Embarking on a job hunt in the mortgage industry, you've likely encountered the need to craft a persuasive mortgage broker cover letter. A daunting task at times, this vital document should complement—not echo—your resume, by spotlighting your proudest professional triumph. Striking a balance between formality and originality without resorting to clichés is key. And, remember, brevity is your ally; your narrative should unfold on a single page, inviting hiring managers into your career’s defining moment.

- Making excellent use of job-winning real-life professional cover letters;

- Writing the first paragraphs of your mortgage broker cover letter to get attention and connect with the recruiters - immediately;

- Single out your most noteworthy achievement (even if it's outside your career);

- Get a better understanding of what you must include in your mortgage broker cover letter to land the job.

Let the power of Enhancv's AI work for you: create your mortgage broker cover letter by uploading your resume.

If the mortgage broker isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

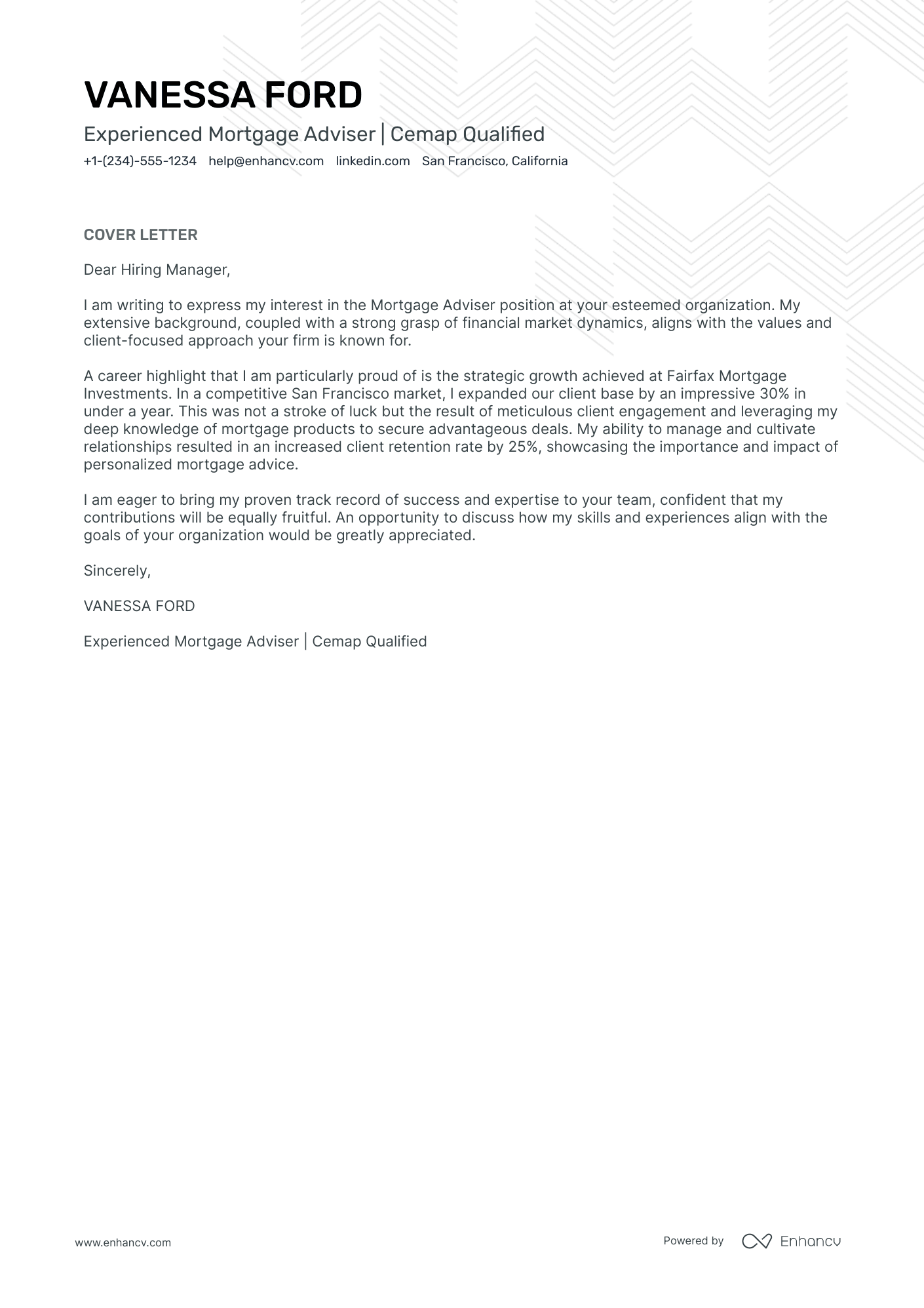

Mortgage broker cover letter example

VANESSA FORD

San Francisco, California

+1-(234)-555-1234

help@enhancv.com

- Demonstrating quantifiable achievements, such as growing the client base by 30% and increasing client retention by 25%, provides concrete evidence of past performance and potential contribution.

- Highlighting industry-specific qualifications like the Cemap (Certificate in Mortgage Advice and Practice) showcases the applicant's commitment and specialized knowledge in the mortgage advising field.

- Emphasizing the ability to manage and cultivate client relationships points to the candidate’s interpersonal skills, crucial for a customer-facing role like a Mortgage Adviser.

Structuring and formatting your mortgage broker cover letter

Here's what the structure of your mortgage broker cover letter should include:

- Header (with your name, the position you're applying for, and the date);

- Salutation (or greeting);

- Introductory paragraph (or your opening statement);

- Body paragraph (or further proof of your experience);

- Closing paragraph (with a call to action);

- Signature (that is optional).

Use the same font for your mortgage broker resume and cover letter - modern fonts like Lato and Rubik would help you stand out.

Your mortgage broker cover letter should be single-spaced and have a one-inch margins - this format is automatically set up in our cover letter templates and our cover letter builder.

When submitting your cover letter, always ensure it's in PDF, as this format keeps the information intact (and the quality of your document stays the same).

On one final note - the Applicant Tracker System (ATS or the software that is sometimes used to initially assess your application) won't read your mortgage broker cover letter.

Let us save you time! With our free cover letter generator, you can create a professional letter instantly using your resume.

The top sections on a mortgage broker cover letter

- Header with Contact Information: This section is crucial as it provides the recruiter with the candidate's name, address, phone number, and email, ensuring they have the means to promptly follow up for an interview or further discussion.

- Opening Greeting: A personalized greeting to the hiring manager shows the candidate has researched the company and is serious about the position, which is important in a relationship-driven industry like mortgage broking.

- Introduction with Career Objective: The introduction should briefly mention the candidate's career goals and enthusiasm for the mortgage industry, demonstrating a long-term commitment to helping clients with their home financing needs.

- Professional Experience and Achievements: This section should highlight relevant experiences and notable accomplishments, such as successful loan closures or client satisfaction rates, illustrating the candidate's ability to perform effectively as a mortgage broker.

- Strong Closing with Call to Action: A compelling closing that reaffirms the candidate's interest in the position and invites further discussion or an interview is essential to leaving a memorable impression and prompting the recruiter to take the next step.

Key qualities recruiters search for in a candidate’s cover letter

Deep understanding of the mortgage lending process: Recruiters look for candidates who can efficiently navigate the complexities of mortgage lending, including knowledge of various loan types, underwriting criteria, and regulatory requirements.

Proven sales and negotiation skills: Mortgage brokers must be skilled in selling financial products and negotiating terms to find the best outcomes for clients while also considering the lender's requirements.

Strong network of industry contacts: A well-developed network with lenders, real estate agents, and other financial professionals can be crucial for a mortgage broker to provide clients with a range of options and facilitate smoother transactions.

Exceptional customer service abilities: Providing personalized and high-quality service ensures client satisfaction, repeat business, and referrals, which are key to a mortgage broker's success.

Attention to detail and accuracy: Mortgage brokers must produce accurate and complete documentation to comply with legal guidelines and ensure the approval of loan applications.

Current on industry trends and regulations: Continuous education about the changing landscape of mortgage products, interest rates, and government regulations helps mortgage brokers to provide informed advice and maintain compliance.

Greeting recruiters with your mortgage broker cover letter salutation

What better way to start your conversation with the hiring manager, than by greeting them?

Take the time to find out who the professional, recruiting for the role, is.

Search on LinkedIn, the company website. And for those still keen on making a fantastic first impression, you could even contact the organization, asking for the recruiter's name and more details about the job.

Address recruiters in the mortgage broker greeting by either their first name or last name. (e.g. "Dear Anthony" or "Dear Ms. Smarts").

If you're unable to discover the recruiter's name - don't go for the impersonal "To whom it may concern", but instead use "Dear HR team".

List of salutations you can use

- Dear Hiring Manager,

- Dear [Name of the Hiring Manager],

- Dear [Name of the Department] Team,

- Dear [Company Name] Recruitment Team,

- Respected [Name of the Hiring Manager],

- Dear Sir or Madam,

Introducing your profile to catch recruiters' attention in no more than two sentences

The introduction of your mortgage broker cover letter is a whole Catch 22 .

You have an allocated space of no more than just a paragraph (of up to two sentences). With your introduction, you have to stand out and show why you're the best candidate out there.

Set out on a journey with your mortgage broker cover letter by focusing on why you're passionate about the job. Match your personal skills and interests to the role.

Another option for your mortgage broker cover letter introduction is to show you're the ideal candidate. Write about how your achievements and skills are precisely what the company is looking for.

However you decide to start your mortgage broker cover letter, always remember to write about the value you'd bring about. Making it both tangible (with your metrics of success) and highly sought out.

The middle or body of your mortgage broker cover letter body: a great instrument to tell a story

Now that you've set the right tone with the greeting and introduction of your mortgage broker cover letter, it's time to get down to business.

Hear us out, the body of your mortgage broker cover letter is the best storytelling instrument you have, in your job-hunting arsenal.

Writing the next three to six paragraphs, take the time to reassess the advert to discover job-crucial requirements.

Next, choose one accomplishment that covers those key skills and talents.

Use precisely that achievement to tell an exciting story of how you match the ideal candidate profile.

In the undertones of your story or mortgage broker cover letter body, hint at the difference you'd make and sell your application as the perfect one for the job.

Finishing off your mortgage broker cover letter with what matters most

So far, you've done a fantastic job in tailoring your mortgage broker cover letter for the role and recruiter.

Your final opportunity to make a good impression is your closing paragraph.

And, no, a "Sincerely yours" just won't do, as it sounds too vague and impersonal.

End your mortgage broker cover letter with the future in mind.

So, if you get this opportunity, what do you plan to achieve? Be as specific, as possible, of what value you'd bring to the organization.

You could also thank recruiters for their interest in your profile and prompt for follow-up actions (and organizing your first interview).

Is it beneficial to mention that you have no experience in your mortgage broker cover letter?

Lacking professional experience isn't the end of the world for your mortgage broker cover letter.

Just be honest that you may not have had roles in the industry, but bring about so much more.

Like, your transferable skills, attained thanks to your whole work and life experience (e.g. the skills your summer spent working abroad taught you).

Or, focus on what makes you, you, and that one past success that can help you stand out and impress recruiters (think of awards you've attained and how they've helped you become a better professional).

Alternatively, write about your passion and drive to land the job and the unique skill set you would bring to enhance the workplace culture.

Key takeaways

We hope this mortgage broker cover letter writing guide has shown you how to:

- Format your mortgage broker cover letter with the mandatory sections (e.g. header, greeting, intro, body, and closing) and select the right font (P.S. It should be the same as the one you've used for your resume);

- Substitute your lack of professional experience with your most noteworthy achievement, outside of work, or your dreams and passions;

- Ensure recruiters have a more personalized experience by tailoring your cover letter not just to the role, but to them (e.g. writing their first/last name in the salutation, etc.);

- Introducing your biggest achievement and the skills it has taught you in your mortgage broker cover letter body;

- Write no more than two sentences in your mortgage broker cover letter introduction to set the right tone from the get-go.