Many bank manager resumes fail because they read like job descriptions, not performance records. That costs you in ATS screening and fast recruiter scans, where competition is high and space is limited.

A strong resume shows what you improved, not what you used. Knowing how to write a resume that highlights branch revenue growth, deposit and loan volume gains, lower delinquency rates, stronger audit results, larger portfolios managed, and higher customer satisfaction is what sets top candidates apart.

Key takeaways

- Quantify branch results like deposit growth, loan volume, and audit outcomes in every experience bullet.

- Use reverse-chronological format if you have management experience; use hybrid if you're transitioning.

- Tailor each resume to the job posting's exact platforms, KPIs, and compliance frameworks.

- Demonstrate skills through measurable achievements in your summary and experience—not just a skills list.

- Place certifications above education when they're recent, relevant, or required for the role.

- Avoid functional resumes—hiring managers in banking expect a clear, verifiable work timeline.

- Use Enhancv to turn routine banking tasks into strong, metric-driven resume bullets faster.

Job market snapshot for bank managers

We analyzed 282 recent bank manager job ads across major US job boards. These numbers help you understand regional hotspots, salary landscape, experience requirements at a glance.

What level of experience employers are looking for bank managers

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 1.1% (3) |

| 3–4 years | 9.6% (27) |

| 5–6 years | 47.2% (133) |

| 7–8 years | 15.2% (43) |

| 9–10 years | 0.4% (1) |

| 10+ years | 0.7% (2) |

| Not specified | 26.2% (74) |

Bank manager ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 99.6% (281) |

Top companies hiring bank managers

| Company | Percentage found in job ads |

|---|---|

| Accenture | 75.2% (212) |

| BMO (Bank of Montreal) | 11.0% (31) |

Role overview stats

These tables show the most common responsibilities and employment types for bank manager roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a bank manager

| Responsibility | Percentage found in job ads |

|---|---|

| Ai | 31.2% (88) |

| Powerpoint | 31.2% (88) |

| Data | 30.5% (86) |

| Agile | 30.1% (85) |

| Cloud-native architectures | 30.1% (85) |

| Consumer lending | 30.1% (85) |

| Core banking | 30.1% (85) |

| Data governance | 30.1% (85) |

| Data visualization | 30.1% (85) |

| Management consulting | 30.1% (85) |

| Mortgage lending | 30.1% (85) |

| Visual storytelling | 30.1% (85) |

How to format a bank manager resume

Recruiters evaluating bank manager resumes prioritize evidence of branch performance, team leadership, regulatory compliance, and revenue growth. A clear, well-structured resume format ensures these signals surface immediately—both for human reviewers scanning in seconds and for applicant tracking systems parsing your credentials.

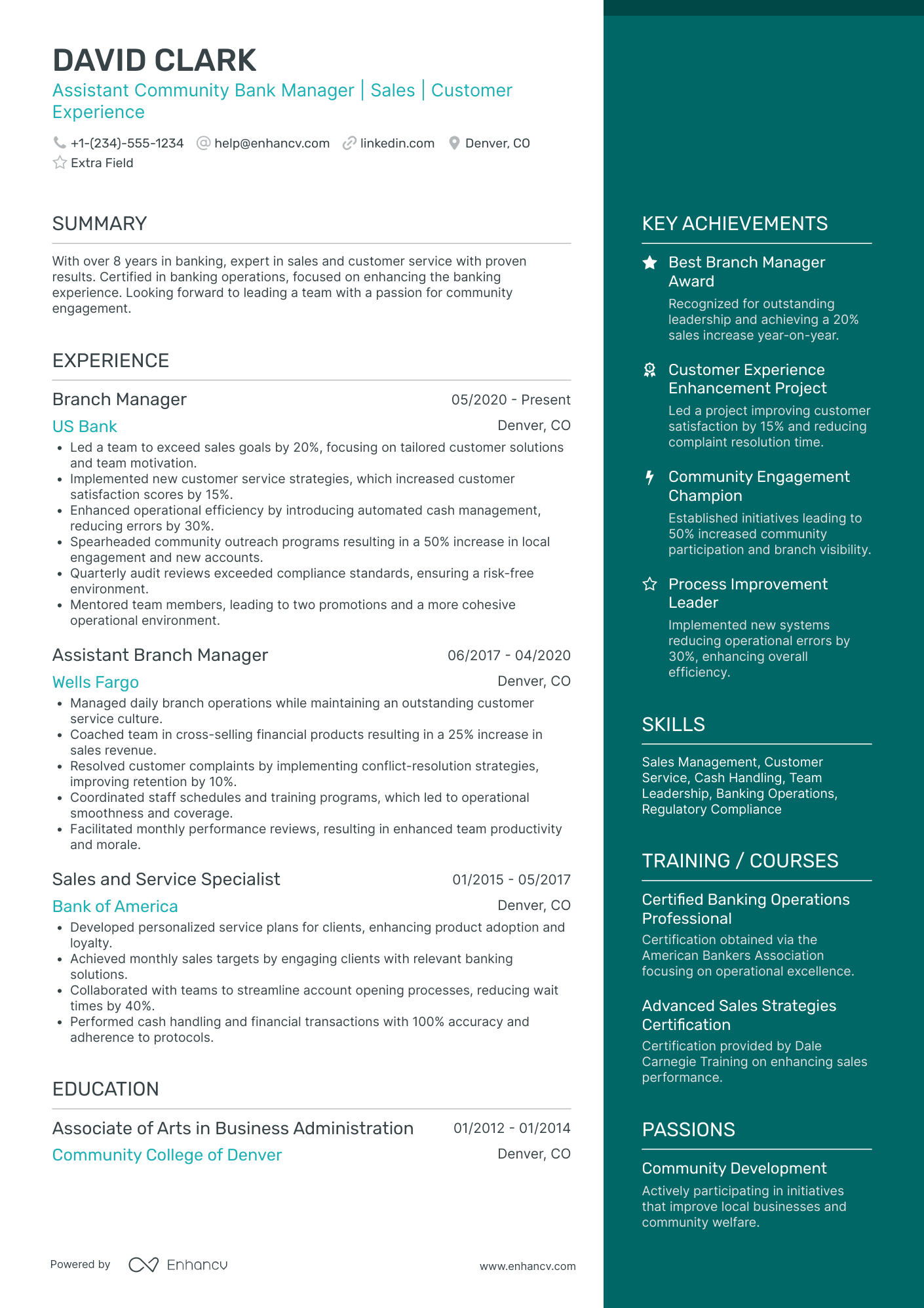

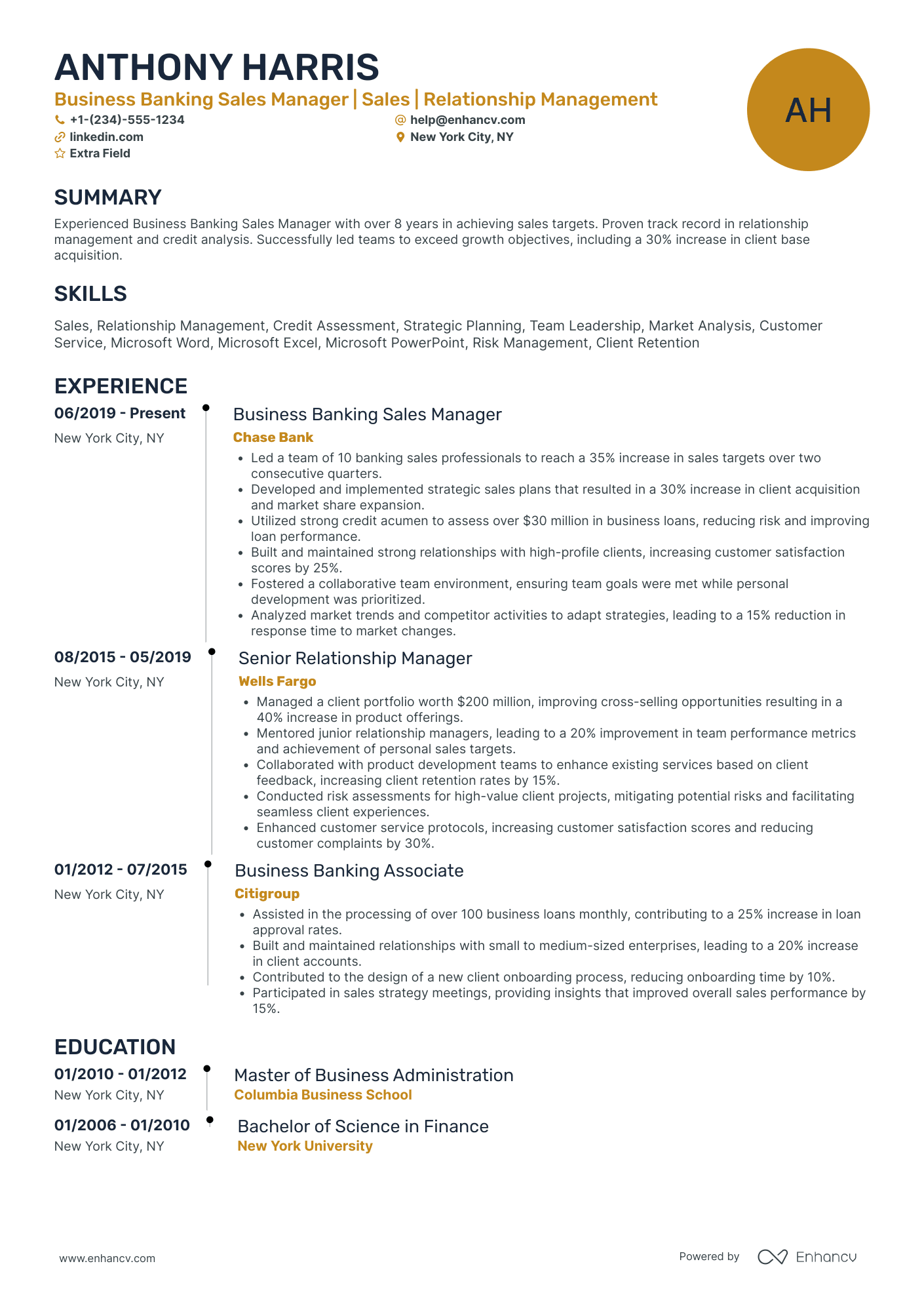

I have significant experience in this role—which format should I use?

Use a reverse-chronological format—it's the strongest choice for an experienced bank manager because it foregrounds your leadership trajectory, expanding scope, and compounding business impact. Do:

- Lead each role entry with your management scope: branch size, team headcount, portfolio value, and decision-making authority.

- Highlight domain-specific expertise such as loan origination, deposit growth strategies, risk assessment frameworks, CRA compliance, and core banking platforms (e.g., FIS, Fiserv, Jack Henry).

- Quantify outcomes tied directly to branch performance, profitability, or operational efficiency improvements.

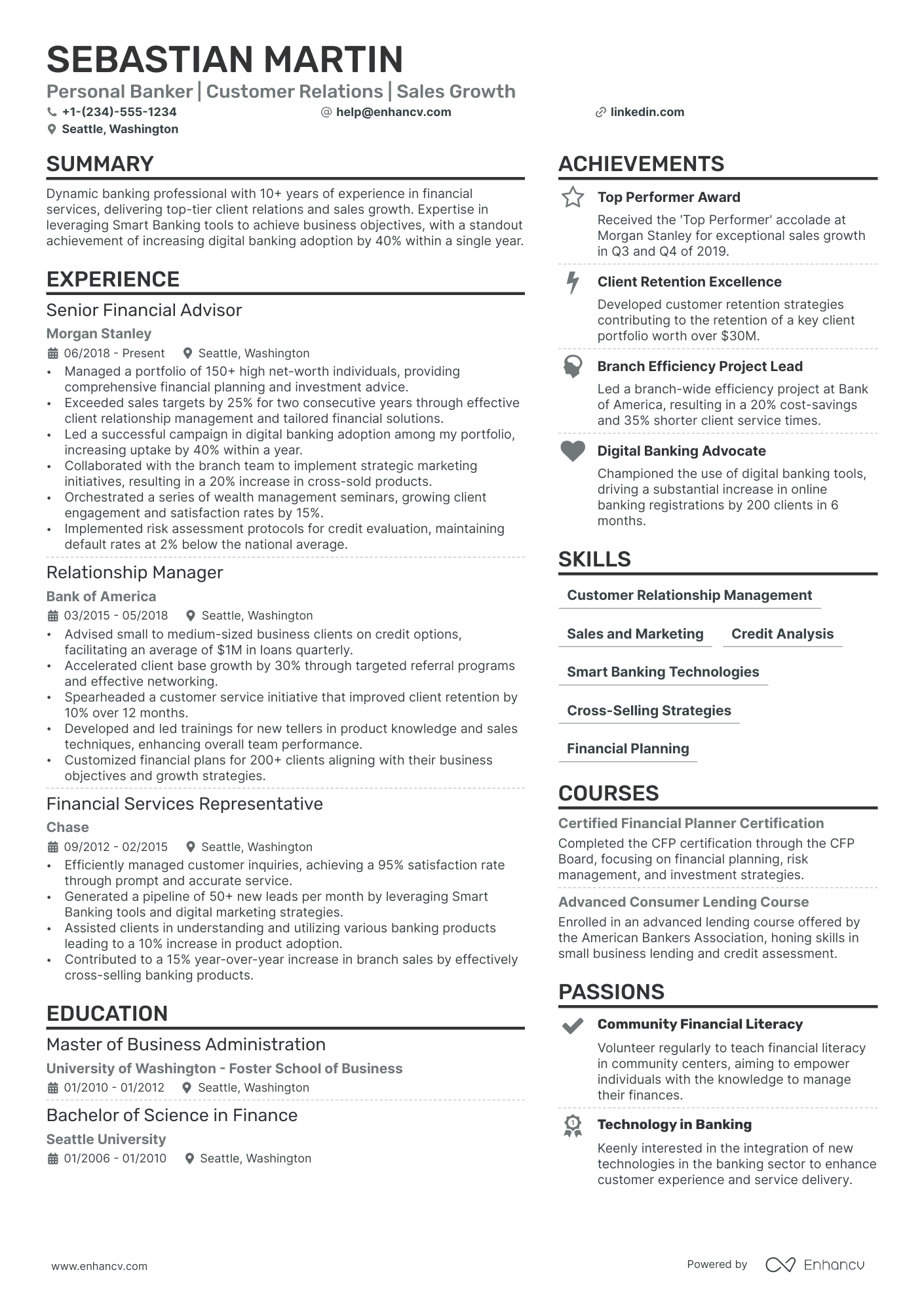

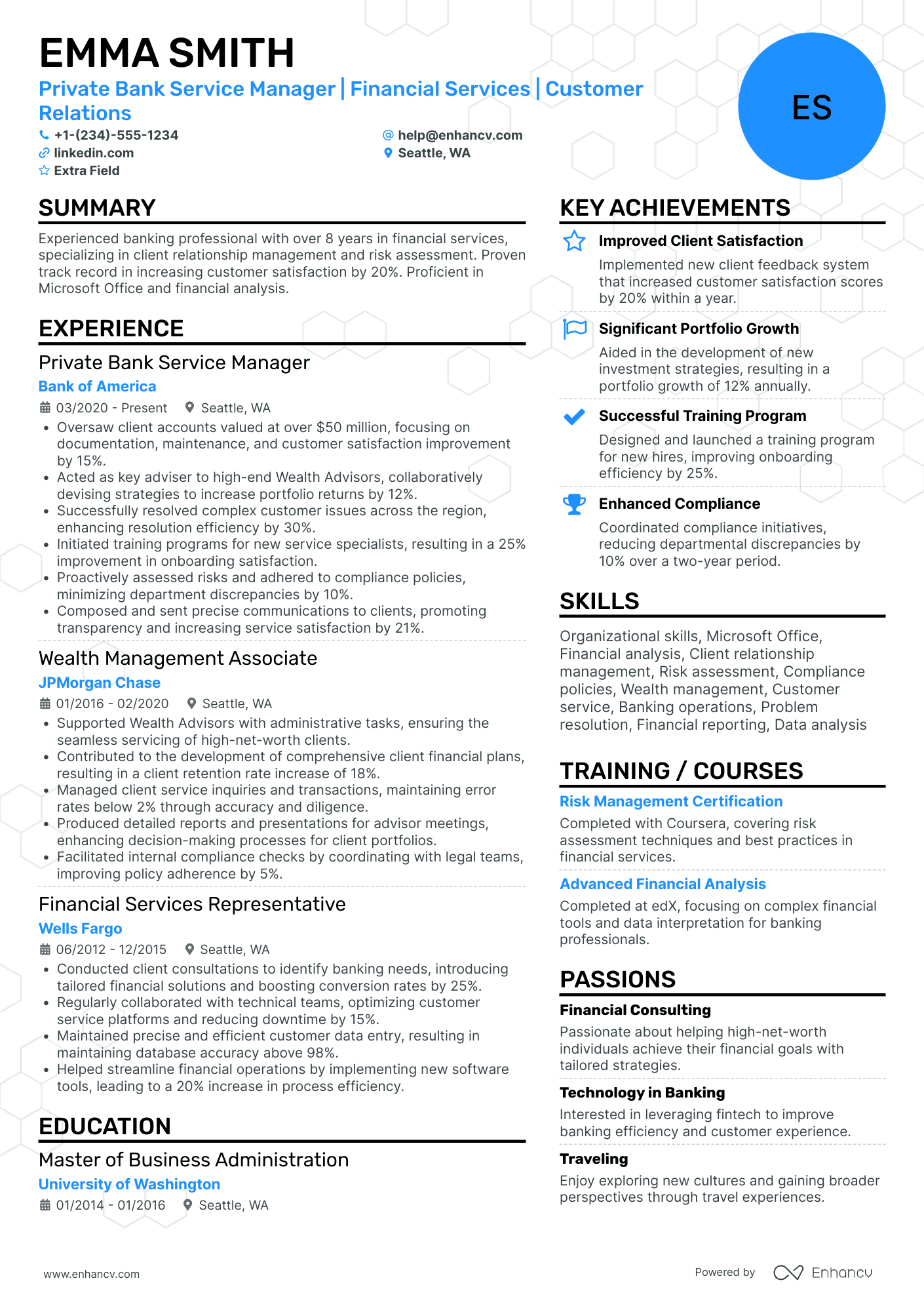

I'm junior or switching into this role—what format works best?

A hybrid format works best if you're transitioning into bank management, as it lets you lead with transferable skills while still showing a clear employment timeline. Do:

- Place a focused skills section near the top highlighting competencies like customer relationship management, cash handling oversight, regulatory knowledge, and sales leadership.

- Include projects or transitional experience—such as acting branch manager assignments, teller supervisor duties, or cross-functional banking initiatives—that demonstrate readiness for management responsibility.

- Connect every skill or experience entry to a concrete action and a measurable result so recruiters can assess your potential impact.

Why not use a functional resume?

A functional resume strips away the timeline and context recruiters need to evaluate your progression toward management responsibility, making it harder to verify where, when, and how you developed your banking competencies. When a functional resume might be acceptable:

- You're re-entering the banking industry after an extended career break and need to reframe transferable management skills around specific branch operations projects and measurable outcomes.

Once you've locked in the right format, it's time to decide which sections to include and how to arrange them for maximum impact.

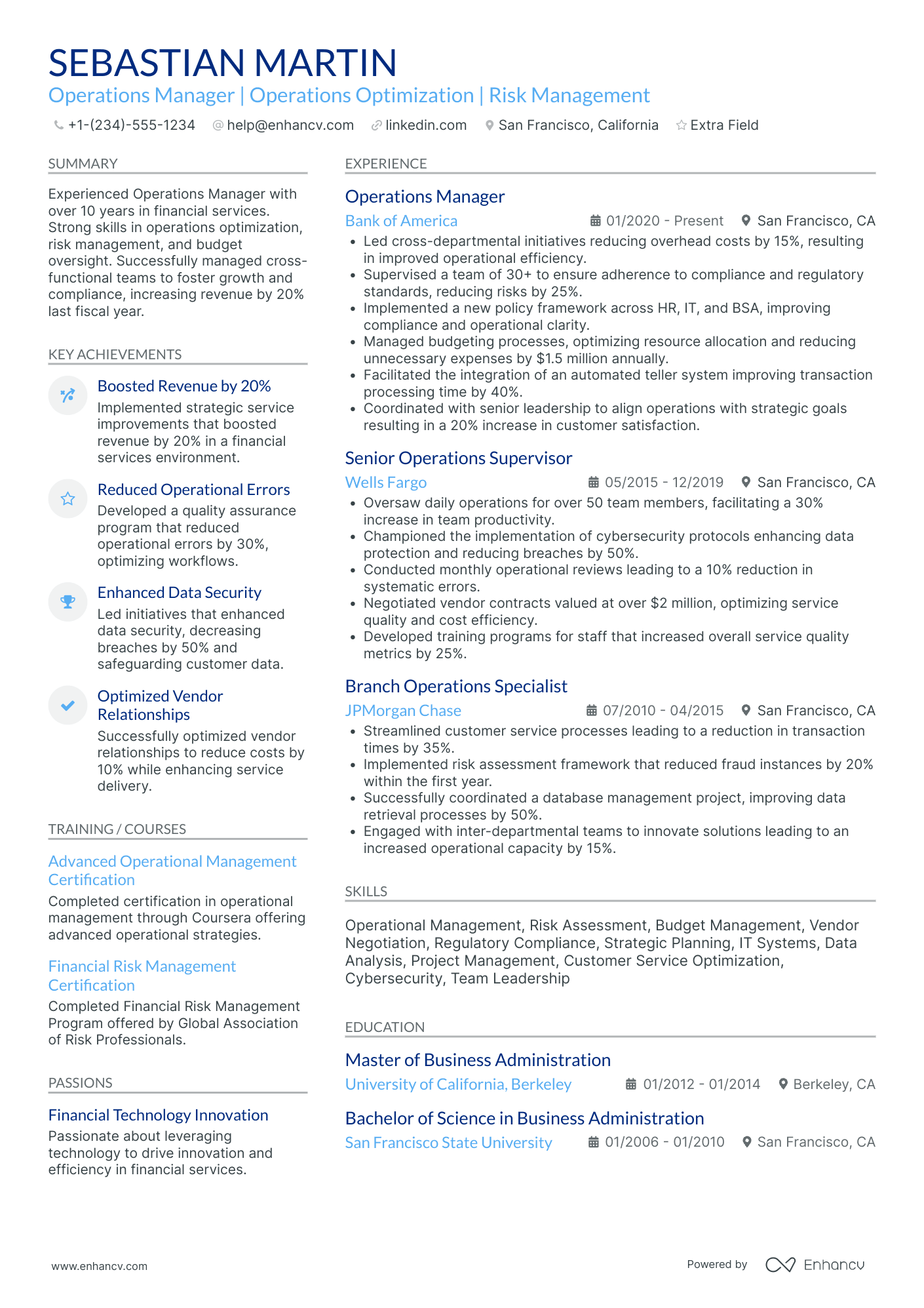

What sections should go on a bank manager resume

Recruiters expect to see a clear record of branch leadership, regulatory compliance, sales performance, and risk management. Understanding which resume sections to include helps you organize this information effectively.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should highlight measurable branch results, portfolio scope, compliance outcomes, and the impact of your leadership on revenue, customer retention, and risk reduction.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right structure, you can focus on writing your bank manager experience section to show impact in the roles you’ve held.

How to write your bank manager resume experience

Your experience section is where you prove you've delivered results—not just held a position. Hiring managers reviewing bank manager candidates prioritize demonstrated impact, including revenue growth, risk mitigation, regulatory compliance, and team leadership, over generic task descriptions. Building a targeted resume ensures every bullet point speaks directly to what the employer values most.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the branch operations, lending portfolios, deposit products, compliance programs, or staff teams you were directly accountable for as a bank manager.

- Execution approach: the banking platforms, risk assessment frameworks, CRM systems, audit procedures, or coaching methods you used to drive decisions and deliver day-to-day results.

- Value improved: changes to loan quality, branch profitability, customer retention, operational efficiency, regulatory adherence, or fraud prevention that resulted from your leadership.

- Collaboration context: how you partnered with loan officers, tellers, compliance teams, regional leadership, auditors, or commercial clients to achieve shared objectives.

- Impact delivered: outcomes expressed through measurable business results—such as portfolio growth, reduced delinquency, improved satisfaction scores, or successful audit outcomes—rather than a list of routine activities.

Each bullet should connect what you owned to how you executed and what changed because of your work. Keep your language specific to banking operations and leadership, and focus every point on the value you created for the branch, the institution, or the customers you served.

Experience bullet formula

A bank manager experience example

✅ Right example - modern, quantified, specific.

Bank Manager

Riverstone Community Bank | Austin, TX

2021–Present

Led a full-service retail branch serving 18,000 customers across consumer, small business, and mortgage products.

- Directed branch performance using Salesforce CRM dashboards and core banking reporting, lifting net new deposit growth by 14% year over year and improving cross-sell rate from 1.6 to 2.1 products per household.

- Reduced fraud losses by 22% by tightening BSA (Bank Secrecy Act) and AML (anti-money laundering) controls, partnering with compliance and fraud operations to tune transaction-monitoring alerts and retrain staff on escalation workflows.

- Improved customer experience by 11 points in Net Promoter Score through queue analytics, appointment scheduling, and service recovery playbooks, cutting average lobby wait time from nine to six minutes.

- Increased small business lending revenue by $420K annually by redesigning the pipeline in Salesforce CRM, standardizing credit package checklists, and aligning weekly deal reviews with underwriters and risk stakeholders.

- Cut teller balancing and end-of-day close time by 25% by standardizing dual-control procedures and optimizing cash logistics with the vault system, reducing cash outages by 30% while maintaining audit-ready documentation.

Now that you've seen how a strong experience section comes together, let's look at how to adjust those details to match the specific bank manager role you're targeting.

How to tailor your bank manager resume experience

Recruiters evaluate your bank manager resume through both human review and applicant tracking systems, so tailoring your resume to the job description is essential. Tailoring ensures the skills, tools, and accomplishments you highlight directly reflect what the employer is looking for.

Ways to tailor your bank manager experience:

- Match banking platforms and core systems named in the job description.

- Mirror the exact terminology used for lending or deposit processes.

- Reflect specific KPIs like portfolio growth or loan volume targets.

- Highlight regulatory compliance frameworks referenced in the posting.

- Emphasize retail or commercial banking experience when specified.

- Include cross-functional collaboration models the role describes.

- Align your leadership style with stated team management expectations.

- Reference risk assessment or audit methodologies the employer prioritizes.

The goal is to align your real achievements with each job's requirements, not to insert keywords where they don't naturally belong.

Resume tailoring examples for bank manager

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| "Oversee daily branch operations, ensuring compliance with federal and state banking regulations, including BSA/AML requirements." | Managed daily operations and ensured the team followed company policies. | Directed daily operations for a full-service branch with 18 staff members, maintaining 100% compliance across quarterly BSA/AML audits and all federal and state regulatory examinations. |

| "Drive growth in consumer and commercial deposit portfolios by developing relationships with local businesses and community organizations." | Helped increase sales and built relationships with customers. | Grew the branch's commercial deposit portfolio by $4.2M in 12 months by establishing partnerships with 35+ local businesses and leading quarterly community outreach events. |

| "Coach, develop, and performance-manage a team of personal bankers and tellers to meet cross-selling and customer satisfaction targets." | Supervised employees and helped improve team performance. | Coached a team of nine personal bankers and tellers through weekly one-on-ones and role-play sessions, increasing cross-sell ratios by 27% and raising Net Promoter Scores from 72 to 86 within two quarters. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your bank manager achievements so hiring teams can see the measurable impact behind those responsibilities.

How to quantify your bank manager achievements

Quantifying your achievements shows how you improved branch results, reduced risk, and delivered better service. Focus on revenue growth, deposit and loan volume, compliance and audit outcomes, customer satisfaction, and efficiency measures like wait time and error rates.

Quantifying examples for bank manager

| Metric | Example |

|---|---|

| Revenue growth | "Grew branch fee and interest revenue 12% year over year by coaching eight bankers on cross-sell scripts and weekly pipeline reviews." |

| Deposit growth | "Increased core deposits by $9.4M in nine months by launching a small business referral program with two local chambers of commerce." |

| Credit quality | "Cut 60+ day delinquency from 2.1% to 1.4% by tightening underwriting checklists and adding monthly portfolio reviews in the loan system." |

| Compliance outcomes | "Passed two internal audits with zero high-risk findings by standardizing Bank Secrecy Act (BSA) documentation and running quarterly teller controls testing." |

| Service efficiency | "Reduced average lobby wait time from 14 to seven minutes by redesigning staffing schedules and adding appointment slots in the branch calendar tool." |

Turn your everyday tasks into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With your experience clearly articulated in strong bullet points, the next step is ensuring your skills section highlights the right mix of hard and soft skills that bank manager roles demand.

How to list your hard and soft skills on a bank manager resume

Your skills section shows you can grow deposits, manage risk, and lead a branch—recruiters and an ATS (applicant tracking system) scan this section to confirm role fit fast—so aim for a balanced mix of hard skills and job-specific soft skills. bank manager roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Branch P&L management

- Deposit growth strategy

- Consumer and small business lending

- Underwriting and credit analysis

- Loan portfolio monitoring

- Risk controls, audit readiness

- Bank Secrecy Act and anti-money laundering compliance

- Know your customer, customer identification program

- Fraud detection and dispute operations

- Core banking systems, teller platforms

- Customer relationship management systems

- Microsoft Excel, Tableau

Soft skills

- Coach bankers to targets

- Lead daily branch huddles

- Resolve escalations fast

- Communicate risk tradeoffs clearly

- Hold teams accountable to controls

- Prioritize competing branch demands

- Partner with regional leadership

- Influence without formal authority

- Deliver candid performance feedback

- Make decisions with incomplete data

- Negotiate win-win customer outcomes

- Drive cross-sell through needs analysis

How to show your bank manager skills in context

Skills shouldn't live only in a bulleted list on your resume. Browse examples of how other professionals present their resume skills to see what works.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what both look like in practice.

Summary example

Senior bank manager with 12 years in commercial lending and retail operations. Skilled in portfolio risk analysis, Fiserv, and cross-functional team leadership. Grew branch deposit base 34% while maintaining a loan default rate under 1.2%.

- Reflects senior-level experience clearly

- Names industry-relevant tools and methods

- Leads with a measurable financial outcome

- Highlights leadership as a soft skill

Experience example

Senior Bank Manager

Crestline National Bank | Portland, OR

March 2018–Present

- Managed a $210M loan portfolio using Fiserv and internal risk dashboards, reducing delinquency rates by 18% over three years.

- Collaborated with compliance and lending teams to streamline approval workflows, cutting average processing time by 25%.

- Coached a team of 14 branch staff on consultative sales techniques, driving a 31% increase in new business account openings.

- Every bullet includes a measurable outcome

- Skills surface naturally through real achievements

Once you’ve demonstrated your banking leadership strengths through specific, results-driven examples, the next step is adapting that approach to build a bank manager resume with no experience.

How do I write a bank manager resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Bank teller or vault support

- Branch internship or job shadowing

- Cash handling and reconciliation

- Customer account opening support

- Retail store shift supervision

- Sales targets and pipeline tracking

- Compliance training and quizzes

- Community financial literacy volunteering

If you're in this situation, our guide on writing a resume without work experience walks you through strategies that apply directly to banking roles.

Focus on:

- Metrics: deposits, loans, retention

- Compliance: KYC, AML, audits

- Cash controls and reconciliations

- Leadership scope and process improvements

Resume format tip for entry-level bank manager

Use a combination resume format. It highlights transferable achievements and projects while still showing steady experience and training. Do:

- Put a summary with target role.

- Add a "Relevant projects" section.

- Quantify results with clear metrics.

- List compliance training with dates.

- Tailor keywords to each posting.

- Led weekly cash reconciliation using Excel checklists and dual-control logs, reducing cash overage and shortage incidents by 30% over eight weeks.

Even without direct experience, your education section can demonstrate the foundational knowledge and qualifications that make you a strong candidate for a bank manager role.

How to list your education on a bank manager resume

Your education section helps hiring teams confirm you have the foundational knowledge needed for a bank manager role. It validates your financial expertise and academic credentials quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Avoid listing specific months or days for graduation. Use the year only for a clean, professional look.

Here's a strong education entry tailored to a bank manager resume.

Example education entry

Bachelor of Science in Finance

University of Michigan, Ann Arbor, MI

Graduated 2018

GPA: 3.7/4.0

- Relevant Coursework: Financial Risk Management, Commercial Lending, Corporate Banking, and Business Ethics

- Honors: Magna Cum Laude, Dean's List (six consecutive semesters)

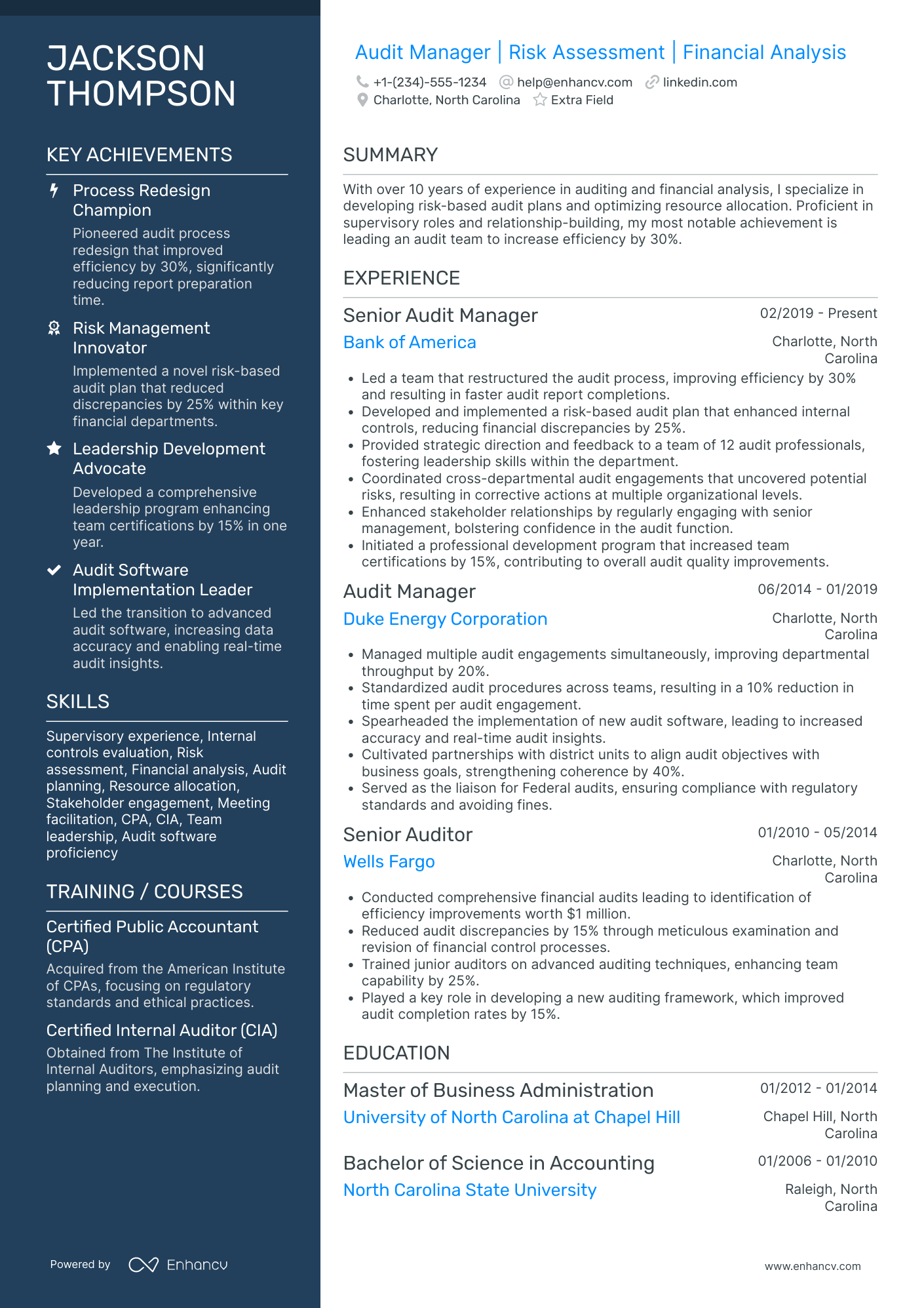

How to list your certifications on a bank manager resume

Certifications on your resume show a bank manager's commitment to learning, proficiency with financial tools, and alignment with current banking standards and regulations.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they are older, secondary to your degree, or only loosely related to bank manager responsibilities.

- Place certifications above education when they are recent, highly relevant to bank manager work, or required for your target role.

Best certifications for your bank manager resume

Chartered Financial Analyst (CFA) Certified Treasury Professional (CTP) Certified Anti-Money Laundering Specialist (CAMS) Financial Risk Manager (FRM) Certified Financial Planner (CFP) Certified Regulatory Compliance Manager (CRCM) Six Sigma Green Belt

Once you’ve positioned your credentials where they add the most value, you can write your bank manager resume summary to highlight those qualifications upfront.

How to write your bank manager resume summary

Your resume summary is the first thing a recruiter reads, so it must immediately signal you're qualified. A strong summary tailored to a bank manager role sets the tone for everything that follows.

Keep it to three to four lines, with:

- Your title and total years of banking or financial services experience.

- The domain you specialize in, such as retail banking, commercial lending, or branch operations.

- Core skills like P&L management, regulatory compliance, CRM platforms, or loan portfolio oversight.

- One or two measurable achievements, such as revenue growth, portfolio size, or customer retention rates.

- Soft skills tied to real outcomes, like team development that reduced turnover or client relationship management that drove deposits.

PRO TIP

As a bank manager, emphasize operational leadership, financial results, and team performance in your summary. Highlight the scope of your responsibility—branch size, portfolio value, or headcount managed. Avoid vague phrases like "passionate leader" or "results-driven professional." Recruiters want proof, not personality descriptors.

Example summary for a bank manager

Bank manager with eight years in retail banking, overseeing a 15-member team and $120M deposit portfolio. Grew new account openings 30% year over year through targeted community outreach and streamlined onboarding processes.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary communicates your value as a bank manager, make sure your header presents the essential contact and professional details recruiters need to reach you.

What to include in a bank manager resume header

A resume header is the contact and identity block at the top, and it boosts visibility, credibility, and recruiter screening for a bank manager role.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link lets recruiters confirm your roles and dates fast, which supports quick screening.

Don't include a photo on a bank manager resume unless the role is explicitly front-facing or appearance-dependent.

Match your header job title to the posting and keep every detail consistent with your application and LinkedIn profile.

Example

Bank manager resume header

Jordan Taylor

Bank manager | Retail banking operations and team leadership

Chicago, IL

(312) 555-01XX

your.name@enhancv.com

github.com/yourname

yourwebsite.com

linkedin.com/in/yourname

Once your contact details and role identifiers are set at the top, you can strengthen the rest of the document by adding additional sections for bank manager resumes that support your candidacy.

Additional sections for bank manager resumes

When your core sections look similar to other candidates, additional sections can set you apart and reinforce your credibility as a bank manager.

- Languages

- Certifications and licenses

- Professional affiliations and memberships

- Volunteer experience and community involvement

- Awards and recognitions

- Publications and industry contributions

Once you've strengthened your resume with relevant additional sections, it's worth pairing it with a cover letter to give hiring managers even more context about your qualifications.

Do bank manager resumes need a cover letter

A cover letter isn't required for a bank manager, but it often helps in competitive searches or when hiring teams expect one. If you're unsure where to start, understanding what a cover letter is and how it complements your resume can clarify when it's worth including one. It can make a difference when your resume needs context, or when you're targeting a specific branch or segment.

Use a cover letter to add context your resume can't:

- Explain why you fit the branch, team, and leadership style, and how you'll support performance, compliance, and customer experience.

- Highlight one or two outcomes, like improving deposit growth, reducing operational losses, or raising customer satisfaction scores, and state your role.

- Show you understand the bank's products, customers, and local market, and how you'll balance sales goals with risk controls.

- Address career transitions or non-obvious experience, and connect it to bank manager responsibilities with one clear example.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you include a cover letter to add context beyond your resume, using AI to improve your bank manager resume helps you strengthen the document recruiters review first.

Using AI to improve your bank manager resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight measurable results. But overuse can strip away your authentic voice. If you're exploring this approach, our guide on which AI is best for writing resumes can help you choose the right tool. Once your content is clear and role-aligned, step away from AI.

Here are 10 practical prompts to strengthen specific sections of your bank manager resume:

- Sharpen your summary. "Rewrite my bank manager resume summary to highlight leadership scope, portfolio size, and key achievements in under four sentences."

- Quantify experience bullets. "Review my bank manager experience bullets and suggest where I can add specific metrics like revenue growth, team size, or loan volume."

- Align skills strategically. "Compare my bank manager skills section against this job description and recommend missing hard or soft skills I should include."

- Strengthen action verbs. "Replace weak or repeated verbs in my bank manager experience section with strong, specific action verbs tied to banking operations."

- Tighten project descriptions. "Edit my bank manager project descriptions to emphasize measurable outcomes, stakeholder impact, and timeline efficiency."

- Refine education details. "Suggest how to format my bank manager education section to highlight relevant coursework, honors, or financial certifications."

- Improve certification visibility. "Reorganize my bank manager certifications section so the most role-relevant credentials appear first with issuing bodies and dates."

- Remove filler language. "Identify and remove vague or redundant phrases across my entire bank manager resume without losing important details."

- Target compliance experience. "Rewrite my bank manager experience bullets to better reflect regulatory compliance, audit readiness, and risk management contributions."

- Tailor for ATS clarity. "Restructure my bank manager resume formatting and keyword usage to improve readability by applicant tracking systems."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong bank manager resume highlights measurable outcomes, role-specific skills, and a clear structure. Use metrics to show growth, risk control, service improvements, and team performance. Keep sections clean, consistent, and easy to scan.

This approach shows you’re ready for today’s hiring market and near-future expectations. Your bank manager resume should connect results to leadership, compliance, lending, and operations. With a focused format, hiring teams can quickly see your fit.