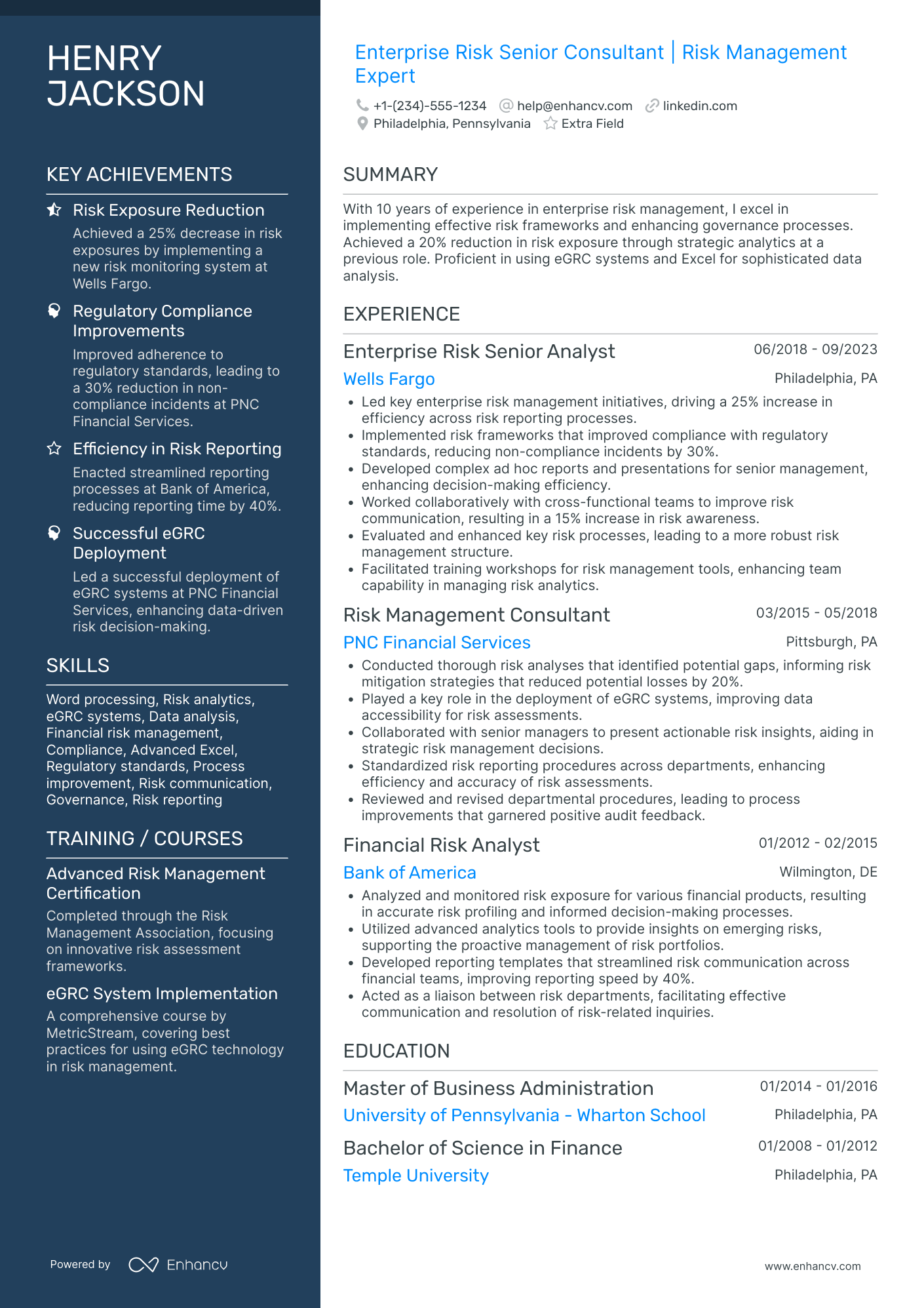

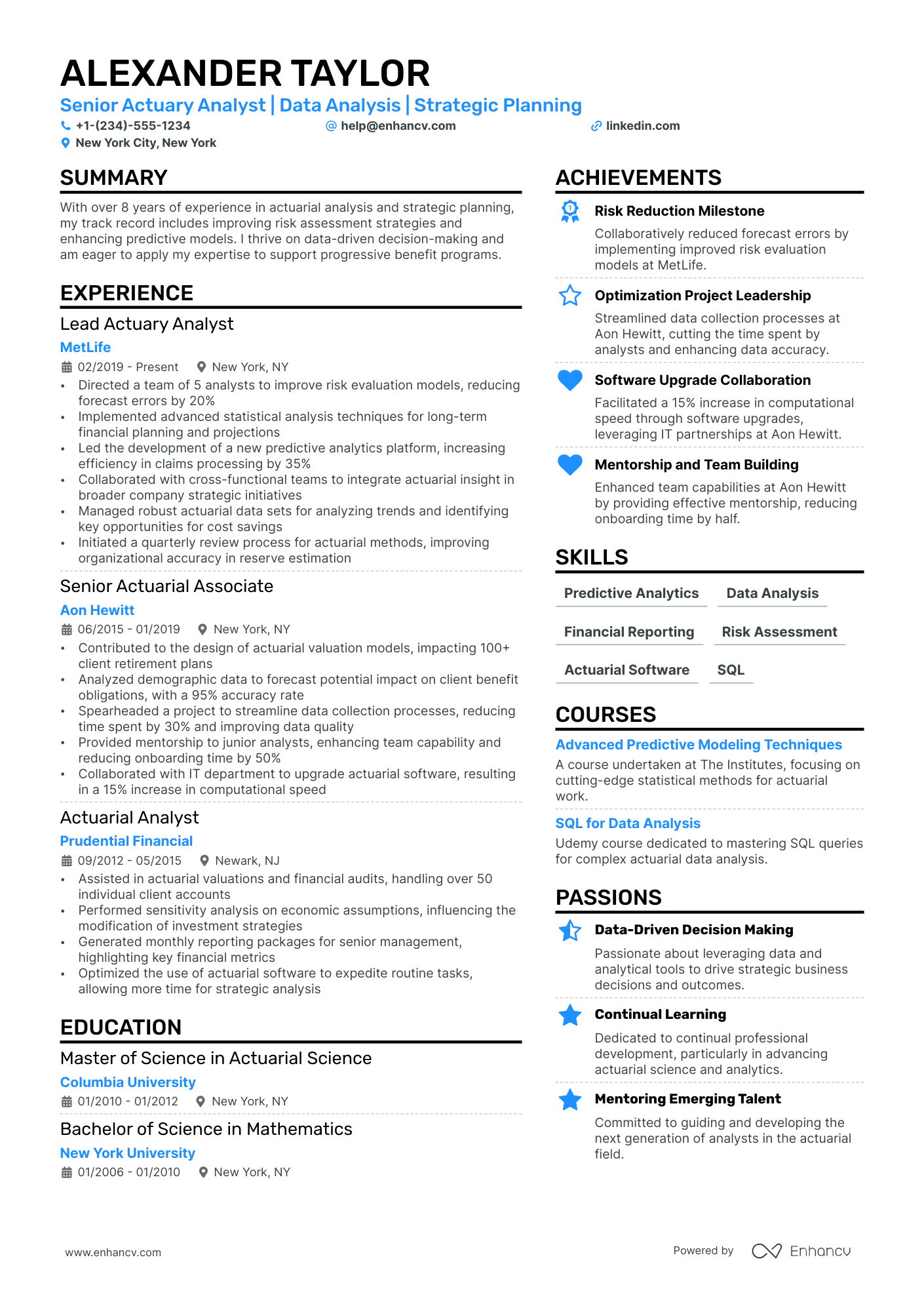

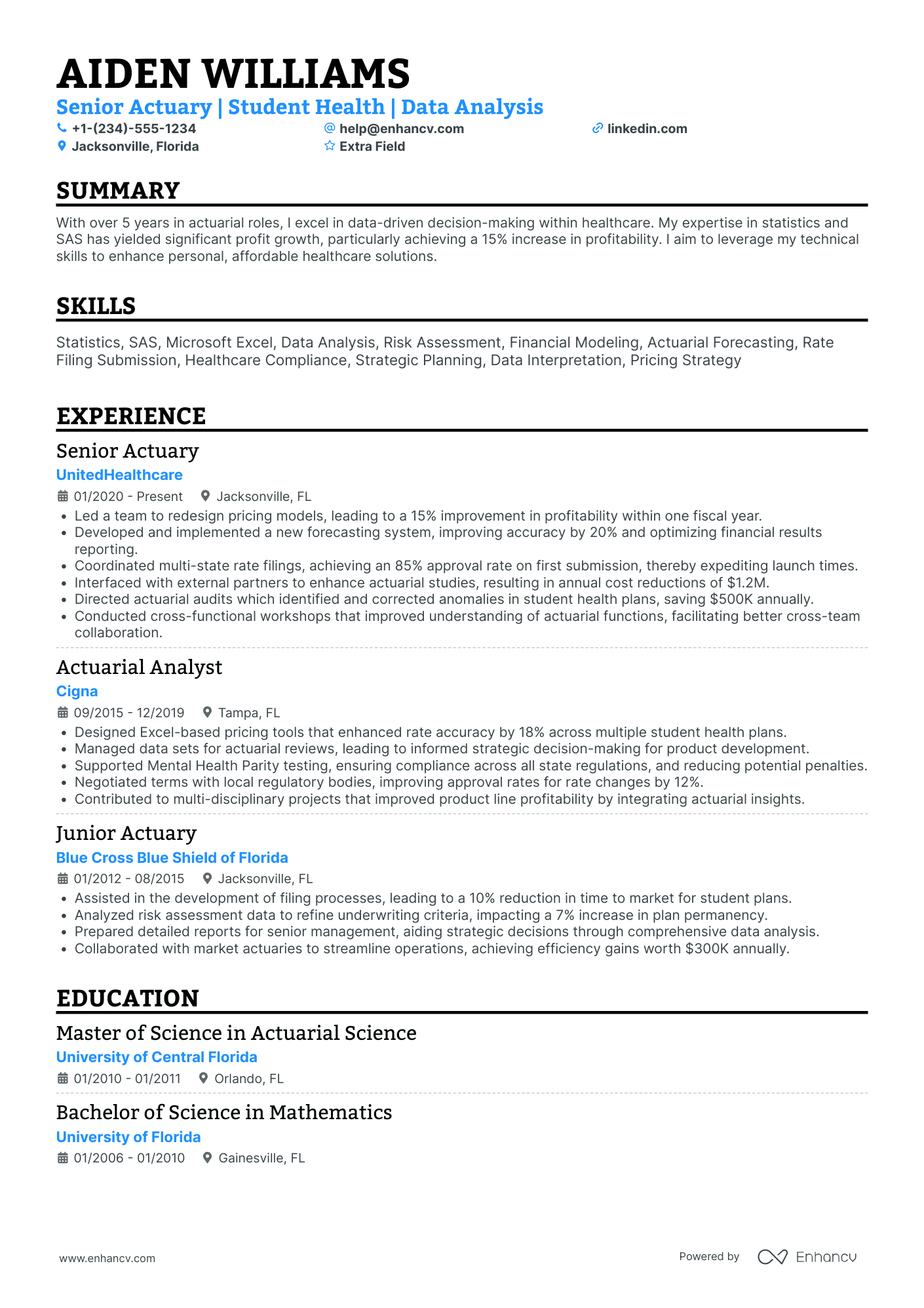

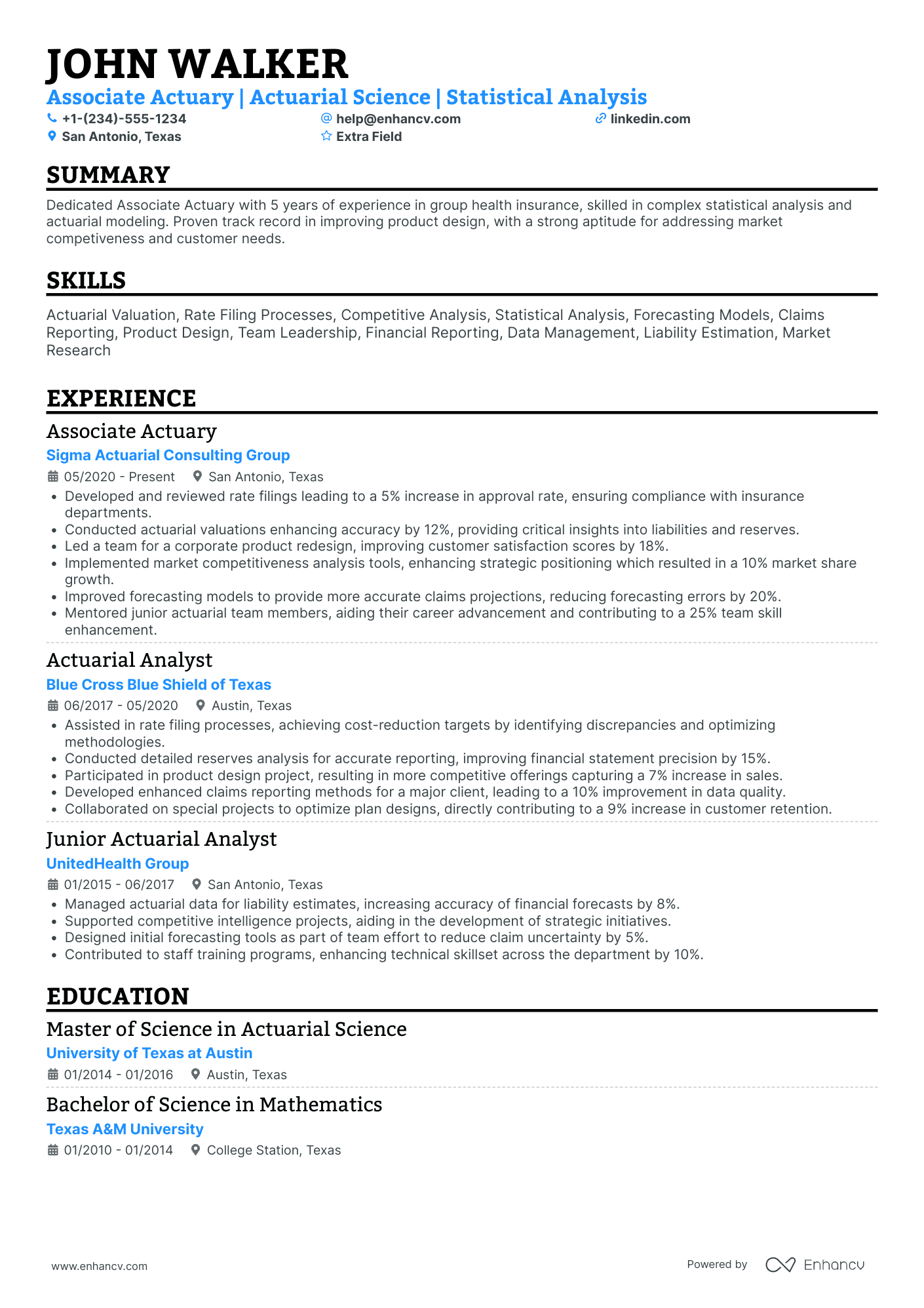

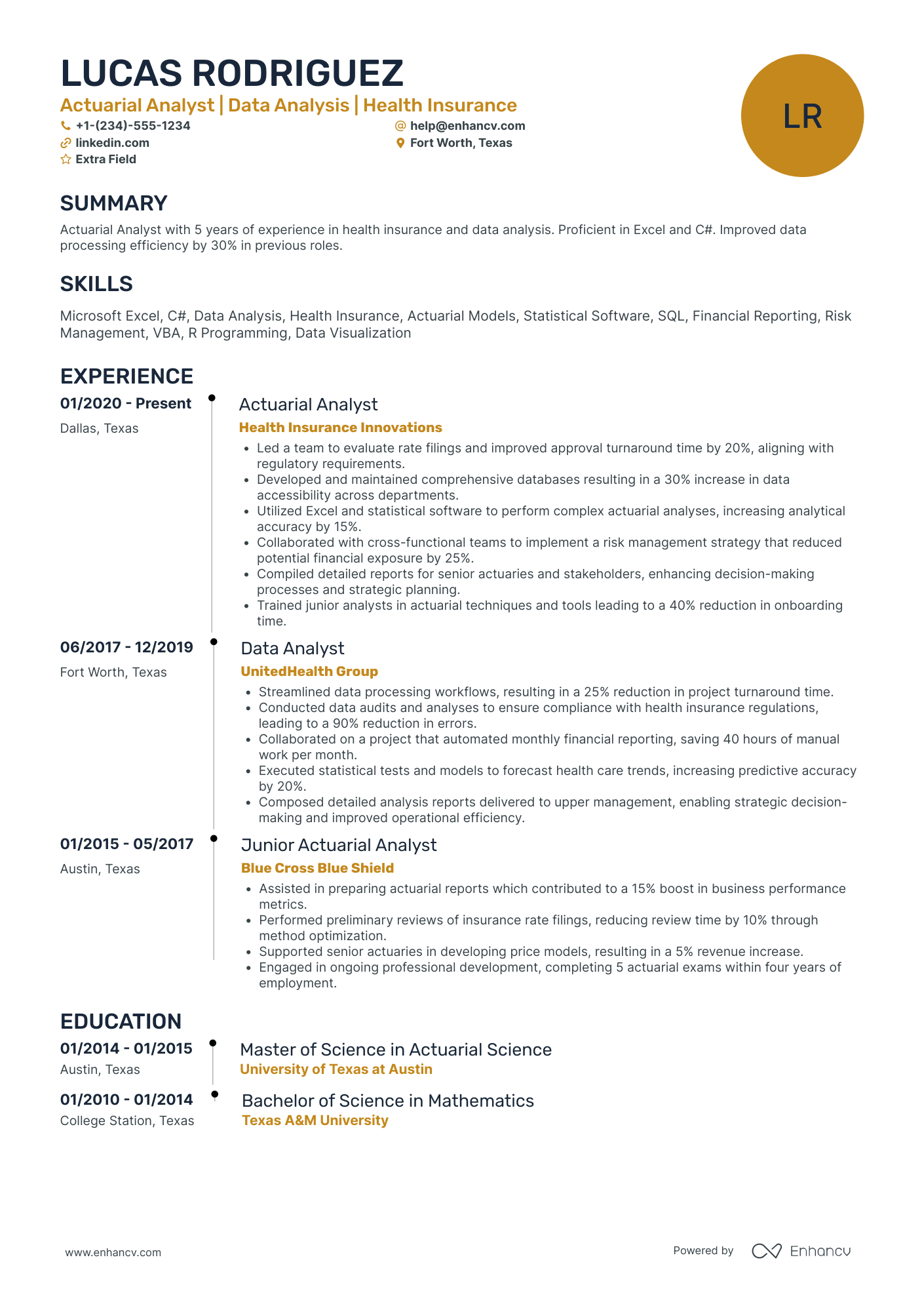

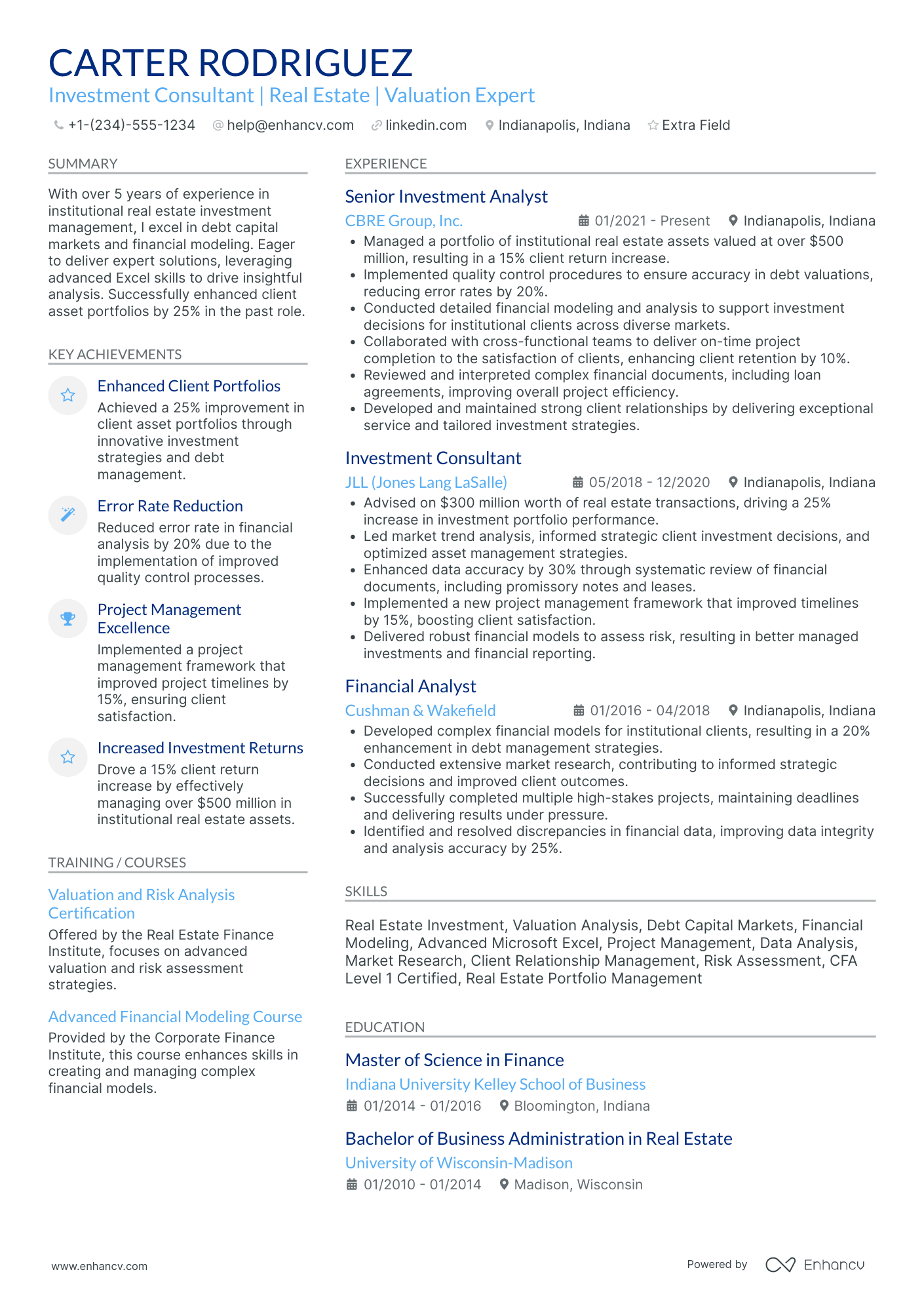

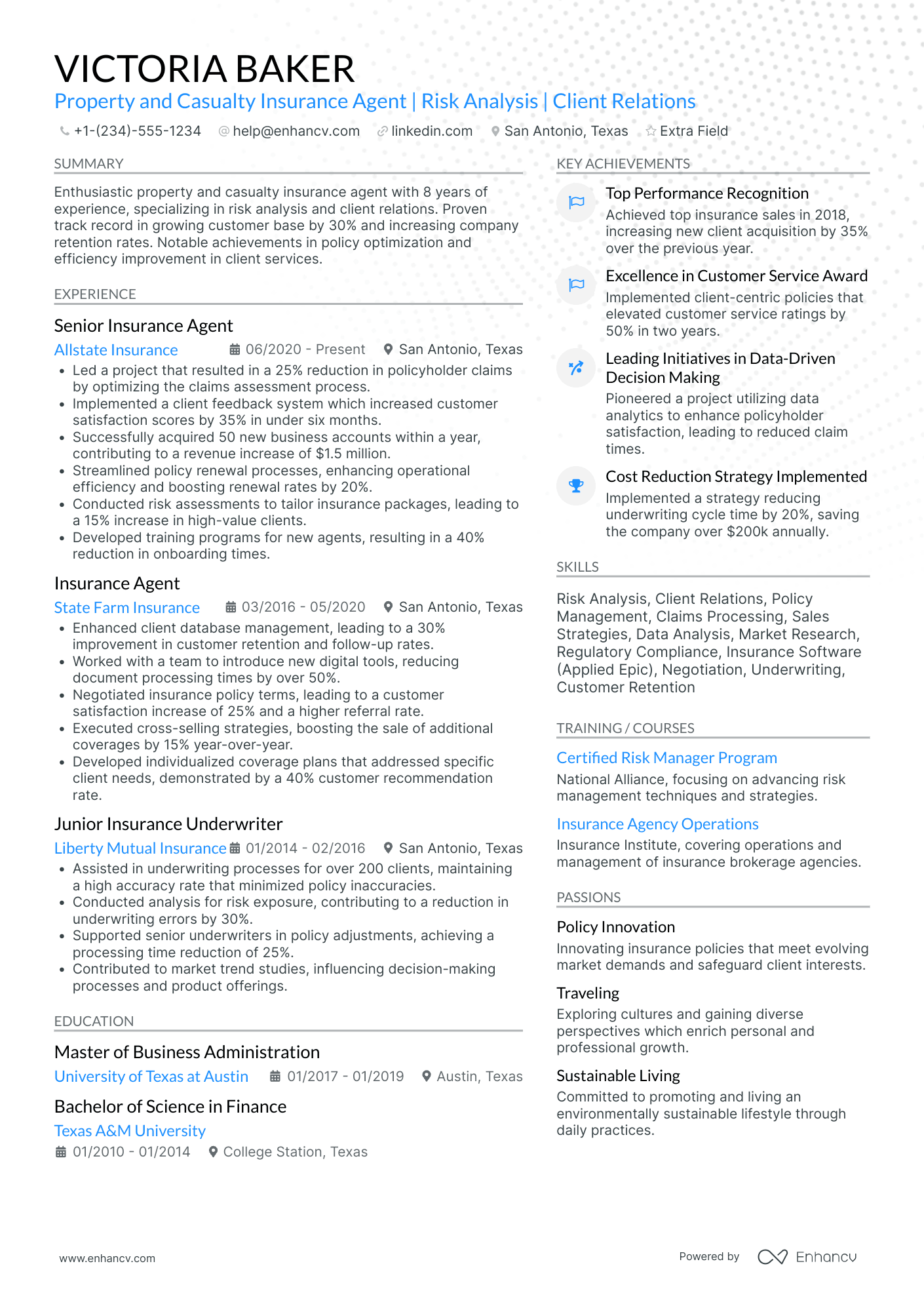

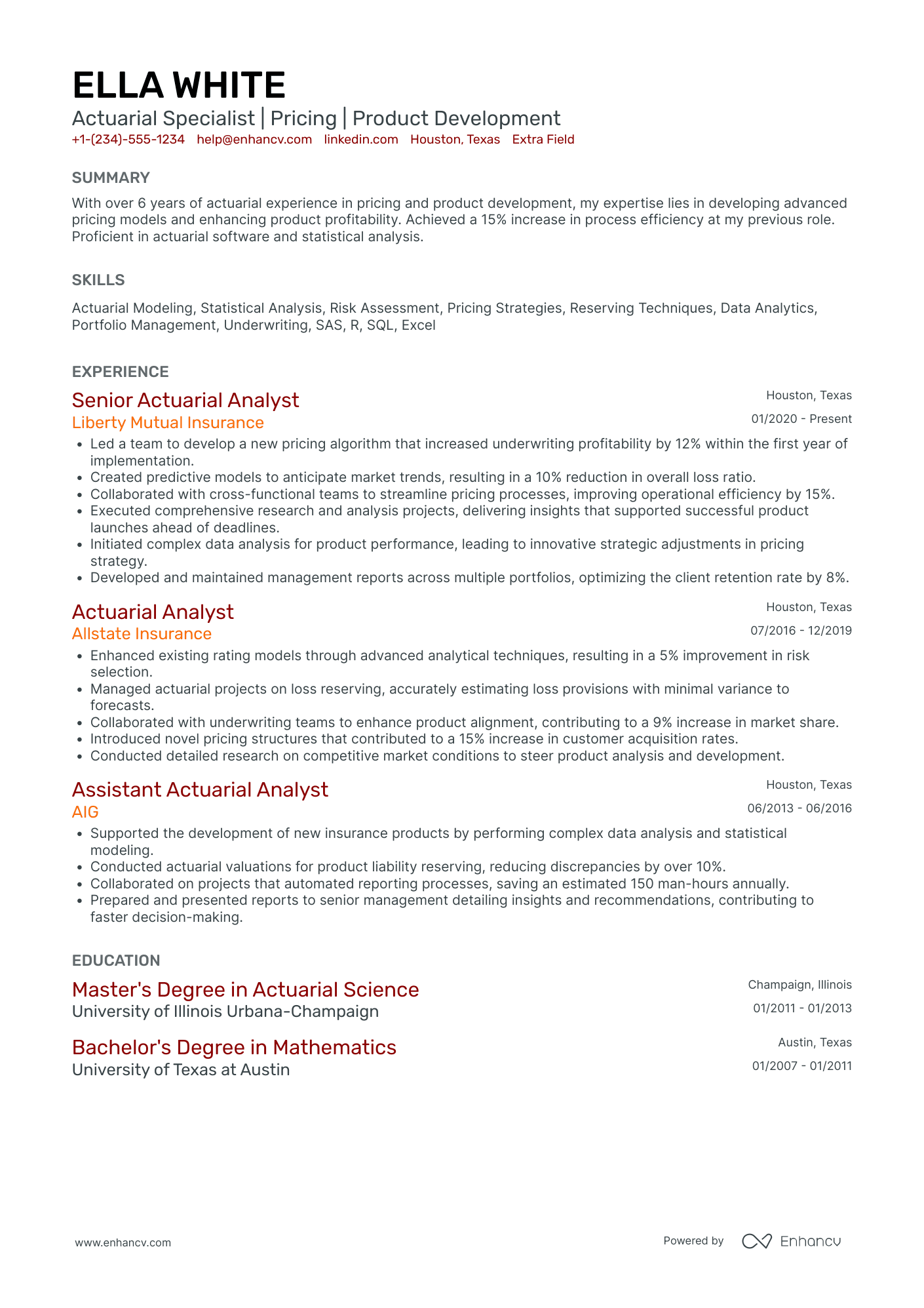

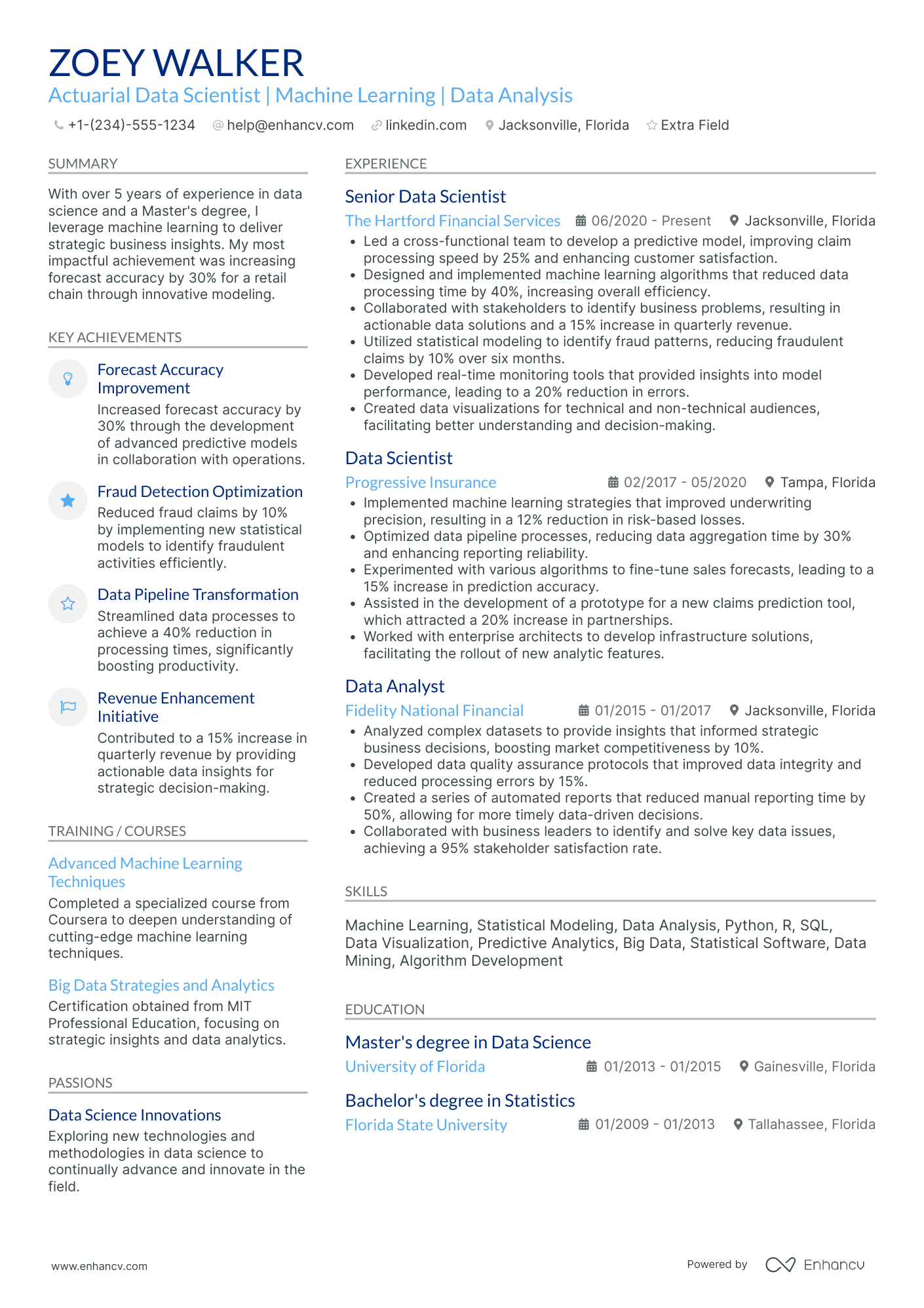

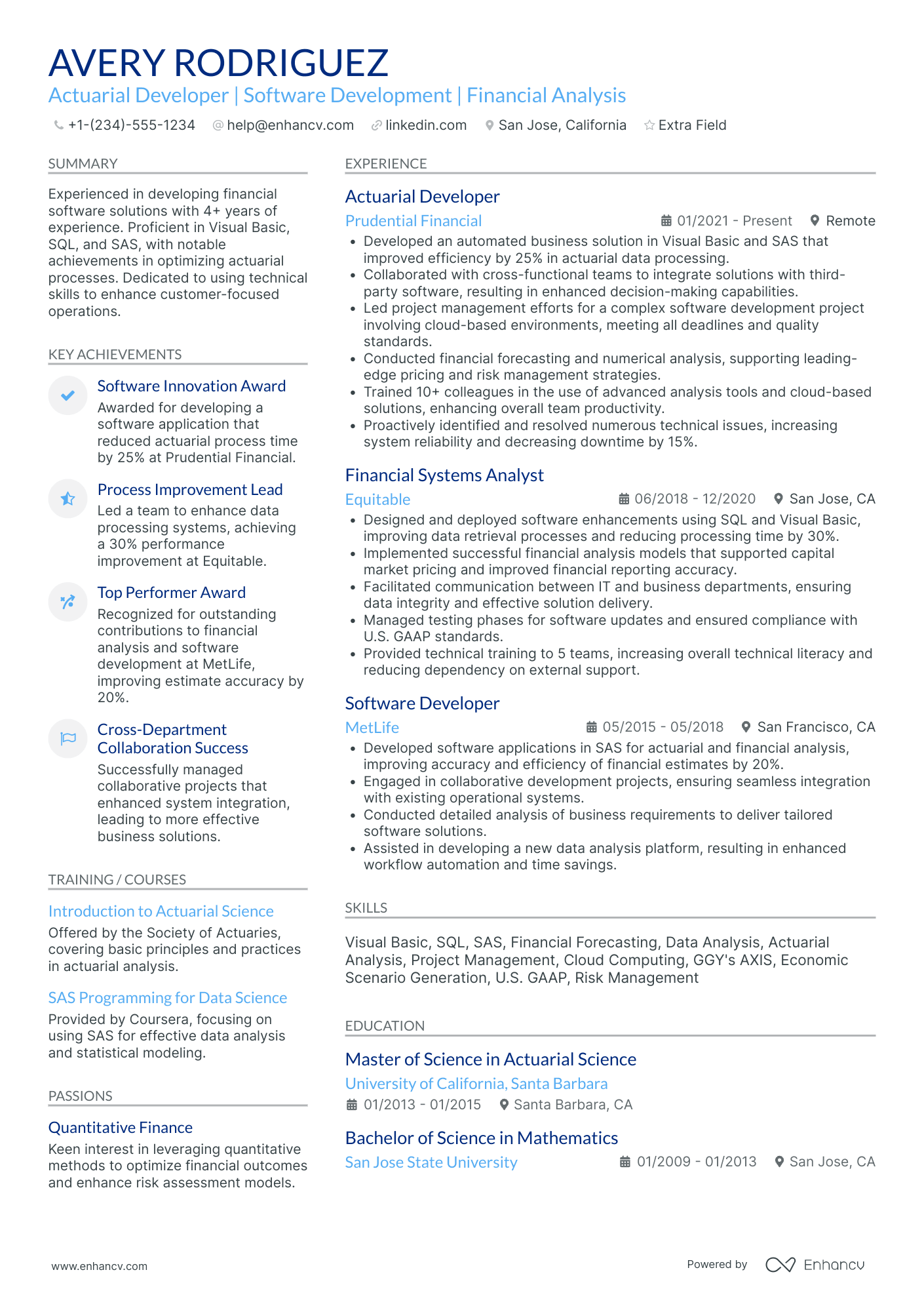

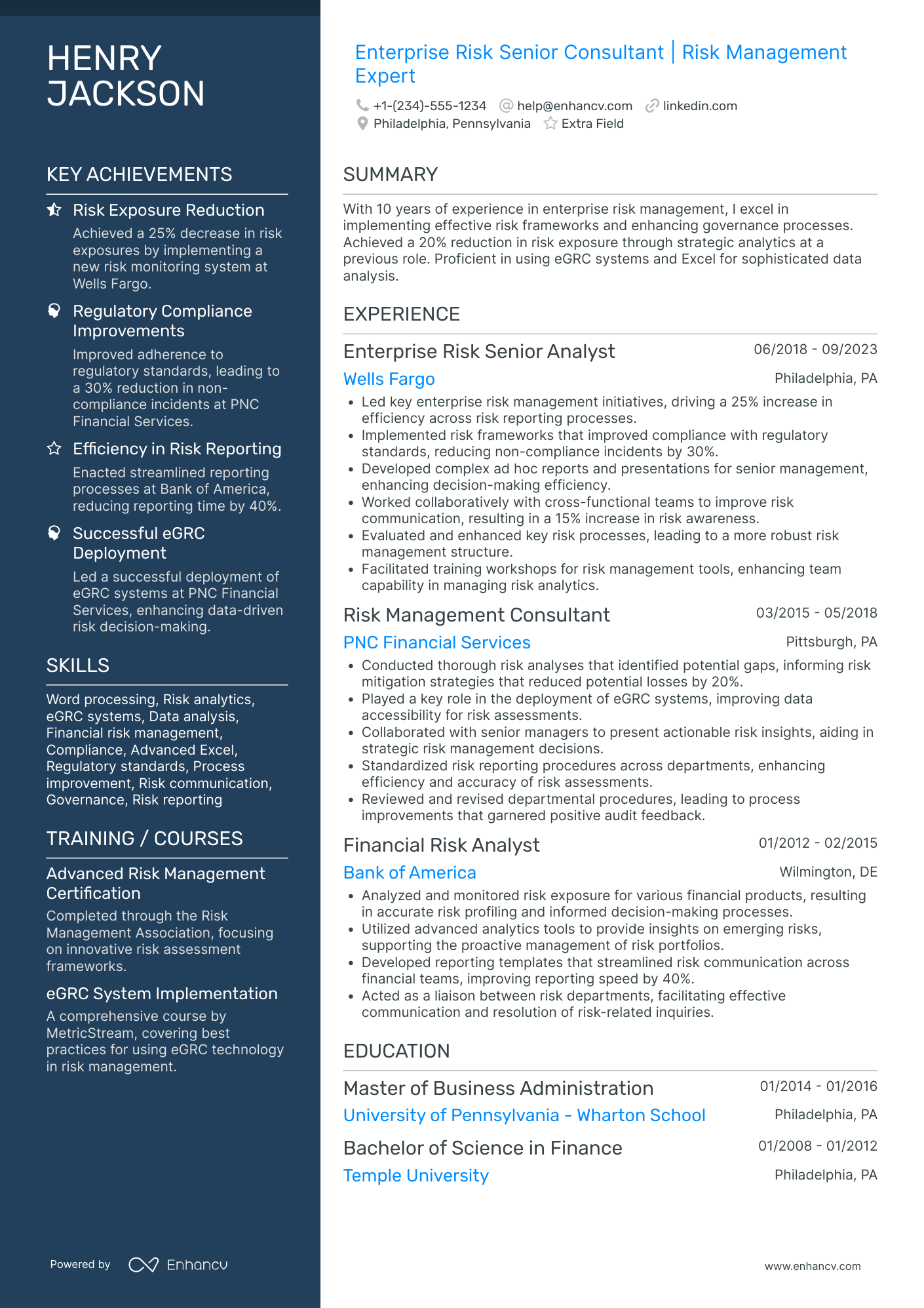

Actuaries often struggle to effectively communicate their complex analytical skills and technical expertise on a resume. Our resume examples demonstrate how to concisely showcase these skills in a compelling and understandable way. Dive into the examples section to see how you can enhance your own resume.

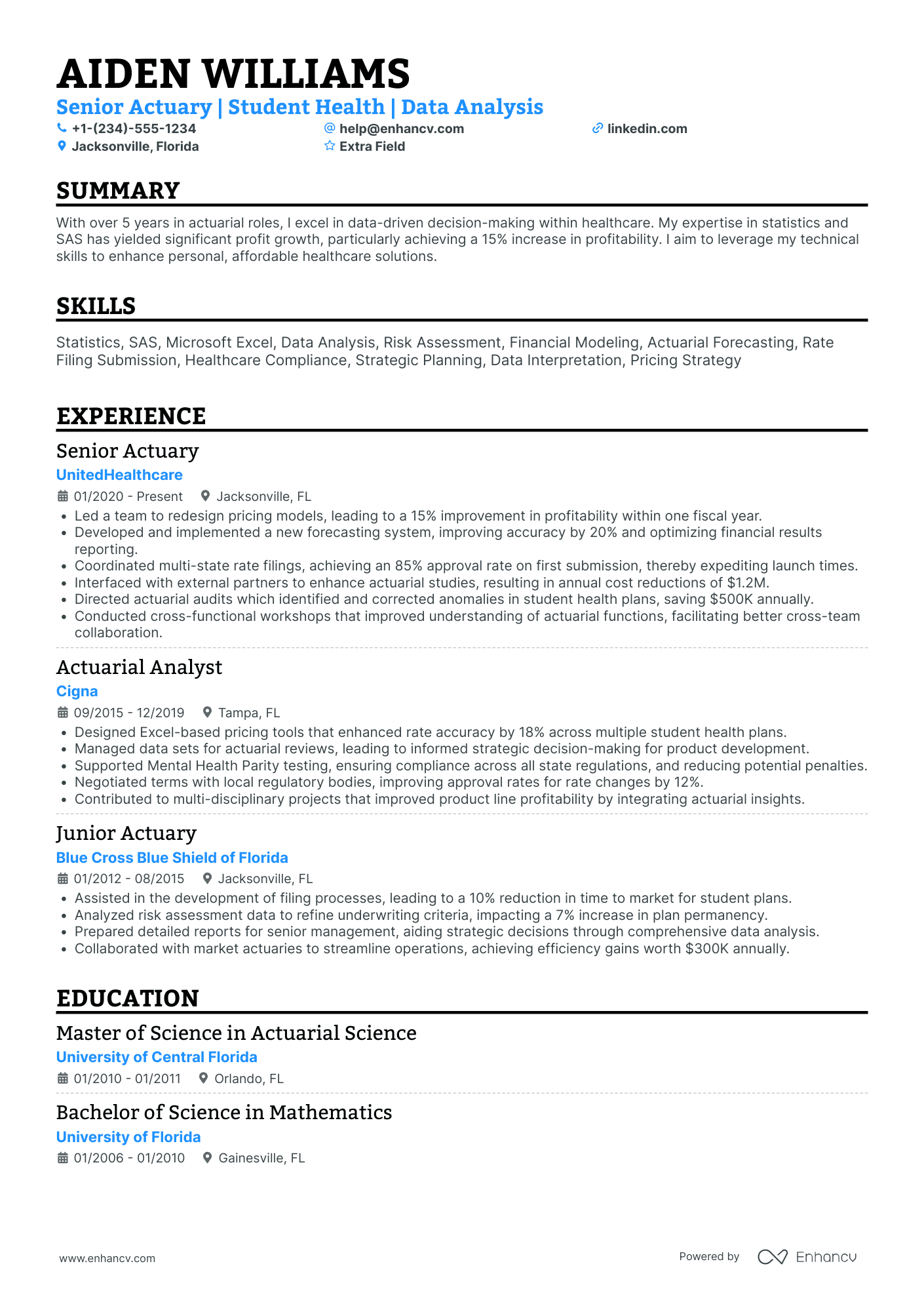

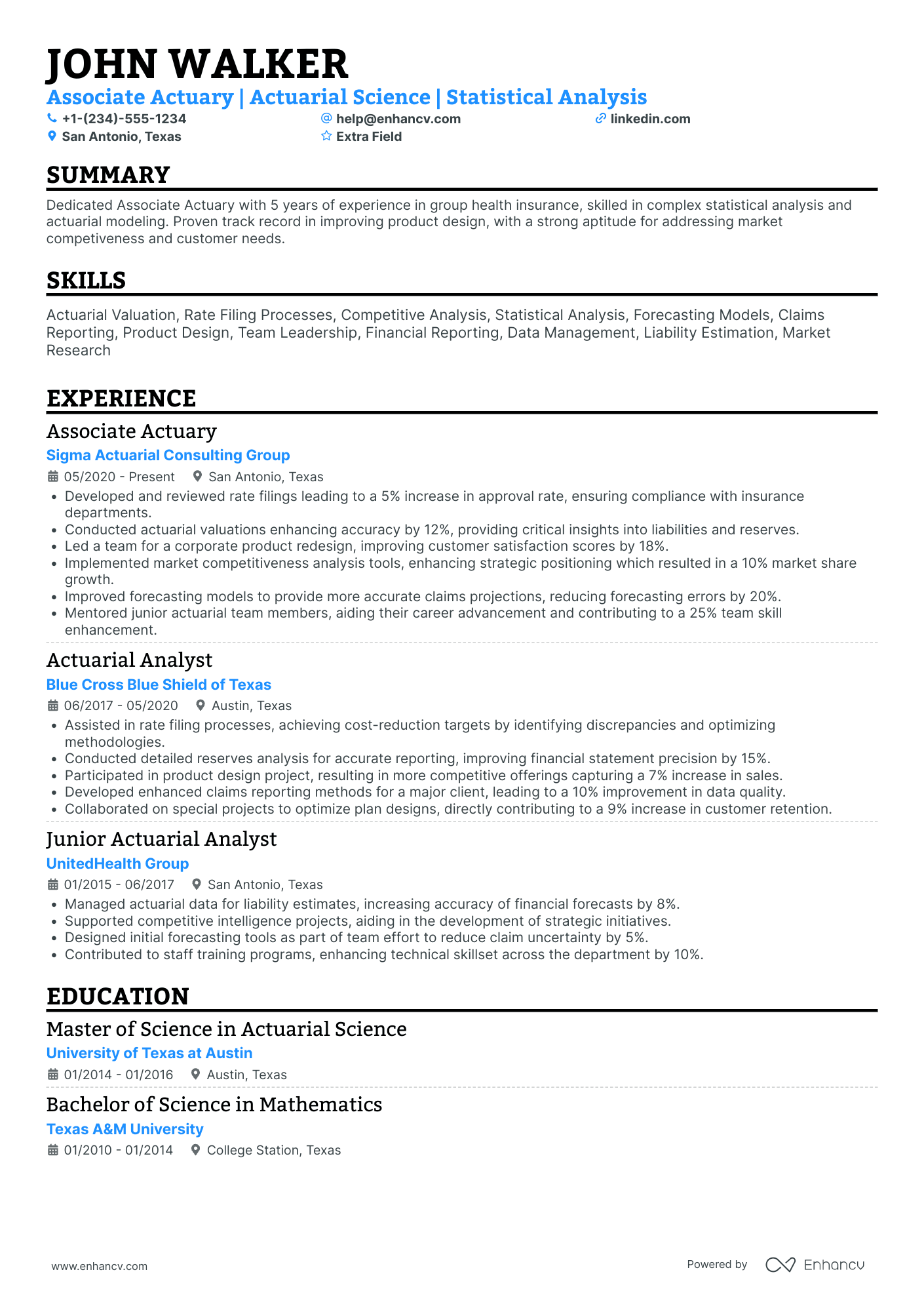

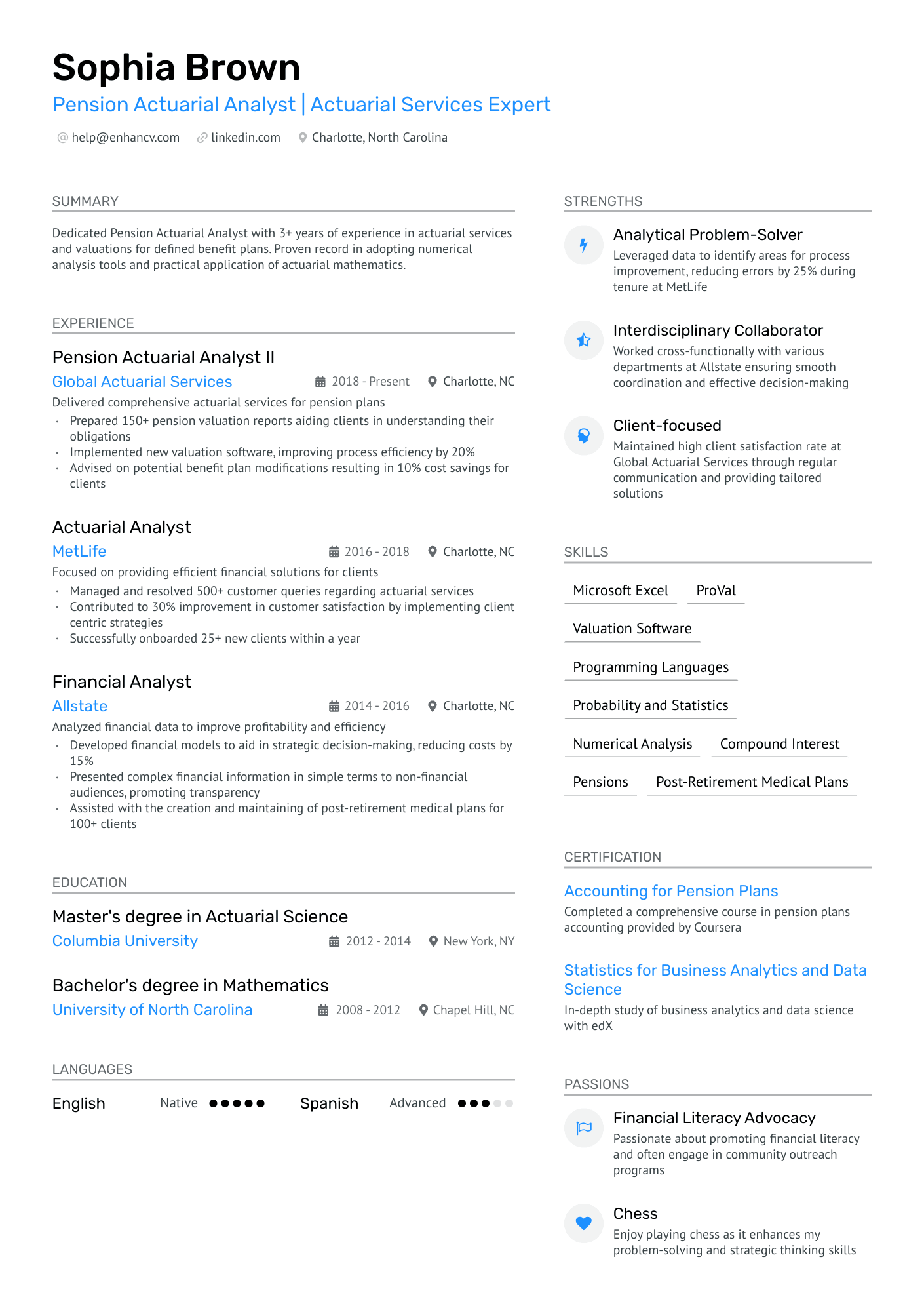

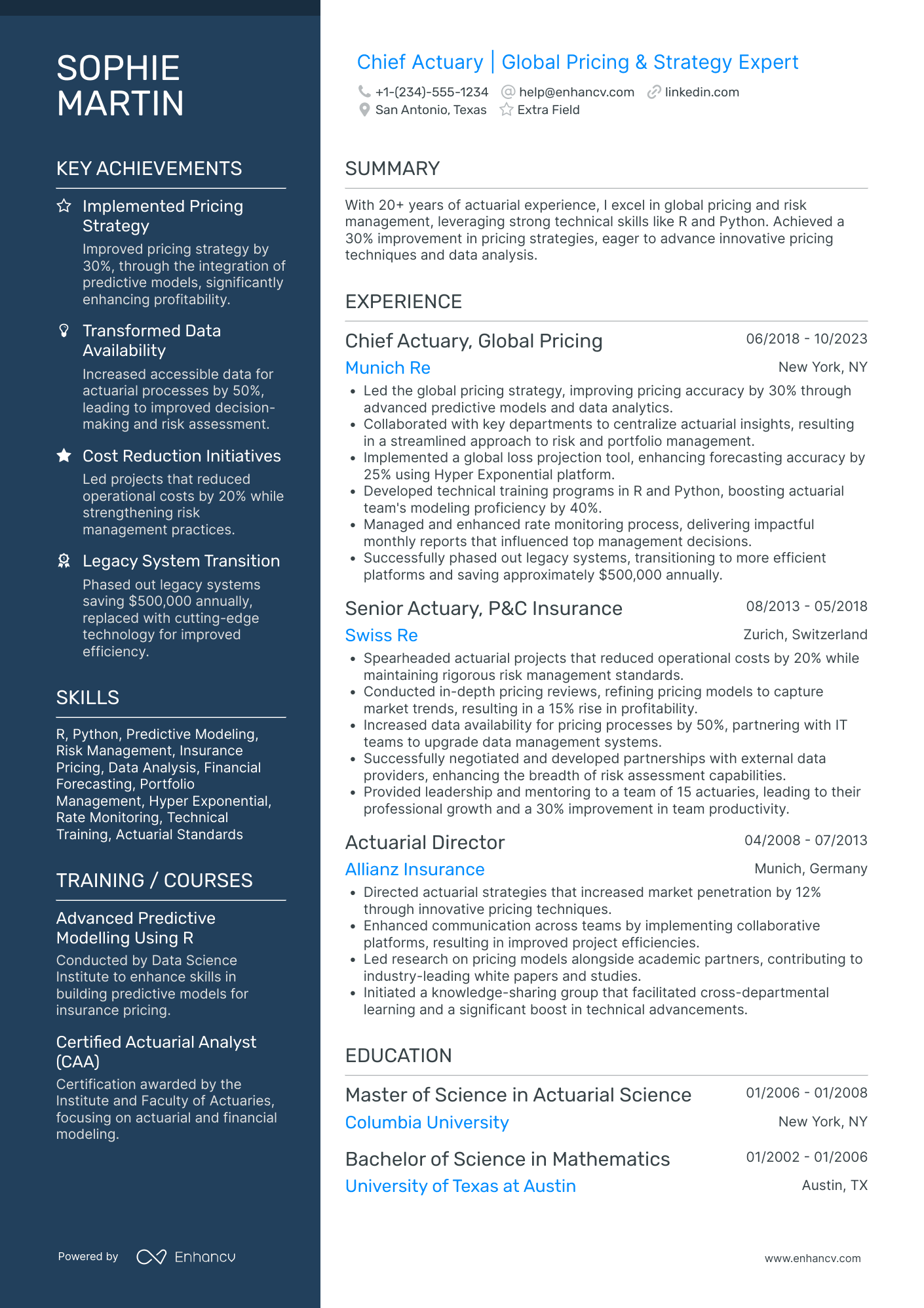

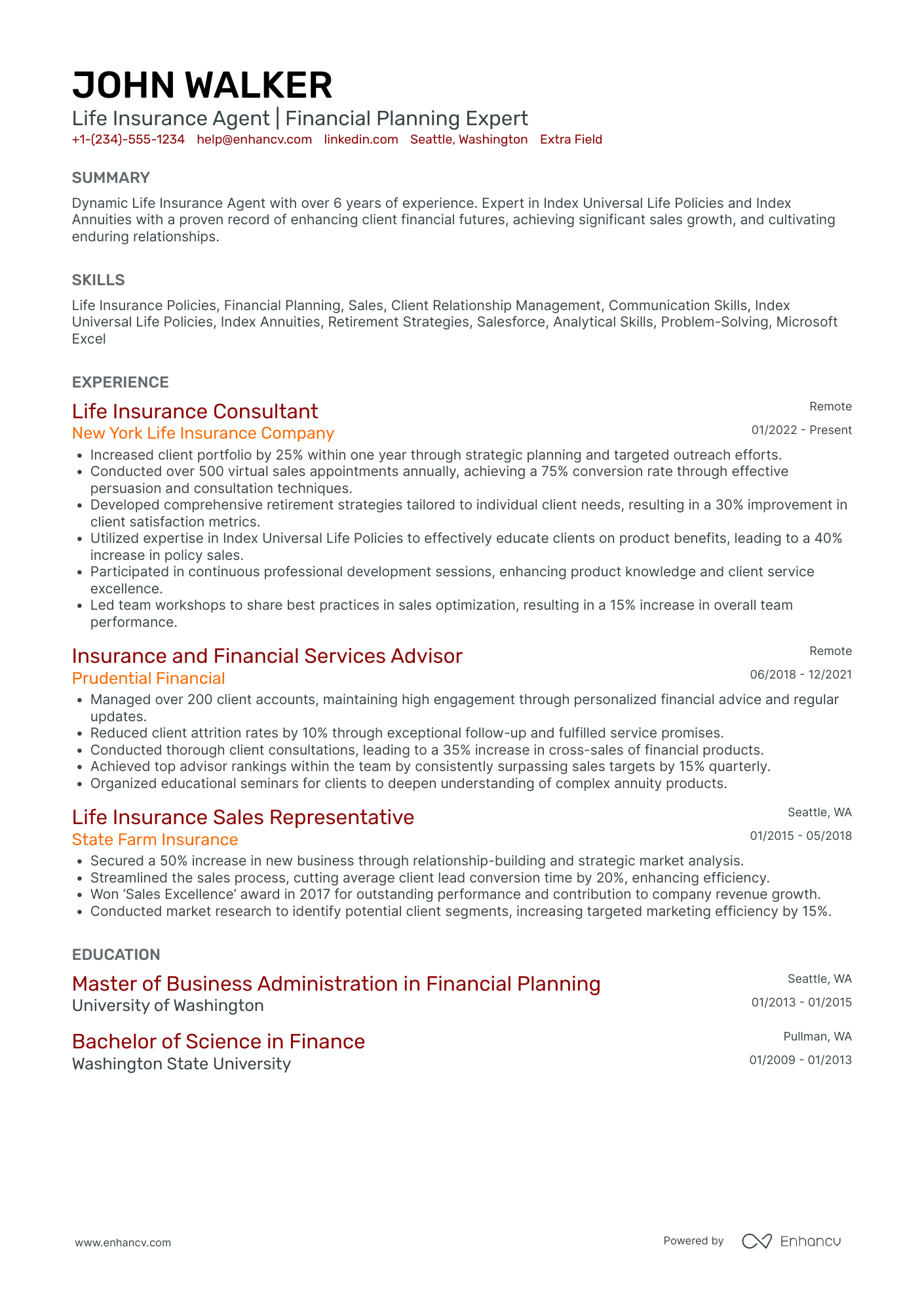

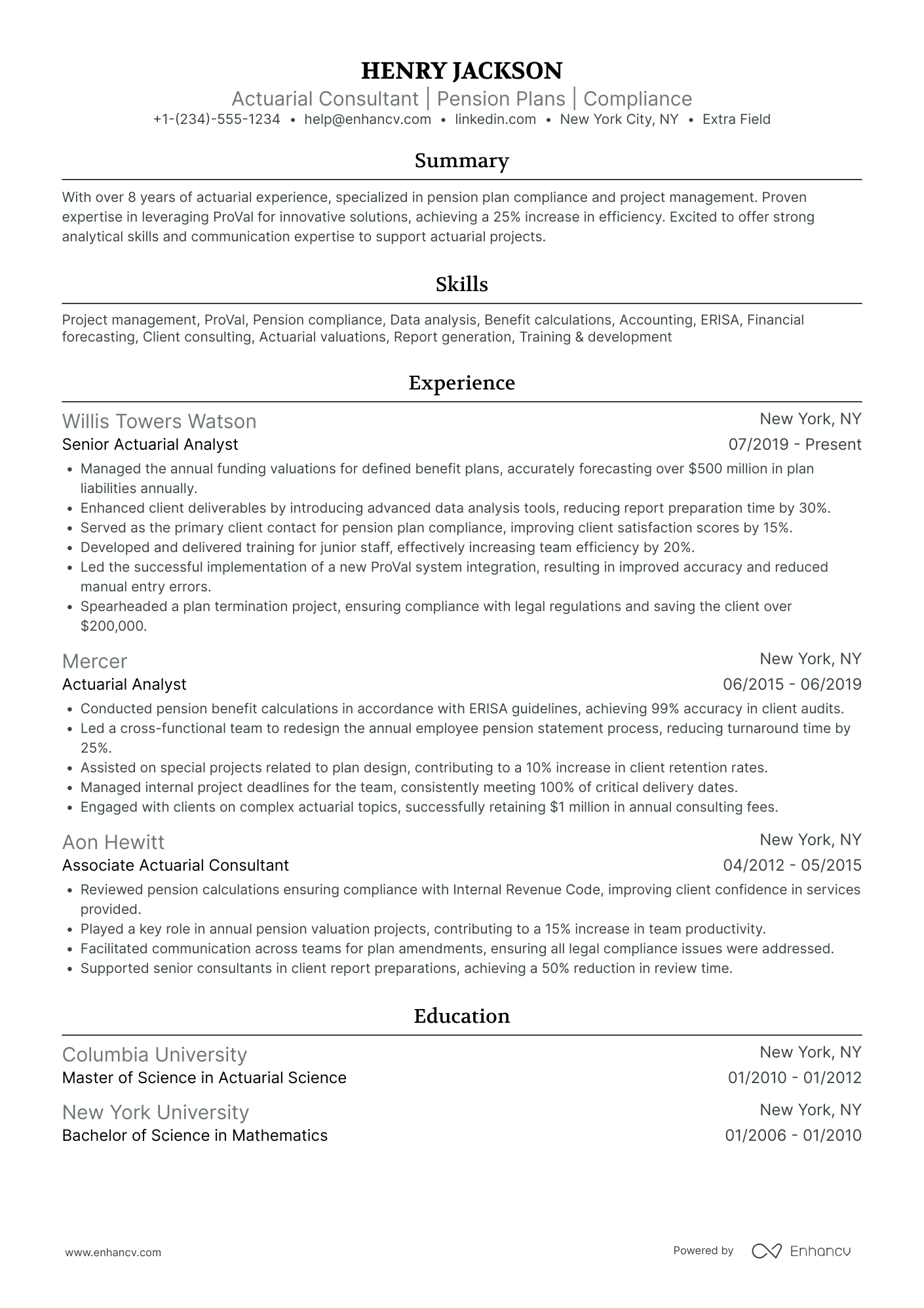

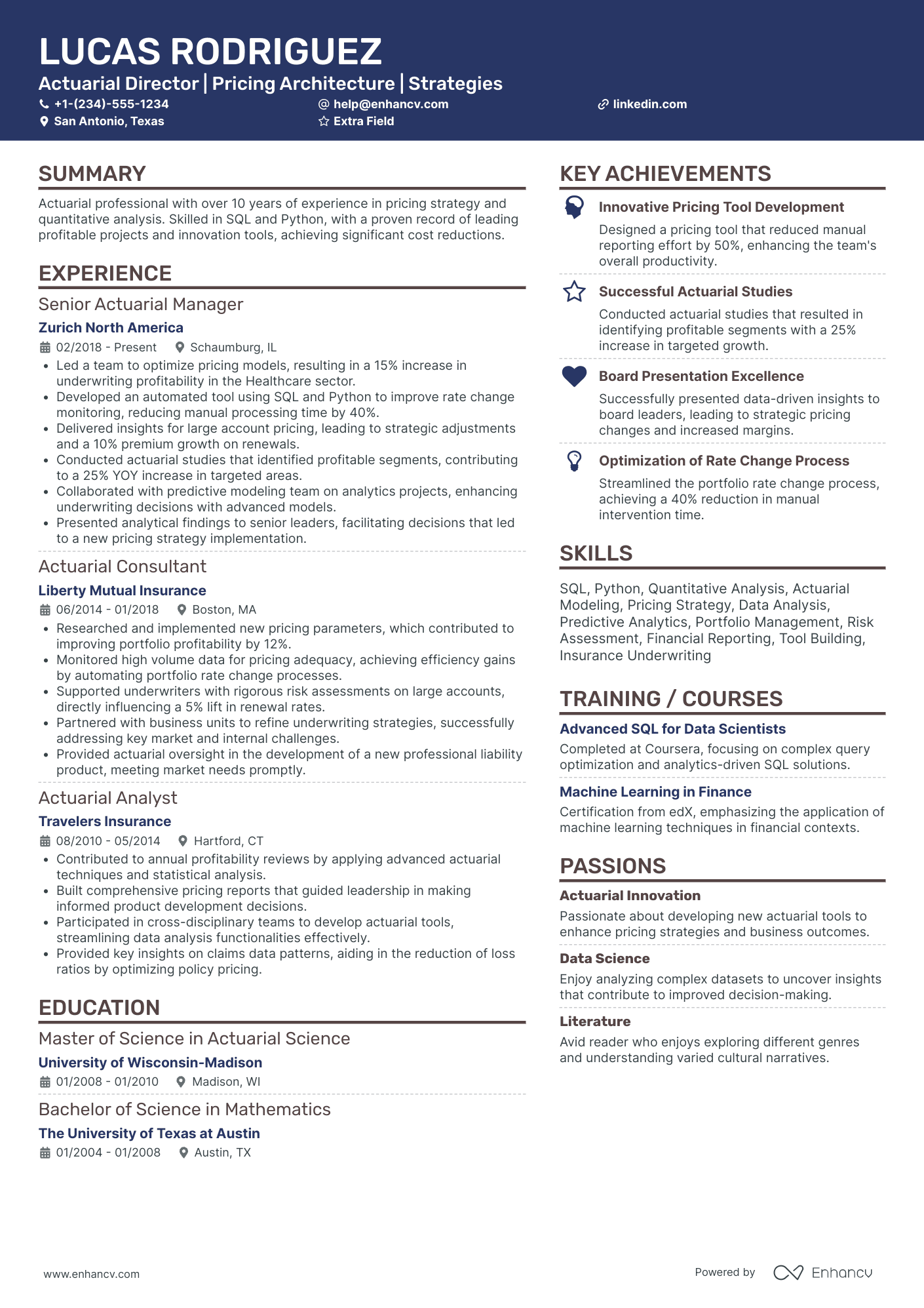

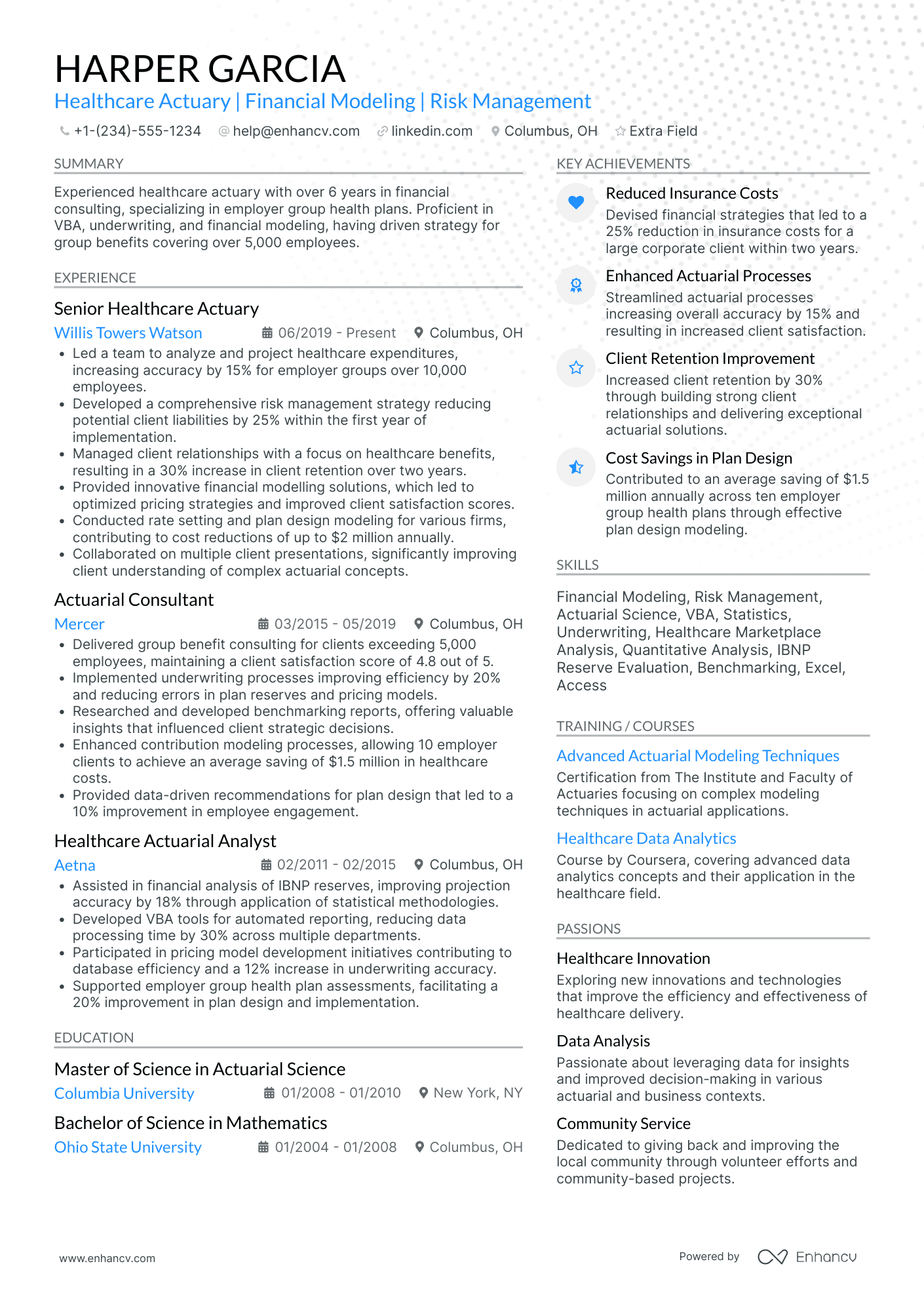

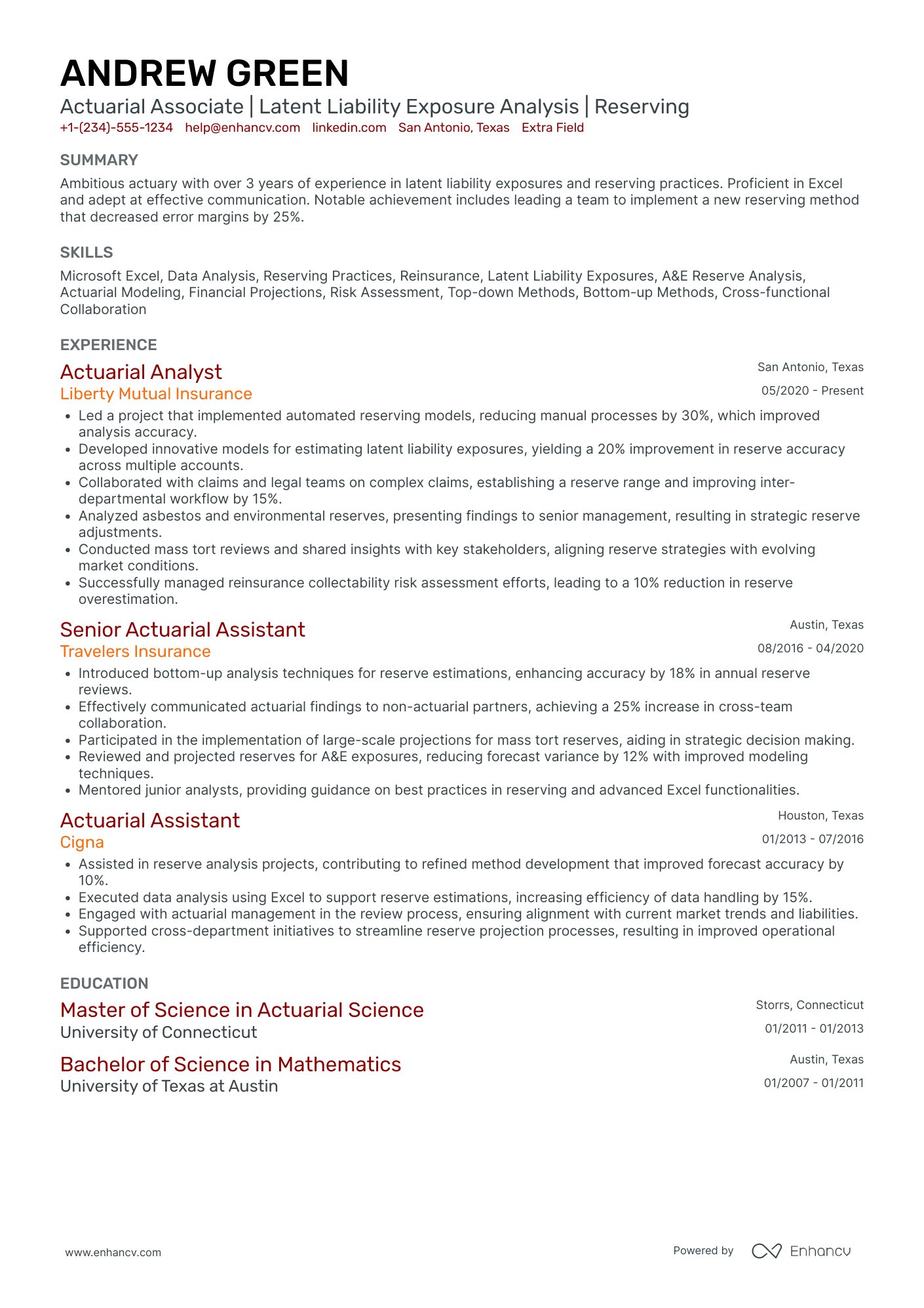

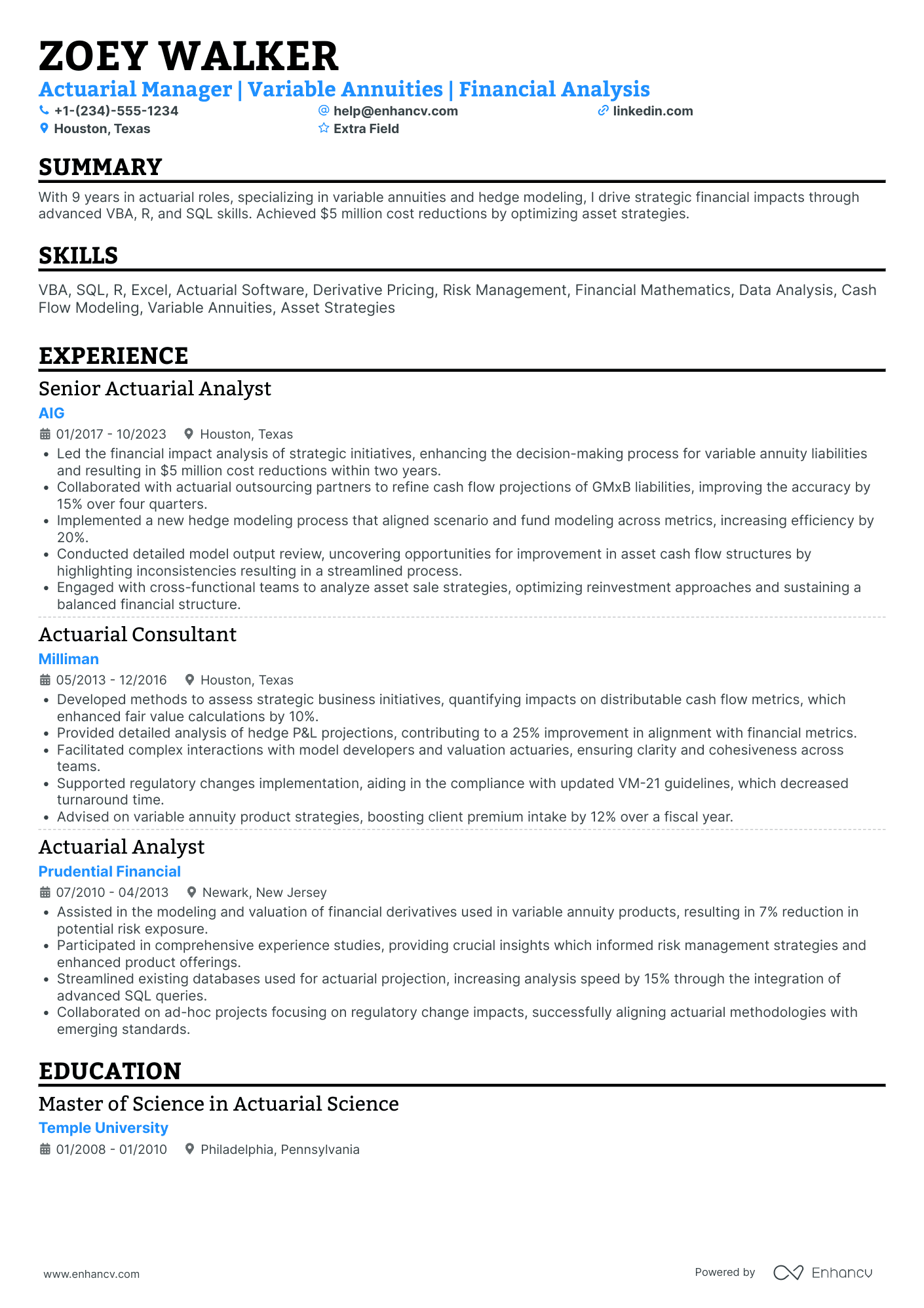

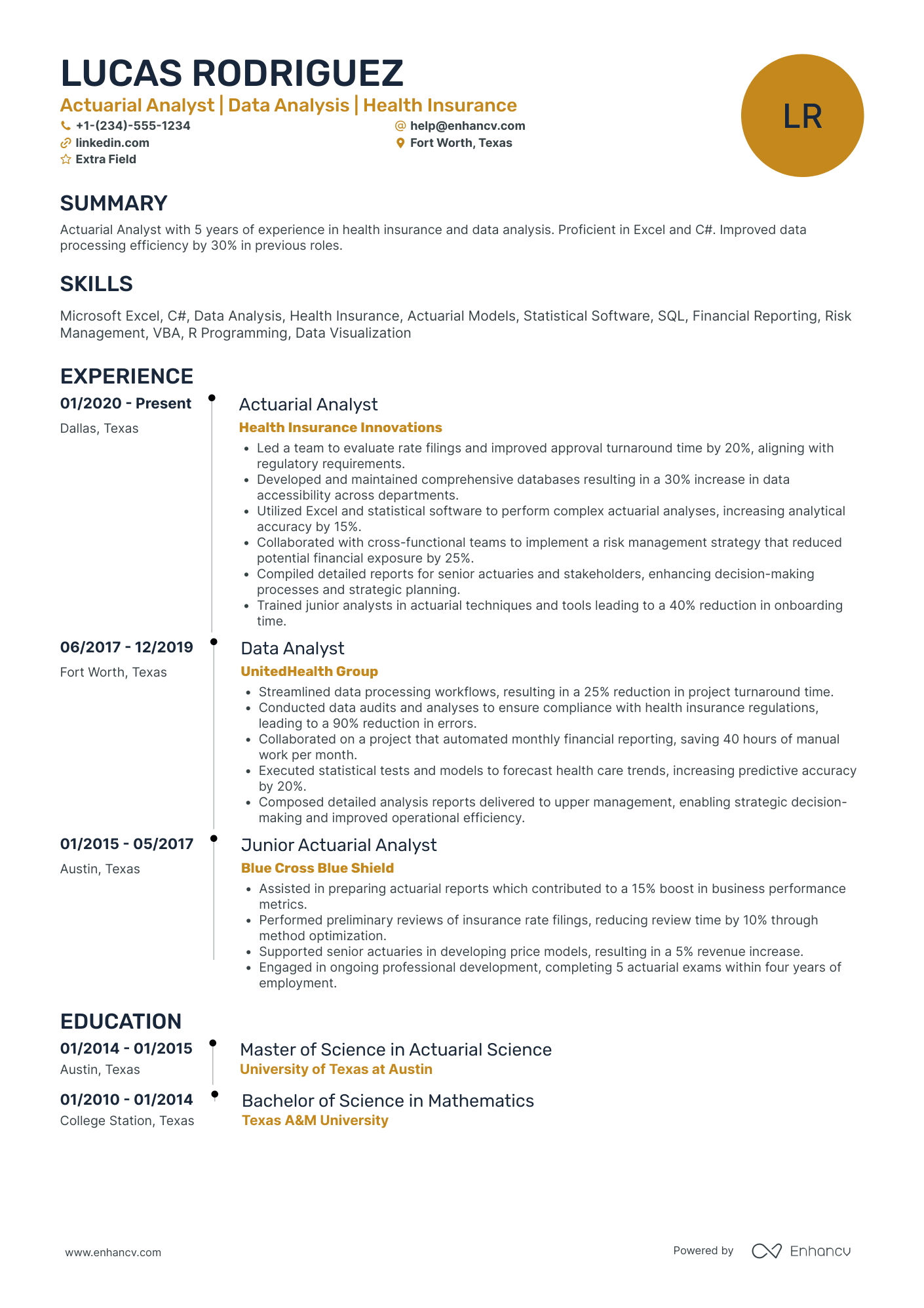

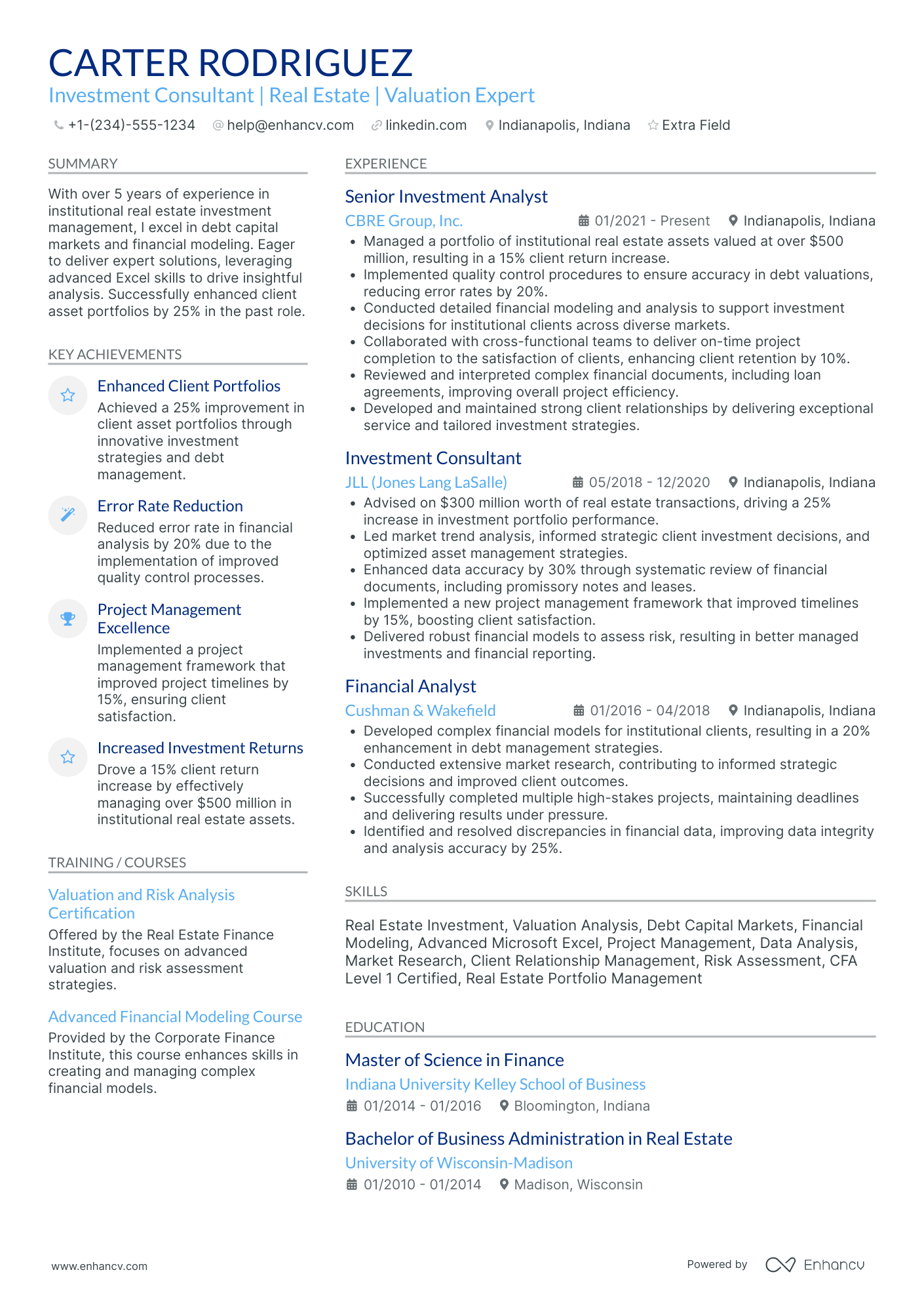

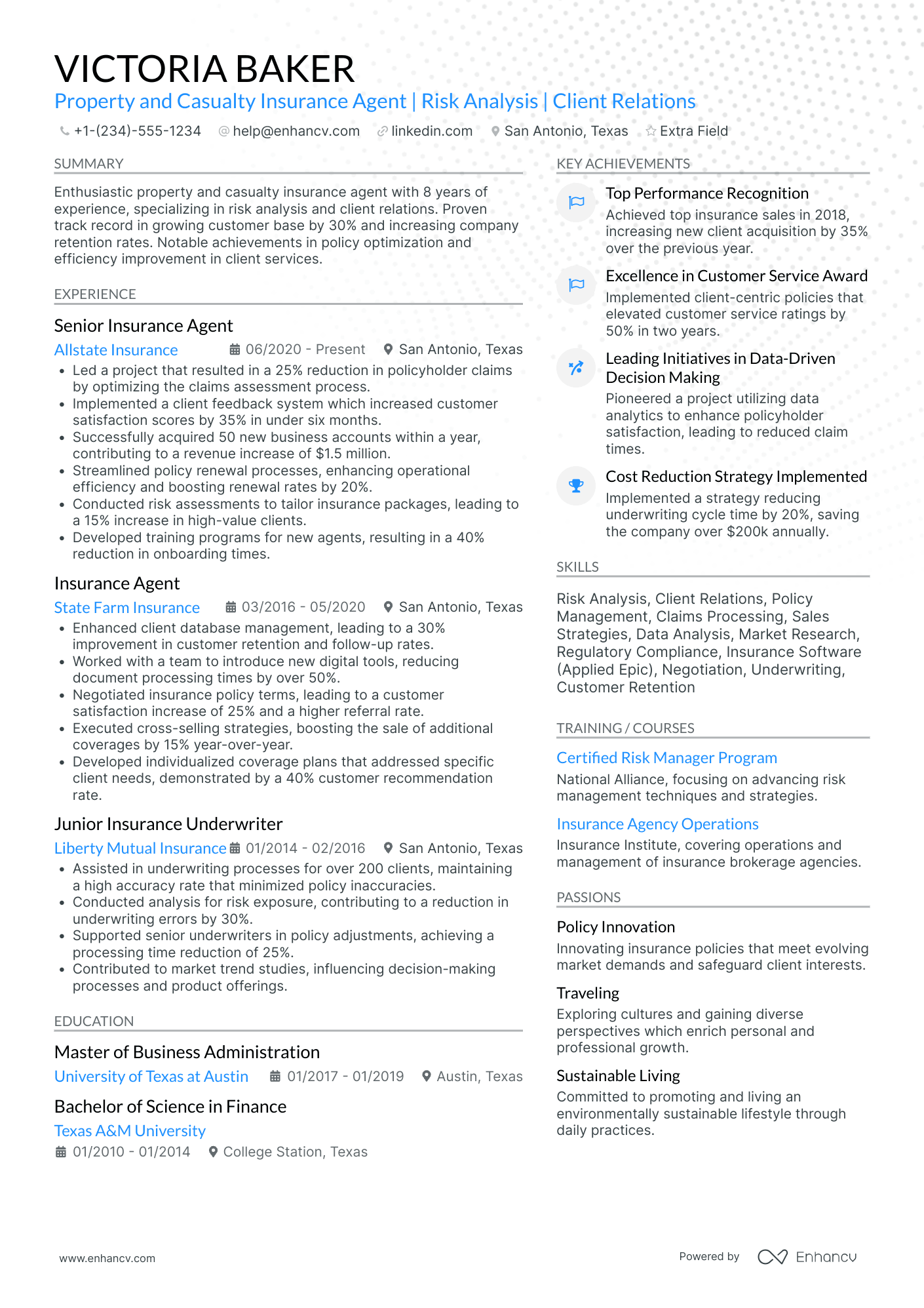

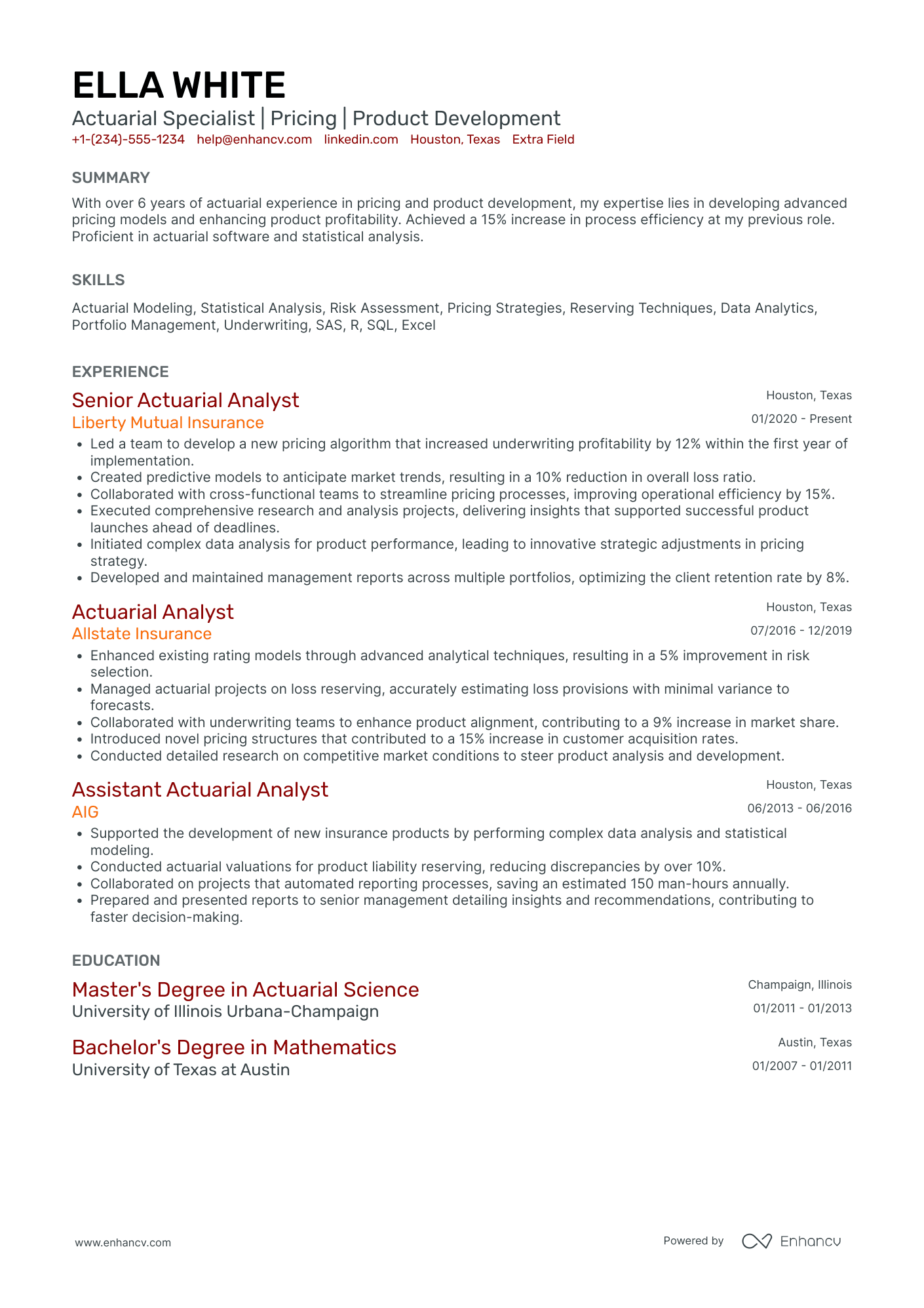

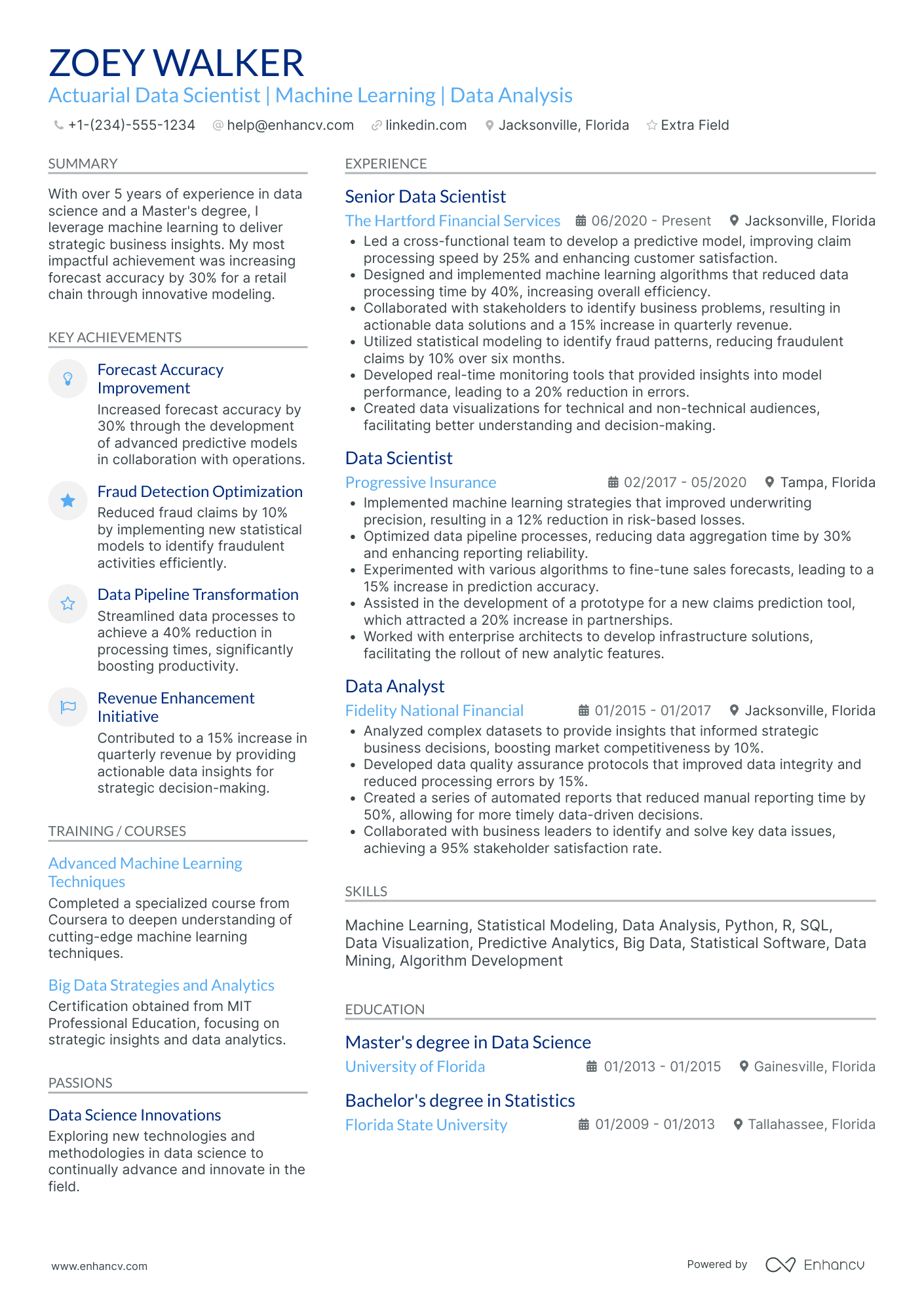

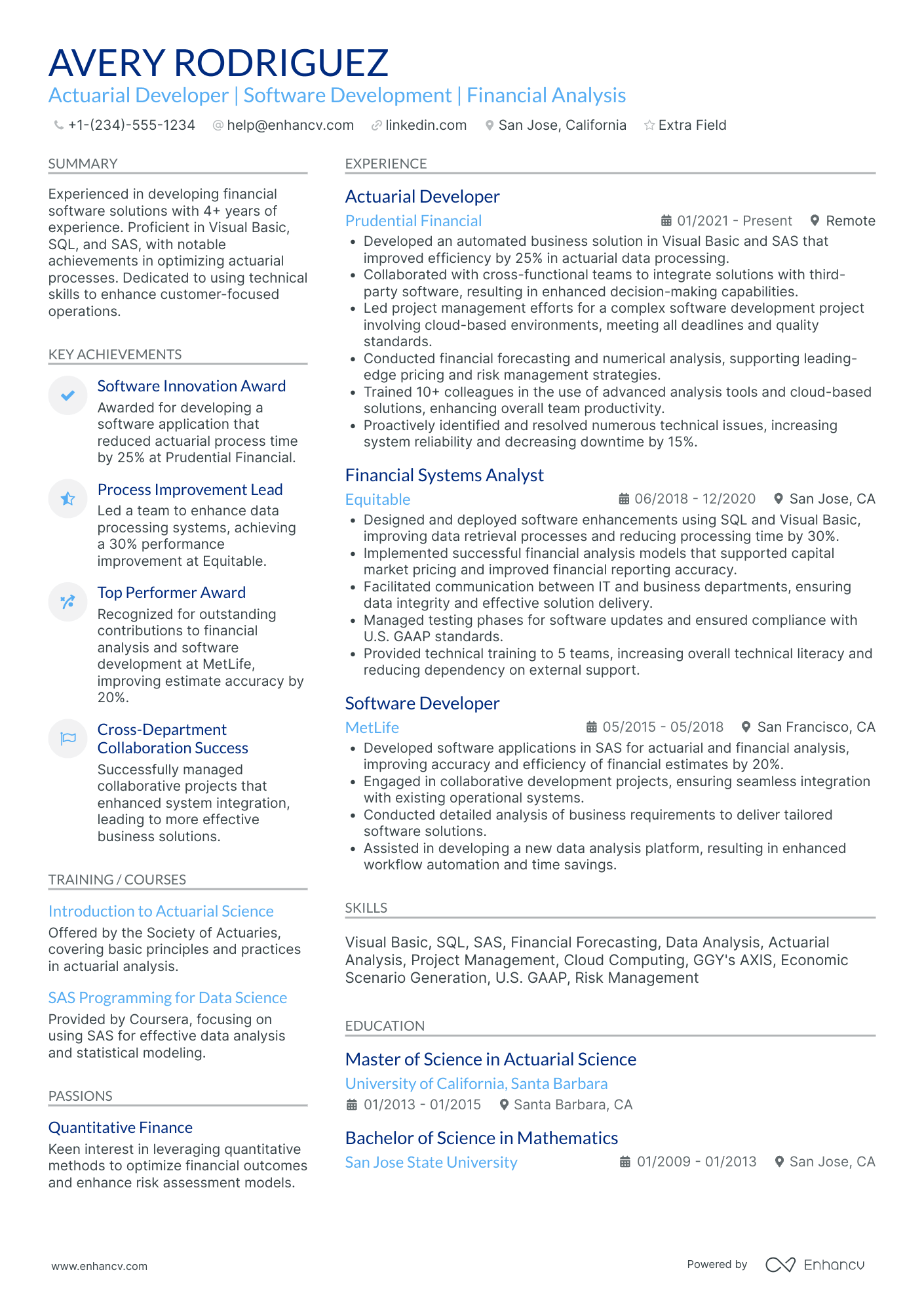

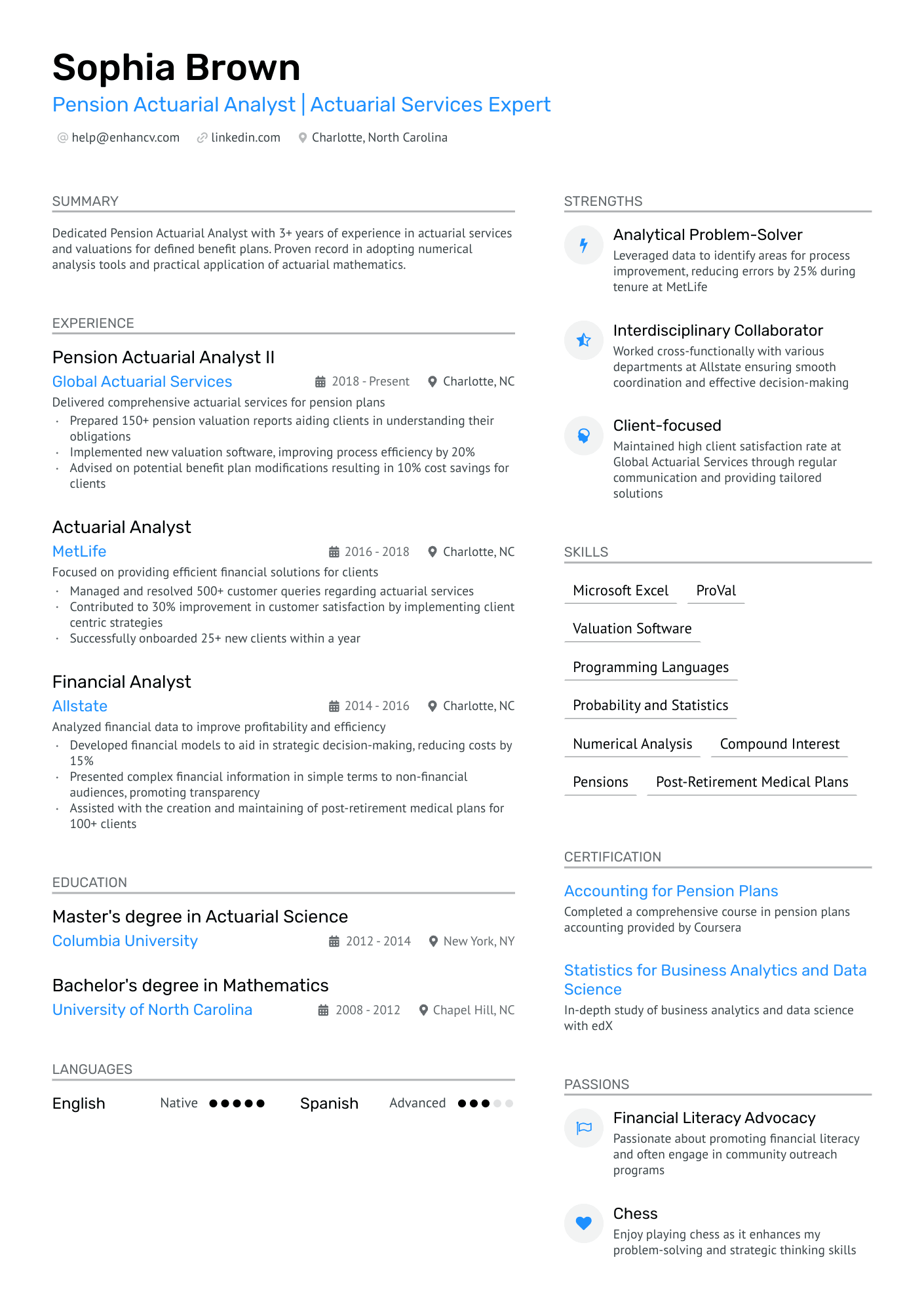

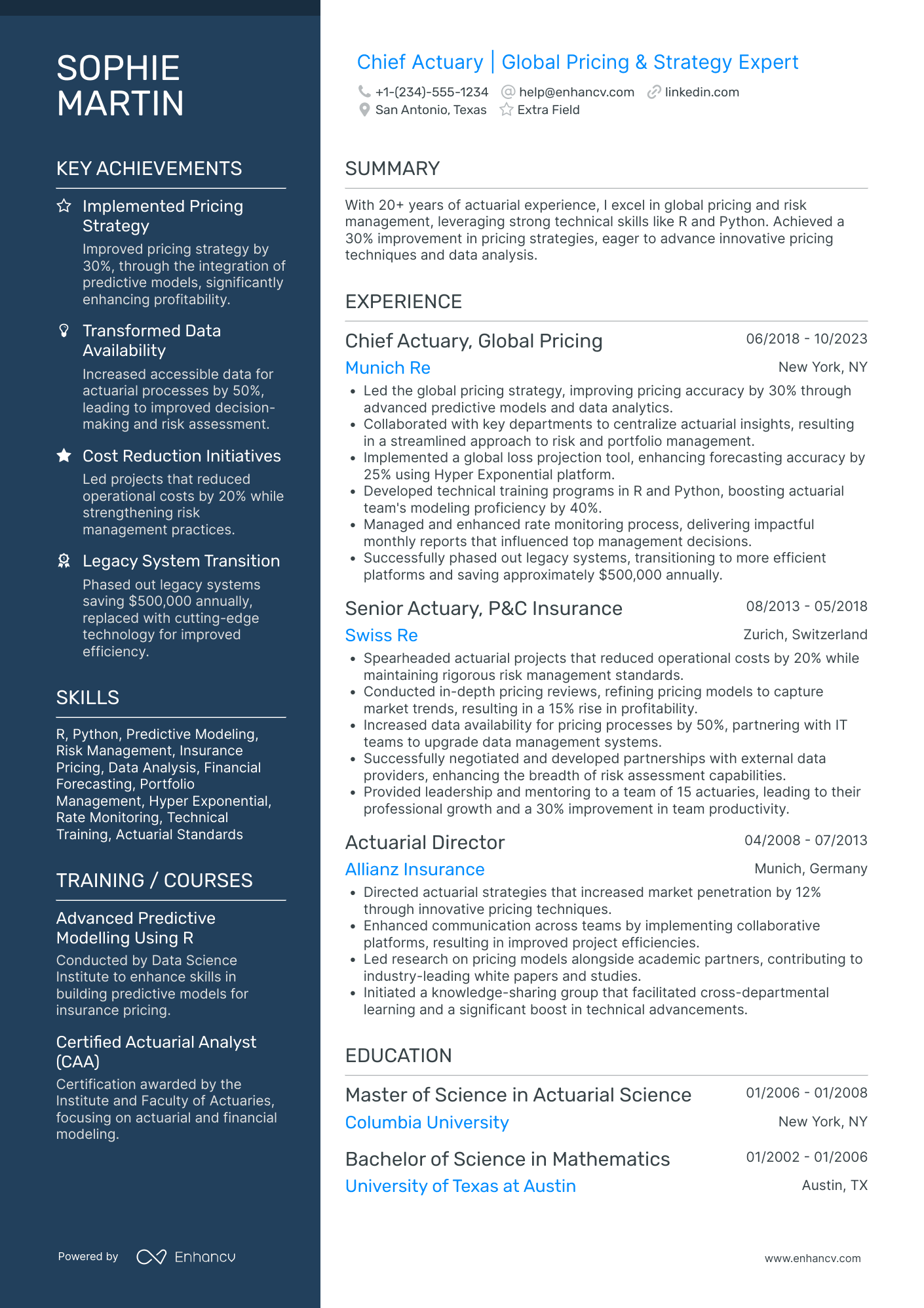

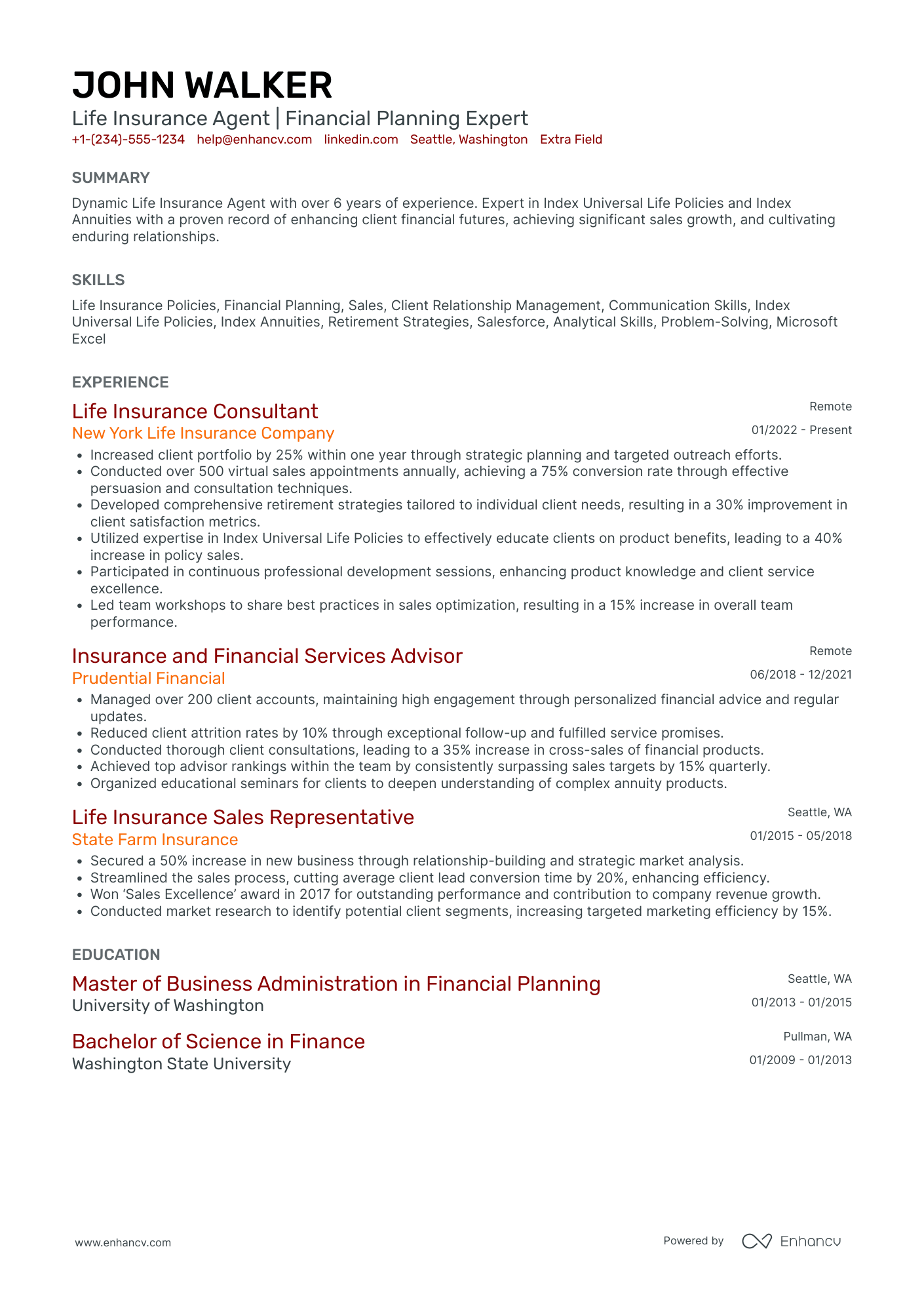

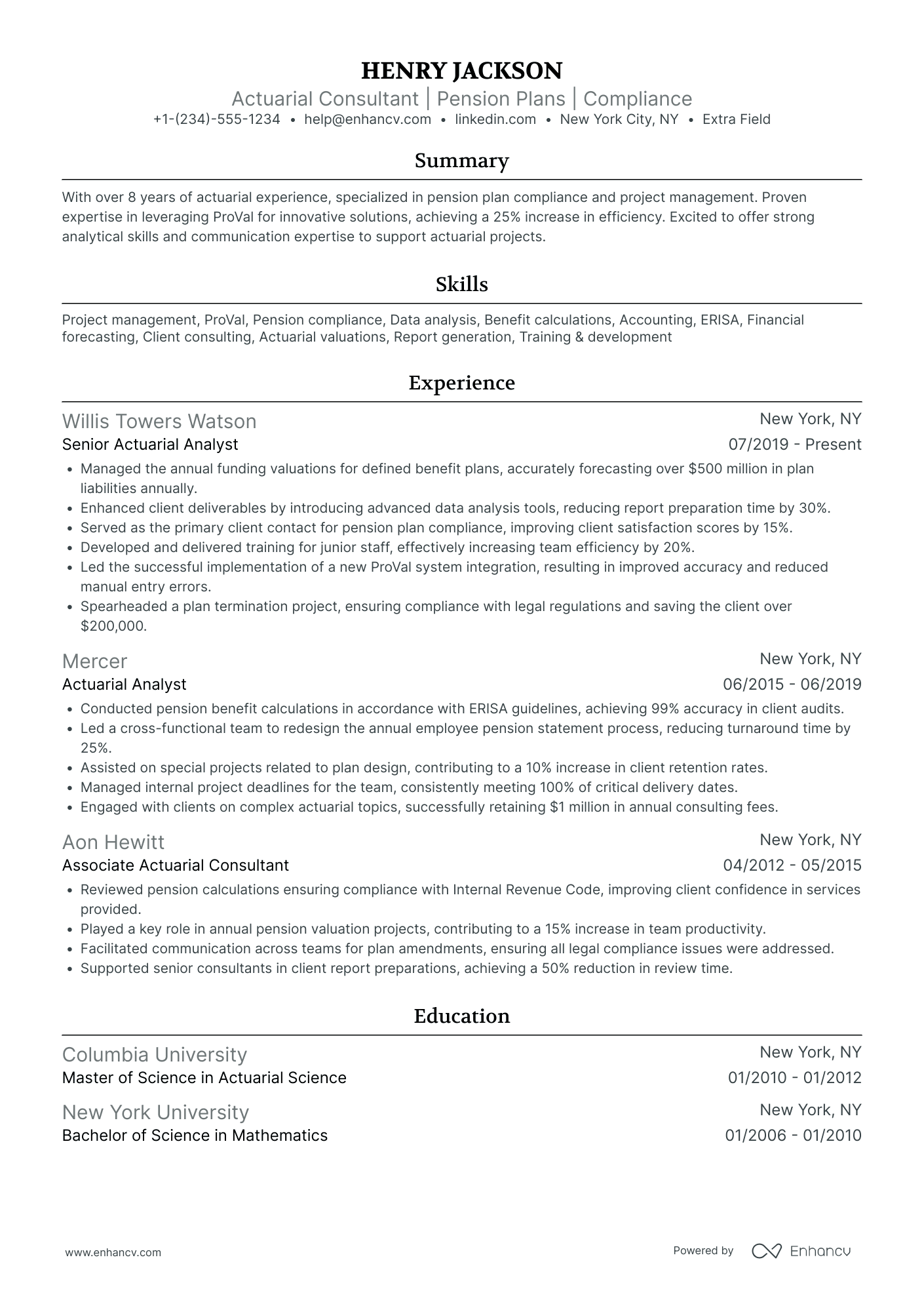

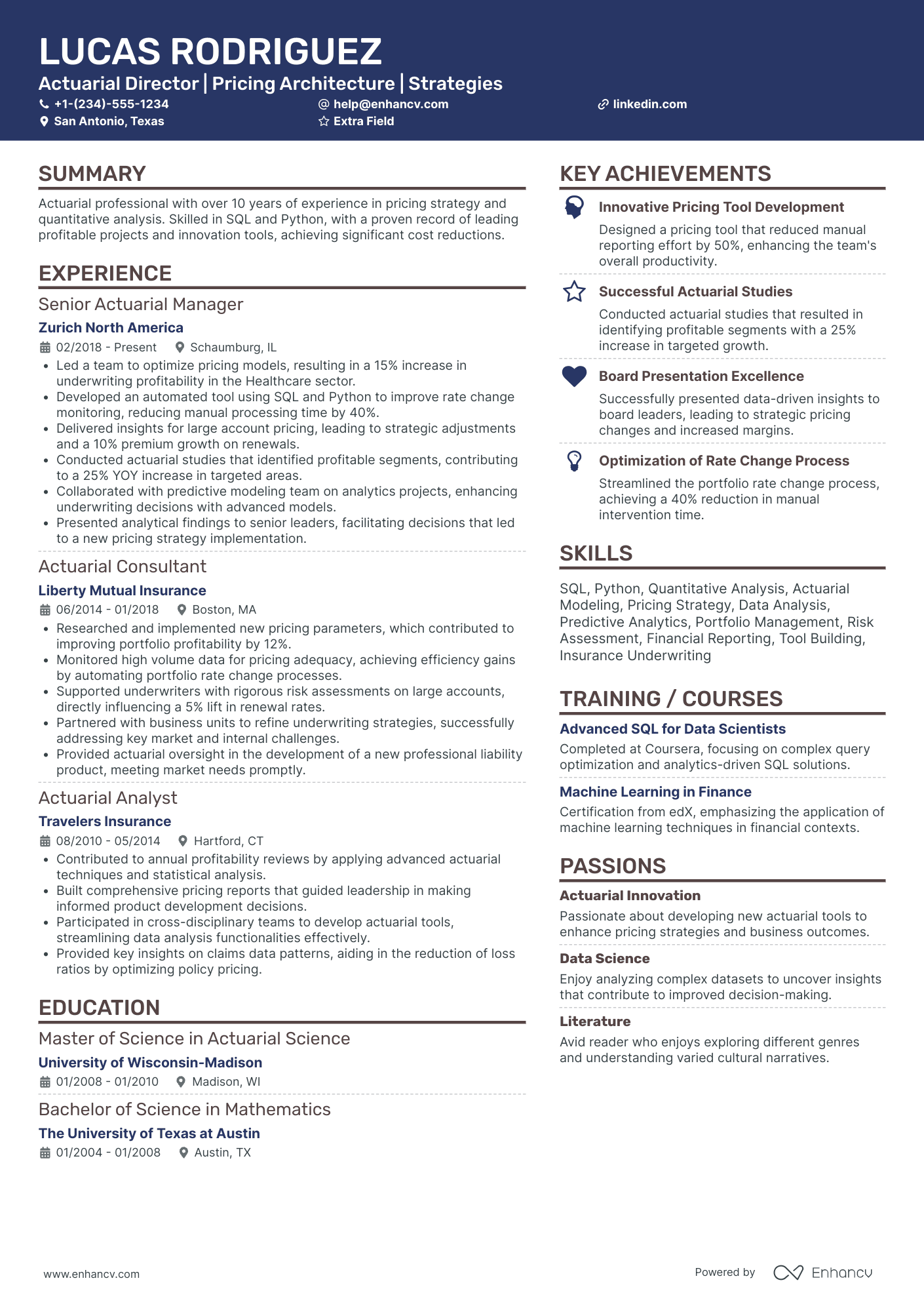

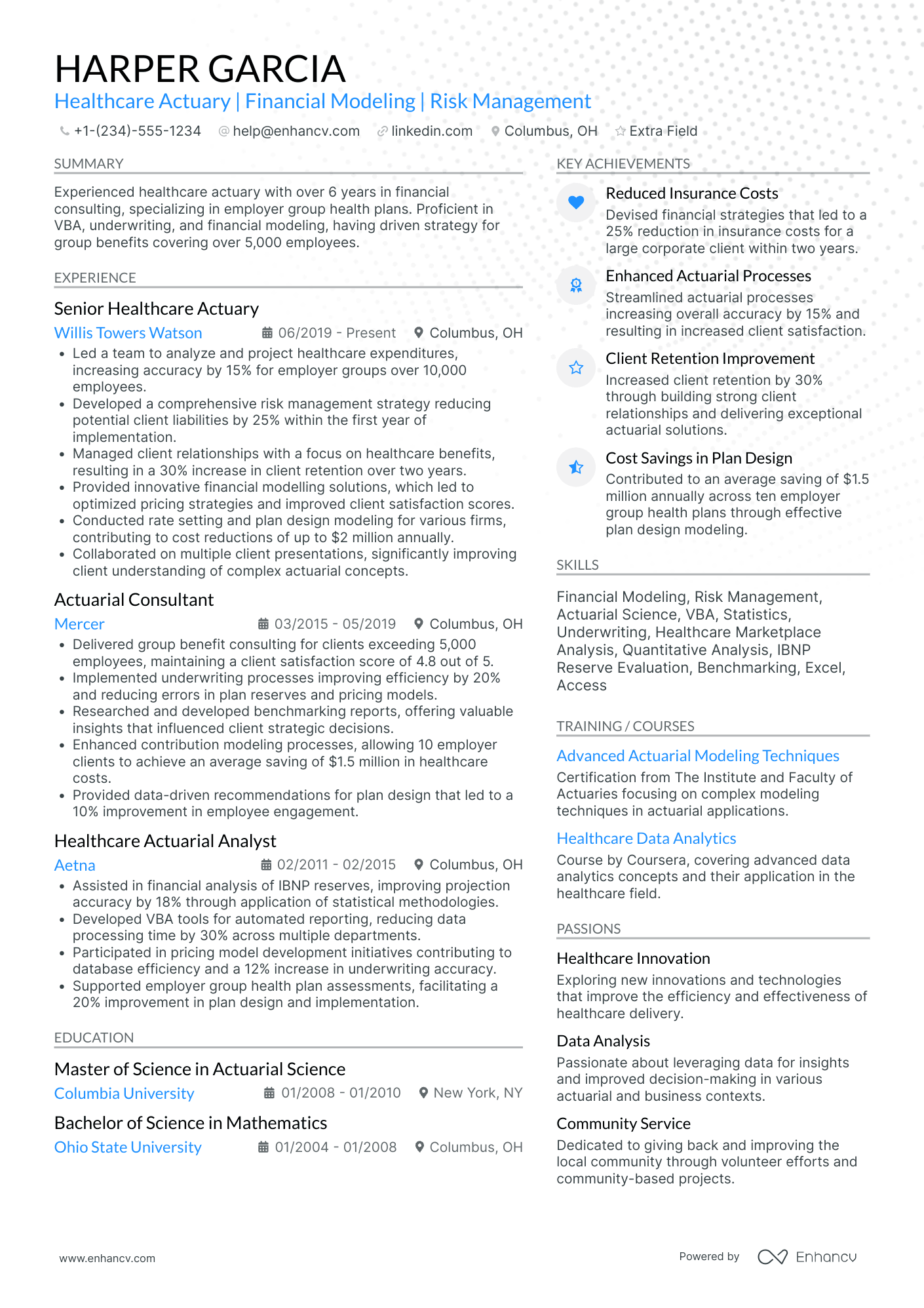

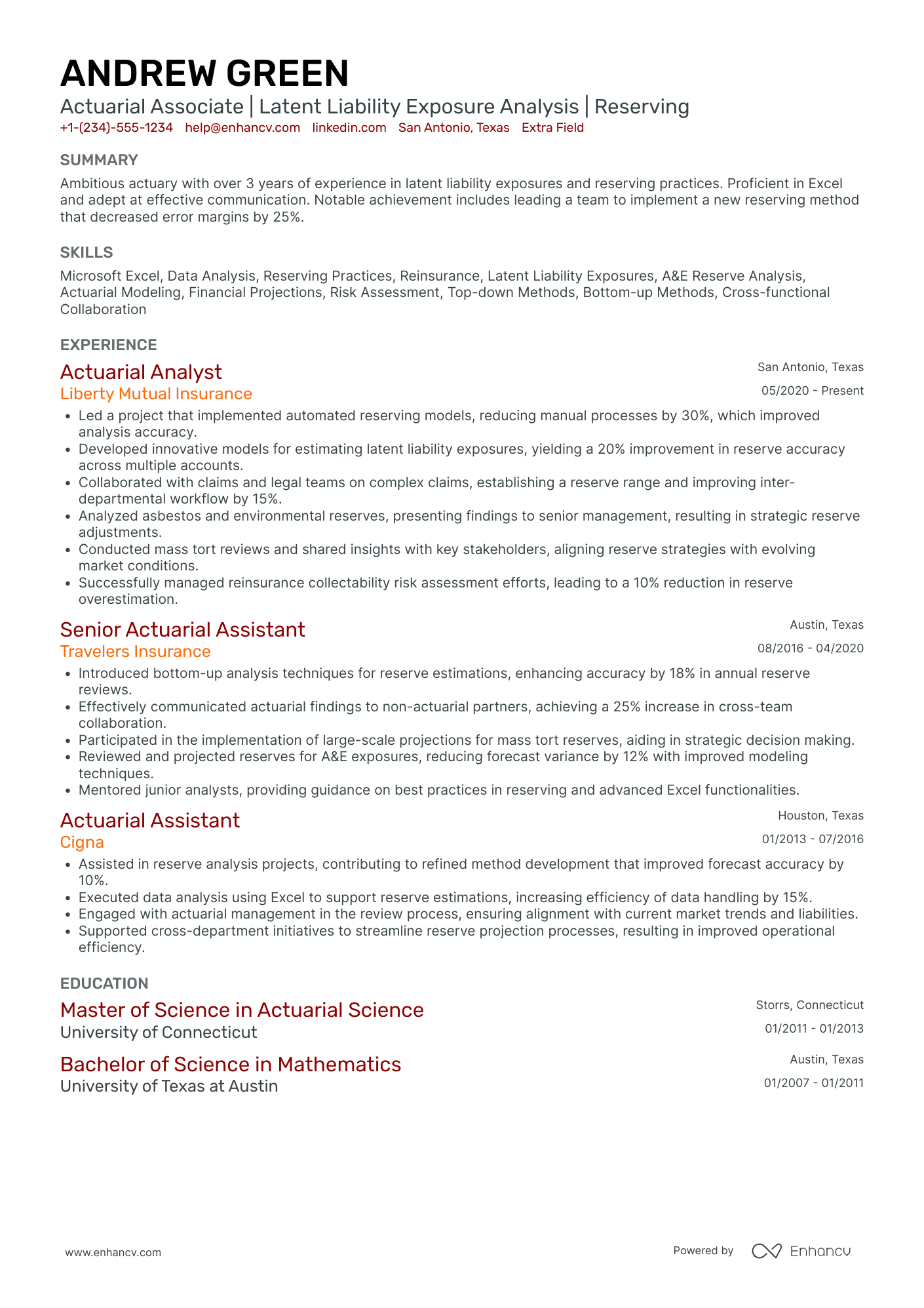

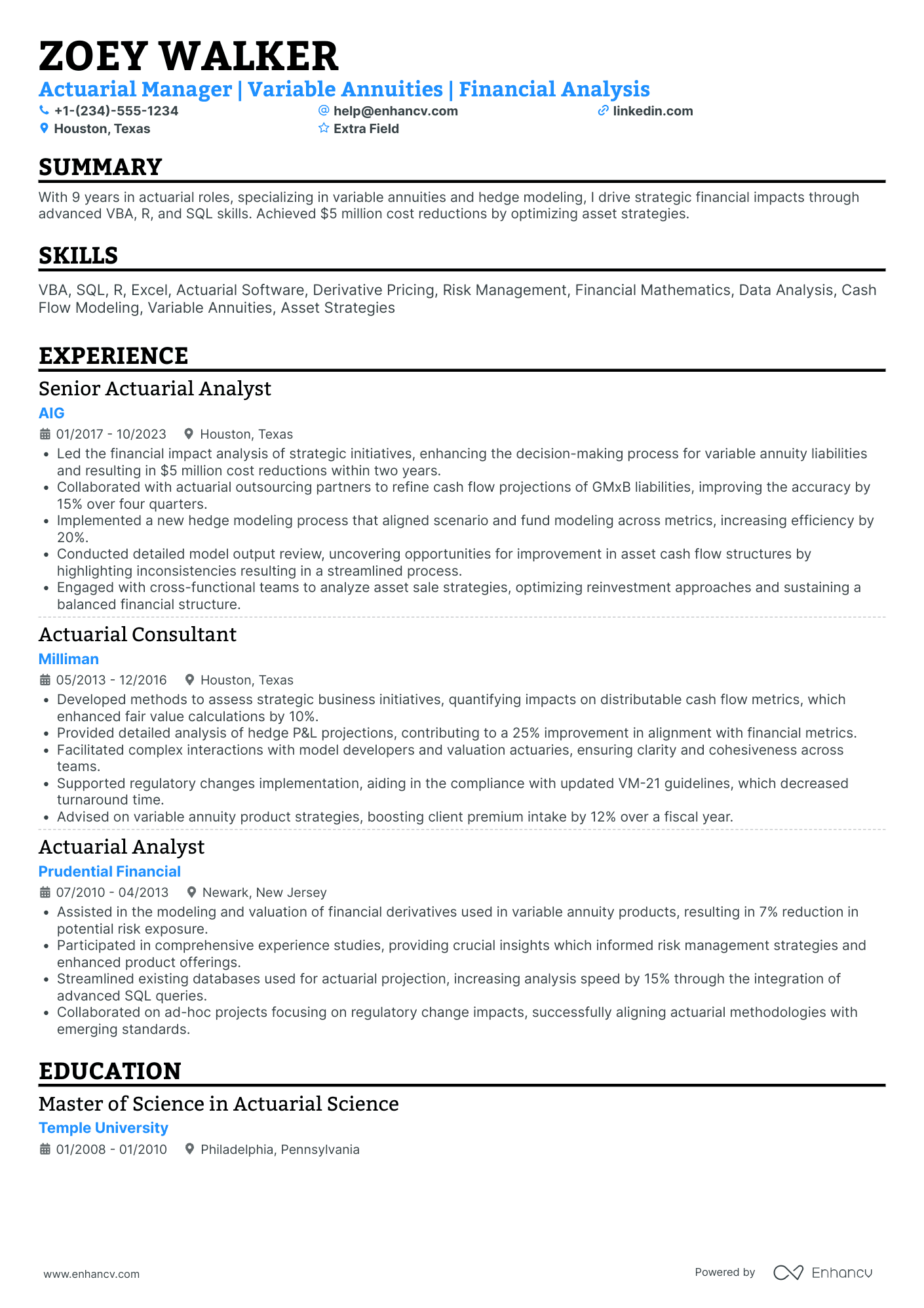

Actuary resume examples

By Experience

By Role