One resume challenge you may encounter in the field of phone banking is effectively showcasing your ability to handle high volumes of customer interactions while maintaining excellent service quality. Our guide provides tailored advice on how to highlight these critical skills, ensuring your resume stands out to potential employers.

- Sample industry-leading examples to learn how to write your best resume yet.

- Improve the experience, education, and achievements section of your resume with insights from resume-writing professionals.

- Curate your technical expertise and personality to stand out amongst the pool of candidates.

- Succinctly focus on your unique skill set all through your phone banking resume.

If the phone banking resume isn't the right one for you, take a look at other related guides we have:

Tips and tricks for your phone banking resume format

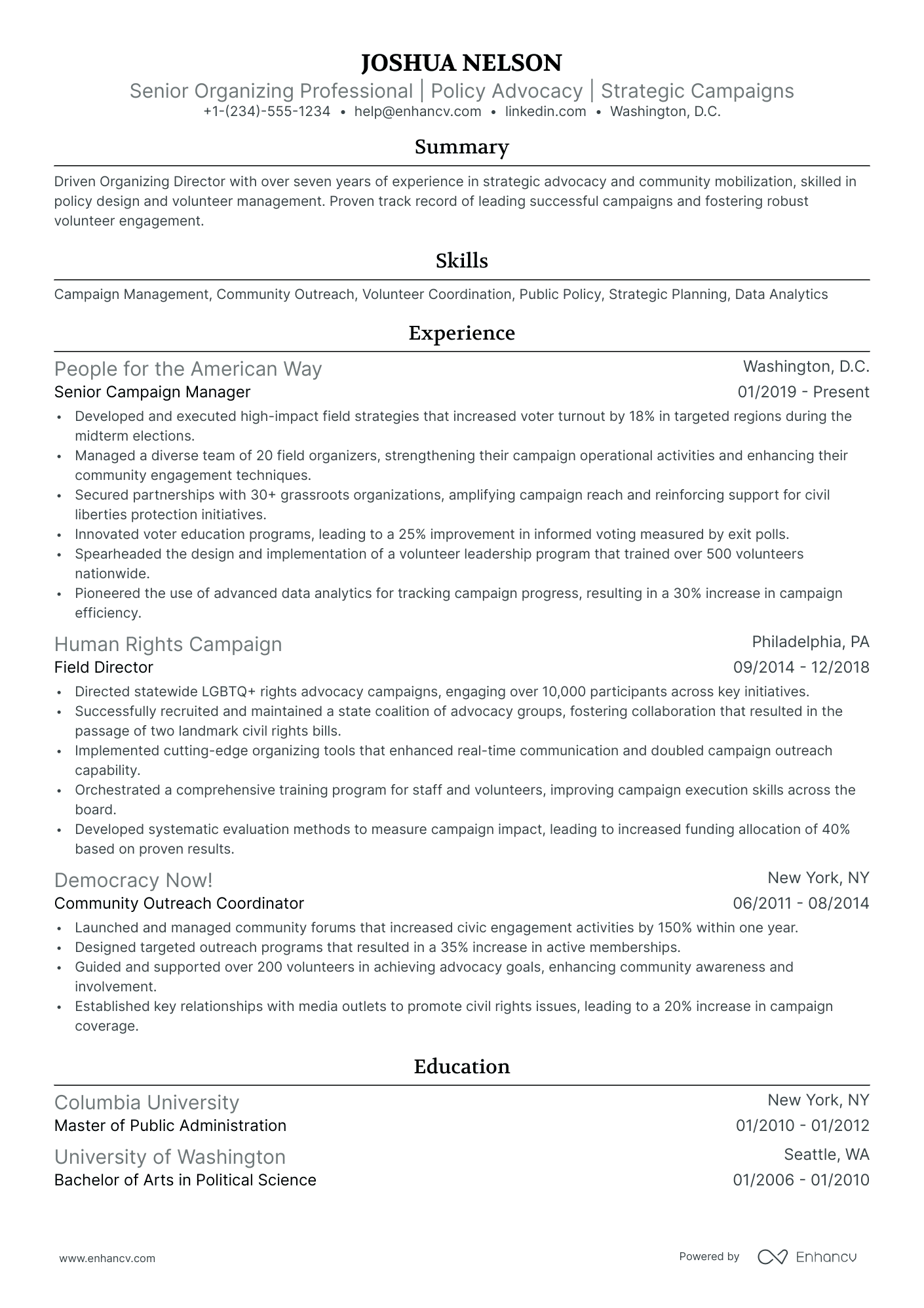

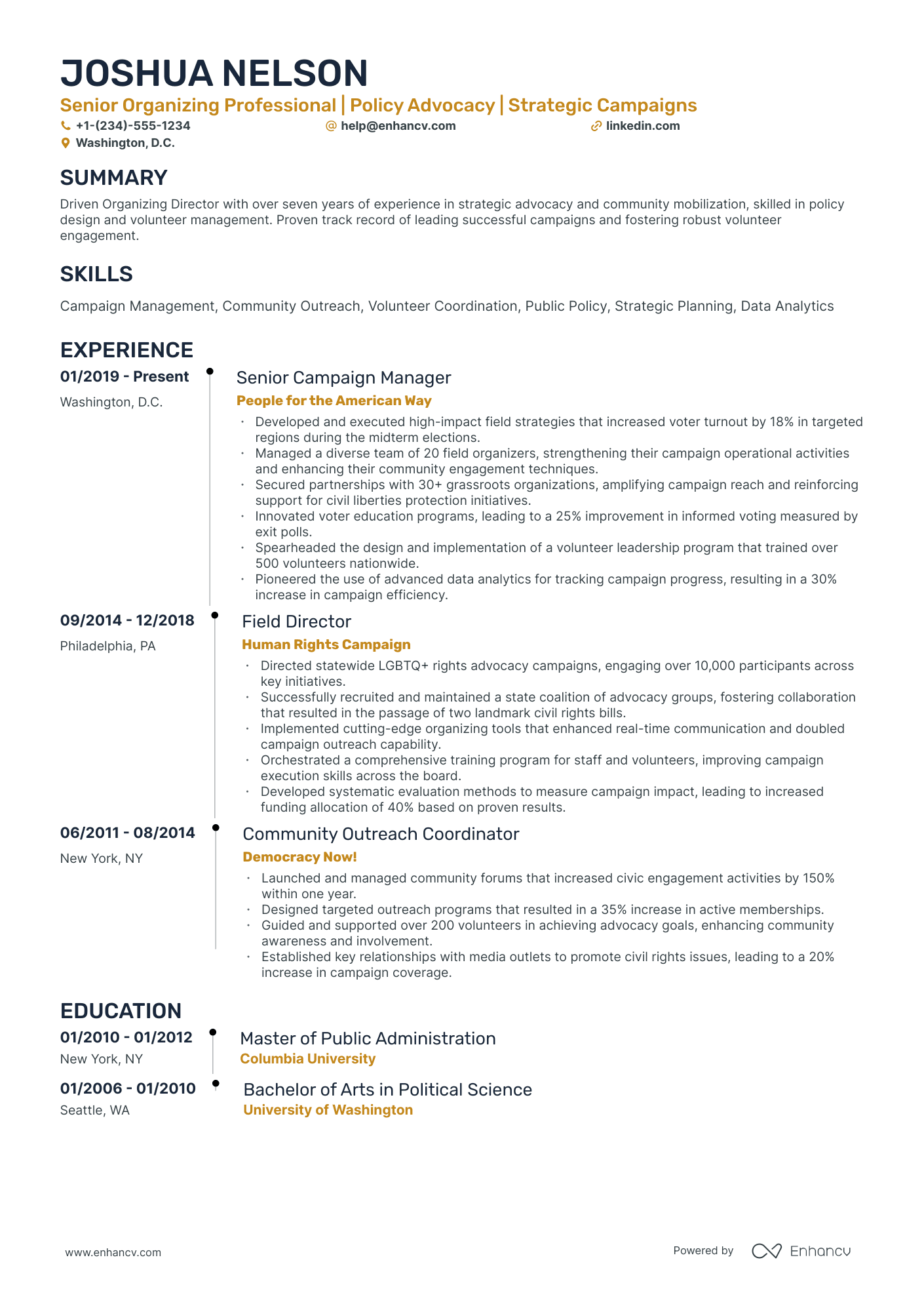

Before you start writing your resume, you must first consider its look-and-feel - or resume format . Your professional presentation hence should:

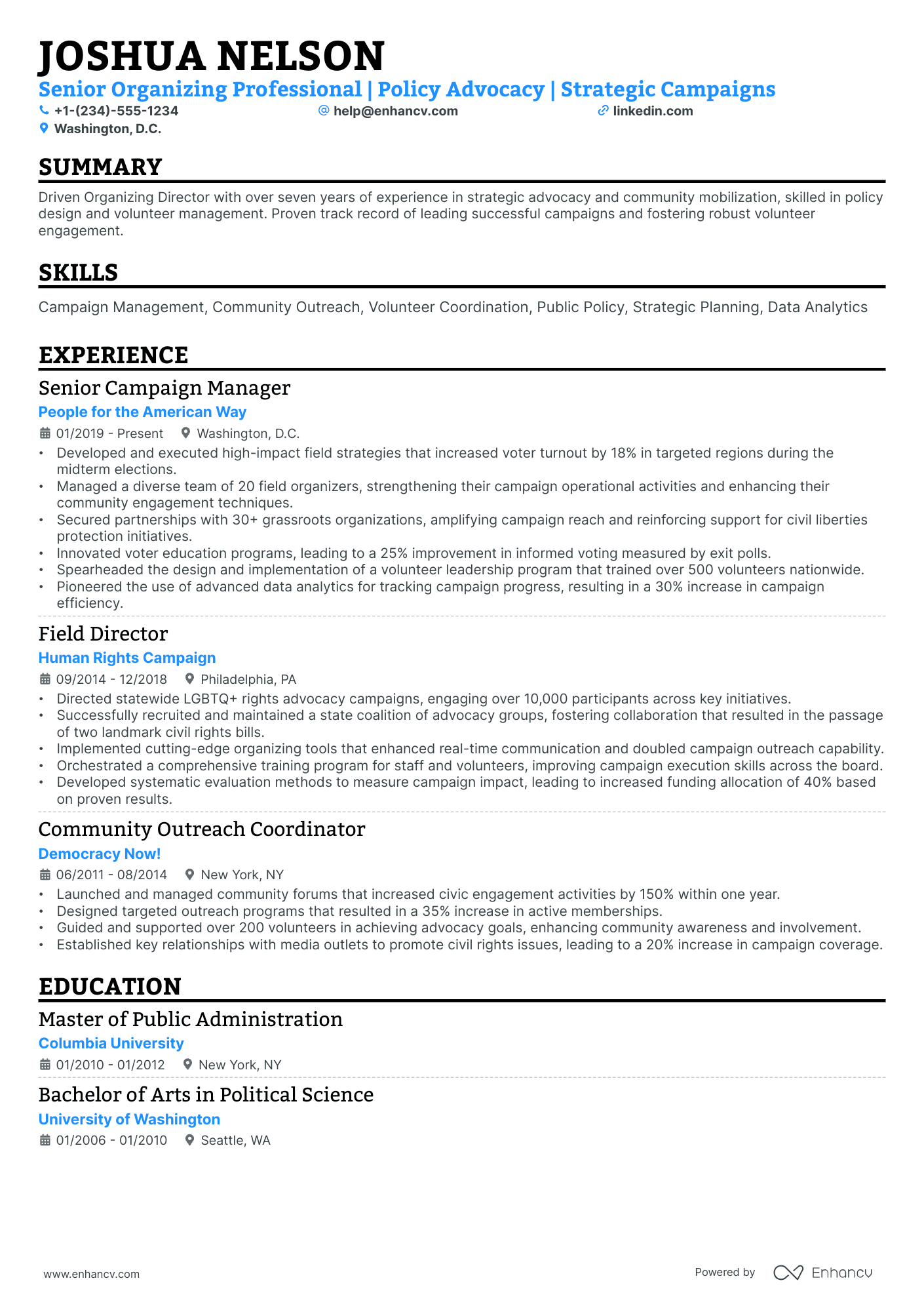

- Follow the reverse-chronological resume format , which incroporates the simple logic of listing your latest experience items first. The reverse-chronological format is the perfect choice for candidates who have plenty of relevant (and recent) experience.

- State your intention from the get-go with a clear and concise headline - making it easy for recruiters to allocate your contact details, check out your portfolio, or discover your latest job title.

- Be precise and simple - your resume should be no more than two pages long, representing your experience and skills that are applicable to the phone banking job.

- Ensure your layout is intact by submitting it as a PDF. Thus, your resume sections would stay in place, even when assessed by the Applicant Tracker System (ATS).

Be aware of location-based layout differences – Canadian resumes, for instance, might differ in format.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Traditional sections, appreciated by recruiters, for your phone banking resume:

- Clear and concise header with relevant links and contact details

- Summary or objective with precise snapshot of our career highlights and why you're a suitable candidate for the phone banking role

- Experience that goes into the nuts and bolts of your professional qualifications and success

- Skills section(-s) for more in-depth talent-alignment between job keywords and your own profile

- Education and certifications sections to further show your commitment for growth in the specific niche

What recruiters want to see on your resume:

- Proven experience in handling high volume inbound and outbound calls efficiently.

- Strong understanding of banking products, services, and procedures.

- Excellent communication and interpersonal skills, with an emphasis on customer service excellence.

- Ability to navigate banking software and CRM systems with speed and accuracy.

- Demonstrated ability to handle sensitive financial information with discretion and complying with banking regulations and privacy laws.

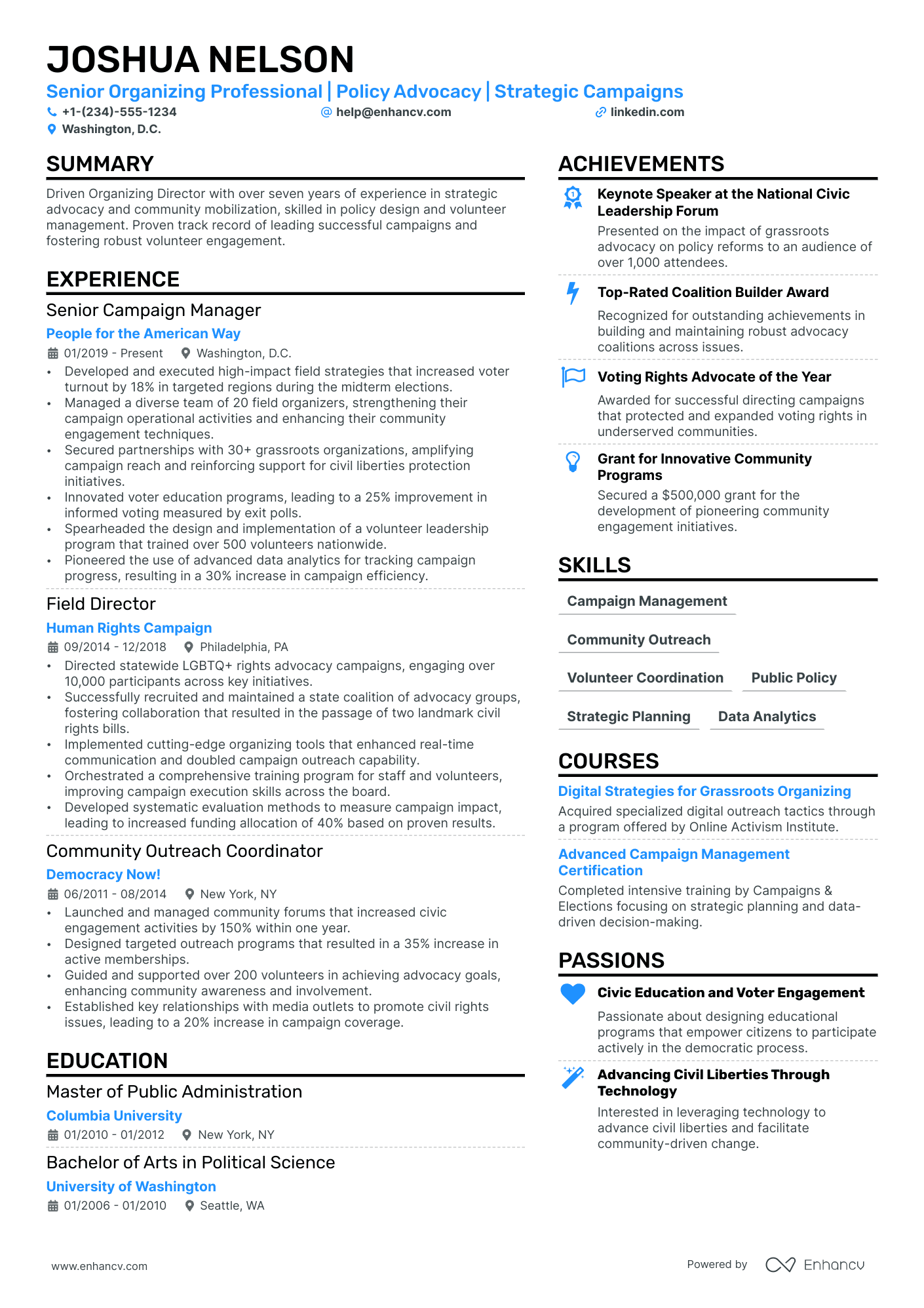

Quick guide to your phone banking resume experience section

After deciding on the format of your resume, it's time to organize your experience within the dedicated section.

It's common for phone banking professionals to be confused in this part of the process, as they may have too much or little expertise.

Follow the general rules of thumb to be successful when writing this part of your resume:

- The perfect number of bullets you should have under each experience item is no more than six;

- Select not merely your responsibilities, but the most noteworthy achievements for each role that match the job requirements;

- List any certificates or technical expertise you've gained on the job and how they've helped you progress as a professional;

- Carefully select the power verbs to go along with each bullet to avoid generic ones like "managed" and instead substitute those with the actuality of your particular responsibility;

- Integrate valuable keywords from the job advert in the form of achievements under each role you list.

If you're on the search for further advice on how to write your phone banking experience section, get some ideas from real-world professional resumes:

- Managed a team of 10 phone banking representatives, fostering a customer-centric environment, leading to a 15% increase in customer satisfaction scores.

- Developed and executed targeted sales strategies that expanded the customer base by 30% through successful cross-selling of financial products.

- Implemented a comprehensive training module for new recruits that reduced average handle time by 25 seconds while improving service quality.

- Conducted detailed analysis of customer satisfaction trends and implemented strategic changes, achieving a 20% reduction in complaint rates.

- Collaborated with the product development team to deliver new banking services that aligned with customers' needs, leading to a 10% increase in product adoption.

- Oversaw the launch of an online phone banking interface that provided users with a more efficient transaction experience, driving a 40% increase in digital transactions.

- Championed the optimization of phone banking scripts, tailoring conversations for client retention, which decreased account closures by 18%.

- Facilitated cross-functional workshops to improve inter-departmental communication, leading to quicker resolution of complex customer issues.

- Created monthly performance review reports highlighting critical KPIs, which became a decisive tool for strategic planning and staff incentivization.

- Pioneered the adoption of an AI-based call routing system, reducing customer wait times by 35% and enhancing overall service efficiency.

- Collaborated with IT to enhance secure authentication processes, which decreased potential fraud occurrences by 22% during customer phone interactions.

- Spearheaded a community outreach program via phone banking to educate customers on financial literacy, registering over 5000 participants in the first year.

- Led a remote team of 25 phone banking consultants amidst the COVID-19 pandemic, maintaining operational efficiency and hitting all sales targets.

- Introduced gamification in performance management that increased employee engagement by 40% and decreased average call resolution time by 15%.

- Negotiated with software vendors to implement a state-of-the-art CRM system, improving lead tracking and personalized customer service.

- Launched a bilingual phone banking service, catering to a diverse customer base and boosting call volume by 20% with high customer service ratings.

- Masterminded a feedback loop for customer interactions that identified key areas for process improvement, reducing resolution times by 30%.

- Managed regulatory compliance for phone banking operations, ensuring zero breaches and maintaining full compliance with financial regulations.

- Orchestrated a comprehensive disaster recovery plan for the phone banking department that ensured business continuity during unexpected service outages.

- Authored a department-wide best practices handbook that became the standard for training new phone banking agents, reducing initial error rates by 50%.

- Generated a monthly business intelligence report to track the effectiveness of service strategies, informing leadership decisions on process enhancements.

- Revitalized underperforming phone banking sales scripts, achieving a record-high conversion rate of 8% for upselling premium accounts.

- Collaborated with Marketing to drive seasonal campaigns via phone banking channels, resulting in a 25% uptick in engagement with promotional offers.

- Led an initiative to incorporate customer feedback directly into product development pipelines, enhancing the relevance and appeal of new banking services.

Quantifying impact on your resume

- Document the total number of customers you successfully assisted through phone banking services.

- Record the exact percentage by which you helped reduce call resolution times.

- Highlight the specific amount of upsells or cross-sells you achieved within a given period.

- Capture the net promoter score (NPS) improvement contribution made through your customer interactions.

- Quantify any increase in customer retention rates as a result of your phone banking efforts.

- Specify the volume of transactions processed daily to demonstrate work capacity and efficiency.

- Mention the amount of revenue generated from your leads or referrals.

- Indicate the percentage reduction in customer complaints due to your service quality.

Action verbs for your phone banking resume

What to do if you don't have any experience

It's quite often that candidates without relevant work experience apply for a more entry-level role - and they end up getting hired.

Candidate resumes without experience have these four elements in common:

- Instead of listing their experience in reverse-chronological format (starting with the latest), they've selected a functional-skill-based format. In that way, phone banking resumes become more focused on strengths and skills

- Transferrable skills - or ones obtained thanks to work and life experience - have become the core of the resume

- Within the objective, you'd find career achievements, the reason behind the application, and the unique value the candidate brings about to the specific role

- Candidate skills are selected to cover basic requirements, but also show any niche expertise.

Recommended reads:

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

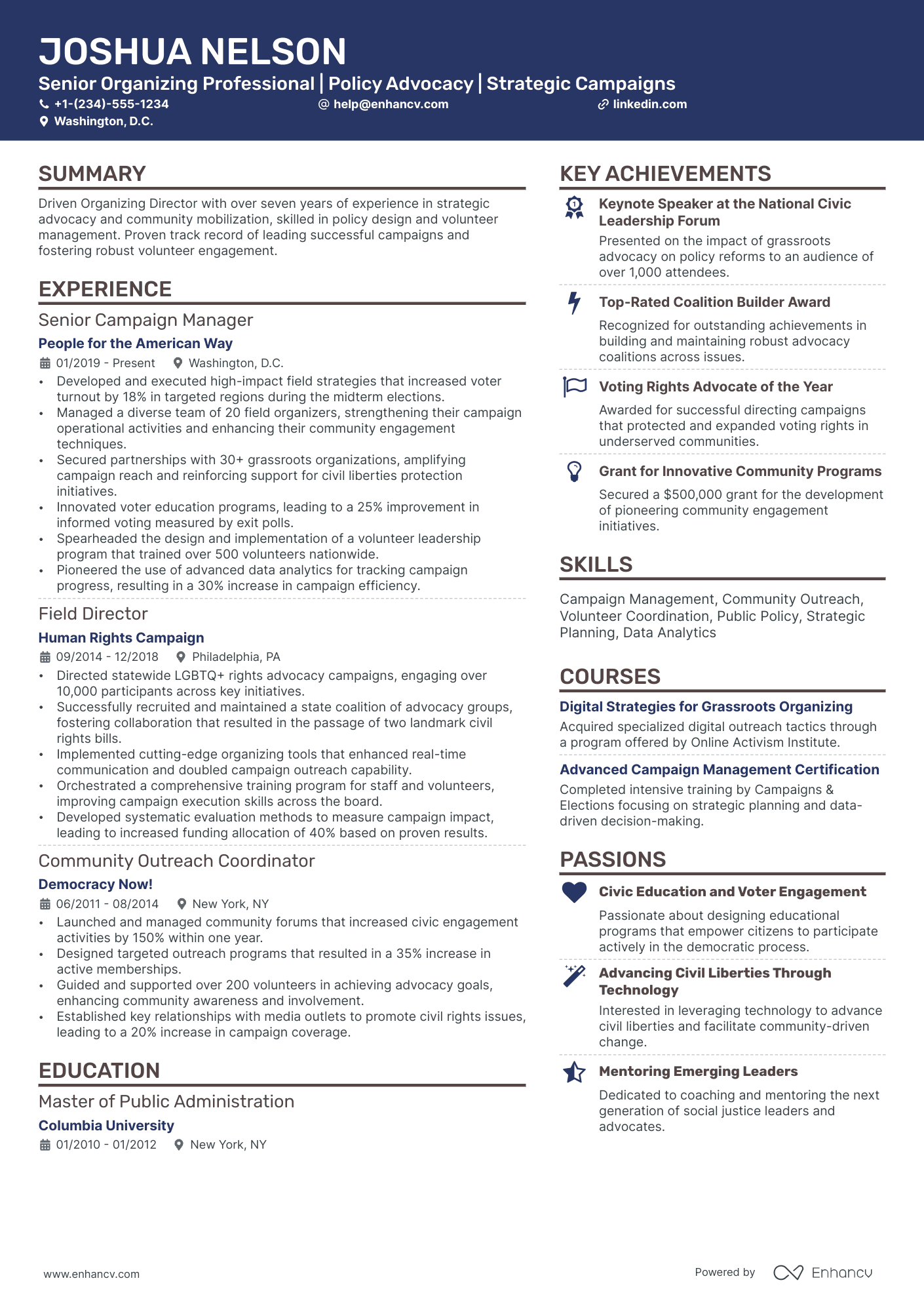

How to showcase hard skills and soft skills on your resume

Reading between the lines of your dream job, you find recruiters are looking for candidates who have specific software or hardware knowledge, and personal skills.

Any technology you're adept at shows your hard skills. This particular skill set answers initial job requirements, hinting at how much time your potential employers would have to invest in training you. Showcase you have the relevant technical background in your communicate, solve problems, and adapt to new environments. Basically, your interpersonal communication skills that show recruiters if you'd fit into the team and company culture. You could use the achievements section to tie in your greatest wins with relevant soft skills.

It's also a good idea to add some of your hard and soft skills across different resume sections (e.g. summary/objective, experience, etc.) to match the job requirements and pass the initial screening process. Remember to always check your skill spelling and ensure that you've copy-pasted the name of the desired skills from the job advert as is.

Top skills for your phone banking resume:

Customer Relationship Management (CRM) Software

Automated Dialing Systems

Data Entry Software

Telecommunication Systems

Payment Processing Systems

Fraud Detection Tools

Call Monitoring Software

Microsoft Office Suite

Customer Service Software

Voice Recognition Technology

Communication Skills

Problem-Solving

Active Listening

Empathy

Time Management

Attention to Detail

Adaptability

Team Collaboration

Interpersonal Skills

Stress Management

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

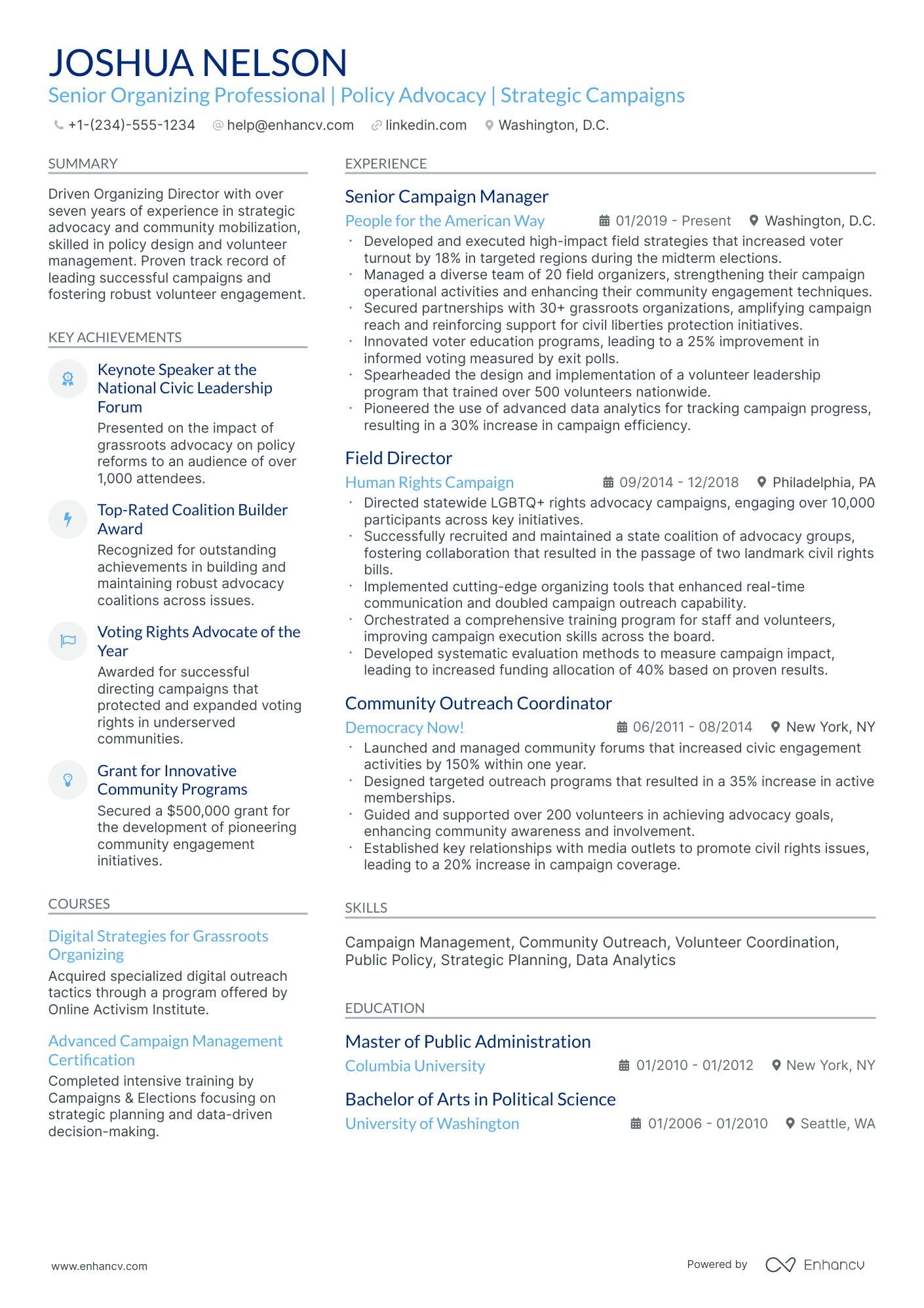

Education section and most popular phone banking certifications for your resume

Your resume education section is crucial. It can indicate a range of skills and experiences pertinent to the position.

- Mention only post-secondary qualifications, noting the institution and duration.

- If you're still studying, highlight your anticipated graduation date.

- Omit qualifications not pertinent to the role or sector.

- If it provides a chance to emphasize your accomplishments, describe your educational background, especially in a research-intensive setting.

Recruiters value phone banking candidates who have invested their personal time into their professional growth. That's why you should include both your relevant education and certification . Not only will this help you stand out amongst candidates, but showcase your dedication to the field. On your phone banking resume, ensure you've:

- Curated degrees and certificates that are relevant to the role

- Shown the institution you've obtained them from - for credibility

- Include the start and end dates (or if your education/certification is pending) to potentially fill in your experience gaps

- If applicable, include a couple of job advert keywords (skills or technologies) as part of the certification or degree description

If you decide to list miscellaneous certificates (that are irrelevant to the role), do so closer to the bottom of your resume. In that way, they'd come across as part of your personal interests, instead of experience. The team at Enhancv has created for you a list of the most popular phone banking certificates - to help you update your resume quicker:

The top 5 certifications for your phone banking resume:

- Certified Customer Service Professional (CCSP) - International Customer Service Association (ICSA)

- Consumer Banking Association Diploma (CBA) - American Bankers Association (ABA)

- Certified Bank Teller (CBT) - American Bankers Association (ABA)

- Certificate in Retail Banking Conduct of Business (CeRBCB) - Chartered Banker Institute

- Certified Financial Services Security Professional (CFSSP) - Institute of Certified Bankers (ICB)

PRO TIP

Always remember that your phone banking certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Recommended reads:

Choosing between a phone banking resume summary or objective

Many may argue that, in recent times, the phone banking resume summary or objective has become completely obsolete.

But the reality is different as both of these resume sections provide you with an opportunity to :

- integrate phone banking-vital keywords

- showcase your accomplishments

- answer why you're applying for this particular role.

The difference (between the summary and the objective) is that the:

- Resume objective puts your career goals in a more prominent position.

- Resume summary focuses more on career milestones.

We recommend you select the summary if you happen to have plenty of experience you'd like to spotlight from the very start of your phone banking resume.

Meanwhile, the objective is ideal for those candidates who'd like to further prove their suitability for the role with their goals and soft skills.

We've featured some industry professional phone banking resume samples to the best resume summary and objective structures:

Resume summaries for a phone banking job

- With over six years of dedicated experience in financial customer service, I have honed expert-level skills in handling complex customer inquiries and providing personalized banking advice. My diligence in managing a high-volume call center and achieving a 95% customer satisfaction rate highlights my commitment to excellence in the phone banking sector.

- Formerly a retail manager with a knack for customer engagement and 5 years of experience, I am pivoting to phone banking with a zeal for utilizing my communication skills to build strong client relationships. My proven track record in boosting store sales through exceptional service is poised to translate into achieving high customer retention rates in a financial setting.

- Entering the phone banking industry with an extensive background in IT support, I bring 7 years of experience in problem-solving, technical troubleshooting, and customer service excellence. My passion for helping others and my adeptness in managing tech solutions is geared to enhance customer interactions and support seamless banking operations.

- With 10 meticulous years in the insurance field and recognized for surpassing quarterly sales targets by 20% consistently, I am transitioning my sales prowess and relationship-building expertise to the realm of phone banking. Confident in my ability to contribute to customer financial empowerment through strategic advice and product knowledge.

- Eager to launch my career in financial services with a specific interest in phone banking, where I can apply my freshly acquired degree in finance and my impressive interpersonal skills acquired from volunteering engagements. Driven to learn quickly and contribute value through meticulous attention to detail and an enthusiastic approach to client support.

- Aspiring to enter the dynamic sphere of phone banking with a commitment to leverage my exceptional communication skills sharpened during my tenure as a public relations assistant. With zero industry experience but immense motivation, I aim to absorb industry knowledge and excel in providing outstanding customer experiences.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

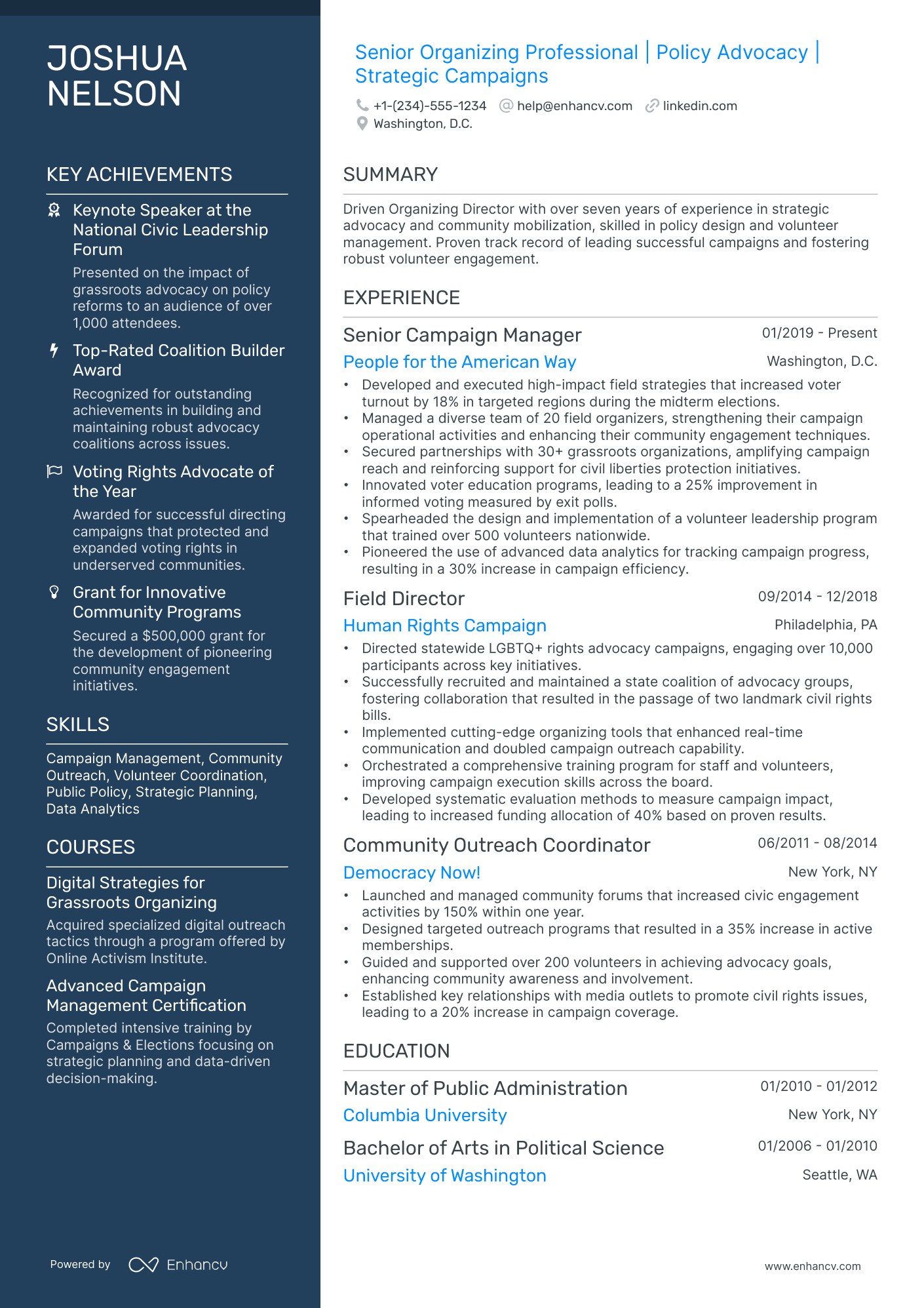

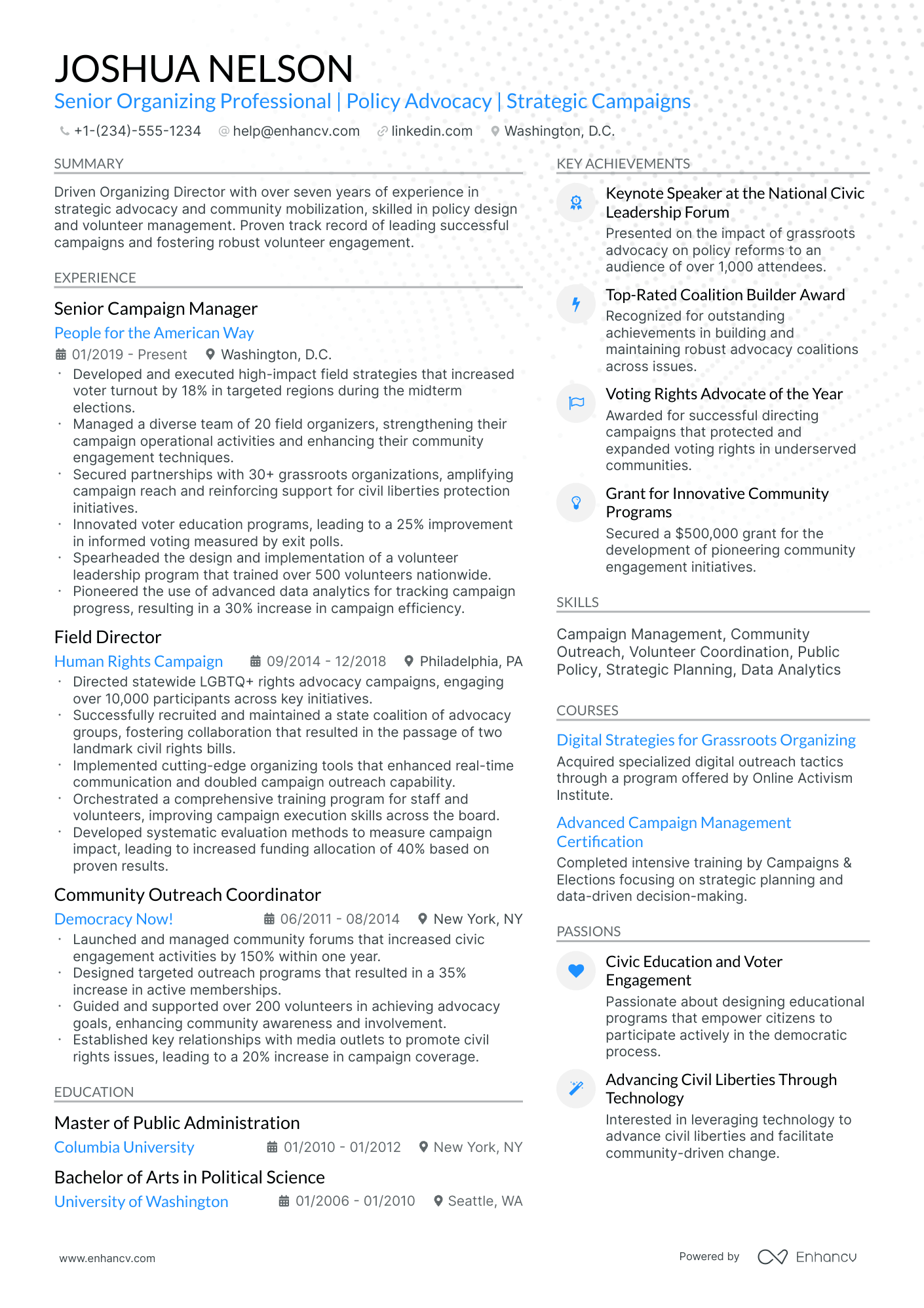

What else can you add to your phone banking resume

What most candidates don't realize is that their phone banking resumes should be tailored both for the job and their own skillset and personality.

To achieve this balance between professional and personal traits, you can add various other sections across your resume.

Your potential employers may be impressed by your:

- Awards - spotlight any industry-specific achievements and recognitions that have paved your path to success;

- Languages - dedicate some space on your phone banking resume to list your multilingual capabilities, alongside your proficiency level;

- Publications - with links and descriptions to both professional and academic ones, relevant to the role;

- Your prioritization framework - include a "My Time" pie chart, that shows how you spend your at-work and free time, would serve to further backup your organization skill set.

Key takeaways

- The layout of your resume should take into consideration your professional background while integrating vital sections and design elements;

- Highlight your most pertinent achievements for the role all through different sections;

- Be very specific when selecting your certifications, hard skills, and soft skills to showcase the best of your talents;

- Include within the top one-third of your phone banking resume a header and summary to help recruiters understand your experience and allocate your contact details. A skills box is optional, but it will help you align your expertise with the role;

- Detail the full extent of your professional experience with specific bullets that focus on tasks, actions, and outcomes.