Most loan officer resumes fail because they list duties and tools but don't prove loan volume, pull-through, or compliance quality. In today's ATS-driven, high-competition market, a loan officer resume must earn fast trust in seconds. Understanding how to make your resume stand out is critical when competing against dozens of other qualified candidates.

A strong resume shows outcomes and the business impact you delivered. Highlight funded volume, pull-through rate, cycle time from application to close, portfolio growth, and audit results. Show how you improved borrower experience, reduced conditions, and expanded referral partnerships.

Key takeaways

- Quantify funded volume, pull-through rate, and cycle time instead of listing routine duties.

- Tailor every experience bullet to mirror the job posting's loan products and tools.

- Use reverse-chronological format if you have steady lending experience and growing production.

- Place certifications like the NMLS license where they carry the most weight for each role.

- Pair hard skills with measurable proof in your experience bullets, not just a skills list.

- Use AI to sharpen language and add metrics, but stop before it invents or inflates claims.

- Enhancv can help you turn everyday loan officer tasks into recruiter-ready, quantified bullet points.

Job market snapshot for loan officers

We analyzed 496 recent loan officer job ads across major US job boards. These numbers help you understand top companies hiring, salary landscape, skills in demand at a glance.

What level of experience employers are looking for loan officers

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 10.7% (53) |

| 3–4 years | 7.1% (35) |

| 5–6 years | 6.9% (34) |

| 7–8 years | 0.2% (1) |

| 9–10 years | 0.4% (2) |

| 10+ years | 0.4% (2) |

| Not specified | 74.6% (370) |

Loan officer ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 100.0% (496) |

Top companies hiring loan officers

| Company | Percentage found in job ads |

|---|---|

| Zillow | 15.9% (79) |

| PNC Financial Services Group, Inc. | 8.5% (42) |

| FCS of Mid America | 4.8% (24) |

| Citizens Financial Group, Inc. | 4.4% (22) |

| Orchard | 3.2% (16) |

| Columbia Banking System, Inc. | 2.8% (14) |

| Loan Depot | 2.8% (14) |

| Cadence Bank | 2.6% (13) |

| CrossCountry Mortgage | 2.4% (12) |

| Navy Federal Credit Union | 2.4% (12) |

Role overview stats

These tables show the most common responsibilities and employment types for loan officer roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a loan officer

| Responsibility | Percentage found in job ads |

|---|---|

| Excel | 25.4% (126) |

| Word | 22.0% (109) |

| Crm | 17.5% (87) |

| Los | 17.1% (85) |

| Outlook | 16.3% (81) |

| Sales | 11.1% (55) |

| Nmls | 10.9% (54) |

| Microsoft | 10.5% (52) |

| Microsoft office | 9.3% (46) |

| Financial analysis | 9.1% (45) |

| Fha | 8.7% (43) |

| Va | 8.3% (41) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 68.1% (338) |

| Remote | 19.0% (94) |

| Hybrid | 12.9% (64) |

How to format a loan officer resume

Recruiters evaluating loan officer candidates prioritize lending volume, regulatory compliance knowledge, client relationship management, and familiarity with loan origination systems. A clean, well-structured resume format ensures these signals surface quickly during both automated screening and manual review. Choosing the right resume layout also helps hiring managers find the information they need without unnecessary friction.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to showcase your lending track record, growing client portfolios, and deepening expertise across loan products. Do:

- Lead with your most recent role and clearly define scope: loan types handled, portfolio size, and team or branch-level responsibilities.

- Highlight proficiency in role-specific tools and domains such as Encompass, Calyx, FHA/VA/conventional lending guidelines, and TRID compliance.

- Quantify outcomes tied to production volume, approval rates, funding timelines, or client retention.

I'm junior or switching into this role—what format works best?

A hybrid format works best, letting you lead with relevant skills and certifications while still providing a chronological work history that shows progression. Do:

- Place a skills section near the top featuring lending fundamentals, compliance knowledge, CRM tools, and any NMLS licensing details.

- Include internships, banking roles, financial services projects, or client-facing experience that demonstrates transferable competencies.

- Connect every action to a clear outcome, even in non-lending roles, to show results-oriented thinking.

Why not use a functional resume?

A functional format strips away the timeline context that hiring managers rely on to assess your growth in lending knowledge, compliance awareness, and client relationship development.

- Career changers with financial services experience: You hold relevant certifications (such as NMLS licensing) and have completed lending coursework or projects but lack a formal loan officer title.

- Candidates with resume gaps: You've been out of the workforce but maintained industry knowledge through continuing education or freelance financial consulting.

- Recent graduates with internship experience: You completed internships or academic projects focused on underwriting, credit analysis, or mortgage lending.

Once your format establishes a clean, readable structure, the next step is filling it with the right sections to showcase your qualifications effectively.

What sections should go on a loan officer resume

Recruiters expect to quickly find proof that you can originate loans, manage the pipeline, and close compliant deals. Knowing which resume sections to include ensures nothing critical gets overlooked.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize funded volume, conversion rates, cycle times, portfolio quality, compliance accuracy, and measurable results across your pipeline and partners.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

With your resume’s key components in place, the next step is learning how to write your loan officer resume experience so each role supports the structure and goals you’ve set.

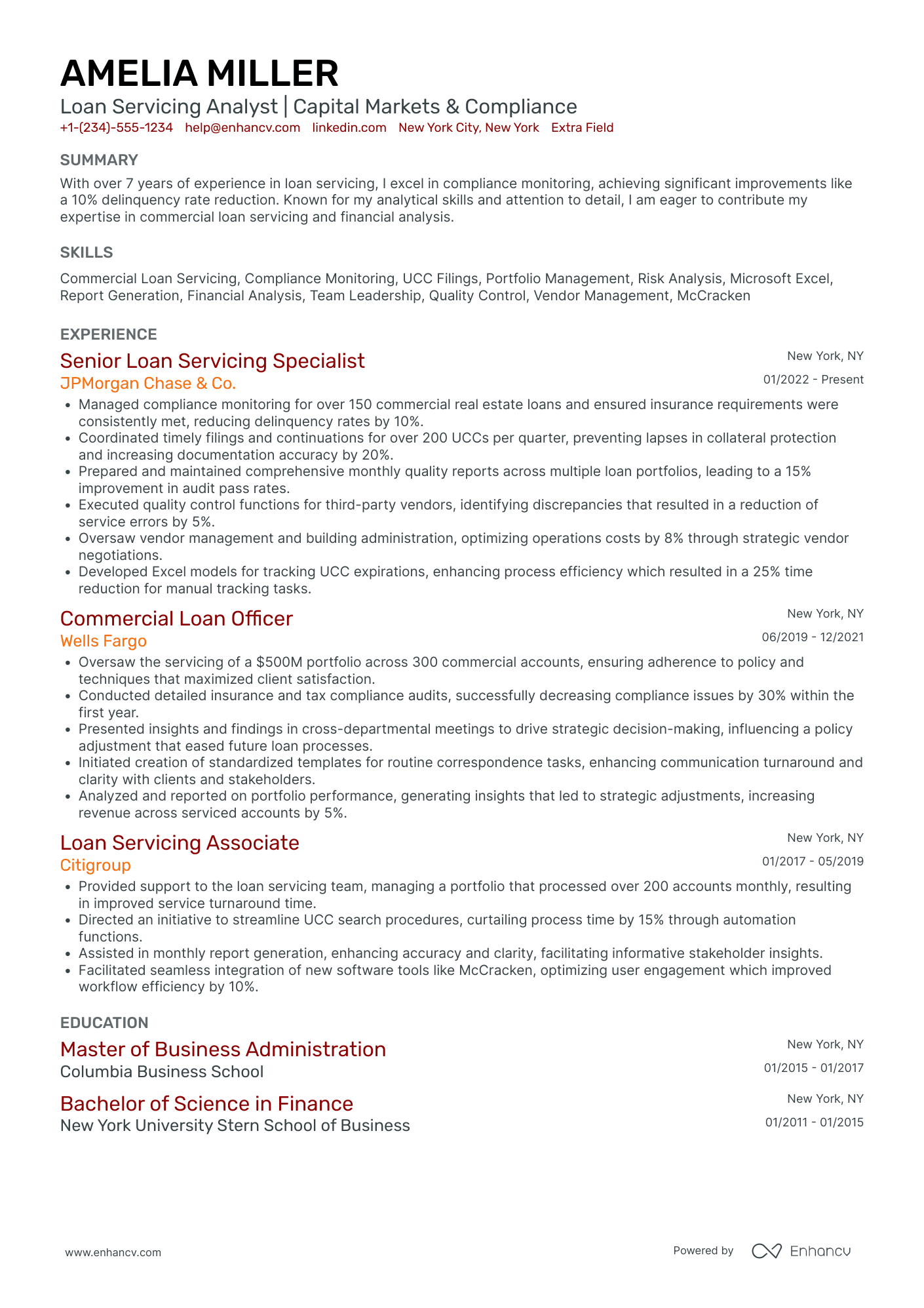

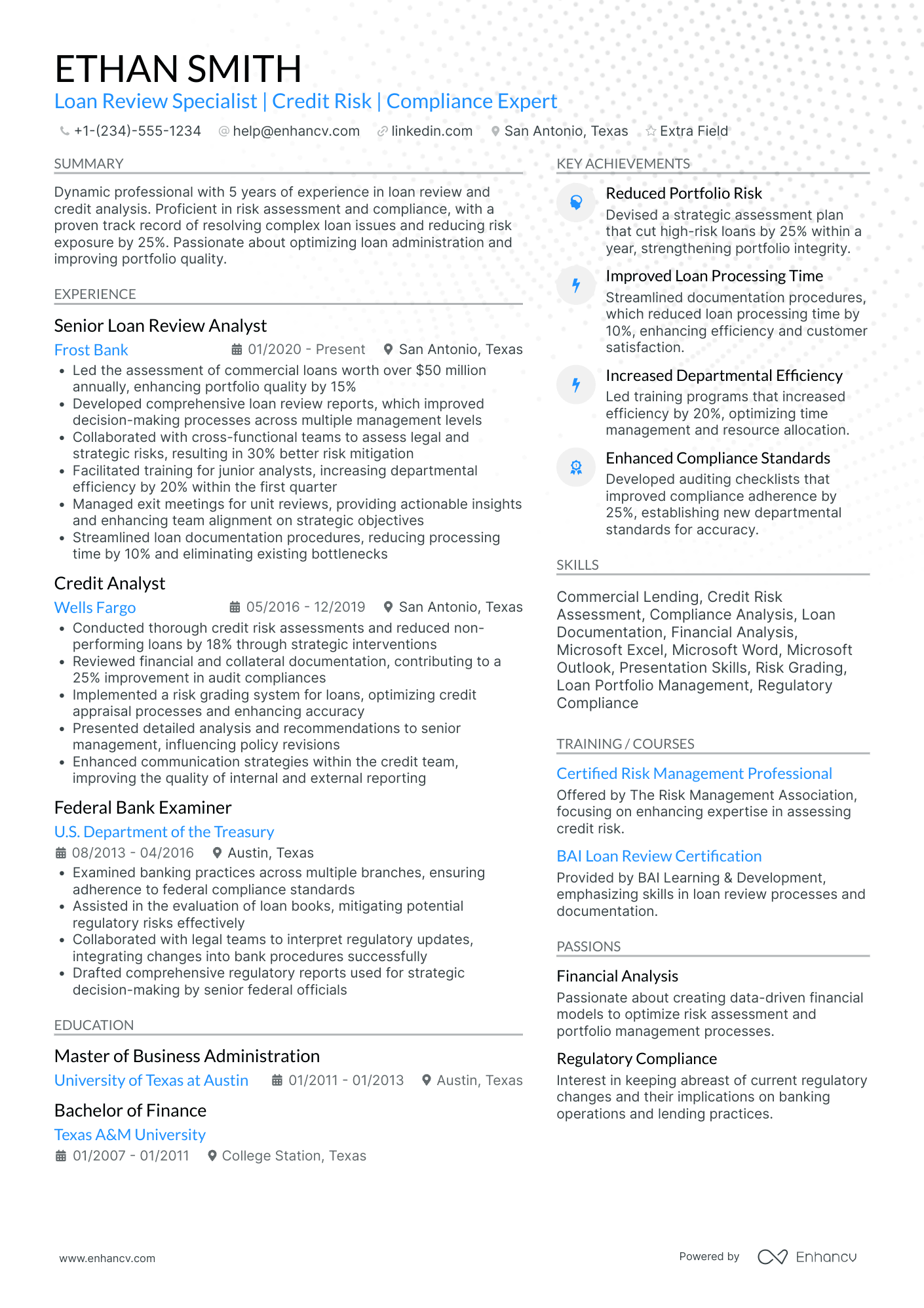

How to write your loan officer resume experience

The experience section is where you prove you've originated loans, guided borrowers through complex pipelines, and delivered measurable portfolio growth. Hiring managers prioritize demonstrated impact—closed volume, approval ratios, compliance adherence—over generic task lists that describe daily duties without outcomes.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the loan products, borrower segments, geographic markets, or origination pipelines you were directly accountable for as a loan officer.

- Execution approach: the underwriting platforms, CRM systems, pricing engines, compliance frameworks, or needs-analysis methods you used to evaluate applications and structure deals.

- Value improved: the changes you drove in approval turnaround time, pull-through rates, borrower satisfaction, document accuracy, or regulatory compliance within your lending operation.

- Collaboration context: how you partnered with underwriters, processors, real estate agents, title companies, or branch leadership to move loans from application through funding.

- Impact delivered: the lending outcomes you produced—expressed through funded volume, portfolio quality, client retention, or risk reduction—rather than a summary of routine activities.

Experience bullet formula

A loan officer experience example

✅ Right example - modern, quantified, specific.

Senior Loan Officer

RiverStone Credit Union | Phoenix, AZ

2021–Present

Member-owned credit union serving 120,000+ members across Arizona with a focus on consumer and mortgage lending.

- Originated and closed $48M in residential mortgages annually across conventional, Federal Housing Administration, and Veterans Affairs products using Encompass and Desktop Underwriter (DU), sustaining a 34% referral-driven pipeline.

- Reduced average clear-to-close time by 18% by standardizing borrower document collection in Salesforce, automating status updates, and tightening handoffs with processors and underwriters.

- Improved pull-through rate from 62% to 71% by redesigning pre-qualification workflows, running credit reviews in FICO and Experian, and coaching clients on debt-to-income targets and pricing options.

- Cut post-close condition defects by 27% by strengthening compliance checks for TRID disclosures, Know Your Customer verification, and anti-money laundering documentation in partnership with compliance and quality assurance.

- Increased quarterly fee and interest revenue by $210K by partnering with branch leaders and marketing to launch a first-time homebuyer webinar series and track lead conversion through Google Analytics and Salesforce dashboards.

Now that you've seen how a strong experience section comes together, let's break down how to tailor each element to match the specific loan officer role you're targeting.

How to tailor your loan officer resume experience

Recruiters evaluate your loan officer resume through both applicant tracking systems and manual review, so tailoring your resume to the job description is essential. Tailoring ensures the specific skills, tools, and qualifications a lender seeks are clearly reflected in your work history.

Ways to tailor your loan officer experience:

- Mirror the exact loan products listed in the job description.

- Reference the loan origination software the employer uses by name.

- Match compliance standards or regulatory frameworks the posting specifies.

- Highlight pipeline management methods that align with their workflow.

- Include volume or production KPIs the role emphasizes.

- Emphasize borrower relationship strategies relevant to their market segment.

- Align your underwriting guideline knowledge with their stated requirements.

- Reflect cross-functional collaboration with processors or underwriters if mentioned.

Tailoring means connecting your real accomplishments to what the employer prioritizes, not forcing keywords where they don't belong.

Resume tailoring examples for loan officer

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| "Originate and close residential mortgage loans, maintaining a pipeline of $5M+ monthly while ensuring compliance with TILA, RESPA, and HMDA regulations." | Helped customers with loan applications and processed paperwork in a timely manner. | Originated and closed an average of $6.2M in residential mortgage loans per month, maintaining full compliance with TILA, RESPA, and HMDA throughout the pipeline lifecycle. |

| "Build relationships with realtors and financial planners to generate referral business, using Encompass LOS to manage applications from pre-qualification through funding." | Worked with outside partners to bring in new business and entered data into company systems. | Cultivated a referral network of 40+ realtors and financial planners, managing all applications from pre-qualification through funding in Encompass LOS and increasing referral volume by 25% year over year. |

| "Analyze borrower financials, including DTI ratios, credit reports, and asset documentation, to structure conventional and FHA loan products that meet investor guidelines." | Reviewed financial documents and helped determine if applicants qualified for loans. | Analyzed borrower DTI ratios, credit reports, and asset documentation to structure conventional and FHA loans, maintaining a 94% approval rate by aligning each file with investor guideline requirements before submission. |

Once you’ve aligned your experience with the role’s requirements, quantify your loan officer achievements to show the measurable impact of that work.

How to quantify your loan officer achievements

Quantifying your achievements proves you drive revenue, manage risk, and move loans faster without compliance issues. Focus on funded volume, pull-through rate, cycle time, defect rates, and delinquency outcomes.

Quantifying examples for loan officer

| Metric | Example |

|---|---|

| Funded volume | "Funded $18.6M in purchase loans across sixty-two files in one quarter while maintaining a 4.8/5 borrower satisfaction score." |

| Pull-through rate | "Improved application-to-funding pull-through from 56% to 68% by tightening pre-qualification and using Encompass milestones to flag stalled files." |

| Cycle time | "Cut clear-to-close time from twelve days to seven by standardizing conditions checklists and scheduling appraisals within forty-eight hours." |

| Compliance quality | "Reduced post-close audit exceptions by 35% by adding a TRID (TILA-RESPA Integrated Disclosure) checklist and double-checking fee tolerances before CD issuance." |

| Credit risk | "Lowered sixty-day delinquency rate from 1.9% to 1.2% for a $9M portfolio by strengthening DTI review and documenting compensating factors." |

Turn your everyday tasks into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points highlighting your experience, you'll want to ensure your resume also showcases the right mix of hard and soft skills that lending employers prioritize.

How to list your hard and soft skills on a loan officer resume

Your skills section shows how you qualify loans, manage compliance, and close on time, and recruiters and an ATS (applicant tracking system) scan them to match job requirements, so aim for a hard-skill-heavy mix supported by role-specific soft skills. Loan officer roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Conventional loan underwriting

- FHA, VA, USDA guidelines

- Debt-to-income calculations

- Loan origination systems: Encompass, Calyx Point

- Automated underwriting: DU, LP

- RESPA, TILA, TRID compliance

- Credit report analysis

- Income, asset documentation review

- Rate lock and pricing engines

- Pipeline management and forecasting

- HMDA reporting basics

- Fraud detection and red flags

Soft skills

- Consultative borrower interviewing

- Clear loan option explanations

- Objection handling and negotiation

- Cross-functional coordination with processors

- Partner management with realtors

- Documentation follow-up cadence

- Risk-based decision-making

- Prioritization across active pipeline

- Deadline-driven execution

- Escalation management and issue resolution

- Compliance-first judgment

- Accurate, timely status updates

How to show your loan officer skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how top candidates weave competencies throughout their documents.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what that looks like in practice.

Summary example

Senior loan officer with 12 years in residential and commercial lending. Skilled in Encompass, FHA/VA compliance, and borrower consultations. Consistently maintained a 97% pull-through rate while managing a $45M annual pipeline.

- Reflects senior-level expertise immediately

- Names industry-specific tools and programs

- Quantifies pipeline and pull-through performance

- Signals strong client relationship skills

Experience example

Senior Loan Officer

Meridian Home Lending | Charlotte, NC

March 2018–Present

- Originated and closed $52M in annual mortgage volume using Encompass, exceeding branch targets by 18% for three consecutive years.

- Collaborated with underwriters and real estate partners to reduce average loan cycle time from 38 days to 27 days.

- Mentored four junior loan officers on FHA/VA guidelines, improving team compliance audit scores by 22%.

- Every bullet includes measurable proof.

- Skills surface naturally through outcomes.

Once you’ve demonstrated your abilities through specific, job-relevant examples, the next step is applying that same approach to structuring a loan officer resume when you don’t have direct experience.

How do I write a loan officer resume with no experience

Even without full-time experience, you can demonstrate readiness through: Building a resume without work experience is entirely possible when you focus on transferable skills and relevant training.

- Mortgage lending coursework or certificate

- Banking teller or personal banker work

- Loan processing or underwriting shadowing

- Customer intake and document verification

- Credit report review practice cases

- Sales pipeline tracking in a customer relationship management system

- Compliance training: Truth in Lending

- Volunteer tax prep financial interviews

Focus on:

- Regulated finance exposure with specifics

- Document accuracy and audit readiness

- Sales metrics and pipeline results

- Loan officer tools and workflows

Resume format tip for entry-level loan officer

Use a hybrid resume format. It highlights relevant skills and projects first, while still showing steady work history and education. Do:

- Put licenses, coursework, and training first.

- Add a "Relevant Projects" section.

- List tools: Microsoft Excel, customer relationship management system, loan origination system.

- Quantify outcomes: volume, accuracy, turnaround time.

- Mirror keywords from the job posting.

- Built a customer relationship management system pipeline for twenty mock borrowers, verified documents against a checklist, and cut follow-up time by 30% over two weeks.

Even without direct experience, your educational background can serve as a strong foundation for your loan officer resume—here's how to present it effectively.

How to list your education on a loan officer resume

Your education section helps hiring teams confirm you have the foundational knowledge needed. It validates your understanding of finance, lending principles, and regulatory frameworks relevant to the loan officer role.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for a loan officer resume.

Example education entry

Bachelor of Science in Finance

University of Central Florida, Orlando, FL

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Real Estate Finance, Consumer Lending, Risk Management, Financial Statement Analysis

- Honors: Magna Cum Laude, Dean's List (six consecutive semesters)

How to list your certifications on a loan officer resume

Certifications on your resume show your commitment to learning, your proficiency with key tools, and your industry relevance as a loan officer.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when your degree is recent and your certifications add support, not differentiation.

- Place certifications above education when they are recent, highly relevant, or required for the loan officer roles you target.

Best certifications for your loan officer resume

NMLS Mortgage Loan Originator (MLO) License Certified Mortgage Banker (CMB) Certified Residential Mortgage Specialist (CRMS) Certified Mortgage Consultant (CMC) FHA Direct Endorsement (DE) Underwriter Certification VA Loan Certification (Department of Veterans Affairs) SAFE Mortgage Loan Originator (SAFE MLO) Certification

Once you’ve added your credentials in a clear, easy-to-scan format, focus on your loan officer resume summary to show how those qualifications translate into results.

How to write your loan officer resume summary

Your resume summary is the first thing a recruiter reads, so it must immediately signal your fit for the role. A strong opening positions you as a qualified loan officer before the hiring manager scans further.

Keep it to three to four lines, with:

- Your title and total years of experience in loan origination or mortgage lending.

- Domain focus, such as conventional loans, FHA/VA lending, or commercial real estate.

- Core skills like underwriting guidelines, CRM platforms, Encompass, or Calyx Point.

- One or two measurable wins, such as funded loan volume or approval turnaround times.

- Soft skills tied to results, like client communication that improved retention or referral rates.

PRO TIP

At the loan officer level, emphasize hands-on lending skills, product knowledge, and early production numbers. Highlight specific loan types you've closed and tools you've used daily. Avoid vague phrases like "passionate self-starter" or "motivated team player." Recruiters want to see volume, accuracy, and client outcomes instead.

Example summary for a loan officer

Loan officer with three years of experience originating conventional and FHA loans. Funded $18M in residential mortgages annually while maintaining a 96% client satisfaction rate using Encompass.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary is ready to showcase your qualifications at a glance, make sure your header presents your contact details correctly so recruiters can actually reach you.

What to include in a loan officer resume header

A resume header lists your key contact details and role focus, helping loan officers improve visibility, build credibility, and pass recruiter screening faster.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Don't include a photo on a loan officer resume unless the role is explicitly front-facing or appearance-dependent.

Use a clear headline with your loan officer specialty and keep all links short, consistent, and easy to copy.

Example

Loan officer resume header

Jordan Taylor

Loan Officer | Residential Mortgage Lending | Purchase and Refinance

Austin, TX

(512) 555-19XX

your.name@enhancv.com

github.com/yourname

yourwebsite.com

linkedin.com/in/yourname

Once your contact details and key identifiers are in place at the top, add targeted additional sections to reinforce your qualifications and round out your resume.

Additional sections for loan officer resumes

When your core qualifications match other candidates, well-chosen additional sections can set you apart and reinforce your credibility. For example, listing language skills can be a strong differentiator if you serve multilingual borrower communities.

- Languages

- Professional affiliations (e.g., Mortgage Bankers Association)

- Licenses and certifications

- Volunteer experience in financial literacy

- Awards and recognition

- Continuing education and training

- Publications or industry contributions

Once you've strengthened your resume with relevant extra sections, pairing it with a well-crafted cover letter can further set your application apart.

Do loan officer resumes need a cover letter

A cover letter isn't required for a loan officer, but it often helps in competitive searches or when hiring managers expect one. If you're unsure where to start, understanding what a cover letter is and how it complements your resume can clarify when it's worth including. It can make a difference when your resume needs context, or when the role demands strong client communication.

Use a cover letter to add value, not repeat your resume:

- Explain role and team fit: Connect your lending strengths to the branch, market, and how the loan officer role supports sales and compliance.

- Highlight one or two outcomes: Share a specific project or result, like improving pull-through rates, reducing cycle time, or increasing referral volume.

- Show business understanding: Reference the loan products, borrower profile, and key constraints such as credit policy, documentation, and service standards.

- Address career transitions: Clarify non-obvious experience, employment gaps, or a move from banking, sales, or operations into a loan officer role.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you decide not to include a cover letter, the next step is to use AI to improve your loan officer resume so it communicates your value clearly and consistently.

Using AI to improve your loan officer resume

AI can sharpen your resume's clarity, structure, and impact. It helps reframe weak bullets and tighten language. But overuse strips authenticity. Once your content sounds clear and role-aligned, step away from AI. If you're wondering which AI is best for writing resumes, the answer depends on how much control you want over tone and formatting.

Here are 10 practical prompts to strengthen specific sections of your loan officer resume:

- Strengthen your summary: "Rewrite my loan officer resume summary to highlight my top lending specialties, client volume, and years of experience in under four sentences."

- Quantify experience bullets: "Add specific metrics like loan volume, approval rates, or portfolio size to each of my loan officer experience bullet points."

- Tighten action verbs: "Replace weak or passive verbs in my loan officer experience section with strong, finance-specific action verbs."

- Align skills strategically: "Compare my loan officer skills section against this job description and suggest missing keywords I should add."

- Clarify certification value: "Rewrite the certifications section of my loan officer resume to briefly explain each credential's relevance to mortgage lending."

- Improve education details: "Refine my loan officer education section to emphasize coursework or honors directly related to finance or lending."

- Refine project descriptions: "Rewrite my loan officer project entries to clearly state the business problem, my role, and the measurable outcome."

- Remove redundant phrasing: "Identify and remove filler words or redundant phrases throughout my loan officer resume without losing meaning."

- Tailor for compliance: "Adjust my loan officer experience bullets to emphasize regulatory compliance, risk assessment, and underwriting guideline adherence."

- Fix inconsistent formatting: "Standardize tense, punctuation, and structure across all bullet points in my loan officer resume."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong loan officer resume proves results with numbers, highlights role-specific skills, and stays easy to scan. Show measurable outcomes like funded volume, pull-through rate, approval rate, and referral growth. Pair them with underwriting knowledge, compliance, and relationship management.

Keep a clear structure with a focused summary, impact-driven experience, and relevant certifications. This approach shows you can meet today’s hiring standards and adapt to near-future expectations. It helps hiring teams see your value fast and confidently.