Many investment banking associate resumes fail because they read like job descriptions, burying deal impact under generic responsibilities. That gets you filtered by ATS keywords and missed in ten-second recruiter scans, especially when competition is heavy.

A strong resume shows what you drove and what changed because of your work. Understanding how to make your resume stand out starts with quantifying deal size, number of live mandates, model accuracy, turnaround time, and outcomes like higher valuation, tighter comps, faster diligence, or cleaner committee approval.

Key takeaways

- Quantify deal size, fees, and cycle time to prove impact beyond generic responsibilities.

- Use reverse-chronological format to show clear progression from analyst to associate-level ownership.

- Tailor every resume to mirror the job posting's deal types, tools, and sector language.

- Lead experience bullets with ownership scope, execution method, and a measurable outcome.

- Place skills above experience if you're junior; below experience if you're mid-level or senior.

- Write a three- to four-line summary featuring domain focus, deal volume, and one quantified result.

- Use Enhancv's bullet point generator to turn vague duties into recruiter-ready, metrics-driven bullets.

Job market snapshot for investment banking associates

We analyzed 58 recent investment banking associate job ads across major US job boards. These numbers help you understand employer expectations, top companies hiring, skills in demand at a glance.

What level of experience employers are looking for investment banking associates

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 3.4% (2) |

| 3–4 years | 13.8% (8) |

| 5–6 years | 13.8% (8) |

| Not specified | 69.0% (40) |

Investment banking associate ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 100.0% (58) |

Top companies hiring investment banking associates

| Company | Percentage found in job ads |

|---|---|

| Houlihan Lokey | 17.2% (10) |

Role overview stats

These tables show the most common responsibilities and employment types for investment banking associate roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a investment banking associate

| Responsibility | Percentage found in job ads |

|---|---|

| Financial modeling | 72.4% (42) |

| Financial analysis | 48.3% (28) |

| Accounting | 32.8% (19) |

| Valuation | 31.0% (18) |

| Investment banking | 29.3% (17) |

| Due diligence | 25.9% (15) |

| M&a | 22.4% (13) |

| Corporate finance | 19.0% (11) |

| Excel | 19.0% (11) |

| Powerpoint | 17.2% (10) |

| Series 63 | 17.2% (10) |

| Series 79 | 17.2% (10) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 86.2% (50) |

| Hybrid | 12.1% (7) |

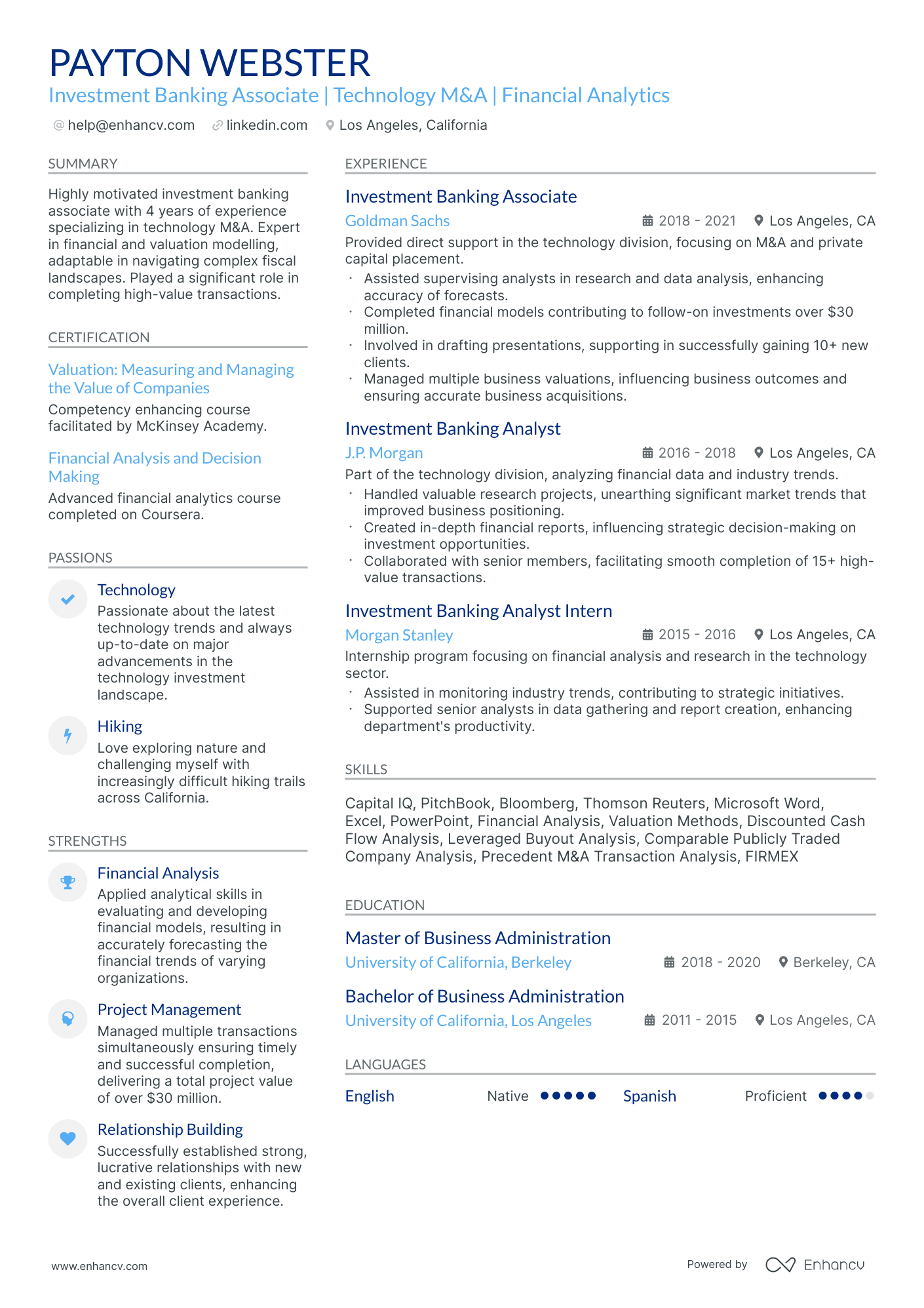

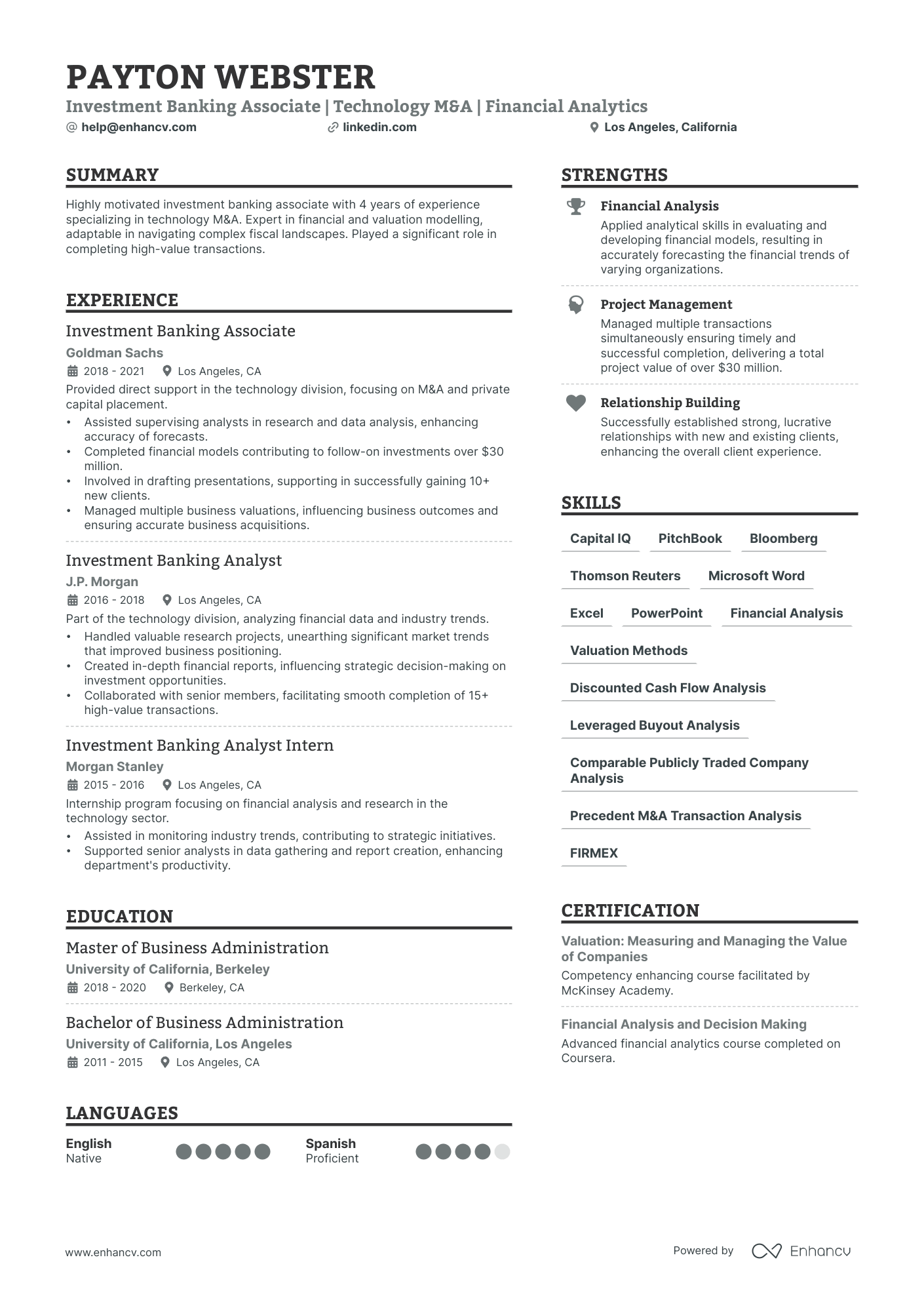

How to format a investment banking associate resume

Recruiters evaluating investment banking associate resumes prioritize deal experience, financial modeling proficiency, and a clear trajectory from analyst to associate-level responsibility. A well-chosen resume format ensures these signals—transaction volume, client exposure, and technical depth—surface within the first few seconds of a recruiter's scan.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to showcase your progression from analyst work into associate-level deal ownership and client management. Do:

- Lead with your most recent role and emphasize scope: deal sizes, number of live transactions, and level of client interaction you managed.

- Highlight role-specific tools and domains—financial modeling, DCF and LBO analysis, pitch book preparation, due diligence coordination, and platforms like Capital IQ, Bloomberg, or FactSet.

- Quantify outcomes tied to business impact, including closed deal values, revenue generated, or process improvements that shortened execution timelines.

I'm junior or switching into this role—what format works best?

A hybrid format lets you lead with core financial and analytical skills while still providing enough work history to demonstrate relevant experience. Do:

- Place a skills section near the top that highlights financial modeling, valuation methodologies, and proficiency in Excel, Capital IQ, or Bloomberg.

- Include internships, deal-adjacent projects, or transitional experience such as corporate finance, equity research, or consulting engagements that demonstrate transferable competencies.

- Connect every action to a measurable result so recruiters can assess your potential contribution.

Why not use a functional resume?

A functional format strips away the deal-by-deal context and timeline progression that investment banking recruiters rely on to evaluate your readiness for associate-level execution.

- Career changers with no finance experience who need to foreground transferable analytical skills from adjacent fields like consulting, accounting, or data analytics.

- Candidates with resume gaps who completed relevant certifications (CFA, FMVA) or bootcamps during time away and need to lead with those credentials.

With your formatting choices in place, the next step is deciding which sections to include so each one reinforces your qualifications for the role.

What sections should go on a investment banking associate resume

Recruiters expect to see a deal-driven resume that proves you can lead execution, manage analysts, and deliver results under tight timelines. Knowing what to put on a resume is critical for structuring your content effectively. Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize transaction impact, measurable outcomes, deal size and complexity, client and stakeholder scope, and your role in driving execution.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right building blocks, the next step is to write your investment banking associate resume experience so it fits those sections and supports your candidacy.

How to write your investment banking associate resume experience

Your work experience section should demonstrate the deals you've closed, the financial models you've built, and the measurable outcomes you've driven as an investment banking associate. Hiring managers prioritize demonstrated impact—transaction value, efficiency gains, and client outcomes—over descriptive task lists that simply catalog daily responsibilities.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the deal types, client relationships, pitch processes, sector coverage, or junior analyst teams you were directly accountable for as an investment banking associate.

- Execution approach: the valuation methodologies, financial modeling techniques, due diligence frameworks, or market analysis tools you used to structure transactions and inform client recommendations.

- Value improved: changes to deal execution speed, model accuracy, client retention, process efficiency, or risk assessment quality that resulted from your contributions.

- Collaboration context: how you coordinated with senior bankers, legal counsel, institutional investors, corporate clients, or cross-functional teams across compliance and capital markets to advance transactions.

- Impact delivered: outcomes expressed through completed transactions, portfolio growth, revenue generation, or strategic advisory results rather than a summary of routine banking activities.

Experience bullet formula

A investment banking associate experience example

✅ Right example - modern, quantified, specific.

Investment Banking Associate

Evergreen Partners | New York, NY

2022–Present

Middle-market investment bank advising sponsor-backed and founder-led clients across industrials and business services.

- Led end-to-end sell-side execution for seven mandates ($120M–$900M enterprise value), running the virtual data room in Intralinks and coordinating diligence to reduce average signing-to-close timeline by 18 percent.

- Built three-statement operating models, leveraged buyout models, and merger models in Excel with FactSet and Capital IQ inputs, improving valuation accuracy and tightening bid-ask spreads by 6 percent across two competitive processes.

- Authored confidential information memorandums, management presentations, and lender decks in PowerPoint, partnering with client CFOs and legal counsel to cut revision cycles by 30 percent and accelerate committee approvals by two weeks.

- Managed buyer outreach and process analytics using DealCloud, tracking one hundred twenty-plus targets and automating status reporting to increase response rates by 22 percent and maintain weekly cadence with managing directors and clients.

- Negotiated key diligence workstreams with accounting advisors and tax counsel, surfacing working-capital and net-debt adjustments that improved purchase price outcomes by $14.6M across three closed transactions.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match the specific role you're targeting.

How to tailor your investment banking associate resume experience

Recruiters evaluate your resume through both applicant tracking systems and manual review, so tailoring your resume to the job description is essential. Tailoring ensures the specific skills, tools, and deal types you highlight match what the hiring bank prioritizes.

Ways to tailor your investment banking associate experience:

- Mirror the exact financial modeling platforms and tools listed in the posting.

- Match deal types like M&A or DCM to those the role emphasizes.

- Use the same valuation methodology terms the job description specifies.

- Reflect the industry verticals or sector coverage groups mentioned.

- Highlight regulatory compliance and due diligence processes when referenced.

- Align your pitch book and client presentation experience with stated expectations.

- Emphasize cross-functional collaboration with legal or accounting teams if noted.

- Include relevant deal size thresholds or transaction volume language they reference.

Tailoring means reframing your real accomplishments to reflect the language and priorities of each specific role, not forcing irrelevant keywords into your experience.

Resume tailoring examples for investment banking associate

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Lead financial modeling and valuation analyses, including DCF, LBO, and comparable company analyses, to support M&A advisory engagements for clients in the healthcare sector. | Performed financial analysis and created models for various projects. | Built and maintained DCF, LBO, and comparable company valuation models across 12 healthcare M&A advisory engagements, delivering board-ready analyses that supported $3.2B in aggregate transaction value. |

| Prepare client-facing pitch books and confidential information memoranda (CIMs) while coordinating with senior bankers to manage deal execution timelines across multiple live transactions. | Helped prepare presentations and documents for client meetings. | Drafted and refined 15+ pitch books and CIMs in coordination with managing directors, managing parallel workstreams across four live sell-side transactions while consistently meeting accelerated deal execution timelines. |

| Conduct detailed industry and market research to identify potential acquisition targets and strategic buyers, leveraging Capital IQ, Bloomberg, and internal proprietary databases. | Did research on companies and market trends to support the team. | Screened 200+ potential acquisition targets and strategic buyers using Capital IQ and Bloomberg, producing sector-specific market maps that directly informed outreach strategy for two buyside mandates in the industrials space. |

Once you’ve aligned your experience with the role’s priorities, quantify your investment banking associate achievements to show the measurable impact of that work.

How to quantify your investment banking associate achievements

Quantifying your achievements proves deal impact beyond responsibilities. For investment banking associates, focus on deal volume, revenue and fees, cycle time, model accuracy, risk and compliance outcomes, and workload managed across pitches, diligence, and closing.

Quantifying examples for investment banking associate

| Metric | Example |

|---|---|

| Deal fees | "Supported three closed M&A deals totaling $1.8B enterprise value, contributing to $12.4M in advisory fees through valuation, synergy analysis, and buyer Q&A support." |

| Cycle time | "Cut pitchbook turnaround from five days to two by building reusable PowerPoint templates and Excel model drivers, enabling six pitches delivered in one month." |

| Accuracy | "Reduced model errors by 60% by adding Excel checks, sensitivity tables, and tie-outs to Capital IQ and company filings across eight live and pitch models." |

| Risk control | "Flagged two covenant risks during diligence by reconciling credit agreement terms with projections, preventing a leverage breach and avoiding a re-trade at signing." |

| Volume handled | "Managed diligence trackers for four workstreams and 120+ requests, coordinating with legal and accounting to keep weekly deliverables on schedule through signing." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong, results-driven bullet points, the next step is ensuring your skills section reinforces those achievements with the right mix of hard and soft skills.

How to list your hard and soft skills on a investment banking associate resume

Your skills section matters because investment banking associates drive valuation, deal execution, and client deliverables; recruiters and ATS scan this section for exact keywords and proficiency signals, and strong resumes balance hard skills like modeling and transaction expertise with execution-focused soft skills like communication and teamwork.

investment banking associate roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Financial modeling, Microsoft Excel

- Three-statement modeling

- Discounted cash flow valuation

- Comparable company analysis

- Precedent transactions analysis

- Merger model, accretion dilution

- Leveraged buyout modeling

- Sensitivity, scenario analysis

- Pitchbook, information memorandum

- Debt and equity capital markets

- Bloomberg Terminal, Capital IQ, FactSet

- Financial statement analysis, accounting

Soft skills

- Lead deal workstreams end-to-end

- Prioritize under tight deadlines

- Synthesize insights into clear narratives

- Present recommendations to senior bankers

- Manage client communications and follow-ups

- Coordinate across legal and diligence teams

- Challenge assumptions with data-backed logic

- Maintain quality control on deliverables

- Escalate risks early and clearly

- Mentor analysts and review their work

How to show your investment banking associate skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how top candidates weave competencies throughout their applications.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what strong, skill-rich entries look like in practice.

Summary example

Investment banking associate with eight years in healthcare M&A, skilled in financial modeling, due diligence, and deal execution. Led 12 transactions totaling $3.4B, leveraging DealogicΒ and cross-functional collaboration to consistently accelerate time-to-close by 15%.

- Signals senior-level depth immediately

- Names role-relevant tools and methods

- Leads with a measurable deal outcome

- Highlights collaboration as a soft skill

Experience example

Investment Banking Associate

Meridian Partners | New York, NY

June 2019–March 2025

- Built and maintained 30+ DCF and LBO models in Excel and Capital IQ, supporting $1.8B in closed transactions across industrials.

- Coordinated with legal, compliance, and client teams to streamline due diligence workflows, reducing average deal cycle time by 18%.

- Prepared management presentations and CIMs for six sell-side mandates, contributing to a 95% pitch-to-engagement conversion rate.

- Every bullet includes measurable proof.

- Skills surface naturally through real outcomes.

Once you’ve anchored your capabilities in real examples and measurable outcomes, the next step is translating that approach into a resume when you don’t have direct investment banking experience.

How do I write a investment banking associate resume with no experience

Even without full-time experience, you can demonstrate readiness through the strategies outlined in our guide on building a resume without work experience:

- Financial modeling course capstone

- Student investment fund analyst role

- Equity research reports and pitches

- Transaction case competitions placements

- Internship in corporate finance

- Independent valuation of public companies

- Pro bono nonprofit fundraising analysis

- Deal sourcing and screening project

Focus on:

- Modeling, valuation, and assumptions

- Deal exposure and transaction thinking

- Industry coverage and thesis quality

- Results, metrics, and deliverables

Resume format tip for entry-level investment banking associate

Use a reverse chronological resume format. It highlights recent, relevant substitutes and keeps your progression easy to scan. Do:

- Lead bullets with analysis verbs.

- Quantify scope, inputs, and outputs.

- List tools: Excel, PowerPoint, Bloomberg.

- Mirror investment banking associate job keywords.

- Add a deals section for cases.

- Built a three-statement model and discounted cash flow valuation for a public industrials company in Excel, supporting a buy thesis and a 12% upside target.

Even without direct experience, your education section can carry significant weight on your resume—here's how to present it effectively.

How to list your education on a investment banking associate resume

Your education section helps hiring teams confirm you have the analytical and financial foundation required. It validates your readiness for the investment banking associate role quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to an investment banking associate resume.

Example education entry

Master of Business Administration (MBA)

Columbia Business School, New York, NY

Graduated 2022 | GPA: 3.8/4.0

- Relevant coursework: Advanced Valuation, Leveraged Buyouts, Mergers & Acquisitions, Corporate Finance, and Financial Modeling

- Honors: Dean's List, Beta Gamma Sigma Honor Society

How to list your certifications on a investment banking associate resume

Certifications on a resume show an investment banking associate's commitment to learning, proficiency with key tools, and alignment with industry standards, especially for valuation, modeling, and compliance.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they're older, less relevant, or supplemental to your core finance training.

- Place certifications above education when they're recent, highly relevant, or required for your target investment banking associate role.

Best certifications for your investment banking associate resume

Chartered Financial Analyst (CFA) Financial Modeling & Valuation Analyst (FMVA) Series 79 Series 63 Bloomberg Market Concepts (BMC) Chartered Alternative Investment Analyst (CAIA) Certified Public Accountant (CPA)

Once your credentials are clearly positioned to validate your expertise, the next step is writing your investment banking associate resume summary to frame that value upfront.

How to write your investment banking associate resume summary

Your resume summary is the first thing a recruiter reads. A strong one immediately signals you're qualified for the investment banking associate role.

Keep it to three to four lines, with:

- Your title and two to five years of relevant experience.

- Domain focus such as M&A, leveraged finance, or equity capital markets.

- Core skills like financial modeling, valuation, due diligence, and pitch book creation.

- One or two quantified achievements, such as deal volume or revenue impact.

- Soft skills tied to real outcomes, like cross-functional coordination or client management.

PRO TIP

At the associate level, emphasize hands-on deal execution, analytical rigor, and your ability to manage workstreams independently. Highlight specific transaction types and dollar values you've supported. Avoid vague descriptors like "passionate" or "motivated self-starter." Recruiters want proof of technical skill and measurable contributions, not aspirational language.

Example summary for a investment banking associate

Investment banking associate with three years of M&A experience. Executed 12 transactions totaling $4.2B. Skilled in financial modeling, valuation, and managing junior analysts through live deal processes.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your strongest qualifications, make sure recruiters can actually reach you by setting up a clear, complete header.

What to include in a investment banking associate resume header

A resume header lists your key contact details and professional identity, improving visibility, credibility, and recruiter screening for a investment banking associate role.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify experience quickly and supports screening.

Do not include photos on a investment banking associate resume unless the role is explicitly front-facing or appearance-dependent.

Keep the header to one or two lines, match the job title to the posting, and use links that load fast and look professional.

Example

Investment banking associate resume header

Jordan Lee

Investment Banking Associate | M&A and Capital Markets

New York, NY

(212) 555-01XX | your.name@enhancv.com | github.com/yourname | yourwebsite.com | linkedin.com/in/yourname

Once your contact details and key identifiers are in place, add the additional sections to round out the rest of your investment banking associate resume.

Additional sections for investment banking associate resumes

Beyond core sections, additional resume sections help you stand out when they demonstrate relevant expertise, cultural fit, or credibility specific to investment banking. For example, listing language skills on your resume can be a differentiator when targeting cross-border deal teams or international coverage groups.

- Languages

- Certifications (CFA, CAIA, Series 79/63)

- Industry awards and honors

- Professional affiliations (e.g., CFA Institute, Wall Street Oasis)

- Volunteer and community leadership

- Hobbies and interests

- Publications and research

Once you've strengthened your resume with relevant additional sections, it's worth ensuring your application package is complete by pairing it with a well-crafted cover letter.

Do investment banking associate resumes need a cover letter

A cover letter isn't always required for an investment banking associate, but it often helps in competitive processes. If you're unsure where to start, learn what a cover letter is and how it complements your resume. It makes a difference when hiring teams expect context beyond bullets, or when your background needs a clear narrative.

Use a cover letter to add value, not to repeat your resume:

- Explain role and team fit: Tie your deal experience to the group's coverage, product focus, and typical transaction size.

- Highlight one or two outcomes: Pick a live deal, pitch, or model where you drove an analysis, improved a process, or influenced a decision.

- Show business context: Reference the bank's client base, industry dynamics, or product mix, and connect it to how you'll execute as an investment banking associate.

- Address transitions or non-obvious experience: Clarify why you moved firms, switched groups, or came from a different function, and how the skills transfer.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even when you decide a separate letter won’t add value, you can strengthen your candidacy by using AI to improve your investment banking associate resume.

Using AI to improve your investment banking associate resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight results. But overuse strips authenticity. If you're exploring this approach, check out ChatGPT resume writing prompts for practical starting points. Once your content is clear and role-aligned, step away from AI.

Here are 10 practical prompts to strengthen specific sections of your resume:

- Strengthen deal experience — "Rewrite this investment banking associate experience bullet to emphasize deal size, transaction type, and my specific contribution."

- Quantify financial impact — "Add measurable outcomes to this investment banking associate achievement, focusing on revenue, multiples, or cost savings."

- Sharpen the summary — "Tighten this investment banking associate resume summary to three sentences highlighting sector expertise and career progression."

- Improve modeling bullets — "Refine this bullet to clearly describe the financial models I built as an investment banking associate, specifying model type and purpose."

- Align skills section — "Review this skills list and remove entries irrelevant to an investment banking associate role. Suggest missing technical skills."

- Clarify project scope — "Rewrite this investment banking associate project description to specify deal structure, client type, and timeline."

- Refine education details — "Suggest how to present my education section to best support an investment banking associate application, including relevant coursework."

- Elevate leadership language — "Strengthen this investment banking associate experience bullet to better reflect team leadership, mentoring, or cross-functional coordination."

- Optimize certification entries — "Format my certifications section for an investment banking associate resume, prioritizing CFA, FINRA licenses, and relevant credentials."

- Tighten action verbs — "Replace weak verbs in these investment banking associate experience bullets with precise, high-impact alternatives used in finance resumes."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong investment banking associate resume shows measurable outcomes, role-specific skills, and a clear structure. Lead with impact, quantify results, and highlight modeling, valuation, deal execution, and client management. Keep formatting consistent so reviewers find key details fast.

Hiring teams want investment banking associate candidates who deliver under pressure and communicate clearly. Your resume should prove that readiness through metrics, relevant experience, and clean sections. When every line earns its space, you stand out in today’s market and the next.