Many accounts payable specialist resume drafts fail because they read like task lists and bury proof of accuracy, speed, and control. That matters when an ATS (applicant tracking system) filters fast and recruiters skim in seconds.

A strong resume shows outcomes you delivered, not just the systems you used. Knowing how to make your resume stand out starts with highlighting invoice volume handled, cycle time reductions, on-time payment rate, error or duplicate-payment reductions, successful audit results, and recovered credits.

Key takeaways

- Quantify invoice volume, cycle time, accuracy, and cost savings in every experience bullet.

- Use reverse-chronological format for experienced candidates and hybrid format for career changers.

- Tailor each resume to the job posting's exact ERP tools, processes, and compliance standards.

- Place hard skills above experience when you lack full-time accounts payable work history.

- Tie every listed skill to a specific outcome in your summary or experience section.

- Add certifications like CAPP or QuickBooks Certified User directly after your education section.

- Use Enhancv's Bullet Point Generator to turn routine duties into measurable, recruiter-ready bullets.

Job market snapshot for accounts payable specialists

We analyzed 284 recent accounts payable specialist job ads across major US job boards. These numbers help you understand salary landscape, employer expectations, industry demand at a glance.

What level of experience employers are looking for accounts payable specialists

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 18.7% (53) |

| 3–4 years | 11.6% (33) |

| 5–6 years | 5.6% (16) |

| 10+ years | 3.5% (10) |

| Not specified | 60.2% (171) |

Accounts payable specialist ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 70.8% (201) |

| Healthcare | 10.2% (29) |

| Education | 6.7% (19) |

Role overview stats

These tables show the most common responsibilities and employment types for accounts payable specialist roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a accounts payable specialist

| Responsibility | Percentage found in job ads |

|---|---|

| Accounts payable | 49.6% (141) |

| Excel | 39.4% (112) |

| Microsoft office | 23.2% (66) |

| Microsoft excel | 20.1% (57) |

| Erp | 15.5% (44) |

| Word | 13.7% (39) |

| Accounting | 11.3% (32) |

| Data entry | 10.9% (31) |

| Outlook | 10.9% (31) |

| Microsoft word | 10.2% (29) |

| Sap | 9.2% (26) |

| Netsuite | 7.7% (22) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 76.8% (218) |

| Hybrid | 19.0% (54) |

| Remote | 4.2% (12) |

How to format a accounts payable specialist resume

Recruiters evaluating accounts payable specialist resumes prioritize accuracy in invoice processing, vendor management experience, and familiarity with accounting software like SAP, Oracle, or QuickBooks. A clean, well-structured resume format ensures these signals surface quickly during both human review and applicant tracking system (ATS) scans, giving your resume the best chance of advancing past initial screening.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to showcase your growing expertise in accounts payable workflows and the increasing complexity of responsibilities you've handled. Do:

- Lead with your most recent position and emphasize the scope of your workload, such as invoice volume, number of vendor accounts managed, and approval authority.

- Highlight proficiency in role-specific tools and domains, including ERP systems (SAP, Oracle, NetSuite), three-way matching, month-end close processes, and compliance with GAAP standards.

- Quantify outcomes that reflect efficiency, accuracy, and cost savings tied to your direct contributions.

- Processed an average of 1,200 invoices per month across three business units with a 99.6% accuracy rate, reducing late payment penalties by 34% year over year.

I'm junior or switching into this role—what format works best?

A hybrid format works best because it lets you lead with relevant skills and certifications while still providing a chronological work history that shows your trajectory. Do:

- Place a skills section near the top featuring accounts payable competencies such as invoice reconciliation, data entry accuracy, vendor correspondence, and proficiency in QuickBooks or Excel.

- Include internships, academic projects, or freelance bookkeeping work that demonstrates hands-on exposure to payable cycles or general ledger tasks.

- Connect every skill or experience to a concrete action and a measurable or observable result.

- Advanced Excel proficiency → automated a weekly invoice tracking spreadsheet for a university finance office → reduced manual data entry errors by 25% and cut reporting time in half.

Why not use a functional resume?

A functional format strips away the timeline of your experience, making it difficult for recruiters to assess how your accounts payable skills developed and where they were applied, which weakens your credibility even at the entry or mid level. Avoid a functional format entirely if you have any relevant work history, internships, or project-based experience that can populate a chronological or hybrid layout.

- A functional resume may be acceptable if you're making a career change from a related field (such as general bookkeeping or administrative support), have a gap in employment longer than a year, or have no formal accounts payable work history—but even then, every listed skill must be tied to a specific project, task, or outcome rather than presented in isolation.

Once your resume's structure and layout are set, the next step is filling it with the right sections to showcase your accounts payable expertise effectively.

What sections should go on a accounts payable specialist resume

Recruiters expect to see clear evidence that you can process invoices accurately, manage vendor relationships, and support on-time payments and clean month-end close. Understanding what to put on a resume for this role ensures you include the right details.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Volunteering, Languages

Strong experience bullets should emphasize measurable impact, including invoice volume, cycle-time improvements, error reduction, compliance outcomes, and month-end close scope.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized the right resume components, the next step is to write your accounts payable specialist resume experience so each entry supports those elements with clear, job-relevant results.

How to write your accounts payable specialist resume experience

Your work experience section should highlight the invoice processing workflows, payment cycles, and vendor account management you've delivered—not just the tasks you performed daily. Hiring managers prioritize demonstrated impact on accuracy, efficiency, and financial controls over descriptive lists of routine accounts payable duties.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the invoice volumes, vendor accounts, payment schedules, aging reports, or general ledger reconciliations you were directly accountable for managing.

- Execution approach: the ERP systems, accounting software, three-way matching procedures, or automation tools you used to process payments, resolve discrepancies, and maintain compliance with internal controls.

- Value improved: changes to payment accuracy, processing cycle times, early payment discount capture, error reduction, or audit readiness that resulted from your work.

- Collaboration context: how you partnered with procurement teams, vendors, internal auditors, department managers, or treasury staff to resolve disputes, streamline approvals, and ensure accurate financial reporting.

- Impact delivered: outcomes tied to cost savings, reduced delinquencies, improved vendor relationships, faster close cycles, or strengthened compliance—expressed through results and business impact rather than activity descriptions.

Experience bullet formula

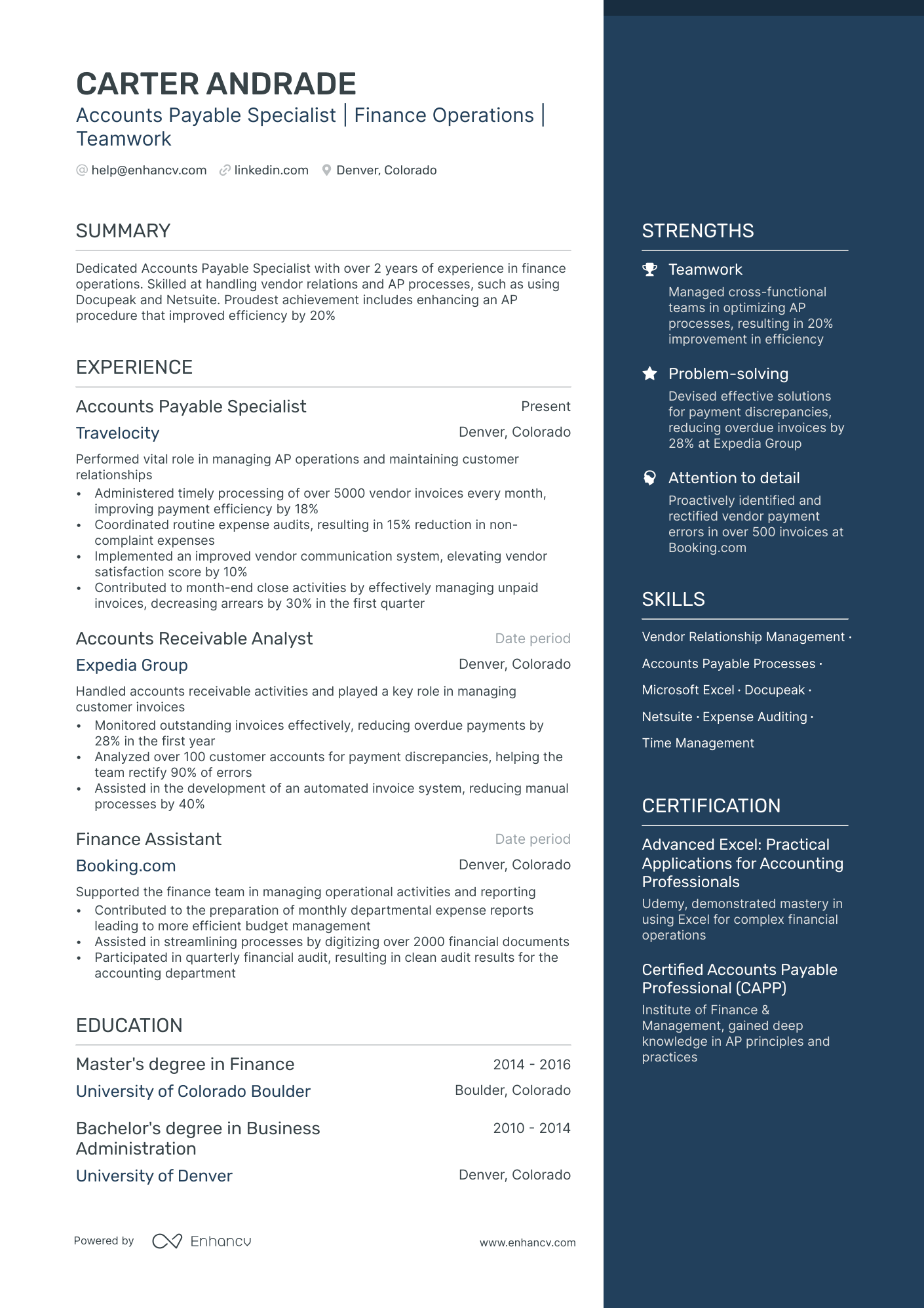

A accounts payable specialist experience example

✅ Right example - modern, quantified, specific.

Accounts Payable Specialist

Brightline Manufacturing | Columbus, OH

2022–Present

Mid-market manufacturing company supporting three plants and a nationwide supplier network.

- Processed 1,200+ invoices per month in Oracle NetSuite, using three-way match and exception queues to cut invoice cycle time from eight days to five days.

- Reconciled vendor statements and resolved 150+ monthly discrepancies in partnership with procurement and plant managers, reducing duplicate payments by 60% and preventing $85K in overpayments annually.

- Automated invoice intake with OCR (optical character recognition) and standardized coding rules in NetSuite, increasing touchless processing from 25% to 55% and saving ten hours per week.

- Executed weekly ACH (automated clearing house) and wire payment runs, validating bank details and approval workflows to maintain 99.5% on-time payments and reduce late fees by 40%.

- Prepared month-end accruals and accounts payable aging reports in Microsoft Excel (Power Query, pivot tables) for finance leadership, improving close accuracy and cutting reclassifications by 30%.

Now that you've seen what a strong experience section looks like, let's break down how to customize yours for each specific job posting.

How to tailor your accounts payable specialist resume experience

Recruiters evaluate your accounts payable specialist resume through both applicant tracking systems and manual review. Tailoring your resume to the job description ensures your qualifications align with what hiring managers prioritize.

Ways to tailor your accounts payable specialist experience:

- Match ERP platforms like SAP or Oracle listed in the posting.

- Mirror the exact invoice processing terminology the employer uses.

- Reflect specific three-way or two-way matching methods referenced.

- Highlight month-end close responsibilities when the role requires them.

- Emphasize vendor reconciliation workflows described in the job description.

- Include relevant compliance standards such as GAAP or SOX mentioned.

- Align your payment cycle metrics with KPIs the employer values.

- Reference cross-functional collaboration with procurement or finance teams noted.

Tailoring means aligning your real accomplishments with each job's stated requirements rather than forcing disconnected keywords into your experience.

Resume tailoring examples for accounts payable specialist

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Process full-cycle AP using SAP, including three-way matching, vendor reconciliations, and month-end accruals for a multi-entity organization. | Handled accounts payable tasks and helped with monthly closing activities. | Processed full-cycle AP across 12 entities in SAP, performing three-way matching on 2,000+ invoices monthly and completing vendor reconciliations and month-end accruals within five business days of close. |

| Review and code invoices to correct GL accounts, cost centers, and project codes while ensuring compliance with internal controls and SOX requirements. | Entered invoices into the system and made sure they were coded correctly. | Reviewed and coded 800+ invoices monthly to appropriate GL accounts, cost centers, and project codes, maintaining 99.5% accuracy while adhering to SOX compliance standards and internal control procedures. |

| Manage vendor relationships, resolve payment discrepancies, and process weekly check runs and ACH/wire payments using Oracle NetSuite. | Communicated with vendors and processed payments on a regular basis. | Managed relationships with 300+ vendors in Oracle NetSuite, resolving payment discrepancies within 48 hours and executing weekly check runs, ACH, and wire payments totaling $4.2M per month. |

Once you’ve aligned your experience with the role’s requirements, the next step is to quantify your accounts payable specialist achievements so employers can see the impact behind those responsibilities.

How to quantify your accounts payable specialist achievements

Quantifying your achievements proves business impact beyond "processed invoices." Focus on cycle time, accuracy, volume, compliance, and cost savings. Use numbers tied to invoices, payments, exceptions, audits, and vendor performance.

Quantifying examples for accounts payable specialist

| Metric | Example |

|---|---|

| Invoice volume | "Processed 1,200 invoices per month in SAP while maintaining daily queue under 150 items across four business units." |

| Cycle time | "Cut invoice-to-payment cycle time from nine days to five days by standardizing three-way match steps and using Excel trackers." |

| Accuracy rate | "Reduced duplicate payments from 0.8% to 0.2% by tightening vendor master reviews and adding exception checks in Oracle." |

| Compliance risk | "Passed two internal audits with zero high-risk findings by enforcing approval thresholds and documenting payment controls in SharePoint." |

| Cost savings | "Captured $48,000 in early-payment discounts in one year by prioritizing discount terms and coordinating weekly payment runs." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With strong bullet points in place, it's time to highlight the hard and soft skills that make you a standout accounts payable specialist.

How to list your hard and soft skills on a accounts payable specialist resume

Your skills section shows you can process invoices accurately, protect cash flow, and support audits, and recruiters and applicant tracking systems (ATS) scan this section for role keywords—aim for a mostly hard-skill mix with a smaller set of job-specific soft skills. accounts payable specialist roles require a blend of:

- Product strategy and discovery skills: Vendor onboarding, payment terms setup, and process improvements that reduce cycle time.

- Data, analytics, and experimentation skills: Exception tracking, aging analysis, and root-cause analysis for invoice and payment errors.

- Delivery, execution, and go-to-market discipline: High-volume invoice processing, month-end close support, and on-time payment execution.

- Soft skills: Cross-functional coordination, clear vendor communication, and ownership of issue resolution.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

Include hard skills that reflect your technical proficiency in accounts payable workflows:

- Three-way matching (PO, invoice, receipt)

- Invoice processing and coding

- Accounts payable aging and accruals

- Month-end close support

- Vendor master data maintenance

- Payment runs, ACH, wire transfers

- Sales and use tax basics

- 1099 preparation and tracking

- Purchase order and receiving workflows

- ERP systems: SAP, Oracle, NetSuite

- Microsoft Excel: PivotTables, VLOOKUP/XLOOKUP

- Document management and invoice imaging

Soft skills

Complement your technical abilities with soft skills that demonstrate how you work effectively within finance teams:

- Resolve invoice exceptions end-to-end

- Communicate payment status clearly

- Follow up persistently with vendors

- Partner with procurement and receiving

- Coordinate with finance on close deadlines

- Document processes and approvals

- Prioritize urgent holds and escalations

- Maintain confidentiality with bank details

- Spot discrepancies and flag risks early

- Manage workload under tight cutoffs

- Ask clarifying questions on coding

- Own corrections through final payment

How to show your accounts payable specialist skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how top candidates integrate competencies throughout their resumes.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Accounts payable specialist with eight years in healthcare finance, skilled in SAP, three-way matching, and vendor negotiations. Reduced invoice processing errors by 32% while managing 1,200+ monthly transactions and mentoring a team of three.

- Reflects senior-level experience clearly

- Names role-specific tools like SAP

- Includes a concrete, measurable outcome

- Highlights leadership as a soft skill

Experience example

Senior Accounts Payable Specialist

Ridgeline Health Partners | Denver, CO

March 2019–Present

- Processed 1,400+ monthly invoices using SAP, reducing cycle time by 22% through automated three-way matching workflows.

- Collaborated with procurement and finance teams to resolve 95% of vendor disputes within five business days.

- Led quarterly audits of AP aging reports, identifying $180K in duplicate payments and recovering funds within 60 days.

- Every bullet includes measurable proof

- Skills appear naturally through real outcomes

Once you’ve demonstrated your accounts payable specialist skills through specific examples, the next step is applying that approach to build an accounts payable specialist resume with no experience.

How do I write a accounts payable specialist resume with no experience

Even without full-time experience, you can demonstrate readiness. Our guide on building a resume without work experience walks through this in detail. Consider showcasing:

- Accounts payable coursework and labs

- Volunteer invoice processing for nonprofits

- Internship in accounting operations

- Accounts payable simulation projects

- Personal bookkeeping using QuickBooks Online

- Vendor statement reconciliation practice

- Data entry roles handling invoices

- Job shadowing accounts payable specialist tasks

Focus on:

- Invoice processing accuracy and volume

- Three-way matching and approvals

- Reconciliations and exception tracking

- Accounts payable tools and systems

Resume format tip for entry-level accounts payable specialist

Use a combination resume format because it highlights accounts payable specialist skills and projects before limited work history. Do:

- Add a skills section with tools.

- Include projects with measurable results.

- List coursework tied to accounts payable.

- Quantify invoice volume and error rates.

- Mirror keywords from job postings.

- Completed an accounts payable simulation in Excel, processing 120 invoices with three-way matching and reducing entry errors by 15% through validation rules.

Once you've shaped your resume around transferable skills and relevant coursework, the next step is ensuring your education section is formatted to maximize its impact.

How to list your education on a accounts payable specialist resume

Your education section helps hiring teams confirm you have the foundational accounting and finance knowledge needed. It validates your readiness for an accounts payable specialist role quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for an accounts payable specialist:

Example education entry

Bachelor of Science in Accounting

University of Central Florida, Orlando, FL

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Financial Accounting, Managerial Accounting, Business Law, Accounts Payable & Receivable Systems

- Honors: Magna Cum Laude, Dean's List (six semesters)

How to list your certifications on a accounts payable specialist resume

Certifications on your resume show your commitment to learning, your proficiency with accounting tools, and your relevance to finance workflows as an accounts payable specialist.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Put certifications below education when your degree is recent and more relevant than older or general certifications.

- Put certifications above education when they are recent, role-specific, or required for the accounts payable specialist job you want.

Best certifications for your accounts payable specialist resume

- Certified Accounts Payable Professional (CAPP)

- Certified Professional Bookkeeper (CPB)

- Certified Bookkeeper (CB)

- QuickBooks Certified User

- Microsoft Office Specialist: Excel Associate

- Oracle Financials Cloud Certification

- SAP S/4HANA Financial Accounting Certification

Once you’ve positioned your credentials where recruiters will see them, you’re ready to write your accounts payable specialist resume summary to highlight them upfront and connect them to your value.

How to write your accounts payable specialist resume summary

Your resume summary is the first thing a recruiter reads. A strong one instantly signals you're qualified for the accounts payable specialist role.

Keep it to three to four lines, with:

- Your title and total years of accounts payable experience.

- The industry or domain you've worked in, such as manufacturing or retail.

- Core tools like SAP, Oracle, QuickBooks, or advanced Excel.

- One or two measurable achievements, such as error reduction or cycle time improvements.

- Soft skills tied to real outcomes, like accuracy that reduced invoice discrepancies.

PRO TIP

At this level, emphasize your hands-on skills, tool proficiency, and early wins that show reliability. Highlight specific processes you've improved or error rates you've lowered. Avoid vague phrases like "detail-oriented team player" unless tied to a measurable result. Skip motivational statements about passion or career goals entirely.

Example summary for a accounts payable specialist

Accounts payable specialist with three years of experience processing high-volume invoices in manufacturing. Reduced payment errors by 18% using SAP and automated three-way matching workflows.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that you've crafted a summary that highlights your value, make sure the header above it presents your contact details correctly so recruiters can actually reach you.

What to include in a accounts payable specialist resume header

A well-crafted resume header lists your key contact details and role focus, improving visibility, credibility, and recruiter screening for a accounts payable specialist.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify experience quickly and supports screening.

Don't include a photo on a accounts payable specialist resume unless the role is explicitly front-facing or appearance-dependent.

Place your header at the top, keep it to one to two lines, and match your job title to the posting for cleaner searches.

Example

Accounts payable specialist resume header

Jordan Lee

Accounts Payable Specialist | Invoice processing, three-way matching, vendor reconciliation

Austin, TX

(512) 555-12XX

your.name@enhancv.com

github.com/yourname

yourwebsite.com

linkedin.com/in/yourname

Once your contact details and professional identifiers are clear at the top, add optional sections to strengthen the rest of your accounts payable specialist resume.

Additional sections for accounts payable specialist resumes

When your core qualifications match other candidates, additional sections help you stand out by showcasing relevant expertise and professional depth.

- Languages

- Certifications (e.g., Certified Accounts Payable Professional)

- Professional affiliations (e.g., Institute of Financial Operations & Leadership)

- Volunteer experience

- Software proficiencies

- Continuing education and training

Once you've rounded out your resume with relevant additional sections, it's worth pairing it with a cover letter to strengthen your overall application.

Do accounts payable specialist resumes need a cover letter

A cover letter isn't required for an accounts payable specialist, but it helps in competitive roles or when hiring managers expect one. If you're unsure what a cover letter is and how it complements your resume, it's worth learning before you apply. It can make a difference when your resume needs context, or when you want to clarify fit fast.

Use a cover letter when it adds information your resume can't:

- Explain role or team fit: Connect your experience to the company's invoice volume, systems, approval workflows, and cross-functional partners.

- Highlight one or two relevant projects or outcomes: Share a specific result, like reducing invoice cycle time, improving match rates, or lowering exception volume.

- Show understanding of the business context: Mention how accounts payable supports cash flow, vendor relationships, compliance, and accurate month-end close.

- Address career transitions or non-obvious experience: Translate adjacent work into accounts payable specialist skills, like reconciliations, audit support, or process documentation.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you decide a cover letter adds value for your accounts payable specialist application, using AI to improve your accounts payable specialist resume is the next step to strengthen your core document quickly and consistently.

Using AI to improve your accounts payable specialist resume

AI can sharpen your resume's clarity, structure, and impact. It helps refine bullet points, tighten language, and highlight measurable results. But overuse strips authenticity. Once your content is clear and aligned with the role, step away from AI. For practical starting points, explore these ChatGPT resume writing prompts tailored to different resume sections.

Here are 10 practical prompts you can copy and paste to strengthen specific sections of your accounts payable specialist resume:

Strengthen your summary

Quantify experience bullets

Tighten action verbs

Align skills section

Improve certification descriptions

Refine education details

Remove redundant phrasing

Clarify process achievements

Tailor project descriptions

Fix keyword gaps

Conclusion

A strong accounts payable specialist resume proves impact with measurable outcomes, like faster invoice cycles, fewer errors, and improved on-time payments. It highlights role-specific skills, including invoice processing, three-way matching, reconciliations, and vendor management.

Keep the structure clear and scannable with focused experience bullets and relevant tools. This approach shows you can support accurate reporting, stronger controls, and efficient workflows in today’s hiring market.