Embarking on your job hunt, you've meticulously polished your resume, only to hit a snag when it comes to crafting your tax preparer cover letter. Unlike a resume that lists your experiences, your cover letter should narrate the triumph you're most proud of, engagingly illustrating your skills. Striking the delicate balance between professionalism and originality, steering clear of tired platitudes, your letter must encapsulate your career highlight in a concise, one-page story that captivates. Let's dive in and make your application stand out.

- Introduce your profile to catch recruiters' attention;

- Use professional templates and examples to make sure your tax preparer cover letter follows the best industry standards;

- Settle on your most story-worthy achievement to shine a light on what makes your application unique;

- Write a tax preparer cover letter, even when you lack professional experience.

Ready to start with the basics: upload your resume to Enhancv's AI, below, to see the tax preparer cover letter it would write for you.

If the tax preparer isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

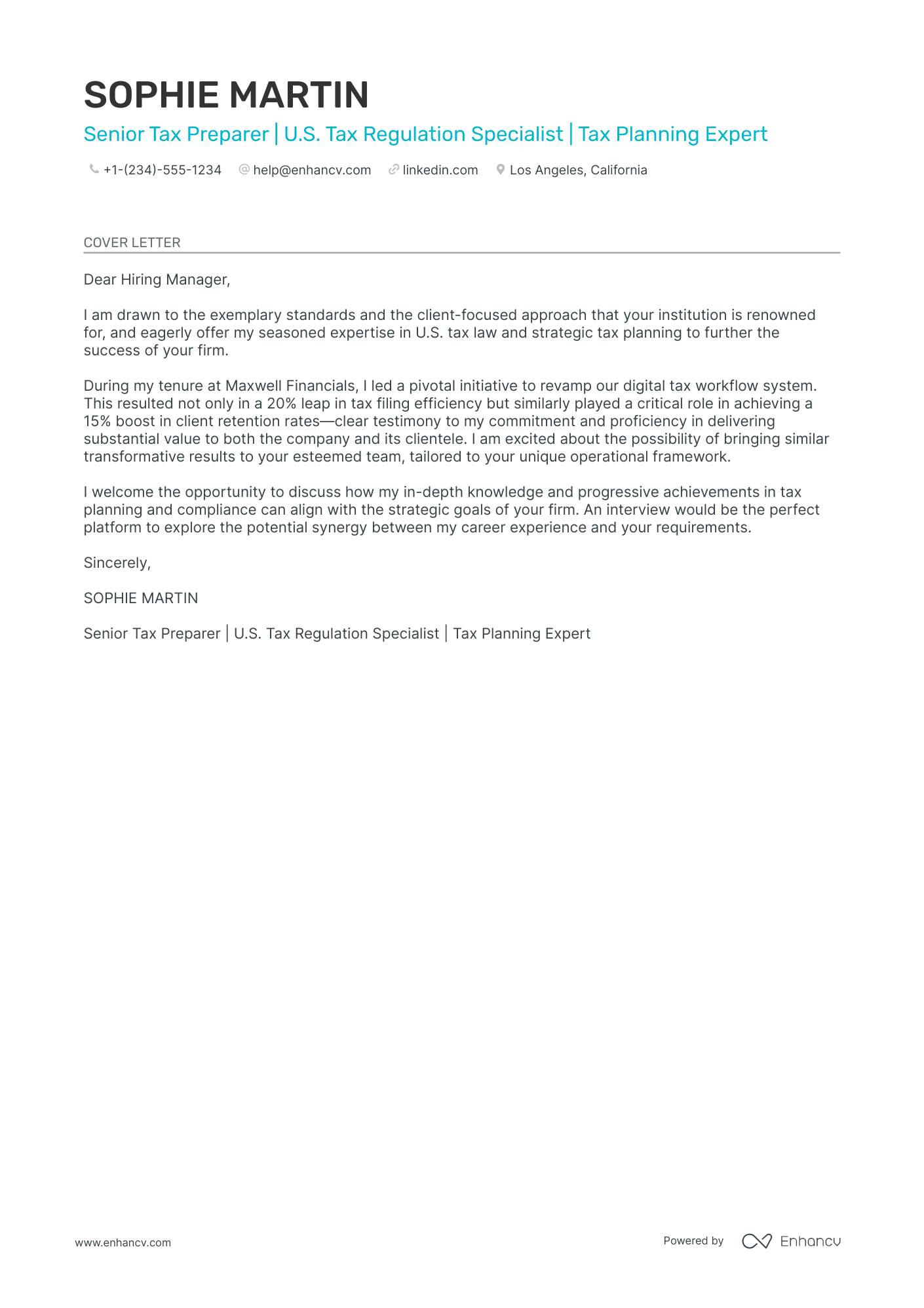

Tax preparer cover letter example

SOPHIE MARTIN

Los Angeles, California

+1-(234)-555-1234

help@enhancv.com

- Emphasizing relevant experience and achievements can demonstrate the candidate's value and potential impact, as seen with the mention of leading a digital tax workflow system revamp and the resulting increase in efficiency and client retention.

- Asserting knowledge in a specific area of expertise relevant to the role, such as U.S. tax law and strategic tax planning, establishes the candidate as a knowledgeable and skilled professional.

- Mentioning a willingness to tailor strategies to the new firm’s operational framework shows adaptability and a client-focused approach, which are valuable in roles that require customization and collaboration.

- Requesting an interview as a call to action encourages the hiring manager to take the next step, moving the application process forward into a more personal and detailed discussion.

What about your tax preparer cover letter format: organizing and structuring your information

Here is one secret you should know about your tax preparer cover letter assessment. The Applicant Tracker System (or ATS) won't analyze your cover letter.

You should thus focus on making an excellent impression on recruiters by writing consistent:

- Header

- Greeting

- Introduction

- Body paragraphs (and explanation)

- Promise or Call to action

- Signature (that's optional)

Now, let's talk about the design of your tax preparer cover letter.

Ensure all of your paragraphs are single-spaced and have a one-inch margins on all sides (like in our cover letter templates).

Also, our cover letter builder automatically takes care of the format and comes along with some of the most popular (and modern) fonts like Volkhov, Chivo, and Bitter.

Speaking of fonts, professionals advise you to keep your tax preparer cover letter and resume in the same typography and avoid the over-used Arial or Times New Roman.

When wondering whether you should submit your tax preparer cover letter in Doc or PDF, select the second, as PDF keeps all of your information and design consistent.

Struggling to find time to write a cover letter? Try our free cover letter generator to create one in just seconds, straight from your resume.

The top sections on a tax preparer cover letter

- Header with Contact Information: Include your name, address, phone number, and email so that the recruiter can easily contact you, and so the cover letter appears professional and well-organized.

- Opening Greeting: Address the letter to a specific person if possible, such as "Dear Hiring Manager" or "Dear [Name of the Manager]," to personalize your application and demonstrate attention to detail.

- Introduction: Begin with a strong opening statement that highlights your enthusiasm for the tax preparation industry and specific reasons why you are a good fit for the position, based on your relevant experience and skills.

- Professional Experience and Expertise: Elaborate on your previous tax-related roles, detailing your knowledge of tax laws, your proficiency with tax software, and any certifications like Enrolled Agent (EA) or Certified Public Accountant (CPA), to illustrate your qualifications for the job.

- Conclusion and Call to Action: End the cover letter by reiterating your interest in the position, thanking the reader for considering your application, and inviting them to contact you for an interview, signaling your eagerness to move forward in the hiring process.

Key qualities recruiters search for in a candidate’s cover letter

- Attention to Detail: To ensure accuracy in calculating taxes and detecting potential errors in financial documents.

- Up-to-date Tax Knowledge: To provide clients with the most current tax advice and to navigate the constantly changing tax laws effectively.

- Strong Numerical Skills: For performing precise calculations and working with complex numerical data related to tax preparation.

- Confidentiality: To protect client privacy and sensitive financial information, which is crucial in maintaining trust and adhering to legal standards.

- Client-focused: To understand and meet the specific needs of each client, offering tailored tax solutions and building lasting relationships.

- Problem-solving Abilities: To tackle complex tax issues and find optimal solutions for clients that could save them money and prevent legal issues.

How to start your tax preparer cover letter: with a greeting, of course

Have you ever considered just how powerful a personalized salutation can be?

We sure have news for you! Your tax preparer cover letter should start with the right salutation to recruiters, nurturing a sense of respect and individuality.

Greet recruiters by using their first name (e.g. "Dear Tom" or "Dear Patricia") if you've previously established contact with them.

Otherwise, opt out for the less familiar, "Dear Ms. Peaches" or "Dear Ms Kelsey", if you've found the recruiter's name on LinkedIn or a corporate website.

"To whom it may concern" is never a good option, as it creates a sense that you've been sending out your tax preparer cover letter to anyone. Instead, use "Dear HR team" or "Dear (company name) recruiter" for a feeling of exclusivity.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Name of the Hiring Manager],

- Dear [Name of the Tax Department Manager],

- Dear [Full Name of the Contact Person],

- Dear [Mr./Ms./Dr.] [Last Name],

- Dear Members of the [Name of the Team/Department],

Get creative with your tax preparer cover letter introduction

Recruiters are going to assess plenty of candidate profiles for the role. Thus, anything you do to stand out will win you brownie points.

Use your tax preparer cover letter introduction to share something memorable about your experience.

But before you go down the rabbit hole of creativity and humor, align your message with the company culture.

For example, if you are applying for a role in some startup, use those first two sentences to tell a funny story (about your experience) to quickly connect with the recruiter.

What to write in the middle or body of your tax preparer cover letter

Here's where it gets tricky.

Your tax preparer cover letter body should present you in the best light possible and, at the same time, differ from your resume.

Don't be stuck in making up new things or copy-pasting from your resume. Instead, select just one achievement from your experience.

Use it to succinctly tell a story of the job-crucial skills and knowledge this taught you.

Your tax preparer cover letter is the magic card you need to further show how any organization or team would benefit from working with you.

Ending your tax preparer cover letter to avoid "sincerely yours"

Yes, this sort of closing statement may work best before your signature.

But you want to give recruiters something more with your tax preparer cover letter ending.

Some professionals choose to go down the path of promises. In a single sentence, they map out what they'd bring about to the role (whether that's a particular technical skill set or personal traits).

Others, decide to be more concrete by thanking recruiters for their time and prompting for their next interview.

Whatever path you choose, remember to always be polite and respectful of the opportunity you've had. Good manners go a long way.

Keep this in mind when writing your zero experience tax preparer cover letter

Even though you may not have any professional experience, your tax preparer cover letter should focus on your value.

As a candidate for the particular role, what sort of skills do you bring about? Perhaps you're an apt leader and communicator, or have the ability to analyze situations from different perspectives.

Select one key achievement from your life, outside work, and narrate a story that sells your abilities in the best light.

If you really can't think of any relevant success, you could also paint the picture of how you see your professional future developing in the next five years, as part of the company.

Key takeaways

Winning at your job application game starts with a clear and concise tax preparer cover letter that:

- Has single-spaced paragraphs, is wrapped in a one-inch margin, and uses the same font as the tax preparer resume;

- Is personalized to the recruiter (using their name in the greeting) and the role (focusing on your one key achievement that answers job requirements);

- Includes an introduction that helps you stand out and show what value you'd bring to the company;

- Substitutes your lack of experience with an outside-of-work success, that has taught you valuable skills;

- Ends with a call for follow-up or hints at how you'd improve the organization, team, or role.