Embarking on your journey as a certified financial planner, you've meticulously tailored your resume and started applying for your dream job when suddenly you hit a snag — the cover letter requirement. Unlike a resume, your cover letter is the narrative of your proudest professional triumph, not just a repeat of your achievements. Crafting it calls for a delicate balance of formality and originality, all the while avoiding clichés and maintaining brevity. Let's sculpt that one-page story that stands out.

- Personalize the greeting to address the recruiter and your introduction that fits the role;

- Follow good examples for individual roles and industries from job-winning cover letters;

- Decide on your most noteworthy achievement to stand out;

- Format, download, and submit your certified financial planner cover letter, following the best HR practices.

Use the power of Enhancv's AI: drag and drop your certified financial planner resume, which will swiftly be converted into your job-winning cover letter.

If the certified financial planner isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Certified Financial Planner resume guide and example

- Finance Coordinator cover letter example

- Finance cover letter example

- Finance Manager cover letter example

- Compliance Analyst cover letter example

- Bank Teller cover letter example

- Business Analyst Accounting cover letter example

- Payroll Director cover letter example

- Staff Auditor cover letter example

- Entry Level Actuary cover letter example

- Finance Associate cover letter example

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

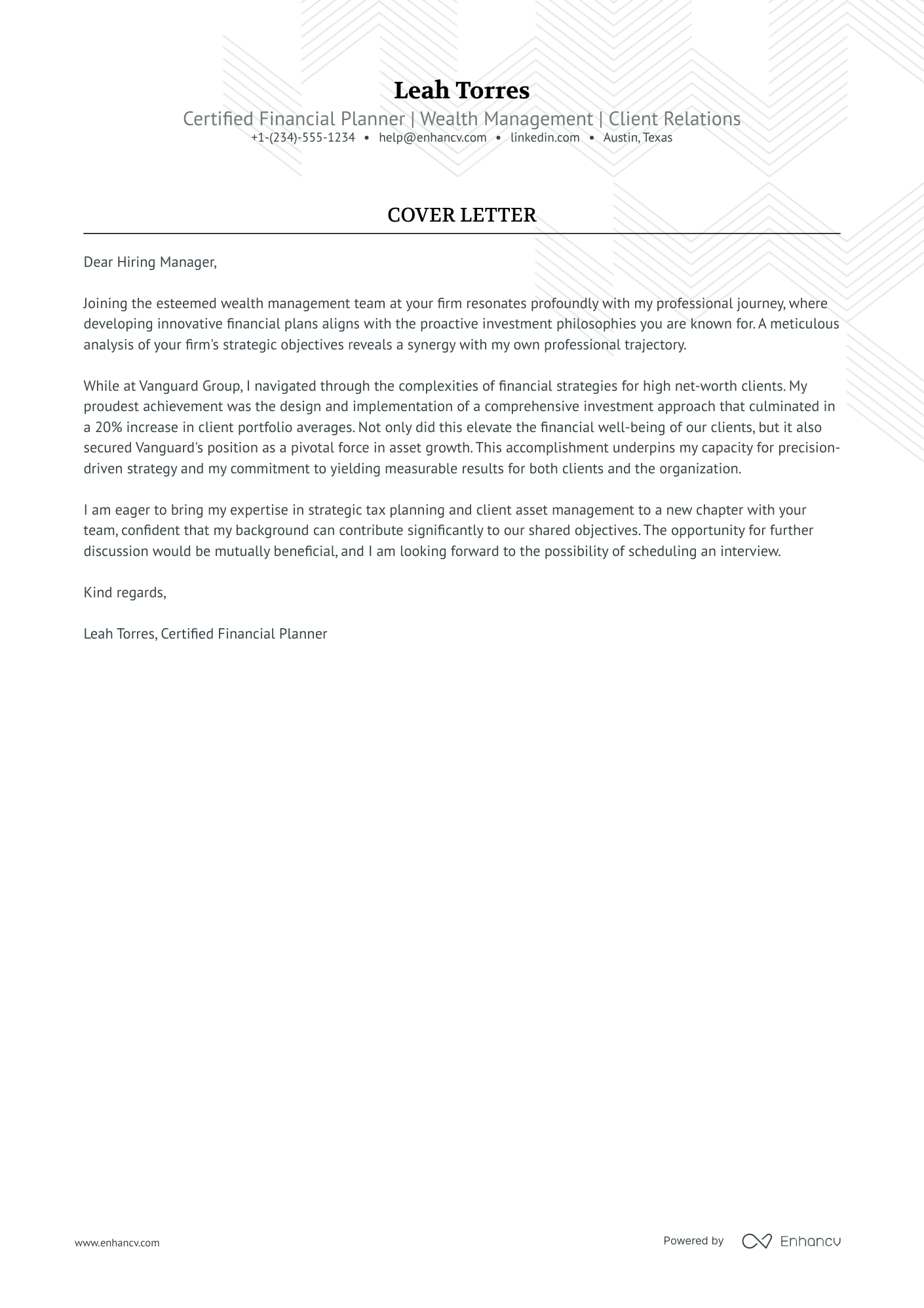

Certified financial planner cover letter example

Leah Torres

Austin, Texas

+1-(234)-555-1234

help@enhancv.com

- Emphasizing specialized certifications such as "Certified Financial Planner" which directly relate to the role, highlighting professional qualifications that can set a candidate apart for a wealth management position.

- Detailing specific professional achievements, like the "design and implementation of a comprehensive investment approach" that led to a "20% increase in client portfolio averages," demonstrating the ability to produce tangible results that align with the firm's goals.

- Aligning personal career goals with the firm's strategic objectives, which suggests that the candidate has done their research and is genuinely interested in the unique opportunities and challenges presented by the firm's philosophy and approach to wealth management.

The format of your certified financial planner cover letter: structure, fonts, margins, and more

Your certified financial planner cover letter should include a header (with your name, position, and date); a greeting and introductory paragraph; a body and closing paragraphs; and an optional signature.

Remember that you're writing your certified financial planner cover letter for recruiters - as the Applicant Tracker System won't scan this content.

Here are a few more tips and tricks to keep in mind when formatting your certified financial planner cover letter:

- Use the same font in your certified financial planner cover letter and resume. We recommend modern fonts, e.g. Lato and Rubik, to help you stand out, instead of the stereotypical Arial and Times New Roman.

- Each paragraph should have single spacing, which is already set up for you in our cover letter templates.

- Our cover letter builder follows industry standards for your certified financial planner cover letter formatting - with a one-inch margin, surrounding your content.

- Always export your certified financial planner cover letter in PDF to ensure the image or text quality stays the same and your writing isn't moved about.

Tight on time? Our free cover letter generator helps you create a cover letter instantly from your resume.

The top sections on a certified financial planner cover letter

- Header: This should include the candidate’s contact information, making it straightforward for the recruiter to reach out and demonstrates professional attention to detail, which is critical for a Certified Financial Planner.

- Opening Salutation: A personalized greeting shows the candidate has done their research on the company and is reaching out to a specific individual, reflecting the interpersonal skills necessary for advising clients in financial planning.

- Introductory Paragraph: The introduction should briefly showcase the candidate's passion for financial planning and their fundamental understanding of the industry’s impact on individual clients, highlighting their client-centric approach.

- Experience and Skills Summary: This section should focus on the candidate’s relevant financial planning certifications, experience with client portfolio management, strategic investment advising, and risk assessment skills, which are core competencies for a CFP.

- Closing Statement: The closing should reiterate the candidate's enthusiasm for the role and express a desire for a personal interview, along with a courteous thank you, demonstrating the professional courtesy expected of someone in a client-facing financial advisory role.

Key qualities recruiters search for in a candidate’s cover letter

- Strong analytical skills: Demonstrates the ability to analyze financial data and present well-informed recommendations.

- In-depth knowledge of financial planning: Shows a thorough understanding of tax planning, investment management, estate planning, retirement planning, and risk management.

- Exceptional communication skills: To effectively convey complex financial concepts to clients of varying levels of financial literacy.

- Certified Financial Planner (CFP) certification: Indicates dedication to the profession and adherence to ethical standards set by the Certified Financial Planner Board of Standards.

- Proven experience with financial planning software: Practical knowledge of tools like MoneyGuidePro, eMoney Advisor, or similar platforms is essential for efficiency and accuracy.

- Relationship-building expertise: The ability to establish and maintain trust with clients, which is critical in managing their financial well-being over time.

Greeting recruiters with your certified financial planner cover letter salutation

What better way to start your conversation with the hiring manager, than by greeting them?

Take the time to find out who the professional, recruiting for the role, is.

Search on LinkedIn, the company website. And for those still keen on making a fantastic first impression, you could even contact the organization, asking for the recruiter's name and more details about the job.

Address recruiters in the certified financial planner greeting by either their first name or last name. (e.g. "Dear Anthony" or "Dear Ms. Smarts").

If you're unable to discover the recruiter's name - don't go for the impersonal "To whom it may concern", but instead use "Dear HR team".

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Mr./Ms./Dr.] [Last Name],

- Dear [Job Title] Hiring Committee,

- Dear [Department] Leadership,

Using your certified financial planner cover letter intro to show your dedication

We know just how difficult it is to start writing your certified financial planner cover letter introduction.

There are so many great qualities you have as a professional, which one should you choose?

How about writing up to two sentences about your passion and commitment to the work you do or are set to do?

Try to describe exactly what you enjoy about the potential role.

A positive attitude from the get-go will help you stand out as a motivated certified financial planner professional.

Structuring your certified financial planner cover letter body to add more value

You've hinted at your value as a professional (this may be your passion for the job or interest in the company) in your introduction.

Next, it's time to pan out the body or middle of your certified financial planner cover letter.

When creating your resume, you've probably gone over the advert a million times to select the most relevant skills.

Well, it's time to repeat this activity. Or just copy and paste your previous list of job-crucial requirements.

Then, select one of your past accomplishments, which is relevant and would impress hiring managers.

Write between three and six paragraphs to focus on the value your professional achievement would bring to your potential, new organization.

Tell a story around your success that ultimately shows off your real value as a professional.

Two ideas on how to end the final paragraph of your certified financial planner cover letter

Closing your certified financial planner cover letter, you want to leave a memorable impression on recruiters, that you're a responsible professional.

End your cover letter with how you envision your growth, as part of the company. Make realistic promises on what you plan to achieve, potentially, in the next six months to a year.

Before your signature, you could also signal hiring managers that you're available for the next steps. Or, a follow-up call, during which you could further clarify your experience or professional value.

Is it beneficial to mention that you have no experience in your certified financial planner cover letter?

Just be honest that you may not have had roles in the industry, but bring about so much more.

Like, your transferable skills, attained thanks to your whole work and life experience (e.g. the skills your summer spent working abroad taught you).

Or, focus on what makes you, you, and that one past success that can help you stand out and impress recruiters (think of awards you've attained and how they've helped you become a better professional).

Alternatively, write about your passion and drive to land the job and the unique skill set you would bring to enhance the workplace culture.

Key takeaways

Winning recruiters over shouldn't be difficult if you use your certified financial planner cover letter to tell a story that:

- Is personalized by greeting your readers and focusing on key job skills greets;

- Isn't spread all over the place, but instead focuses on one key achievement and selling your value as a professional;

- Introduces your enthusiasm for the role, passion for the job, or creativity in communication;

- Is also visually appealing - meeting the best HR practices;

- Ends with a nod to the future and how you envision your growth, as part of the company.