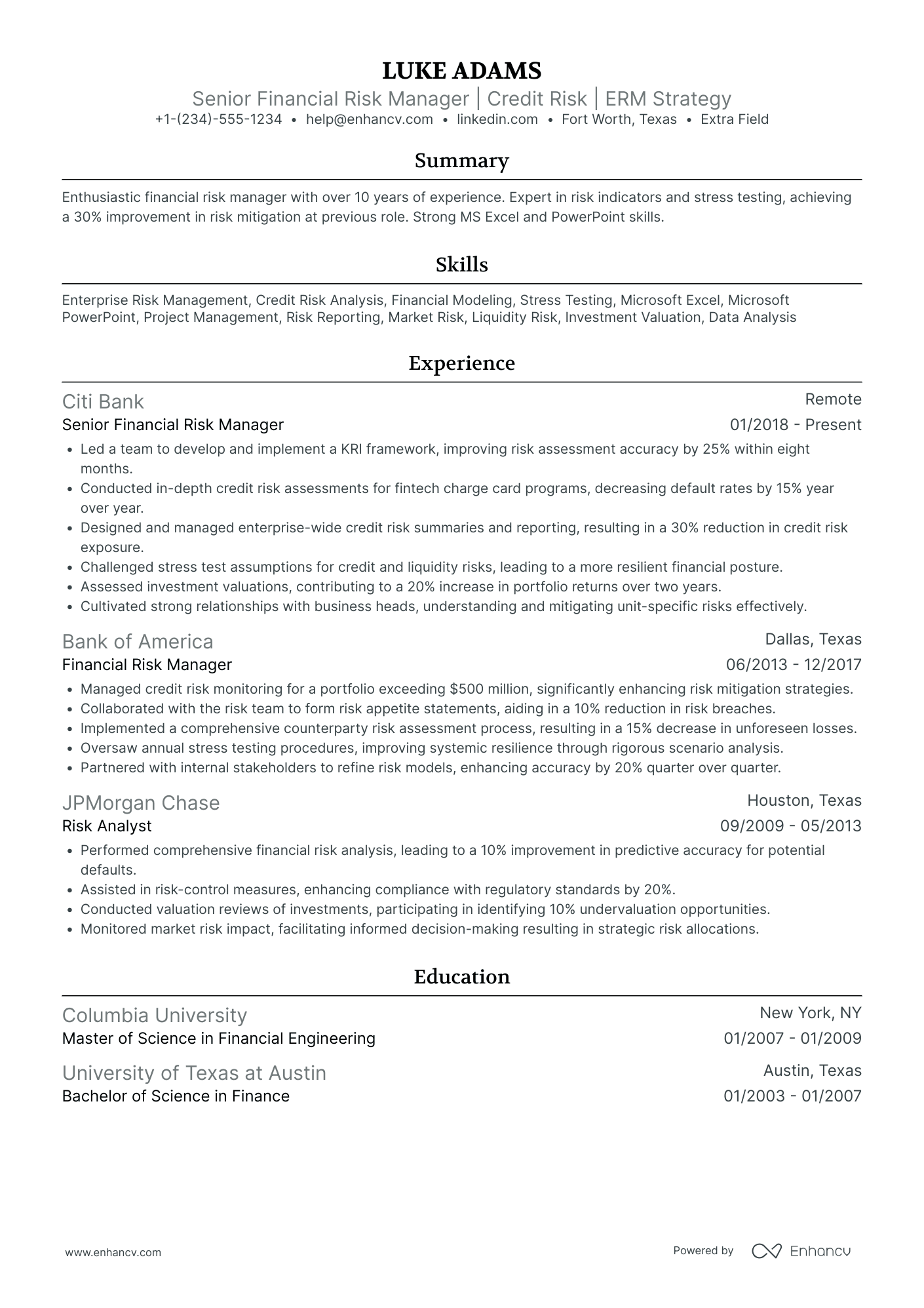

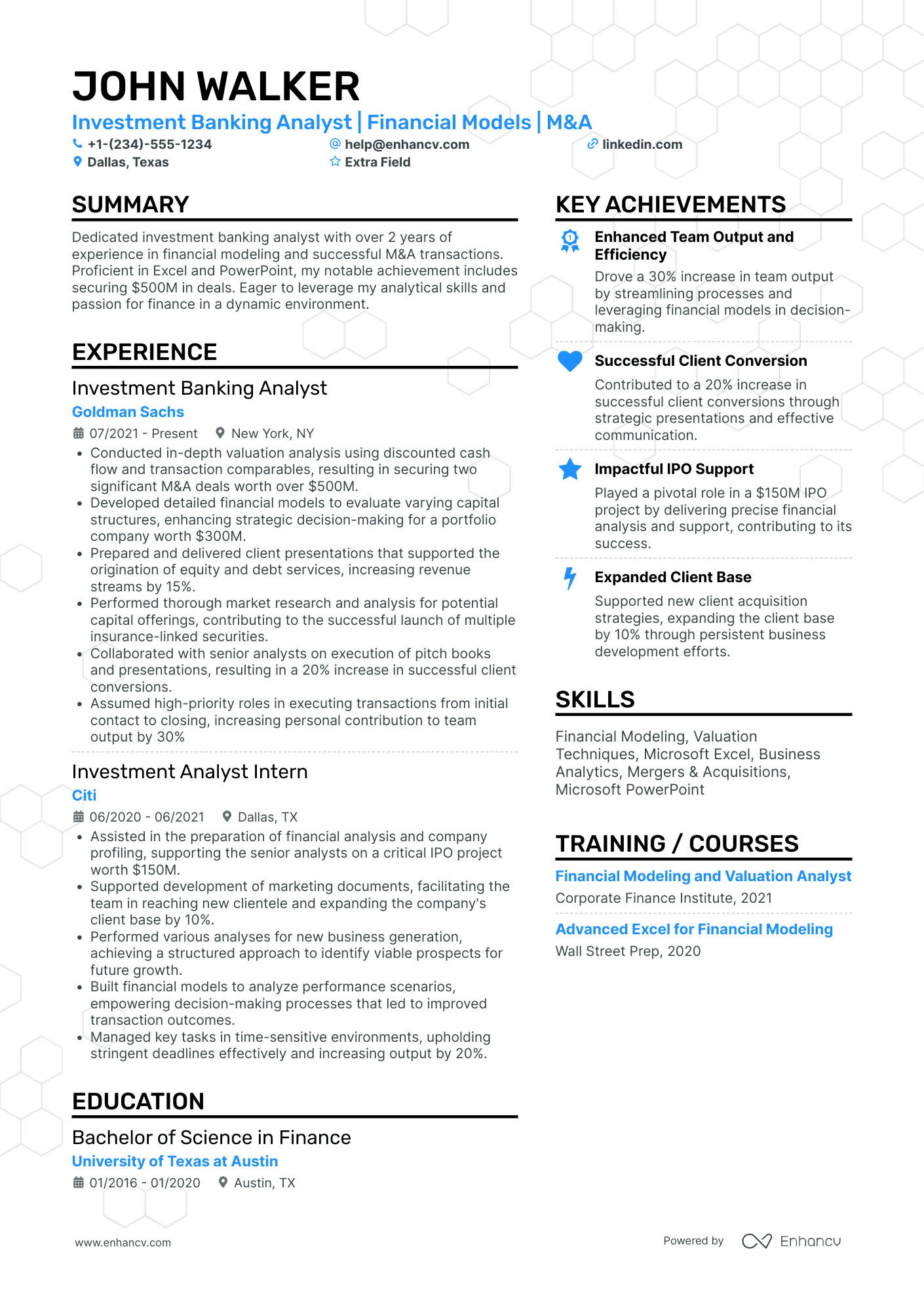

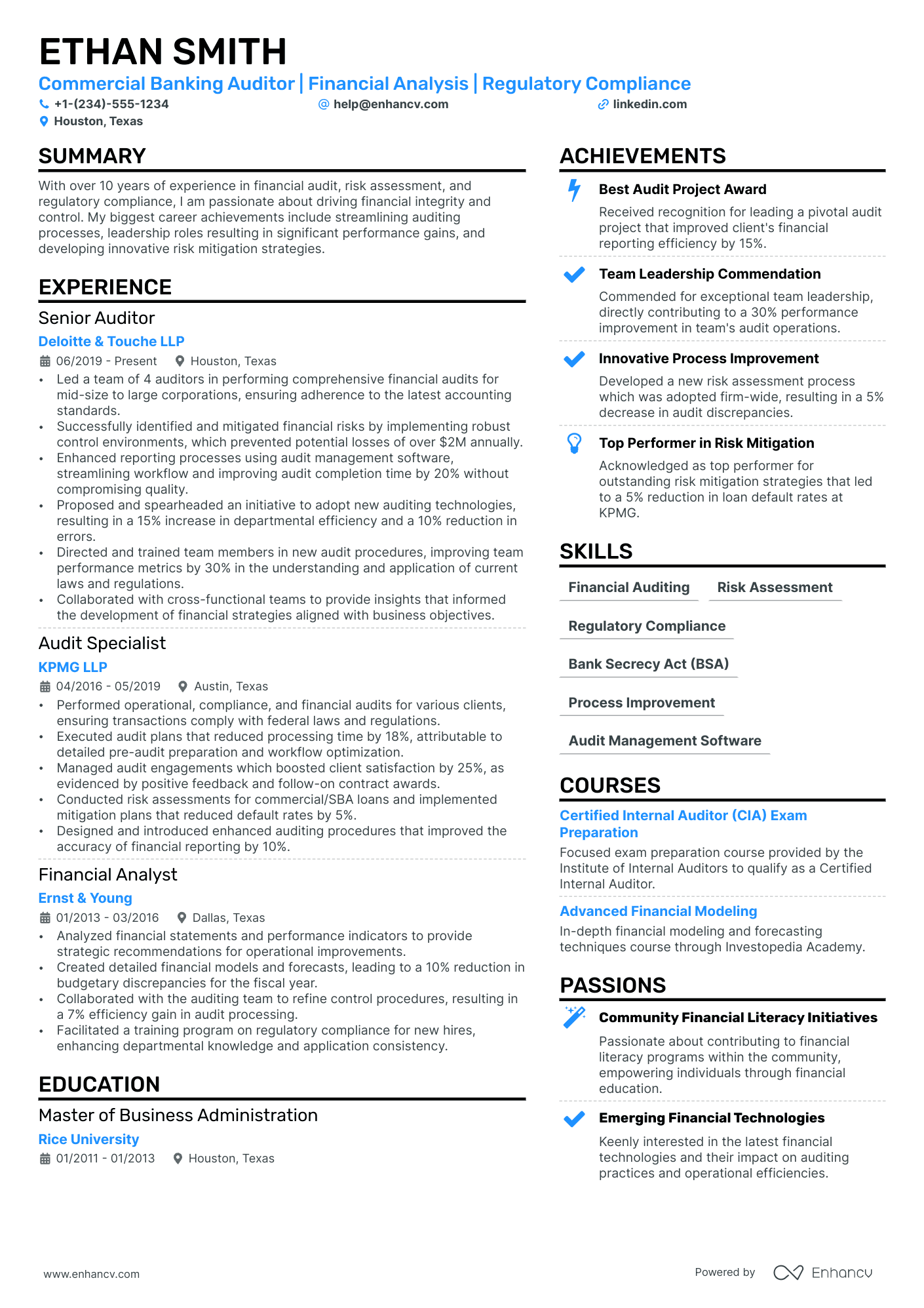

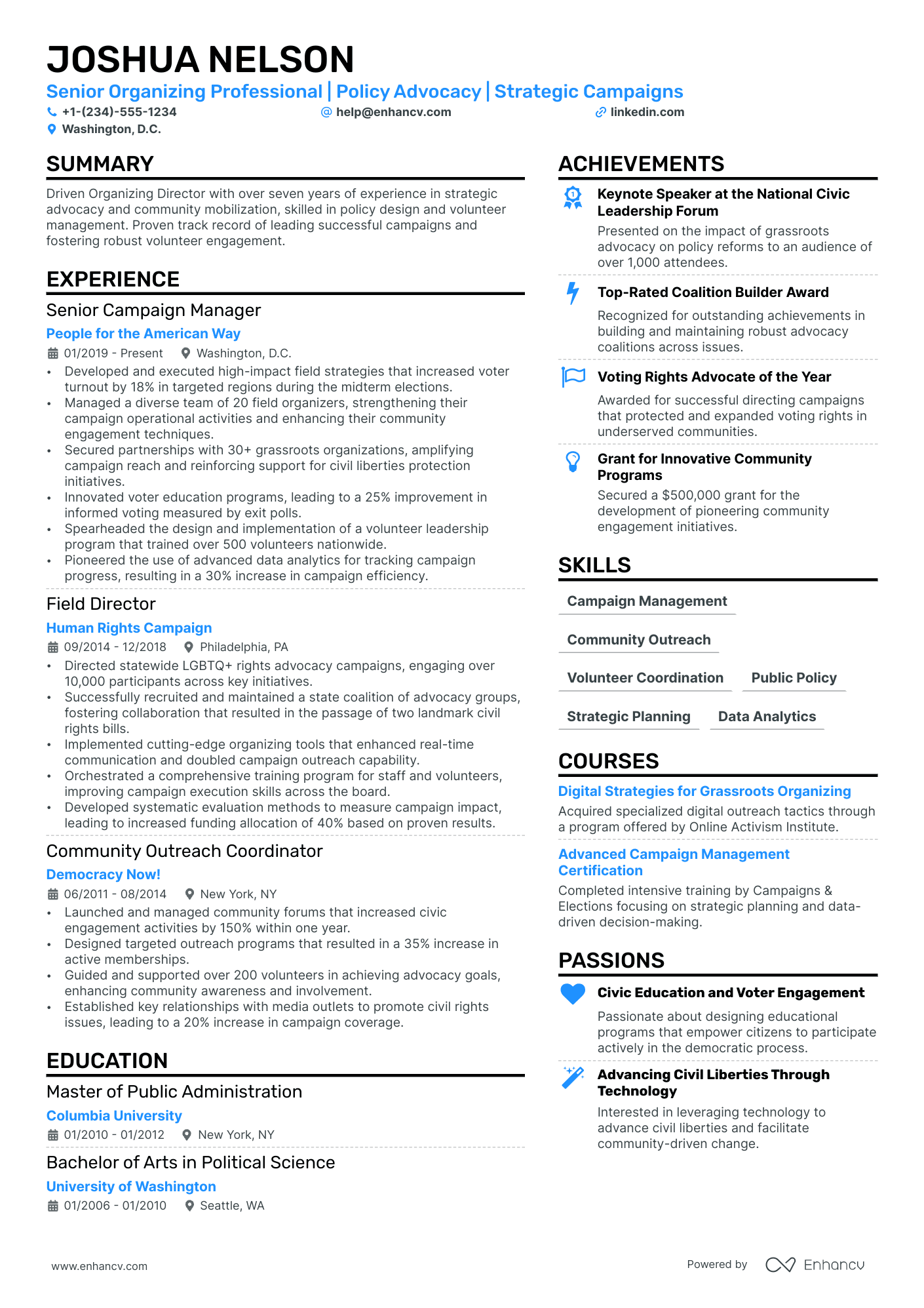

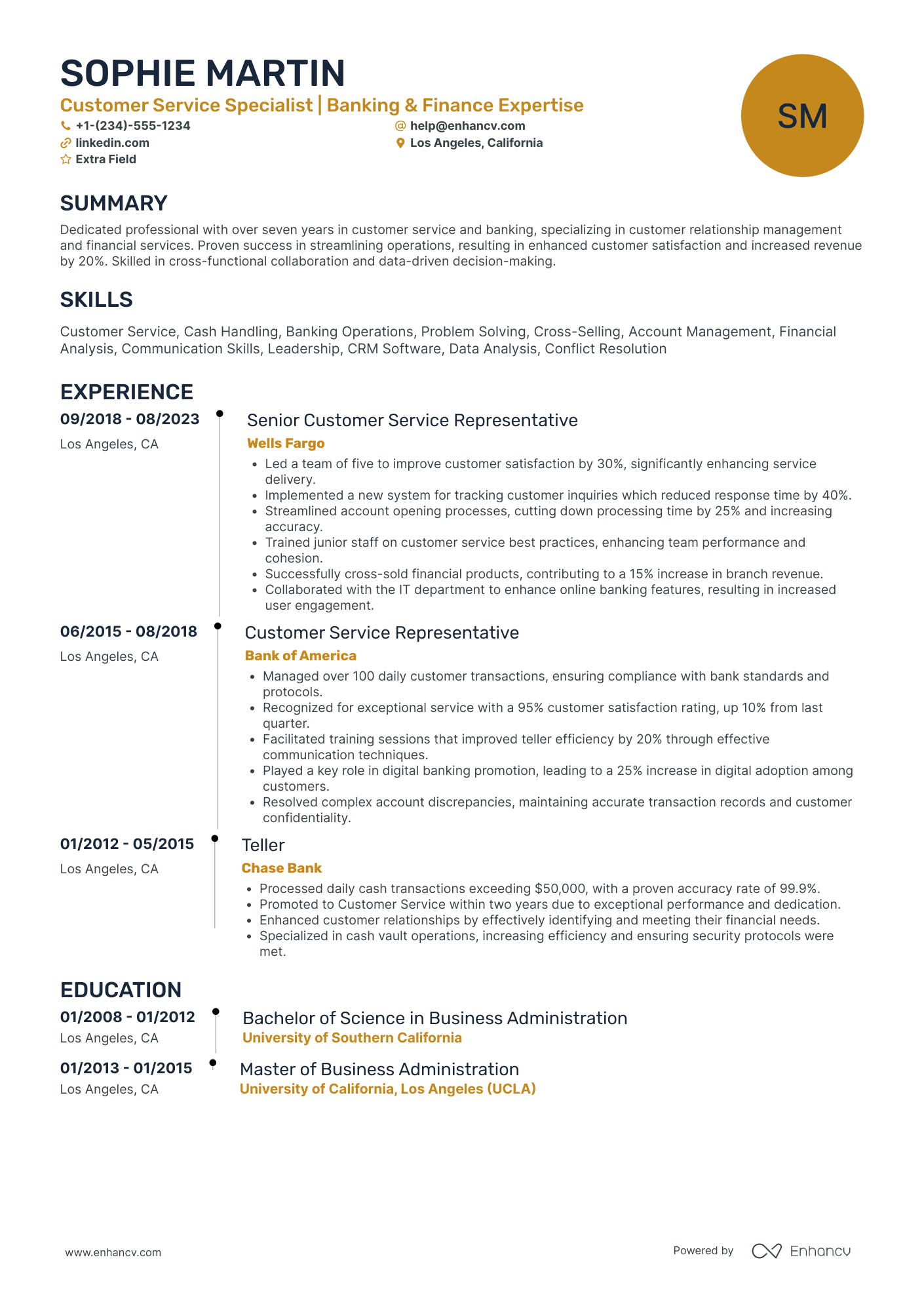

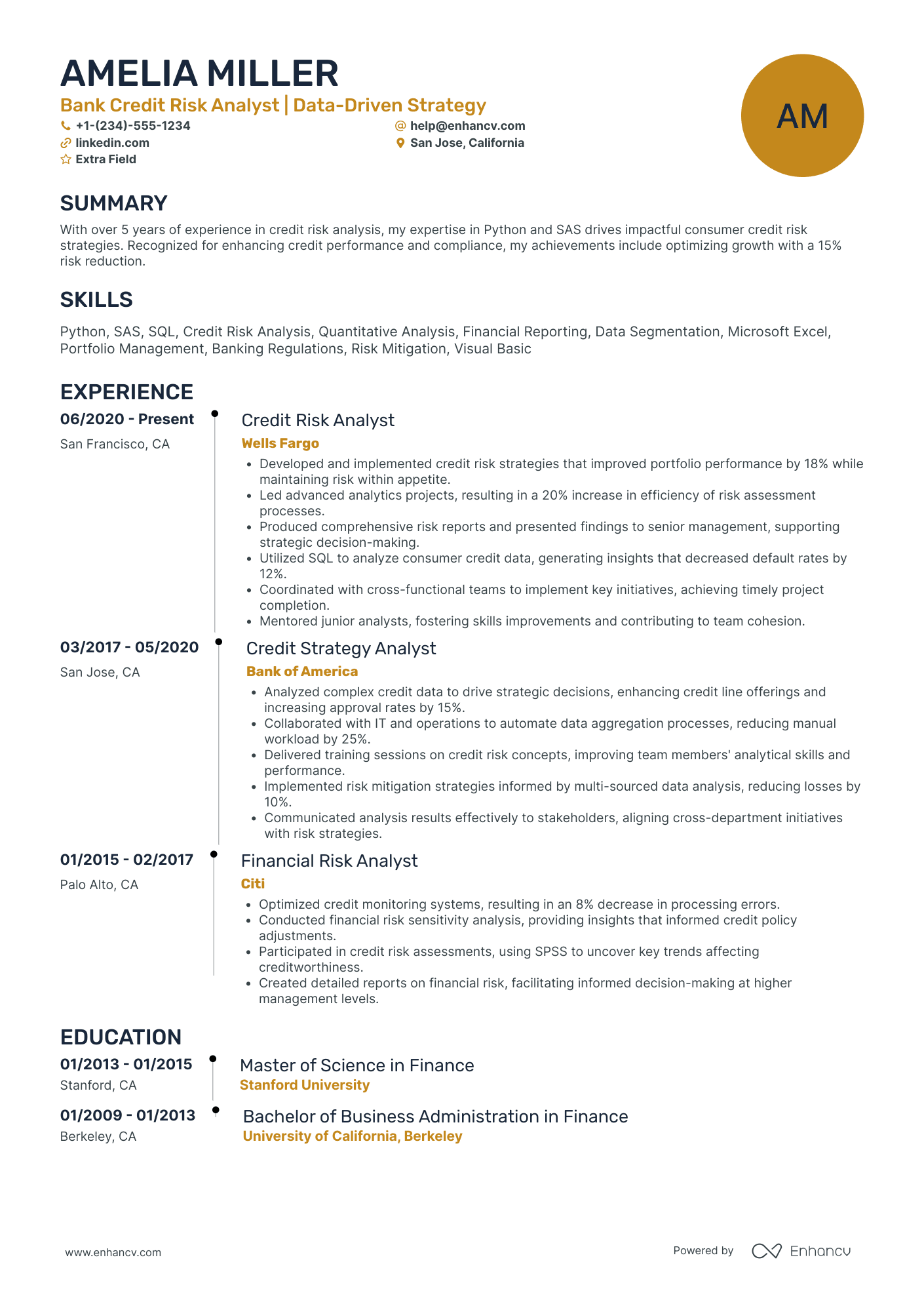

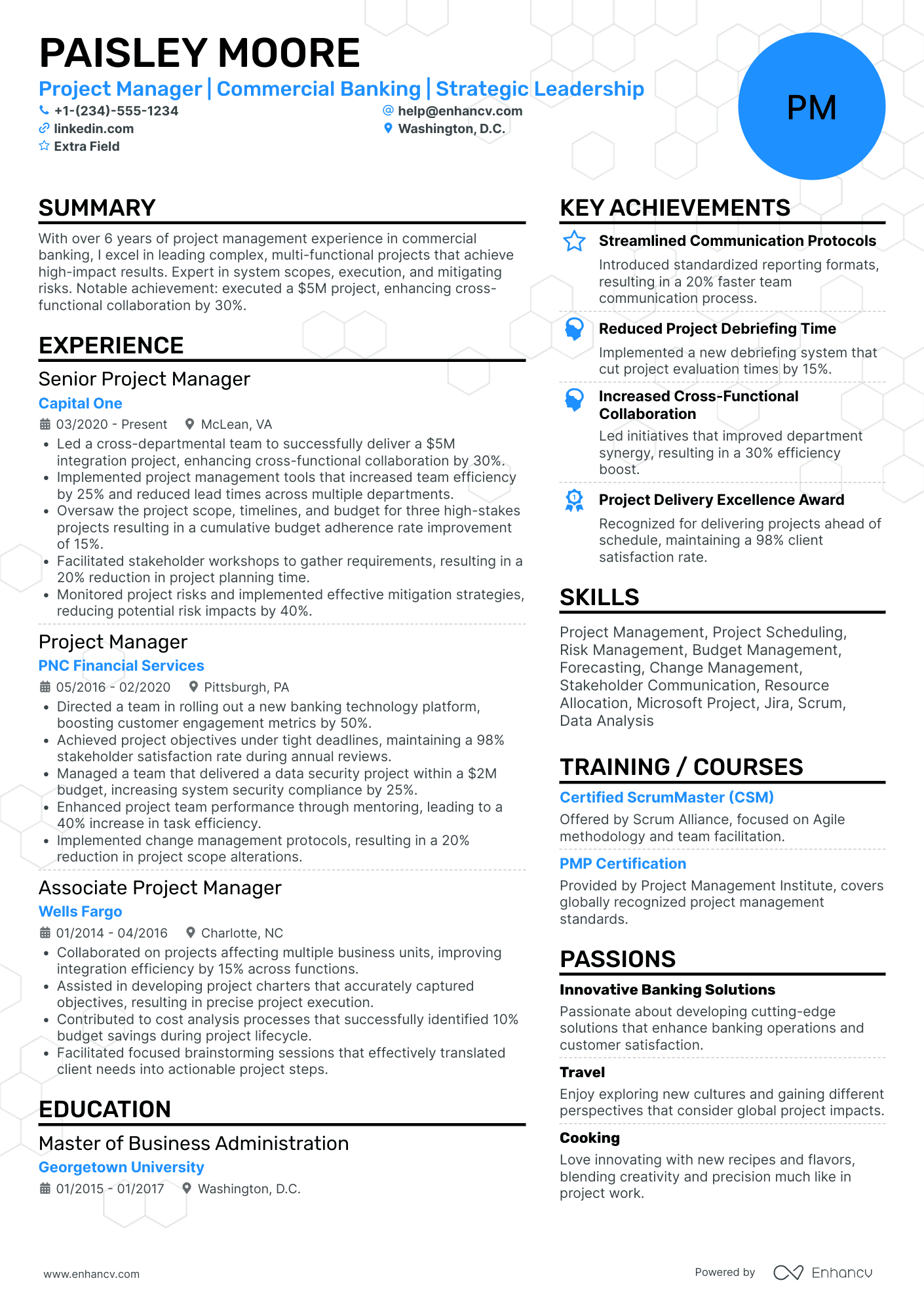

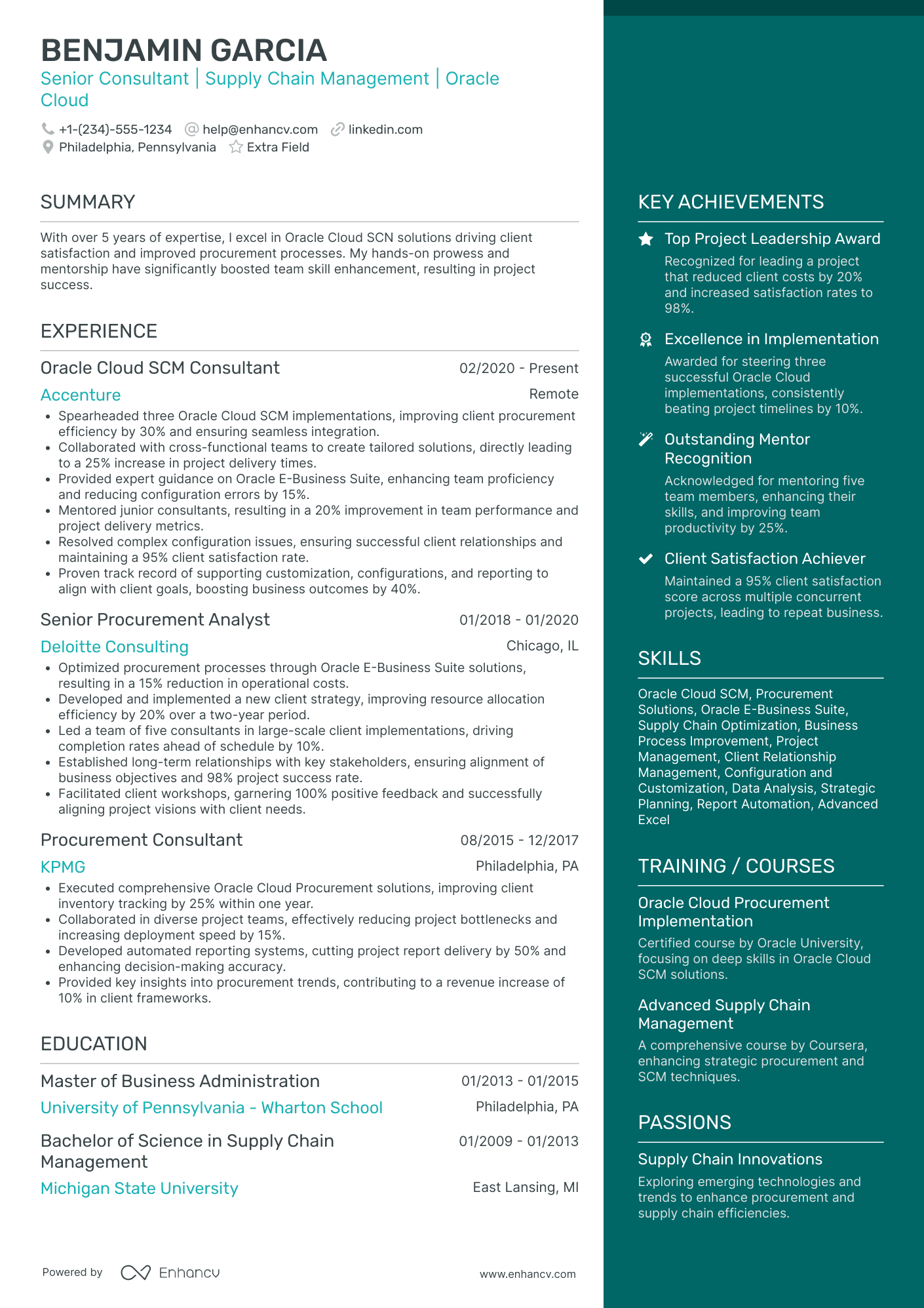

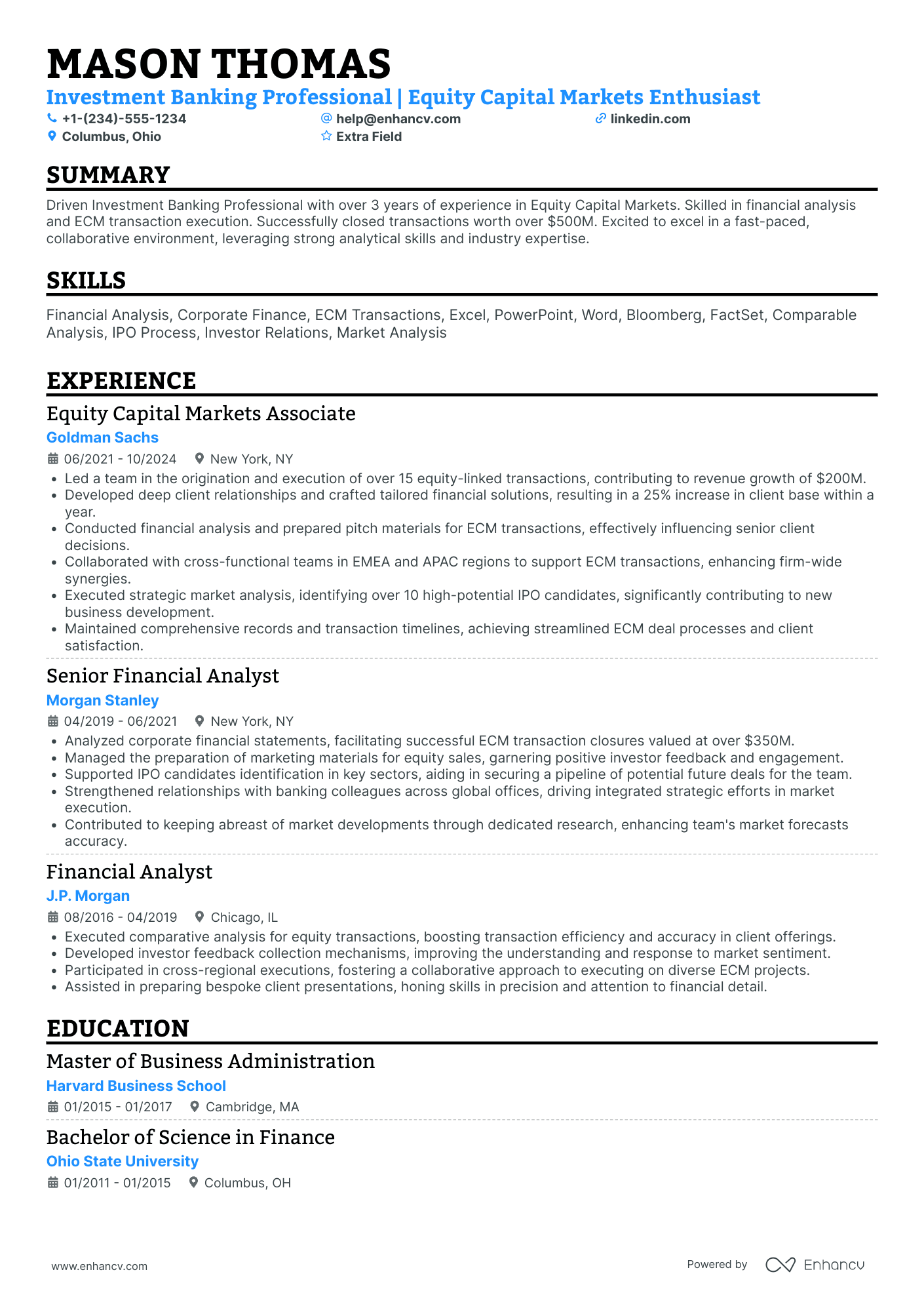

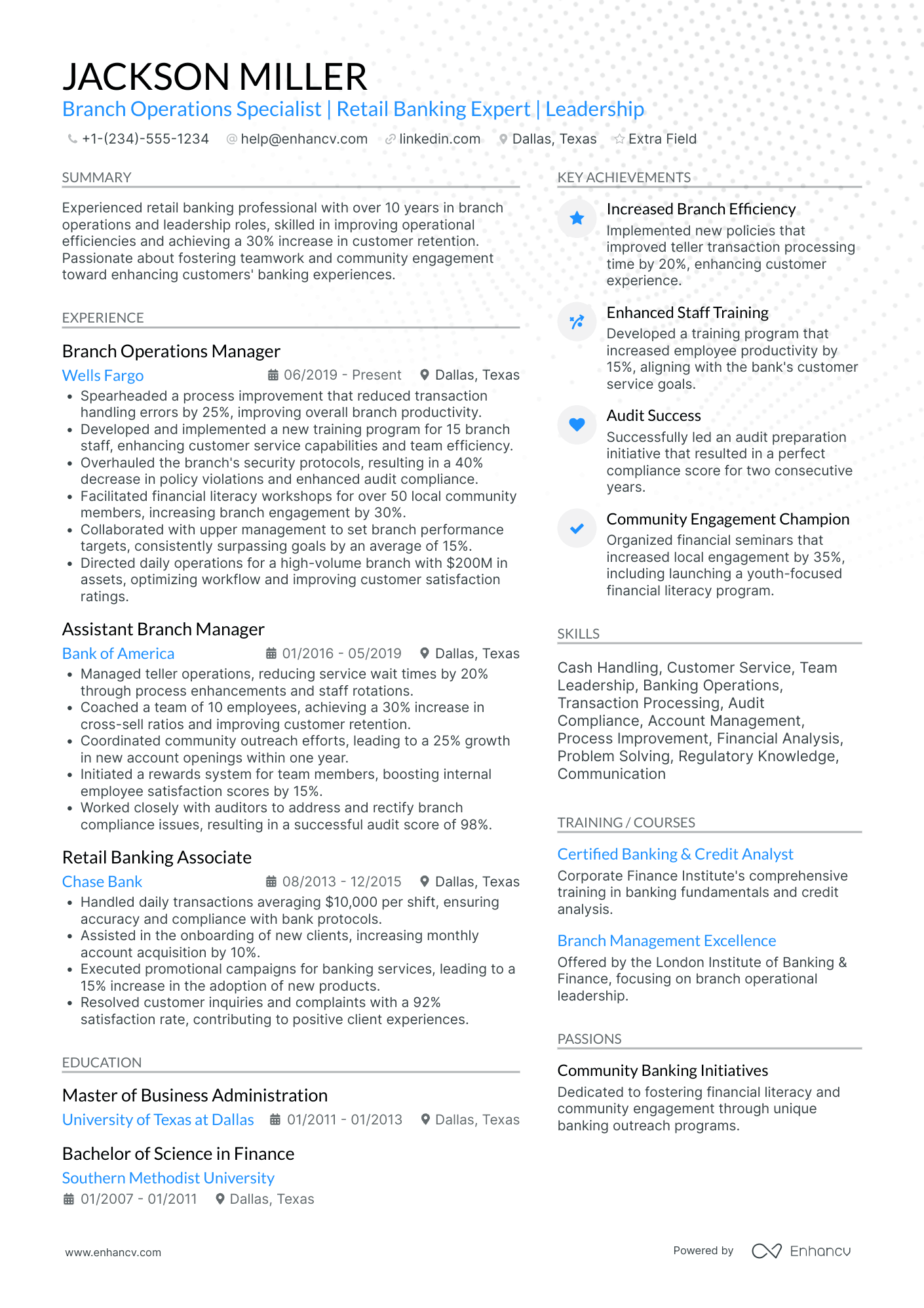

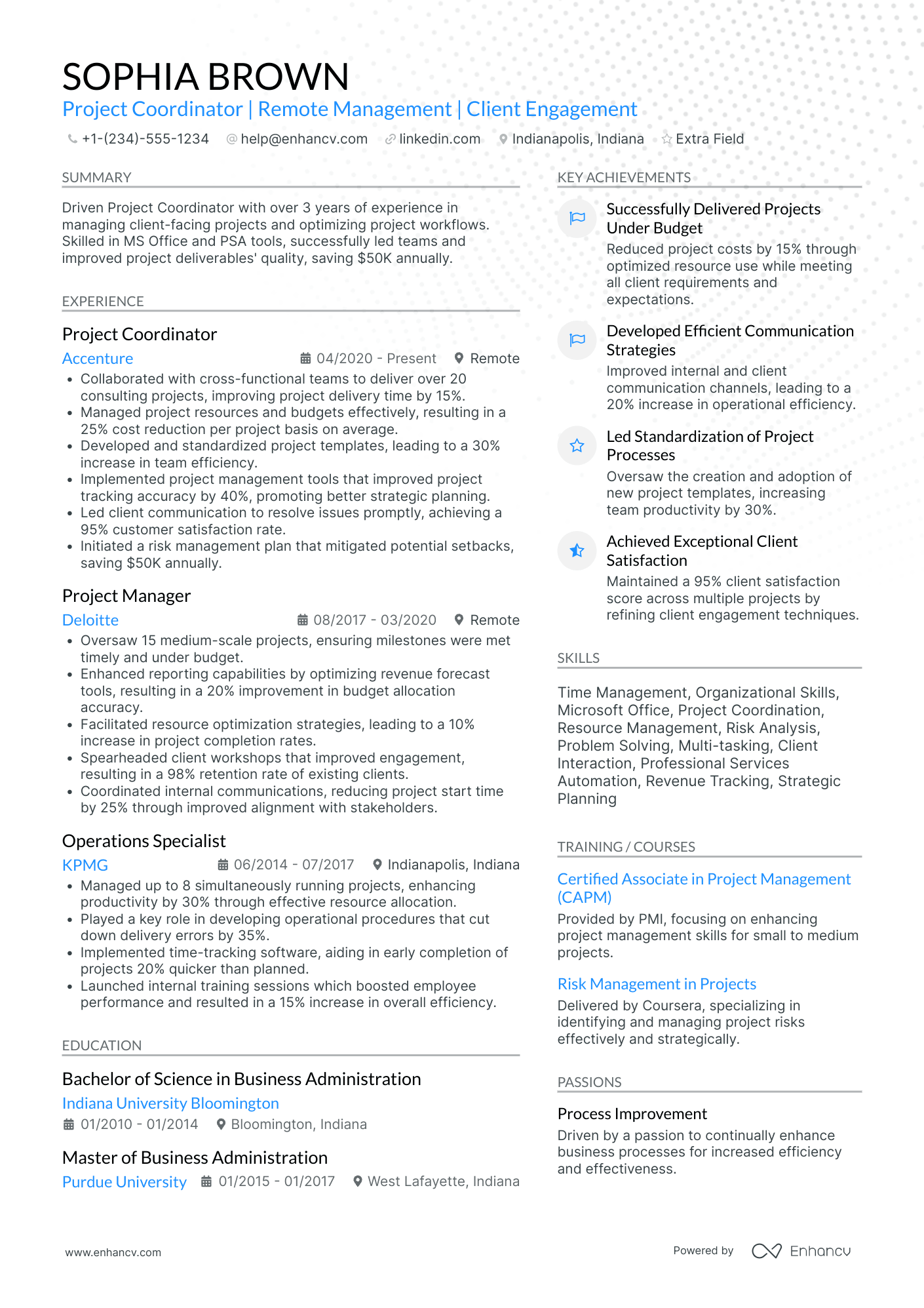

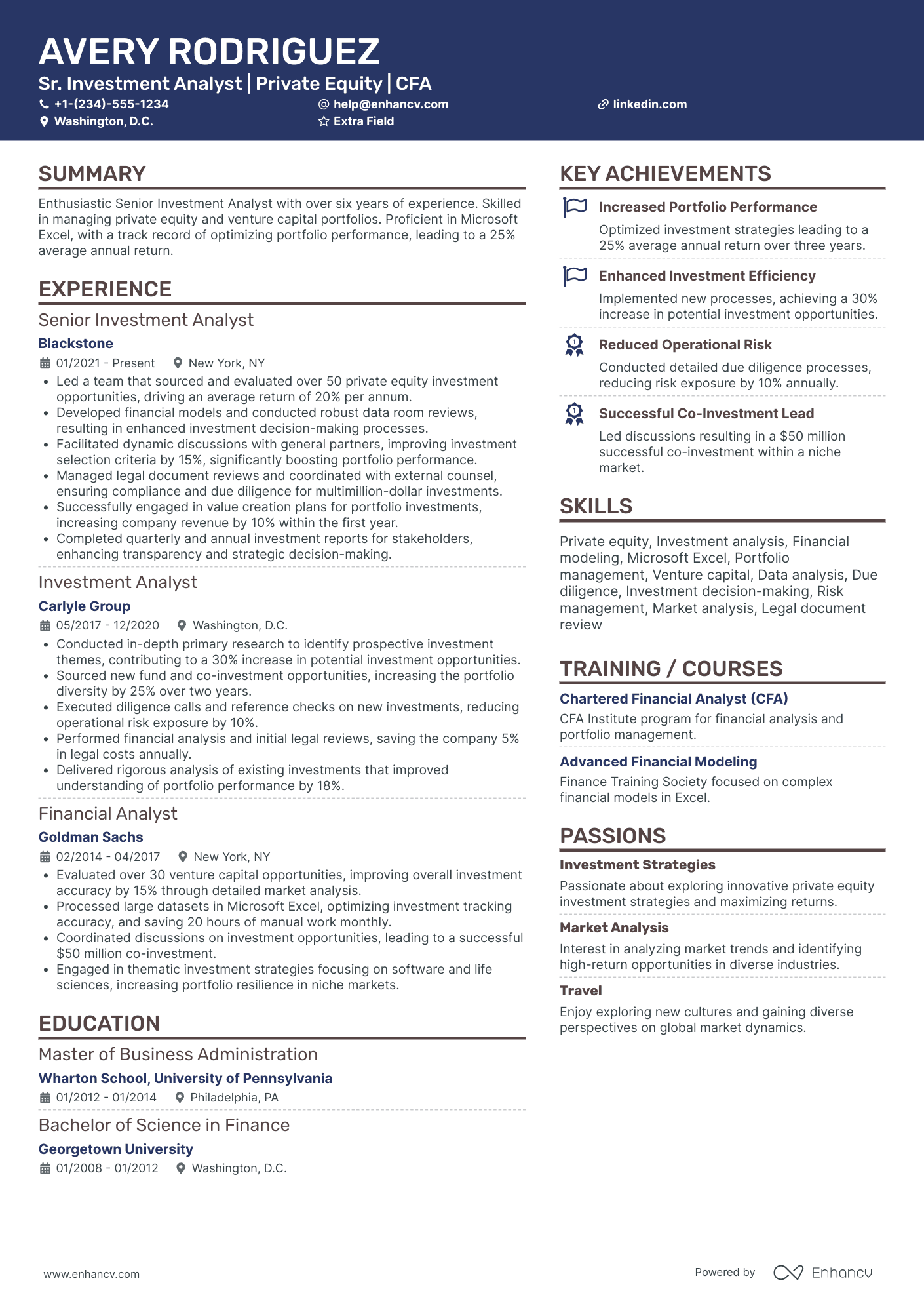

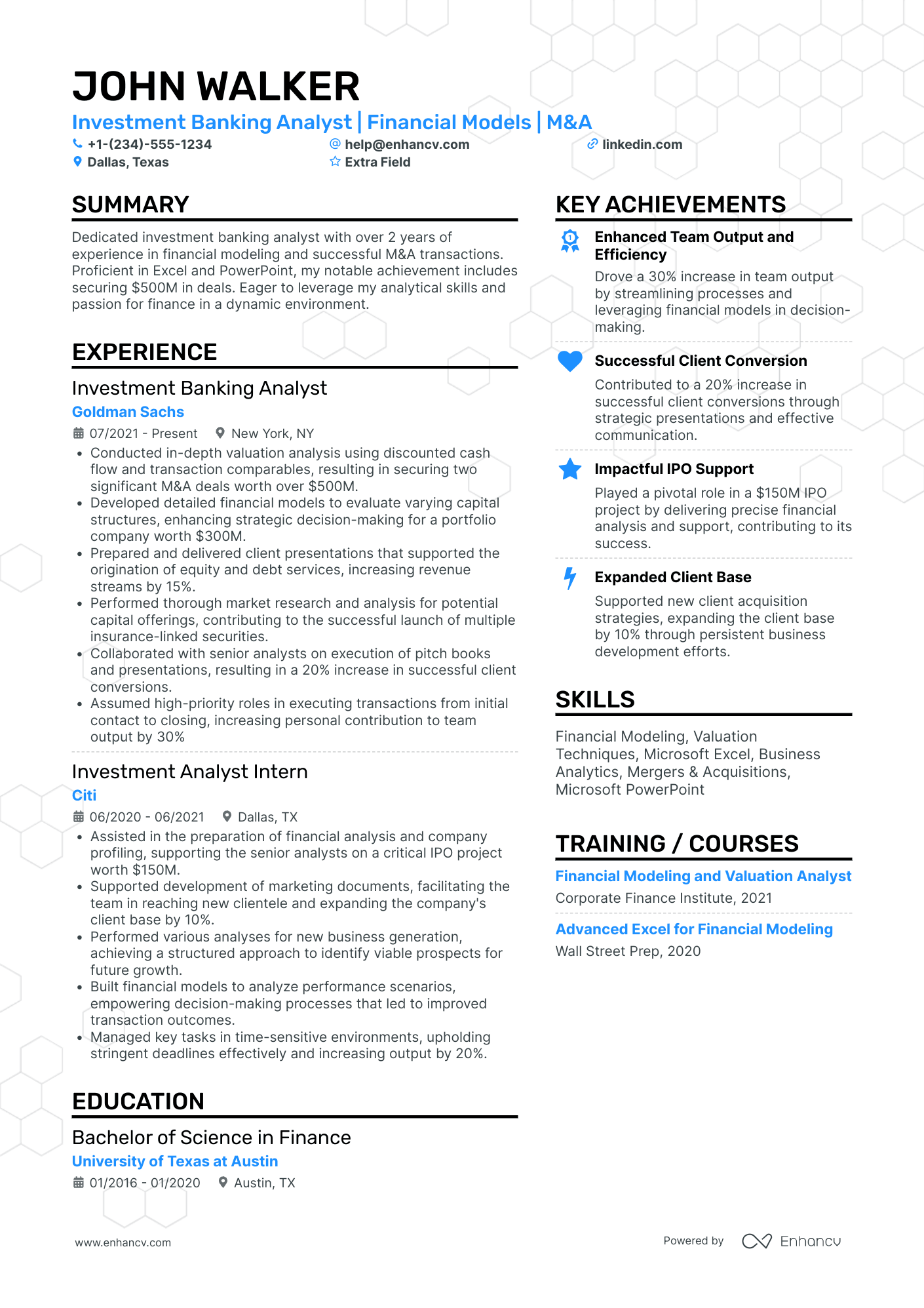

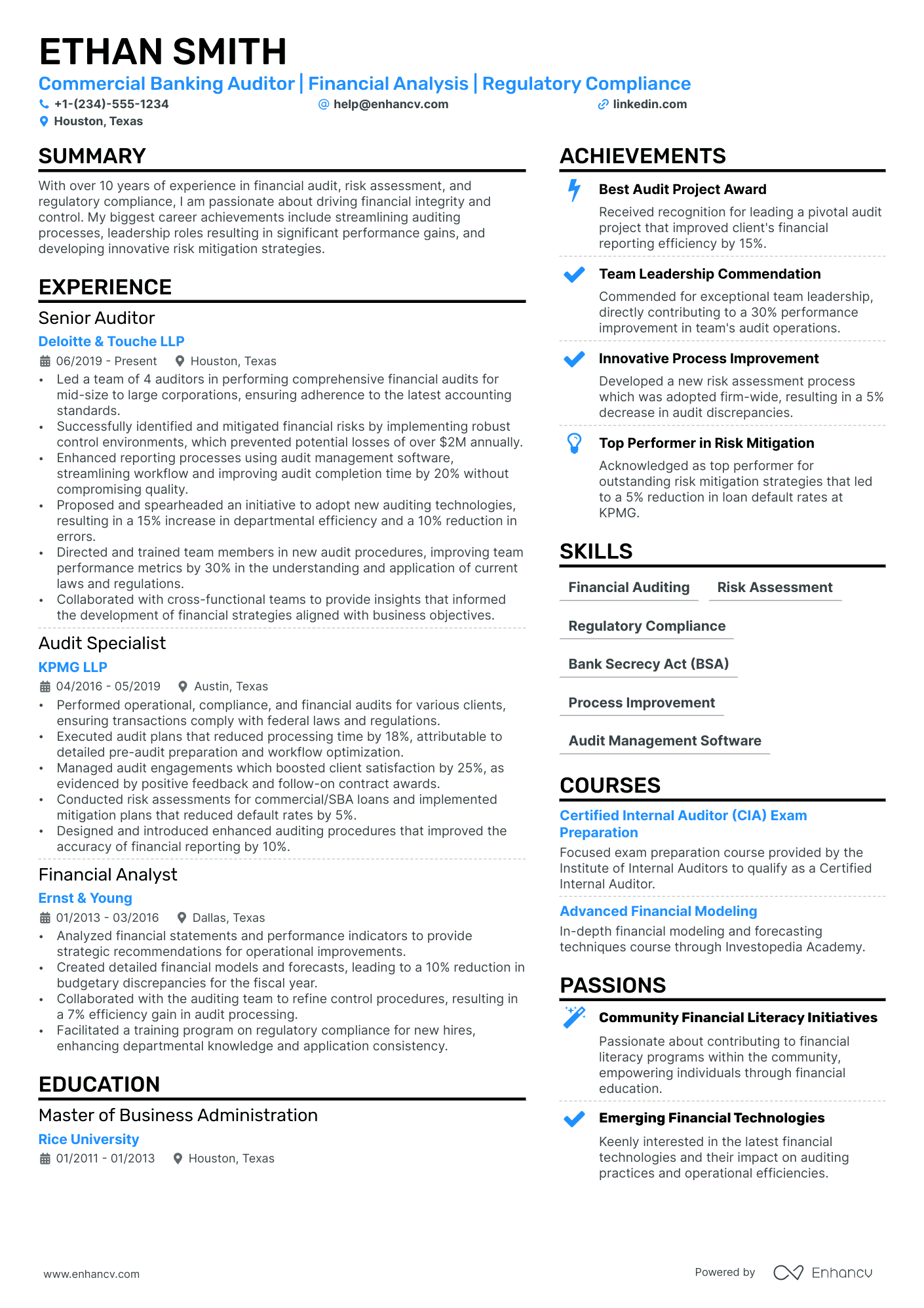

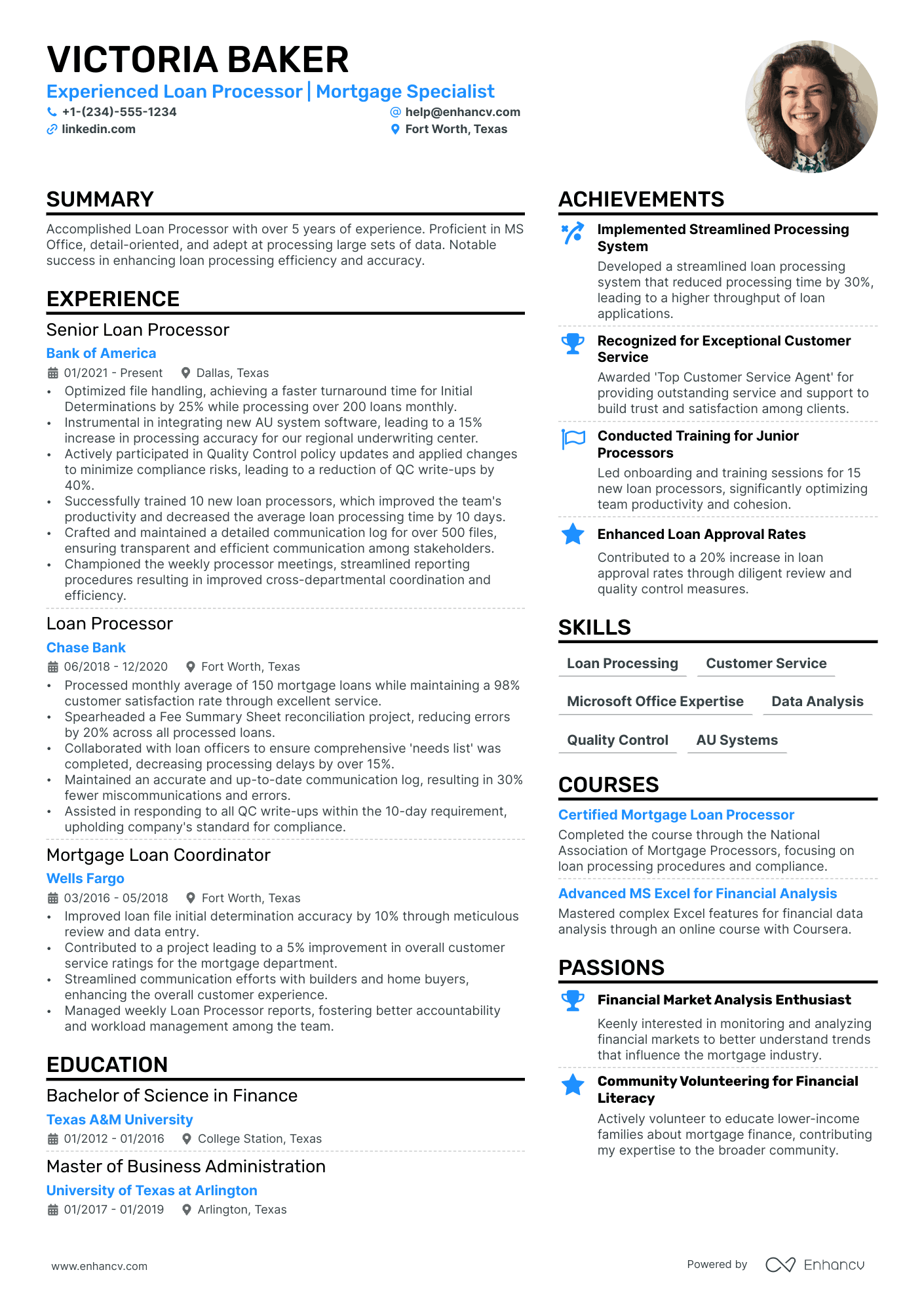

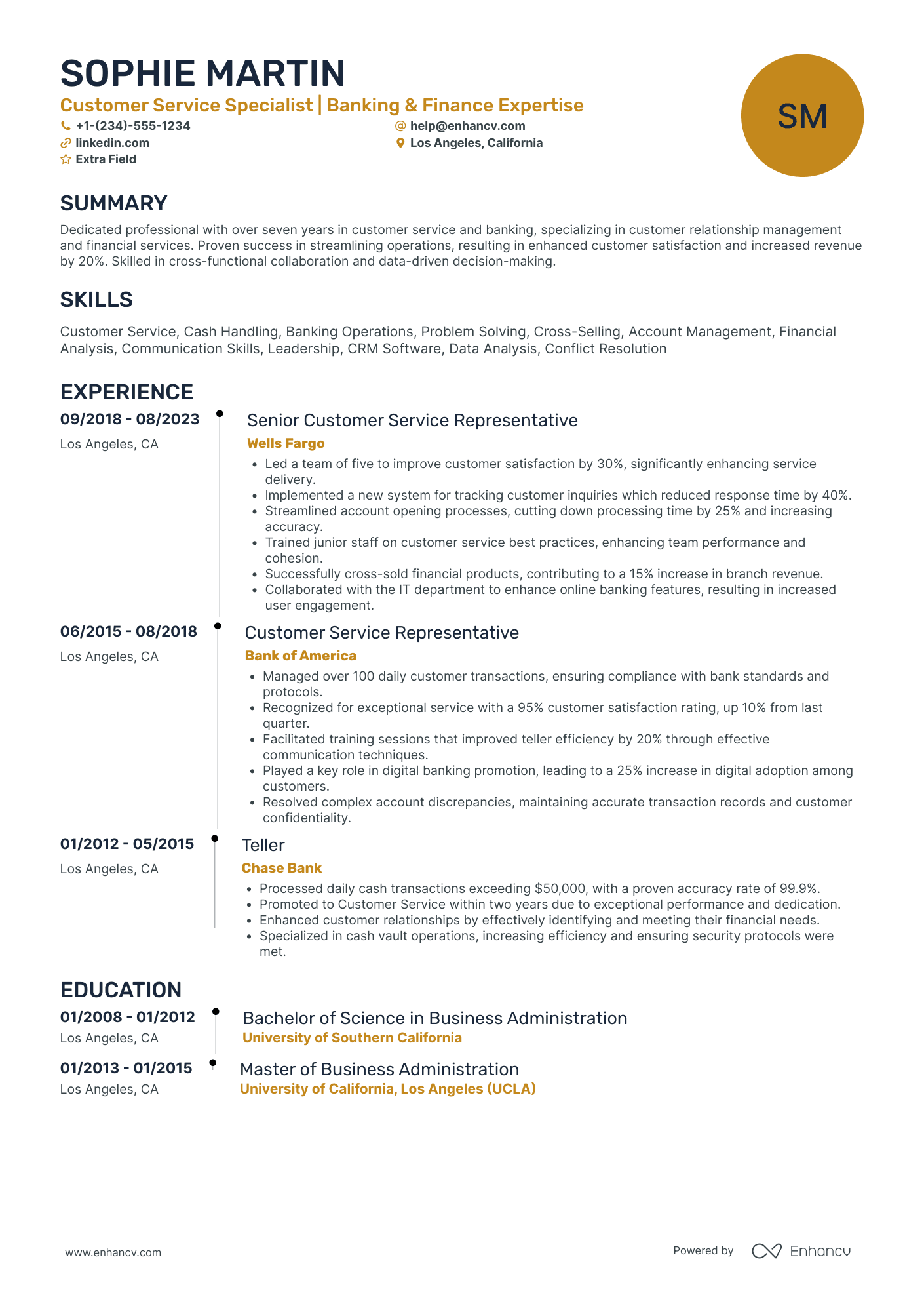

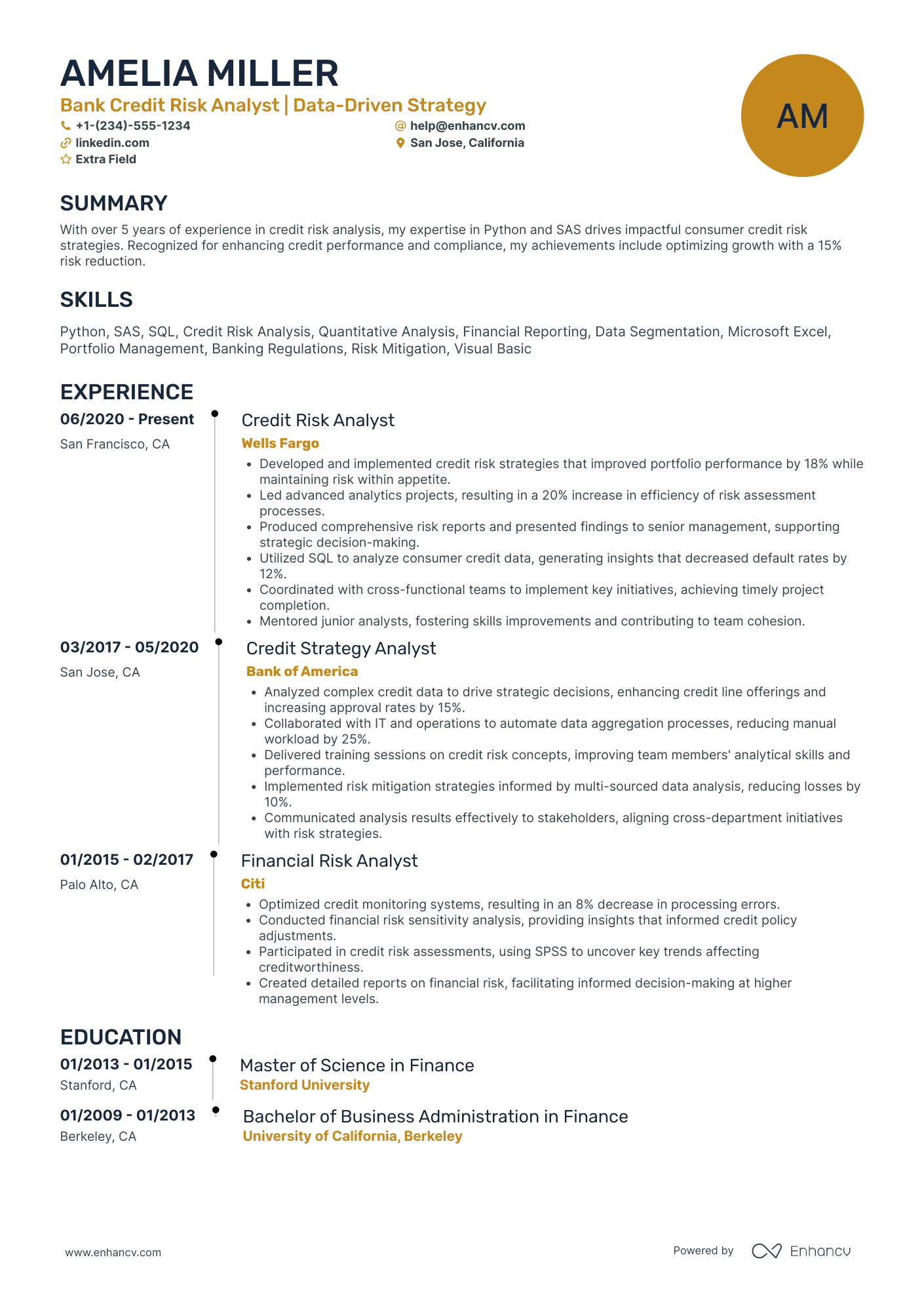

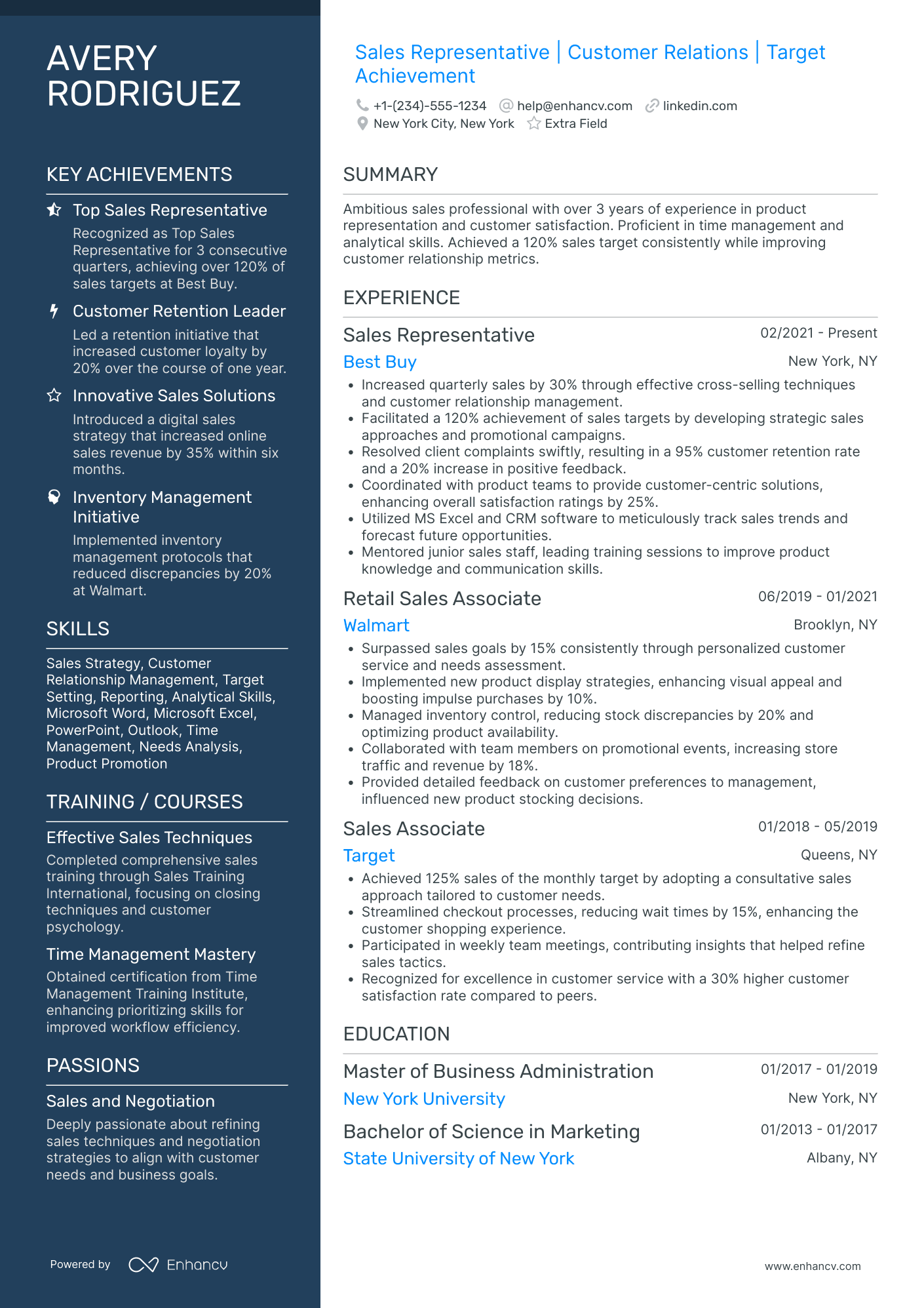

Banking resume examples

By Experience

By Role