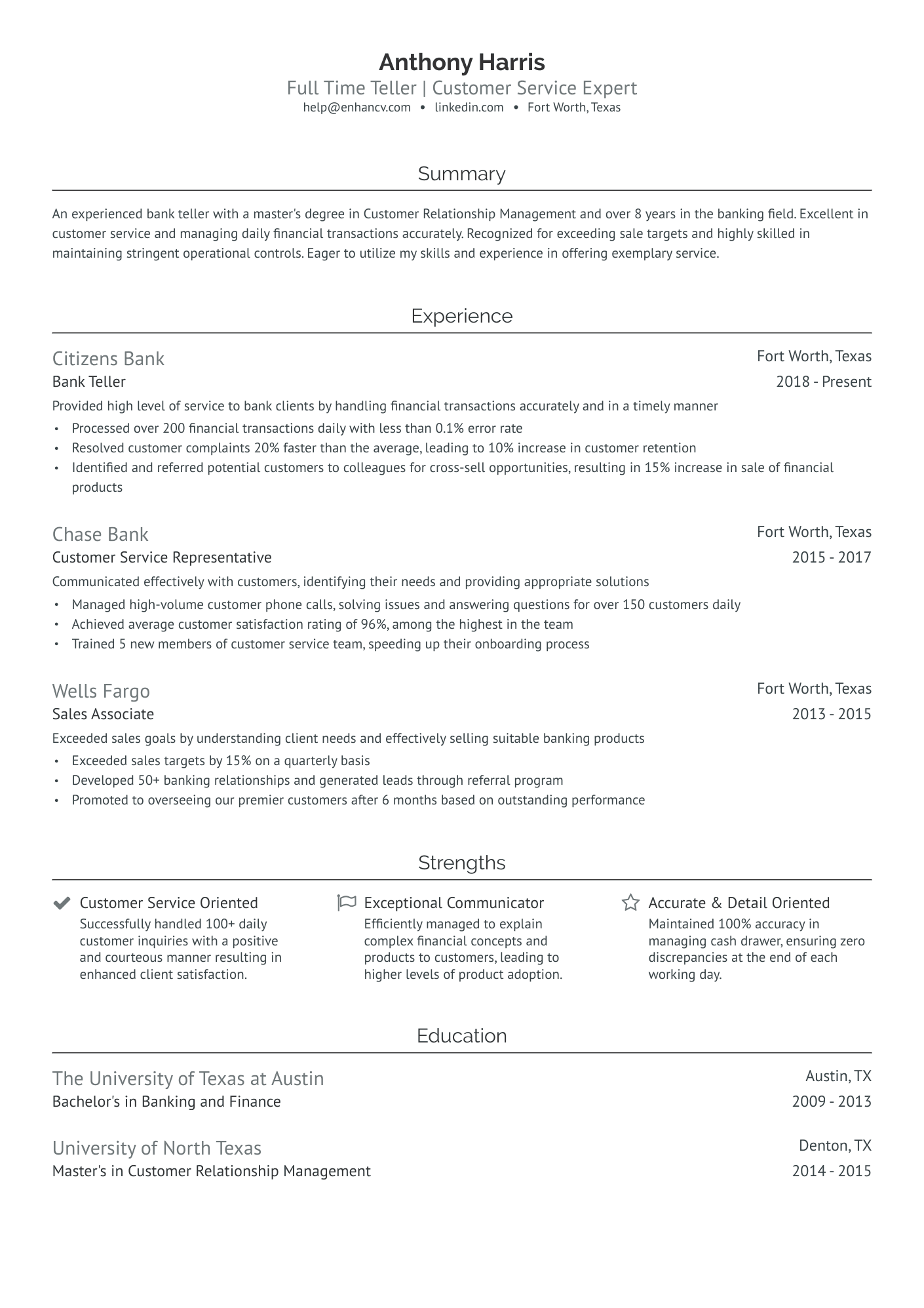

Crafting a compelling resume as a bank teller can be challenging. After all, you handle sensitive information. The goal’s to show your skills and experiences without breaching confidentiality. Bank tellers often engage in delicate financial discussions and resolve complex issues. These must be conveyed effectively on a resume while respecting privacy protocols.

Banktelling is expected to witness about 29,000 openings each year. This competitive job market means your resume needs to stand out. Our guide provides real-life examples and insightful strategies to help you write each section. Learn how to describe your experience, list your skills effectively, and maintain discretion. This will ensure your resume highlights your value while protecting sensitive information.

You’ll also learn how to:

- Format your resume to reflect your seriousness and professionalism;

- Tailor your experience section to fit a real job description for a bank teller;

- Describe your education and certifications;

- Include an incomplete degree on your resume;

- List your abilities, so that they reflect your technical knowledge and your people skills;

- Craft a well-written bank teller summary;

- Show proactivity and dedication with original additional sections.

Check out these related guides as well:

- Banking resume example

- Loan officer resume example

- Loan processor resume example

- Phone banking resume example

- Credit analyst resume example

- Personal banker resume example

- Bank manager resume example

- Call center representative resume example

- Entry-level customer service resume example

How to format a bank teller resume

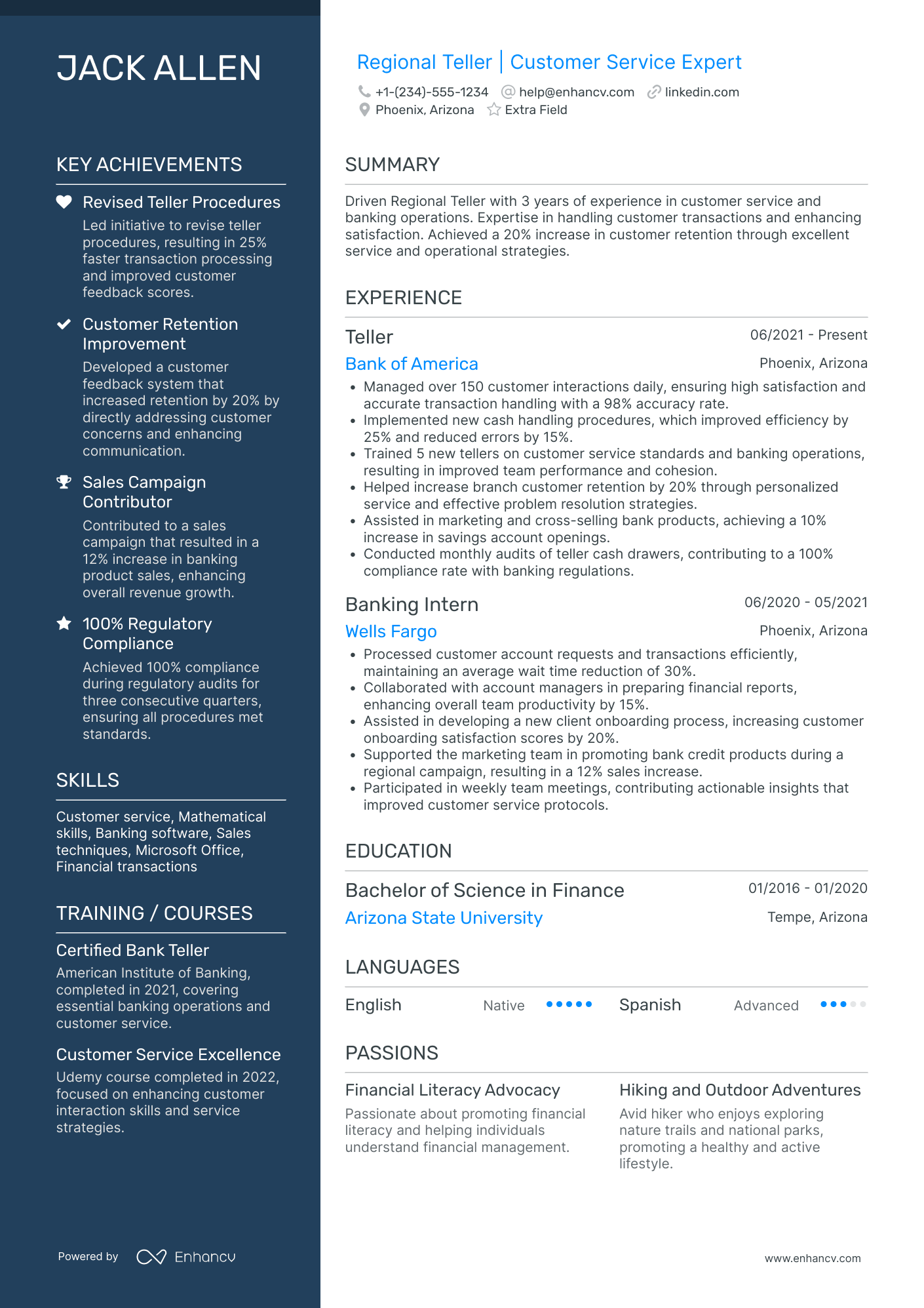

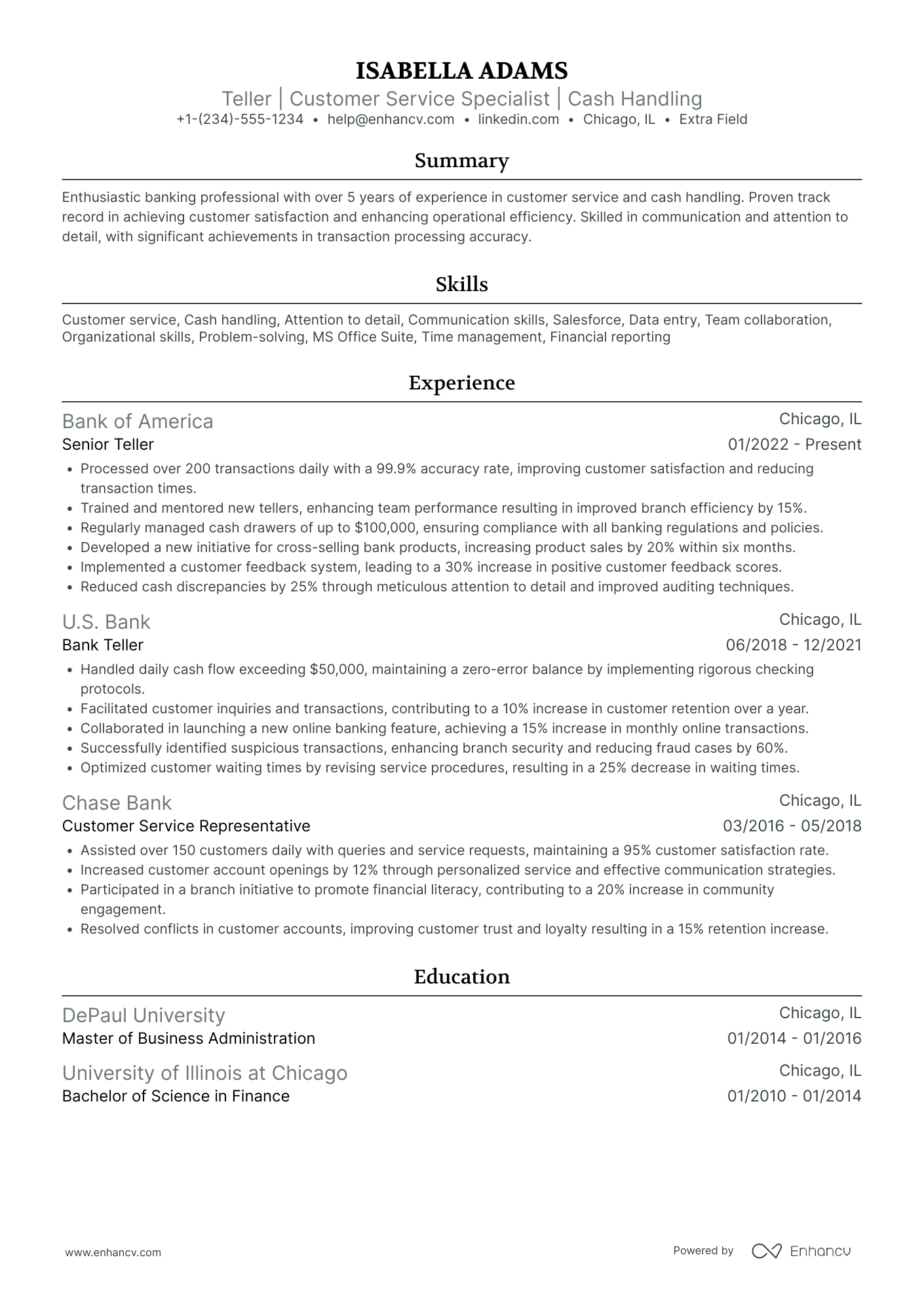

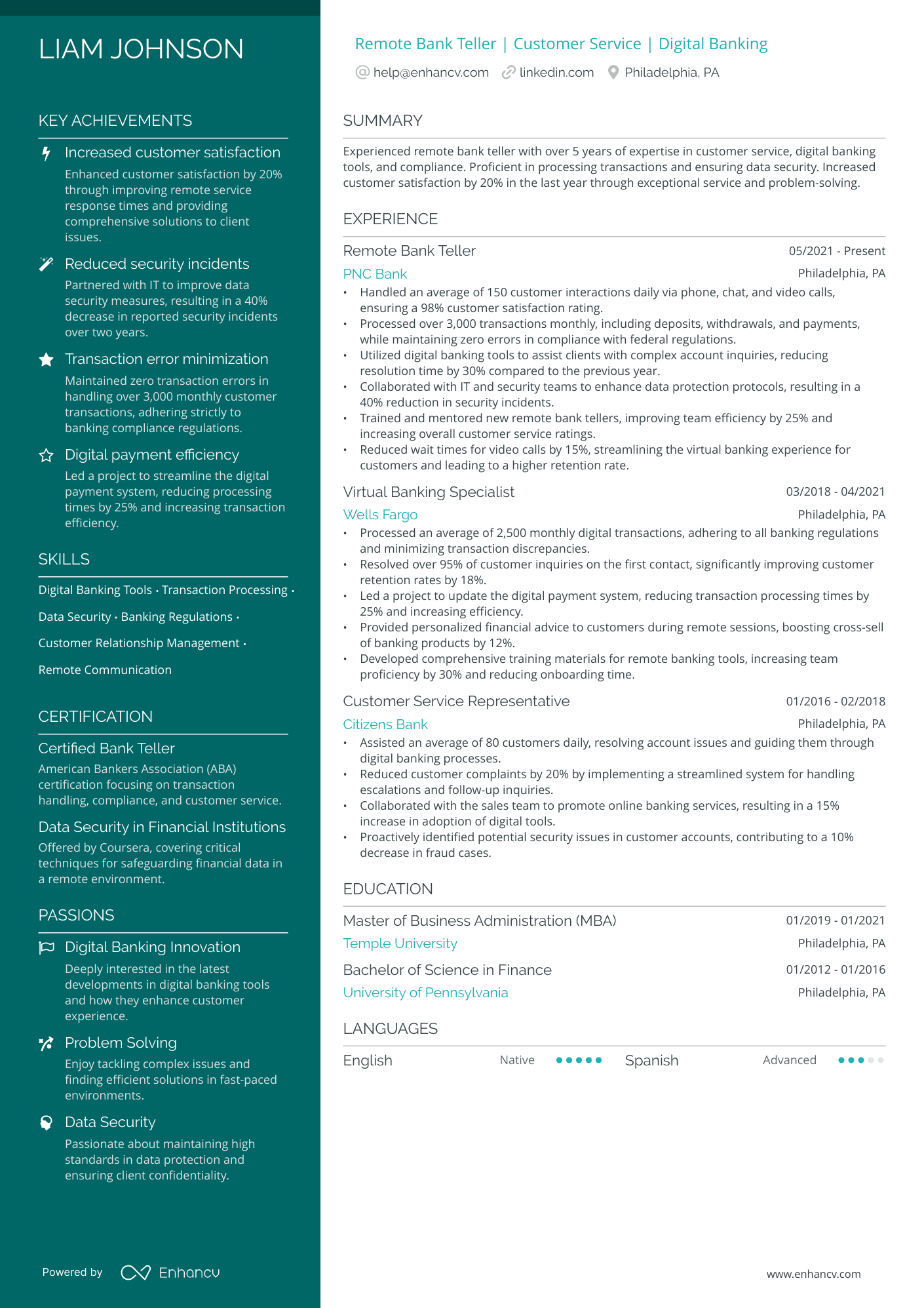

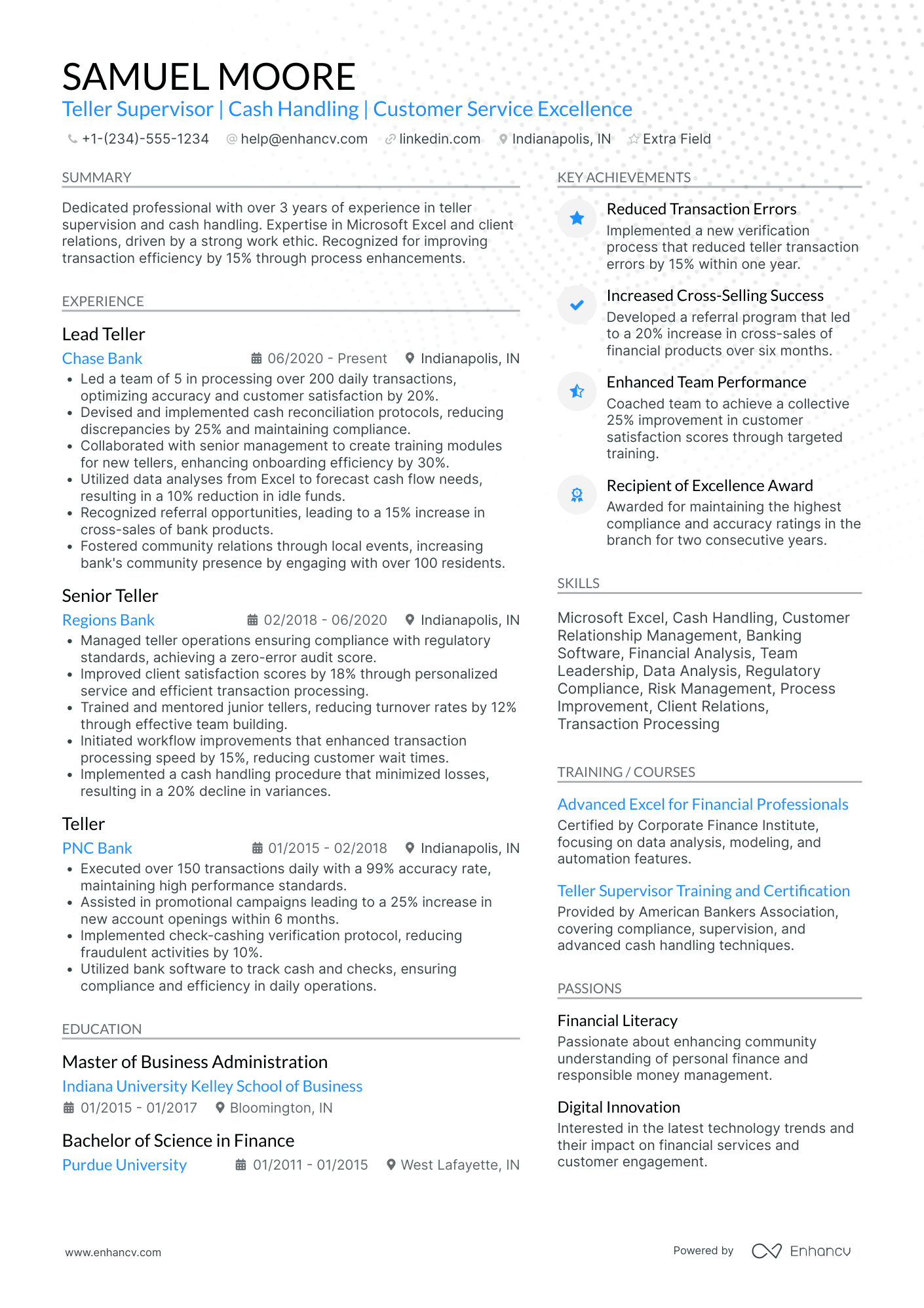

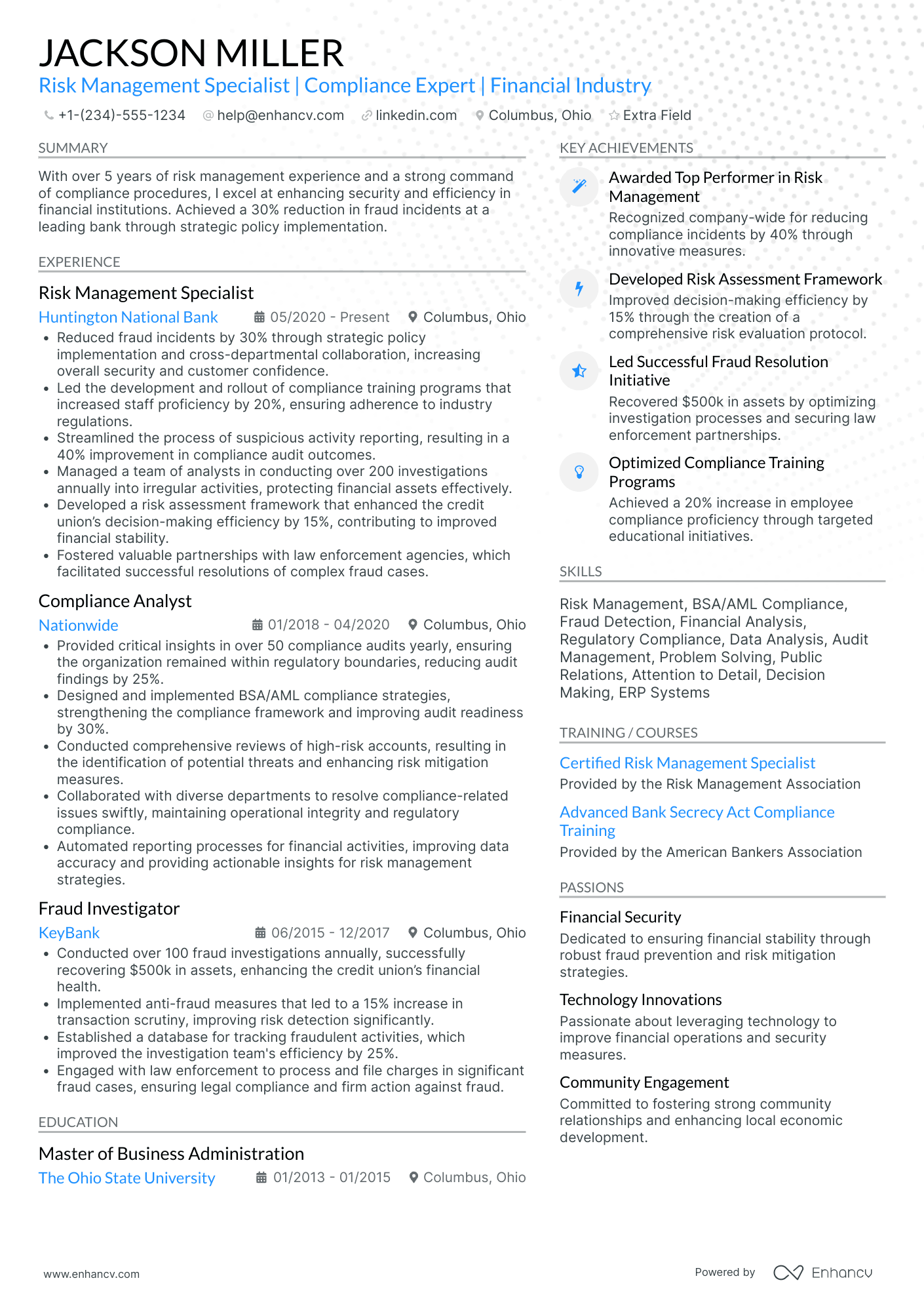

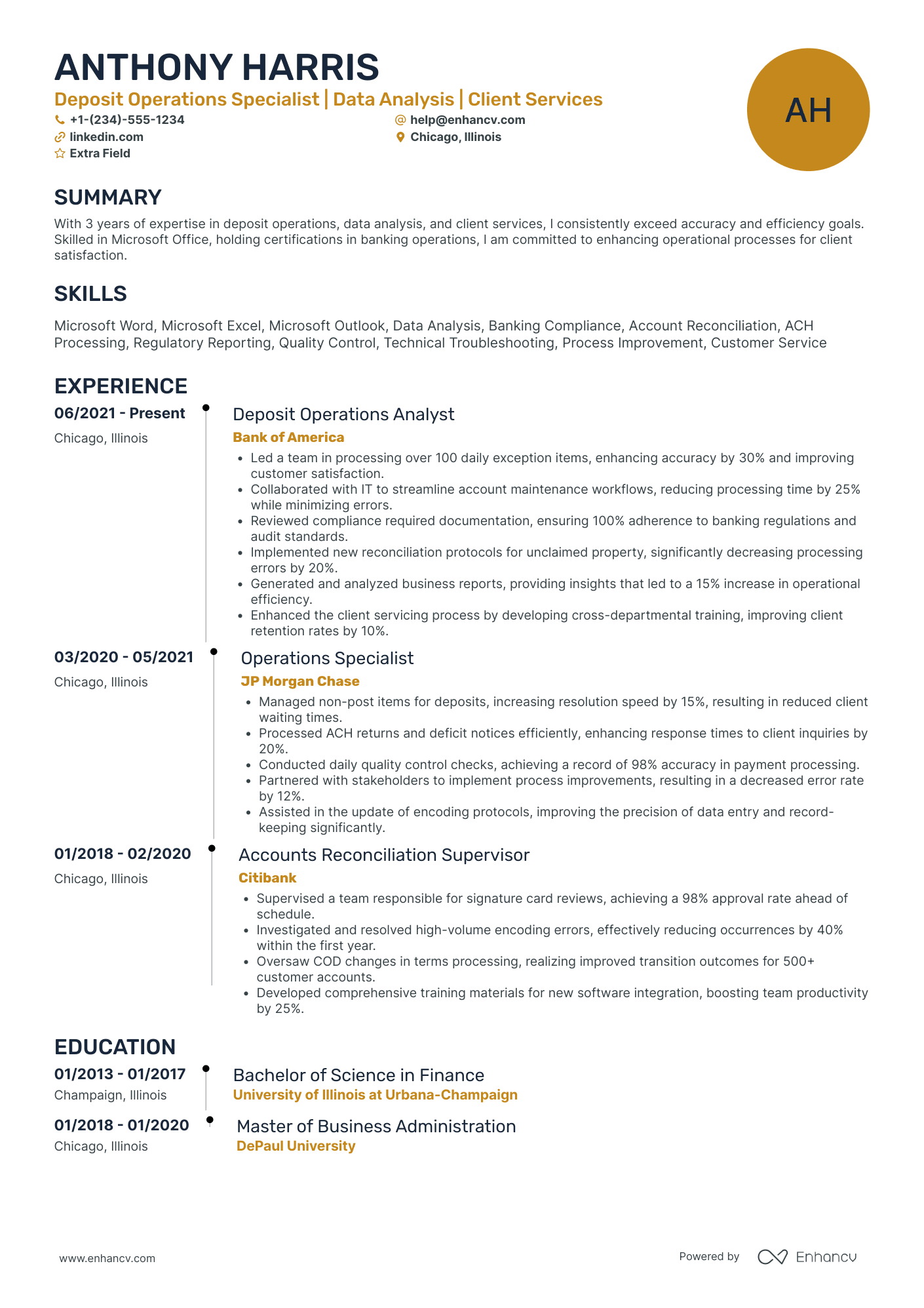

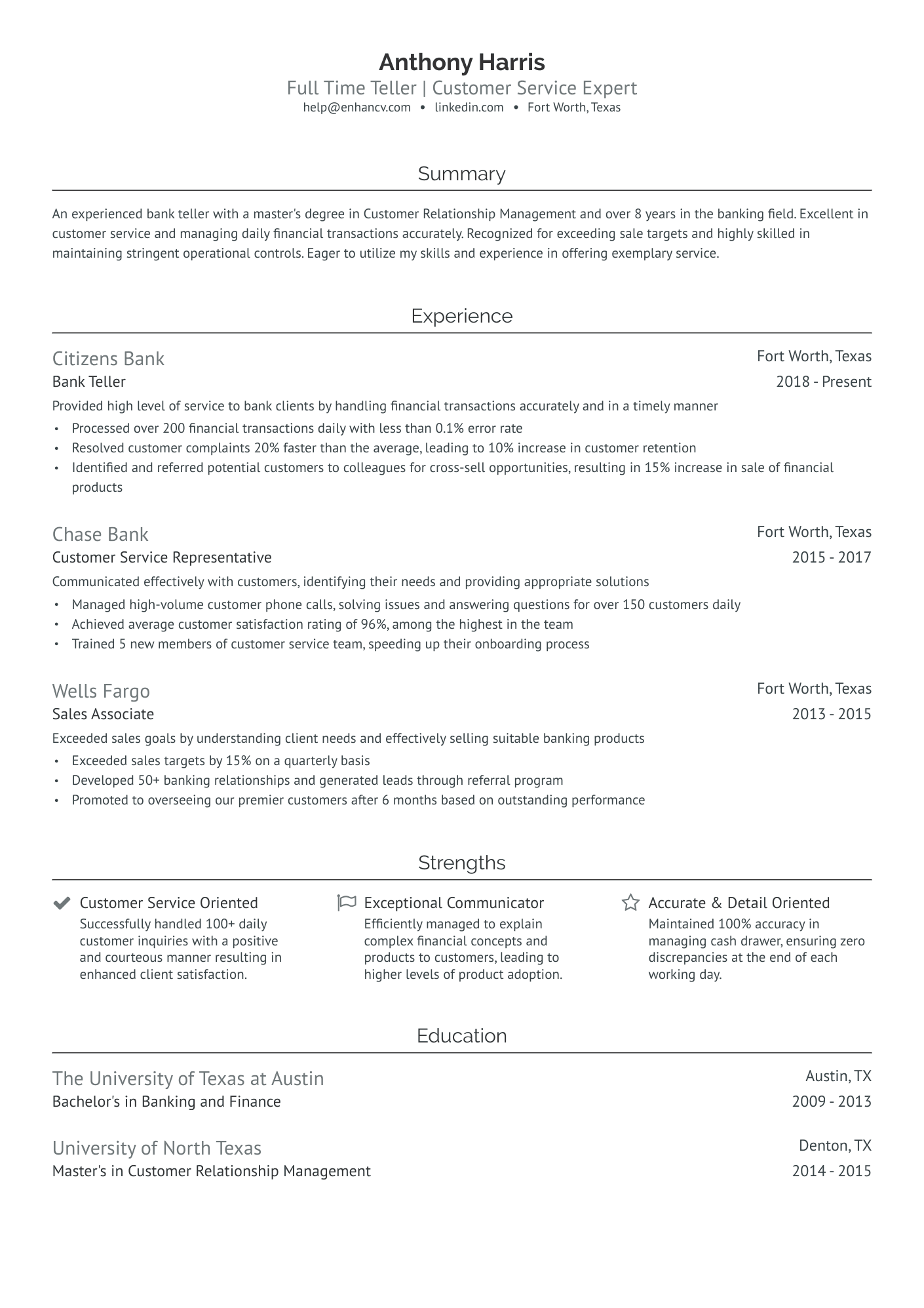

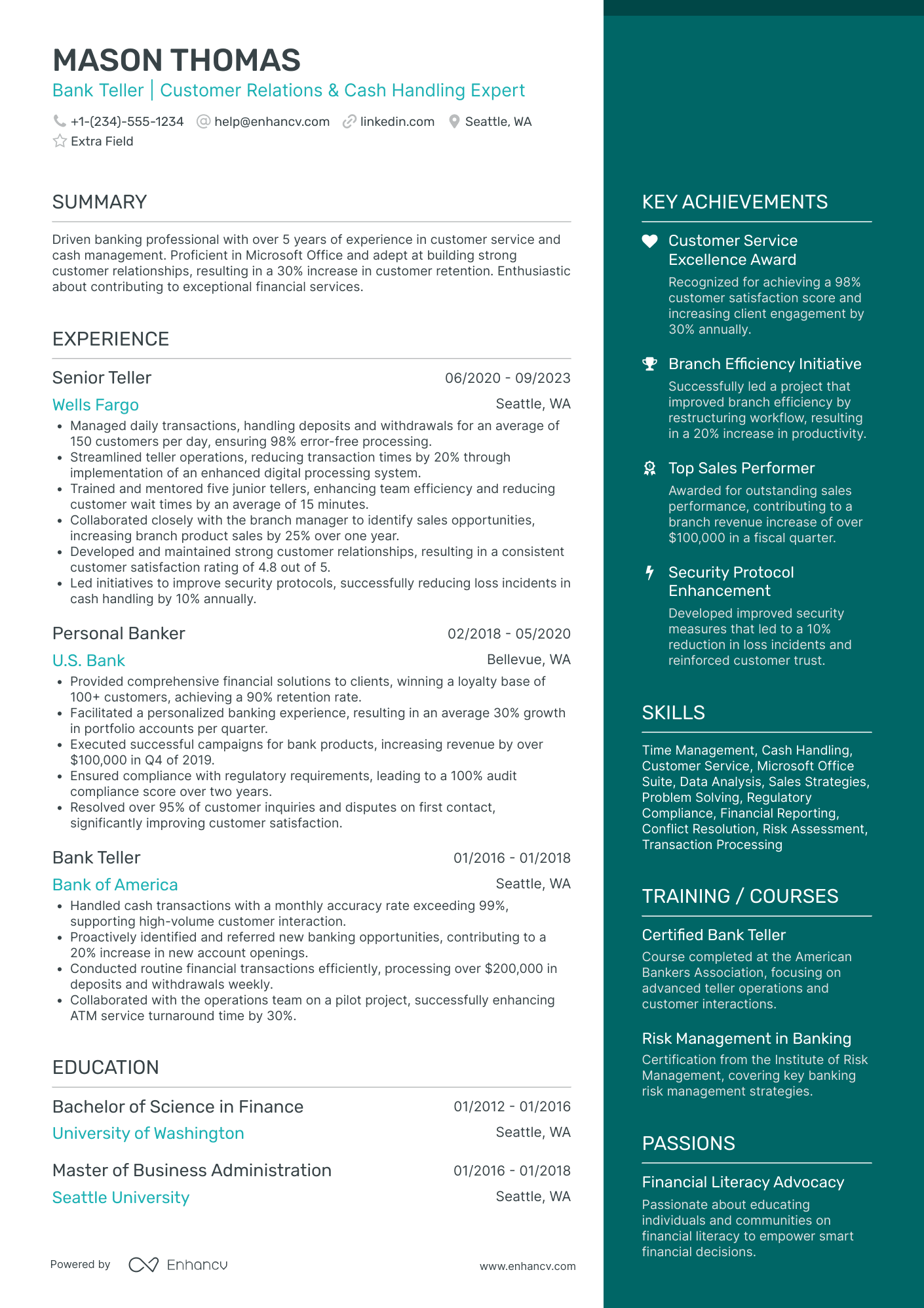

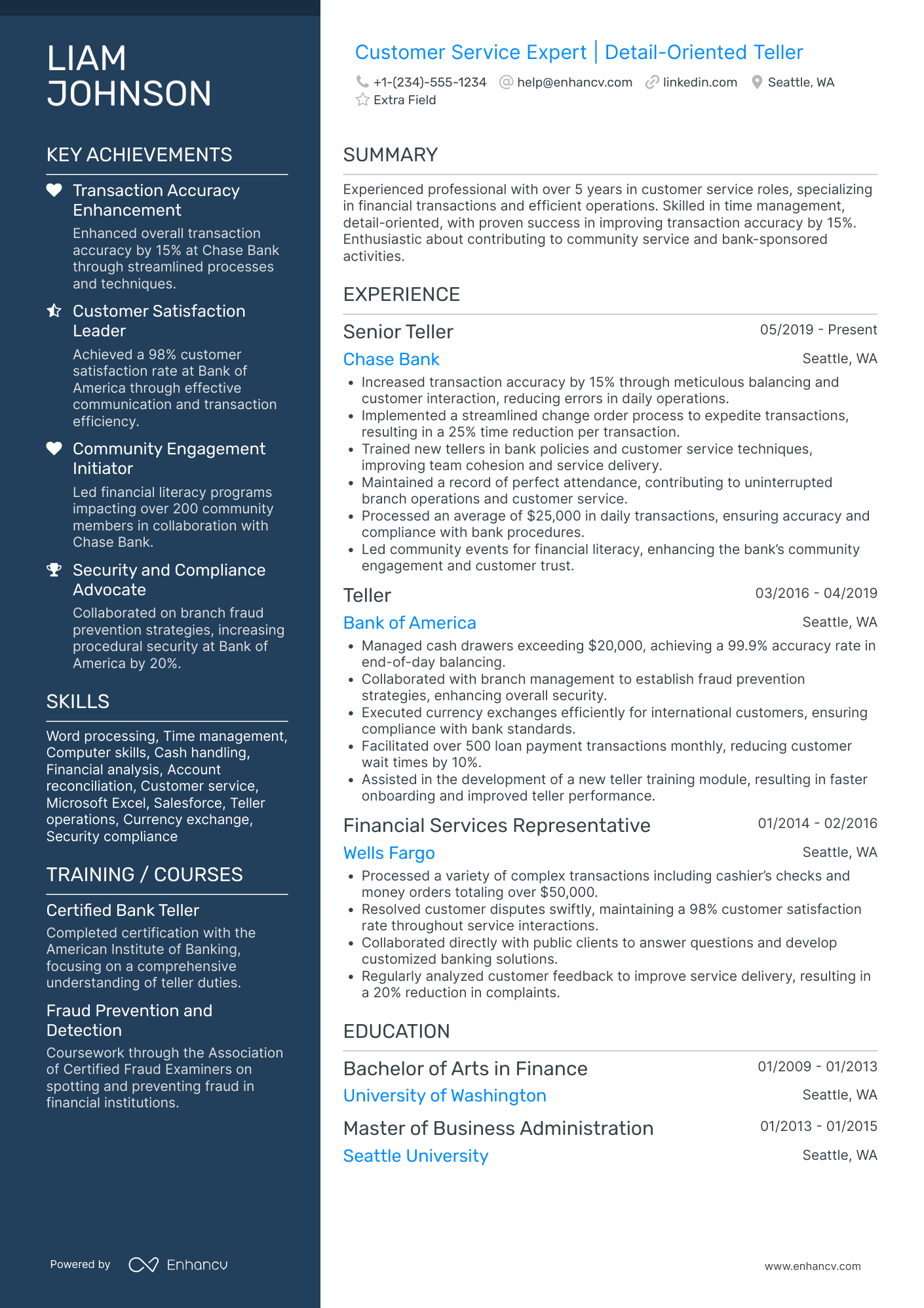

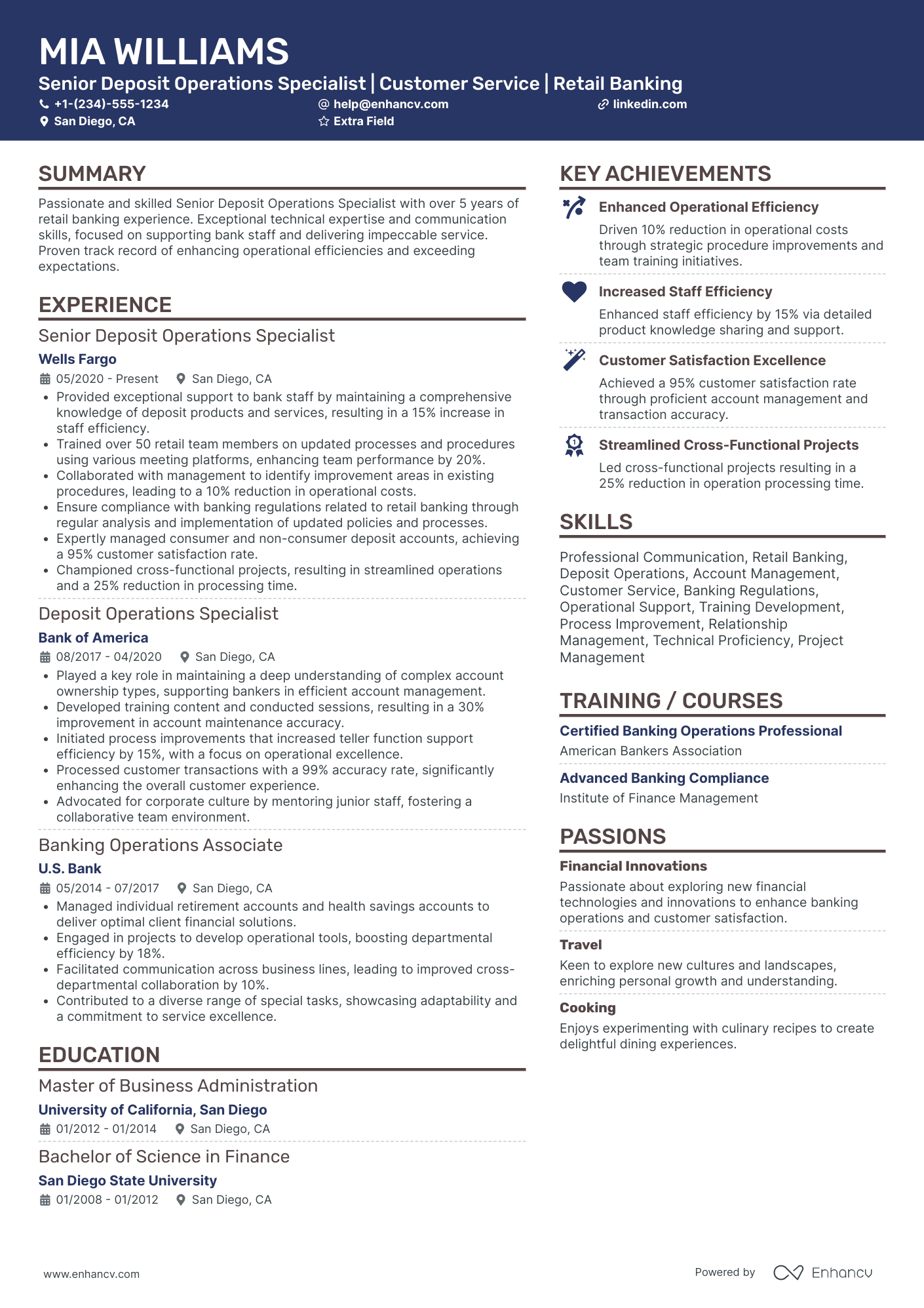

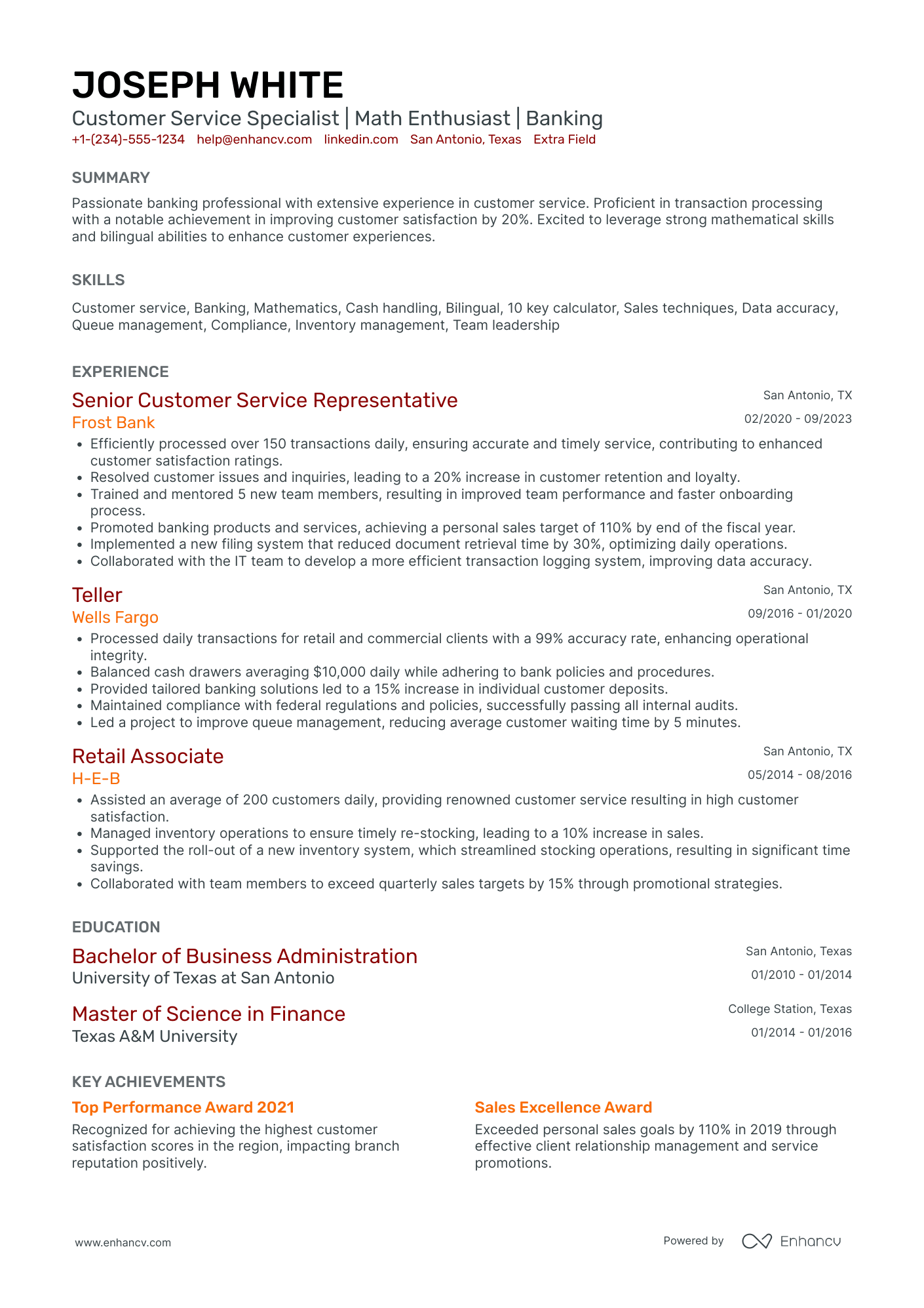

The first step in crafting a fascinating bank teller resume is choosing the right layout. Make your resume easy to read, scan, and remember. Choose between the three main resume formats: reverse chronological, functional, and hybrid. Your choice will depend on your goals and needs.

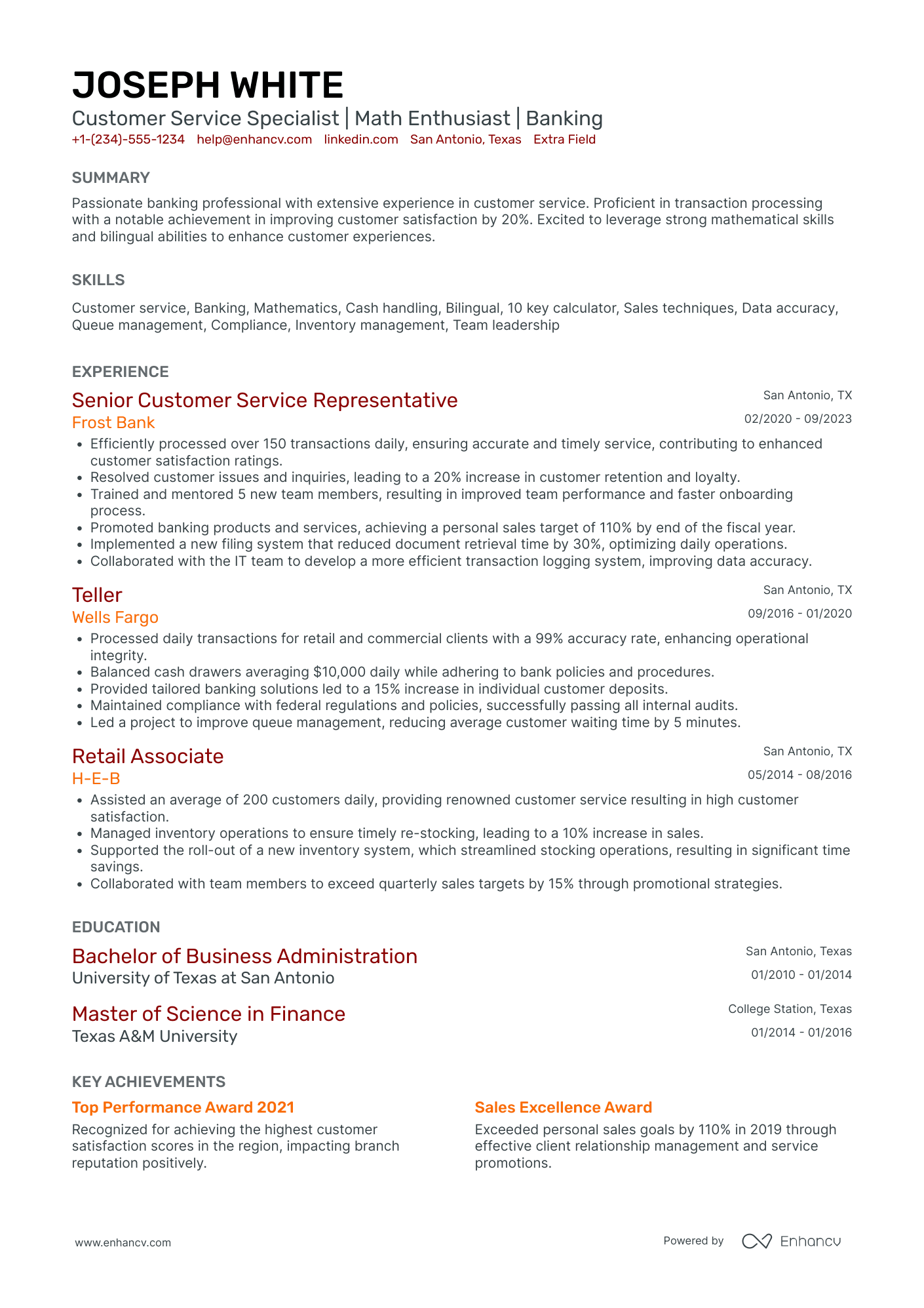

- For those who already have some bank teller experience, a reverse chronological resume is a neat way to present it. It lists your experience in reverse chronological order, starting with the most recent. This ensures a clear outline of your career path.

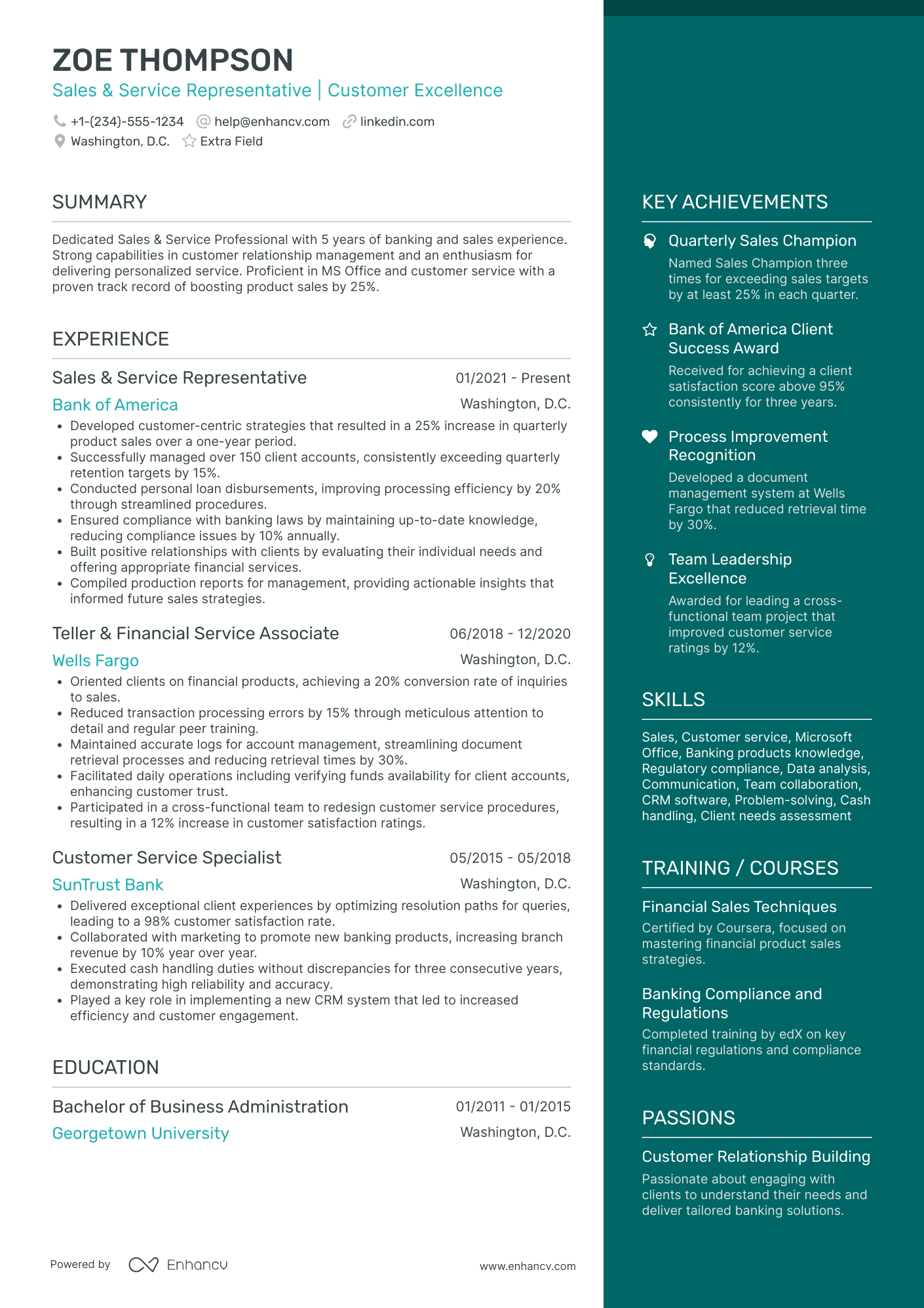

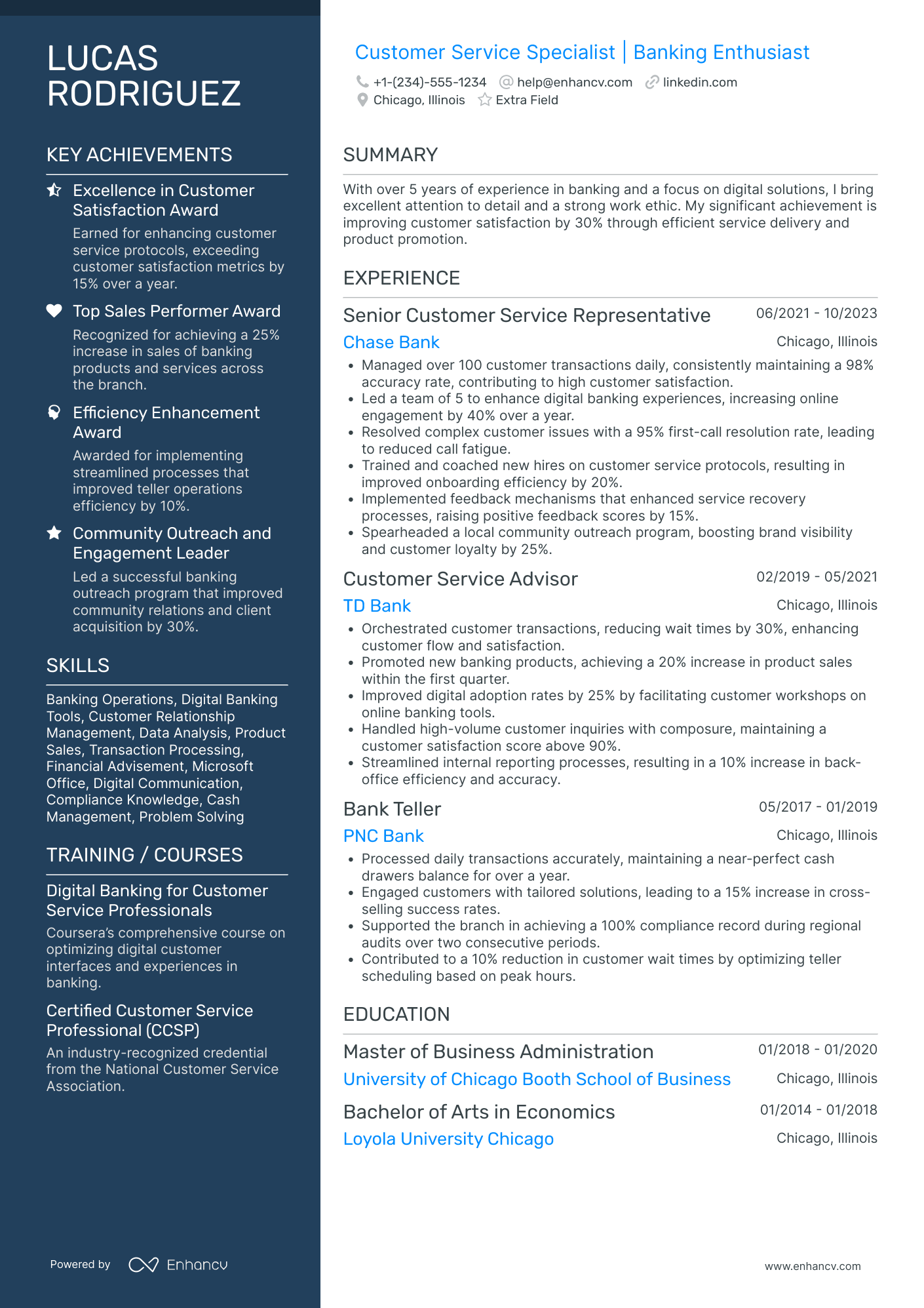

- A functional resume emphasizes your skills and abilities rather than your experience. That’s why it’s perfect for entry-level positions or those who are switching careers.

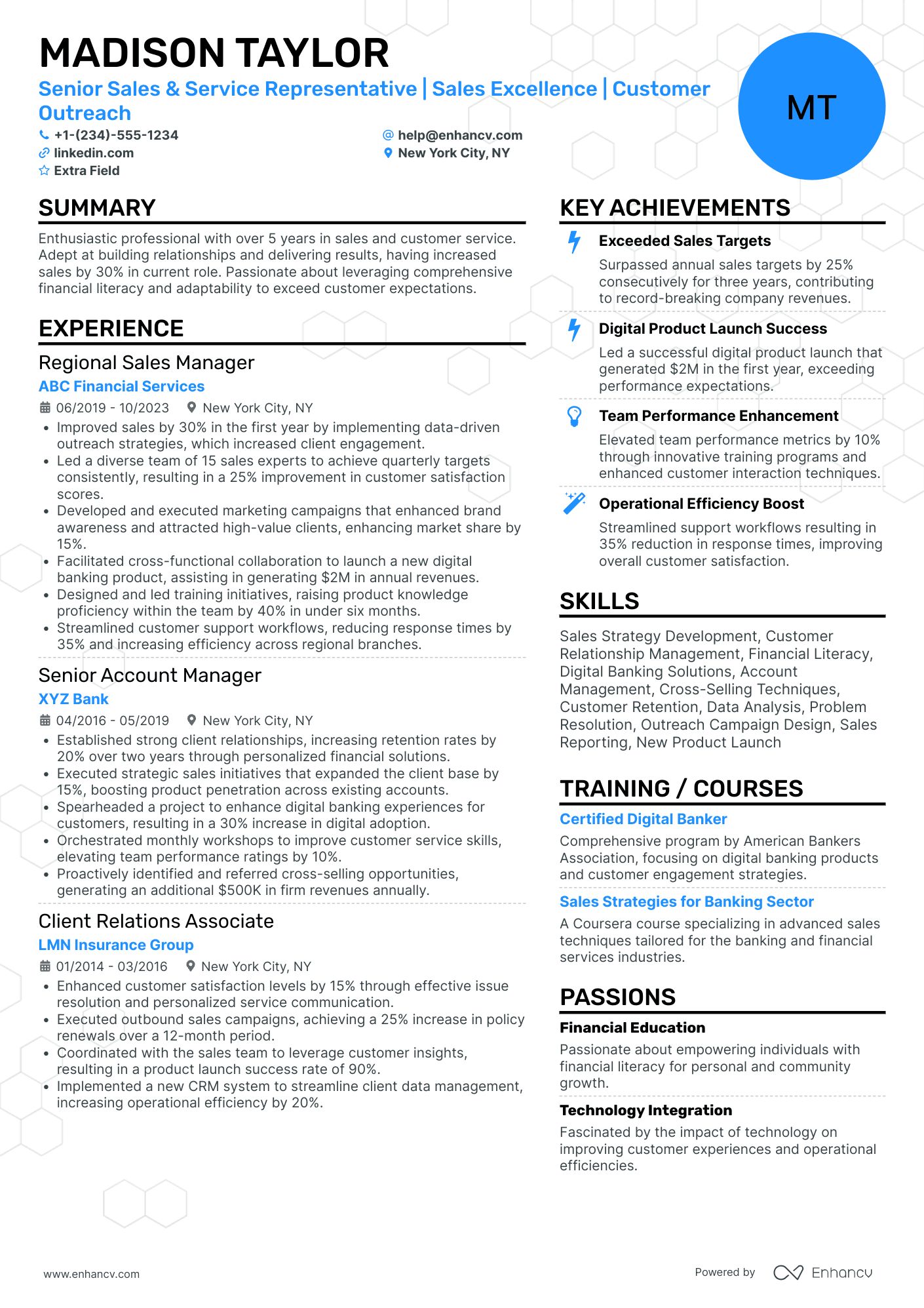

- And finally, there’s the hybrid resume. Also called the combination resume, this layout puts equal focus on your experience and skills. If you believe yours are equally strong, opt for this resume format.

Be sure to follow these resume writing guidelines for a stand-out application:

- Design, colors, fonts: Both 1 and 2-column designs work with ATS (Applicant Tracking Systems), so it’s a matter of preference. A little color on your resume can go a long way. Choose blue, dark green, or gray to stay professional in the banking field. Avoid using too many color variations, though. And as for fonts, go with modern sans-serifs such as Rubik, Lato, or Arial. Your font size should be between 10–12 pt, with headings a little bit bigger.

- Resume length: Most professionals would need a 1-page resume to showcase their experience. However, if you’ve got a lot of it, you can opt for a 2-page resume. Make sure the most important information is placed on the first page, and keep the header on both pages.

- Header and photo: Feature your header at the top of your resume. It should include basic contact information such as full name, e-mail, and phone number. Including a photo and your physical address would depend on the specific job posting requirements.

- Resume format and naming: A PDF format is generally preferred as it keeps your chosen design in place. It’s also readable by ATS. As for naming conventions, use your name, the word “resume”, and the position you’re applying for. Don’t include special symbols, such as :, / or .

Think about the location of your application – Canadian resumes, for instance, might follow a different structure.

Worried about typos on your resume? Ensure yours is proof-ready with our free ATS resume checker.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

So what sections should you include on your resume?

The top sections on a bank teller resume:

- Contact information: This should be included so recruiters can easily reach out for interviews or further clarification.

- Personal summary: Recruiters look at this to quickly figure out if the candidate matches the general qualifications for the job.

- Job experience: Specifically related banking and customer service experiences will show how well-suited the candidate is for the bank teller position.

- Skills: Highlighting relevant skills for a bank teller resume, like cash handling and customer service, can make an applicant stand out amongst others.

- Education: Including educational credentials will give recruiters a full picture of the candidate's background and potential growth within the bank.

Recruiters look for several main components on a bank teller resume. Check them out:

What recruiters want to see on your resume:

- Cash handling experience: This is crucial because bank tellers perform numerous cash transactions daily and accuracy is key.

- Customer service skills: It's about interaction with customers, resolving their issues, and providing first-class service for customer retention.

- Attention to detail: Errors can be costly in banking, so the ability to work with precision is highly valued.

- Numeracy skills: Proficiency in working with numbers is an integral part of the job, so high numeracy skills are a priority.

- Knowledge about banking procedures: Recruiters seek candidates who are familiar with banking processes to lessen training efforts and improve productivity.

Now you know what you need on your resume. Let’s break down the most important section: your experience.

How to write your bank teller resume experience

Think of your experience section as a magnet for recruiters. If you write it well, it’ll attract attention. Include relevant job titles–ideally, all related to banking and finance. That is one way to tailor your resume to the job posting. Your resume should be straightforward and concise, so don’t waste valuable space on experiences you can’t relate to the job you’re applying to. When creating your experience section, remember:

- Each entry should include 4—6 bullets detailing your work expertise.

- Focus on key achievements in your career.

- Start your sentences with action verbs to build a powerful narrative.

Make sure you never lie about career results on your resume. Maintaining trust with potential employers from the start is the right way to go.

Let’s explore a real bank teller job description:

Job title: Bank Teller

Company introduction: Founded in 1904, ABC Bank serves businesses and individuals from our 30 offices located throughout the US. Our team takes pride in providing an unparalleled level of customer service and attention.

Job description: The position of bank teller is responsible for performing routine branch and customer service duties; accepting consumer and commercial checking and savings deposits; processing loan payments; cashing checks and processing withdrawals; promoting business for the Bank by maintaining good customer relations and referring customers to appropriate staff for new services. In addition, the bank teller should follow all compliance regulations as applicable and adhere to discretion in handling sensitive information, ensuring confidentiality and security when dealing with financial data.

Responsibilities:

- Receives consumer and commercial checking and savings deposits by determining that all necessary deposit documents are in proper form, and issuing receipts.

- Cashes checks, processes withdrawals and redeem U.S. Savings Bonds; confirms all necessary documents are properly authorized, are in proper form, and are within authorized limits; processes currency and coin orders; requests assistance when questionable items are presented for cashing.

- Issues official checks, counter checks, etc.

- Assists with night depository duties; logs bags; processes deposits; makes change orders; issues receipts and returns bags to customers.

- Cross-sells the Bank’s other products and services, referring customers to appropriate staff as indicated.

- Provides effective customer service and assists in resolving problems within given authority.

- Records, files, scans documents, and sorts mail as required.

- Answers telephones and directs callers to proper Bank personnel by properly identifying customers and specific requests.

- Types routine letters, reports, and forms. Performs basic account maintenance and requests.

- Treats others with respect; adheres to Bank’s policies and procedures; inspires the trust of others; works ethically and with integrity.

- Positive customer and coworker interactions; shows respect and sensitivity for cultural differences; acknowledges the value of diversity in a work environment; promotes working environment free of harassment of any type.

- Assures compliance with all Bank policies, procedures, and processes, and all applicable state and federal banking laws, rules, and regulations; adheres to Bank Secrecy Act (BSA) responsibilities that are specific to the position.

- Maintains discretion in handling sensitive information, ensuring confidentiality and security when dealing with financial data.

- Performs the position safely, without endangering the health or safety of themselves or others and will be expected to report potentially unsafe conditions.

Location: Bishopville, SC

And now, here are two bank teller experience examples—a bad one, and a good one, tailored to that exact job posting.

Starting with the bad:

- •Helped with general administrative tasks around the branch.

- •Answered phones and directed calls to appropriate staff.

- •Participated in staff meetings and team-building activities.

This one doesn’t work because it’s:

- Lack of specificity: The responsibilities listed (e.g., "helped with general administrative tasks") are too vague and do not demonstrate any specialized skills or knowledge relevant to the bank teller position, such as handling financial transactions or customer service.

- Irrelevant duties: Tasks such as "participated in staff meetings and team-building activities" do not directly relate to the core duties of a bank teller, which are more focused on financial transactions, customer interactions, and confidentiality.

- Absence of compliance and confidentiality: There is no mention of adhering to compliance regulations or handling sensitive information, which are critical aspects of working as a bank teller. This omission suggests a lack of experience in crucial areas for the role.

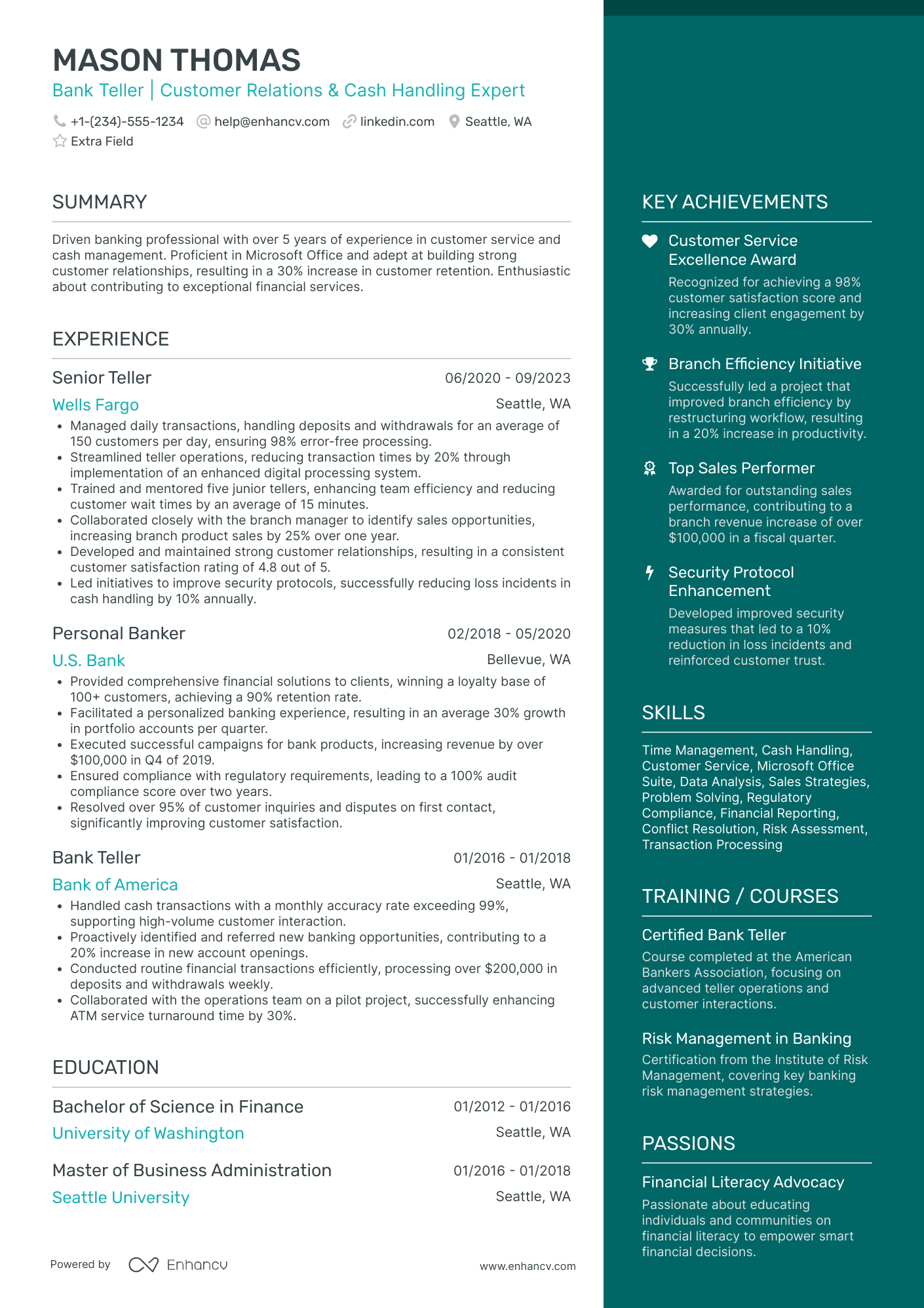

And here’s a bank teller experience section that’ll win recruiters over:

- •Accurately processed deposits, withdrawals, and check cashing transactions, ensuring compliance with all regulations.

- •Maintained confidentiality and security of sensitive financial information, adhering to bank policies and procedures.

- •Successfully promoted and cross-sold bank products and services, enhancing customer engagement and satisfaction.

Here’s why it’s better:

- Accurate transaction processing: The first bullet point highlights the candidate's ability to perform key teller duties with precision and adherence to regulations, demonstrating reliability and attention to detail.

- Confidentiality and security: "Maintained confidentiality and security of sensitive financial information, adhering to bank policies and procedures" shows that the candidate understands the importance of discretion and can be trusted with sensitive information, which is vital for a teller role.

- Customer engagement: "Successfully promoted and cross-sold bank products and services, enhancing customer engagement and satisfaction" indicates the candidate's proactive approach in contributing to the bank's business growth and providing excellent customer service, both important for a teller's success.

One way to really stand out with your experience is to fill it with quantifiable impact.

How to quantify impact on your resume

We don’t need to tell you numbers speak for themselves. Specific numbers to illustrate your accomplishments will keep potential employers engaged. Measurable outcomes impress easily and are much nicer to look at than mundane job responsibilities. Here are some examples of how to quantify key achievements on your resume:

- Highlight the cash amounts you've handled daily or monthly: This demonstrates your trustworthiness and ability to manage large sums. Both are integral skills for a bank teller resume.

- Include the number of transactions processed each day: It reflects your speed and efficiency. These are crucial in providing timely banking services to customers.

- Note any improvement in transaction speed or transaction error reduction: This could impress recruiters. It signifies your focus on improving the quality of your performance.

- Mention if you've contributed to reducing customer wait times: This directly impacts customer satisfaction, a key measure of success in any client-facing role.

- Mention if you've played a role in accomplishing audit scores: High audit scores highlight your precision and adherence to the bank's policies and procedures.

- Outline if you've contributed to meeting or exceeding sales targets for banking products: This could signify that you're not just a transactional employee but also proactive in contributing to the bank's revenue.

- Include instances where you accurately identified fraudulent transactions: This signifies your vigilance and understanding of banking safeguards. It means you strive to provide a secure environment for customers.

- If you've trained new employees, mention the number of employees trained: This underlines your ability to share knowledge and contribute to team growth. Which can be an asset in a collaborative work environment like a bank.

But what if you’re just starting out? We’ll give you some tips on how to write your resume if you don’t have much experience.

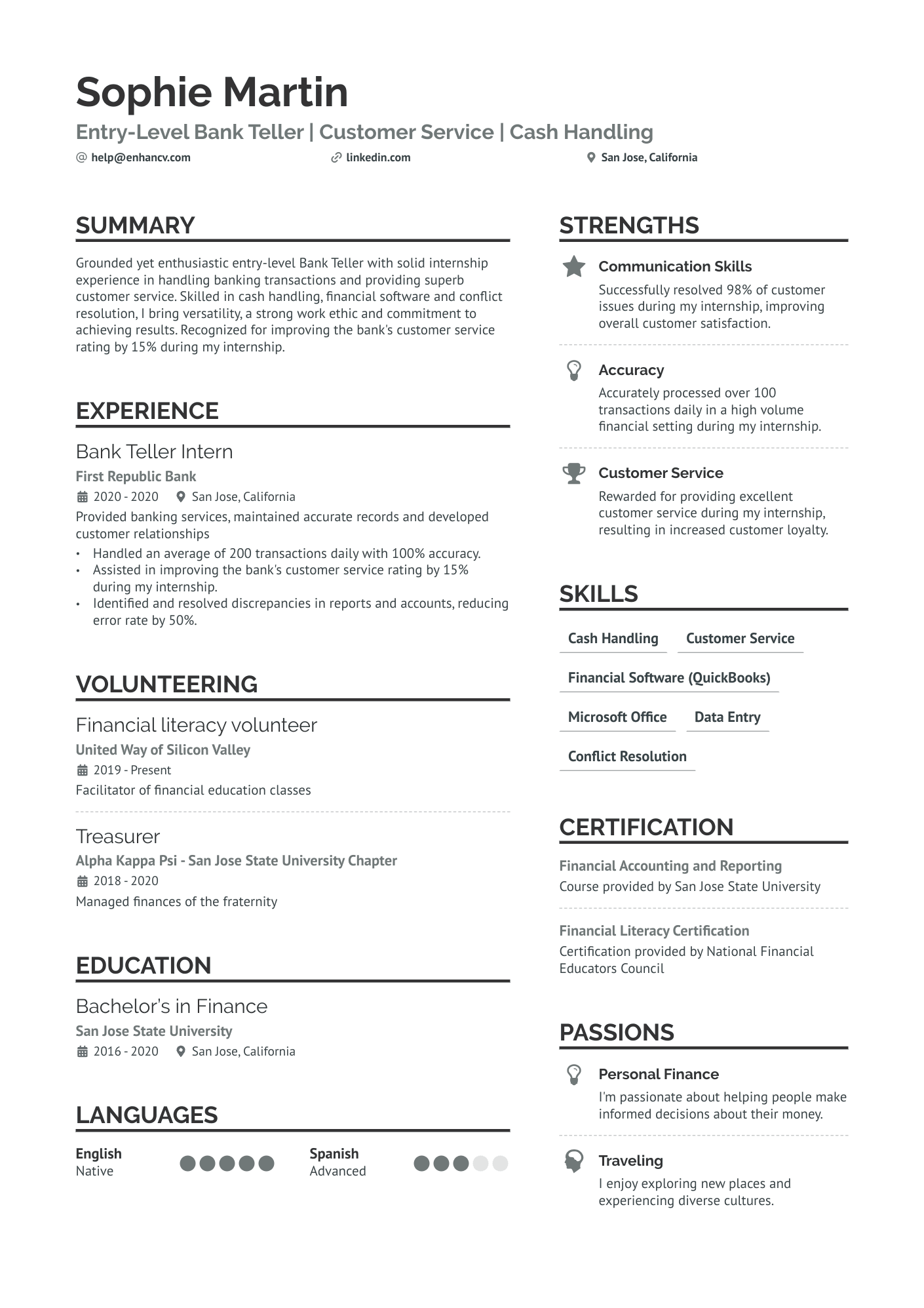

How do I write a bank teller resume with no experience

Worried about having little or no experience in bank telling? Don’t be. Everybody’s got to start somewhere, and we’ll give you some practical tips on how to do just that.

It’s always important to evaluate what transferable skills and experience you have. Maybe you’ve worked in retail or customer service? Or you’re good with numbers and you took Economics in college? Think about what you can list on your resume that’ll relate to the job you’re applying for.

Rather than leaving your entry-level resume sparse, try to include some of these sections:

- Education: Mention any coursework that involves finance, economics, mathematics, or business administration. These courses demonstrate your understanding of financial principles and your ability to work with numbers, which are crucial for a bank teller role.

- Extracurricular activities: Highlight your involvement in any clubs or organizations, especially related to finance, business, or community service.

- Volunteer work: Volunteering experiences, especially those involving customer interaction, cash handling, or organizational tasks, can be very relevant.

- Projects: Detail any projects where you handled financial transactions, conducted data analysis, or managed budgets. You can mention a project where you helped organize a fundraising event, managed its budget, or used financial software to track expenditures and revenue.

- Internships: Whether they’re paid or unpaid, internships offer crucial hands-on experience that’s always appreciated in your future endeavors. Describe what you have learned and how you think this contributes to your fit for the role.

- Hobbies and interests: Underscore any hobbies or interests that prove your aptitude for finance, numbers, or customer service. This could include things like managing a personal budget, reading financial news, or any activities that require precision and accuracy.

All in all, transferable experience is your go-to when applying for an entry-level bank teller position. Don’t forget to include your transferable skills, too. These are usually soft skills such as teamwork and time management. Alter them to the job description in your bank teller resume. Pick the best applicable ones and try to demonstrate them through examples on your resume.

Let’s explore more valuable skills in our next section.

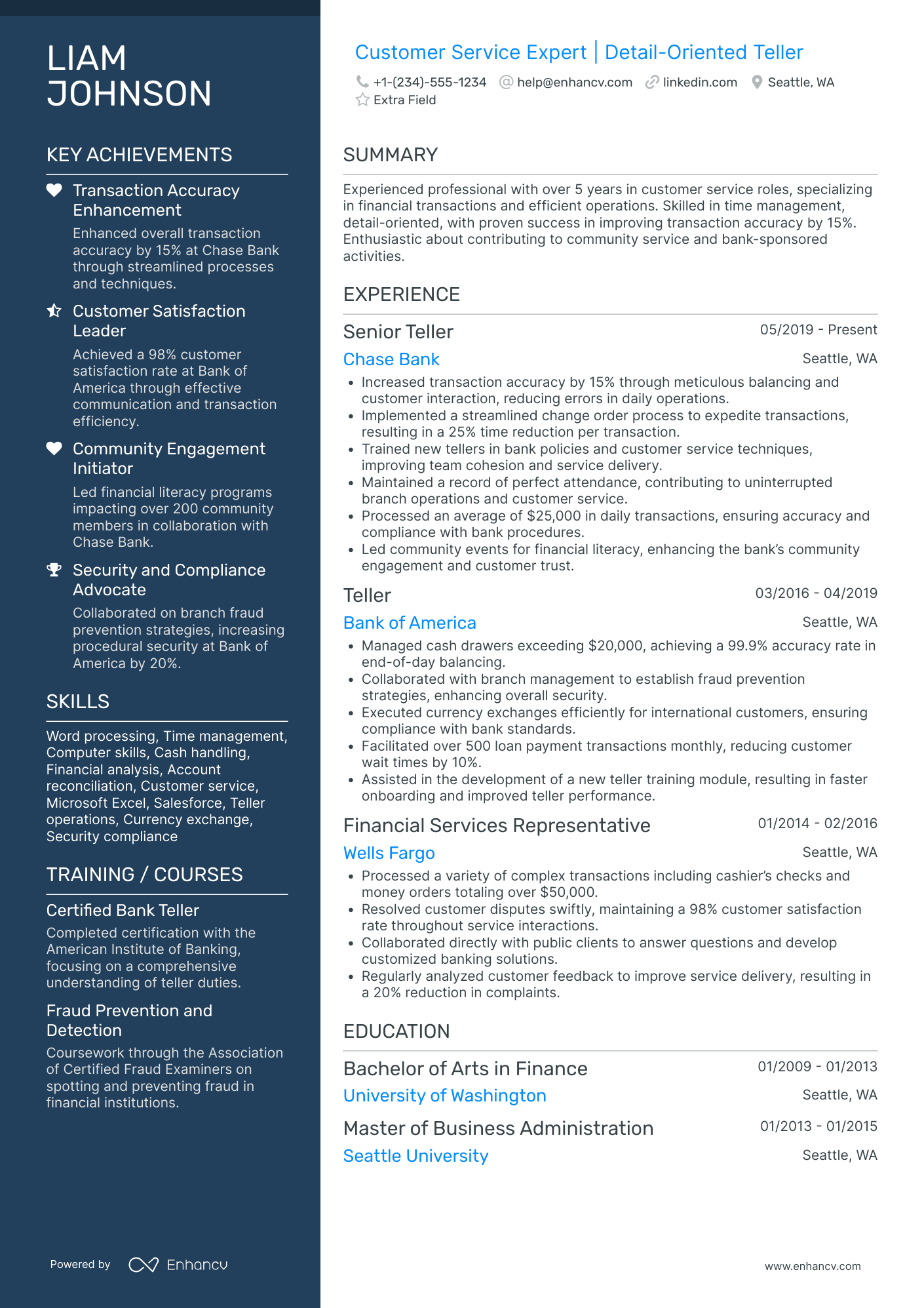

Hard and soft skills on your resume

Your bank teller skills should vary. Hard skills are the role-specific skills you’ve acquired throughout your working career. They help improve your performance in the workplace and allow you to handle a wide set of job duties more effectively. Hard skills include technical skills, which can relate to using specific bank software, for example. When crafting your resume for a bank teller position, dedicate a specific section to "Hard skills" and place it where it's easy to spot—either at the top or right after your work experience. If you've got plenty of skills, sort them into categories to keep things organized and approachable.

Soft skills, on the other hand, are any character traits and personal attitudes that help you do your job better. That includes any non-measurable talents such as communication, attention to detail, or problem-solving. Make a strong first impression by spotlighting key soft skills in the summary or objective. For example, detail your problem-solving prowess in handling customer issues. Another thing you can do is underscore soft skills in your work and education sections, showing your capability to lead and work well with others, which is vital for succeeding as a bank teller.

When crafting your skill section, consider the following:

- Your skills section should always be relevant to the description.

- Feature 5–10 highly sought-after bank tellers duties and responsibilities.

- Focus on skills that will enhance your application and pepper your resume with them.

Here’s a list of hand-picked skills for a bank teller resume:

Best bank teller hard skills

- Cash handling

- Financial software applications

- Account balancing

- Numerical computations

- Money orders processing

- Cash drawer maintenance

- Check verification

- Electronic funds transfers

- Foreign currency transactions

- Teller operations

- Bank product knowledge

- ATM operations

- Customer relationship management software

- Risk management

- Fraud detection

- Loan processing

- Credit card services

- Microsoft Office Suite

- General ledger balancing

- Banking regulations knowledge

Best bank teller soft skills

- Patience

- Communication

- Attention to detail

- Problem-solving

- Customer service

- Multitasking

- Active listening

- Time management

- Salesmanship

- Adaptability

- Critical thinking

- Teamwork

- Discretion

- Empathy

- Interpersonal skills

- Stress management

- Reliability

- Integrity

- Conflict resolution

- Professionalism

Your commitment to professional growth can be demonstrated through your educational background. See how to craft your education and certifications section below.

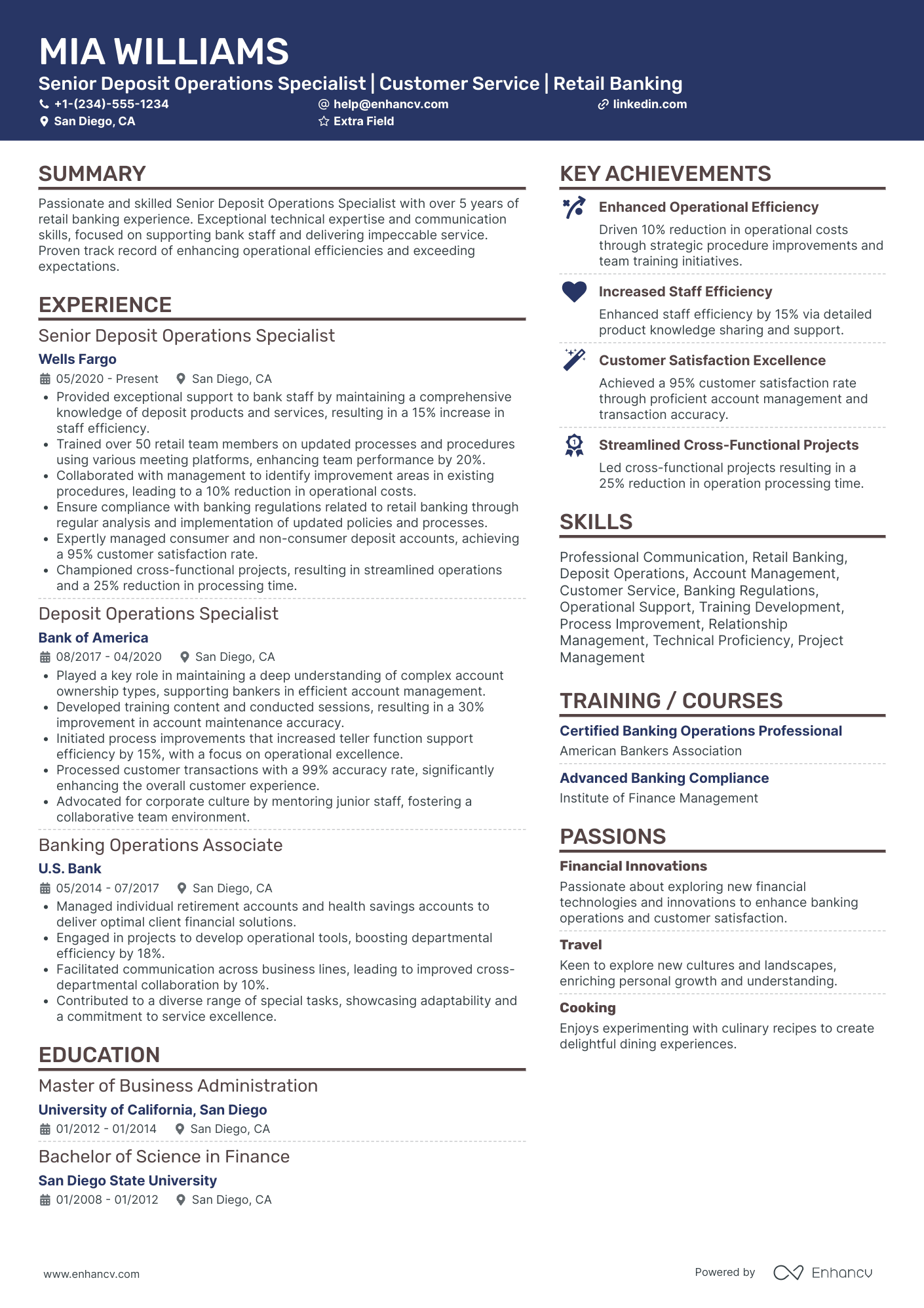

How to list your certifications and education on your resume

Relevant education always gets you ahead in your career. Whenever you’re polishing your resume, think of customizing, customizing, customizing. What can you include in your education section that’s relevant to your desired position? For example, showing you’re a recent graduate can prove your knowledge is up-to-date and relevant to the actuality of the field. And a diploma from a well-established university gives extra credibility to your resume.

Keep these practical tips in mind:

- List your degrees in reverse chronological order.

- Be specific. Let’s say you have more than one degree, the more relevant one should be given preference.

- Even if your degree is incomplete, you can still include it in your resume. Either state the number of credits you’ve completed or simply when you expect to graduate.

If you haven't finished your degree and don't plan to, you can still turn this to your advantage. Focus on the skills and knowledge you gained during your studies. If you're now pursuing a degree that's more relevant to your career, emphasize this strategic decision. Think of ways to present yourself in the best light.

Here’s a bank teller education sample for your resume:

- •Completed coursework in Financial Management, Corporate Finance, and Investment Analysis

- •Participated in the university's investment club, managing a student-run portfolio

This bank teller education sample section works because it:

- Includes relevant coursework: The coursework in Financial Management, Corporate Finance, and Investment Analysis is directly relevant to the skills required for a bank teller, demonstrating the candidate's foundational knowledge in finance.

- Shows extracurricular involvement: Participation in the university's investment club shows practical experience and engagement beyond classroom learning, indicating a proactive approach to applying financial knowledge.

- Displays strong academic performance: A high GPA (3.8/4.0) highlights the candidate's academic excellence and reliability, which are important traits for a bank teller responsible for handling financial transactions and providing customer service.

Certifications on your resume are another way you can assert yourself professionally. They show commitment to the professional field. Obtaining a certification can also prove you’re willing to advance in your career.

PRO TIP

Attending an online course doesn't always lead to certification, so it's important to choose wisely. Some courses offer certificates upon completion, while others focus solely on skill development. If you need specific skills but don't require a certificate, those skill-focused courses might be perfect for you.

We’ve saved you some time and gathered the certifications that are most relevant to a teller resume. Take a look:

Best certifications for your bank teller resume

Let’s move on to the personal statement section.

How to write your bank teller resume summary or objective

Your personal statement is an integral part of your application. And so, it’s best if it goes on top of your teller resume. It can seem counterintuitive, but try writing it after writing the other sections in your resume. This ensures that you’ve already reviewed all your information and know exactly what your strong points are. Which makes it much easier to render them in your personal statement.

But which one to choose? A resume summary is a way to connect your past experiences with your future aspirations. It’s great for more experienced professionals. A well-written summary includes:

- 3–5 sentences on your key achievements as a bank teller

- Keywords from the bank teller job description

- Highly relevant experience

- Active verbs

Here’s a bank teller summary example that doesn’t follow our advice:

This summary is poorly written because it’s:

- Lacking specific achievements: The summary doesn’t mention any achievements or accomplishments from the teller's past experience.

- Generic and vague: Phrases like "familiar with banking procedures" and "customer service" are too broad. They don’t highlight the teller's skills or expertise.

- Missing a clear career objective: The statement "seeking new opportunities to expand my skills" is vague. There’s no clear career objective. Also, no mention of how the teller's skills align with the prospective job.

PRO TIP

To keep your resume summary or objective professional, avoid personal pronouns. For one, it saves space. And also, the repetitive use of “I” on your resume can be interpreted as you being self-centered or bragging.

Now here’s a bank teller resume summary aligning with our tips:

You can see why it works:

- Specific аchievements: The summary mentions managing transactions exceeding $1M daily and a high customer satisfaction rate, showcasing the teller's accomplishments.

- Relevant еxperience: It highlights over 5 years of experience in high-volume branches and the training of junior tellers, demonstrating the teller's relevant expertise and leadership skills.

- Clear career objective: The teller clearly states their intention to contribute to XYZ Bank, linking their past experience and skills to the prospective job, and showing their readiness to bring value to the new position.

A resume objective is the way to go if you’re an entry-level bank teller. It’s also great for when you’re switching careers and want to emphasize your goals and aspirations rather than specific work ventures. Make sure your objective is about 3 sentences long. Clearly state what you’re bringing to the company you’re applying to. Show that you and the company you’re interested in can benefit from your mutual endeavors.

Let’s see a bad and a good example of an entry-level personal statement for a bank teller:

This one is too generic and doesn’t really outline a clear goal or ambition. Let’s see an improvement:

The good example is effective because it clearly states the candidate's relevant experience and skills, demonstrates how they will benefit the company and maintains a concise, professional tone. This approach shows specificity, relevance, and mutual benefit, making it a compelling introduction.

There are always more things you can add that can make you stand out. Yes, even more! How about some additional sections?

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Additional sections for a bank teller resume

Adding extra sections to your resume is like adding sparkle to your application. It gives a fuller, more vibrant picture of who you are and what you bring to the table. Here’s why these sections are game-changers:

- They make you stand out from the crowd: Everything we've covered so far is a tool to set you apart. Additional sections are another powerful way to do that. Why not use every opportunity to shine?

- They showcase depth: These sections demonstrate that you're not just going through the motions in your role. Including professional affiliations or key achievements highlights your commitment and dedication.

- They reveal your personality: While job-specific qualities are important, your personality is how you truly connect with people. Don’t miss the chance to make a personal impression by adding a section on hobbies and interests.

Incorporating these sections enriches your resume. It also presents a well-rounded view of your professional and personal strengths.

And now, here are some specific examples of additional sections to add to your bank teller resume:

- Professional development: Let’s say you’ve attended a seminar on "Customer Service Excellence in Financial Services.” This shows you’re proactive. A strive to improve your skills is valuable to employers.

- Accomplishments: Think about what your key achievements as a bank teller are. Maybe you’ve successfully managed a daily average of 150 transactions. Provide concrete evidence of your effectiveness and success in previous roles. This makes your resume more compelling.

- Languages: Being fluent in Spanish and English, for example, enables effective communication with a broader customer base. This always makes you a more versatile and desirable candidate.

- Hobbies and interests: Perhaps you’re an active member of a local chess club. Or a volunteer at a community center! Provide a glimpse into your personality and soft skills. This will help the recruiter assess your cultural fit and potential for team cohesion.

How to put a projects section on a bank teller resume

And finally, here’s one more suggestion. A projects section, professional or personal, demonstrates initiative. It also proves an ability to handle bank teller duties and responsibilities beyond daily tasks. Here’s how to format it:

- •Implemented a new CRM system to enhance customer service and streamline operations.

- •Trained staff on the new system, resulting in a 20% increase in customer satisfaction ratings.

- •Coordinated with IT to ensure smooth integration with existing banking systems.

- •Organized and conducted financial literacy workshops for local community members.

- •Covered topics such as budgeting, saving, and basic banking operations.

- •Received positive feedback from participants, with many reporting improved financial management skills.

Adding a projects section to your resume is wise as it shows your practical experience and gives you real-life examples to discuss in interviews. It’s a good way to underscore your achievements. Don’t overlook its importance.

Key takeaways

Creating a standout bank teller resume involves careful consideration of format, style, and content. Follow these tailored tips to highlight your qualifications and make a strong impression on potential employers.

- Choose between a reverse chronological, functional, and hybrid format depending on your banking experience and career goals.

- A 1-page resume is enough for most bank teller positions.

- Your bank teller resume doesn’t have to be bland. Add subtle color and modern fonts to make it stylish.

- Stick to a naming convention that includes your name, the word “resume”, and the position you’re applying for.

- Tailor your experience section to the bank teller job description. Highlight relevant duties like handling cash transactions, customer service, and sales of banking products. Never lie on your resume.

- Focus on your key achievements and how they relate to your desired bank teller position, such as improving customer satisfaction or efficiently managing cash drawers.

- If you’ve got no direct experience, think about what transferable skills you can present, like attention to detail, customer service, and numerical proficiency.

- Intersperse your resume with hard and soft skills relevant to the bank teller job description, such as cash handling, problem-solving, and communication.

- Your education and certificates section can get you noticed. Include any relevant coursework or certifications, such as banking courses or financial services certificates.

- The additional sections on your bank teller resume are a great way to show your personality. Include volunteer work, language skills, or hobbies related to finance and customer service.

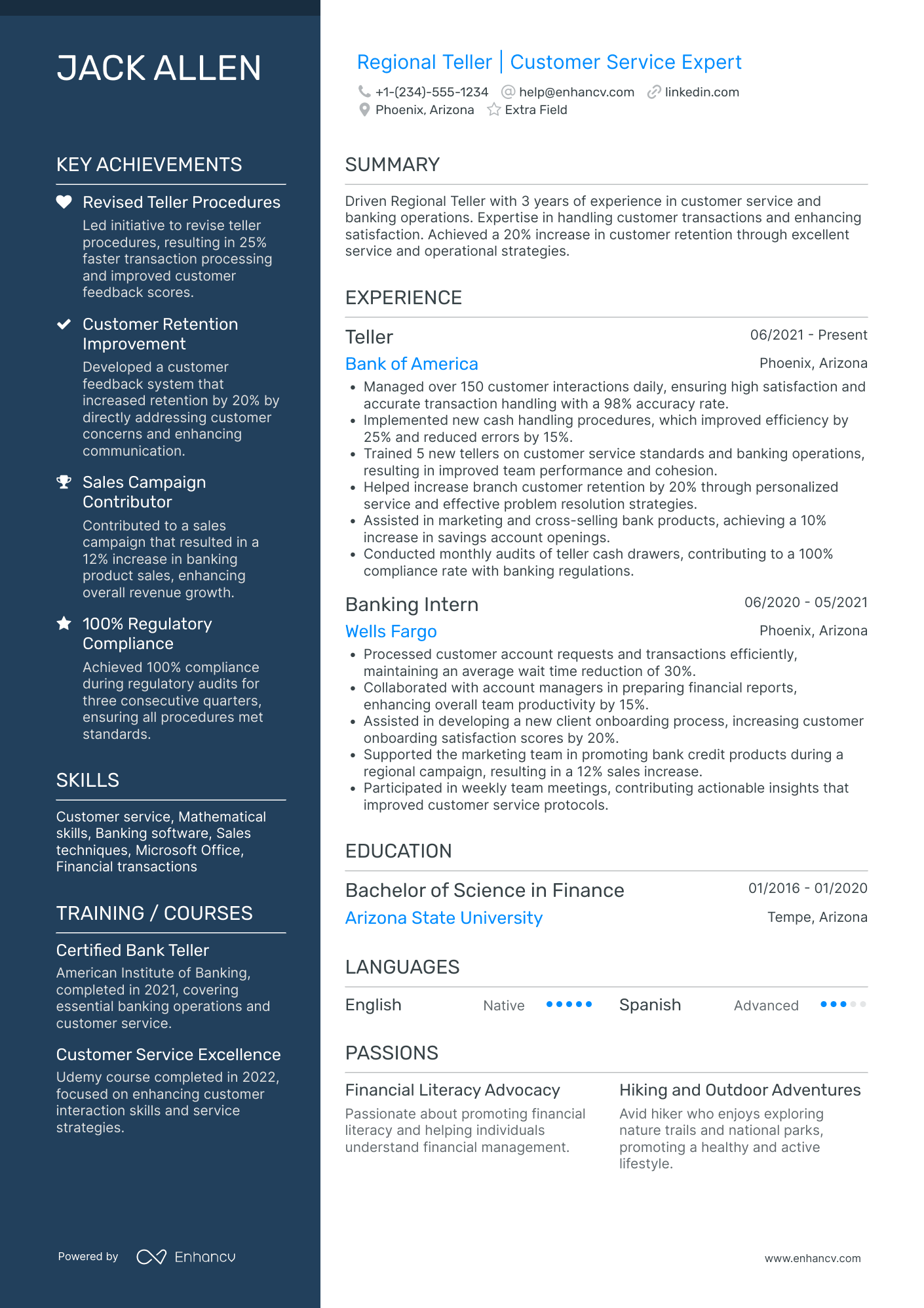

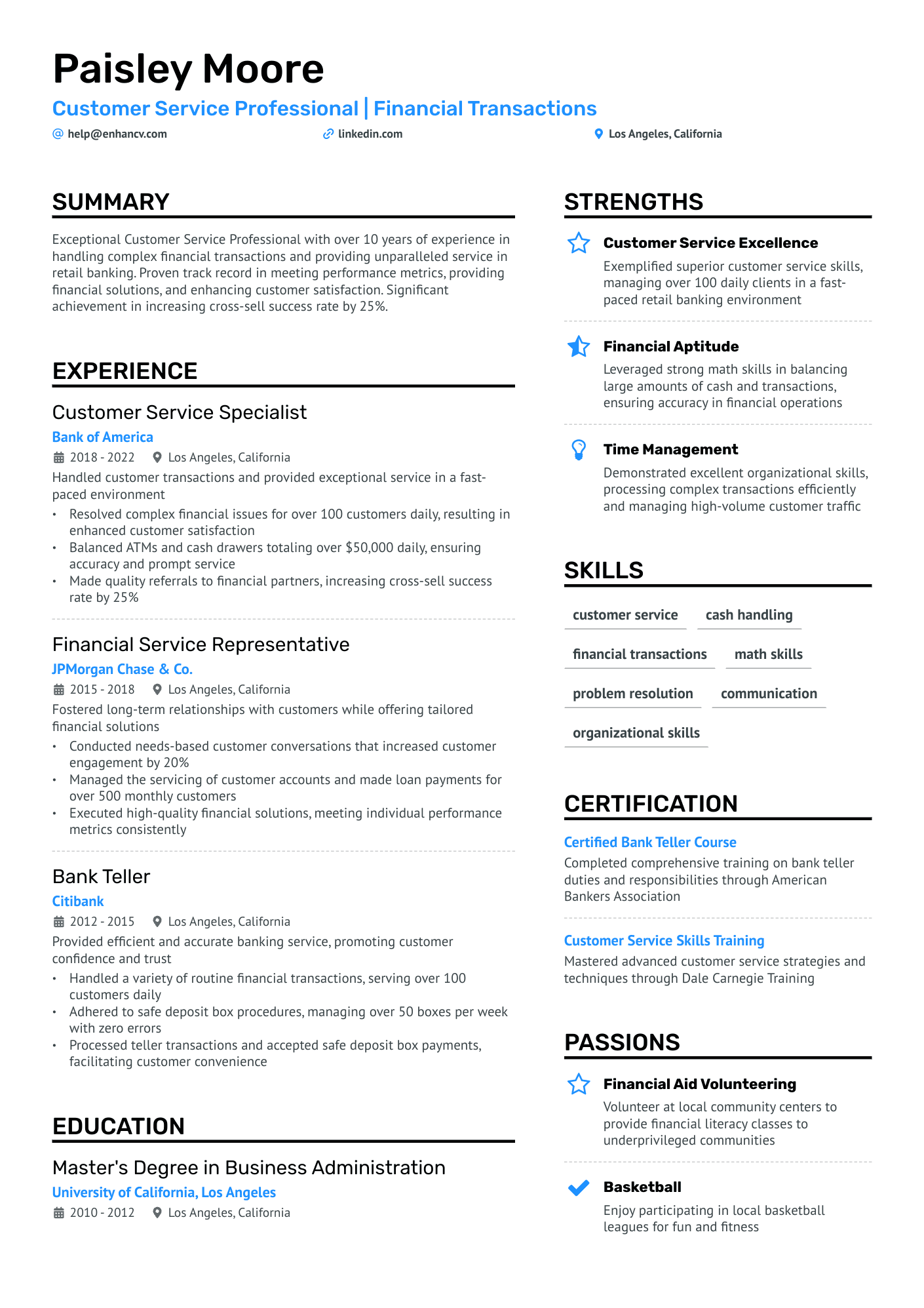

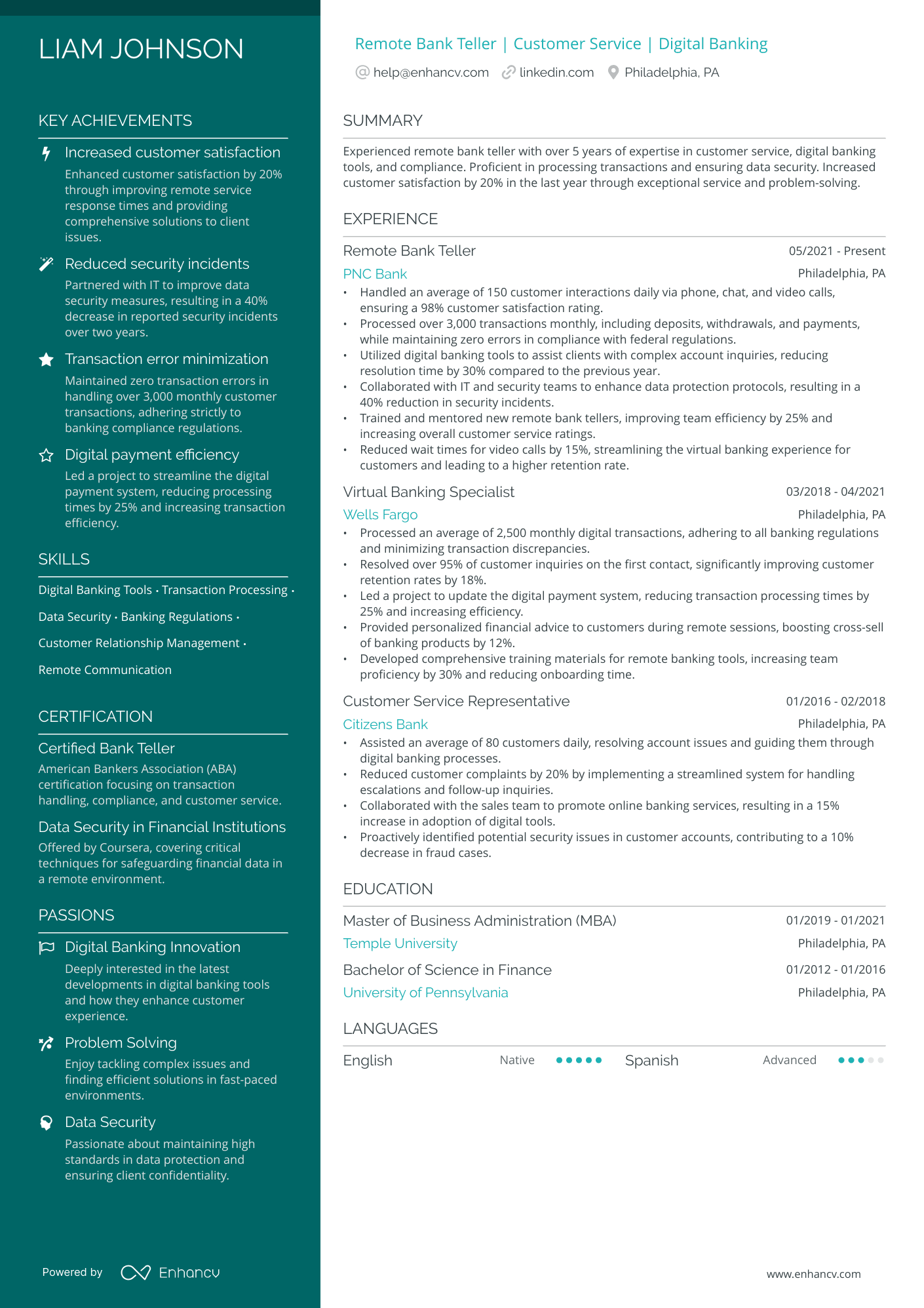

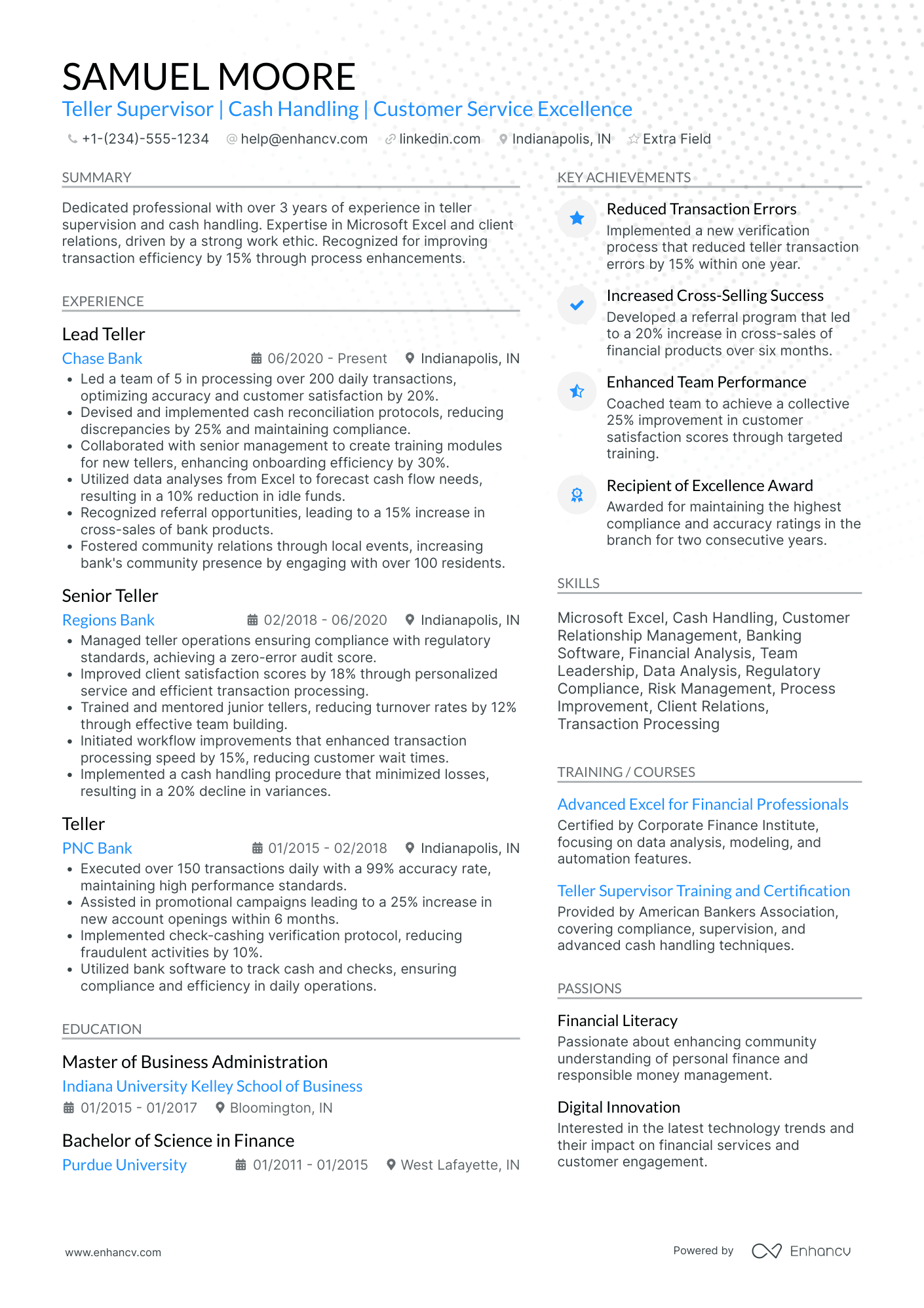

Bank Teller resume examples

By Experience

By Role