As a collector crafting your resume, you may struggle to convey your expertise in identifying, acquiring, and managing unique items in a way that resonates with employers outside the collecting field. Our guide provides tailored strategies to help you translate your passion and skills into professional terms, ensuring your resume appeals to a broad range of industries.

- Incorporate collector job advert keywords into key sections of your resume, such as the summary, header, and experience sections;

- Quantify your experience using achievements, certificates, and more in various collector resume sections;

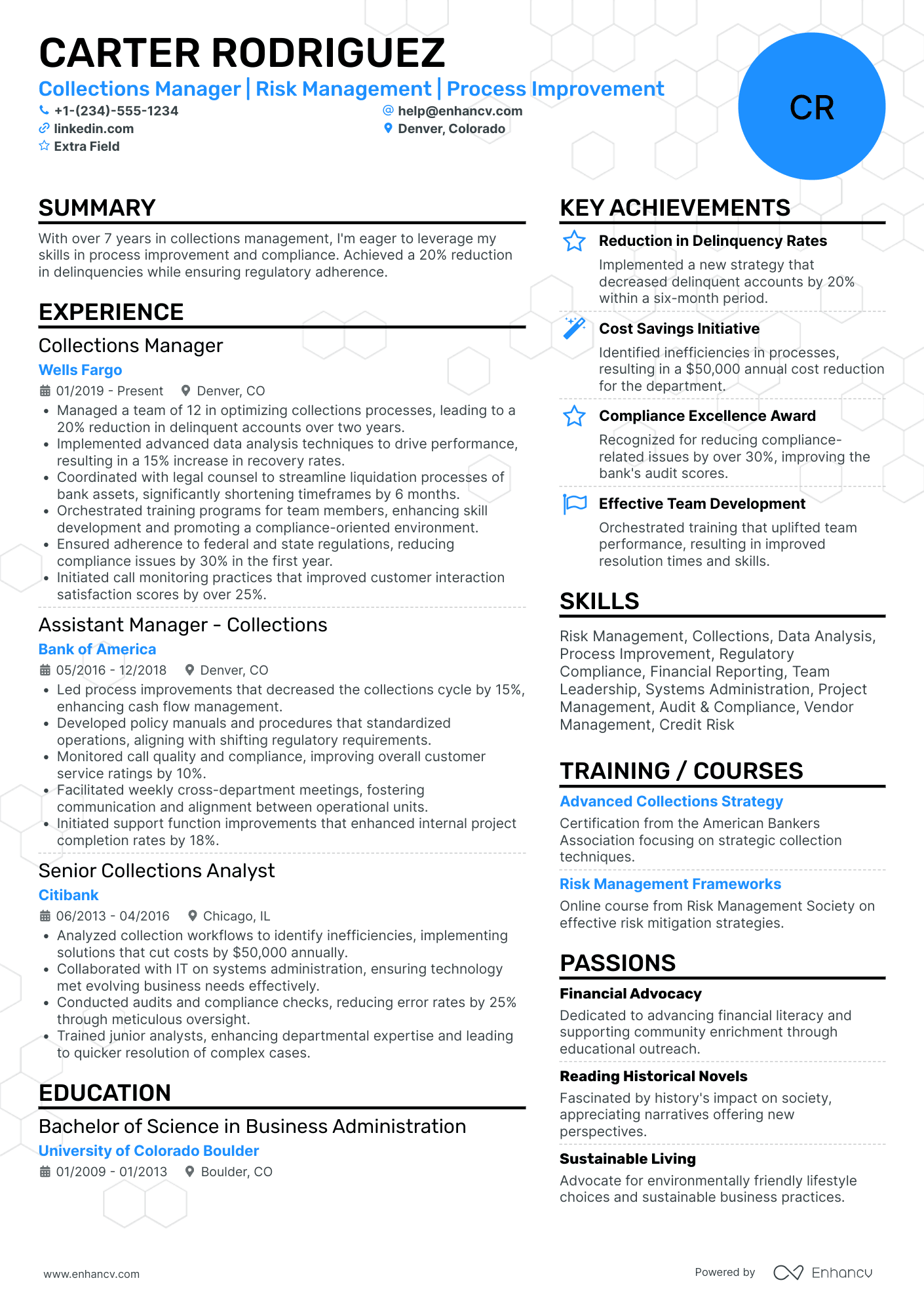

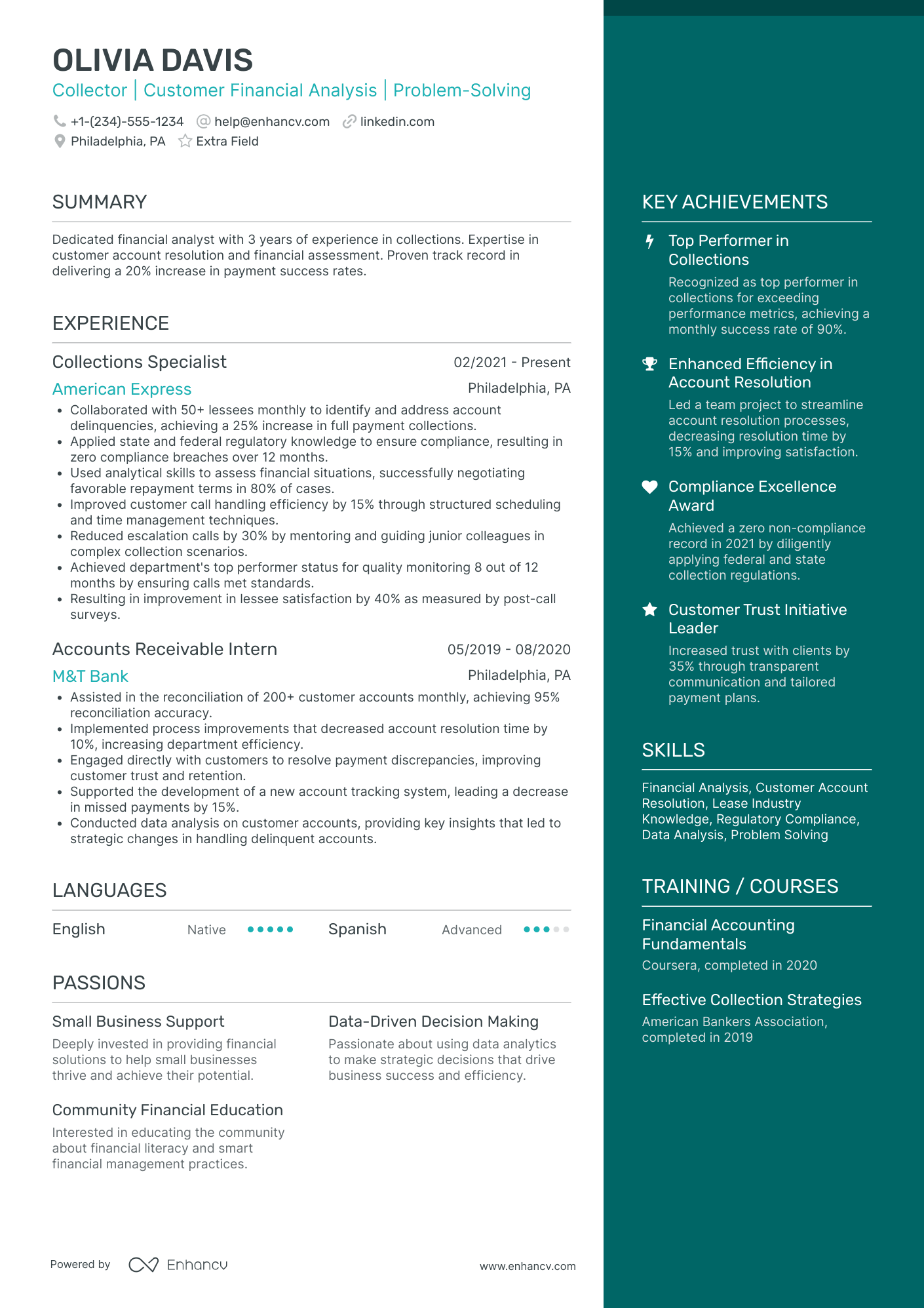

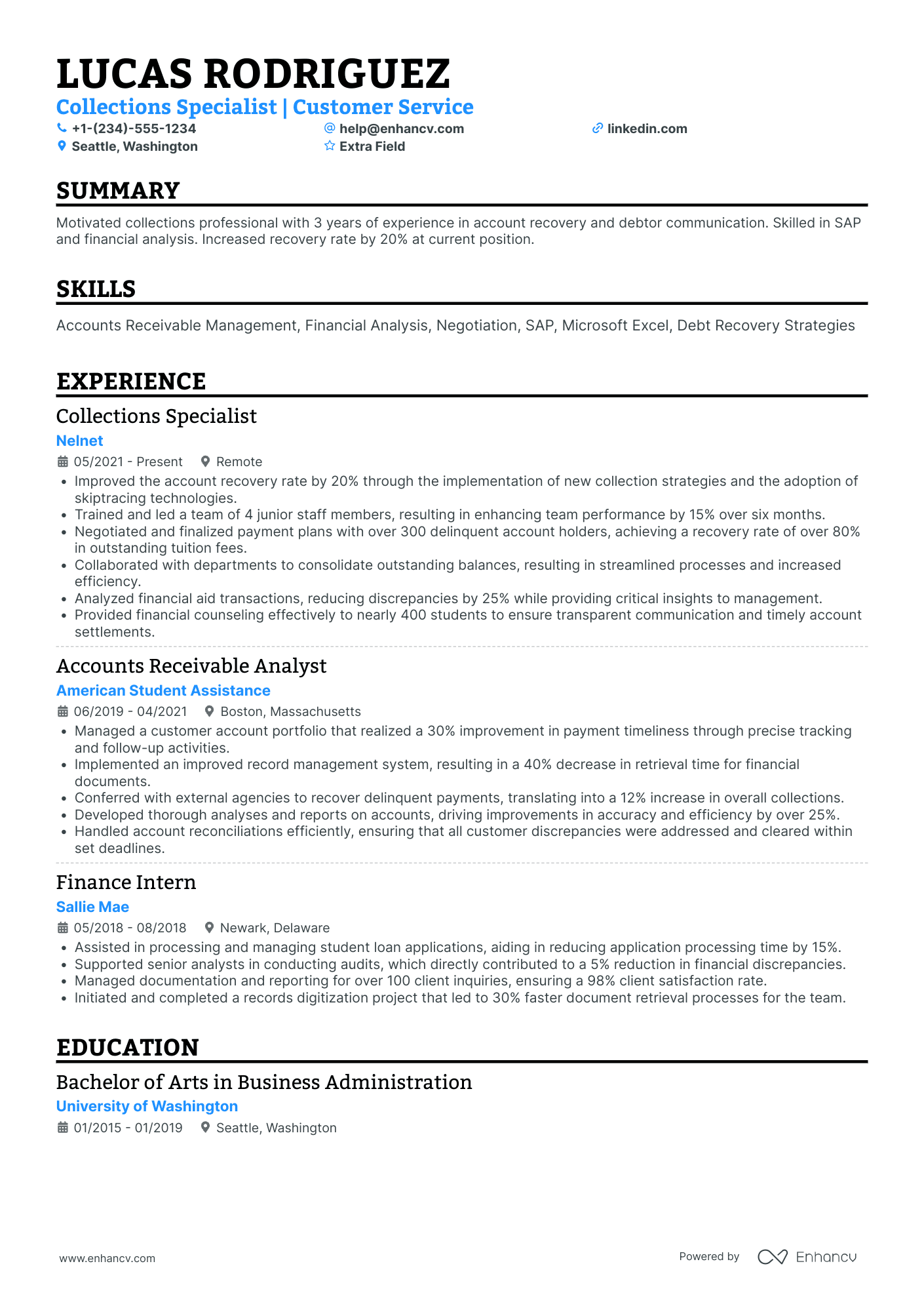

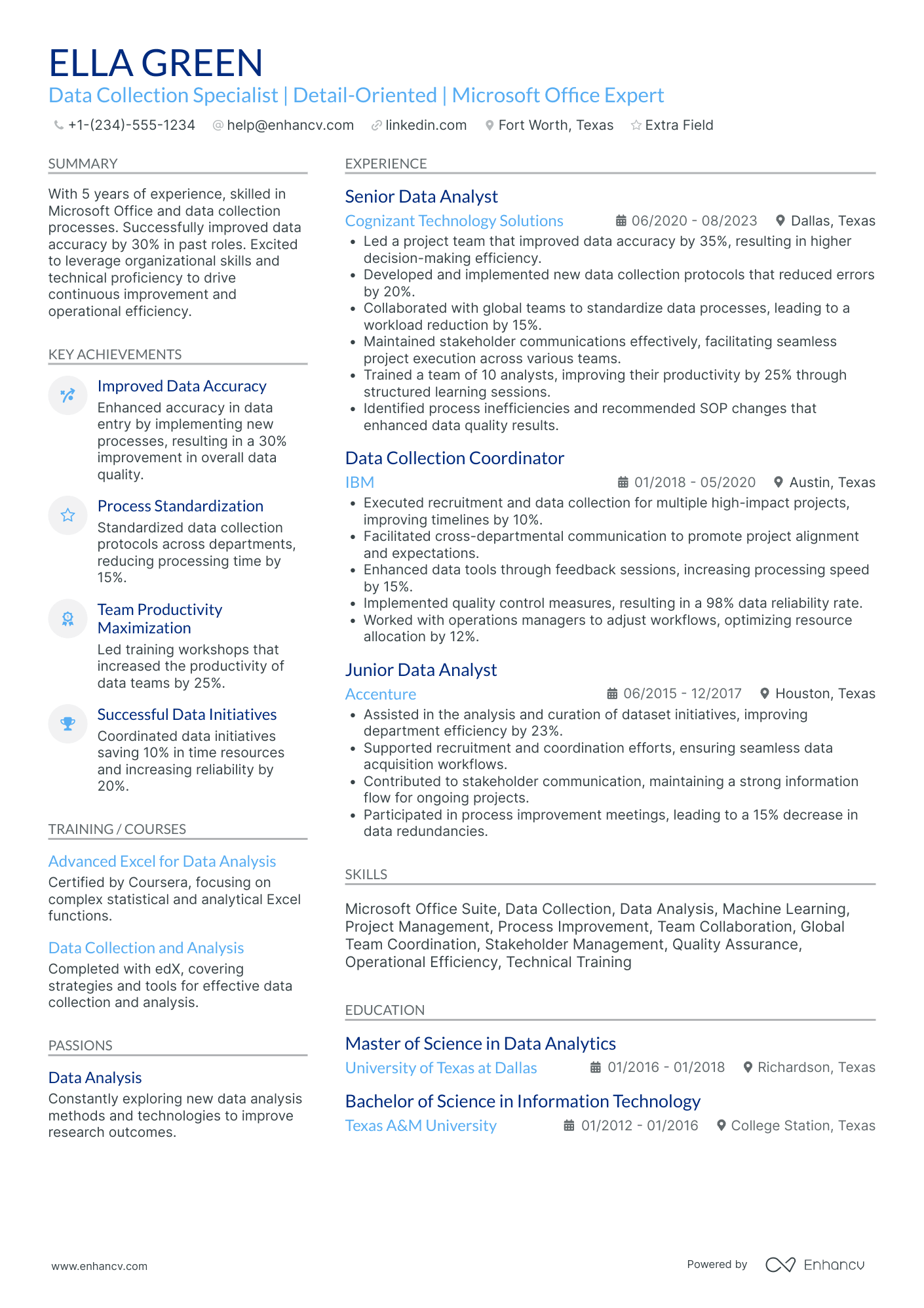

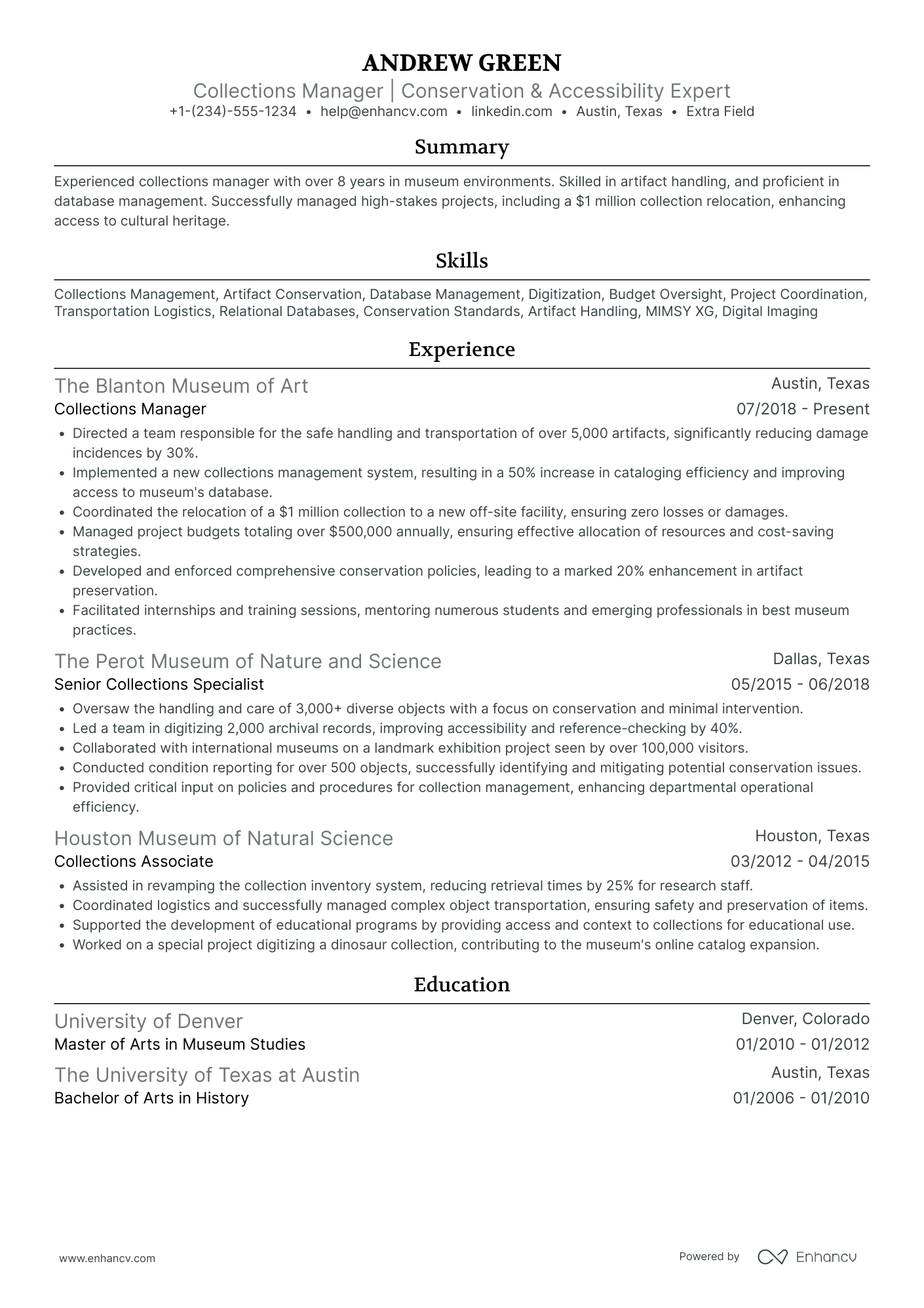

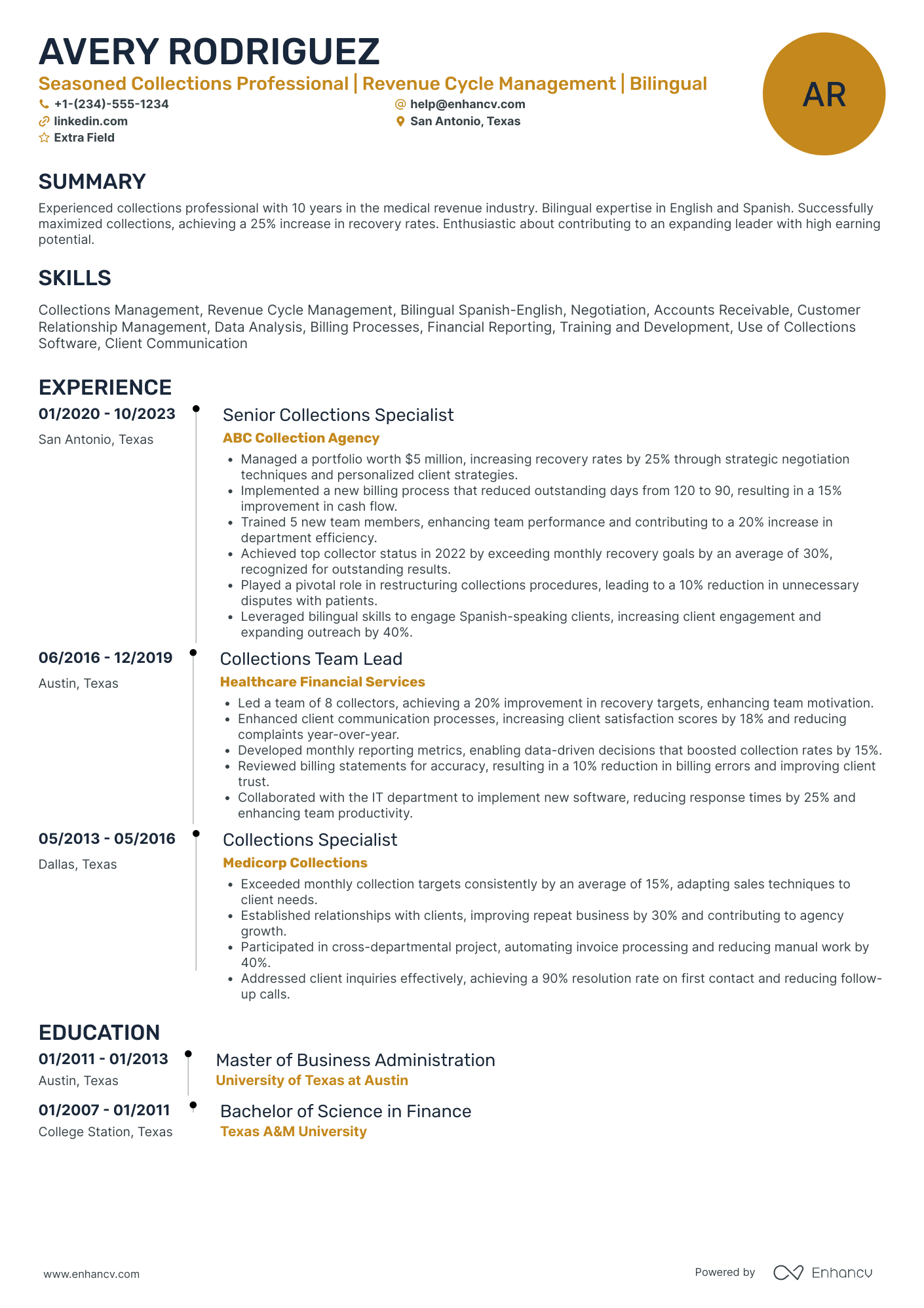

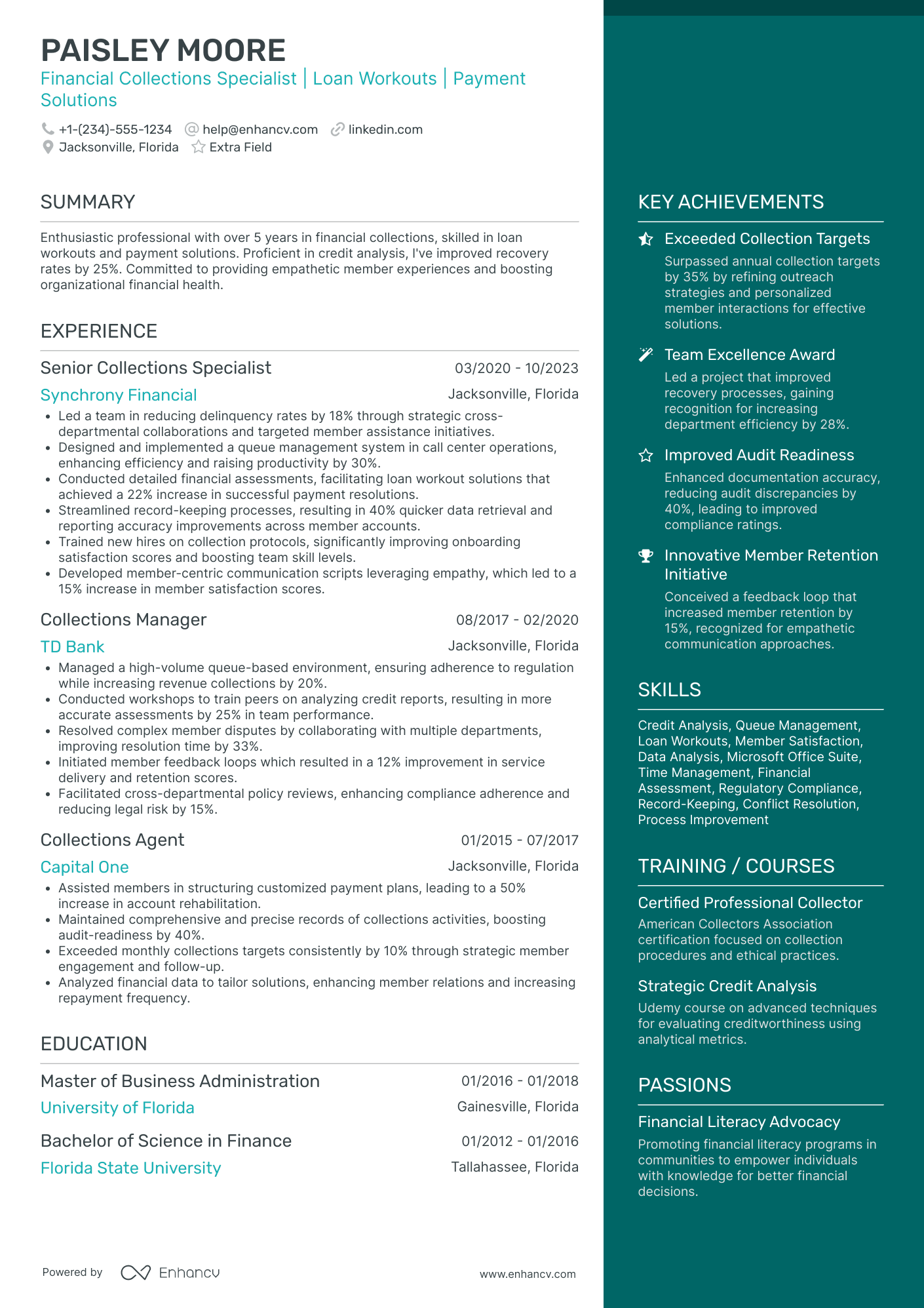

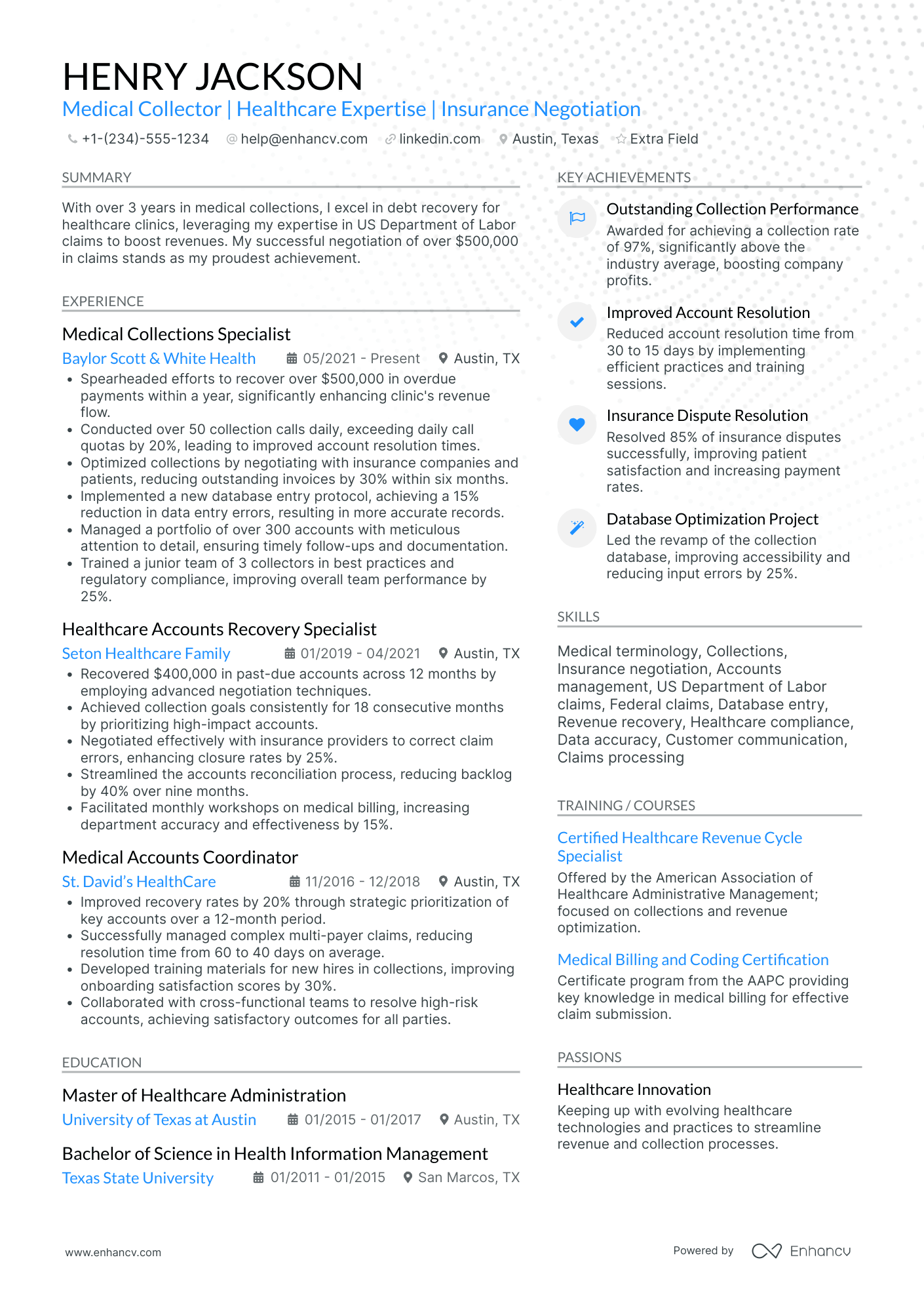

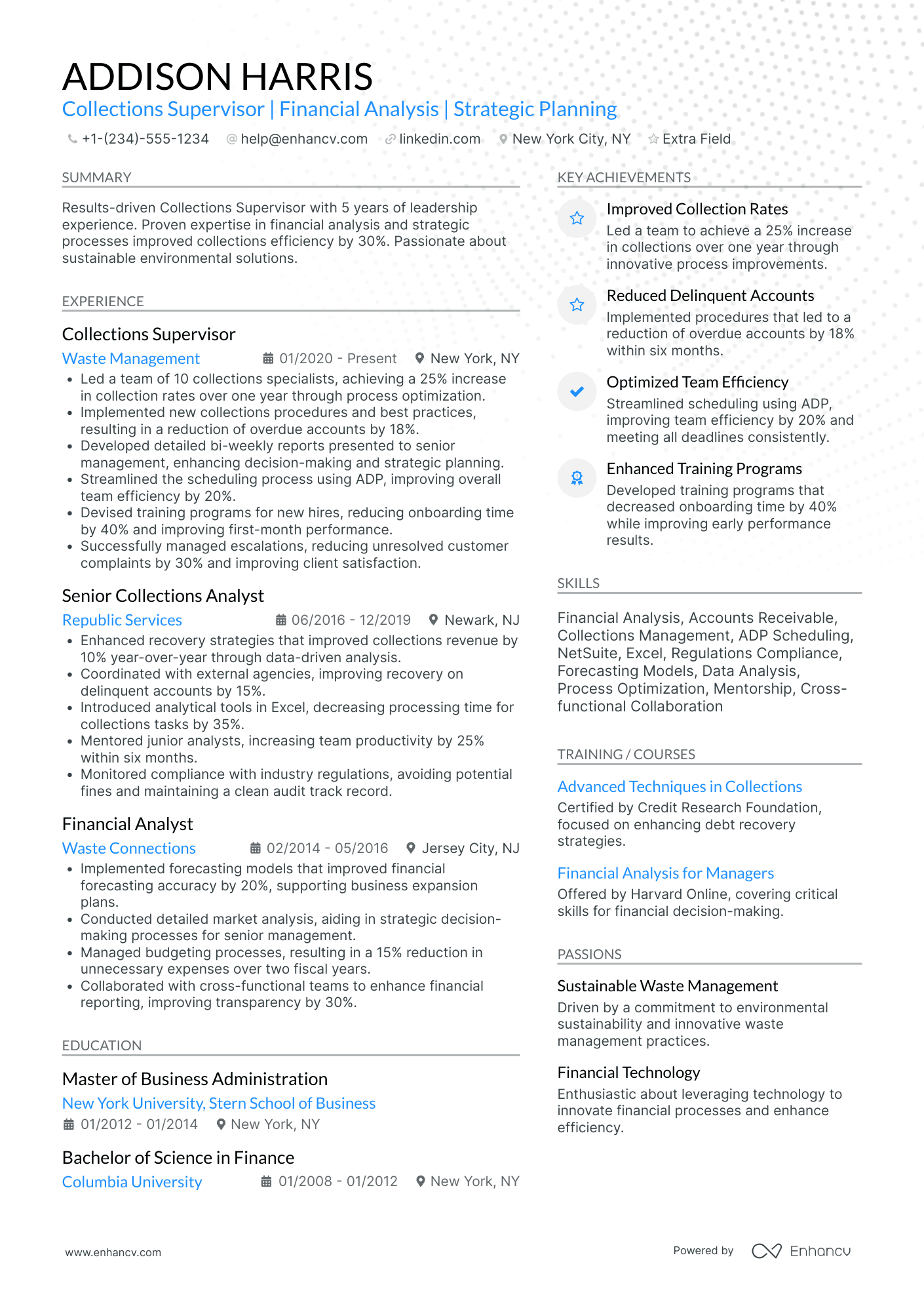

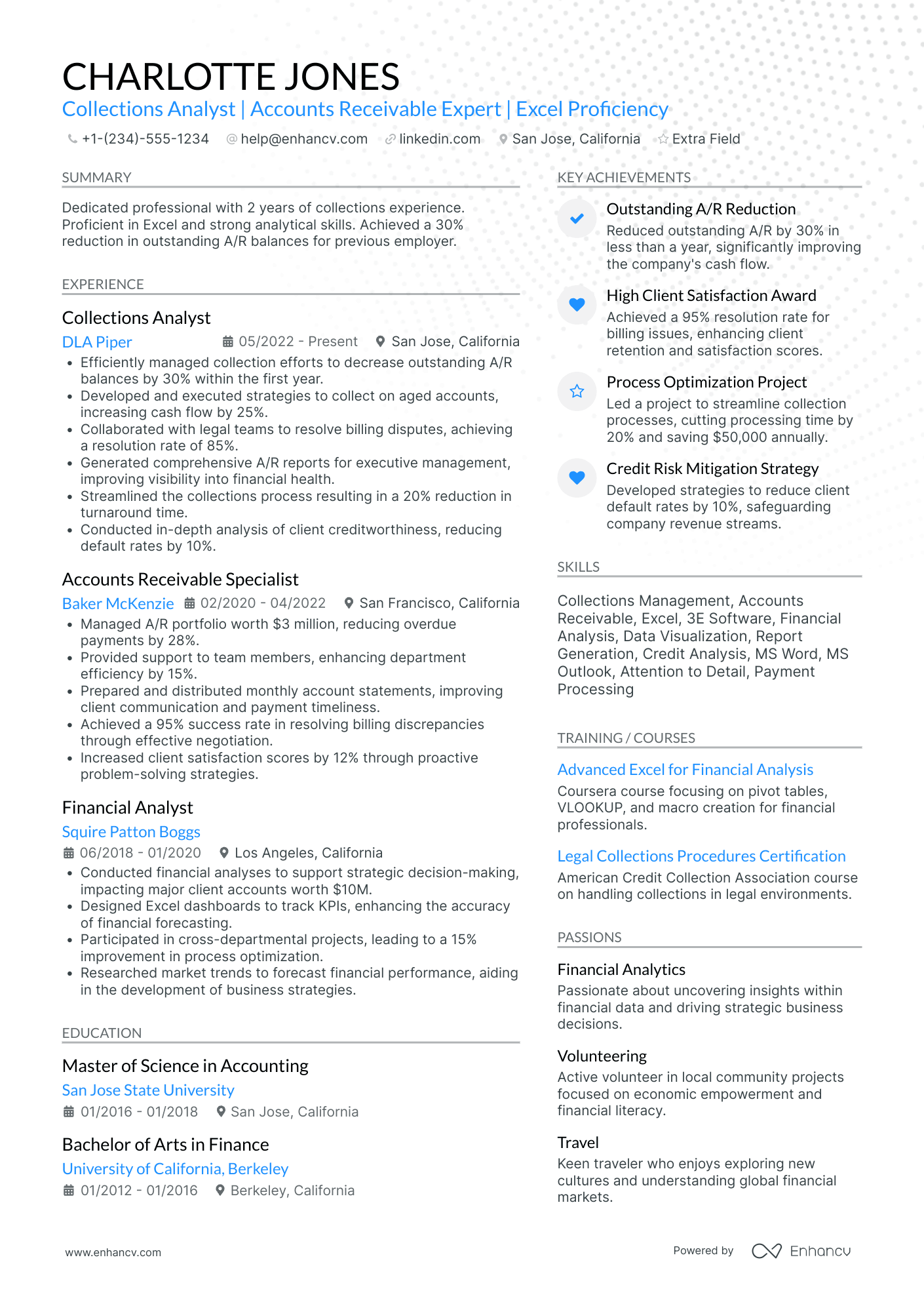

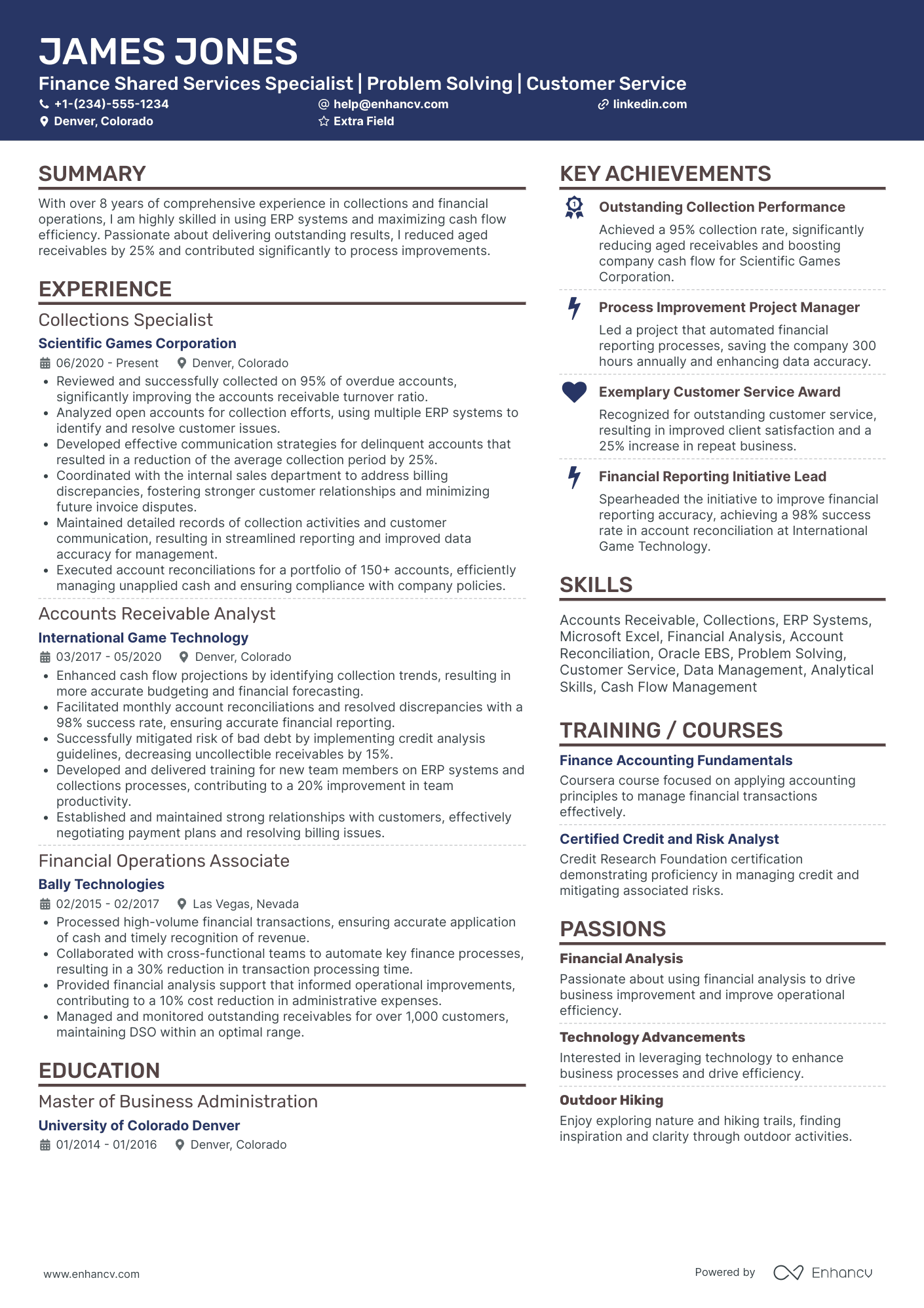

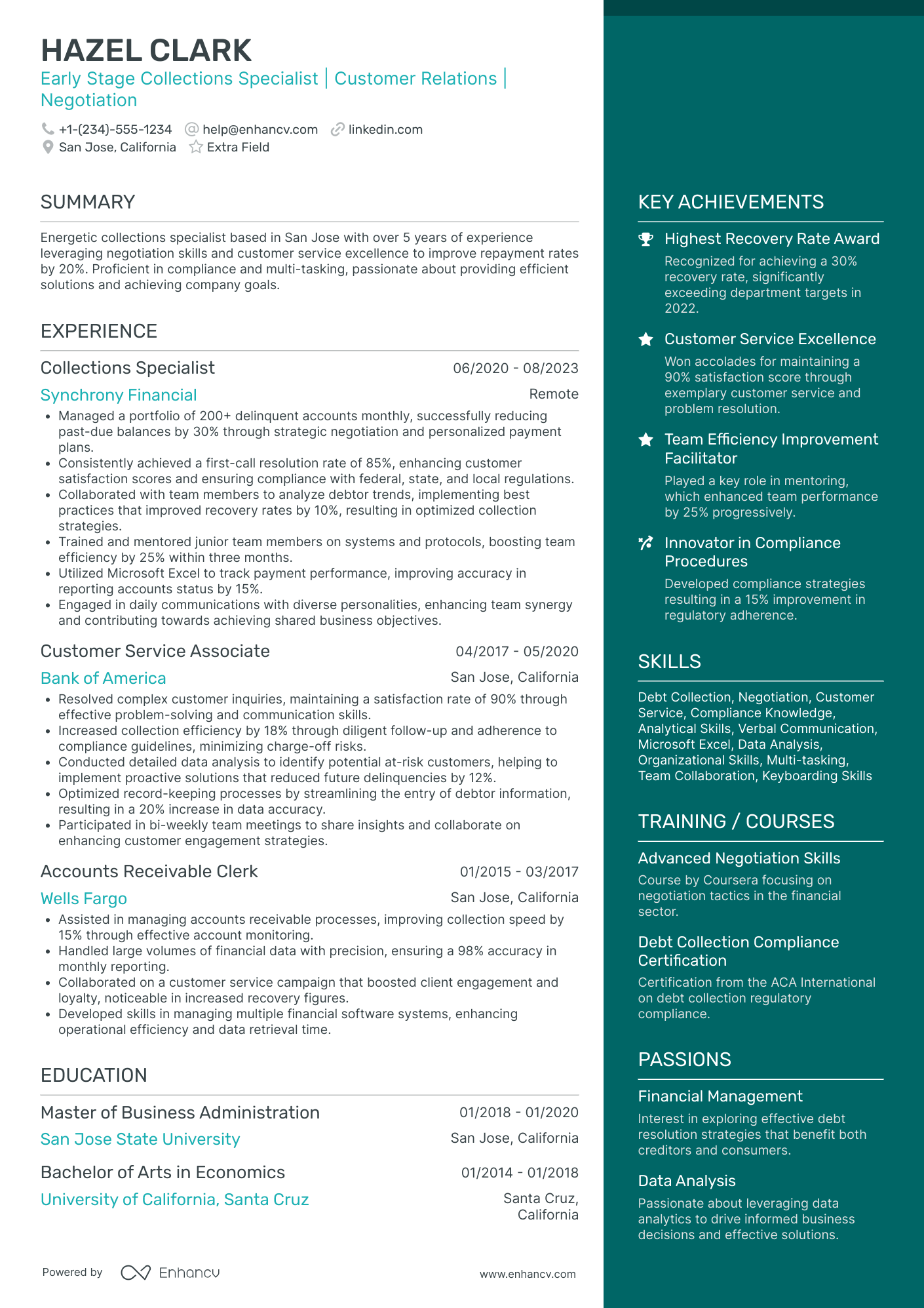

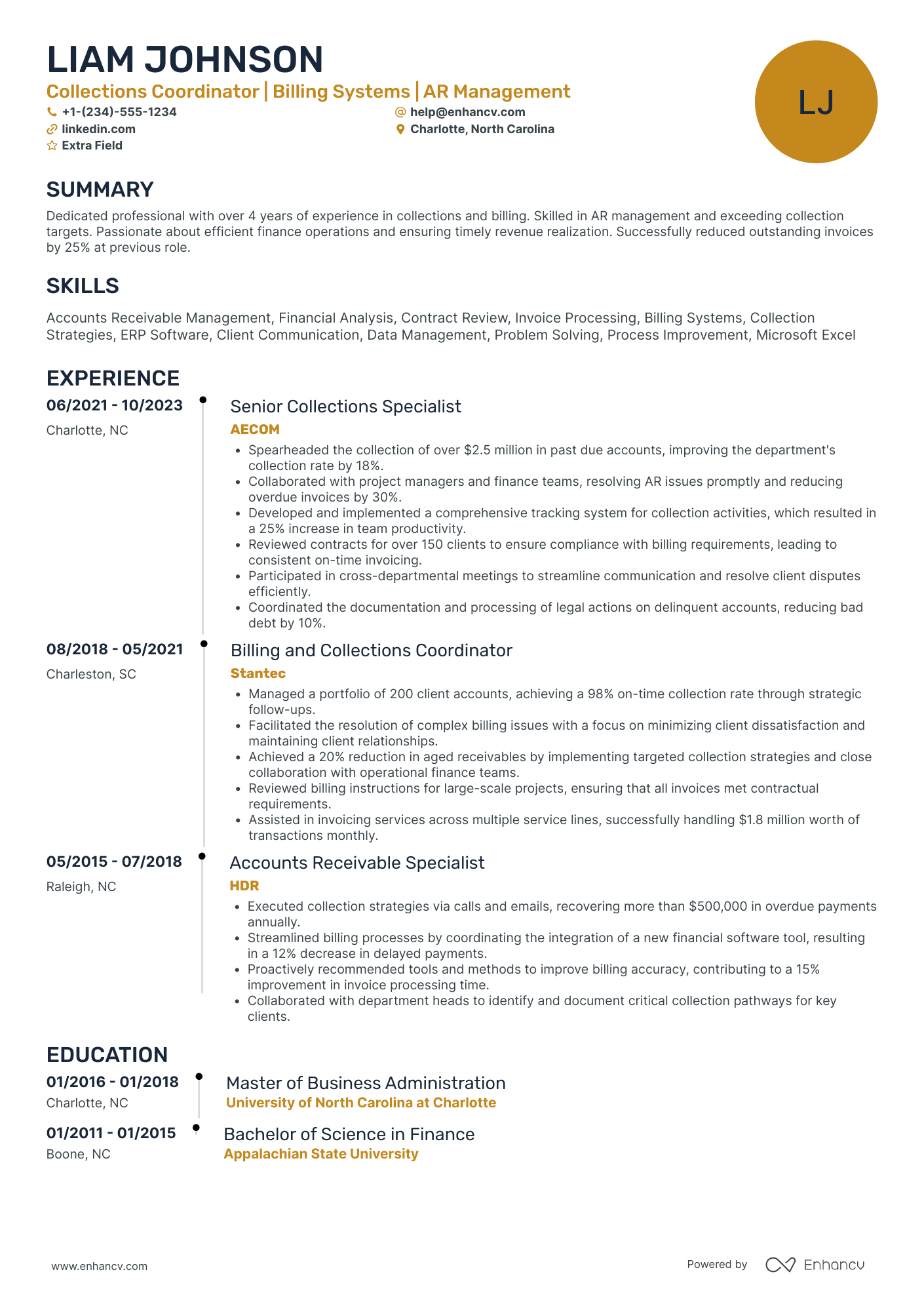

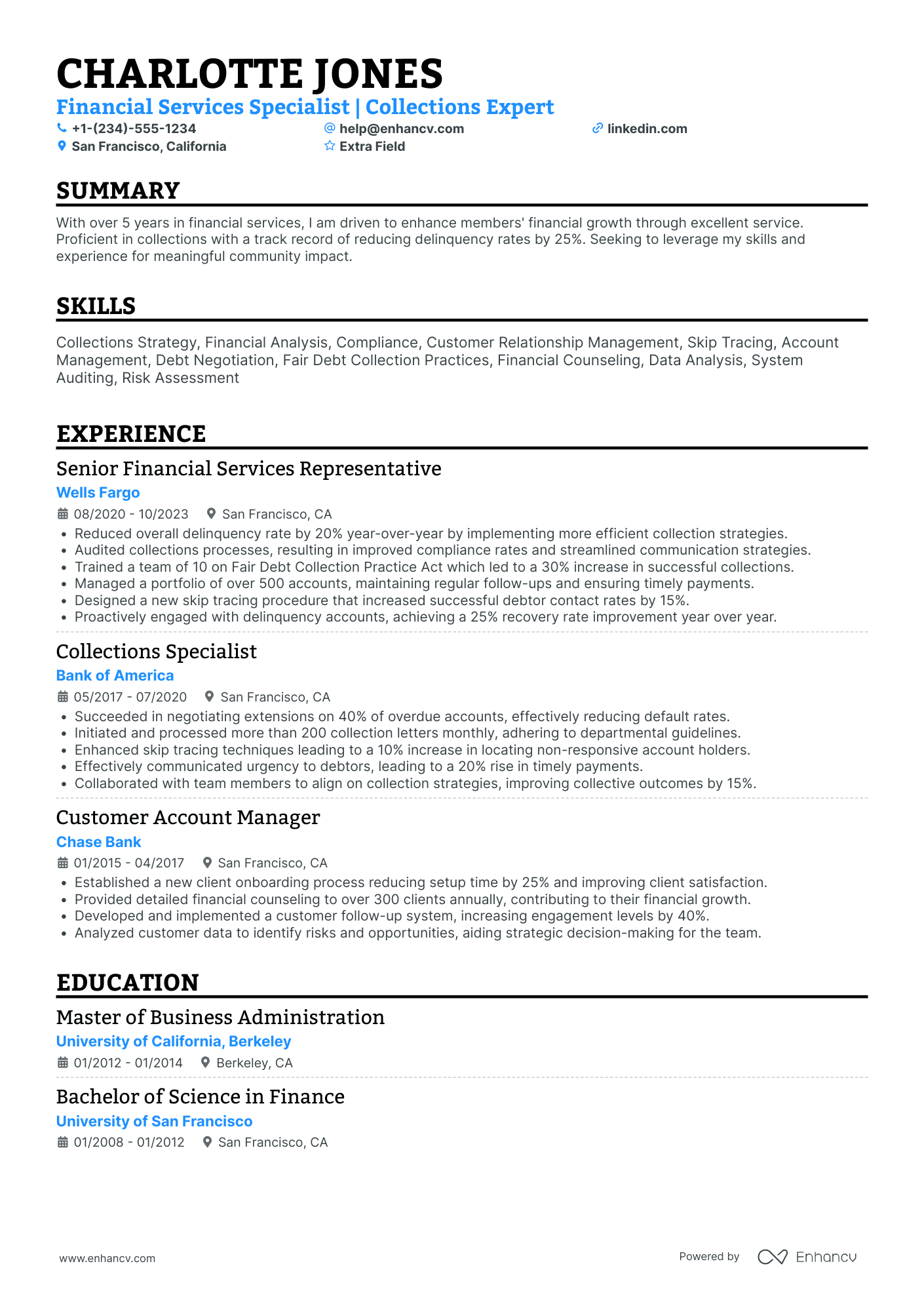

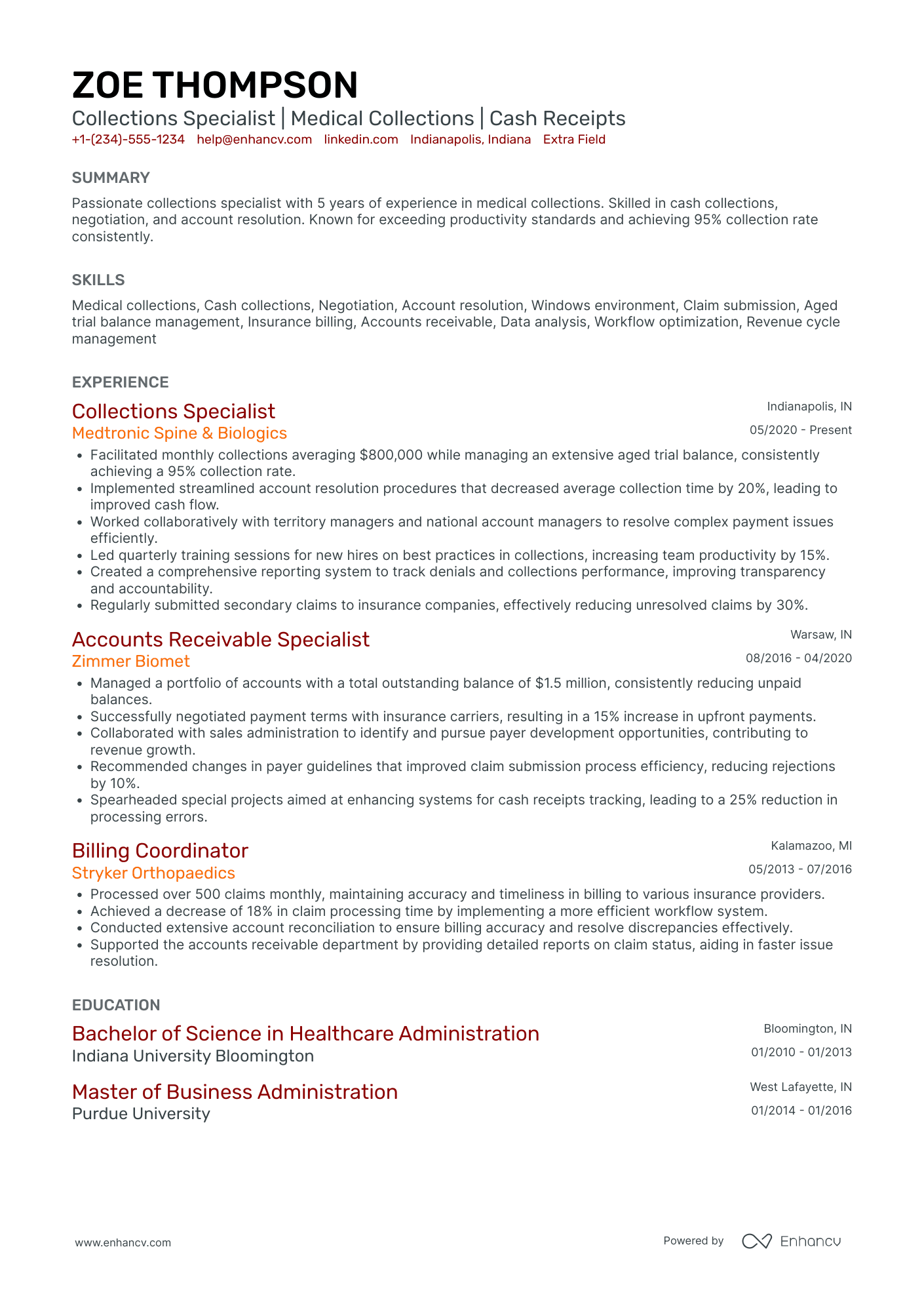

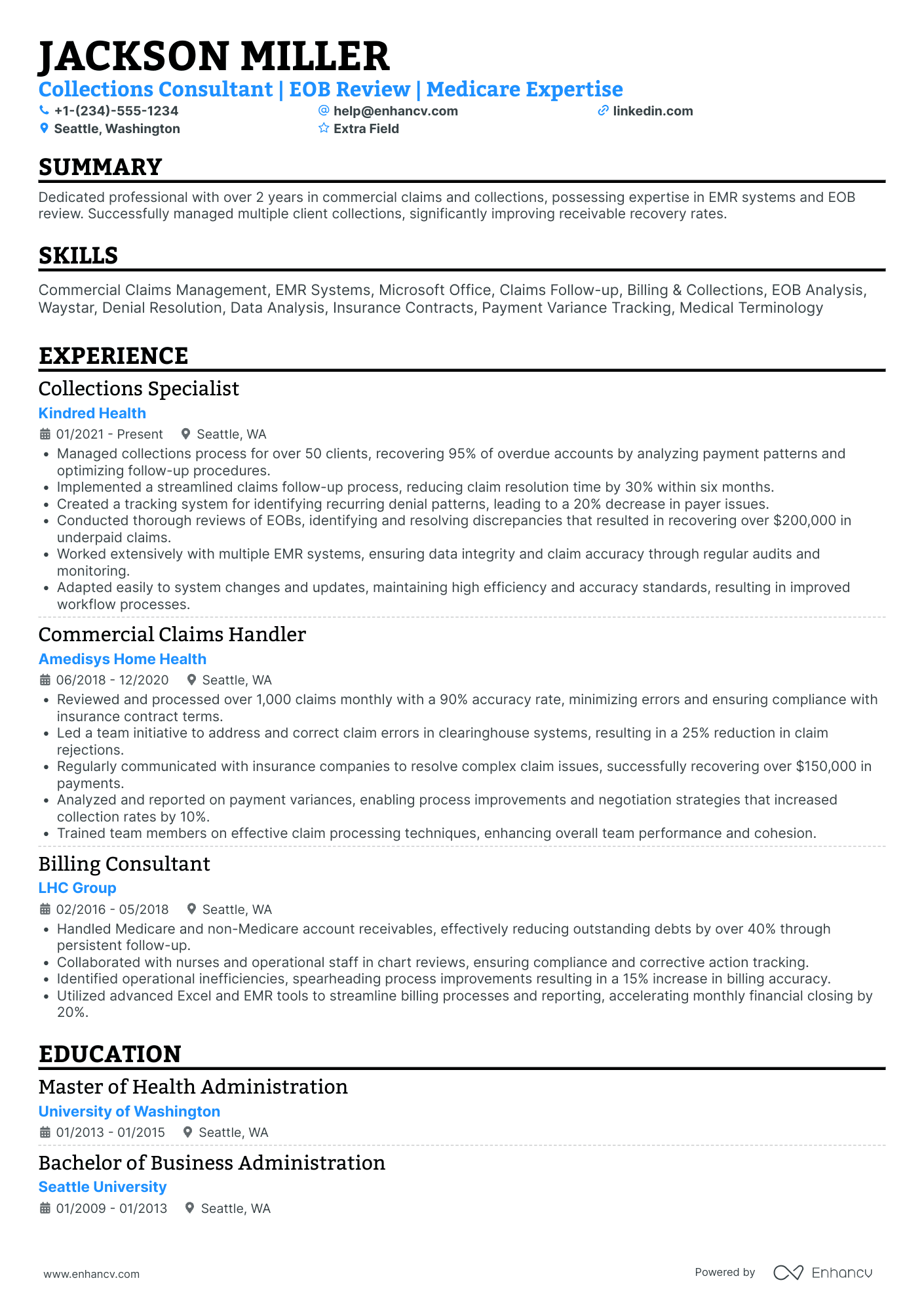

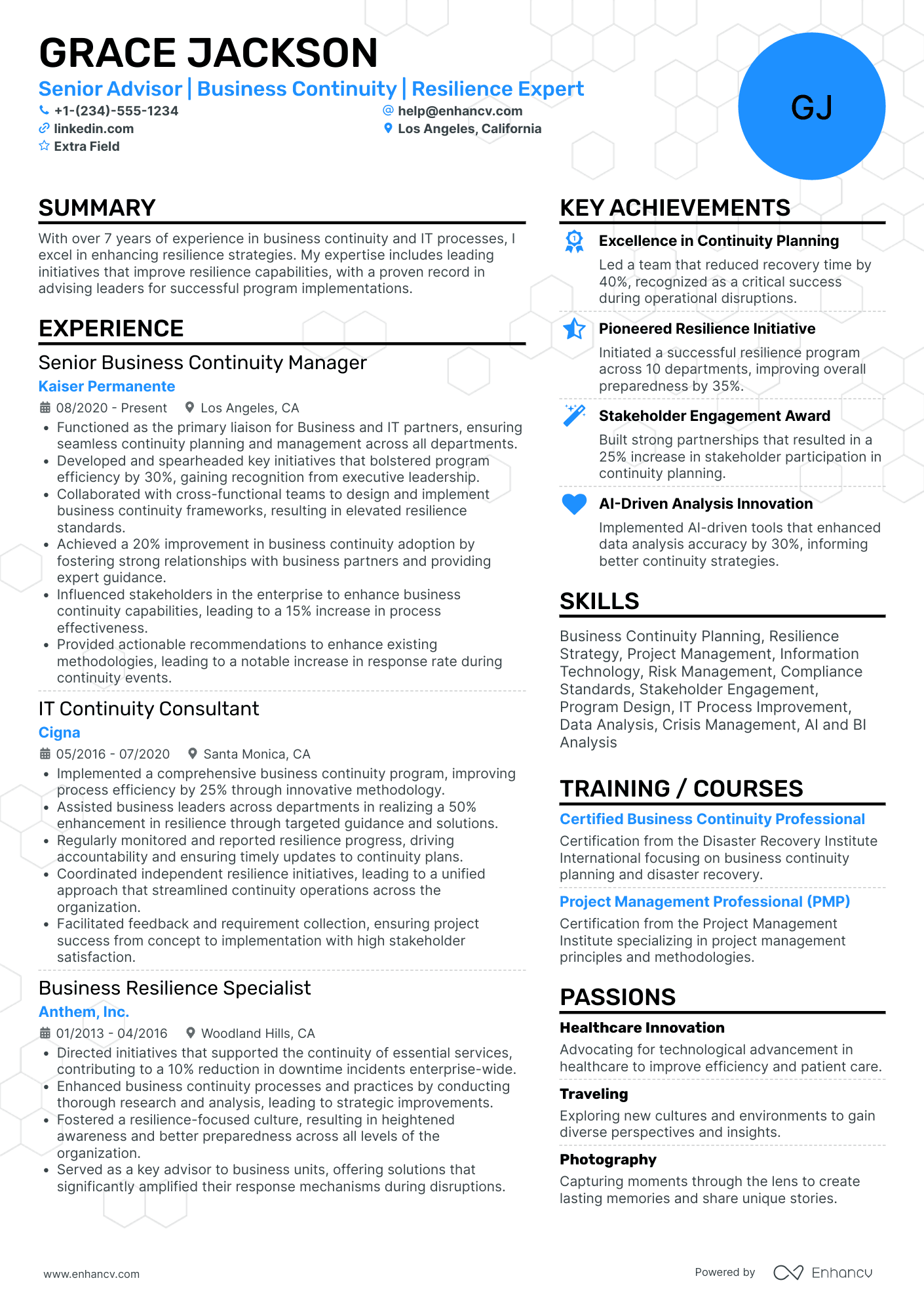

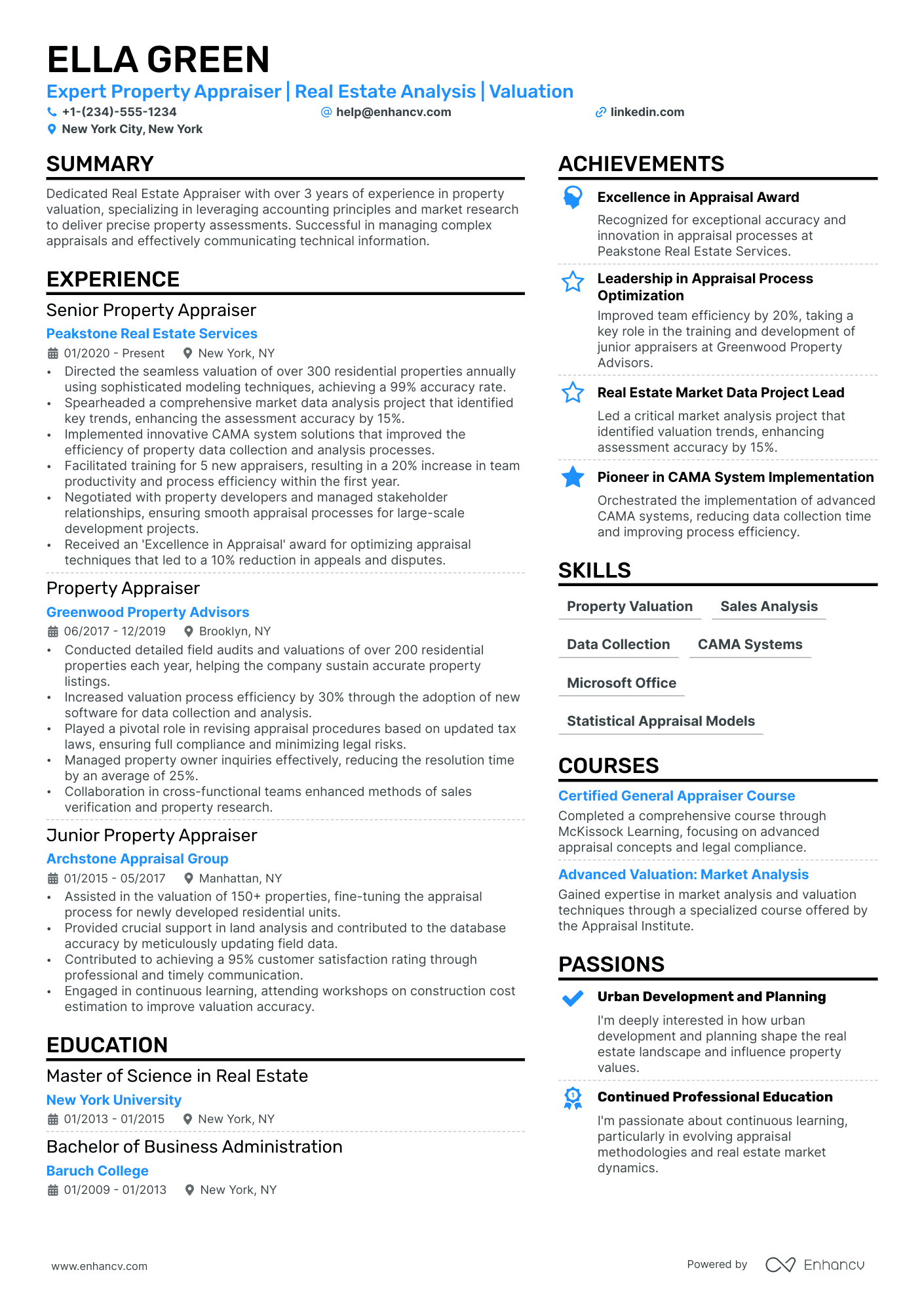

- Apply practical insights from real-life collector resume examples to enhance your own profile;

- Choose the most effective collector resume format to succeed in any evaluation process.

- Financial Operations Manager Resume Example

- Phone Banking Resume Example

- Financial Auditor Resume Example

- Personal Banker Resume Example

- Financial Planning Analyst Resume Example

- Purchase Manager Resume Example

- Financial Management Analyst Resume Example

- Fund Accountant Resume Example

- Audit Director Resume Example

- Management Accounting Resume Example

Tips and tricks for your collector resume format

Before you start writing your resume, you must first consider its look-and-feel - or resume format . Your professional presentation hence should:

- Follow the reverse-chronological resume format , which incroporates the simple logic of listing your latest experience items first. The reverse-chronological format is the perfect choice for candidates who have plenty of relevant (and recent) experience.

- State your intention from the get-go with a clear and concise headline - making it easy for recruiters to allocate your contact details, check out your portfolio, or discover your latest job title.

- Be precise and simple - your resume should be no more than two pages long, representing your experience and skills that are applicable to the collector job.

- Ensure your layout is intact by submitting it as a PDF. Thus, your resume sections would stay in place, even when assessed by the Applicant Tracker System (ATS).

Keep in mind market-specific formats – for example, a Canadian resume might follow a different structure.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

The six in-demand sections for your collector resume:

- Top one-third should be filled with a header, listing your contact details, and with a summary or objective, briefly highlighting your professional accolades

- Experience section, detailing how particular jobs have helped your professional growth

- Notable achievements that tie in your hard or soft skills with tangible outcomes

- Popular industry certificates to further highlight your technical knowledge or people capabilities

- Education to showcase your academic background in the field

What recruiters want to see on your resume:

- Demonstrated experience or ability in debt and account recovery processes

- Proven negotiation and conflict resolution skills specific to collections

- Strong knowledge of collections regulations and fair debt collection practices

- Experience with collections software and tools for account management

- Quantifiable achievements in previous collection roles (e.g., reduced delinquency rates, amount of debt recovered)

Quick formula for writing your collector resume experience section

Have you ever wondered why recruiters care about your collector expertise?

For starters, your past roles show that you've obtained the relevant on-the job training and expertise that'd be useful for the role.

What is more, the resume work experience section isn't just your work history , but:

- shows what you're capable of achieving based on your past success;

- proves your skills with (oftentimes, tangible) achievements;

- highlights the unique value of what it's like to work with you.

To ensure your resume work experience section is as effective as possible, follow this formula:

- start each bullet with a powerful, action verb , followed up by your responsibilities, and your workplace success.

The more details you can include - that are relevant to the job and linked with your skill set - the more likely you are to catch recruiters' attention.

Additionally, you can also scan the job advert for key requirements or buzzwords , which you can quantify across your experience section.

Not sure what we mean by this? Take inspiration from the collector resume experience sections below:

- Managed a portfolio of over 500 accounts with a focus on high-balance consumer debt, achieving a 70% recovery rate through strategic negotiation.

- Developed and implemented a tailored communication strategy that increased successful contact rates by 40% within the first six months.

- Trained and mentored 10 new collectors, leading to a 15% increase in the team's overall productivity and efficiency.

- Pioneered the use of data analytics for predicting debt recovery outcomes, which boosted recovery rates by 20% within the first year.

- Facilitated debt resolution for over 3000 delinquent accounts, consistently surpassing quarterly targets by at least 25%.

- Led a cross-functional initiative to improve the debt settlement process, resulting in a 15% decrease in the average resolution time.

- Implemented a new customer-centric approach to debt recovery that improved customer satisfaction scores by 30% while maintaining robust collection rates.

- Negotiated debt settlements on accounts averaging $20,000, securing an overall 85% repayment rate across managed portfolios.

- Coordinated with legal teams to facilitate the collection process for accounts in litigation, ensuring compliance with state and federal regulations.

- Oversee the collection operations for online retail accounts, incorporating digital payment solutions that improved recovery rates by 25%.

- Spearheaded the integration of AI-driven predictive modeling to enhance collection strategies, leading to a 10% reduction in delinquency rates.

- Championed the development of a debt recovery app which has been adopted by 2000+ users, significantly streamlining the payment process.

- Directed regional collection efforts for auto loans, strategizing recovery for over 10,000 accounts with a focus on empathetic customer engagement.

- Authored a comprehensive playbook on regulatory compliance for collections, reducing infractions by 95% across the team.

- Implemented targeted outreach campaigns, which resulted in reducing the average days delinquent from 60 to 45 days.

- Cultivated relationships with high-risk clientele to negotiate payment plans, securing over $5 million in revenue recovery within three years.

- Designed and executed a collector training program that improved team recovery rates by 18% within the first year of implementation.

- Leveraged bilingual capabilities to expand the collections department's reach, allowing for successful recovery from an additional 150 Spanish-speaking accounts annually.

- Orchestrated the transition to a fully automated dialing system that increased contact efficiency by 50%, reducing operational costs by 20%.

- Successfully recovered outstanding consumer credit debt exceeding $30 million, outperforming individual targets by 35% annually.

- Partnered with the compliance department to ensure collection tactics adhered strictly to the Fair Debt Collection Practices Act, maintaining a flawless legal compliance record.

- In charge of medical collections for a healthcare system, reducing bad debt by 22% through collaborative work with insurance companies.

- Implemented compassionate collection techniques that not only preserved patient dignity but also increased successful payment arrangements by 30%.

- Automated patient follow-up procedures that reduced manual call time by 50%, allowing collectors to focus on high-priority cases.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for collector professionals.

Top Responsibilities for Collector:

- Send notices to taxpayers when accounts are delinquent.

- Confer with taxpayers or their representatives to discuss the issues, laws, and regulations involved in returns, and to resolve problems with returns.

- Notify taxpayers of any overpayment or underpayment, and either issue a refund or request further payment.

- Maintain records for each case, including contacts, telephone numbers, and actions taken.

- Contact taxpayers by mail or telephone to address discrepancies and to request supporting documentation.

- Answer questions from taxpayers and assist them in completing tax forms.

- Collect taxes from individuals or businesses according to prescribed laws and regulations.

- Determine appropriate methods of debt settlement, such as offers of compromise, wage garnishment, or seizure and sale of property.

- Check tax forms to verify that names and taxpayer identification numbers are correct, that computations have been performed correctly, or that amounts match those on supporting documentation.

- Examine and analyze tax assets and liabilities to determine resolution of delinquent tax problems.

Quantifying impact on your resume

- Include the total amount of debt successfully collected over a specific period to demonstrate your effectiveness in recovering outstanding funds.

- List the percentage increase in collections compared to previous periods to highlight growth and success in your role.

- Detail the number of accounts managed to illustrate your capability of handling a significant workload and maintaining organization.

- Specify the average time taken to collect on overdue accounts to show efficiency and effectiveness in reducing collection cycles.

- Mention any reduction in delinquency rates you contributed to to emphasize your skills in debt recovery and credit management.

- State the number of negotiation plans you've successfully implemented to show expertise in providing mutually beneficial solutions for the company and debtors.

- Quantify the cost savings achieved through effective negotiation or process improvement initiatives that led to more efficient collections.

- Present the growth in customer retention rates due to your tailored collection practices, indicating your ability to maintain customer relations while enforcing payment policies.

Action verbs for your collector resume

No relevant experience - what to feature instead

Suppose you're new to the job market or considering a switch in industry or niche. In such cases, it's common to have limited standard professional experience. However, this isn't a cause for concern. You can still craft an impressive collector resume by emphasizing other sections, showing why you're a great fit for the role:

- Emphasize your educational background and extracurricular activities to demonstrate your industry knowledge;

- Replace the typical experience section with internships or temporary jobs where you've gained relevant skills and expertise;

- Highlight your unique skill set, encompassing both technological and personal abilities;

- Showcase transferable skills acquired throughout your life and work experiences so far.

Recommended reads:

PRO TIP

List all your relevant higher education degrees within your resume in reverse chronological order (starting with the latest). There are cases when your PhD in a particular field could help you stand apart from other candidates.

The heart and soul of your collector resume: hard skills and soft skills

If you read between the lines of the collector role you're applying for, you'll discover that all requirements are linked with candidates' hard skills and soft skills.

What do those skills have to do with your application?

Hard or technical skills are the ones that hint at your aptitude with particular technologies. They are easy to quantify via your professional experience or various certifications.

Meanwhile, your soft skills are more difficult to assess as they are personality traits, you've gained thanks to working in different environments/teams/organizations.

Your collector resume skills section is the perfect opportunity to shine a light on both types of skills by:

- Dedicating a technical skills section to list up to six technologies you're apt at.

- Focusing a strengths section on your achievements, thanks to using particular people skills or technologies.

- Including a healthy balance of hard and soft skills in the skills section to answer key job requirements.

- Creating a language skills section with your proficiency level - to hint at an abundance of soft skills you've obtained, thanks to your dedication to learning a particular language.

Within the next section of this guide, stay tuned for some of the most trending hard skills and soft skills across the industry.

Top skills for your collector resume:

Debt Collection Software

Customer Relationship Management (CRM) Systems

Microsoft Excel

Payment Processing Systems

Accounting Software (e.g., QuickBooks)

Data Entry Tools

Communication Tools (e.g., VoIP, Email)

Credit Reporting Systems

Database Management

Legal Compliance Knowledge

Communication Skills

Negotiation Skills

Problem-Solving Skills

Empathy

Time Management

Attention to Detail

Resilience

Interpersonal Skills

Conflict Resolution

Adaptability

Next, you will find information on the top technologies for collector professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Collector’s resume:

- Fund accounting software

- Intuit QuickBooks

- Microsoft PowerPoint

- Email software

- Microsoft Outlook

PRO TIP

Always remember that your collector certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

The collector resume sections you may underestimate: certifications and education

Your education and certifications provide insight into both your technical capabilities and personal attributes, such as perseverance. When crafting your collector resume, consider how you present these elements:

- For your higher education degrees, prioritize listing those most relevant to the job or indicative of your academic dedication;

- Include applicable coursework as a stand-in for relevant experience or if it might impress recruiters;

- Include incomplete higher education only if it's pertinent to meeting job requirements;

- If your degree is from a renowned university, mention how often you made the Dean's list to underline academic excellence.

Regarding certifications, it's not necessary to list all of them. Instead, match up to three of your most recent or significant certificates with the technical skills required in the job description.

Below, we've selected some of the top industry certifications that could be vital additions to your collector resume.

The top 5 certifications for your collector resume:

- Certified Receivables Compliance Professional (CRCP) - Receivables Management Association International (RMAI)

- Professional Collection Specialist (PCS) - ACA International (The Association of Credit and Collection Professionals)

- Fair Debt Collection Practices Act Certification (FDCPA Certification) - ACA International (The Association of Credit and Collection Professionals)

- Certified Collection Professional (CCP) - International Association of Commercial collectors (IACC)

- Credit and Collection Compliance Officer (CCCO) - ACA International (The Association of Credit and Collection Professionals)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for collector professionals.

Top US associations for a Collector professional

- AICPA and CIMA

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Recommended reads:

Practical guide to your collector resume summary or objective

First off, should you include a summary or objective on your collector resume?

We definitely recommend you choose the:

- Resume summary to match job requirements with most noteworthy accomplishments.

- Resume objective as a snapshot of career dreams

Both the resume summary and objective should set expectations for recruiters as to what your career highlights are.

These introductory paragraphs (that are no more than five sentences long) should help you answer why you're the best candidate for the job.

Industry-wide best practices pinpoint that the collector resume summaries and objectives follow the structures of these samples:

Resume summaries for a collector job

- With over 10 years of dedicated experience amassing and managing notable art collections, my expertise encompasses strategic acquisition, meticulous documentation, and preservation. My career pinnacle includes curating an internationally acclaimed exhibition that significantly elevated a mid-size gallery's profile in the global art scene.

- Seasoned collection manager with a 15-year track record in the numismatic domain, recognized for advancing the cataloging and digital archiving systems at the National Coin Treasury. My detailed organizational skills have contributed to enhancing the authenticity verification process, ensuring the Treasury's impressive 99.8% accuracy rate.

- Transitioning from a successful 12-year career in archives management, I bring a wealth of knowledge in cataloging, preservation, and digital conversion techniques. At the forefront of digitizing a state library's rare manuscripts collection, my skills are now pivoting towards excelling in contemporary art collection management.

- As a former database analyst with 8 years of experience optimizing data retrieval systems, my transferable skills are primed to innovate inventory tracking and client engagement within the art collections field. Securing the Most Innovative Tech Solution Award for a large-scale company exemplifies my ability to enhance operational efficiency.

- Eager to embark on a career as a collector, I am committed to learning the intricacies of art acquisition and conservation. My objective is to blend my fresh enthusiasm with hands-on learning, aiming to contribute significantly to preserving cultural heritage and supporting community-oriented art collections.

- With a newly kindled passion for historic artifacts and keen research abilities honed during my Bachelor's degree in History, my goal is to immerse myself in collection management. I am determined to excel in this field by leveraging my robust analytical skills and academic background to contribute to the curation of engaging exhibits.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for collector professionals

Local salary info for Collector.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $58,530 |

| California (CA) | $70,280 |

| Texas (TX) | $51,670 |

| Florida (FL) | $36,190 |

| New York (NY) | $68,600 |

| Pennsylvania (PA) | $53,100 |

| Illinois (IL) | $75,570 |

| Ohio (OH) | $68,700 |

| Georgia (GA) | $54,230 |

| North Carolina (NC) | $59,510 |

| Michigan (MI) | $60,690 |

Additional valuable collector resume sections to stand out

When assessing candidate applications, recruiters are often on the lookout for elements that go beyond meeting standard requirements and technical expertise.

This is where extra sections could play a key role in showcasing your unique skill set and personality.

Make sure to include sections dedicated to:

- How you spend your free time, outside of work. The interests resume section also goes to show your personality and transferrable skills; and may also serve to fill in gaps in your experience;

- Most innovative work. The projects resume section brings focus to what you're most proud of within the field;

- How you're able to overcome language barriers. The language resume section is always nice to have, especially if communication would be a big part of your future role;

- Industry-wide recognitions. Remember that the awards resume section should highlight your most noteworthy accolades and prizes.

Key takeaways

- All aspects of your resume should be selected to support your bid for being the perfect candidate for the role;

- Be intentional about listing your skill set to be balanced with both technical and people capabilities, while aligning with the job;

- Include any experience items that are relevant to the role and ensure you feature the outcomes of your responsibilities;

- Use the summary or objective as a screenshot of your best experience highlights;

- Curate various resume sections to showcase personal, transferable skills.

Collector resume examples

By Experience

By Role